Financial Planning Certification Review: Embark on a hilarious yet informative journey through the often-serious world of financial planning certifications. We’ll dissect the intricacies of CFPs, ChFCs, and other alphabet soup designations, revealing the secrets (and maybe a few jokes) behind achieving financial planning nirvana. Prepare for a roller coaster ride of exam prep strategies, career paths that might surprise you, and ethical considerations that will make you chuckle nervously. Buckle up, it’s going to be a wild ride!

This comprehensive review covers everything from understanding the various certification types and their respective requirements to mastering the exam content and developing effective study strategies. We’ll explore diverse career paths, delve into the importance of continuing education, and even touch upon the surprisingly exciting world of financial planning software. Expect insightful comparisons, practical tips, and enough humor to keep you engaged throughout this enriching exploration of the financial planning certification landscape.

Types of Financial Planning Certifications

Navigating the world of financial planning certifications can feel like trying to decipher a particularly complex investment portfolio – daunting at first, but ultimately rewarding with careful study. This section will illuminate the landscape of these credentials, helping you understand the distinctions and decide which path best suits your aspirations (and perhaps your caffeine tolerance). Think of it as a financial planning certification tasting menu, before you commit to the full course.

Choosing the right certification is a crucial step in your financial planning journey. Different certifications cater to different needs and career goals, offering varying levels of specialization and recognition within the industry. Understanding the nuances between these certifications will empower you to make an informed decision aligned with your professional ambitions.

Common Financial Planning Certifications

The world of financial planning certifications is diverse, with various organizations offering their own unique credentials. This table provides a snapshot of some globally recognized certifications, highlighting their key differences. Remember, the specific requirements may vary slightly depending on location and the awarding body’s updates, so always check the official website for the most up-to-date information.

| Certification Name | Awarding Body | Geographic Focus | Typical Requirements |

|---|---|---|---|

| Certified Financial Planner (CFP) | Financial Planning Standards Board (FPSB) and various local chapters | Global (with regional variations) | Bachelor’s degree, education coursework, examination, experience |

| Chartered Financial Consultant (ChFC) | American College of Financial Services | Primarily United States | Bachelor’s degree, education coursework, examination |

| Certified Financial Analyst (CFA) | CFA Institute | Global | Bachelor’s degree, rigorous examination process, professional experience |

| Registered Financial Consultant (RFC) | International Association of Registered Financial Consultants (IARFC) | Global | Education coursework, examination, experience |

| Personal Financial Specialist (PFS) | American Institute of CPAs (AICPA) | United States | CPA license, additional education and examination |

Comparing CFP, ChFC, and Other Prominent Certifications

The CFP and ChFC certifications are often compared, and understanding their key differences is vital. While both demonstrate a commitment to financial planning expertise, they differ in their scope and focus. The CFP certification is internationally recognized and emphasizes comprehensive financial planning, whereas the ChFC certification, offered by the American College, focuses more on advanced financial planning techniques. Other certifications, like the CFA, cater to investment management specialists, requiring a more intensive focus on investment analysis and portfolio management. Each certification has its unique strengths, aligning with specific career paths and professional goals. Think of it like choosing between a sports car (CFA) for speed and precision, or a comfortable SUV (CFP) for practicality and versatility.

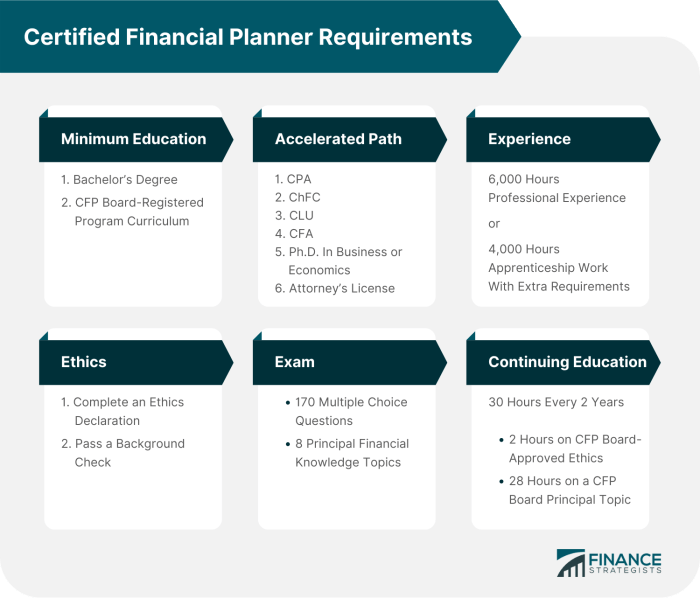

Educational Prerequisites for Financial Planning Certifications

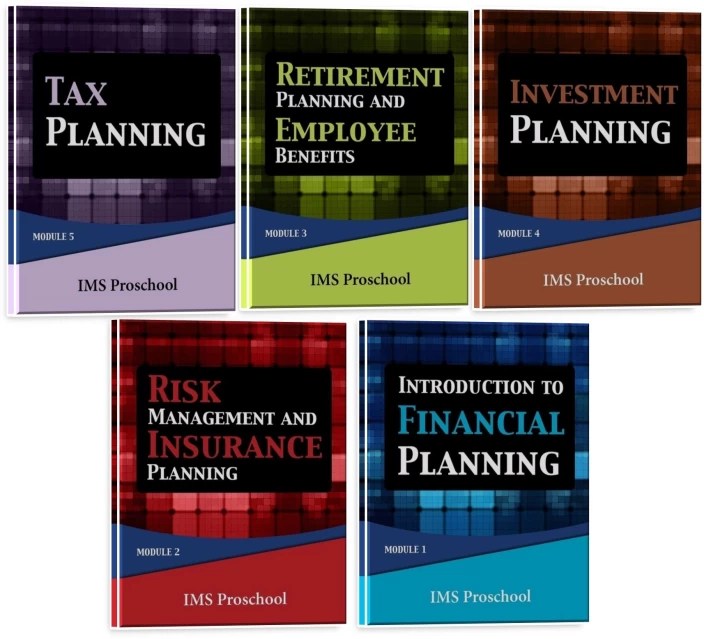

The educational prerequisites for various financial planning certifications vary considerably. Many require a bachelor’s degree as a minimum entry requirement, while some may accept equivalent professional experience. Beyond the basic degree, specific coursework in financial planning, economics, and related fields is often mandatory. The CFA program, for instance, is notoriously rigorous, demanding extensive self-study and a series of challenging examinations. The CFP certification also necessitates a significant commitment to education, including specific coursework covering all aspects of financial planning. For example, many programs require a minimum number of hours of coursework covering topics such as retirement planning, estate planning, and insurance planning. These requirements ensure candidates possess a comprehensive understanding of the field before being awarded the certification.

Exam Content and Structure

Ah, the exam. That crucible of knowledge, that fiery trial by spreadsheet. Fear not, aspiring financial planners! This section will illuminate the path to success, guiding you through the treacherous terrain of exam content and structure. We’ll arm you with a study schedule sharper than a freshly-minted Roth IRA, and example questions that’ll make you feel like a financial planning ninja.

Navigating the world of financial planning certifications requires a strategic approach. Understanding the exam format, content areas, and time allocation is crucial for success. This section provides a detailed overview of these elements, focusing on the Certified Financial Planner (CFP) exam as a prime example, while also offering a comparative look at other certifications.

Sample Study Schedule for the CFP Exam

This schedule assumes a dedicated study period of six months, allowing for flexibility and periodic review. Remember, adjust this based on your individual learning style and prior knowledge. Think of this as a marathon, not a sprint – unless you’re secretly a superhuman with a photographic memory. In that case, congratulations! You’re probably already a CFP.

| Month | Topic Focus | Activities |

|---|---|---|

| 1-2 | Financial Planning Process, Education Planning | Review core concepts, complete practice questions. |

| 3-4 | Retirement Planning, Investment Planning | Deep dive into investment strategies, practice exam simulations. |

| 5 | Tax Planning, Estate Planning | Focus on complex topics, attend review courses (optional). |

| 6 | Risk Management, Insurance Planning, Review | Comprehensive review, full-length practice exams. |

Example CFP Exam Questions

The following questions represent the diverse range of topics covered in the CFP exam. They are not intended to be exhaustive, but rather to illustrate the style and complexity you might encounter.

- Financial Planning Process: A client wants to retire in 15 years. Describe the steps involved in developing a comprehensive financial plan to meet this goal, including the importance of defining goals, gathering data, analyzing the client’s financial situation, and developing and implementing a plan.

- Retirement Planning: Explain the differences between a defined contribution plan and a defined benefit plan, and discuss the implications for retirement planning.

- Investment Planning: A client with a moderate risk tolerance and a long-term investment horizon wants to diversify their portfolio. Recommend suitable asset allocation strategies, considering factors such as inflation, market risk, and liquidity needs.

- Tax Planning: Compare and contrast the tax implications of traditional and Roth IRAs. When might one be preferable to the other?

- Estate Planning: Explain the purpose of a will and a trust, and discuss the circumstances under which each might be appropriate.

Comparison of Exam Formats Across Certifications

While the CFP exam is a rigorous benchmark, other certifications also hold significant value. Here’s a glimpse into the differences in exam formats.

| Certification | Exam Format | Number of Questions | Passing Score |

|---|---|---|---|

| CFP | Multiple-choice, case studies | 170 | 70% (approximate) |

| ChFC | Multiple-choice | 100 | 70% (approximate) |

| CIMA | Multiple-choice, essay | Varies | Varies |

Note: Exam formats and passing scores are subject to change. Always refer to the official certification body for the most up-to-date information. This is not financial advice, just a helpful guide to help you avoid becoming a financial planning *faux pas*.

Study Resources and Strategies

Embarking on the journey to becoming a certified financial planner is akin to scaling Mount Everest in stilettos – challenging, but undeniably rewarding. The right resources and a solid strategy are your Sherpa and oxygen tank, ensuring a successful summit. Choosing the correct study approach and materials will significantly impact your exam performance and overall experience. This section will illuminate the path towards conquering your financial planning certification exam.

Navigating the sea of study materials can feel overwhelming, but fear not! We’ll dissect the best options and provide strategies to maximize your study time. Remember, consistent effort beats sporadic bursts of frantic cramming every time.

Recommended Study Materials, Financial Planning Certification Review

Selecting the right study materials is crucial. A poorly chosen textbook can be as frustrating as a rogue tax audit. Therefore, carefully consider the following options, balancing your learning style and budget.

- Textbooks: Consider established financial planning textbooks from reputable publishers. Look for books that align with the specific certification exam’s curriculum Artikel. A well-structured textbook can provide a comprehensive foundation. For example, a popular choice often includes detailed explanations of complex financial concepts, accompanied by practice problems to solidify your understanding.

- Online Courses: Many reputable institutions offer online courses specifically designed for financial planning certifications. These courses often provide structured learning paths, interactive exercises, and access to instructors. The benefit of online courses is the flexibility they offer, allowing you to study at your own pace. For example, a course might offer video lectures, downloadable materials, and online forums for peer-to-peer learning.

- Practice Exams: Practice exams are your secret weapon. They allow you to identify your weak areas and simulate the actual exam environment. Many providers offer practice exams mirroring the actual certification exam’s format and difficulty level. The more practice exams you take, the more comfortable you’ll become with the exam structure and question types. For instance, a reputable provider might offer timed practice exams with detailed explanations for each question, helping you learn from your mistakes.

Effective Time Management Techniques

Time management is the unsung hero of exam preparation. Failing to plan is planning to fail, as the old adage goes (and it’s particularly true for high-stakes exams). A structured approach will prevent last-minute panic and ensure thorough preparation.

- Create a Study Schedule: Allocate specific time slots for studying each topic. Be realistic and break down the material into manageable chunks. Don’t try to cram everything into the last few days – this will only lead to burnout and poor performance.

- Prioritize Topics: Identify your weaker areas and dedicate more time to them. Use practice exams to pinpoint the topics that need extra attention. Remember, focusing on your weaknesses is more effective than endlessly reviewing what you already know.

- Regular Breaks: Consistent, focused study is key, but regular breaks are essential to maintain concentration and prevent burnout. Short, frequent breaks are more effective than long, infrequent ones. Consider the Pomodoro Technique (25 minutes of focused study followed by a 5-minute break).

Self-Study vs. Prep Courses: Weighing the Pros and Cons

The age-old debate: self-study versus prep courses. Both have their merits and drawbacks, and the best choice depends on your learning style, budget, and discipline. Let’s examine the advantages and disadvantages of each.

| Method | Advantages | Disadvantages |

|---|---|---|

| Self-Study | Flexibility, Cost-effective (potentially), Personalized pace | Requires strong self-discipline, Potential for gaps in knowledge, Lack of immediate feedback |

| Prep Courses | Structured learning, Expert guidance, Peer support, Immediate feedback | Can be expensive, Less flexible scheduling, May not cater to individual learning styles |

Career Paths and Job Prospects

So, you’ve conquered the financial planning certification exam – congratulations! Now, the real fun begins: choosing your career path. The world of finance awaits, and with your shiny new certification, the opportunities are surprisingly diverse and, dare we say, lucrative. Forget counting pennies; you’ll be helping others manage their fortunes (and maybe even a few of your own along the way).

The career paths open to certified financial planners are as varied as the financial instruments they manage. From advising high-net-worth individuals to crafting retirement strategies for the everyday person, the possibilities are endless. The specific job titles and salary expectations, however, are heavily influenced by the sector and the level of experience.

Financial Planning Career Paths

Certified Financial Planners (CFPs) and other certified professionals find employment in a multitude of settings. The level of responsibility and compensation varies greatly depending on the specific role and the employer. Some choose the independence of private practice, while others prefer the structure and resources of larger firms.

- Private Wealth Management: Advising high-net-worth individuals and families on investment strategies, tax planning, estate planning, and charitable giving. Think bespoke financial solutions for the ultra-wealthy – expect a hefty salary to match.

- Financial Planning Firms: Working within established firms, offering comprehensive financial planning services to a wider range of clients. This offers a good balance between independence and team support.

- Corporate Finance: Providing financial guidance and analysis within corporations, often focusing on areas such as retirement planning for employees or investment decisions.

- Insurance Companies: Working as financial advisors, often selling and managing insurance products alongside financial planning services.

- Government Agencies: Some government agencies employ financial planners to assist citizens with financial planning or retirement planning related to government benefits.

Job Descriptions Requiring Specific Certifications

Many job descriptions explicitly require specific financial planning certifications. The specific certification needed varies greatly based on the role and responsibilities. For example, a role focused on retirement planning might favor a retirement planning certification, while a position focusing on investment management might prioritize a Chartered Financial Analyst (CFA) designation. Here are a few illustrative examples (note: specific requirements vary by employer and location):

- Senior Financial Planner: Typically requires a CFP designation, along with several years of experience. This role often involves managing a portfolio of clients, developing comprehensive financial plans, and providing ongoing advice.

- Financial Analyst: While not always requiring a CFP, a CFA or other investment-related certification is often preferred. This role involves analyzing financial data, making investment recommendations, and managing investment portfolios.

- Retirement Specialist: A specialized role often requiring a retirement planning certification or equivalent experience. This position focuses on helping clients plan for retirement, often involving managing retirement accounts and advising on retirement income strategies.

Salary Expectations and Career Progression

Salary expectations for certified financial planners vary widely based on experience, location, employer, and the specific certification held. Entry-level positions might start around $50,000-$70,000 per year, while experienced professionals can earn significantly more, often exceeding $100,000 annually, and sometimes reaching into the hundreds of thousands for senior roles or those in private wealth management. Career progression typically involves increased responsibility, managing larger portfolios of clients, and potentially leading teams. Senior roles may involve mentoring junior planners, developing new business, and shaping the overall direction of a firm’s financial planning services. For example, a financial planner starting in a junior role at a large firm might progress to a senior planner, then a team lead, and eventually a director of financial planning over a 10-15 year period, with corresponding salary increases at each stage. The path to becoming a highly successful financial planner often involves building a strong client base, developing a specialized niche, and consistently exceeding client expectations.

Continuing Education Requirements

Maintaining your hard-earned financial planning certification isn’t a case of “set it and forget it”—it’s more like tending a demanding but rewarding bonsai tree. Regular upkeep is crucial, and that upkeep comes in the form of continuing education. Failing to meet these requirements could lead to the dreaded revocation of your certification, leaving you with nothing but a slightly embarrassing framed certificate and a hefty dose of regret.

Continuing education requirements for financial planning certifications vary depending on the awarding body. These requirements ensure that certified professionals stay abreast of the ever-evolving financial landscape, preventing them from dispensing advice that’s as outdated as a rotary phone. Think of it as a constant professional upgrade, ensuring you remain a relevant and valuable asset in the ever-changing world of finance.

Continuing Education Requirements by Certification Body

The specific requirements for continuing education differ significantly among various certification bodies. For example, the Certified Financial Planner (CFP) board might require a certain number of continuing education credits each year, focusing on specific topics relevant to the profession. Other organizations may have different credit requirements, different topic focuses, or different methods for tracking and verifying completion. This variability necessitates careful review of each specific organization’s rules.

| Certification Body | Typical Annual Credit Requirement | Credit Types Accepted | Renewal Frequency |

|---|---|---|---|

| Certified Financial Planner Board of Standards (CFP Board) | 30 hours | Various courses, workshops, conferences | Biennial |

| Chartered Financial Analyst (CFA) Institute | Variable, dependent on level | Self-study, courses, conferences | Annual |

| Personal Financial Planning (PFP) designation (various organizations) | Varies widely by organization | Variety of educational options | Varies by organization |

Sample Five-Year Continuing Education Plan

A well-structured continuing education plan is essential to avoid last-minute scrambles and ensure consistent professional development. This plan should be tailored to your individual needs and career goals, but a structured approach can help you stay organized and on track. Think of it as a financial plan for your professional development.

This example assumes a requirement of 30 continuing education credits per year.

| Year | Credit Type | Hours | Topic Focus | Notes |

|---|---|---|---|---|

| Year 1 | Online Courses | 15 | Retirement Planning, Investment Strategies | Completed through reputable online providers |

| Year 1 | Conference Attendance | 15 | Financial Planning Trends | Attended national financial planning conference |

| Year 2 | Workshops | 10 | Tax Law Updates, Estate Planning | Participated in specialized workshops |

| Year 2 | Self-Study | 20 | Behavioral Finance, Risk Management | Utilized professional journals and books |

| Year 3 | Online Courses | 15 | Insurance Planning, Financial Technology | Focused on emerging technologies in financial planning |

| Year 3 | Conference Attendance | 15 | Ethical Considerations | Attended a regional conference focused on ethics |

| Year 4 | Mentorship Program | 10 | Practical Application of Knowledge | Engaged in mentorship to refine skills |

| Year 4 | Advanced Course | 20 | Advanced Investment Strategies | Completed an advanced certification course |

| Year 5 | Workshops | 15 | Retirement Planning, Client Communication | Refresher courses on core areas |

| Year 5 | Self-Study & Journal Articles | 15 | Current Events in Finance | Stayed up-to-date with industry news |

Methods for Tracking Continuing Education

Maintaining accurate records of your continuing education is paramount. Many certification bodies provide online portals for tracking progress. Utilizing spreadsheets, dedicated apps, or even a simple notebook can help you stay organized and avoid any unpleasant surprises when renewal time rolls around. Think of it as creating a meticulous audit trail of your professional growth. A well-maintained record ensures a smooth and stress-free renewal process. Failing to do so could result in headaches, delays, and possibly even a lapse in your certification.

Ethical Considerations in Financial Planning

The world of financial planning isn’t just about crunching numbers; it’s about building trust and safeguarding clients’ futures. Certified financial planners (CFPs) navigate a complex ethical landscape, requiring a strong moral compass and a commitment to acting in their clients’ best interests, even when it’s not the most profitable path. Failing to uphold these ethical standards can lead to serious consequences, both professionally and legally. Let’s delve into the fascinating – and sometimes surprisingly tricky – world of ethics in financial planning.

Ethical Responsibilities of Certified Financial Planners

CFPs are bound by a strict code of ethics, demanding unwavering integrity and professionalism. This includes a fiduciary duty, meaning they must always prioritize their clients’ interests above their own. Transparency is key; clients need to understand all fees, commissions, and potential conflicts of interest. Confidentiality is paramount, protecting sensitive financial information with the utmost care. Competence is also crucial; CFPs must maintain their knowledge and skills to provide effective and appropriate advice. Essentially, they’re sworn to uphold the highest standards of conduct, ensuring their clients’ financial well-being is always the top priority – even if it means turning down a lucrative opportunity that might not be in the client’s best interest.

Ethical Dilemmas in Financial Planning

Financial planners often face difficult situations that test their ethical resolve. These dilemmas can arise from various sources, including conflicts of interest, pressure from superiors, or ambiguous regulatory guidelines.

For instance, imagine a planner advising a client nearing retirement who has a significant portion of their portfolio invested in a high-risk, high-reward stock. The planner knows the client is risk-averse and that a sudden market downturn could severely impact their retirement plans. However, the planner also receives a significant commission on this investment. The ethical dilemma? Prioritizing the client’s best interest (conservative investment strategy) versus personal gain (maintaining the high-commission investment).

Another common dilemma involves receiving gifts or preferential treatment from financial product providers. Accepting these gifts, even seemingly small ones, can create the appearance of a conflict of interest, undermining the planner’s impartiality and eroding client trust. This highlights the importance of strict adherence to disclosure requirements and maintaining a clear separation between personal and professional relationships.

Strategies for Maintaining Ethical Conduct

Maintaining ethical conduct requires ongoing vigilance and a proactive approach. Regular review and updates on relevant regulations and ethical guidelines are essential. Seeking guidance from professional organizations and mentors is invaluable, particularly when faced with challenging ethical dilemmas. Transparency and open communication with clients are also crucial; keeping clients informed of potential conflicts of interest fosters trust and strengthens the planner-client relationship. Furthermore, establishing clear boundaries and adhering to a strict code of conduct prevents even the appearance of impropriety. Remember, the long-term reputation of a financial planner hinges on their unwavering commitment to ethical practice. It’s not just about following the rules; it’s about embodying the spirit of ethical conduct in every interaction.

Technology and Tools for Financial Planners

The world of financial planning isn’t just about number-crunching anymore; it’s about harnessing the power of technology to streamline processes, enhance client experiences, and ultimately, make everyone’s financial lives a little less stressful (and a lot more profitable!). Think of it as upgrading from an abacus to a supercharged, AI-powered financial spaceship. The right technology can be the difference between a mildly successful practice and a thriving, highly efficient empire of financial wellness.

Financial planning software and technology have revolutionized the industry, transforming how financial planners manage client data, analyze investments, and create personalized financial plans. Gone are the days of endless spreadsheets and manual calculations; now, sophisticated software handles the heavy lifting, freeing up planners to focus on what truly matters: building strong client relationships and providing exceptional advice. This increased efficiency translates directly into improved client service and, let’s be honest, a much better work-life balance.

Financial Planning Software

A wide array of software caters to the diverse needs of financial planners, ranging from basic portfolio management tools to comprehensive planning platforms. These tools typically offer features such as client relationship management (CRM), portfolio tracking, financial planning modeling, and reporting capabilities. Choosing the right software often depends on the size of the practice, the types of clients served, and the specific needs of the financial planner. The right software can be the key to unlocking organizational zen.

Examples of Commonly Used Financial Planning Software

The selection of software available can seem overwhelming, but a few standouts consistently rise to the top. Let’s explore some popular choices:

MoneyGuidePro: This robust software is known for its comprehensive financial planning capabilities. It allows for detailed modeling of various financial scenarios, including retirement planning, education funding, and estate planning. Imagine having a crystal ball that can predict the future of your clients’ finances – that’s the power of MoneyGuidePro. Its user-friendly interface and strong reporting features make it a favorite among many planners.

eMoney Advisor: eMoney is another popular choice, prized for its sophisticated financial planning models and its strong emphasis on client collaboration. Clients can access their plans online, participate in goal-setting, and easily communicate with their planners. This collaborative aspect fosters trust and transparency, leading to stronger client relationships. It’s like having a shared financial roadmap, always visible and easily updated.

RightCapital: This software shines in its ability to provide clear, visually appealing presentations of complex financial data. RightCapital uses interactive dashboards and intuitive visualizations to make financial information more accessible and understandable for both planners and clients. It’s a master of turning financial jargon into clear, compelling narratives.

Benefits of Utilizing Technology for Improved Efficiency and Client Service

The advantages of embracing technology in financial planning are numerous and significant. Beyond the obvious time savings, technology enhances client communication, improves data accuracy, and allows for more personalized service.

Increased Efficiency: Automation of repetitive tasks, such as data entry and report generation, frees up valuable time for planners to focus on higher-level activities, like strategic planning and client interaction. This efficiency boost translates to more clients served and a healthier bottom line.

Enhanced Client Communication: Secure client portals and online communication tools facilitate easy and efficient communication, keeping clients informed and engaged throughout the financial planning process. No more endless phone tag or frustrating email chains – technology streamlines communication and builds stronger relationships.

Improved Data Accuracy: Software solutions minimize the risk of human error associated with manual data entry and calculations. This leads to more accurate financial plans and improved decision-making. Say goodbye to those pesky spreadsheet errors that can derail even the most meticulously crafted plan.

Personalized Client Service: Technology enables planners to personalize their services by tailoring financial plans to the unique needs and goals of each client. Sophisticated software allows for scenario planning and “what-if” analyses, empowering planners to create truly customized solutions.

Networking and Professional Development

Navigating the world of financial planning isn’t just about crunching numbers; it’s about building relationships and establishing yourself as a trusted advisor. Think of it as a sophisticated game of financial Jenga – one wrong move, and your tower of success could crumble. Networking and professional development are the key to building a strong, stable, and lucrative career in this field. It’s not just about who you know, but about *how* you know them – and how they know you’re a valuable asset to their network.

Networking within the financial planning community is paramount for success. It’s the lifeblood of professional growth, offering opportunities for collaboration, mentorship, and staying ahead of the curve in a constantly evolving industry. Without a strong network, you’re essentially a lone wolf howling into the financial wilderness. Building meaningful connections leads to referrals, shared knowledge, and access to opportunities you might otherwise miss – opportunities that could significantly impact your income and career trajectory. Consider it a strategic investment with high returns, where the currency is trust and mutual respect.

Strategies for Building Professional Relationships

Building strong professional relationships requires more than just exchanging business cards at a conference (though that’s a start!). It involves genuine engagement and a commitment to nurturing those connections. Think of it as tending a garden – you need to consistently water, weed, and fertilize those relationships to ensure they thrive. This involves actively participating in industry events, engaging in meaningful conversations, offering help where you can, and consistently staying in touch with your contacts.

For example, consider attending local chapter meetings of professional organizations. Engage actively in discussions, offer your unique perspectives, and be genuinely interested in learning from others. Don’t just be a passive observer; become an active participant.

Furthermore, consider offering your expertise to others. Perhaps you have a skill that others lack, or a perspective that could be valuable. Mentoring junior planners, providing guest lectures, or contributing to industry publications are all excellent ways to build your reputation and network simultaneously. Remember, generosity in sharing knowledge often leads to reciprocal benefits.

Benefits of Joining Professional Organizations

Joining professional organizations is like gaining access to a secret society of financial planning gurus (but without the weird initiation rituals, we hope!). These organizations offer a wealth of resources and opportunities to enhance your professional development, from continuing education credits to networking events. Membership can provide access to exclusive conferences, webinars, and publications, keeping you abreast of the latest industry trends and regulatory changes. Consider it an ongoing professional development program with built-in social networking.

These organizations often provide opportunities for mentorship. Connecting with experienced professionals can provide invaluable guidance, helping you navigate the challenges of the financial planning profession and accelerate your career growth. Many organizations have formal mentorship programs, but even informal connections can be immensely beneficial.

Moreover, membership can enhance your credibility. The affiliation with a respected professional organization signals to clients and colleagues alike that you are committed to upholding the highest standards of professional conduct and continuing education. It’s a stamp of approval, demonstrating your dedication to the profession.

Last Word

So, there you have it – a whirlwind tour through the world of financial planning certifications! From the daunting exam prep to the rewarding career prospects, we’ve covered the highs, lows, and everything in between. Remember, becoming a certified financial planner isn’t just about acing an exam; it’s about embarking on a journey of continuous learning, ethical practice, and (hopefully) a healthy dose of laughter along the way. Now go forth and conquer those certifications – and maybe treat yourself to a celebratory margarita afterward. You deserve it!

Essential FAQs: Financial Planning Certification Review

What if I fail an exam?

Don’t panic! Most certification programs allow for retakes. Use the experience to refine your study strategy and try again. Think of it as a learning opportunity, not a failure.

How much does it cost to get certified?

Costs vary widely depending on the certification and the study resources you choose. Factor in exam fees, study materials, and potential prep course costs. Budget accordingly!

Are there scholarships or financial aid available?

Some organizations offer scholarships or grants for financial planning certifications. Research the specific awarding bodies for available options. It’s worth a look!

What’s the difference between a CFP and a ChFC?

While both are respected certifications, they differ in focus and requirements. The CFP is generally considered more comprehensive and widely recognized globally, while the ChFC often focuses on insurance and estate planning.