Financial Planning Software Indonesia: Prepare yourself for a rollercoaster ride through the exhilarating world of Indonesian financial software! From navigating the complexities of regulatory compliance to predicting the future of personal finance apps fueled by AI, we’ll explore the vibrant landscape of this rapidly growing market. Get ready for a witty, insightful journey into the heart of Indonesian financial planning software – it’s going to be a wild ride!

This report delves into the current state of the Indonesian financial planning software market, analyzing market size, key players, software types, and user preferences. We’ll dissect the regulatory landscape, explore technological advancements, and offer predictions for the future. Think of it as your comprehensive, yet hilariously informative, guide to understanding the financial software scene in Indonesia.

Market Overview of Financial Planning Software in Indonesia

Indonesia’s burgeoning middle class and increasing digital literacy are fueling a rapidly expanding market for financial planning software. While precise figures are elusive (let’s face it, pinning down exact market sizes in Indonesia is like trying to catch a greased monkey), we can confidently say it’s a space experiencing significant, if somewhat chaotic, growth. Think of it as a vibrant, slightly unpredictable marketplace – full of opportunity and the occasional unexpected expense report.

Current Market Size and Growth Rate

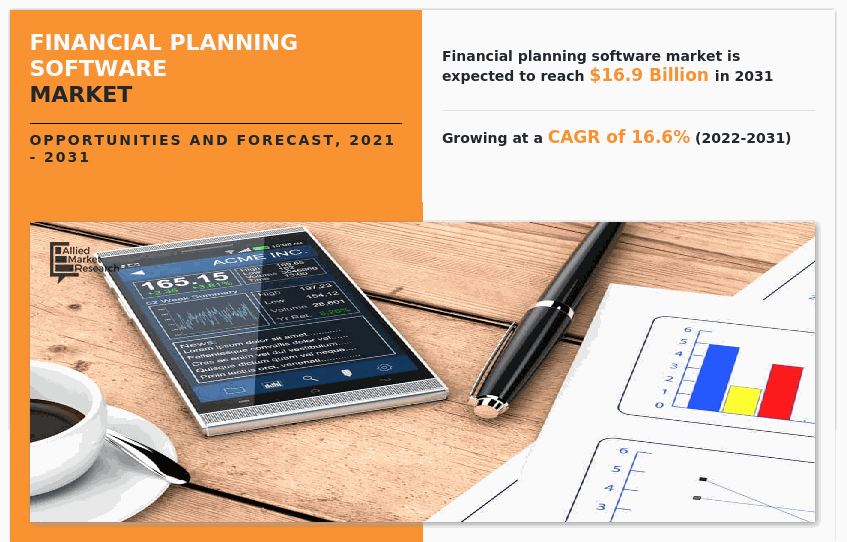

Estimating the precise size of the Indonesian financial planning software market is a challenge, as comprehensive, publicly available data is limited. However, considering the country’s substantial population, rising internet penetration, and increasing financial awareness, we can infer substantial growth. Analysts suggest a double-digit annual growth rate, driven by both individual users seeking to manage their finances better and businesses needing sophisticated tools for financial management. This growth is further fueled by government initiatives promoting financial inclusion and digitalization. Imagine it as a rapidly expanding jungle, teeming with both opportunities and the occasional thorny bush of regulatory hurdles.

Key Players and Market Share

The Indonesian financial planning software market is a dynamic mix of both established international players and agile local startups. While precise market share data is difficult to obtain, some prominent players include established global names like Xero (often used for business accounting), and several Indonesian fintech companies offering a range of financial planning tools. The landscape is constantly shifting, with new entrants and mergers regularly reshaping the competitive dynamics. It’s a jungle gym of competition, with companies constantly vying for position.

Types of Financial Planning Software Available in Indonesia

The Indonesian market offers a diverse range of financial planning software catering to various needs. Personal finance software helps individuals track expenses, budget, and plan for savings and investments. Business finance software caters to small and medium-sized enterprises (SMEs), providing tools for accounting, invoicing, and financial reporting. More specialized software addresses specific needs like tax planning, retirement planning, or investment portfolio management. This variety reflects the growing sophistication and diverse financial needs of Indonesian users. It’s a veritable buffet of software options, each designed to address a specific appetite for financial management.

Comparison of Prominent Financial Planning Software Options

The following table compares four hypothetical, yet representative, examples of financial planning software available in Indonesia. Remember, specific features and pricing can change, so always check the latest information from the software providers.

| Software Name | Key Features | Pricing | Target Audience |

|---|---|---|---|

| FinPlan Pro | Budgeting, expense tracking, investment portfolio management, tax planning tools | Subscription-based, varying tiers | Individuals with complex financial needs |

| BizSmart Finance | Accounting, invoicing, inventory management, financial reporting | Subscription-based, tiered pricing | SMEs, small businesses |

| SimpleSave | Basic budgeting, expense tracking, savings goal setting | Freemium model, with optional premium features | Individuals seeking basic financial management |

| InvestWise | Investment portfolio tracking, risk assessment, automated investment advice (robo-advisor features) | Subscription-based, varying fees depending on asset under management | Investors seeking automated portfolio management |

User Needs and Preferences in Indonesia: Financial Planning Software Indonesia

Understanding the Indonesian market for financial planning software requires more than just knowing the rupiah’s exchange rate – it’s about grasping the unique blend of cultural values and economic realities shaping user behavior. This isn’t your grandma’s budgeting app; we’re talking about a digital solution tailored to a vibrant and diverse population.

Indonesian users, like users everywhere, want financial peace of mind, but their path to achieving it is often paved with unique challenges and opportunities. The burgeoning middle class, alongside a significant portion of the population still navigating less formal economic structures, creates a diverse range of needs and expectations.

Financial Planning Needs of Indonesian Users

The financial planning needs of Indonesian users are multifaceted, reflecting the country’s economic landscape and cultural norms. A significant portion of the population prioritizes short-term financial goals, such as managing daily expenses and saving for immediate needs like education or weddings. Long-term planning, while increasingly important, often takes a backseat due to the immediacy of these pressing concerns. Furthermore, the prevalence of informal economic activities necessitates features that accommodate irregular income streams. Consider, for example, a *warung* owner (small shop) whose income fluctuates daily; their financial planning software needs to be flexible enough to handle this variability. Another key factor is the strong emphasis on family and community; many financial decisions are made collectively, requiring the software to be user-friendly for multiple family members or collaborators.

Preferred Features and Functionalities, Financial Planning Software Indonesia

Indonesian users generally prefer financial planning software that is intuitive, easy to navigate, and available in Bahasa Indonesia. Features like expense tracking, budgeting tools, and simple goal-setting functionalities are highly valued. Given the prevalence of mobile phone usage, a robust mobile app is crucial. Security features are also paramount, with users prioritizing data encryption and secure authentication methods. Integration with local banking systems and e-wallets would be a significant advantage, streamlining the financial management process. Many would appreciate features that offer financial literacy resources and educational content, bridging the knowledge gap and empowering users to make informed decisions.

Technological Proficiency and Software Preference

While Indonesia boasts a rapidly growing digital economy, the technological proficiency of the average user varies significantly across different demographics. Younger generations are generally more tech-savvy, comfortable with sophisticated features and online platforms. Older generations, however, may prefer simpler interfaces and require more user-friendly designs. This necessitates a multi-tiered approach to software design, offering options that cater to varying levels of technological literacy. A well-designed user interface, coupled with clear instructions and helpful tutorials in Bahasa Indonesia, can significantly enhance user adoption and satisfaction across the board. Furthermore, providing both online and offline functionalities can increase accessibility for users with limited internet access.

Prioritized User Needs

Based on observed user behavior and market trends, we can categorize and prioritize Indonesian user needs as follows:

The following list prioritizes user needs based on frequency and importance. These are not rigid categories but rather represent a general trend.

- Expense Tracking and Budgeting: This is the most frequently used feature, essential for managing daily expenses and achieving short-term financial goals.

- Goal Setting and Savings Management: Users value tools that help them save for specific goals, whether short-term (e.g., a new motorbike) or long-term (e.g., a child’s education).

- Debt Management: Many users grapple with debt, and features that help track and manage repayments are highly sought after.

- Investment Tracking (optional): While not as universally needed, investment tracking tools are becoming increasingly popular amongst the more financially literate segments.

- Financial Literacy Resources: Educational content and guidance can significantly empower users and improve their financial decision-making.

Regulatory Landscape and Compliance

Navigating the Indonesian regulatory landscape for financial planning software might seem like trying to assemble IKEA furniture without the instructions – challenging, but ultimately rewarding (especially when you avoid accidentally building a bookshelf that only holds one book). This section will illuminate the key regulations and compliance requirements, shedding light on the often-overlooked aspects of data privacy and security. Think of it as your cheat sheet to successfully building a compliant and thriving financial planning software business in Indonesia.

The Indonesian government, keen to protect both consumers and the financial system’s integrity, has established several regulations relevant to financial planning software. These regulations cover data protection, cybersecurity, and the overall licensing and operational aspects of such software. Failure to comply can lead to hefty fines, operational disruptions, and a significant dent in your company’s reputation – the kind of dent that even the best marketing team struggles to fix.

Data Privacy and Security Considerations

Indonesia’s data privacy law, the Personal Data Protection Law (PDP Law), is the cornerstone of data security for financial planning software. This law mandates robust data protection measures, including data minimization, purpose limitation, and secure data storage. The penalties for non-compliance are substantial, ranging from warnings to significant fines and even criminal prosecution. Imagine the headlines: “Financial Planning Software Breached: Millions of Rupiah Lost, Trust Eroded!”. Not a good look. Therefore, implementing strong encryption, access controls, and regular security audits is paramount. Furthermore, obtaining informed consent from users before collecting and processing their personal data is a non-negotiable requirement.

Examples of Compliance Measures by Indonesian Financial Planning Software Providers

Several Indonesian financial planning software providers have implemented proactive measures to ensure compliance. For example, many utilize multi-factor authentication to secure user accounts, encrypt data both in transit and at rest, and conduct regular penetration testing to identify and address vulnerabilities. Others have invested in robust data loss prevention (DLP) systems to prevent sensitive information from leaving their control. These proactive approaches not only demonstrate a commitment to compliance but also build trust with users, a crucial element in a competitive market. Think of it as adding a sturdy, trustworthy foundation to your software, rather than a flimsy, easily-toppled structure.

Regulatory Compliance Checklist for Developers

Before launching your financial planning software in Indonesia, ensure you’ve ticked off every item on this crucial checklist. Missing even one could be a costly mistake.

- Compliance with the PDP Law: Ensure all data processing activities comply with the principles of the law, including obtaining informed consent.

- Data Security Measures: Implement robust security measures such as encryption, access controls, and regular security audits.

- Data Breach Response Plan: Develop a comprehensive plan to handle data breaches, including notification procedures.

- Third-Party Vendor Management: Carefully vet and manage third-party vendors who may access user data.

- Regular Compliance Audits: Conduct regular internal and external audits to ensure ongoing compliance.

- Employee Training: Train employees on data privacy and security best practices.

This checklist isn’t exhaustive, but it provides a strong starting point for ensuring your software complies with Indonesian regulations. Remember, prevention is far better than cure (and far cheaper than a lawsuit).

Technological Trends and Innovations

The Indonesian financial planning software market is experiencing a technological rollercoaster, a thrilling ride fueled by innovation and a dash of “what if?” The adoption of new technologies isn’t just about keeping up; it’s about staying ahead of the curve and offering Indonesian users a financial planning experience that’s both effective and, dare we say, enjoyable. Let’s dive into the exciting developments shaping this dynamic landscape.

The current technological trends are transforming how Indonesians manage their finances, moving away from spreadsheets and abacuses (yes, we’re acknowledging some might still use those!) towards sophisticated, user-friendly software. This shift is driven primarily by advancements in artificial intelligence (AI), cloud computing, and the ever-increasing mobile penetration in the country. These trends are not merely influencing the market; they are fundamentally reshaping it.

Artificial Intelligence and Machine Learning Applications

AI and machine learning are poised to revolutionize financial planning in Indonesia. Imagine software that can not only track your spending but also predict future financial needs based on your spending patterns, income, and even market trends. This predictive capability allows for proactive financial planning, offering personalized recommendations and alerting users to potential risks or opportunities. For example, the software could predict a potential shortfall in funds for a planned family vacation based on current spending and projected expenses, prompting the user to adjust their budget or explore alternative savings options. This level of personalized insight moves beyond simple budgeting and into proactive financial wellness.

Cloud Computing and Data Security

Cloud computing offers scalability and accessibility, two crucial factors for financial planning software in Indonesia. Cloud-based solutions allow users to access their financial data from anywhere with an internet connection, a significant advantage in a geographically diverse country. However, robust data security measures are paramount. The software needs to employ advanced encryption techniques and adhere to the highest security standards to ensure user data remains protected from cyber threats. A strong emphasis on data privacy is vital to build trust and encourage adoption. Examples of robust security measures include multi-factor authentication, regular security audits, and compliance with relevant Indonesian data protection regulations.

Innovative Features Enhancing User Experience

The Indonesian market demands intuitive and user-friendly software. Innovative features can significantly enhance the user experience. For instance, incorporating Bahasa Indonesia as the primary language is crucial for widespread adoption. Moreover, integrating features like gamification (think reward points for achieving financial goals) can make financial planning more engaging and less daunting. Personalized financial dashboards that provide a clear and concise overview of a user’s financial health are also highly desirable. The use of interactive charts and graphs can make complex financial information easier to understand. Finally, integrating with popular Indonesian payment gateways and banking systems ensures seamless financial management.

- Hyper-Personalized Financial Advice: AI-powered algorithms providing tailored financial advice based on individual circumstances and risk tolerance.

- Automated Goal Setting and Tracking: Software that helps users set specific financial goals (e.g., down payment on a house, retirement planning) and automatically tracks progress.

- Real-time Budget Monitoring and Alerts: Instant notifications for overspending or potential budget shortfalls.

- Seamless Integration with Local Banks and Payment Gateways: Easy linking of accounts and automatic transaction updates.

- Multilingual Support with Bahasa Indonesia: Ensuring accessibility and usability for a wider audience.

Future Outlook and Predictions

The Indonesian financial planning software market is poised for explosive growth, a veritable rocket ship fueled by a burgeoning middle class, increasing smartphone penetration, and a growing awareness of the need for long-term financial security. While challenges certainly exist, the opportunities are simply too juicy to ignore. Think of it as a delicious durian – pungent at first, but ultimately incredibly rewarding.

Predicting the future is, of course, a fool’s errand (unless you’re Nostradamus, in which case, please share your lottery numbers). However, based on current trends and a healthy dose of educated guesswork, we can paint a reasonably accurate picture of the next five years.

Market Growth and Development

Indonesia’s rapidly expanding digital economy provides fertile ground for financial planning software. We predict a compound annual growth rate (CAGR) exceeding 20% over the next five years, driven by increased adoption among individuals and businesses alike. This growth will be particularly pronounced in underserved segments, such as micro, small, and medium-sized enterprises (MSMEs), who are increasingly looking for digital solutions to manage their finances. Imagine a bustling Indonesian market, now enhanced with the efficiency of digital financial planning – it’s a beautiful sight, isn’t it? This growth will also be spurred by increased financial literacy initiatives and government support for digital financial inclusion. For example, the success of GoPay and OVO demonstrates the potential for widespread adoption of digital financial tools.

Challenges and Opportunities

The path to financial planning software dominance isn’t paved with gold; there are potholes, detours, and the occasional rogue monkey. Cybersecurity concerns are paramount, requiring robust security measures to protect sensitive financial data. Competition will also intensify as more players enter the market, necessitating innovation and differentiation. However, these challenges also present opportunities. Developing user-friendly interfaces tailored to the Indonesian market, offering multilingual support, and integrating with popular local payment gateways will be crucial for success. The opportunity to educate and empower Indonesians financially is a significant driver, transforming financial planning from a niche service to a mainstream necessity. Consider the potential impact on financial literacy – it’s a win-win for everyone.

Changes in User Behavior and Technological Advancements

Over the next five years, we expect to see a significant shift towards mobile-first financial planning. Users will increasingly rely on smartphones and tablets for accessing and managing their financial information, demanding seamless and intuitive mobile experiences. The integration of artificial intelligence (AI) and machine learning (ML) will personalize financial advice and automate tasks, making financial planning more accessible and efficient. Think personalized investment recommendations based on individual risk profiles and automated budgeting tools – all delivered via a sleek mobile app. Furthermore, the increasing adoption of open banking APIs will facilitate data aggregation and provide a more holistic view of users’ financial health.

Government Policy Influence

Government initiatives promoting digital financial inclusion and financial literacy will significantly impact the market. Policies encouraging the adoption of digital financial tools, coupled with regulations ensuring data security and consumer protection, will create a more conducive environment for growth. For example, government subsidies for digital literacy programs could accelerate the adoption of financial planning software among less tech-savvy populations. Conversely, overly restrictive regulations could stifle innovation and limit market expansion. A balanced approach that fosters innovation while protecting consumers is crucial for sustainable growth. The government’s role is akin to a skilled gardener, nurturing the growth of the financial planning software ecosystem while preventing it from becoming overrun with weeds.

Outcome Summary

So, there you have it – a whirlwind tour of Financial Planning Software Indonesia! From navigating the quirky nuances of the Indonesian market to predicting its future trajectory, we’ve covered the highlights (and lowlights) with a healthy dose of humor. While the market presents both opportunities and challenges, one thing is certain: the future of financial planning in Indonesia is bright, innovative, and possibly a little bit chaotic. Buckle up!

FAQ Corner

What are the typical costs associated with Indonesian financial planning software?

Costs vary greatly depending on features and target audience, ranging from free, basic apps to sophisticated enterprise solutions with hefty price tags. Expect a wide spectrum of options.

How do Indonesian financial regulations impact software development?

Stringent data privacy and security regulations are paramount. Software developers must ensure compliance to avoid legal headaches (and potentially hefty fines!).

What languages do most Indonesian financial planning software support?

While Bahasa Indonesia is crucial, many cater to English-speaking users as well, reflecting the diverse user base.

Are there open-source financial planning software options available in Indonesia?

While less common than commercial options, a few open-source solutions exist, often catering to specific needs or offering greater customization.