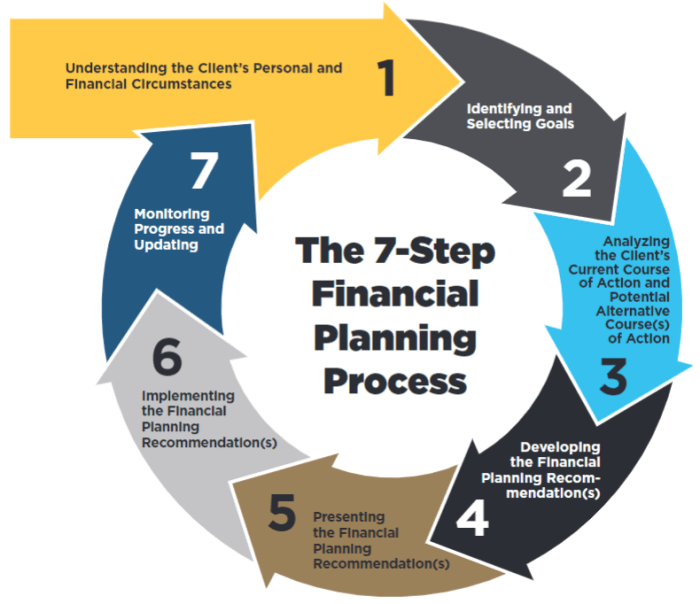

Securing your financial future requires a proactive and well-defined strategy. The Financial Planning Process isn’t just about saving money; it’s about aligning your financial goals with your overall life aspirations, creating a roadmap to achieve financial freedom and security. This guide explores the key stages, from assessing your current financial situation to developing a robust plan and mitigating potential risks.

We will delve into the crucial elements of short-term and long-term financial goal setting, exploring various investment strategies tailored to different risk tolerances. We’ll also examine the importance of debt management, insurance planning, tax optimization, and estate planning, ensuring a holistic approach to securing your financial well-being. This process is iterative, requiring regular review and adjustments to stay on track.

Defining Financial Planning

Financial planning is the process of creating a comprehensive roadmap for your financial future. It involves setting financial goals, assessing your current financial situation, and developing strategies to achieve those goals. A well-structured plan considers various aspects of your life, ensuring you’re prepared for both the expected and the unexpected. It’s a dynamic process, requiring regular review and adjustment as your circumstances change.

Financial planning is not just about accumulating wealth; it’s about managing your resources effectively to achieve your life goals. This includes everything from saving for retirement and paying off debt to planning for major purchases and protecting your assets. A successful financial plan empowers you to make informed decisions, leading to greater financial security and peace of mind.

Core Components of a Comprehensive Financial Plan

A comprehensive financial plan typically includes several key components. These work together to create a holistic picture of your financial health and guide your decision-making. These components are interconnected and should be considered as a whole, not in isolation.

- Financial Goal Setting: Clearly defining short-term and long-term goals is crucial. These goals should be specific, measurable, achievable, relevant, and time-bound (SMART).

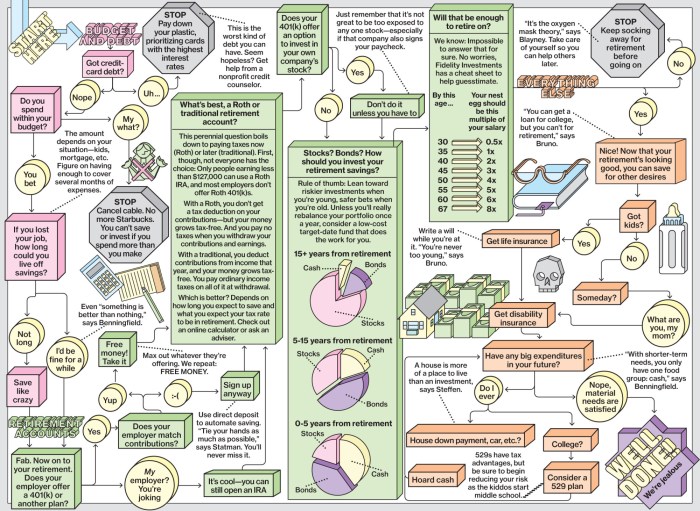

- Budgeting and Cash Flow Management: Tracking income and expenses is essential to understand your current financial situation and identify areas for improvement.

- Debt Management: Developing a strategy to manage and pay down debt is vital for improving your financial health. This might involve prioritizing high-interest debt or negotiating lower interest rates.

- Investment Planning: Investing your money to grow your wealth over time is a key component of long-term financial planning. This requires understanding different investment vehicles and developing a suitable portfolio.

- Risk Management: Protecting yourself against unforeseen events, such as illness, accidents, or job loss, is crucial. This often involves insurance planning.

- Retirement Planning: Planning for retirement involves determining how much you need to save and invest to maintain your desired lifestyle after you stop working.

- Estate Planning: This involves planning for the distribution of your assets after your death, including creating a will and considering trusts.

Short-Term versus Long-Term Financial Goals

Short-term goals are typically achieved within one to three years, while long-term goals extend beyond three years. The strategies employed to achieve each type of goal differ significantly.

- Short-Term Goals: Examples include paying off credit card debt, saving for a down payment on a car, or funding a vacation. These goals often involve saving and budgeting strategies.

- Long-Term Goals: Examples include buying a house, funding a child’s education, or planning for retirement. These goals typically involve long-term investments and careful financial planning over many years.

Financial Planning Methodologies

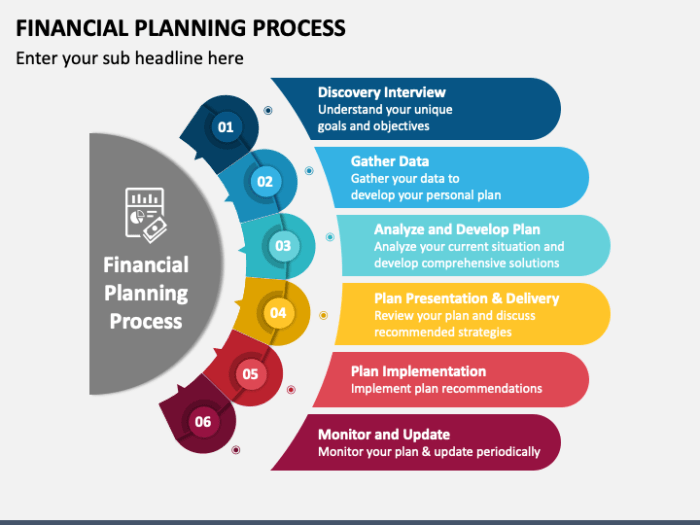

Several methodologies guide the financial planning process. The best approach depends on individual circumstances and preferences.

- Traditional Financial Planning: This approach focuses on building a comprehensive plan covering all aspects of personal finances.

- Behavioral Finance: This incorporates psychological factors influencing financial decisions, aiming to address emotional biases that can hinder financial success.

- Goal-Based Financial Planning: This prioritizes achieving specific financial goals, structuring the plan around those objectives.

Hypothetical Financial Plan for a Young Professional

Let’s consider a 25-year-old single professional, earning $60,000 annually, with minimal debt and a desire to save for a down payment on a house and retirement.

- Short-Term Goals (0-3 years): Save $20,000 for a down payment, build an emergency fund of 3-6 months’ expenses (approximately $10,000-$20,000).

- Long-Term Goals (3+ years): Save for retirement through a 401(k) or IRA, aiming for at least 15% of annual income. Invest in a diversified portfolio of stocks and bonds.

- Strategies: Create a detailed budget, aggressively pay down any existing debt, maximize employer-sponsored retirement plans, invest consistently in low-cost index funds.

This plan demonstrates a balance between short-term needs and long-term financial security. Regular review and adjustments are crucial to adapt to changing circumstances and progress toward financial goals.

Assessing Financial Situation

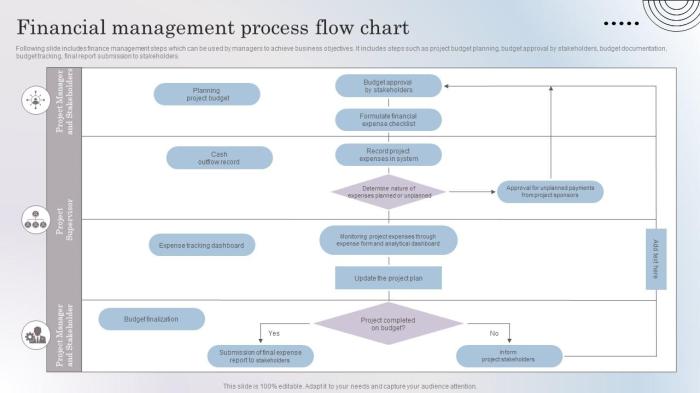

Understanding your current financial standing is the cornerstone of effective financial planning. A clear picture of your assets, liabilities, and cash flow allows you to make informed decisions about your financial future, setting realistic goals and developing strategies to achieve them. This assessment provides a baseline against which you can measure your progress and make necessary adjustments along the way.

Key Elements of a Personal Financial Statement

A comprehensive personal financial statement typically includes a balance sheet and a cash flow statement. The balance sheet provides a snapshot of your financial position at a specific point in time, showing your assets (what you own), liabilities (what you owe), and net worth (the difference between assets and liabilities). The cash flow statement, on the other hand, tracks the flow of money into and out of your accounts over a period of time, usually a month or a year. This allows you to identify areas where you are spending more than you earn and opportunities to improve your financial situation.

Calculating Net Worth and Analyzing Cash Flow

Net worth is calculated by subtracting total liabilities from total assets. For example, if your total assets are $150,000 and your total liabilities are $50,000, your net worth is $100,000. Analyzing cash flow involves tracking your income and expenses. This can be done manually using a spreadsheet or budgeting app, or by utilizing online banking tools that provide detailed transaction history. Identifying patterns in spending helps to pinpoint areas where adjustments can be made to improve your cash flow. For instance, consistently high spending on dining out might indicate an area for potential savings.

The Importance of Debt Management in Financial Planning

Effective debt management is crucial for long-term financial health. High levels of debt can significantly impact your ability to save, invest, and achieve your financial goals. Strategies for managing debt include creating a debt repayment plan, prioritizing high-interest debts, and exploring debt consolidation options. A well-structured debt repayment plan, such as the snowball or avalanche method, can help you systematically pay down your debts and reduce the overall interest burden. For example, the snowball method prioritizes paying off the smallest debt first for motivational purposes, while the avalanche method focuses on paying off the highest-interest debt first to minimize total interest paid.

Sample Personal Balance Sheet

| Assets | Liabilities | Net Worth | Notes |

|---|---|---|---|

| Checking Account: $5,000 | Credit Card Debt: $2,000 | ||

| Savings Account: $10,000 | Student Loan: $15,000 | ||

| Investment Portfolio: $25,000 | Mortgage: $100,000 | ||

| Home: $200,000 | Car Loan: $5,000 | ||

| Car: $15,000 | |||

| Total Assets: $265,000 | Total Liabilities: $122,000 | $143,000 | Net Worth = Total Assets – Total Liabilities |

Setting Financial Goals

Setting clear, achievable financial goals is crucial for effective financial planning. Without defined objectives, your efforts may be scattered and unproductive, making it difficult to measure progress and achieve long-term financial security. This section Artikels a structured approach to goal setting and prioritization, ensuring your financial plan aligns with your broader life aspirations.

A well-defined financial goal provides a roadmap for your financial decisions. It guides your savings, investments, and spending habits, ultimately leading to the attainment of your desired financial outcomes. The process involves identifying your aspirations, translating them into measurable targets, and developing strategies to reach them.

SMART Goals Framework for Financial Planning

The SMART framework provides a structured approach to defining effective financial goals. Each goal should be Specific, Measurable, Achievable, Relevant, and Time-bound. This ensures clarity, focus, and accountability throughout the planning process.

For example, instead of a vague goal like “save more money,” a SMART goal would be: “Save $10,000 (Measurable) for a down payment on a house (Specific) within two years (Time-bound) by increasing monthly savings by $417 (Achievable) and aligning this with my long-term goal of homeownership (Relevant).” This level of detail makes the goal actionable and easily trackable.

Prioritizing Financial Goals

Prioritizing financial goals is essential, especially when multiple objectives compete for resources. Consider factors like urgency, importance, and potential impact when ranking your goals. A common approach involves categorizing goals based on their time horizon (short-term versus long-term) and their alignment with broader life goals. This ensures you allocate resources effectively and achieve the most impactful objectives first.

For instance, an emergency fund might take precedence over a long-term investment goal, as it addresses immediate needs and reduces financial vulnerability. Similarly, goals aligned with core life values (e.g., supporting children’s education) might receive higher priority than less essential goals (e.g., a luxury vacation).

Examples of Short-Term and Long-Term Financial Objectives

Short-term goals typically have a time horizon of less than one year, while long-term goals extend beyond that. Short-term goals often serve as stepping stones toward achieving larger, long-term objectives.

Short-Term Examples: Paying off credit card debt, saving for a vacation, creating an emergency fund, purchasing a new appliance. These goals are typically more easily achievable and provide a sense of accomplishment that motivates further progress towards long-term goals.

Long-Term Examples: Buying a home, funding retirement, paying for children’s education, starting a business. These goals require consistent effort and planning over an extended period. Successfully achieving these long-term goals often involves careful investment strategies and disciplined saving habits.

Aligning Financial Goals with Overall Life Goals

Your financial goals should support your broader life aspirations. Consider your career ambitions, family plans, lifestyle preferences, and personal values when setting financial objectives. This alignment ensures your financial plan contributes to a fulfilling and meaningful life.

For example, if your life goal is to travel extensively after retirement, your financial plan should incorporate strategies for accumulating sufficient funds and managing expenses during retirement. Similarly, if your goal is to start a family, your financial plan should account for the costs of raising children, including education and healthcare.

Developing a Financial Strategy

Crafting a robust financial strategy involves aligning your investment choices, retirement planning, and insurance coverage with your individual risk tolerance and long-term goals. This process transforms your financial goals into actionable steps, providing a roadmap for achieving financial security. A well-defined strategy considers various factors, from market fluctuations to personal circumstances, to ensure your plan remains adaptable and effective.

Investment Strategies Based on Risk Tolerance

Investment strategies should be tailored to individual risk tolerance. Generally, risk tolerance is categorized as conservative, moderate, and aggressive. Conservative investors prioritize capital preservation and low risk, often favoring low-volatility investments. Moderate investors seek a balance between risk and return, diversifying their portfolio across different asset classes. Aggressive investors are comfortable with higher risk for the potential of greater returns.

Retirement Planning Approaches

Several approaches exist for retirement planning. Defined benefit plans, often offered by employers, guarantee a specific monthly payment upon retirement. Defined contribution plans, such as 401(k)s and IRAs, require individuals to contribute regularly, with investment growth dependent on market performance. A comprehensive strategy often combines elements of both, leveraging the security of guaranteed income with the potential growth of self-directed investments. For example, a retiree might rely on a defined benefit pension for a stable base income, supplementing it with withdrawals from a diversified investment portfolio built through a 401(k) and IRA contributions.

The Role of Insurance in Financial Planning

Insurance plays a crucial role in mitigating financial risks. Life insurance provides financial security for dependents in the event of the policyholder’s death. Health insurance protects against the high costs of medical care. Disability insurance replaces income lost due to injury or illness. Property and casualty insurance covers losses from damage to property or liability claims. A comprehensive financial plan incorporates appropriate insurance coverage to safeguard against unforeseen events and their potential financial impact. For instance, a young family might prioritize life insurance to protect their children’s future, while a self-employed individual might need disability insurance to maintain income stability.

Sample Investment Portfolio Allocation

A sample portfolio allocation for a moderate-risk investor might be:

| Asset Class | Allocation |

|---|---|

| Stocks (Large-Cap) | 40% |

| Stocks (Small-Cap) | 10% |

| Bonds (Investment Grade) | 30% |

| Cash/Money Market | 20% |

This allocation provides a balance between growth potential (stocks) and stability (bonds and cash). The specific percentages can be adjusted based on individual risk tolerance and time horizon. An aggressive investor might increase the stock allocation, while a conservative investor might increase the bond and cash allocations. This is a simplified example, and professional financial advice is recommended for personalized portfolio construction.

Implementing and Monitoring the Plan

Putting your financial plan into action requires dedication and consistent effort. This phase involves actively managing your finances according to the strategies you’ve developed, and regularly tracking your progress to ensure you’re on track to achieve your goals. Effective implementation and monitoring are crucial for realizing your financial aspirations.

Successful implementation hinges on translating your financial strategy into concrete actions. This involves making conscious decisions about spending, saving, investing, and debt management, all aligned with your previously defined goals. Regular monitoring allows you to identify any deviations from your plan and make necessary adjustments to stay on course.

Practical Steps for Implementing a Financial Plan

Implementing your financial plan requires a systematic approach. Begin by prioritizing your goals based on urgency and importance. Then, break down larger goals into smaller, manageable steps. This makes the process less daunting and allows for more frequent progress checks. For instance, if your goal is to pay off a mortgage, you might break it down into monthly payment milestones. Consistent action, even in small increments, leads to significant long-term results.

Budgeting Tools and Techniques

Utilizing budgeting tools and techniques is crucial for effective financial plan implementation. Several methods exist, each offering unique advantages. A simple spreadsheet can effectively track income and expenses. Budgeting apps, available on smartphones and computers, automate many aspects of budget management, providing real-time insights into spending habits. The 50/30/20 rule, which allocates 50% of income to needs, 30% to wants, and 20% to savings and debt repayment, offers a straightforward framework for budgeting. Zero-based budgeting, where every dollar is assigned a purpose, provides a comprehensive approach to managing finances. The choice of tool depends on individual preferences and technological comfort.

Importance of Regular Financial Plan Reviews

Regular reviews are essential to ensure your financial plan remains relevant and effective. Life circumstances change, and your financial goals may evolve. Annual reviews are generally recommended, allowing you to assess progress, adjust for unforeseen events, and adapt to changing economic conditions. For instance, a job change or unexpected medical expenses might necessitate revisions to your savings or investment strategies. Regular review ensures that your plan continues to serve your evolving needs and circumstances. Without periodic reviews, your plan risks becoming obsolete and failing to achieve its intended purpose.

Checklist for Monitoring Progress Toward Financial Goals

A checklist facilitates efficient tracking of progress. This provides a structured approach to monitoring your financial health and identifying areas needing attention.

| Goal | Target Date | Progress | Action Needed | Review Date |

|---|---|---|---|---|

| Pay off credit card debt | December 31, 2024 | $500 remaining | Increase debt repayment | October 31, 2024 |

| Save for down payment on a house | June 30, 2025 | $10,000 saved of $20,000 goal | Increase savings rate | March 31, 2025 |

| Increase investment portfolio | December 31, 2026 | Portfolio value increased by 8% | Rebalance portfolio | September 30, 2026 |

Risk Management in Financial Planning

Effective financial planning necessitates a thorough understanding and proactive management of potential risks. Ignoring risk can severely undermine even the most meticulously crafted plan, leading to significant financial setbacks. This section explores common financial risks, strategies for mitigation, and the integration of risk management into your overall financial strategy.

Common Financial Risks and Their Potential Impact

Various financial risks can significantly impact an individual’s or family’s financial well-being. These risks can be broadly categorized, but understanding their potential consequences is crucial for effective planning. Failure to adequately address these risks can lead to substantial financial losses and hinder the achievement of long-term goals.

Strategies for Mitigating Financial Risks

Mitigating financial risks involves implementing strategies to reduce the likelihood and impact of negative events. A multi-pronged approach is often most effective, combining various techniques tailored to specific risks. The goal is not to eliminate risk entirely – that’s often impossible – but to manage it to an acceptable level.

Examples of Risk Management Tools and Techniques

Several tools and techniques can be employed to effectively manage financial risks. These range from simple strategies like diversification to more complex instruments like insurance policies. The appropriate tools will depend on individual circumstances, risk tolerance, and financial goals. For instance, insurance policies act as a crucial risk mitigation tool, transferring the risk of unforeseen events (like illness or property damage) to an insurance company. Diversification of investments across different asset classes reduces the impact of poor performance in any single asset. Regularly reviewing and adjusting your portfolio based on market conditions and your changing circumstances is also critical.

Incorporating Risk Management into a Financial Plan

Integrating risk management into your financial plan requires a systematic approach. It starts with identifying potential risks, assessing their likelihood and potential impact, and then developing strategies to mitigate those risks. This involves setting aside emergency funds, securing adequate insurance coverage, and diversifying investments. Regularly reviewing and updating the risk management component of your plan is crucial as your circumstances and the financial landscape change. For example, a young family with children might prioritize life insurance and disability insurance, while a retiree might focus on managing inflation risk and healthcare costs. The plan should be a living document, adaptable to changing circumstances and new information.

Tax Planning Considerations

Effective tax planning is an integral part of comprehensive financial planning. Minimizing your tax liability allows for greater accumulation of wealth and improved overall financial health. Understanding tax laws and employing suitable strategies can significantly impact your long-term financial goals.

Key Tax Considerations in Financial Planning

Several key tax considerations should be factored into your financial plan. These include understanding your tax bracket, the various types of income you receive (e.g., salary, investment income, capital gains), and the applicable tax rates for each. Additionally, deductions, credits, and tax-advantaged accounts play a crucial role in minimizing your tax burden. Careful consideration of these factors allows for optimized tax efficiency.

Tax-Saving Strategies

Numerous strategies can help reduce your tax liability. These strategies vary based on individual circumstances and financial goals. Common approaches include maximizing contributions to tax-advantaged retirement accounts (like 401(k)s and IRAs), taking advantage of deductions for charitable contributions, and strategically timing capital gains and losses. Tax loss harvesting, where losses are used to offset gains, is another effective technique. Moreover, understanding the tax implications of various investment vehicles is crucial for effective tax planning. For example, choosing investments with lower tax implications, like municipal bonds for some investors, can significantly reduce tax burdens.

Importance of Tax Diversification

Tax diversification is not about simply spreading investments across different asset classes; it’s also about diversifying your tax exposure. By utilizing a combination of tax-advantaged and taxable accounts, you can create a more resilient and efficient tax strategy. This approach reduces the overall risk associated with relying solely on one type of account and allows for greater flexibility in managing your tax liability over time. For instance, a combination of a Roth IRA (tax-free withdrawals in retirement) and a traditional IRA (tax-deferred growth) allows for greater control over when taxes are paid, based on your anticipated income in retirement.

Comparison of Tax-Advantaged Investment Accounts

The following table compares different tax-advantaged investment accounts, highlighting their key features:

| Account Type | Tax Advantages | Investment Limits | Suitable Investors |

|---|---|---|---|

| Traditional IRA | Tax-deductible contributions (subject to income limits), tax-deferred growth | Contribution limits set annually by the IRS | Individuals who expect to be in a lower tax bracket in retirement than they are currently. |

| Roth IRA | Tax-free withdrawals in retirement (subject to certain conditions) | Contribution limits set annually by the IRS (income limits apply) | Individuals who expect to be in a higher tax bracket in retirement than they are currently. |

| 401(k) | Tax-deferred growth, potential employer matching contributions | Contribution limits set annually by the IRS | Employees offered a 401(k) plan by their employer. |

| 529 Plan | Tax-advantaged growth for qualified education expenses | Contribution limits vary by state | Individuals saving for future education expenses. |

Estate Planning

Estate planning is a crucial component of comprehensive financial planning. It involves the process of legally organizing your assets and outlining how you want them distributed after your death. Effective estate planning protects your loved ones from potential financial hardship and ensures your wishes are respected regarding the distribution of your property and the care of any dependents. Failing to plan can lead to lengthy legal battles, significant tax burdens, and emotional distress for your family.

The Importance of Estate Planning in Financial Planning

Estate planning is inextricably linked to overall financial well-being. It ensures that your accumulated wealth is distributed according to your desires, minimizing potential conflicts and maximizing the benefit to your heirs. A well-structured estate plan protects assets from unnecessary taxes and legal fees, preserving more of your legacy for your beneficiaries. Furthermore, it provides peace of mind, knowing that your affairs are in order and your family is protected.

Estate Planning Tools and Techniques

Several tools and techniques facilitate effective estate planning. These vary depending on individual circumstances and financial complexity.

Wills and Trusts in Estate Planning

A will is a legal document that Artikels how you wish to distribute your assets after your death. It names an executor who will manage the distribution process. A trust, on the other hand, is a legal arrangement where assets are held by a trustee for the benefit of beneficiaries. Trusts offer more control and flexibility than wills, providing options for managing assets and protecting them from creditors or taxes. For example, a revocable living trust allows you to change or revoke the trust during your lifetime, while an irrevocable trust offers greater asset protection but limits your control.

Estate Planning Considerations for Different Family Structures

Estate planning needs vary significantly depending on family structure. A single individual might focus on naming a beneficiary for their assets and designating a guardian for any dependents. A married couple might consider joint ownership of assets, survivorship rights, and strategies for minimizing estate taxes. Families with minor children need to address guardianship and the management of assets until the children reach adulthood. For example, a family with significant wealth might establish a trust to manage assets for their children, ensuring responsible distribution and protecting the inheritance from mismanagement. Conversely, a family with modest assets might focus on a simple will and life insurance to provide financial security for surviving family members.

Seeking Professional Advice

Navigating the complexities of personal finance can be challenging, even with a well-defined plan. Seeking professional financial advice can significantly enhance the effectiveness and success of your financial journey, providing valuable expertise and support often unavailable through self-directed efforts. This section explores the benefits of professional guidance, the qualifications of competent advisors, the various types of advisors available, and how to select a suitable professional for your needs.

The benefits of engaging a financial advisor are numerous and impactful. A qualified advisor brings specialized knowledge and experience to bear on your unique financial situation, offering objective insights and strategies that may not be readily apparent to someone without extensive financial training. This expertise can lead to better investment decisions, more effective tax planning, and a more comprehensive approach to wealth management, ultimately improving your financial well-being. Furthermore, a professional advisor can provide much-needed accountability, helping you stay on track with your financial goals and make necessary adjustments along the way.

Financial Advisor Qualifications

Competent financial advisors possess a combination of education, experience, and certifications. While specific requirements vary by jurisdiction and the type of advice offered, a strong foundation in financial principles is essential. Many advisors hold degrees in finance, economics, or a related field. Professional certifications, such as the Certified Financial Planner (CFP) designation, demonstrate a commitment to ongoing professional development and adherence to a strict code of ethics. Extensive experience in managing client portfolios and providing financial guidance is also a crucial indicator of competence. Thorough due diligence, including checking professional licenses and disciplinary records, is always recommended.

Types of Financial Advisors

Several types of financial advisors cater to different needs and financial situations. These include Certified Financial Planners (CFPs), who offer comprehensive financial planning services; Registered Investment Advisors (RIAs), who are fiduciaries obligated to act in their clients’ best interests; and financial brokers, who typically sell financial products and may receive commissions. Each type has its own strengths and limitations, and the best choice depends on individual circumstances and preferences. For example, a high-net-worth individual might benefit from a wealth manager specializing in complex investment strategies, while someone starting their financial planning journey might find a comprehensive financial planner more suitable.

Choosing a Suitable Financial Advisor

Selecting the right financial advisor is a crucial step in the financial planning process. Several factors should be considered. Firstly, assess the advisor’s experience and qualifications, verifying their credentials and checking for any disciplinary actions. Secondly, evaluate their approach to financial planning and whether it aligns with your personal values and risk tolerance. Thirdly, consider the fees charged and the services provided, ensuring transparency and clarity in the fee structure. Finally, schedule consultations with several advisors before making a decision to find a professional you feel comfortable with and trust implicitly. Building a strong advisor-client relationship based on mutual respect and open communication is vital for long-term success.

Closing Summary

Mastering the Financial Planning Process empowers you to take control of your financial destiny. By understanding your current financial health, setting clear goals, and developing a strategic plan, you can navigate the complexities of personal finance with confidence. Remember that consistent monitoring and adaptation are vital for long-term success. This journey towards financial security is a marathon, not a sprint, and professional guidance can significantly enhance your progress.

User Queries

What is the difference between a financial advisor and a financial planner?

While the terms are often used interchangeably, financial advisors typically offer a broader range of services, including investment management, while financial planners focus more on developing comprehensive financial plans encompassing various aspects of your financial life.

How often should I review my financial plan?

Ideally, your financial plan should be reviewed annually, or more frequently if significant life changes occur (marriage, job change, birth of a child, etc.).

What is the role of insurance in financial planning?

Insurance acts as a crucial risk mitigation tool, protecting you from unforeseen events like illness, accidents, or property damage that could significantly impact your financial stability.

How can I choose the right financial advisor?

Look for a qualified professional with relevant certifications (e.g., CFP), experience, a good reputation, and a fee structure that aligns with your needs and budget. Check references and ensure their approach aligns with your financial goals and risk tolerance.