Effective financial planning is crucial for achieving long-term financial well-being. This guide explores the diverse world of financial planning templates, providing a practical understanding of their types, key elements, and effective utilization across different life stages. We’ll delve into the nuances of designing personalized templates, incorporating security measures, and leveraging various software options to streamline the process.

From budgeting and retirement planning to investment strategies and debt management, we’ll examine how these templates can simplify complex financial tasks. We’ll also discuss the importance of user-friendly design, the role of visual aids in enhancing comprehension, and the best practices for customizing templates to meet individual needs and financial goals.

Types of Financial Planning Templates

Financial planning templates are invaluable tools for individuals and families seeking to organize their finances and achieve their financial goals. These templates provide a structured framework for tracking income and expenses, projecting future finances, and making informed decisions about saving, investing, and debt management. Choosing the right template depends on your specific needs and financial objectives.

Categories of Financial Planning Templates

Several categories of financial planning templates cater to diverse financial needs. These include budgeting templates, retirement planning templates, investment tracking templates, and debt management templates. Each category offers specific tools and features to assist users in managing their finances effectively.

Budgeting Templates

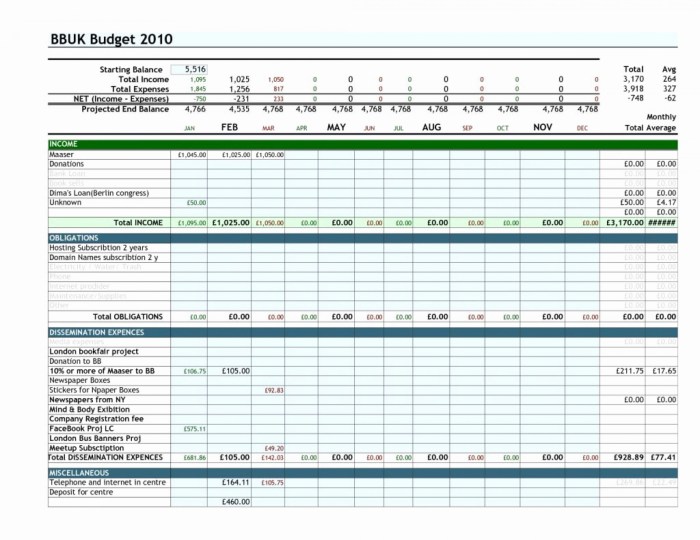

Budgeting templates are fundamental tools for tracking income and expenses. They help users understand their spending habits, identify areas for savings, and create a plan for achieving financial goals. Effective budgeting is crucial for financial stability and long-term success.

Retirement Planning Templates

Retirement planning templates assist individuals in estimating their retirement needs and developing a savings plan to meet those needs. These templates consider factors such as current income, anticipated expenses in retirement, and expected investment returns. Proper retirement planning ensures a comfortable and secure retirement.

Investment Tracking Templates

Investment tracking templates allow users to monitor their investment portfolio’s performance. These templates track asset allocation, gains, losses, and overall portfolio value. They help users make informed decisions about buying, selling, and rebalancing their investments. Effective investment tracking is vital for maximizing investment returns and minimizing risks.

Debt Management Templates

Debt management templates help individuals organize and track their debts. These templates allow users to strategize repayment plans, compare interest rates, and identify opportunities to reduce debt. Managing debt effectively is crucial for improving credit scores and achieving financial freedom.

Examples of Financial Planning Templates

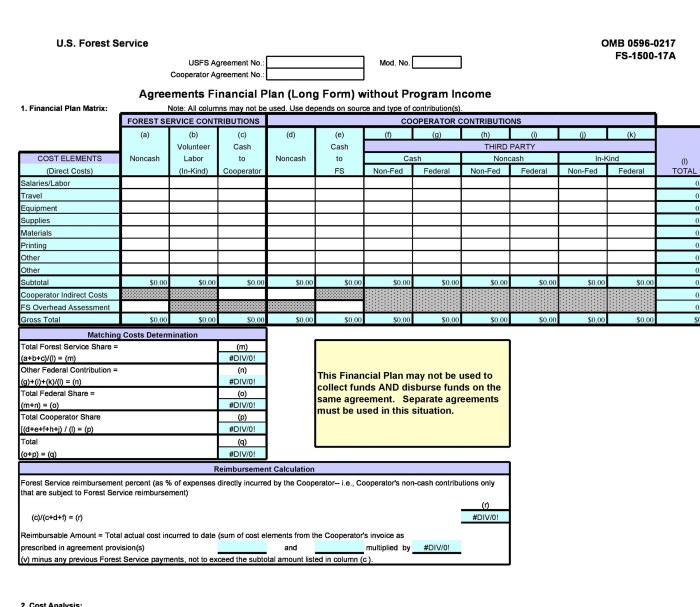

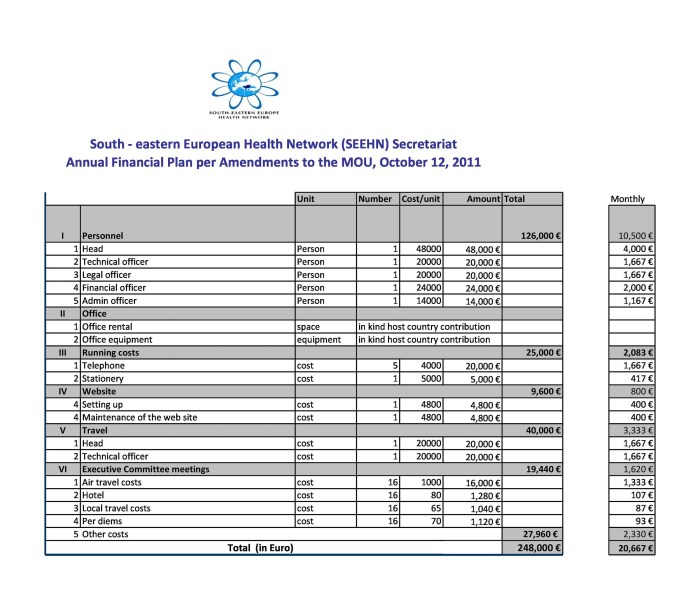

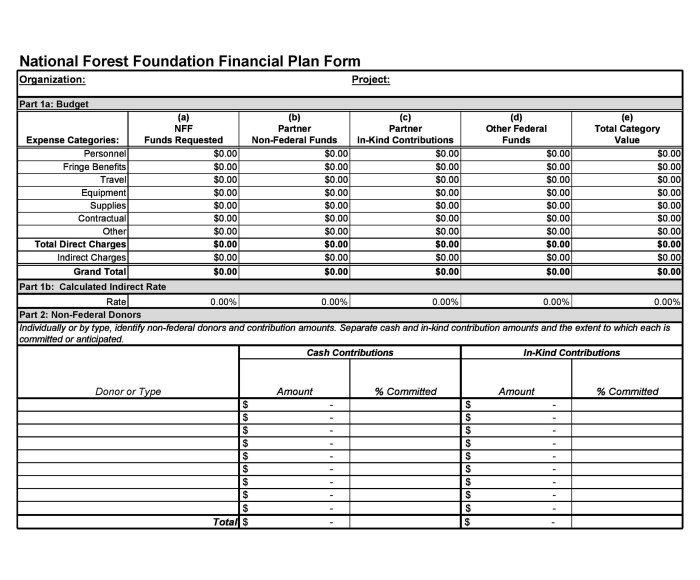

Below is a table detailing specific examples of financial planning templates, their key features, and their intended users.

| Template Name | Category | Key Features | Target User |

|---|---|---|---|

| Simple Budget Tracker | Budgeting | Income/Expense Tracking, Monthly Summary, Basic Goal Setting | Individuals with straightforward income and expenses |

| Detailed Budget Planner with Debt Allocation | Budgeting | Income/Expense Tracking, Categorized Spending Analysis, Debt Repayment Schedule, Savings Goals | Individuals with multiple income streams and significant debt |

| Retirement Savings Calculator | Retirement Planning | Retirement Income Projection, Savings Goal Calculation, Investment Growth Simulation | Individuals planning for retirement |

| Investment Portfolio Tracker | Investment Tracking | Asset Allocation Tracking, Gain/Loss Calculation, Performance Reporting | Investors with diverse investment portfolios |

| Debt Snowball Calculator | Debt Management | Debt Listing, Repayment Strategy (Snowball Method), Projected Payoff Dates | Individuals with multiple debts seeking a structured repayment plan |

Comparison of Budgeting Templates

Three budgeting templates – Simple Budget Tracker, Detailed Budget Planner with Debt Allocation, and a hypothetical “Zero-Based Budget Template” – offer varying functionalities. The Simple Budget Tracker provides basic income and expense tracking, suitable for individuals with uncomplicated finances. The Detailed Budget Planner adds features like categorized spending analysis and debt repayment scheduling, catering to those with more complex financial situations. A hypothetical Zero-Based Budget Template would incorporate the principle of allocating every dollar to a specific purpose, enhancing budgeting control. The choice depends on the user’s financial complexity and desired level of detail.

Key Elements of Effective Financial Planning Templates

A well-designed financial planning template is crucial for effective personal finance management. It provides a structured framework to organize financial information, track progress towards goals, and make informed decisions. The effectiveness of a template hinges on several key elements that contribute to its usability, accuracy, and overall impact on the user’s financial well-being.

Essential Components of a Well-Designed Financial Planning Template

A robust financial planning template should include sections for recording income and expenses, tracking assets and liabilities, setting financial goals, and projecting future financial scenarios. It needs to be adaptable enough to cater to various financial situations and personal goals, from simple budgeting to complex retirement planning. Specific sections might include dedicated areas for detailing investment portfolios, debt management strategies, tax planning considerations, and insurance coverage. The template should also allow for easy data entry and modification, facilitating regular updates and adjustments as needed.

User-Friendliness and Intuitive Design in Financial Templates

User-friendliness is paramount. A confusing or overly complicated template will likely be abandoned, rendering it ineffective. Intuitive design involves clear labeling of sections, logical data flow, and a visually appealing layout that minimizes cognitive load. The use of consistent formatting, easily understandable terminology, and helpful prompts significantly enhances the user experience. Consideration should be given to different levels of financial literacy; the template should be accessible to both beginners and experienced users. A well-designed template guides users through the process smoothly, making financial planning less daunting and more manageable.

Visual Aids: Charts and Graphs for Improved Understanding and Engagement

Visual aids are invaluable in making complex financial information more accessible and engaging. Charts and graphs effectively communicate trends, patterns, and relationships within financial data. For example, a bar chart could compare monthly expenses across different categories, while a line graph could illustrate savings growth over time. These visual representations transform numbers into easily digestible insights, promoting better understanding and encouraging consistent engagement with the planning process.

Sample Chart: Debt Reduction Over Time

Imagine a line graph showing debt reduction. The x-axis represents time (months or years), and the y-axis represents the total debt amount. The line itself would decline steadily over time, illustrating the progress made in paying down debt. Different colored lines could represent different types of debt (e.g., credit card debt, student loans), allowing for a visual comparison of reduction rates across various debt categories. Markers along the line could indicate milestones achieved, such as reaching a specific debt reduction target. This visual representation clearly shows the impact of consistent repayment efforts.

Incorporating Security Features to Protect Sensitive Financial Information

Protecting sensitive financial data is crucial. Templates should incorporate security measures to prevent unauthorized access and data breaches. This could involve password protection for the template file itself, encryption of sensitive data within the template, and limiting access to specific users or devices. Regular backups are also essential to mitigate the risk of data loss. Adherence to best practices for data security is paramount to ensure the confidentiality and integrity of the user’s financial information.

Creating a Personalized Financial Planning Template

A generic financial planning template provides a solid framework, but its true power lies in its adaptability to individual circumstances. Personalization ensures the template effectively reflects your unique financial situation, goals, and risk tolerance, leading to more accurate projections and informed decision-making. This process involves more than simply plugging in numbers; it’s about tailoring the template’s structure and content to meet your specific needs.

Personalizing a financial planning template involves a systematic approach, transforming a generic structure into a powerful tool for managing your finances. This customization ensures the template accurately reflects your personal financial landscape and assists in achieving your financial aspirations. By adapting the template, you gain a clear picture of your financial health and progress toward your goals.

Customizing a Generic Template

Transforming a generic financial planning template into a personalized tool requires a step-by-step approach. First, carefully review the template’s existing categories and sections. Identify which sections are relevant to your situation and which need modification or removal. For instance, if you don’t own a property, you might remove the section dedicated to mortgage payments. Next, add new categories or subcategories as needed to accommodate aspects of your financial life not covered in the original template. This could include specific savings goals, like a down payment on a house or funding a child’s education. Finally, input your specific financial data into the relevant sections, ensuring accuracy and consistency across all entries. Regularly update the template as your financial circumstances change.

Adapting for Different Income Levels and Financial Goals

A key aspect of personalization is adapting the template to your income level and financial goals. For lower income levels, the focus might shift to budgeting and debt reduction, possibly incorporating sections for tracking expenses meticulously and strategies for paying off high-interest debts. Conversely, higher income levels might warrant sections dedicated to investment strategies, tax planning, and estate planning. Regardless of income, clearly defining short-term and long-term financial goals—such as buying a car, paying off student loans, or planning for retirement—is crucial. These goals should be integrated into the template, allowing you to track progress and make necessary adjustments along the way. For example, someone aiming for early retirement might allocate a larger percentage of their income towards investments, while someone focusing on immediate debt reduction might prioritize paying down high-interest debt.

Integrating Various Financial Accounts

Integrating your various financial accounts—bank accounts, investment accounts, and credit cards—into a single template provides a comprehensive overview of your financial health. This consolidated view allows for accurate tracking of assets, liabilities, and cash flow. You can create separate sections within your template for each account type, listing account balances, interest rates, and transaction history (where applicable). This integration facilitates easier budgeting and financial planning, as you can readily see the interplay between different accounts. For instance, you can easily track how much you’re saving each month and how that aligns with your investment goals. Software applications can greatly simplify this process by automatically importing data from linked accounts.

Best Practices for Personalizing a Financial Planning Template

Effective personalization relies on certain best practices. A well-structured template facilitates easy navigation and data entry. Consistency in data entry is vital for accurate analysis. Regular updates ensure the template remains a current reflection of your financial status. Using visual aids, such as charts and graphs, helps illustrate progress and identify areas needing attention. Finally, seek professional advice when necessary. A financial advisor can provide personalized guidance and help you refine your template to align with your specific financial situation and long-term goals.

- Maintain a well-structured template for easy navigation and data entry.

- Ensure consistent data entry for accurate analysis and informed decision-making.

- Regularly update the template to reflect your current financial situation.

- Utilize visual aids like charts and graphs to enhance understanding and identify areas for improvement.

- Seek professional financial advice when needed for personalized guidance and refinement.

Utilizing Financial Planning Templates for Different Life Stages

Financial planning is a lifelong journey, and the priorities and needs shift significantly across different life stages. A well-structured financial planning template can be a powerful tool to adapt to these changing circumstances, ensuring you stay on track towards your financial goals regardless of your age or family situation. By customizing a template to reflect your specific stage of life, you can streamline the planning process and make informed decisions.

Financial Planning Needs Across Life Stages

The financial priorities and challenges faced vary greatly between young adults, families, and retirees. Young adults often focus on building a foundation, families prioritize security and education, while retirees concentrate on preserving assets and managing healthcare costs. Understanding these differences is crucial for effective financial planning.

Adapting Financial Planning Templates for Different Life Stages

A flexible financial planning template can be easily adapted to suit the specific needs of each life stage. This involves adjusting the sections, adding or removing elements, and focusing on the most relevant financial goals for that particular period. For example, a template for a young adult might emphasize debt reduction and savings, while a template for a retiree might highlight income generation and estate planning.

| Life Stage | Key Financial Goals | Template Adaptations | Example Template Features |

|---|---|---|---|

| Young Adult (20s-30s) | Debt reduction (student loans, credit cards), establishing emergency fund, saving for a down payment (house/car), investing for long-term growth | Emphasis on budgeting, debt tracking, investment planning sections; simplified retirement planning; minimal estate planning | Debt amortization calculator, investment return projections, emergency fund tracker, basic budgeting worksheet |

| Family (30s-50s) | Mortgage payments, children’s education, saving for retirement, insurance coverage (life, health, disability), college fund contributions | Detailed budgeting, expense tracking for household, education cost projections, retirement savings calculators, insurance needs assessment; expanded estate planning section | College savings calculator, life insurance needs analysis, mortgage amortization schedule, detailed family budget template, will creation guide |

| Retiree (60s+) | Managing retirement income (pensions, social security, investments), healthcare expenses, estate planning, long-term care planning | Focus on income streams, healthcare cost projections, estate distribution planning, legacy planning; reduced emphasis on debt and savings | Retirement income projection calculator, healthcare cost estimator, estate tax planning worksheet, long-term care insurance comparison tool, legacy document templates |

Resources and Tools for Finding and Using Financial Planning Templates

Finding and utilizing appropriate financial planning templates is crucial for effective personal finance management. The right template can streamline the budgeting process, improve financial awareness, and help individuals achieve their long-term financial goals. Access to a variety of resources and tools, both free and paid, significantly impacts the quality and usability of the planning process.

Reputable Sources for Financial Planning Templates

Numerous reputable sources offer high-quality financial planning templates. These sources vary in their offerings, from free basic templates to sophisticated, feature-rich paid options. Choosing a reliable source is critical to ensuring the accuracy and functionality of the template.

- Government Websites: Many government agencies, such as the Consumer Financial Protection Bureau (CFPB) in the US, offer free, downloadable templates and resources focused on financial literacy and planning. These often provide basic budgeting and savings tools.

- Financial Institutions: Banks and credit unions frequently provide their customers with access to financial planning tools and templates, sometimes as part of their online banking services. These templates often integrate with their other financial products.

- Reputable Financial Websites: Websites dedicated to personal finance, such as NerdWallet or Investopedia, often offer downloadable templates or links to reliable resources. However, always carefully review the source’s credibility before downloading.

- Financial Software Companies: Companies specializing in financial planning software (discussed in more detail below) typically offer templates as part of their software packages. These templates are often designed to integrate seamlessly with the software’s features.

Advantages and Disadvantages of Free versus Paid Templates

The decision to use a free or paid financial planning template depends on individual needs and technical skills. Both options have their strengths and weaknesses.

- Free Templates: Advantages include low cost and easy accessibility. Disadvantages may include limited functionality, lack of customization options, and potential for errors or inaccuracies. A free template might only offer basic budgeting features, lacking advanced tools for investment tracking or retirement planning.

- Paid Templates: Advantages include advanced features, greater customization, professional design, and often, technical support. Disadvantages include the cost and the need for potential software or platform compatibility. A paid template could include features like automated calculations, tax planning tools, and scenario modeling.

Importing and Exporting Data Between Financial Planning Templates and Software

The ability to seamlessly transfer data between different financial planning templates and software is essential for maintaining accurate and consistent financial records. This often involves using common file formats like CSV (Comma Separated Values) or XLSX (Excel).

The process typically involves exporting data from one template or software in a compatible format and then importing that data into the new template or software. Many programs offer built-in import/export functions, simplifying the process. However, it’s important to carefully review the data mapping to ensure accurate transfer. Manual data entry is always a last resort and should be avoided due to increased chances of error.

Software Options for Managing Financial Plans

Several software options are available for managing financial plans, each offering unique features and user interfaces. The choice depends on individual needs and budget.

- Mint: Mint is a popular free budgeting and financial management app. Its user interface is intuitive and easy to navigate. Key features include automatic account aggregation, budgeting tools, bill payment reminders, and credit score monitoring. The interface is visually appealing and straightforward, making it suitable for beginners.

- Personal Capital: Personal Capital is a free financial planning tool with a more advanced feature set than Mint. It offers comprehensive investment tracking, retirement planning tools, and fee analysis. The interface is more sophisticated, requiring a slightly steeper learning curve. Its strength lies in its robust investment tracking and retirement planning capabilities.

- Quicken: Quicken is a paid financial planning software with a wide range of features, including budgeting, investment tracking, tax preparation assistance, and debt management tools. The interface is powerful but can be more complex than free options. It’s suitable for users needing a comprehensive solution with advanced features and customization options. Its strength is its broad feature set, suited for those with complex financial situations.

Final Thoughts

Mastering financial planning doesn’t have to be daunting. By understanding the various types of templates available and leveraging their customizable features, individuals can gain control over their finances and work towards their financial aspirations. This guide provides the foundational knowledge and practical steps to effectively utilize financial planning templates, leading to improved financial literacy and a more secure financial future.

Essential Questionnaire

What is the difference between a free and paid financial planning template?

Free templates often offer basic functionalities, while paid templates typically provide more advanced features, greater customization options, and potentially better support.

Can I use a financial planning template if I’m not tech-savvy?

Yes, many templates are designed with user-friendliness in mind. Look for templates with intuitive interfaces and clear instructions.

How often should I review and update my financial planning template?

Regularly, at least annually, or whenever significant life changes occur (job change, marriage, birth of a child, etc.).

Where can I find reliable financial planning software to integrate with my template?

Reputable sources include established financial software companies, online reviews, and recommendations from financial advisors.