Financial Planning Templates: Ah, the sweet symphony of spreadsheets and sensible saving! These aren’t just dusty documents; they’re your secret weapons in the thrilling battle against financial uncertainty. Whether you’re a seasoned investor or a budgeting newbie, the right template can transform your financial life from chaotic to controlled, turning money woes into money wins. We’ll explore the various types, features, and tools to help you conquer your financial future, one meticulously planned cell at a time.

From crafting a budget that doesn’t feel like a punishment to projecting a retirement that doesn’t involve ramen noodles, this guide will illuminate the path to financial freedom. We’ll delve into the differences between personal and business templates, dissect the key features of effective designs, and even guide you through creating your own masterpiece. So, buckle up, buttercup, because we’re about to embark on a financial adventure!

Types of Financial Planning Templates

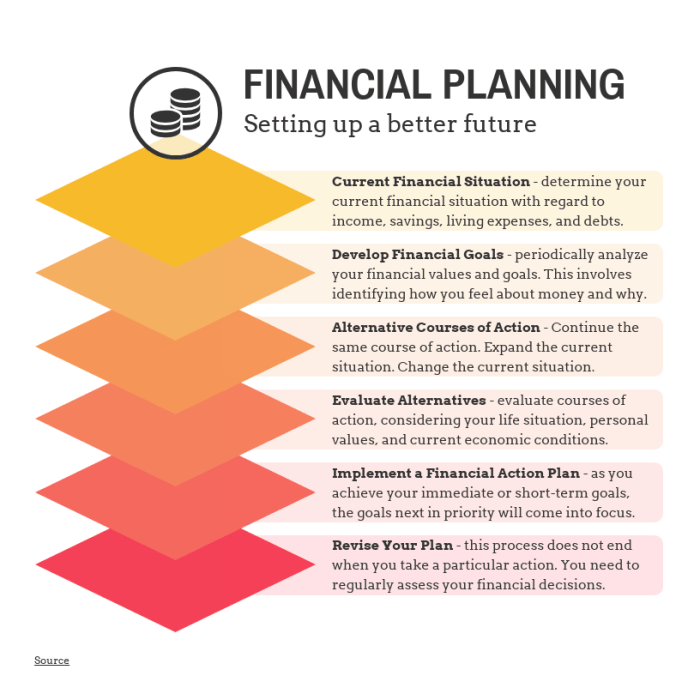

Financial planning: the very words conjure images of spreadsheets stretching to infinity, numbers dancing a dizzying jig, and the faint scent of impending wealth (or, let’s be honest, mild panic). But fear not, intrepid budgeter! Financial planning templates are your trusty sidekicks in this often-chaotic quest for fiscal fitness. They’re pre-designed frameworks that help organize your financial life, transforming a daunting task into a manageable (and maybe even enjoyable) process.

Choosing the right template depends entirely on your specific needs and goals. Whether you’re a seasoned investor or a fresh-faced graduate navigating the world of student loans, there’s a template out there with your name on it (or at least, your financial information). Let’s dive into some of the most popular types.

Types of Financial Planning Templates and Their Uses

The following table details various financial planning templates, highlighting their purpose and ideal user.

| Template Name | Purpose | Target Audience | Key Features |

|---|---|---|---|

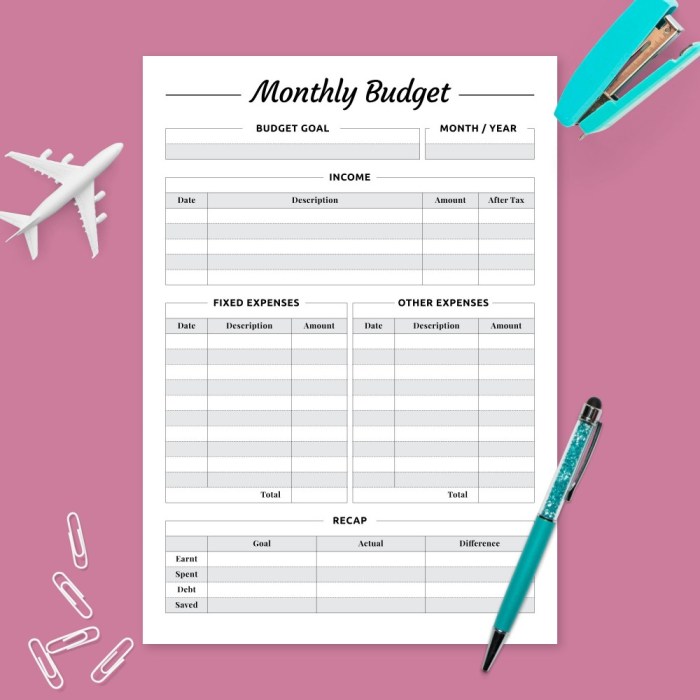

| Personal Budget Template | Track income and expenses to manage cash flow and identify areas for savings. | Individuals, families, students | Categorized expense tracking, net worth calculation, savings goal setting. |

| Retirement Planning Template | Estimate retirement needs and develop a savings plan to achieve financial security in retirement. | Individuals nearing retirement, those planning for long-term financial security | Retirement income projections, investment growth calculations, Social Security benefit estimation. |

| Investment Tracking Template | Monitor investment performance, track gains and losses, and analyze portfolio diversification. | Investors, portfolio managers | Asset allocation tracking, performance analysis, dividend tracking, tax implications reporting. |

| Debt Reduction Template | Organize and strategize for paying off debt, comparing different repayment methods. | Individuals with high-interest debt, those seeking to improve their credit score. | Debt snowball/avalanche method calculations, minimum payment tracking, interest calculations. |

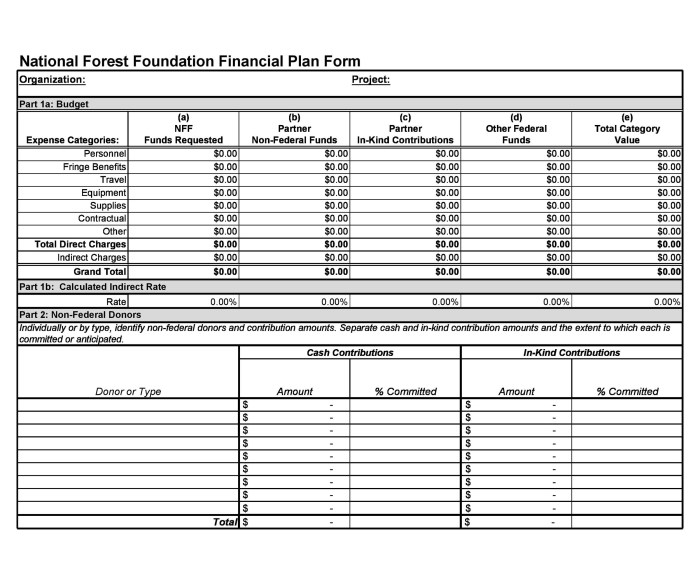

| Business Financial Planning Template | Forecast revenue, manage expenses, and track profitability for a business. | Entrepreneurs, small business owners, financial managers | Cash flow projections, profit and loss statements, balance sheet projections, break-even analysis. |

Personal vs. Business Financial Planning Templates

While both aim to organize finances, personal and business templates differ significantly in scope and focus. Personal templates center around individual or household finances, emphasizing budgeting, saving, and debt management. Business templates, on the other hand, focus on the financial health of an organization, encompassing profit and loss statements, cash flow projections, and balance sheet analysis. Think of it this way: personal finance is about managing your own money, while business finance is about managing money for a larger entity. The scale, complexity, and goals are vastly different.

Comparison of Budgeting, Retirement, and Investment Tracking Templates

These three template types, while distinct, often intertwine. A budgeting template provides the foundational framework for tracking income and expenses, informing both retirement and investment strategies. A retirement planning template uses data from the budget to project future needs and plan accordingly. Investment tracking, in turn, helps monitor the progress of investments made to achieve retirement goals. In essence, they’re a financial planning trifecta – each playing a crucial role in a comprehensive financial strategy.

Key Features of Effective Financial Planning Templates

Let’s face it, financial planning isn’t exactly a barrel of laughs. Unless you find meticulously tracking your expenses and projecting future wealth incredibly amusing (and if you do, please, tell me your secrets!). However, a well-designed template can significantly reduce the drudgery and even inject a touch of…dare we say…enjoyment? The right template is your financial superhero sidekick, guiding you through the often-murky waters of personal finance.

A truly effective financial planning template isn’t just a spreadsheet; it’s a carefully crafted instrument designed to help you achieve your financial goals. Think of it as a finely tuned financial orchestra, with each element playing its part in creating a harmonious financial symphony (or at least a decent budget). The right features are crucial to making this happen.

Essential Features of Effective Financial Planning Templates

Before diving into specifics, let’s acknowledge that the perfect template is as individual as your financial situation. However, some core features consistently elevate a template from “meh” to “magnificent.” These features are not mere suggestions; they’re the pillars upon which a successful financial plan is built.

- Customizability: A one-size-fits-all approach to financial planning is about as effective as a square peg in a round hole. A good template allows for personalization, adapting to individual needs and goals, whether you’re saving for a down payment, retirement, or that dream vacation to the Bahamas (we all need a little escapism, right?).

- Comprehensive Data Fields: A template needs to be able to handle the whole shebang – income, expenses, assets, liabilities, debts, and even those pesky little irregular payments. The more comprehensive the data fields, the more accurate your financial picture will be. Think of it as a financial X-ray; the more detailed the image, the better the diagnosis (and the better your treatment plan).

- Clear Visualizations: Numbers can be daunting. A good template will present your financial data in easily digestible visual formats, such as charts and graphs. Think pie charts showing your expense breakdown or line graphs illustrating your savings progress. These visualizations transform complex data into readily understandable insights.

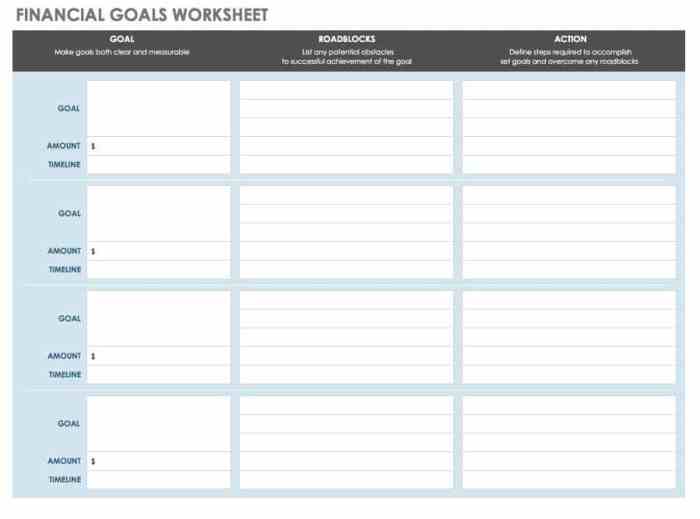

- Goal Setting and Tracking Functionality: What’s the point of a financial plan without goals? A robust template incorporates features for setting specific, measurable, achievable, relevant, and time-bound (SMART) goals and provides tools for tracking progress towards those goals. It’s like having a personal financial cheerleader, constantly reminding you of your aspirations and celebrating your milestones.

- Scenario Planning Capabilities: Life throws curveballs. A good template should allow you to explore different financial scenarios – “what if” situations – to prepare for unexpected events. Imagine the peace of mind knowing you’ve considered various possibilities, from a job loss to a sudden medical expense. This proactive approach is crucial for building financial resilience.

User-Friendliness and Intuitive Design

Let’s be honest, wrestling with a clunky, confusing template is about as enjoyable as a root canal. User-friendliness is paramount. An intuitive design ensures that even those with limited financial literacy can easily navigate the template, input data, and interpret the results. Clear labeling, logical organization, and straightforward instructions are essential. Think of it as a user-friendly financial GPS – guiding you to your financial destination without getting you hopelessly lost along the way.

Hypothetical Template Design

Imagine a template with clearly labeled sections for income (salary, investments, etc.), expenses (housing, transportation, entertainment, etc.), assets (checking accounts, savings accounts, investments, etc.), and liabilities (credit card debt, student loans, mortgages, etc.). Each section would use intuitive drop-down menus and input fields. Visualizations, such as pie charts for expense categorization and line graphs for net worth tracking, would provide immediate insights. A dedicated section for goal setting would allow users to input their financial objectives, complete with target dates and progress tracking mechanisms. Finally, a “Scenario Planning” section would allow users to input variables (e.g., job loss, unexpected medical expense) and see how these changes affect their overall financial picture. The template would use a color-coded system to highlight areas needing attention (e.g., red for overspending, green for exceeding savings goals). The overall aesthetic would be clean, modern, and uncluttered, prioritizing ease of use and data clarity.

Software and Tools for Creating Financial Planning Templates

Crafting the perfect financial planning template is a bit like baking a cake – you need the right ingredients (data), the right tools (software), and a dash of creativity (personalization). Choosing the right software is crucial, as it determines how easily you can create, manage, and use your template. Let’s explore some options, shall we?

Spreadsheet Programs for Financial Planning Templates

Spreadsheet programs like Microsoft Excel or Google Sheets are readily available, user-friendly (mostly!), and offer a surprisingly robust set of tools for building financial templates. Their strengths lie in their versatility and widespread familiarity. You can easily create formulas for calculations, visualize data with charts, and protect sensitive information with password protection. However, their weaknesses become apparent when dealing with complex financial models or needing advanced features like scenario planning or tax optimization; these often require significant manual input and formula crafting, which can be time-consuming and prone to errors. Think of them as the trusty hand mixer in your baking arsenal – reliable for basic tasks, but perhaps not ideal for a seven-layer cake.

Dedicated Financial Planning Software

For more sophisticated needs, dedicated financial planning software packages offer a significant advantage. These programs, such as Quicken or Moneydance, are specifically designed for managing finances and often include pre-built templates, advanced features like goal setting and retirement planning, and data import capabilities from various financial institutions. The strengths here are efficiency and advanced features, but the weaknesses are the cost (subscriptions or one-time purchases) and the learning curve – they’re not always as intuitive as a spreadsheet. Consider them the stand mixer – powerful and efficient, but requiring a bit more expertise to master.

Financial Modeling Software

For those who want to build truly intricate financial models, specialized financial modeling software packages like @RISK or Palisade DecisionTools Suite are the heavy hitters. These programs allow for Monte Carlo simulations and advanced sensitivity analysis, ideal for complex scenarios and risk assessment. However, these tools have a steep learning curve and are generally more expensive than spreadsheet or dedicated personal finance software. They are the culinary equivalent of a professional-grade kitchen – incredibly powerful, but requiring substantial investment and expertise.

Creating a Simple Budget Template Using a Spreadsheet Program

Creating a budget template in a spreadsheet is surprisingly straightforward. Follow these steps to whip up your own financial masterpiece:

- Set up your categories: Create columns for income sources (salary, investments, etc.) and expense categories (housing, food, transportation, etc.).

- Input your data: Enter your monthly income and expenses for each category. Be as detailed as possible!

- Create formulas for totals: Use the SUM function to calculate total income and total expenses.

- Calculate your net income (or deficit): Subtract total expenses from total income to determine your net income (or deficit). A positive number is good; a negative number… less so.

- Format your sheet: Use formatting tools to make your budget visually appealing and easy to read. Consider using conditional formatting to highlight areas needing attention (like overspending).

- Add charts (optional): Visualizing your data with charts (pie charts for expense distribution, for example) can make it easier to understand your spending habits.

Spreadsheet Programs vs. Dedicated Financial Planning Software for Template Creation

While spreadsheet programs offer flexibility and ease of access, dedicated financial planning software provides a more streamlined and feature-rich experience, especially for complex financial planning. Spreadsheets excel at basic budgeting and simple calculations, but dedicated software shines with advanced features like goal tracking, tax optimization, and investment projections. The choice depends entirely on your needs and technical expertise. If you’re a spreadsheet ninja, you might find that the extra features of dedicated software are overkill. However, if you need more powerful tools and don’t want to spend hours creating complex formulas, dedicated software is likely the better option.

Using Financial Planning Templates Effectively

So, you’ve got your shiny new financial planning template. Congratulations! Now comes the slightly less glamorous, but infinitely more rewarding, part: actually using it. Think of this template not as a magic money-making machine (sadly, those don’t exist… yet!), but as a highly organized, incredibly helpful roadmap to your financial future. Let’s navigate this together.

Accurate data input is the bedrock of any successful financial plan. Garbage in, garbage out, as they say. Without precise figures, your projections will be as reliable as a weather forecast in a hurricane. This means meticulously gathering all relevant financial information before you even think about opening the template.

Data Input for Accurate Financial Planning

The process of populating your financial planning template requires a methodical approach. First, gather all necessary documents: bank statements, investment account statements, tax returns, loan agreements – anything that sheds light on your current financial situation. Then, carefully transfer the relevant data into the designated fields within the template. For example, if the template requests your monthly income, ensure you input the *net* income (after taxes and deductions), not your gross income. Similarly, when entering expenses, be as specific as possible. Instead of simply writing “groceries,” break it down into categories like “supermarket,” “farmers market,” and “eating out.” The more detailed your data, the more accurate your analysis will be. Think of it as forensic accounting for your personal finances – the devil is in the detail!

Interpreting and Analyzing Results from a Financial Planning Template

Once you’ve diligently entered all your data, the fun begins (well, the *financially responsible* fun). The template will generate various reports and projections based on the information provided. These reports might include net worth calculations, cash flow analyses, retirement projections, or debt reduction strategies. Let’s imagine your template projects a retirement income shortfall of $10,000 per year. This isn’t necessarily a cause for panic, but it *is* a signal that adjustments might be needed. Perhaps increasing your retirement savings contributions by a small percentage each year, or delaying your retirement by a couple of years, could bridge this gap. The key is to understand the *why* behind the numbers – what are the contributing factors to the shortfall? Is it low savings rates, high debt levels, or unrealistic retirement spending expectations?

Tracking Progress Toward Financial Goals

Let’s consider a hypothetical scenario. Sarah aims to save $50,000 for a down payment on a house within three years. Using a financial planning template, she sets a monthly savings goal, factoring in her current income and expenses. The template projects her progress over the three-year period, showing monthly balances and the projected shortfall or surplus at each stage. Now, every month, Sarah updates the template with her actual savings. If she’s consistently above her target, she might even consider accelerating her goal or setting a new one, perhaps buying a slightly more expensive house. Conversely, if she falls behind, the template immediately highlights the shortfall, prompting her to adjust her spending habits or explore additional income streams. This constant monitoring and adjustment is crucial for staying on track. The template isn’t just a static snapshot; it’s a dynamic tool that adapts to life’s ever-changing circumstances. Think of it as your personal financial Sherpa, guiding you up the mountain of financial success.

Illustrative Examples of Financial Planning Templates

Financial planning templates, while seemingly dry as toast, are actually the unsung heroes of achieving your financial goals. Think of them as your trusty sidekicks on the journey to financial freedom – they’ll help you organize your thoughts, track your progress, and (dare we say it?) even make budgeting slightly less painful. Let’s delve into some specific examples, illustrating their power and practicality.

Personal Net Worth Statement Template

A personal net worth statement is a snapshot of your financial health at a specific point in time. It’s a simple yet powerful tool for understanding your overall financial position. Imagine it as a financial selfie – a quick glance at your assets and liabilities. The template typically includes two main sections: Assets and Liabilities.

Assets represent everything you own that has monetary value. This includes liquid assets like cash, checking and savings accounts; investments such as stocks, bonds, and mutual funds; and illiquid assets such as real estate and vehicles. Each asset should be listed with its current market value. For example, if you own a house worth $300,000, that’s listed under assets.

Liabilities, on the other hand, represent your debts. This encompasses things like mortgages, student loans, credit card debt, and any other outstanding loans. Each liability should be listed with its outstanding balance. Let’s say you have a $100,000 mortgage; that goes under liabilities.

To calculate your net worth, you simply subtract your total liabilities from your total assets. The result is a number that represents your financial standing. A positive net worth indicates you have more assets than liabilities, while a negative net worth means the opposite. Regularly updating this statement allows you to track your progress over time and make informed financial decisions.

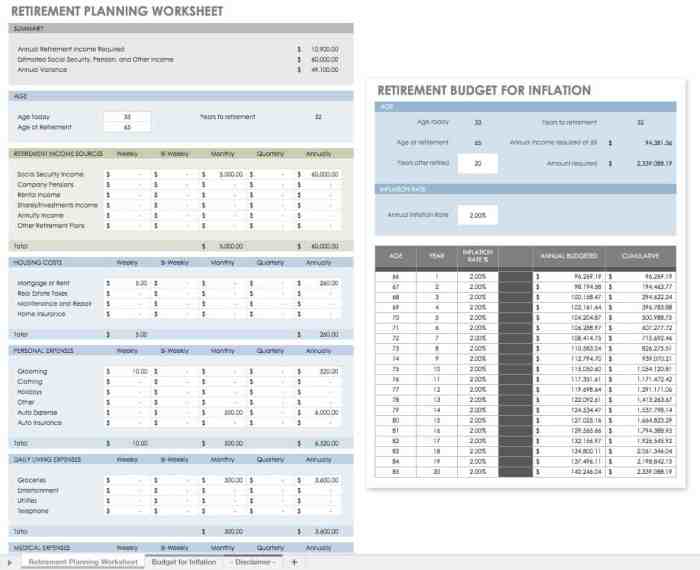

Retirement Planning Template

Retirement planning is less about the magic of compound interest and more about meticulously planning your financial future. A retirement planning template is your roadmap to a comfortable and financially secure retirement. Key sections include income projections, expense estimations, and asset allocation.

Income projections focus on estimating your income sources during retirement. This could include Social Security benefits, pension payments, and income from investments. For example, you might project receiving $2,000 per month from Social Security and $1,500 from a pension, for a total of $3,500. This section needs realistic projections based on current legislation and investment performance.

Expense estimations involve forecasting your monthly and annual expenses during retirement. These could include housing costs, healthcare expenses, travel, and entertainment. Let’s say your projected monthly expenses are $2,800, which includes $1,000 for healthcare and $500 for housing. It’s crucial to be realistic and account for inflation.

Asset allocation Artikels how your retirement savings will be invested. This involves diversifying your investments across different asset classes like stocks, bonds, and real estate to balance risk and return. For instance, you might allocate 60% of your portfolio to stocks, 30% to bonds, and 10% to real estate, adjusting the allocation based on your risk tolerance and time horizon. This section often includes a schedule for regular portfolio reviews and rebalancing.

Investment Tracking Template

An investment tracking template helps you monitor the performance of your investments. It’s your personal financial scoreboard, showing you wins, losses, and overall progress. This template is designed to record transactions, calculate returns, and monitor portfolio performance.

Recording transactions involves meticulously logging each buy and sell order. This includes the date, the asset purchased or sold, the quantity, the price per unit, and the total cost or proceeds. For example, you might record buying 100 shares of XYZ Corp. on January 15th at $50 per share, resulting in a total cost of $5,000.

Calculating returns involves determining the overall performance of your investments. This is usually expressed as a percentage return, calculated by dividing the gain or loss by the initial investment. For instance, if you bought a stock for $100 and sold it for $120, your return is 20%. The template can automatically calculate this, making it easy to track your progress.

Monitoring portfolio performance involves regularly reviewing your investment holdings and their performance. This includes tracking the overall value of your portfolio, calculating returns over various periods, and analyzing the performance of individual investments. This continuous monitoring allows you to make informed adjustments to your investment strategy. A well-maintained template can help identify underperforming assets and inform strategic rebalancing.

Final Conclusion

Mastering the art of financial planning doesn’t require a PhD in economics; it simply requires the right tools and a willingness to take control. Financial Planning Templates are your indispensable allies in this quest. By understanding their diverse applications, utilizing the appropriate software, and interpreting the results effectively, you can transform your financial future from a hazy blur into a clear, well-defined path towards prosperity. So ditch the financial anxieties and embrace the power of organized finances – your future self will thank you!

FAQ Summary

Can I use free templates?

Absolutely! Many free templates are available online, but carefully vet their source and ensure they meet your specific needs. Beware of templates with hidden fees or overly simplistic features.

What if I need a very specific type of template?

While pre-made templates are a great starting point, you might need to customize them or create your own from scratch using spreadsheet software to perfectly fit your unique financial situation.

How often should I update my financial plan?

Regularly! Life throws curveballs. Review and update your plan at least annually, or more frequently if significant life changes occur (new job, marriage, etc.).

Are these templates secure?

The security of your data depends on where you store the template and how you protect it. Use strong passwords, keep backups, and consider using encrypted storage if dealing with highly sensitive financial information.