Financial Planning Software Demo: Forget spreadsheets and cryptic formulas! This isn’t your grandpappy’s financial planning. We’re diving headfirst into the exhilarating world of software demos designed to make your money work harder (and smarter), while simultaneously making your life significantly less stressful. Prepare for a journey into the land of interactive charts, automated projections, and the sweet, sweet sound of financial freedom.

This exploration will cover everything from identifying your ideal target audience (are they seasoned investors or nervous newbies?) to crafting a demo that’s so compelling, they’ll be signing up faster than you can say “compound interest.” We’ll tackle the art of handling those inevitable awkward questions (yes, even the ones about crypto) and learn how to leave a lasting impression that’ll have them clamoring for more. Buckle up, it’s going to be a wild ride!

Introduction to Financial Planning Software Demos

Let’s face it, nobody wants to wade through endless spreadsheets and complex formulas when planning their financial future. That’s where financial planning software demos come in – your friendly guide to a stress-free, financially secure tomorrow. These demos offer a sneak peek into the powerful tools and features that can help you navigate the often-murky waters of personal finance. Think of them as a test drive before committing to a potentially life-changing purchase.

Software demos for financial planning provide a crucial bridge between the abstract concept of financial software and its practical application. They allow potential users to visualize how the software can streamline their financial processes, leading to improved organization, better decision-making, and, ultimately, a clearer path towards achieving their financial goals. Essentially, it’s a low-risk way to assess if a particular software is the right fit for your specific needs. You wouldn’t buy a car without a test drive, would you?

Types of Financial Planning Software Demos

There’s a demo style for every personality. Choosing the right one depends on your learning style and time constraints. Live demos offer the advantage of real-time interaction and personalized guidance from a software expert, allowing you to ask questions and receive immediate feedback. Recorded demos, on the other hand, provide flexibility, allowing you to view them at your convenience. Interactive demos blend the best of both worlds, offering a pre-recorded presentation with opportunities for interactive elements, like quizzes or personalized scenarios. Imagine choosing a demo as carefully as you’d choose a financial advisor – it’s that important!

Key Features Commonly Showcased in a Financial Planning Software Demo

A typical demo will highlight the software’s core functionalities, showcasing its ability to simplify complex tasks. This often includes features like budgeting tools (allowing for detailed income and expense tracking), investment portfolio management (visualizing asset allocation and performance), retirement planning tools (projecting future income and expenses in retirement), tax planning capabilities (estimating tax liability and exploring strategies for tax optimization), and debt management features (tracking debt balances and exploring repayment strategies). For example, a demo might show how easily the software projects a retirement portfolio’s growth based on various investment strategies and contribution amounts, or how it visualizes debt reduction scenarios based on different repayment plans. Seeing is believing, and these demos aim to show, not just tell.

Target Audience for Financial Planning Software Demos

Crafting the perfect financial planning software demo requires a keen understanding of your audience. After all, pitching a complex budgeting tool to a seasoned financial advisor is a vastly different beast than showcasing the same software to a first-time investor nervously eyeing their first Roth IRA. Tailoring your demo to resonate with each user type is key to maximizing engagement and ultimately, driving conversions. Let’s explore the nuances of targeting different demographics.

The effectiveness of your demo hinges on addressing the specific needs and pain points of each user group. A one-size-fits-all approach is likely to fall flatter than a week-old soufflé. Instead, think of your demo as a finely tuned instrument, adjusted to play the perfect melody for each audience member.

User Segmentation and Demo Customization

Below, we’ve categorized key user types and Artikeld how to tailor your demo to their unique requirements. Remember, a well-structured demo not only showcases the software’s features but also highlights its value proposition for that specific audience. It’s about demonstrating how the software can solve *their* problems, not just displaying its capabilities in a vacuum.

| User Type | Key Needs | Demo Focus | Preferred Demo Format |

|---|---|---|---|

| Individual Investors | Easy-to-use interface, clear visualization of financial goals (retirement, college savings, etc.), budgeting tools, investment tracking, and simple reporting. | Highlight user-friendliness, focus on intuitive navigation, demonstrate goal setting and progress tracking features with realistic examples (e.g., planning for a down payment on a house). Show how the software simplifies complex financial tasks. | Short, engaging video tutorial followed by a Q&A session. A concise, visually appealing presentation with a strong emphasis on ease of use. |

| Financial Advisors | Robust reporting capabilities, client portfolio management tools, tax optimization strategies, advanced analytics, and integration with other financial software. Time-saving features are crucial. | Showcase advanced features, emphasize efficiency and time-saving capabilities, highlight client reporting features, and demonstrate seamless integration with other financial tools they already use. Focus on the software’s ability to streamline their workflow and improve client service. | In-depth webinar showcasing advanced features and client management tools. A detailed, data-driven presentation with a focus on efficiency and scalability. |

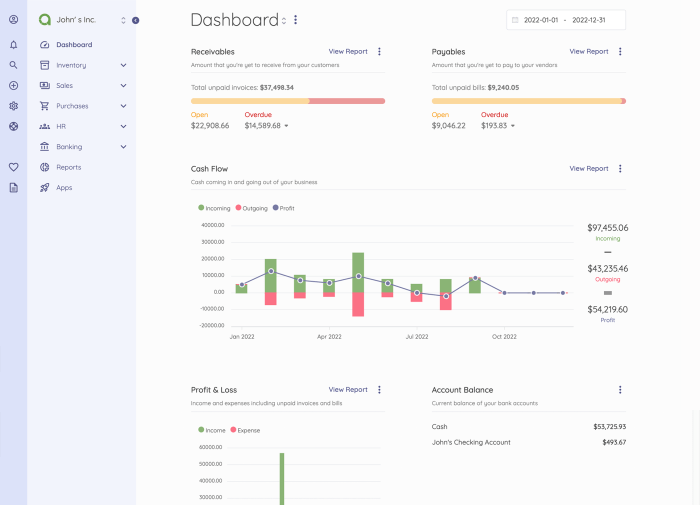

| Small Business Owners | Cash flow management, expense tracking, invoicing, budgeting, and financial forecasting tools. Simplicity and integration with accounting software are key. | Focus on features that improve cash flow management, demonstrate expense tracking and reporting features, showcase integration with accounting software, and highlight the software’s ability to provide valuable insights into business performance. | Combination of a short video demonstrating core functionalities and a live demo focusing on specific business scenarios (e.g., managing seasonal cash flow). A practical, results-oriented presentation. |

| Large Enterprises | Scalability, robust security features, integration with existing enterprise systems, advanced analytics, and compliance with regulatory requirements. Customizable reporting is a must. | Showcase scalability and security features, highlight integration capabilities, demonstrate advanced analytics and reporting, and emphasize compliance with relevant regulations. Focus on the software’s ability to handle large volumes of data and meet the specific needs of a large organization. | Personalized, in-person demonstration tailored to the specific needs of the enterprise. A comprehensive, detailed presentation with a focus on customization and scalability. |

Key Features Highlighted in Demos

Let’s face it, nobody wants to watch paint dry, especially when it comes to software demos. A successful demo needs to be as engaging as a David Attenborough documentary about meerkats – informative, entertaining, and leaving the audience wanting more (of your amazing software, of course!). To achieve this, we need to strategically showcase the key features, emphasizing the software’s user-friendliness and problem-solving capabilities. Think of it as a carefully orchestrated financial ballet, where every move is deliberate and elegant.

The key is to present the features in a way that resonates with the audience’s needs and aspirations. We’re not just showing off bells and whistles; we’re demonstrating solutions to real-world financial challenges. Imagine the sigh of relief from a user finally understanding their tax implications, or the gleeful grin when they see their retirement projections looking rosy. That’s the power of a well-executed demo.

Essential Features for the Demo

The features demonstrated should directly address the pain points of our target audience. We need to focus on the features that provide the most value and are easiest to understand in a short demonstration. Presenting too many features can be overwhelming and dilute the impact.

- Goal Setting: Show how easily users can define and track their financial goals (retirement, down payment, etc.). Visual representations, like charts and graphs, will make a big impact.

- Budgeting and Expense Tracking: Demonstrate the software’s ability to categorize transactions, create budgets, and identify areas for potential savings. A simple, relatable example like tracking coffee expenses could be quite effective.

- Investment Portfolio Management: Showcase the software’s ability to track assets, analyze performance, and provide recommendations for portfolio diversification. A mock portfolio with diversified asset classes would be visually appealing.

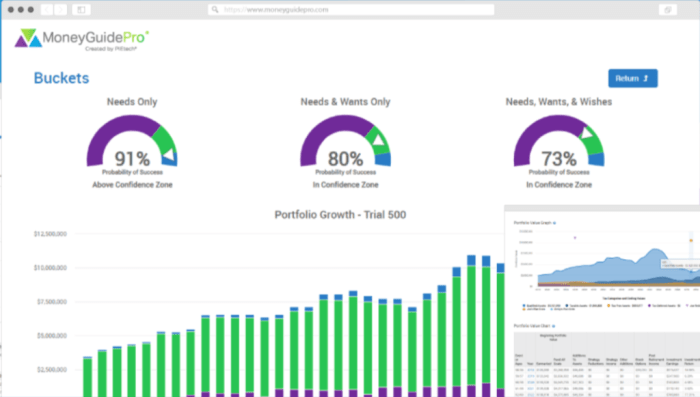

- Retirement Planning: Display projections based on various scenarios (e.g., different contribution levels, retirement ages). This is where the “rosy projections” come in handy.

- Tax Optimization Strategies (if applicable): If the software includes tax planning tools, show how it can help users minimize their tax burden. Use simple examples, avoiding complex tax jargon.

Demonstrating Ease of Use and Intuitive Interface, Financial Planning Software Demo

The goal here isn’t just to show *what* the software can do, but *how easily* it can be done. Think of it like teaching a child to ride a bike – you don’t start with wheelies and jumps. We want to build confidence and excitement through a smooth, logical flow.

To demonstrate ease of use, we should focus on a clear, concise demonstration. Avoid technical jargon. Use simple language and relatable examples. The user interface should be clean and uncluttered, guiding the user through the process intuitively. Imagine the software as a friendly financial guide, holding the user’s hand through the process.

Sample Demo Script: Goal Setting

Let’s say we’re focusing on the goal-setting feature. Here’s a possible script:

“Hi everyone, let’s say you’re dreaming of a relaxing retirement on a tropical beach in ten years. With our software, achieving that dream is surprisingly straightforward. First, we define the goal: ‘Retirement Fund – $1,000,000’. Then, we simply input the timeframe (10 years), and the software automatically calculates the required monthly contribution based on your estimated rate of return. See? No complicated formulas or spreadsheets needed! We can even adjust the timeframe or contribution amount to see how it affects the outcome. It’s that simple!”

Structuring a Compelling Demo

Crafting a financial planning software demo isn’t just about showcasing features; it’s about weaving a narrative that resonates with your audience, leaving them yearning for more (and, ideally, signing on the dotted line). Think of it as a carefully choreographed ballet, not a chaotic mosh pit. A well-structured demo transforms a potentially dry technical presentation into an engaging experience.

A compelling demo hinges on a clear structure and impactful visuals. Imagine trying to explain the intricacies of compound interest with nothing but a monotone voice and a blank screen. The result? Financial planning’s equivalent of watching paint dry. Instead, let’s create a demo that’s so captivating, your audience will be checking their watches, not to see when it ends, but to see how much time is *left*.

Visual Storytelling and Data Representation

Effective visuals are paramount. Instead of presenting dense spreadsheets, consider using interactive charts and graphs to illustrate key data points. For instance, a dynamic bar chart showing projected portfolio growth under different investment scenarios would be far more engaging than a static table of numbers. Similarly, using clear, concise icons to represent complex financial concepts can significantly improve comprehension and retention. Think of it as translating financial jargon into a visual language everyone can understand. A simple graphic showing the breakdown of asset allocation, for example, is far more accessible than a lengthy explanation. Remember, a picture is worth a thousand words, especially when those words involve compound interest and tax implications.

Step-by-Step Guide for a Successful Demo

Let’s Artikel a structured approach. First, begin with a captivating hook—a relatable scenario highlighting a common financial challenge your software addresses. Perhaps a young couple struggling to save for a down payment, or a retiree concerned about outliving their savings. This immediately connects with the audience’s emotions and establishes the software’s relevance.

Next, showcase the core functionalities in a logical sequence, starting with the most intuitive features. Think of it as a guided tour, not a technical deep dive. Each feature should be demonstrated with real-world examples, showing how it directly solves the problems presented in your opening scenario. For example, demonstrate how the software easily calculates retirement projections, showing a clear, optimistic (but realistic!) outcome.

Finally, conclude with a strong call to action. Clearly Artikel the next steps for interested parties, providing contact information and perhaps offering a free trial or consultation. This leaves a lasting impression and encourages follow-up. Remember, a successful demo isn’t just about showing *what* the software does, but *why* it matters to the audience. The goal is not just to inform, but to inspire action.

Handling Questions and Objections

Demoing financial planning software can be a rollercoaster – the thrill of showcasing your amazing product juxtaposed with the potential for unexpected questions and the ever-present fear of a catastrophic technical glitch. But fear not, intrepid presenter! With the right preparation and a dash of wit, you can navigate these choppy waters with grace and even a touch of humor.

Addressing audience queries and potential objections is crucial for converting a demo into a sale. Anticipating these concerns allows you to proactively address them, building trust and demonstrating your software’s robustness. A well-handled objection can be more valuable than a flawlessly executed feature demonstration.

Common Questions and Objections

Let’s face it, some questions are as predictable as the sunrise. Knowing what to expect allows you to craft concise and compelling responses, leaving your audience impressed with your expertise and the software’s capabilities. Here are some common queries and how to tackle them head-on:

- Question: “Is the software user-friendly, even for someone who’s not tech-savvy?” Response: “Absolutely! We designed the interface with simplicity in mind. Think of it as financial planning, but without the spreadsheet-induced headaches. We even have extensive tutorials and support documentation to guide users every step of the way.”

- Question: “How secure is my data?” Response: “Data security is paramount. We employ bank-level encryption and adhere to the strictest industry standards. Your financial information is as safe with us as it is in Fort Knox…probably safer, actually. We’ll happily provide you with a detailed security whitepaper upon request.”

- Question: “What if my needs change in the future? Can the software adapt?” Response: “Our software is designed to grow with you. We provide regular updates with new features and enhancements, ensuring it remains relevant to your evolving financial goals. Think of it as a financial chameleon, adapting to your changing needs.”

- Question: “How does your pricing compare to competitors?” Response: “While pricing is competitive, our focus is on delivering unparalleled value. We offer a range of packages to suit various needs and budgets, and we’re confident that the return on investment will far outweigh the cost. Let’s discuss your specific requirements and find the perfect fit.”

Strategies for Effective Question Handling

Handling questions effectively is an art form. It’s about more than just providing answers; it’s about building rapport and demonstrating your expertise.

- Listen Actively: Truly hear the question, not just wait for your turn to speak. Restate the question to ensure understanding and show the audience you value their input.

- Maintain Eye Contact: Engage with the questioner directly. Eye contact builds trust and demonstrates your sincerity.

- Keep it Concise: Avoid rambling or overly technical jargon. Get to the point, but don’t sacrifice clarity. Remember, brevity is the soul of wit (and effective demos).

- Acknowledge Uncertainty (If Necessary): It’s okay to say, “That’s a great question, and I’ll need to get back to you on that specific detail,” rather than bluffing your way through an answer. Follow up promptly with the correct information.

Handling Technical Difficulties

The dreaded technical glitch. It’s happened to the best of us. However, the way you handle it can significantly impact the audience’s perception.

- Stay Calm: Panic is contagious. Maintain composure, even if the software decides to take an unexpected vacation. A calm demeanor reassures the audience that you’re in control.

- Be Transparent: Don’t try to hide the problem. Acknowledge it directly, offering a brief explanation without getting bogged down in technical details. For example: “Apologies, we seem to be experiencing a slight hiccup with the connection. Let me try restarting the system.”

- Offer a Solution: If possible, offer an alternative approach, such as switching to a pre-recorded demo segment or focusing on a different aspect of the software. Think on your feet!

- Follow Up: After the demo, send a follow-up email addressing the technical issue and providing any additional information that may have been missed due to the interruption. This shows professionalism and a commitment to client satisfaction.

Post-Demo Follow-up

The demo’s over, the champagne wishes and caviar dreams have subsided (or at least, the metaphorical ones have), and now comes the crucial next step: following up with your potential clients. A well-executed follow-up can turn a lukewarm “maybe” into a resounding “yes!” Remember, the demo was just the appetizer; the main course is the closing of the deal.

Effective follow-up strategies are vital for converting demo attendees into paying customers. A timely and personalized approach significantly increases your chances of success. Neglecting this stage is like baking a delicious cake and then leaving it to sit on the counter, unadorned and forgotten. Don’t let your hard work go to waste!

Post-Demo Email Template

A well-crafted email is your secret weapon in the post-demo follow-up arsenal. It should be concise, personalized, and reinforce the value proposition of your software. Avoid generic, mass-produced emails; they’re about as appealing as a week-old sandwich.

Subject: Following Up on Your [Software Name] Demo

Body: Dear [Client Name], It was a pleasure demonstrating [Software Name] to you earlier today. I particularly enjoyed discussing [mention a specific point of conversation, showing you listened]. As promised, I’ve attached [relevant document, e.g., case study, pricing sheet]. I’d be happy to schedule a brief call next week to answer any further questions you may have and discuss how [Software Name] can specifically address your needs. Please let me know what time works best for you. Sincerely, [Your Name]

Collecting Feedback from Demo Participants

Gathering feedback is essential for continuous improvement. Think of your demo as a living, breathing entity that needs constant nurturing. Don’t be afraid to ask for honest opinions, even the critical ones. Constructive criticism is a gift, not a curse!

A simple, short survey (perhaps 3-5 questions) sent via email post-demo can yield valuable insights. Questions could include: What aspects of the demo were most helpful? What could be improved? What were your biggest takeaways? Analyzing this feedback will allow you to refine your presentation and address any recurring concerns. Imagine the possibilities: a perfectly polished demo, honed to a razor’s edge by the collective wisdom of your audience!

Illustrative Examples of Effective Demos

A successful financial planning software demo isn’t just about showcasing features; it’s about painting a picture of financial freedom – a compelling narrative that resonates with the audience’s aspirations and anxieties. Think of it as a financial fairy tale, but with spreadsheets instead of magic wands. The key is to demonstrate tangible value, making the software’s benefits crystal clear and undeniably attractive.

A well-structured demo transforms complex financial concepts into easily digestible information, leaving the audience not just informed, but genuinely excited about the possibilities. This isn’t about technical jargon; it’s about showcasing how the software simplifies their financial lives, freeing them up to pursue their dreams – be it early retirement on a tropical island or simply a more stress-free existence.

Successful Demo Scenario: The Retirement Roadmap

Imagine a demo for a group of pre-retirees, aged 55-65. Their primary concern? Securing a comfortable retirement. The demo begins by showcasing the software’s retirement planning module. We start with a hypothetical couple, showcasing their current income, expenses, and savings. The software then projects their future financial situation, highlighting potential shortfalls or surpluses based on various retirement scenarios. We then illustrate how adjusting their savings rate or altering their retirement age can significantly impact their retirement income. Crucially, the demo isn’t just a series of numbers; we use charts and graphs (detailed below) to visually represent these scenarios, making the complex data immediately understandable and impactful. The positive outcome? The attendees leave feeling empowered, equipped with a clear understanding of their retirement prospects and confident in their ability to plan accordingly. They see the software not as a tool, but as a trusted advisor guiding them toward their retirement dreams.

Visual Aid: The Retirement Income Waterfall Chart

The visual aid is a dynamic waterfall chart illustrating the projected flow of retirement income over time. The horizontal axis represents the years of retirement (e.g., years 1-20), while the vertical axis represents the annual income. Each bar represents a year, with the height corresponding to the total annual income. Different colored segments within each bar represent the sources of income: Social Security (blue), pension (green), investment income (orange), and any additional income streams (purple). The chart clearly shows how the sources of income change over time, highlighting the importance of diversified income streams. For example, the chart might initially show a strong reliance on pension income, which gradually declines as Social Security and investment income become more significant. Any potential shortfalls are visually highlighted with a red shaded area, instantly demonstrating the impact of insufficient savings. The chart’s interactivity allows users to adjust various parameters (savings rate, retirement age, etc.), immediately updating the chart to reflect the changes. This interactive visualization transforms complex financial projections into a compelling and readily understandable story.

Case Study: The Unexpected Inheritance

Sarah, a successful entrepreneur, inherited a substantial sum of money from a distant relative. Initially overwhelmed, she lacked a clear strategy for managing this unexpected windfall. She was unsure how to best invest the funds to maximize returns while minimizing risk, and worried about potential tax implications. Using our software’s portfolio optimization feature, we analyzed Sarah’s risk tolerance, financial goals (e.g., purchasing a vacation home, funding her children’s education), and time horizon. The software then generated a diversified investment portfolio tailored to her specific circumstances, suggesting optimal asset allocation across various asset classes (stocks, bonds, real estate, etc.). The software also calculated the potential tax implications of various investment strategies, helping Sarah make informed decisions that minimized her tax burden. The result? Sarah felt confident and empowered in managing her inheritance, transforming a stressful situation into an opportunity for long-term financial growth. The software helped her navigate the complexities of wealth management, providing clarity and control over her financial future.

Comparing Different Software Demos

Let’s delve into the wonderfully weird world of financial planning software demos. Two distinct approaches, each with its own charm (and occasional catastrophic flaws), will be dissected with the precision of a seasoned tax auditor. Prepare for a comparison so insightful, it’ll make your spreadsheets sing.

We’ll examine two hypothetical demos: “FinPlan Pro,” a slick, visually-driven presentation focused on the user experience, and “NumberCruncher 5000,” a data-heavy demonstration emphasizing the software’s raw power and complex calculations. Both aim to impress, but their methods differ wildly, resulting in vastly different outcomes.

FinPlan Pro Demo Analysis

FinPlan Pro boasts a vibrant, intuitive interface. Its demo is a whirlwind tour of attractive charts, graphs, and user-friendly dashboards. The presenter, a charismatic individual with an unnervingly cheerful demeanor, focuses on ease of use and the software’s ability to simplify complex financial planning tasks. The demo features a carefully curated selection of scenarios, showcasing the software’s ability to handle various user needs. However, it glosses over the intricacies of the underlying calculations and lacks a deep dive into the software’s more advanced features. The focus is clearly on attracting a broad audience, particularly those less comfortable with financial jargon and complex formulas.

NumberCruncher 5000 Demo Analysis

In stark contrast, the NumberCruncher 5000 demo is a relentless barrage of numbers, formulas, and complex financial models. The presenter, a quietly intense individual who seems to subsist solely on caffeine and spreadsheets, focuses on the software’s computational prowess and its ability to handle vast amounts of data with lightning-fast speed. While undeniably impressive in its technical capabilities, the demo lacks visual appeal and can be overwhelming for users unfamiliar with financial modeling. The presenter’s enthusiasm for complex algorithms borders on the fanatical, leaving the audience potentially lost in a sea of numerical equations.

Comparison Table

The following table summarizes the key differences between the two demos:

| Feature | FinPlan Pro | NumberCruncher 5000 |

|---|---|---|

| Demo Style | Visually driven, user-friendly, focuses on ease of use | Data-heavy, technical, emphasizes computational power |

| Target Audience | Broad audience, including those new to financial planning | Experienced financial professionals, data analysts |

| Strengths | Engaging, accessible, highlights key benefits clearly | Demonstrates powerful capabilities, appeals to technically-minded users |

| Weaknesses | Oversimplifies complex features, lacks depth | Overwhelming for non-technical users, lacks visual appeal |

| Effectiveness | High for attracting a broad user base | High for impressing experienced users, low for attracting novices |

Conclusive Thoughts

So, there you have it: a whirlwind tour of the financial planning software demo universe. From crafting captivating presentations to navigating the tricky waters of post-demo follow-up, we’ve covered the essentials (and then some!). Remember, a successful demo isn’t just about showcasing features; it’s about building relationships, fostering trust, and ultimately, helping your clients achieve their financial goals. Now go forth and conquer the world of financial planning – one impressive demo at a time!

Detailed FAQs: Financial Planning Software Demo

What if my internet connection fails during a live demo?

Have a backup plan! This could involve a pre-recorded segment or gracefully shifting to a phone call to address questions. A little improvisation goes a long way.

How do I handle a skeptical audience?

Address concerns directly and honestly. Use data and case studies to back up your claims, and don’t be afraid to acknowledge limitations. Transparency builds trust.

What’s the best way to get feedback after a demo?

Include a short survey or feedback form in your post-demo email. Keep it concise and focus on key areas for improvement. The more feedback, the better!