Mastering personal or business finances can feel daunting, but effective financial planning software offers a powerful solution. These sophisticated tools streamline budgeting, investment tracking, and long-term financial goal setting, empowering users to take control of their financial futures. From individual investors managing their portfolios to financial advisors guiding clients, the applications are wide-ranging and continuously evolving.

This guide delves into the core functionalities, key features, and future trends of financial planning software. We’ll explore how these tools manage data securely, enhance user experience, and integrate with other financial platforms. We’ll also analyze pricing models and the substantial return on investment users can expect.

Introduction to Financial Planning Software

Financial planning software empowers individuals and organizations to effectively manage their financial resources. These applications offer a range of tools and features designed to simplify complex financial tasks, improve decision-making, and ultimately achieve financial goals. From budgeting and tracking expenses to investment planning and retirement projections, these programs provide a centralized platform for managing one’s financial life.

Financial planning software encompasses a variety of functionalities aimed at streamlining financial management. Core features typically include budgeting tools to track income and expenses, investment portfolio management capabilities to monitor asset performance and allocate funds, retirement planning tools to project future income needs and savings goals, tax planning features to estimate tax liabilities and optimize tax strategies, and debt management tools to track and reduce outstanding balances. Many advanced programs also incorporate features such as financial forecasting, scenario planning, and goal-setting modules to help users visualize their financial future and make informed decisions.

Types of Users Benefiting from Financial Planning Software

The utility of financial planning software extends across a broad spectrum of users, each with unique needs and applications. Individuals can leverage these tools for personal budgeting, investment tracking, and retirement planning. Businesses utilize the software for financial forecasting, budgeting, and cash flow management, improving operational efficiency and financial decision-making. Financial advisors employ such software to streamline client portfolio management, develop personalized financial plans, and enhance their advisory services, providing a professional and efficient approach to client management and planning. The scalability and adaptability of these programs allow for effective use across various financial contexts.

Historical Overview of Financial Planning Software

The evolution of financial planning software mirrors the broader advancements in computing technology and financial theory. Early versions, appearing in the 1980s, were primarily spreadsheet-based programs with limited functionalities. These programs offered basic budgeting and calculation capabilities, laying the groundwork for more sophisticated applications. The rise of personal computers in the 1990s fueled the development of more user-friendly and feature-rich software. These programs incorporated graphical user interfaces (GUIs) and advanced calculation engines, allowing for more comprehensive financial planning. The 21st century has witnessed the emergence of cloud-based solutions, offering enhanced accessibility, collaboration features, and integration with other financial services. This shift has allowed for greater efficiency and real-time data updates, leading to more dynamic and responsive financial planning tools. For example, the transition from Quicken’s early DOS-based versions to its current cloud-integrated platform exemplifies this evolution, showcasing improved user experience and enhanced capabilities.

Key Features and Functionality

Choosing the right financial planning software can significantly impact your ability to manage your finances effectively. Understanding the key features and functionalities offered by different packages is crucial for making an informed decision. This section will compare popular software options and highlight the distinctions between basic and advanced tools, focusing on the vital role of budgeting.

Comparison of Popular Financial Planning Software Packages

The market offers a variety of financial planning software, each with its own strengths and weaknesses. The following table compares three popular options, focusing on key features. Note that feature availability and pricing may vary depending on the subscription level.

| Software Name | Key Feature 1 | Key Feature 2 | Key Feature 3 |

|---|---|---|---|

| Mint | Automated budgeting and transaction categorization | Comprehensive financial overview dashboard | Free, basic level of features |

| Personal Capital | Advanced investment tracking and analysis | Retirement planning tools | Free for basic features, paid for advanced features |

| Quicken | Detailed budgeting and expense tracking | Tax preparation support | Wide range of features, subscription-based |

Essential Features Differentiating Basic and Advanced Software

Basic financial planning software typically focuses on fundamental features like budgeting, expense tracking, and basic reporting. Advanced software, however, expands on this foundation by offering sophisticated tools for investment management, retirement planning, tax optimization, and comprehensive financial modeling. For example, a basic program might allow you to track income and expenses, while an advanced program might incorporate algorithms to project future cash flow based on various scenarios. This level of sophistication allows for more proactive and strategic financial planning.

The Role of Budgeting Tools in Financial Planning Software

Budgeting tools are a cornerstone of effective financial planning software. These tools enable users to create and monitor budgets, track income and expenses, identify areas for improvement, and ultimately achieve their financial goals. Sophisticated budgeting tools often incorporate features such as automated transaction categorization, personalized spending recommendations based on user data, and visual representations of spending patterns to provide insights and facilitate informed decision-making. For instance, a user might discover through their software’s visual tools that they are consistently overspending on dining out, prompting them to adjust their budget accordingly. Effective budgeting tools are essential for both short-term financial management and long-term financial planning.

Data Management and Security

Protecting your financial data is paramount. Financial planning software employs robust security measures to safeguard sensitive information, ensuring both data integrity and user privacy. This section details the methods used to achieve this, as well as the processes for data import and export and a hypothetical data breach scenario.

Data security in financial planning software typically involves a multi-layered approach. This includes encryption of data both in transit (using protocols like HTTPS) and at rest (using encryption algorithms to protect data stored on servers and local devices). Access controls, such as user authentication with strong passwords and multi-factor authentication (MFA), limit access to authorized personnel. Regular security audits and penetration testing identify vulnerabilities and ensure the software remains resilient against cyber threats. Furthermore, many software providers adhere to industry-standard compliance frameworks like SOC 2, ensuring a high level of security and data protection.

Data Import and Export Methods

Financial planning software offers various methods for importing and exporting data. Common import methods include CSV file uploads, direct connections to bank accounts (with user consent), and integration with other financial applications via APIs. Export options typically include generating reports in various formats (PDF, Excel, CSV) and downloading data backups. The specific methods available will vary depending on the software used, but the general principle remains the same: providing users with flexible options to manage their data. For example, a user might import their investment portfolio data from a brokerage account via a secure API connection, then export a summary report to share with their financial advisor in PDF format.

Hypothetical Data Breach Scenario and Consequences

Imagine a scenario where a financial planning software provider experiences a data breach due to a vulnerability in their system. A malicious actor gains unauthorized access to a database containing client financial information, including account balances, investment details, and personal identifying information (PII). The consequences could be severe. Clients could face identity theft, financial fraud, and reputational damage. The software provider would face legal repercussions, financial losses, and damage to its reputation. Such a breach could also lead to regulatory fines and loss of client trust. This highlights the importance of robust security measures and regular security assessments to mitigate the risks associated with data breaches. A real-world example of the impact of a data breach is the Equifax breach of 2017, which resulted in the exposure of millions of individuals’ sensitive personal information and had significant financial and reputational consequences for the company.

User Interface and User Experience (UI/UX)

A well-designed user interface and user experience (UI/UX) are crucial for the success of any financial planning software. Intuitive navigation, clear data presentation, and efficient workflows contribute significantly to user satisfaction and ultimately, the effective use of the software. A poor UI/UX, conversely, can lead to frustration, errors, and ultimately, abandonment of the software.

The effectiveness of financial planning software hinges on its ability to present complex financial information in a clear, accessible, and actionable manner. This requires careful consideration of visual design, information architecture, and interaction design.

Examples of User-Friendly and User-Unfriendly Interfaces

Understanding the characteristics of effective and ineffective interfaces provides valuable insights into designing a superior user experience. The following examples illustrate key differences.

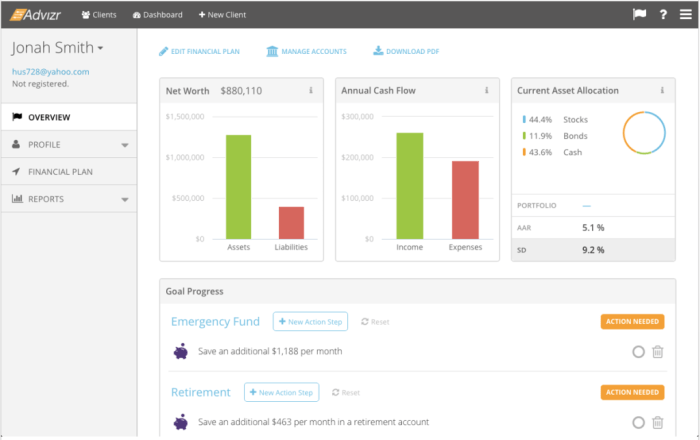

- User-Friendly Interface Example: Software that uses clear visual cues, such as color-coding to differentiate account types (e.g., assets in green, liabilities in red), and employs interactive charts and graphs to visualize financial data, allowing users to easily understand their financial health at a glance. Navigation is straightforward, with clear labels and logical grouping of features.

- User-Unfriendly Interface Example: Software that presents information in dense tables with minimal visual hierarchy, forcing users to sift through large amounts of data to find specific information. The navigation is convoluted, with poorly labeled menus and inconsistent design elements. Charts and graphs, if present, are complex and difficult to interpret.

- User-Friendly Interface Example: Software with a customizable dashboard allowing users to personalize their view by selecting the key metrics and reports they want to monitor regularly. This provides a tailored experience catering to individual needs and preferences.

- User-Unfriendly Interface Example: Software with a fixed dashboard that overwhelms users with unnecessary information, making it difficult to locate essential data. The lack of personalization leads to a generic and inefficient user experience.

Factors Contributing to a Positive User Experience

Several key factors contribute to a positive user experience with financial planning software. These factors work synergistically to create an efficient and satisfying user journey.

- Intuitive Navigation: Easy-to-understand menus, clear labeling, and logical information architecture allow users to quickly find what they need.

- Clear Data Visualization: Interactive charts, graphs, and reports present complex financial data in an easily digestible format, facilitating better understanding and decision-making.

- Personalized Experience: Customizable dashboards and settings allow users to tailor the software to their specific needs and preferences.

- Efficient Workflows: Streamlined processes for common tasks, such as adding transactions or generating reports, minimize the time and effort required to complete tasks.

- Responsive Design: The software adapts seamlessly to different devices (desktops, tablets, smartphones), providing a consistent and optimized experience across platforms.

- Accessibility Features: Features like screen reader compatibility and keyboard navigation ensure the software is usable by individuals with disabilities.

- Excellent Customer Support: Readily available and helpful customer support channels (e.g., online help, phone support, email) address user queries and resolve issues promptly.

Improved User Interface Mock-up: Goal Setting Module

Let’s consider the goal-setting module. Many current financial planning software solutions present goal setting as a simple text input field. An improved UI could use a more visual and interactive approach.

The improved interface would feature a drag-and-drop interface where users can visually represent their goals. For example, a user could drag and drop “Purchase a House” onto a timeline, visually assigning a target date and estimated cost. The system would then automatically calculate the required savings rate and integrate this information into the user’s overall financial plan. A progress bar would dynamically update, visually showcasing the progress towards the goal. This visual representation transforms a potentially daunting task into an engaging and easily manageable process. Color-coding could further enhance the visual appeal and clarity, distinguishing between short-term and long-term goals. Furthermore, the system could provide helpful suggestions and alerts based on the user’s progress and financial situation, fostering engagement and motivation.

Integration with Other Financial Tools

Effective financial planning requires a holistic view of your finances. Our software facilitates this by seamlessly integrating with a range of other popular financial tools, allowing for a centralized and streamlined approach to managing your money. This integration minimizes manual data entry, reduces errors, and provides a more comprehensive understanding of your financial health.

The ability to connect with external financial tools offers significant advantages, but also presents some challenges. Successfully navigating these requires careful consideration of data consistency and security protocols. A well-integrated system provides a unified dashboard showcasing all aspects of your financial life, but poorly integrated systems can lead to conflicting information and data silos.

Benefits of Integration with External Financial Tools

Integrating your financial planning software with other tools offers several key benefits. A connected ecosystem provides a more accurate and complete picture of your financial situation, enabling better decision-making.

- Automated Data Updates: Imagine automatically importing your bank account balances, investment portfolio values, and credit card transactions. This eliminates the time-consuming task of manual data entry, saving you valuable time and reducing the risk of human error.

- Comprehensive Financial Overview: By consolidating data from multiple sources, you gain a unified view of your assets, liabilities, income, and expenses. This holistic perspective facilitates better financial planning and decision-making.

- Enhanced Reporting and Analysis: Integrated data allows for more robust and insightful reporting and analysis. You can easily track your progress toward financial goals, identify areas for improvement, and make informed adjustments to your financial plan.

- Streamlined Workflow: Connecting your financial planning software with tax preparation software, for example, can simplify the tax filing process significantly. Data is automatically transferred, reducing the chance of errors and making tax preparation less stressful.

Challenges of Integrating Multiple Financial Tools

While integration offers many advantages, potential challenges exist. These challenges often revolve around data security, compatibility issues, and the need for robust data management practices.

- Data Security Concerns: Sharing data between multiple platforms requires robust security measures to protect sensitive financial information from unauthorized access or breaches. Our software utilizes industry-standard encryption and security protocols to mitigate these risks.

- Compatibility Issues: Not all financial tools are created equal. Ensuring seamless data exchange between different platforms can be challenging, requiring careful selection of compatible tools and potentially necessitating data transformation processes.

- Data Consistency and Accuracy: Maintaining data consistency across integrated tools is crucial. Discrepancies can lead to inaccurate financial planning and flawed decision-making. Our software employs data validation and reconciliation techniques to minimize inconsistencies.

Importance of Data Consistency Across Integrated Tools

Data consistency is paramount for effective financial planning. Inconsistent data across different tools can lead to inaccurate financial projections, flawed decision-making, and ultimately, poor financial outcomes. For example, if your investment portfolio value in one tool differs significantly from the value reported in your financial planning software, your net worth calculation will be inaccurate, potentially leading to incorrect investment strategies or savings plans. Our software prioritizes data consistency through robust data validation and reconciliation processes, ensuring that all integrated tools reflect the same, accurate, and up-to-date financial information.

Cost and Value Proposition

Choosing the right financial planning software involves careful consideration of its cost and the value it offers in return. This section explores various pricing models, factors influencing software costs, and the potential return on investment (ROI) users can expect. Understanding these aspects is crucial for making an informed decision that aligns with your budget and financial goals.

Different financial planning software packages employ diverse pricing strategies, ranging from subscription-based models with tiered features to one-time purchase options with varying levels of support and updates. The cost often reflects the software’s complexity, the number of users it supports, and the range of features included. A comprehensive understanding of these pricing models is vital for selecting the optimal solution for your needs.

Pricing Models and Feature Comparison

The following table compares the pricing tiers and features of three hypothetical financial planning software packages – “PlanSmart,” “FinancePro,” and “BudgetWise.” Note that these are examples and actual pricing and features may vary across different vendors.

| Feature | PlanSmart | FinancePro | BudgetWise |

|---|---|---|---|

| Pricing Tier | Basic: $29/month Premium: $79/month Enterprise: $199/month |

Starter: $49/month Professional: $149/month Ultimate: $399/month |

Single User: $99 (one-time) Team License (5 users): $499 (one-time) |

| Number of Users | 1 (Basic), 5 (Premium), Unlimited (Enterprise) | 1 (Starter), 3 (Professional), Unlimited (Ultimate) | 1 (Single User), 5 (Team License) |

| Client Portfolio Management | Yes (Basic & Premium), Advanced features (Enterprise) | Yes (all tiers), advanced analytics in Professional & Ultimate | Yes (both tiers) |

| Tax Planning Tools | No (Basic), Yes (Premium & Enterprise) | Yes (all tiers), more comprehensive in Professional & Ultimate | Basic tax tools (both tiers) |

| Reporting & Dashboards | Basic (Basic & Premium), Customizable (Enterprise) | Customizable reports (all tiers) | Standard reports (both tiers) |

| Customer Support | Email support (all tiers), phone support (Premium & Enterprise) | Email & phone support (all tiers) | Email support (both tiers) |

Factors Influencing Software Cost

Several factors contribute to the overall cost of financial planning software. These include the software’s complexity, the level of technical support provided, the number of users it can accommodate, the frequency of updates and new feature releases, and the level of security features incorporated.

For instance, software with advanced features like AI-driven investment analysis or sophisticated tax optimization tools will typically command a higher price than simpler solutions. Similarly, robust customer support, including dedicated phone support and personalized training, increases the cost.

Return on Investment (ROI)

The ROI from financial planning software is multifaceted and can be difficult to quantify precisely. However, significant benefits can be realized through improved efficiency, reduced errors, enhanced client service, and ultimately, better financial outcomes for both the advisor and the client.

For example, automated portfolio rebalancing can save advisors considerable time, allowing them to focus on higher-value activities. Improved data management can reduce the risk of errors and compliance issues, minimizing potential financial penalties. The ability to generate professional reports and visualizations can enhance client communication and trust, leading to increased client retention and acquisition. Ultimately, the improved decision-making enabled by the software can lead to better investment outcomes for clients, further enhancing the overall value proposition.

While a precise ROI calculation requires considering specific costs and benefits within a given context, the potential for increased efficiency, reduced errors, and improved client outcomes makes a strong case for the value of investing in financial planning software.

Future Trends in Financial Planning Software

The financial planning landscape is rapidly evolving, driven by technological advancements and shifting user expectations. Financial planning software is adapting to these changes, incorporating innovative features and functionalities to provide more comprehensive and personalized financial guidance. The integration of emerging technologies is central to this transformation, leading to more sophisticated and user-friendly platforms.

The convergence of artificial intelligence (AI), machine learning (ML), and big data analytics is reshaping the capabilities of financial planning software. These technologies are not merely enhancing existing features; they are fundamentally altering the way financial planning is conducted, leading to more proactive and predictive tools.

Artificial Intelligence and Machine Learning Applications

AI and ML are revolutionizing various aspects of financial planning software. For instance, AI-powered robo-advisors offer automated portfolio management based on individual risk profiles and financial goals. ML algorithms analyze vast datasets to identify patterns and predict market trends, enabling more accurate financial forecasting and risk assessment. These algorithms can also personalize recommendations, tailoring financial plans to individual circumstances and preferences with greater accuracy than ever before. For example, a system might identify a user’s spending habits and suggest adjustments to achieve savings goals more efficiently. Another example would be the automated detection of potential financial risks based on the user’s portfolio composition and market conditions. The ability to personalize recommendations based on individual data points is one of the most powerful applications of AI in financial planning.

Enhanced User Experience Through AI

AI is significantly improving the user experience of financial planning software. Chatbots and virtual assistants provide instant support and answer common questions, reducing the need for human intervention. Personalized dashboards and intuitive interfaces make financial data more accessible and understandable, empowering users to actively participate in managing their finances. Furthermore, AI can personalize the user interface itself, adapting to the individual’s preferences and learning patterns over time. Imagine a system that automatically adjusts the level of detail displayed based on the user’s understanding of financial concepts or prioritizes information relevant to their immediate financial goals.

Data Security and Privacy in an AI-Driven Environment

The increased reliance on AI and data analytics raises concerns about data security and user privacy. Robust security measures, including encryption and access controls, are crucial to protecting sensitive financial information. Transparency regarding data usage and compliance with privacy regulations are essential for building trust and maintaining user confidence. For example, adherence to regulations like GDPR in Europe and CCPA in California is paramount. Financial institutions are investing heavily in advanced security technologies to mitigate potential risks associated with data breaches and unauthorized access. This includes implementing multi-factor authentication, employing blockchain technology for enhanced security, and investing in cybersecurity expertise.

Outcome Summary

Financial planning software has become an indispensable tool for individuals and businesses alike, transforming how we approach financial management. By understanding its capabilities, security protocols, and integration potential, users can leverage these powerful tools to achieve their financial goals more effectively. The future of financial planning software is bright, with continuous innovation promising even more sophisticated and user-friendly solutions in the years to come. Embrace the technology and empower your financial future.

FAQ Insights

What is the best financial planning software for beginners?

The “best” software depends on individual needs, but many user-friendly options exist with intuitive interfaces and helpful tutorials. Look for software with strong customer support.

Is my financial data safe with financial planning software?

Reputable software providers employ robust security measures, including encryption and data backups. However, it’s crucial to choose established providers with strong security reputations and review their privacy policies carefully.

Can I use financial planning software on mobile devices?

Many financial planning software packages offer mobile apps or are accessible through web browsers, providing on-the-go access to your financial information.

How much does financial planning software typically cost?

Pricing varies greatly depending on features and user needs. Options range from free, basic software to subscription-based services with advanced features, costing anywhere from a few dollars to hundreds of dollars per month.