Financial Planning Process Review: Let’s face it, nobody *loves* poring over spreadsheets, but a well-structured financial plan is the difference between a comfortable retirement and ramen noodles for dinner. This review delves into the nitty-gritty of crafting, analyzing, and refining a financial strategy that’s as robust as a grizzly bear and as elegant as a swan (mostly the robust part, let’s be honest).

This document provides a comprehensive guide to reviewing your financial planning process, covering everything from defining the scope of the review and gathering essential data to developing actionable recommendations and monitoring their implementation. We’ll explore various strategies, address potential pitfalls, and offer practical tips to help you navigate the often-complex world of financial planning. Prepare for a journey filled with insightful analysis and, dare we say, a touch of financial enlightenment (or at least a better understanding of your 401k).

Defining the Scope of a Financial Planning Process Review

So, you’ve decided to take a peek under the hood of your financial planning process – bravo! Like a well-oiled machine (or, let’s be honest, a slightly rusty but still functional one), your financial plan needs regular maintenance to ensure it’s chugging along smoothly and efficiently, delivering the desired results. A review isn’t just about tweaking a few numbers; it’s about ensuring your plan still aligns with your ever-evolving life and financial goals.

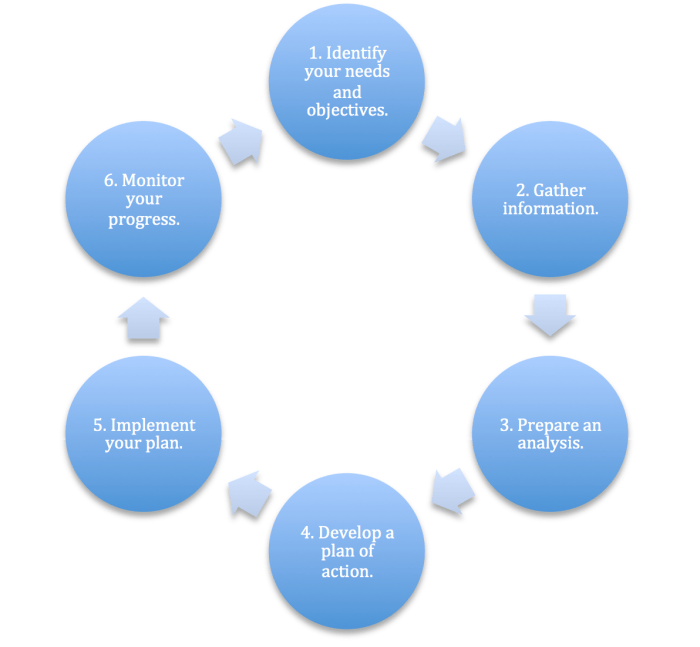

A comprehensive financial planning process typically involves several key components, much like a delicious financial layer cake. We’re talking about data gathering (the delicious sponge), goal setting (the sweet buttercream), strategy development (the delectable jam), implementation (the careful layering), and monitoring and review (the delightful final frosting). Missing even one layer can result in a less-than-satisfying (and potentially financially disastrous) outcome.

Typical Components of a Financial Planning Process

A robust financial plan typically includes elements such as: defining financial goals (retirement, education, etc.), assessing current financial situation (assets, liabilities, income, expenses), developing investment strategies, tax planning, risk management, estate planning, and regular monitoring and adjustments. Think of it as a comprehensive health checkup for your finances, covering everything from your blood pressure (liquidity) to your cholesterol (debt).

Reasons for a Financial Planning Process Review

Several factors can necessitate a review of your financial planning process. Significant life events, such as marriage, divorce, the birth of a child, job changes, or inheritance, can dramatically alter your financial landscape, rendering your existing plan obsolete. Market fluctuations, changes in tax laws, or simply a desire to optimize your investment strategy can also trigger the need for a thorough review. Ignoring these changes is like ignoring a flat tire – it might seem okay for a while, but it will eventually lead to a breakdown.

Situations Triggering a Financial Planning Process Review

Let’s get specific. A major life event like a sudden inheritance (suddenly you have more money than you know what to do with!), a career shift (hello, new salary!), or a change in family structure (a new addition to the family!) would absolutely warrant a review. Similarly, significant market downturns (ouch!), unexpected expenses (that surprise plumbing bill!), or a change in your risk tolerance (you’re getting older and more cautious!) should all trigger a thorough examination of your current financial strategy. Ignoring these signals could lead to missed opportunities or even financial distress.

Key Stakeholders and Their Roles

The individuals involved in a financial planning process review will vary depending on the complexity of the plan. However, key players often include the client (you!), the financial advisor (your trusted guide), and potentially other professionals like tax advisors, attorneys, or insurance specialists (the supporting cast). The client’s role is to provide accurate information and clearly communicate their goals and concerns. The financial advisor analyzes the data, provides recommendations, and helps implement the plan. Other professionals provide specialized expertise as needed. Think of it as a well-orchestrated team effort, each member playing a crucial role in ensuring the success of the review.

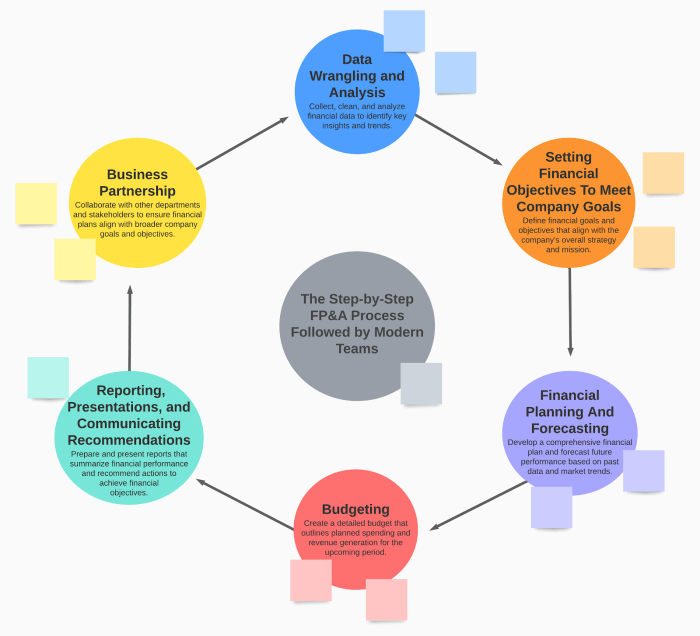

Gathering and Analyzing Financial Data: Financial Planning Process Review

Let’s get down to the nitty-gritty – the numbers! This stage isn’t just about crunching data; it’s about unearthing the financial secrets your client’s portfolio holds. Think of it as a financial archeological dig, except instead of dusty relics, we’re after sparkling insights.

Gathering and analyzing financial data is the bedrock of any successful financial planning review. Without accurate and complete information, our recommendations would be like building a house on quicksand – unstable and prone to collapse. We need to be thorough, methodical, and (dare we say it?) a little bit obsessive about detail.

Essential Financial Data Points

A comprehensive financial planning review requires a wide range of data points. Think of it as a financial profile, painting a vivid picture of your client’s current financial standing. Omitting crucial information would be like trying to paint a portrait with only half the canvas – incomplete and frankly, a bit silly. The key data points include income (from all sources!), expenses (categorized for clarity), assets (including investments, real estate, and personal property), liabilities (debts, loans, and mortgages), and tax information (because let’s face it, nobody loves taxes, but they’re essential to understanding the whole picture). Don’t forget insurance policies and estate planning documents, as these are often crucial pieces of the puzzle.

Methods for Collecting and Verifying Data

Data collection involves a multi-pronged approach. We start with client interviews – a chance to build rapport and gather qualitative data. Then, we request supporting documentation: bank statements, tax returns, investment account statements, and loan agreements. Think of this as forensic accounting – meticulously piecing together the financial story. Verification is crucial; we cross-reference information from multiple sources to ensure accuracy and consistency. Discrepancies are investigated thoroughly, using follow-up calls and requests for clarification.

Addressing Inconsistencies and Gaps

Inconsistent or missing data is inevitable. It’s not a sign of failure; it’s an opportunity to delve deeper. Our process involves identifying these gaps, prioritizing them based on their potential impact, and then proactively seeking clarification from the client. This may involve further interviews, requests for additional documentation, or even consulting with external experts if needed. Remember, a gap in the data is a gap in our understanding – we must strive for completeness.

Organizing and Presenting Financial Data

Presenting data clearly is crucial. A disorganized presentation is a recipe for confusion and missed opportunities. We utilize clear and concise summaries, tables, and charts to visually represent the client’s financial picture. This allows for easy comprehension and facilitates effective communication during the review process. Below is an example of how we might organize the collected data:

| Data Point | Source | Date Collected | Verification Method |

|---|---|---|---|

| Annual Income | Client-provided Tax Return | 2023-10-26 | Cross-referenced with W-2 forms |

| Mortgage Balance | Mortgage Statement | 2023-10-27 | Confirmed with online account access |

| Investment Portfolio Value | Brokerage Account Statement | 2023-10-28 | Compared with online account balance |

| Credit Card Debt | Credit Card Statement | 2023-10-29 | Verified through client’s online account |

Evaluating the Effectiveness of Current Strategies

So, you’ve gathered the financial data – the spreadsheets are stacked higher than a banker’s ambition. Now comes the fun part: dissecting the effectiveness of your client’s current financial strategies. Think of it as a financial autopsy, but hopefully, without the grim reaper. We’re looking for areas of strength and, let’s be honest, areas ripe for improvement.

The goal here isn’t to simply critique; it’s to understand how well the current plan aligns with the client’s goals, risk tolerance, and the ever-shifting landscape of the financial world. We’ll compare and contrast strategies, identify weaknesses, and prepare for the inevitable market hiccups.

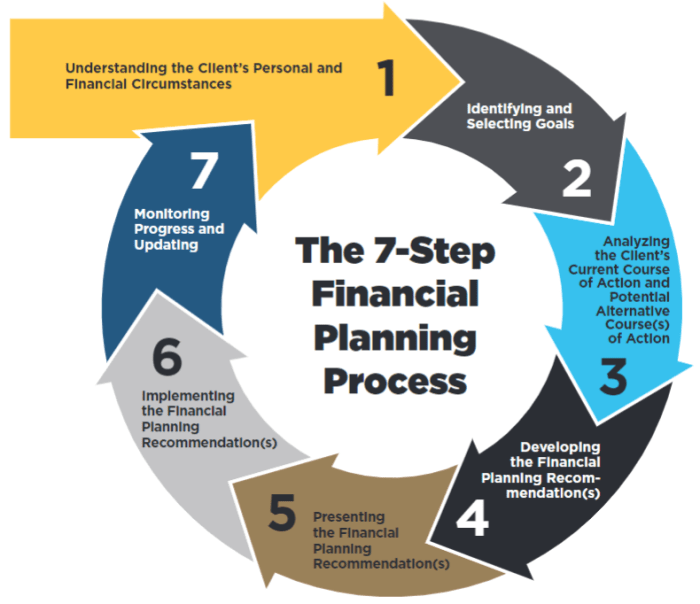

Comparison of Financial Planning Strategies

Different financial strategies suit different circumstances like a perfectly tailored suit (though hopefully less expensive). For instance, a young professional with a high risk tolerance and a long time horizon might benefit from a portfolio heavily weighted towards equities, aiming for aggressive growth. Conversely, someone nearing retirement might favor a more conservative approach, prioritizing capital preservation over high-growth potential. We need to analyze the client’s current strategy in the context of their individual profile. A balanced portfolio, incorporating a mix of stocks, bonds, and other assets, often provides a suitable middle ground, balancing risk and reward. The specific asset allocation will depend on the individual’s risk profile and time horizon. A comprehensive analysis should consider factors such as inflation, interest rates, and potential tax implications.

Identification of Areas for Improvement

This section involves a critical, yet constructive, examination of the current financial plan. Are there any glaring inefficiencies? Perhaps the client is paying excessively high fees for investment management, or their asset allocation is overly concentrated in a single sector, creating unnecessary risk. Maybe their diversification strategy needs a tune-up. We’re looking for areas where small tweaks can lead to significant improvements in long-term performance and risk management. For example, identifying underperforming assets and recommending reallocation to higher-performing ones can boost returns. Similarly, optimizing tax efficiency through strategic tax-loss harvesting can enhance overall financial health.

Impact of Market Fluctuations and Economic Trends

The financial world isn’t static; it’s a rollercoaster of booms and busts. We need to assess how the client’s current plan would weather various economic storms. A recent example would be the impact of rising interest rates on bond portfolios. A detailed analysis should include stress testing the plan under different market scenarios – a recession, a period of high inflation, or even a global pandemic. This allows us to identify potential vulnerabilities and develop contingency plans. Consider historical data and economic forecasts to inform this assessment. For instance, reviewing the performance of various asset classes during past recessions can provide insights into potential future behavior.

Assessment of Risk Tolerance and Investment Goals

Understanding the client’s risk tolerance is paramount. Are they comfortable with potential short-term losses for the chance of higher long-term gains? Or do they prioritize capital preservation above all else? This assessment, combined with their investment goals (retirement planning, education funding, etc.), allows us to determine if the current strategy aligns with their comfort level and objectives. Tools like risk questionnaires and discussions about past investment experiences can help gauge their risk tolerance. We should ensure the client’s investment strategy accurately reflects their risk profile and goals. For example, if a client expresses a low risk tolerance, yet their portfolio is heavily invested in volatile stocks, adjustments are needed. Conversely, if a client with a high risk tolerance is overly conservative, opportunities for growth may be missed.

Developing Recommendations for Improvement

Now that we’ve meticulously dissected your financial planning process – a task akin to performing open-heart surgery on a particularly stubborn piggy bank – it’s time for the fun part: suggesting improvements! Think of this as financial CPR, but with less drama and hopefully, more positive outcomes. We’ll be crafting a prioritized list of recommendations, complete with justifications, potential pitfalls (because let’s face it, even the best-laid plans…), and a roadmap for implementation. Buckle up, buttercup, it’s going to be a wild ride.

This section details the prioritized recommendations for improving the financial planning process, along with justifications, potential drawbacks, and an implementation plan. We’ve aimed for a balance between bold, innovative strategies and practical, easily implemented changes. Remember, Rome wasn’t built in a day, and neither is a perfect financial planning process.

Prioritized Recommendations for Improvement

The following recommendations are prioritized based on their potential impact and feasibility. We’ve considered both short-term wins and long-term strategic goals, striving for a balanced approach that delivers immediate value while laying the groundwork for sustainable growth. Think of it as a financial potluck – a mix of quick appetizers and hearty main courses.

- Implement a robust budgeting software: Switching to a cloud-based budgeting software will streamline data collection, automate reporting, and improve forecasting accuracy. This will save time and reduce errors associated with manual processes. Potential drawbacks include the initial cost of the software and the learning curve for staff. Implementation will involve selecting software, training staff, and migrating existing data. Timeline: 2 months. Responsibility: Finance Department.

- Enhance investment strategy diversification: Currently, the investment portfolio is heavily concentrated in a single asset class. Diversifying across multiple asset classes (stocks, bonds, real estate, etc.) will reduce risk and potentially improve long-term returns. This requires a thorough review of the risk tolerance and investment objectives. Potential drawbacks include increased complexity and the need for specialized expertise. Implementation involves conducting a comprehensive portfolio review and adjusting asset allocations. Timeline: 3 months. Responsibility: Investment Committee.

- Improve communication with clients: Implementing a centralized client communication system will ensure consistent and timely updates. This will enhance client satisfaction and build stronger relationships. Drawbacks might include the cost of implementing the system and the need for staff training. Implementation involves selecting a communication platform, training staff, and developing communication protocols. Timeline: 1 month. Responsibility: Client Relations Team.

Implementation Plan

The successful implementation of these recommendations requires a structured approach with clearly defined roles and timelines. We’ve developed a phased approach to minimize disruption and maximize efficiency. Think of this as a well-orchestrated symphony, where each instrument (department) plays its part to create a harmonious whole.

| Recommendation | Timeline | Responsible Party | Key Milestones |

|---|---|---|---|

| Implement robust budgeting software | 2 months | Finance Department | Software selection (1 month), Staff training (1 week), Data migration (2 weeks) |

| Enhance investment strategy diversification | 3 months | Investment Committee | Portfolio review (1 month), Asset allocation adjustments (2 months) |

| Improve communication with clients | 1 month | Client Relations Team | Platform selection (1 week), Staff training (1 week), Protocol development (1 week) |

Presenting the Review Findings and Recommendations

Presenting your financial planning review findings requires a delicate balance: You need to convey complex information clearly, manage expectations, and leave your clients feeling empowered, not overwhelmed. Think of it as a financial performance review, but instead of your boss, it’s your client’s financial future. The goal? To show them how they can achieve their financial dreams, even if it involves some (financially responsible) tough love.

Presenting complex financial information to non-experts requires a strategic approach, moving beyond jargon and embracing clear, concise language. Analogies, real-world examples, and visual aids are your secret weapons in this battle against financial bewilderment.

Presentation Format for Non-Experts

We recommend a narrative structure, telling the story of the client’s financial health. Start with a brief overview of the current financial situation, highlighting both strengths and weaknesses. Then, present the findings in a logical sequence, using clear, simple language. Avoid technical terms unless absolutely necessary, and when you do use them, be sure to define them clearly. Think of it like explaining quantum physics to a five-year-old – you wouldn’t start with Schrödinger’s cat, would you?

Conveying Positive and Negative Aspects

Presenting both positive and negative findings requires tact and transparency. Frame negative findings as opportunities for improvement, highlighting the potential benefits of addressing these areas. For example, instead of saying “Your investment portfolio is underperforming,” you could say, “By diversifying your investments and adjusting your asset allocation, we can potentially increase your returns while mitigating risk.” Remember, honesty is the best policy, but it needs to be delivered with a spoonful of sugar (and a dash of financial wisdom).

Engaging Stakeholders in Constructive Discussion

Facilitating a constructive discussion requires active listening and a willingness to address concerns. Prepare for questions by anticipating potential objections and formulating responses in advance. Encourage participation by asking open-ended questions, and create a safe space for clients to express their thoughts and feelings without feeling judged. Think of it as a collaborative process, not a lecture.

Visual Representation of Recommended Changes

Imagine a bar graph. The left side represents the client’s current financial trajectory, perhaps showing a relatively flat line, or even a slight downward slope representing potential challenges. The right side, however, depicts the projected trajectory after implementing the recommendations. This line should show a clear upward trend, representing increased wealth, reduced debt, or improved financial security. You can use different colors to highlight key milestones, such as retirement, debt elimination, or achieving a specific financial goal. Label each axis clearly and include a concise title, such as “Projected Financial Growth with Implemented Recommendations.” This visual representation instantly conveys the positive impact of the proposed changes in a way that’s easy to understand and remember. Consider adding small icons to represent key milestones, making it even more engaging. For example, a house icon for achieving homeownership, a graduation cap for funding education, or a beach umbrella for illustrating a comfortable retirement. This visual will serve as a powerful tool to demonstrate the long-term benefits of following the recommendations.

Monitoring and Evaluating the Results of Implementation

Implementing a revamped financial planning process is only half the battle; the other half, and arguably the more exciting one (think champagne wishes and caviar dreams, not just spreadsheets!), involves meticulously tracking its performance. This monitoring phase isn’t about micromanaging; it’s about ensuring your shiny new process actually delivers the promised results, and identifying any unforeseen hiccups before they morph into full-blown financial fiascos.

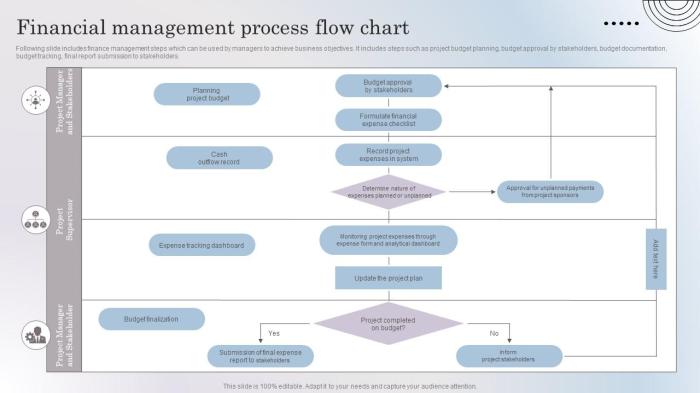

This section details the methods for monitoring the effectiveness of the implemented changes, making necessary adjustments, and ensuring the ongoing success of your financial planning process. We’ll explore key performance indicators (KPIs), regular progress monitoring, periodic reviews, and reporting mechanisms to keep everyone (especially the stakeholders – you know, the ones who hold the purse strings) in the loop.

Key Performance Indicators (KPIs) for Tracking Success

Establishing the right KPIs is crucial. Think of them as your financial planning process’s report card – they provide quantifiable measures of success. Choosing the wrong KPIs is like judging a marathon runner by their ability to knit; you might get some data, but it won’t tell the whole story. Instead, focus on KPIs directly linked to the goals set during the planning process review. For example, if a goal was to improve cash flow forecasting accuracy, a relevant KPI could be the percentage difference between forecasted and actual cash flow over a specified period. Another example could be the reduction in the time taken to complete the budgeting process, measured in days or weeks. The key is to select KPIs that are specific, measurable, achievable, relevant, and time-bound (SMART).

Methods for Regularly Monitoring Progress and Making Adjustments

Regular monitoring shouldn’t feel like a chore; it’s a chance to celebrate successes and proactively address challenges. Consider implementing a monthly review process, using dashboards to visualize key metrics and identify trends. These dashboards could include charts showing actual versus budgeted expenses, revenue growth, and other relevant KPIs. If a KPI shows a significant deviation from the target, a deeper dive is warranted. This might involve investigating the root cause of the deviation, developing corrective actions, and adjusting the financial plan accordingly. Remember, flexibility is key; the financial landscape is constantly shifting, so your plan needs to adapt. Think of it as financial plan yoga – constant stretching and adjustments to maintain balance.

Process for Conducting Periodic Reviews of the Revised Financial Planning Process, Financial Planning Process Review

Regular reviews ensure your financial planning process remains relevant and effective. Schedule these reviews quarterly or semi-annually, depending on the complexity and dynamism of your business. These reviews should involve key stakeholders and should cover aspects like the efficiency of the process, the accuracy of the data, the effectiveness of the implemented changes, and the overall alignment with the organization’s strategic goals. The review process should involve both qualitative and quantitative assessments, including feedback from those directly involved in the process. Think of it as a financial health check-up – keeping everything running smoothly.

Examples of Reporting Mechanisms to Communicate Progress to Stakeholders

Effective communication is vital. Stakeholders need regular updates on the progress of the implemented changes. Consider using a variety of reporting mechanisms, such as:

- Executive Summaries: Concise reports highlighting key achievements and challenges.

- Detailed Reports: Comprehensive reports providing in-depth analysis of KPIs and progress towards goals.

- Visual Dashboards: Interactive dashboards that allow stakeholders to easily monitor progress and identify trends.

- Presentations: Regular presentations to key stakeholders to review progress and discuss any issues.

The choice of reporting mechanism will depend on the preferences and needs of the stakeholders and the complexity of the information being communicated. Remember, clarity and conciseness are key. Avoid jargon and focus on communicating the essential information in a way that is easily understood.

Closure

Ultimately, a thorough Financial Planning Process Review isn’t just about tweaking numbers; it’s about securing your financial future. By meticulously analyzing your current strategy, identifying areas for improvement, and implementing well-defined recommendations, you can build a financial plan that not only withstands market fluctuations but also helps you achieve your long-term goals. So, ditch the financial anxieties and embrace the power of proactive planning – your future self will thank you (and maybe even buy you that fancy coffee you’ve been eyeing).

FAQ Guide

What if my financial data is incomplete?

Incomplete data is a common challenge. The key is to identify the gaps, estimate missing information using reasonable assumptions (documenting those assumptions clearly), and acknowledge the limitations of the analysis in your final report.

How often should I review my financial plan?

Annual reviews are generally recommended, but more frequent reviews (e.g., semi-annually) may be necessary depending on factors like market volatility, significant life changes, or the complexity of your financial situation.

What if I don’t understand the recommendations?

Don’t hesitate to ask clarifying questions! A good financial advisor will explain things in a way you understand, ensuring you’re comfortable with the proposed changes before implementation.