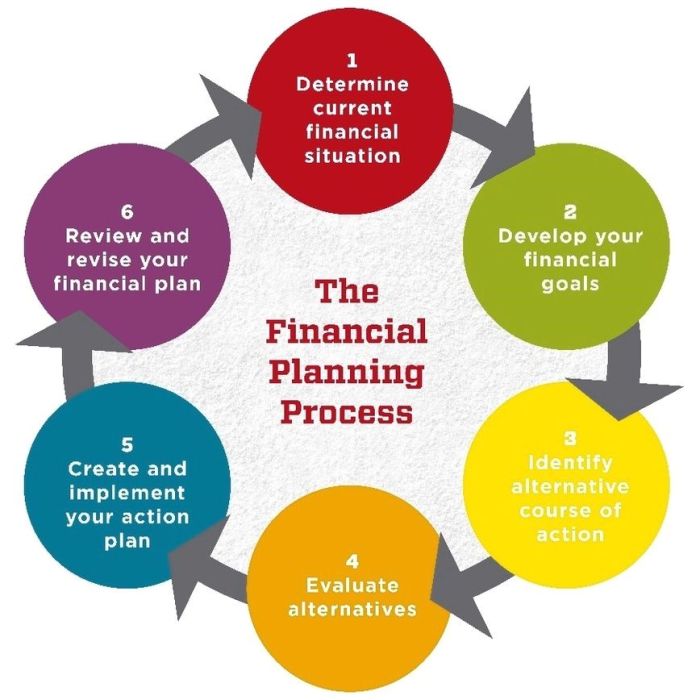

Securing your financial future requires a strategic approach. This guide delves into the Financial Planning Process, offering a structured framework to navigate the complexities of personal finance. From defining your goals and assessing your current situation to developing a robust strategy and mitigating risks, we’ll equip you with the knowledge and tools to build a secure and prosperous financial life.

We’ll explore various aspects, including goal setting, investment strategies, risk management, and estate planning, providing practical examples and actionable steps along the way. Understanding these principles is crucial for making informed financial decisions and achieving long-term financial well-being.

Defining Financial Planning

Financial planning is the ongoing process of defining your financial goals, developing a strategy to achieve them, and regularly monitoring and adjusting your plan as circumstances change. It’s not a one-time event but a dynamic journey that adapts to your evolving needs and priorities throughout your life. Effective financial planning empowers you to make informed decisions about your money, leading to greater financial security and peace of mind.

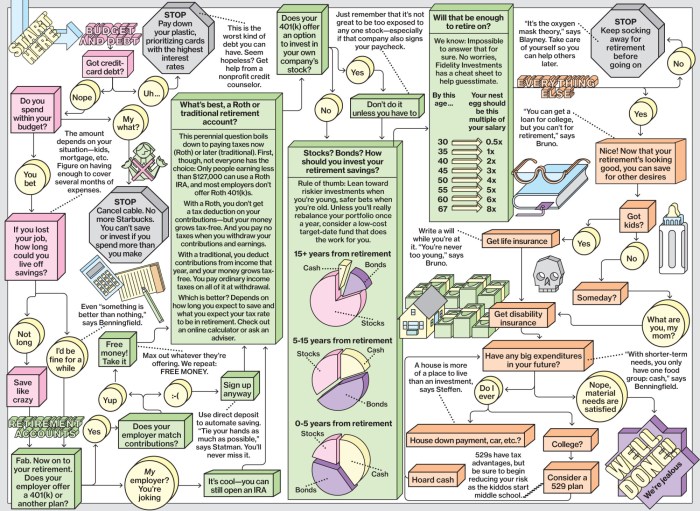

Effective financial planning rests on several core principles. These include setting clear, measurable, achievable, relevant, and time-bound (SMART) goals; creating a realistic budget that tracks income and expenses; managing debt effectively; building an emergency fund; investing wisely for long-term growth; and protecting assets through insurance. Regular review and adjustments are crucial to ensure the plan remains aligned with your goals and changing life circumstances.

Core Components of a Comprehensive Financial Plan

A comprehensive financial plan typically includes several key components. These components work together to provide a holistic view of your financial situation and guide your decision-making. Ignoring any one area can significantly impact the overall success of your plan.

- Financial Goal Setting: This involves identifying your short-term and long-term financial objectives, such as buying a home, retiring comfortably, or funding your children’s education. Clearly defined goals provide direction and motivation for your financial planning efforts. For example, a short-term goal might be saving for a down payment on a car within two years, while a long-term goal could be accumulating enough savings to retire at age 65.

- Budgeting and Cash Flow Management: A well-structured budget tracks your income and expenses, helping you understand where your money is going and identify areas for potential savings. Effective cash flow management ensures you have enough money to meet your obligations while still saving and investing. For example, using budgeting apps or spreadsheets can help visualize spending habits and identify areas for improvement.

- Debt Management: High levels of debt can hinder your financial progress. A financial plan addresses strategies for managing and reducing debt, such as creating a debt repayment plan or negotiating lower interest rates. For example, the snowball method (paying off the smallest debts first) or the avalanche method (paying off the highest interest debts first) are common strategies.

- Emergency Fund Establishment: An emergency fund provides a safety net for unexpected expenses, preventing you from going into debt during financial emergencies. Generally, it’s recommended to have 3-6 months’ worth of living expenses saved in an easily accessible account. For example, if your monthly expenses are $3,000, you should aim to have between $9,000 and $18,000 in your emergency fund.

- Investment Planning: This involves developing an investment strategy aligned with your risk tolerance, time horizon, and financial goals. It might include investments in stocks, bonds, mutual funds, or real estate. For example, a younger investor with a longer time horizon might allocate a larger portion of their portfolio to stocks, while an older investor closer to retirement might prefer a more conservative approach with a higher allocation to bonds.

- Retirement Planning: Retirement planning involves determining how much you need to save to maintain your desired lifestyle in retirement and developing a strategy to achieve that goal. This includes considering factors like Social Security benefits, pensions, and personal savings. For example, using retirement calculators can help estimate how much you need to save and how long it will take to reach your retirement goals.

- Risk Management and Insurance: Protecting yourself and your assets from unforeseen events is crucial. This involves obtaining adequate insurance coverage, such as health, life, disability, and home insurance. For example, having adequate life insurance can protect your family financially in the event of your death.

- Estate Planning: Estate planning involves preparing for the distribution of your assets after your death. This might include creating a will, setting up a trust, or designating beneficiaries for your accounts. For example, a will specifies how your assets will be distributed to your heirs, while a trust can provide for the management of your assets for the benefit of your beneficiaries.

Financial Planning Approaches Across Life Stages

Financial planning needs evolve significantly throughout different life stages. A young adult’s priorities differ dramatically from those of a retiree. Therefore, the approach to financial planning should be adaptable.

- Young Adulthood (20s-30s): Focus on building a strong financial foundation, paying off student loans, establishing an emergency fund, and starting to invest early to take advantage of compound growth. Examples include prioritizing debt reduction, contributing to retirement accounts like 401(k)s or IRAs, and exploring affordable housing options.

- Middle Adulthood (40s-50s): Priorities shift towards saving for children’s education, paying down a mortgage, increasing retirement savings, and potentially investing in higher-risk assets. Examples include maxing out retirement contributions, exploring college savings plans (529 plans), and potentially refinancing a mortgage to lower interest rates.

- Retirement (60s+): The focus is on managing retirement income, withdrawing funds strategically, and ensuring healthcare expenses are covered. Examples include creating a detailed retirement budget, exploring options for long-term care insurance, and adjusting investment strategies to a more conservative approach.

Setting Financial Goals

Setting clear, achievable financial goals is the cornerstone of effective financial planning. Without defined objectives, your efforts may be scattered and ultimately unproductive. This section will guide you through the process of establishing and prioritizing your financial aspirations, ensuring they align with your personal values and long-term vision.

Establishing financial goals requires a structured approach. A well-defined goal provides a roadmap, allowing you to track progress and make informed decisions along the way. Ignoring this crucial step often leads to financial instability and missed opportunities.

A Sample Financial Goal-Setting Framework

This framework uses the SMART methodology – Specific, Measurable, Achievable, Relevant, and Time-bound – to create effective financial goals.

- Specific: Instead of “save more money,” aim for “save $10,000 for a down payment on a house.” The goal is clearly defined and leaves no room for ambiguity.

- Measurable: Track your progress regularly. For example, set up a savings account specifically for your down payment and monitor its balance monthly.

- Achievable: Your goal should be challenging yet realistic. Consider your income, expenses, and current savings when setting your target. A goal of saving $10,000 in a year might be achievable for someone earning a comfortable salary, but unrealistic for someone living paycheck to paycheck.

- Relevant: The goal should align with your overall financial plan and personal values. Saving for a house makes sense if homeownership is a priority, but not if you value renting and travel more.

- Time-bound: Set a deadline for achieving your goal. For example, “Save $10,000 for a down payment within two years.” This creates a sense of urgency and helps you stay focused.

Aligning Financial Goals with Personal Values and Aspirations

Your financial goals should reflect your personal values and aspirations. If you value travel, a goal might be saving for an annual trip. If family is important, you might prioritize saving for your children’s education. Ignoring these values can lead to dissatisfaction, even if you achieve your financial targets. For example, someone who values experiences over material possessions might prioritize saving for travel rather than accumulating assets. Conversely, someone who values financial security above all else might focus on building a large emergency fund and paying off debt quickly.

Prioritizing and Sequencing Financial Goals

Prioritizing financial goals involves considering both urgency and importance. Urgent goals require immediate attention, such as paying off high-interest debt or covering unexpected medical expenses. Important goals are those that contribute to long-term financial well-being, such as saving for retirement or investing in education.

A common approach is to use a matrix that plots goals based on their urgency and importance. Goals in the high-urgency, high-importance quadrant should be addressed first. For example, paying off high-interest credit card debt is both urgent (due to accruing interest) and important (to improve your overall financial health). Goals in the low-urgency, high-importance quadrant, such as saving for retirement, can be addressed over a longer timeframe.

Assessing Current Financial Situation

Understanding your current financial standing is crucial before charting a course for your financial future. A thorough assessment provides a realistic baseline, highlighting strengths and weaknesses to inform effective goal-setting and strategy development. This process involves analyzing your assets, liabilities, income, and expenses.

Conducting a Personal Financial Assessment

A comprehensive personal financial assessment involves several key steps. Following these steps will provide a clear picture of your current financial health.

- Gather Financial Documents: Collect all relevant documents, including bank statements, investment account statements, loan documents, tax returns, and credit card statements. This comprehensive collection forms the foundation of your analysis.

- List Assets: Create a detailed list of all your assets, including cash, checking and savings accounts, investments (stocks, bonds, mutual funds, retirement accounts), real estate, and personal property (vehicles, jewelry, etc.). Record the current market value for each asset, where possible.

- List Liabilities: Similarly, list all your liabilities, such as outstanding loans (mortgages, auto loans, student loans), credit card debt, and any other outstanding balances. Note the current balance and interest rate for each liability.

- Calculate Net Worth: Your net worth is calculated by subtracting your total liabilities from your total assets. This figure represents your overall financial health: Net Worth = Total Assets – Total Liabilities. A positive net worth indicates you own more than you owe, while a negative net worth suggests the opposite.

- Analyze Cash Flow: Track your income and expenses over a period of time (ideally, three to six months). Categorize your income sources and expenses to identify areas of potential savings.

Sample Net Worth Statement

A net worth statement provides a snapshot of your financial position at a specific point in time. Below is a sample, illustrating the structure:

| Asset | Value | Liability | Value |

|---|---|---|---|

| Checking Account | $5,000 | Mortgage | $150,000 |

| Savings Account | $10,000 | Auto Loan | $10,000 |

| Investment Portfolio | $50,000 | Credit Card Debt | $5,000 |

| Home | $200,000 | Student Loan | $20,000 |

| Vehicle | $15,000 | ||

| Total Assets | $280,000 | Total Liabilities | $185,000 |

| Net Worth: $95,000 | |||

Analyzing Cash Flow Statements

Analyzing your cash flow statement helps identify areas where you can increase income or reduce expenses. This process involves categorizing your income and expenses and calculating the net cash flow. A positive net cash flow indicates you are earning more than you are spending, while a negative net cash flow indicates the opposite.

| Category | Income | Expense | Net |

|---|---|---|---|

| Salary/Wages | $5,000 | Rent/Mortgage | -$1,500 |

| Investment Income | $200 | Utilities | -$300 |

| Other Income | $100 | Groceries | -$500 |

| Transportation | -$200 | ||

| Entertainment | -$200 | ||

| Debt Payments | -$500 | ||

| Total Income | $5,300 | Total Expenses | -$3,200 |

| Net Cash Flow: $2,100 | |||

Developing a Financial Strategy

Crafting a robust financial strategy is crucial for achieving your long-term financial goals. This involves carefully considering your risk tolerance, time horizon, and the specific objectives you aim to accomplish. A well-defined strategy acts as a roadmap, guiding your investment decisions and ensuring you stay on track towards financial success. It’s not a static plan, but rather a dynamic one that adapts to changing circumstances and market conditions.

Developing a financial strategy necessitates a thorough understanding of various investment approaches and their associated risks and rewards. It also requires identifying suitable investment vehicles that align with your specific financial goals and risk profile. A diversified portfolio, tailored to your unique circumstances, is often the cornerstone of a successful long-term strategy.

Investment Strategies: Risk Tolerance and Time Horizon

Different investment strategies cater to varying levels of risk tolerance and time horizons. Conservative strategies, suitable for those with low risk tolerance or shorter time horizons, prioritize capital preservation and stability. These often involve investments in low-risk options like government bonds or high-yield savings accounts. Conversely, aggressive strategies, appropriate for those with higher risk tolerance and longer time horizons, aim for higher returns through investments in higher-risk assets such as stocks or emerging market funds. A balanced approach combines elements of both conservative and aggressive strategies, aiming for a blend of risk and reward that aligns with individual circumstances. For example, a young investor with a long time horizon before retirement might comfortably tolerate higher risk in pursuit of potentially greater returns, while an investor nearing retirement might prioritize capital preservation over maximizing returns.

Suitable Investment Vehicles for Specific Goals

The choice of investment vehicles directly impacts the likelihood of achieving specific financial goals. For retirement planning, a diversified portfolio incorporating stocks, bonds, and potentially real estate might be suitable. This allows for long-term growth while managing risk. For education funding, a combination of 529 plans (tax-advantaged savings plans), and other less risky investments might be preferred, given the shorter time horizon and the need for relatively predictable returns to cover tuition costs. Similarly, purchasing a home might require a combination of savings, mortgages, and potentially other investments to secure the necessary down payment and ongoing expenses.

Examples of Diversified Investment Portfolios

The following examples illustrate diversified investment portfolios tailored to different risk profiles. These are illustrative and should not be considered financial advice. Individual circumstances and goals should always be considered when constructing a portfolio.

- Conservative Portfolio (Low Risk): 70% Government Bonds, 20% High-Yield Savings Account, 10% Blue-Chip Stocks. This portfolio prioritizes capital preservation and stability, suitable for individuals with a shorter time horizon or low risk tolerance. It emphasizes lower-risk, fixed-income investments.

- Moderate Portfolio (Medium Risk): 40% Stocks (mix of large-cap and small-cap), 30% Bonds (mix of government and corporate), 20% Real Estate Investment Trust (REITs), 10% Alternative Investments (e.g., commodities). This portfolio aims for a balance between growth and risk mitigation. It diversifies across asset classes to reduce overall portfolio volatility.

- Aggressive Portfolio (High Risk): 70% Stocks (including emerging markets and growth stocks), 20% Alternative Investments (e.g., private equity, hedge funds), 10% Real Estate. This portfolio targets higher growth potential but accepts significantly higher risk. It’s suitable for individuals with a longer time horizon and higher risk tolerance, willing to accept potential short-term losses for potentially higher long-term gains. This strategy requires a thorough understanding of market dynamics and a higher tolerance for volatility.

Implementing and Monitoring the Plan

Successfully creating a financial plan is only half the battle; consistent implementation and monitoring are crucial for achieving your financial goals. This involves regularly reviewing your plan, making necessary adjustments, and tracking your progress. A proactive approach ensures your plan remains relevant and effective throughout changing circumstances.

Implementing your financial plan requires consistent effort and discipline. This section details strategies for regular review, progress tracking, and effective debt management to ensure you stay on track toward your objectives.

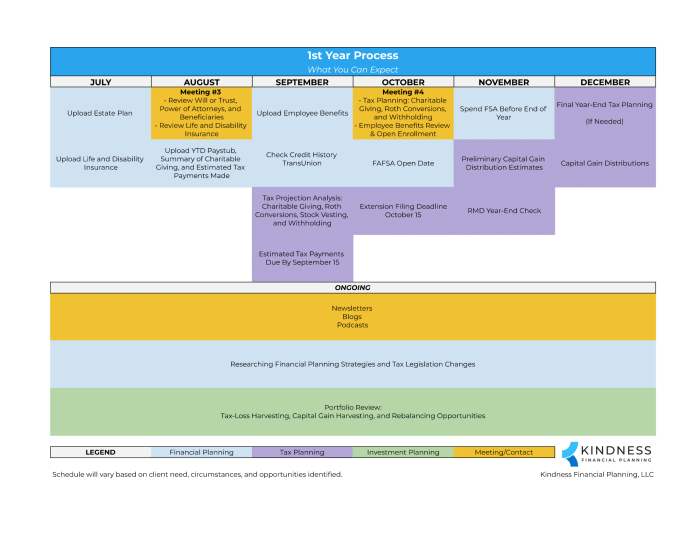

Regular Plan Review and Adjustment

Regular review of your financial plan is essential to ensure it remains aligned with your evolving circumstances and goals. Life changes, such as job changes, marriage, or the birth of a child, can significantly impact your financial situation. Similarly, market fluctuations and economic shifts necessitate adjustments to your investment strategy. A recommended schedule for review is at least annually, or more frequently if significant life events occur. During these reviews, reassess your goals, update your net worth statement, and re-evaluate your asset allocation based on your risk tolerance and time horizon. For example, a young investor with a long time horizon might tolerate a higher level of risk in their investment portfolio compared to someone nearing retirement. Adjustments to your budget, savings plan, and debt repayment strategy may also be necessary. Consider seeking professional advice if significant changes require complex adjustments to your plan.

Progress Tracking Checklist

Tracking your progress towards your financial goals provides valuable feedback and motivation. A simple checklist can help you monitor your performance and identify areas needing improvement.

- Monthly Budget Tracking: Compare actual spending against your budgeted amounts to identify areas of overspending or underspending.

- Debt Repayment Progress: Monitor the principal balance of your debts and track your progress towards paying them off. Celebrate milestones achieved.

- Investment Performance Review: Regularly review your investment portfolio’s performance, comparing it to your benchmarks and adjusting your strategy as needed.

- Savings Goal Progress: Track your savings balance and monitor your progress towards your savings goals. Note any adjustments needed to your savings rate.

- Net Worth Calculation: Calculate your net worth (assets minus liabilities) at least annually to gauge your overall financial health.

This checklist facilitates a clear picture of your financial progress and allows for timely adjustments. Consistency is key to maintaining momentum and reaching your goals.

Debt Management System

Effective debt management is crucial for achieving long-term financial stability. A well-structured system should incorporate several key elements.

- Debt Consolidation: Consider consolidating high-interest debts into a lower-interest loan to simplify repayment and reduce overall interest costs. This can streamline your payments and potentially save you money on interest.

- Debt Snowball or Avalanche Method: Choose a debt repayment strategy, such as the debt snowball (paying off the smallest debt first for motivation) or the debt avalanche (paying off the highest-interest debt first for cost savings). Both are viable methods depending on individual preferences and financial circumstances.

- Budget Allocation for Debt Payments: Allocate a specific portion of your budget towards debt repayment each month, ensuring consistent and timely payments.

- Regular Monitoring of Credit Reports: Regularly review your credit reports for errors and to track your credit score improvement. Addressing errors promptly is crucial for maintaining a healthy credit profile.

A robust debt management system requires discipline and careful planning. By systematically addressing your debts, you can improve your credit score and free up funds for other financial goals.

Risk Management and Insurance

A crucial component of comprehensive financial planning involves proactively managing potential risks that could jeopardize your financial security. Unexpected events, from illness to accidents to economic downturns, can significantly impact your financial well-being. Insurance serves as a vital tool in mitigating these risks, providing a financial safety net to protect against unforeseen circumstances and their associated costs.

Insurance works by transferring the risk of financial loss from an individual to an insurance company. In exchange for regular premium payments, the insurer agrees to compensate the policyholder for covered losses or expenses. This allows individuals to protect themselves and their families from potentially devastating financial consequences without having to bear the full burden of risk alone.

Types of Insurance Coverage

Understanding the various types of insurance available is key to developing a robust risk management strategy. Different policies address different needs and potential risks. Choosing the right coverage depends on individual circumstances, financial goals, and risk tolerance.

- Life Insurance: Provides a death benefit to beneficiaries upon the insured’s death. This can help replace lost income, cover funeral expenses, and ensure financial security for dependents. Several types exist, including term life insurance (coverage for a specific period) and whole life insurance (permanent coverage with a cash value component).

- Health Insurance: Covers medical expenses, including doctor visits, hospital stays, and prescription drugs. Health insurance protects against the potentially crippling costs of illness or injury, ensuring access to necessary medical care without facing overwhelming financial burdens. Options range from employer-sponsored plans to individual market plans with varying levels of coverage and deductibles.

- Disability Insurance: Provides income replacement in the event of an illness or injury that prevents the insured from working. This protects against loss of earnings and ensures financial stability during a period of incapacity. Policies can be purchased through employers or independently, with varying levels of benefit payments and waiting periods.

- Homeowners/Renters Insurance: Protects against property damage or loss due to events such as fire, theft, or natural disasters. Homeowners insurance also provides liability coverage for injuries or damages that occur on the property. Renters insurance protects personal belongings and provides liability coverage for renters.

- Auto Insurance: Covers damages to a vehicle and liability for injuries or damages caused in accidents. Minimum coverage requirements vary by state, but comprehensive and collision coverage provide more extensive protection.

Risk Assessment Questionnaire

Regularly assessing your personal financial vulnerabilities is crucial for effective risk management. The following questionnaire can help identify areas needing attention:

| Question | Yes | No |

|---|---|---|

| Do you have adequate life insurance to cover your dependents’ financial needs? | ||

| Do you have health insurance that adequately covers your medical expenses? | ||

| Do you have disability insurance to replace lost income if you become unable to work? | ||

| Is your home and/or belongings adequately insured against loss or damage? | ||

| Do you have sufficient emergency savings to cover 3-6 months of living expenses? | ||

| Do you have a plan to manage potential debt in case of job loss or unexpected expenses? | ||

| Have you considered the potential financial impact of long-term care needs? |

Estate Planning

Estate planning is the process of preparing for the eventual distribution of your assets after your death. It’s crucial not only to ensure your wishes are carried out but also to minimize potential tax burdens and family disputes. Effective estate planning protects your loved ones and safeguards your legacy.

Importance of Estate Planning

Failing to plan can lead to significant complications for your heirs. Without a will, the state dictates how your assets are distributed, potentially contradicting your intentions. This can lead to lengthy legal battles and emotional distress for your family. Estate planning also provides a framework for managing your assets if you become incapacitated, ensuring continuity of care and financial security. Furthermore, proactive estate planning can help minimize estate taxes and other associated costs.

Key Components of Estate Planning: Wills and Trusts

Wills are legal documents that Artikel how you want your assets distributed after your death. A will names an executor, who is responsible for carrying out your wishes. Trusts, on the other hand, are legal arrangements where a trustee manages assets for the benefit of beneficiaries. Trusts can offer more sophisticated asset protection and tax advantages compared to simply using a will. For instance, a revocable living trust allows you to maintain control over your assets during your lifetime while providing for their distribution after your death. An irrevocable trust, conversely, offers stronger asset protection but relinquishes control to the trustee.

Estate Planning Strategies for Various Family Structures

The optimal estate planning strategy depends heavily on your family structure and individual circumstances. A single individual might opt for a simple will, while a couple with children might benefit from a joint will or a trust. Families with significant wealth or complex assets may require more intricate strategies involving multiple trusts and other legal instruments. For example, a blended family might require careful consideration of how assets are distributed among children from previous marriages, potentially utilizing trusts to ensure fairness and minimize conflict. A family with a disabled child might establish a special needs trust to protect their assets and ensure ongoing support without jeopardizing government benefits.

Legal and Tax Implications of Estate Planning

Estate planning has significant legal and tax implications. Laws governing wills, trusts, and inheritance vary by jurisdiction, necessitating professional legal advice tailored to your specific location. Furthermore, estate taxes can significantly reduce the value of an estate passed to heirs. Proper estate planning strategies, such as utilizing trusts or charitable donations, can help minimize these tax liabilities. For example, the use of a Qualified Personal Residence Trust (QPRT) can help remove the value of a primary residence from your taxable estate. Careful consideration of capital gains taxes and gift taxes is also crucial in crafting a comprehensive estate plan. It is imperative to consult with both legal and financial professionals to ensure your plan complies with all relevant laws and maximizes tax efficiency.

Retirement Planning

Securing a comfortable retirement requires careful planning and proactive saving. This involves understanding various savings vehicles, estimating future income needs, and implementing strategies to maximize savings while minimizing tax burdens. Effective retirement planning ensures financial security during your later years, allowing you to enjoy a fulfilling retirement without financial worries.

Retirement Savings Vehicles

Several vehicles exist to help individuals save for retirement. These offer varying levels of tax advantages and contribution limits. Understanding the differences is crucial for choosing the best option or combination of options for your individual circumstances.

- 401(k) Plans: Employer-sponsored retirement savings plans that allow pre-tax contributions, reducing your current taxable income. Many employers offer matching contributions, essentially providing free money towards your retirement. Growth is tax-deferred, meaning you only pay taxes upon withdrawal in retirement.

- Traditional IRAs (Individual Retirement Accounts): Allow pre-tax contributions, similar to 401(k)s. Contributions may be tax-deductible depending on income and participation in employer-sponsored plans. Growth is tax-deferred, and withdrawals are taxed in retirement.

- Roth IRAs: Contributions are made after tax, meaning you don’t receive an immediate tax deduction. However, withdrawals in retirement are tax-free, providing a significant advantage. Income limits apply to contributions.

- SEP IRAs (Simplified Employee Pension Plans): For self-employed individuals and small business owners, SEP IRAs offer flexibility and high contribution limits. Contributions are tax-deductible, and growth is tax-deferred.

Calculating Retirement Income Needs

Accurately estimating your retirement income needs is vital for setting realistic savings goals. Several methods exist, each with its own strengths and limitations.

- The 80% Rule: A simple rule of thumb suggesting you’ll need approximately 80% of your pre-retirement income to maintain your lifestyle in retirement. This is a starting point and may need adjustment based on individual circumstances.

- The Replacement Ratio Method: This method involves calculating your required income based on your current spending habits, adjusting for anticipated changes in expenses during retirement (e.g., lower work-related expenses, higher healthcare costs).

- The Monte Carlo Simulation: A more sophisticated approach using software to model various market scenarios and estimate the probability of successfully funding your retirement based on your savings and spending plans. This method considers factors like inflation and investment returns.

For example, someone earning $100,000 annually might use the 80% rule to estimate a need for $80,000 in retirement income. However, they might adjust this based on factors like anticipated healthcare expenses and planned travel.

Maximizing Retirement Savings and Minimizing Tax Liabilities

Strategic planning can significantly enhance your retirement savings and reduce your tax burden.

- Maximize Employer Matching Contributions: If your employer offers matching contributions to your 401(k), contribute at least enough to receive the full match. This is essentially free money.

- Consider Tax-Advantaged Accounts: Utilize tax-advantaged accounts like 401(k)s, traditional IRAs, and Roth IRAs to reduce your current tax liability and defer taxes on investment growth.

- Diversify Investments: Spread your investments across different asset classes (stocks, bonds, real estate) to reduce risk and potentially enhance returns.

- Tax-Loss Harvesting: If you have investment losses, strategically selling losing assets can offset capital gains, reducing your tax liability.

Retirement Plan Comparison

| Plan Type | Contribution Limits (2024 – Example, check current IRS guidelines) | Tax Advantages | Withdrawal Rules |

|---|---|---|---|

| 401(k) | $23,000 (employee) + $7,500 (50+) | Pre-tax contributions, tax-deferred growth | Taxed in retirement, early withdrawals may incur penalties |

| Traditional IRA | $7,000 (individual) + $1,000 (50+) | Pre-tax contributions (may be tax deductible), tax-deferred growth | Taxed in retirement, early withdrawals may incur penalties |

| Roth IRA | $7,000 (individual) + $1,000 (50+) | After-tax contributions, tax-free withdrawals in retirement | Tax-free withdrawals after age 59 1/2, provided the account has been open for at least 5 years |

| SEP IRA | Up to 25% of net self-employment income | Pre-tax contributions, tax-deferred growth | Taxed in retirement, early withdrawals may incur penalties |

Seeking Professional Advice

Navigating the complexities of personal finance can be challenging, even with a well-defined plan. Seeking professional guidance can significantly enhance the effectiveness and success of your financial journey. Leveraging the expertise of qualified professionals provides valuable insights, reduces potential risks, and ultimately helps you achieve your financial goals more efficiently.

Financial professionals offer a wide range of specialized services, each designed to address specific aspects of financial planning. Engaging their expertise ensures a comprehensive and tailored approach, maximizing the chances of long-term financial well-being.

Types of Financial Professionals

Various financial professionals can assist in different aspects of financial planning. Choosing the right professional depends on your specific needs and financial situation.

- Financial Advisors: These professionals offer holistic financial planning services, encompassing investment management, retirement planning, tax planning, and estate planning. They provide personalized advice based on your individual circumstances and goals.

- Certified Financial Planners (CFPs): CFPs are financial advisors who have met rigorous education, examination, and experience requirements. Their certification demonstrates a high level of competency and commitment to ethical standards.

- Tax Planners/Accountants: These professionals specialize in tax strategies and compliance. They can help minimize your tax liability through legal and effective strategies, optimizing your financial position.

- Investment Managers/Brokers: These professionals manage investments on behalf of clients, selecting and overseeing a portfolio of assets to achieve specific financial goals. They may focus on specific investment strategies or asset classes.

- Estate Planning Attorneys: These legal professionals specialize in creating and implementing estate plans, including wills, trusts, and power of attorney documents. They ensure your assets are distributed according to your wishes and minimize estate taxes.

Selecting a Qualified Financial Advisor

The process of selecting a qualified financial advisor requires careful consideration and due diligence. A thorough evaluation ensures you find a professional whose expertise and approach align with your needs and values.

- Define your needs and goals: Clearly articulate your financial goals, risk tolerance, and investment timeline. This will help you identify the type of advisor best suited to your circumstances.

- Research potential advisors: Check credentials, certifications, and experience. Look for professionals with a proven track record and positive client reviews. Resources like the Certified Financial Planner Board of Standards (CFP Board) can help verify credentials.

- Conduct interviews: Schedule interviews with several potential advisors to discuss your financial situation and their approach. Assess their communication style, fee structure, and investment philosophy.

- Check references: Contact previous clients to gain insights into the advisor’s professionalism, responsiveness, and effectiveness.

- Review the fee structure: Understand how the advisor charges for their services. Fees can be based on assets under management, hourly rates, or a combination of both.

- Verify their fiduciary duty: Ensure the advisor acts in your best interest, legally bound by a fiduciary duty to prioritize your financial well-being above their own.

Ongoing Communication and Collaboration

Maintaining open and consistent communication with your financial professional is crucial for the long-term success of your financial plan. Regular reviews and adjustments ensure your strategy remains aligned with your evolving needs and market conditions.

Regular meetings allow for proactive adjustments to your financial strategy, accommodating changes in your personal circumstances, market fluctuations, or the emergence of new financial opportunities. This collaborative approach ensures your financial plan remains dynamic and responsive to your changing needs, maximizing its effectiveness and long-term benefits. A strong advisor-client relationship fosters trust and mutual understanding, crucial for making informed financial decisions throughout your life.

Outcome Summary

Mastering the Financial Planning Process is a journey, not a destination. By consistently reviewing and adapting your plan, you can navigate life’s unexpected turns while staying focused on your financial aspirations. Remember, proactive planning empowers you to take control of your financial future, securing stability and achieving your dreams. This comprehensive guide provides the foundation; consistent effort and informed decision-making will pave the way to lasting financial success.

General Inquiries

How often should I review my financial plan?

At least annually, or more frequently if significant life changes occur (marriage, job loss, etc.).

What is the difference between a 401(k) and an IRA?

A 401(k) is employer-sponsored, often with matching contributions, while an IRA is self-directed and offers various tax advantages.

How can I determine my risk tolerance?

Consider your comfort level with potential investment losses and your time horizon. Online questionnaires and discussions with financial advisors can help.

What is the importance of diversification in investing?

Diversification reduces risk by spreading investments across different asset classes, minimizing the impact of poor performance in any single area.

Where can I find a qualified financial advisor?

Seek referrals, check professional certifications (e.g., CFP), and thoroughly research potential advisors before making a decision.