Navigating the world of personal finance can feel overwhelming, but the right tools can transform the process from daunting to manageable. This comparison delves into the diverse landscape of financial planning tools, examining their features, pricing, and suitability for various user needs. We’ll explore budgeting apps, investment platforms, and tax software, highlighting key differences to help you make an informed decision about which tools best align with your financial goals.

From simple budgeting apps to sophisticated investment platforms, the market offers a wide array of choices. Understanding the nuances of each tool – its strengths, weaknesses, and target audience – is crucial for effective financial management. This comparison aims to provide a clear and concise overview, enabling you to select the tools that empower you to take control of your financial future.

Introduction to Financial Planning Tools

Effective financial planning requires the right tools. Fortunately, a wide range of software and applications are available to assist individuals and families in managing their finances, from budgeting and saving to investing and tax preparation. These tools offer varying levels of sophistication and cater to different needs and levels of financial literacy. Choosing the right tool depends on your specific financial goals and comfort level with technology.

Financial planning tools can be broadly categorized into budgeting apps, investment platforms, tax software, and debt management tools. Each category offers a unique set of features designed to address specific aspects of financial management. While some tools focus on a single area, others offer a more integrated approach, combining several functionalities into one platform. This integration can streamline the financial planning process, providing a more holistic view of your financial situation.

Categories of Financial Planning Tools and Examples

Budgeting apps help you track income and expenses, create budgets, and monitor your spending habits. Popular examples include Mint, YNAB (You Need A Budget), and Personal Capital. Investment platforms allow you to buy and sell stocks, bonds, mutual funds, and other investments. Examples include Fidelity, Schwab, and Vanguard. Tax software simplifies the tax filing process by guiding you through the necessary forms and calculations. TurboTax and H&R Block are widely used examples. Debt management tools assist in organizing and tracking debts, creating repayment plans, and potentially negotiating with creditors. Examples include tools built into many budgeting apps and dedicated apps such as Debt Manager.

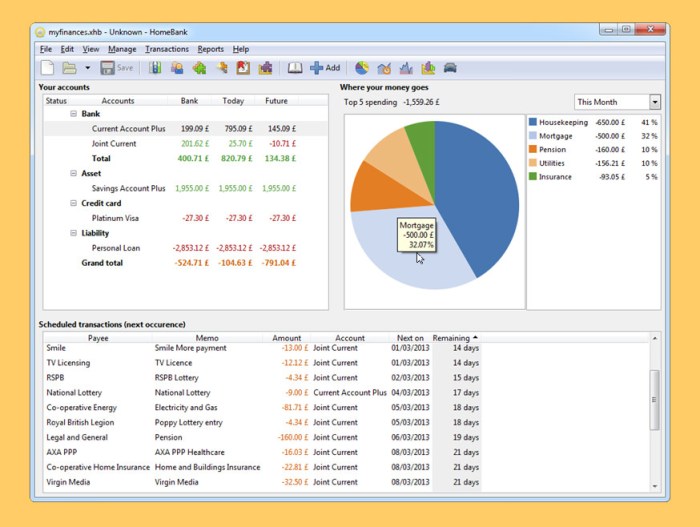

Comparison of Budgeting App User Interfaces

The user interface (UI) is a crucial aspect of any budgeting app, impacting ease of use and overall user experience. A well-designed UI should be intuitive, visually appealing, and efficient. Below is a comparison of the UIs of three popular budgeting apps: Mint, YNAB, and Personal Capital.

| Feature | Mint | YNAB | Personal Capital |

|---|---|---|---|

| Dashboard | Clean and concise overview of accounts and spending categories, using graphs and charts for visual representation. | Focuses on budget allocation and remaining funds, employing a visually distinct system to highlight spending against budget. | Provides a comprehensive overview of net worth, including investment accounts and retirement planning. |

| Transaction Categorization | Automatic categorization with manual override options; uses machine learning to improve accuracy over time. | Requires manual categorization, enforcing a more deliberate budgeting approach. | Automatic categorization with advanced features like custom categories and tagging for enhanced control. |

| Reporting & Analytics | Offers a variety of reports, including spending by category, account balances, and net worth. | Focuses on budget performance and remaining funds, offering insights into spending habits and progress toward goals. | Provides in-depth analysis of investment performance, retirement projections, and comprehensive financial summaries. |

| Mobile App | Intuitive and user-friendly mobile app with full functionality mirroring the desktop version. | Well-designed mobile app, providing convenient access to budgeting tools on the go. | Robust mobile app with features comparable to the desktop version, offering a seamless experience. |

Key Features and Functionality Comparison

Choosing the right financial planning tool depends heavily on individual needs and preferences. This section compares the core features and functionalities of five popular tools to aid in this selection process. We’ll examine their capabilities in goal setting, investment tracking, and retirement planning, highlighting their strengths and weaknesses.

Comparison of Five Financial Planning Tools

This comparison focuses on Personal Capital, Mint, YNAB (You Need A Budget), Betterment, and Fidelity Go. Each tool offers a unique blend of features catering to different financial management styles and levels of sophistication.

| Feature | Personal Capital | Mint | YNAB | Betterment | Fidelity Go |

|---|---|---|---|---|---|

| Goal Setting | Robust goal setting with various options, including retirement, education, and debt reduction. Allows for customization and detailed projections. | Basic goal setting features, primarily focused on budgeting and spending tracking. | Highly focused on goal-oriented budgeting; users define goals and allocate funds accordingly. | Goal-oriented investing with automated portfolio adjustments based on user-defined goals and risk tolerance. | Simple goal-setting tools integrated with investment accounts, focusing primarily on retirement. |

| Investment Tracking | Comprehensive investment tracking across various accounts, including retirement accounts, brokerage accounts, and even crypto. Provides performance analysis and asset allocation visualization. | Tracks investments linked to accounts, but lacks the depth of analysis offered by Personal Capital. | Not primarily an investment tracking tool; focuses on budgeting and spending. | Automated investment management; users select a risk tolerance, and Betterment manages the portfolio. | Investment tracking within Fidelity accounts; provides basic performance summaries. |

| Retirement Planning | Detailed retirement projections based on various scenarios and assumptions. Includes features to help users adjust their savings to meet their retirement goals. | Basic retirement planning features, primarily focused on estimating retirement needs. | Retirement planning is not a core feature; the focus is on current budgeting and spending. | Retirement planning is integrated into the automated investment management; users can adjust their retirement goals and timelines. | Retirement planning tools are a core feature, offering projections and guidance on retirement savings. |

Spreadsheet Software vs. Dedicated Financial Planning Software

Choosing between spreadsheet software (like Microsoft Excel or Google Sheets) and dedicated financial planning software involves weighing several factors.

Spreadsheet software offers unparalleled flexibility and customization. Users can create highly specific formulas and models tailored to their unique financial situations. However, this flexibility comes at a cost; building and maintaining complex spreadsheets requires significant time and expertise. Errors are also more likely, and data integrity can be a concern if not carefully managed.

- Spreadsheet Software Advantages: High level of customization, detailed analysis capabilities, cost-effective (often included with existing software subscriptions).

- Spreadsheet Software Disadvantages: Requires significant time and expertise to build and maintain, prone to errors, lack of automated features, data security and backup can be a concern.

- Dedicated Financial Planning Software Advantages: User-friendly interface, automated features, data security and backup features, built-in error checking, often include educational resources and support.

- Dedicated Financial Planning Software Disadvantages: Can be expensive, may lack the customization options of spreadsheets, limited functionality outside of core financial planning tasks.

Pricing and Subscription Models

Choosing a financial planning tool often involves careful consideration of its cost. Different tools employ various pricing strategies, each offering a different value proposition depending on your needs and budget. Understanding these models is crucial to selecting the best fit for your financial management goals. This section details the pricing structures of several popular tools and analyzes their value relative to the features provided.

Pricing Models Overview

Financial planning tools typically utilize one of three primary pricing models: freemium, subscription-based, and one-time purchase. Freemium models offer a basic version for free, with advanced features available through a paid subscription. Subscription-based models require a recurring payment for access to the tool’s features, often tiered by functionality. One-time purchase models involve a single upfront payment for lifetime access, though updates and support may vary. The best model depends on your individual needs and how frequently you anticipate using the software. A user who only needs basic features occasionally might find a freemium model sufficient, while a professional advisor might prefer a robust subscription model with advanced features.

Comparison of Pricing and Features Across Five Tools

The following table compares the pricing and key features of five different financial planning tools. Note that pricing and features are subject to change, so it’s crucial to check the provider’s website for the most up-to-date information.

| Tool Name | Pricing Model | Key Features Included at Each Price Point |

|---|---|---|

| Personal Capital | Freemium | Free: Net worth tracking, investment performance monitoring. Paid: Retirement planning tools, advanced portfolio analysis, financial advisor access. |

| Mint | Freemium | Free: Budgeting, expense tracking, bill reminders. Paid: Credit score monitoring, advanced budgeting tools, financial insights. |

| YNAB (You Need A Budget) | Subscription-based | Subscription: Budgeting, expense tracking, goal setting, debt reduction tools, various reporting features. |

| Quicken | One-time purchase/Subscription | One-time purchase: Basic budgeting, financial tracking. Subscription: Advanced features such as investment tracking, tax preparation assistance, and more comprehensive reporting. |

| MoneyLion | Freemium/Subscription | Free: Budgeting, expense tracking, financial education resources. Paid: Access to credit building tools, investment options, and personalized financial advice. |

User Experience and Interface Design

A positive user experience is crucial for the success of any financial planning tool. Intuitive navigation and a well-designed interface can significantly impact user engagement and satisfaction, leading to better financial outcomes. Conversely, a poorly designed interface can lead to frustration and abandonment of the tool. This section examines the user experience and interface design of three popular financial planning tools: Personal Capital, Mint, and YNAB (You Need A Budget).

User Experience Comparison of Personal Capital, Mint, and YNAB

Personal Capital, Mint, and YNAB each offer distinct user experiences. Personal Capital boasts a clean, sophisticated design, prioritizing clear data visualization and a comprehensive overview of the user’s financial picture. Navigation is straightforward, with well-defined sections for different aspects of financial planning. Mint, on the other hand, prioritizes ease of use and accessibility. Its interface is more visually busy than Personal Capital’s, but its features are easily accessible and the overall experience is generally considered user-friendly. YNAB takes a more goal-oriented approach. Its interface is designed to guide users through the budgeting process, with a strong emphasis on visualizing spending against allocated budgets. While its interface might seem less visually appealing than the others initially, its functionality is highly praised by users who appreciate its focus on financial control.

User Interface Strengths and Weaknesses

Personal Capital: Strengths include its excellent data visualization, clean design, and comprehensive financial overview. Weaknesses include a steeper learning curve compared to Mint, and a less intuitive interface for users unfamiliar with sophisticated financial metrics.

Mint: Strengths include its ease of use, broad range of supported financial institutions, and intuitive account aggregation. Weaknesses include a cluttered interface that can feel overwhelming to some users, and less sophisticated reporting and analysis features compared to Personal Capital.

YNAB: Strengths include its strong focus on goal-oriented budgeting and its effective tools for tracking spending against allocated budgets. Weaknesses include a less visually appealing interface compared to the other two tools, and a learning curve associated with its unique budgeting methodology.

Improved User Interface Mock-up for Mint

Mint’s current interface, while user-friendly, can feel cluttered. An improved design could focus on modularity and visual hierarchy. A proposed redesign would involve grouping similar features into clearly defined modules, using color-coding and visual cues to improve navigation and information accessibility.

Specific Design Changes:

- Modular Design: Separate sections for budgeting, investing, and debt management, each with its own distinct visual style and clear labeling.

- Improved Visual Hierarchy: Prioritize key information through size, color, and placement. For example, account balances and upcoming bills should be prominently displayed.

- Color-Coding: Use consistent color-coding to represent different account types (checking, savings, credit cards) and spending categories.

- Interactive Charts and Graphs: Replace static charts with interactive versions that allow users to drill down into specific data points.

- Personalized Dashboard: Allow users to customize their dashboard to display the most relevant information based on their individual financial goals.

Rationale: These changes aim to reduce visual clutter, improve navigation, and enhance the overall user experience by making key information more accessible and intuitive. The modular design allows users to focus on specific areas of their finances, while the improved visual hierarchy and color-coding make it easier to understand and interpret data. Interactive charts and a personalized dashboard provide a more engaging and customized experience.

Security and Data Privacy

Protecting your financial data is paramount when using online planning tools. The security measures employed by these platforms vary significantly, impacting both user trust and the overall safety of sensitive information. Understanding these differences is crucial for making informed decisions about which tool best suits your needs.

The security of financial planning tools relies on a combination of technical safeguards and robust privacy policies. These safeguards aim to prevent unauthorized access, data breaches, and misuse of personal financial information. The level of protection offered, however, can differ substantially depending on the specific platform.

Data Encryption Methods

Different financial planning tools utilize varying levels of data encryption to protect user data both in transit and at rest. Strong encryption, such as AES-256, is considered industry standard and offers a high level of protection against unauthorized access. Weaker encryption methods, however, leave data more vulnerable to potential breaches. For example, a tool employing only AES-128 encryption would be considered less secure than one using AES-256. Furthermore, the implementation of encryption protocols needs to be rigorously tested and audited regularly to ensure ongoing effectiveness. The lack of transparency regarding encryption methods can raise concerns about data security.

Privacy Policy Analysis: A Comparison of Three Tools

| Tool | Data Encryption | Data Storage Location | Third-Party Data Sharing |

|---|---|---|---|

| Tool A (Example: hypothetical tool focusing on strong security) | AES-256 encryption, both in transit and at rest | Data centers with SOC 2 Type II compliance | No third-party data sharing without explicit user consent. Data anonymization techniques used for aggregate reporting. |

| Tool B (Example: hypothetical tool with moderate security) | AES-128 encryption, in transit; data at rest encrypted but specifics not publicly disclosed. | Data centers with SOC 2 Type I compliance | Data may be shared with affiliated companies for marketing purposes unless user opts out. |

| Tool C (Example: hypothetical tool with less emphasis on security) | Encryption details not publicly disclosed. | Data storage location not specified. | Privacy policy vague regarding third-party data sharing. |

Security Protocol Implications on User Trust

The security protocols implemented by a financial planning tool directly impact user trust and data safety. Transparent and robust security measures, clearly articulated in a comprehensive privacy policy, foster trust. Conversely, a lack of transparency, weak encryption, or vague privacy policies can significantly erode user confidence. For example, a data breach resulting from weak security measures could lead to significant financial and reputational damage for both the user and the tool provider, potentially leading to legal action. The presence of independent security audits and certifications, such as SOC 2 compliance, can serve as a strong indicator of a tool’s commitment to data security and user protection. Users should prioritize tools that demonstrate a strong commitment to data security and transparency in their security practices.

Integration with Other Financial Services

Seamless integration with other financial services is a crucial factor when evaluating financial planning tools. The ability to connect a planning tool to existing banking apps, investment accounts, and other relevant platforms significantly enhances the user experience and the overall effectiveness of financial planning. This integration allows for a more holistic view of an individual’s financial situation, facilitating more accurate planning and informed decision-making.

The benefits of integrating financial planning tools with other financial services are numerous. Importantly, it streamlines data aggregation, eliminating the need for manual data entry and reducing the risk of human error. This automated data flow ensures that the financial plan always reflects the most up-to-date information. Furthermore, integration fosters a more comprehensive understanding of one’s financial health, enabling more precise goal setting and progress tracking. For example, a tool integrated with a banking app could automatically track spending habits, providing valuable insights for budgeting and savings strategies. Similarly, integration with investment accounts allows for a real-time view of portfolio performance, aiding in informed investment decisions.

Benefits of Integration

Integrated financial planning tools offer several key advantages. These tools significantly reduce the time and effort required for financial planning by automating data collection and analysis. The elimination of manual data entry minimizes errors and inconsistencies, leading to more reliable and accurate financial projections. Moreover, a consolidated view of all financial accounts provides a holistic perspective, empowering users to make more informed decisions. This integrated approach simplifies the entire financial planning process, allowing users to focus on strategic financial goals rather than on tedious data management. For instance, Mint, a popular personal finance app, integrates with numerous bank accounts and credit cards, automatically categorizing transactions and generating personalized financial reports. This integration provides users with a clear picture of their spending habits and helps them to identify areas where they can improve their financial management.

Drawbacks of Integration

While integration offers many benefits, potential drawbacks should also be considered. Security and data privacy concerns are paramount. Users must carefully review the security measures employed by both the financial planning tool and the integrated financial services to ensure their sensitive data is protected. Furthermore, relying on automated data feeds can lead to issues if there are glitches or disruptions in the data flow from the integrated services. This highlights the importance of selecting a reliable and robust financial planning tool with a proven track record of seamless integration. Finally, the level of integration can vary across different tools and financial services, impacting the overall user experience. Some integrations may be more seamless and intuitive than others, affecting the ease of use and efficiency of the system.

Examples of Integrated Financial Planning Tools

Several financial planning tools excel in their integration capabilities. Personal Capital, for example, is known for its robust integration with various investment accounts, providing a comprehensive overview of investment performance and asset allocation. Similarly, YNAB (You Need A Budget) seamlessly integrates with bank accounts, facilitating effective budgeting and tracking of expenses. These tools demonstrate the potential of integration to enhance the overall functionality and user experience of financial planning. The specific features and integration capabilities will vary among providers, so careful research is crucial to identify the best fit for individual needs and preferences.

Suitability for Different User Profiles

Financial planning tools aren’t one-size-fits-all. Their effectiveness depends heavily on the user’s financial knowledge, investment experience, and specific needs. Matching the right tool to the right user profile is crucial for maximizing its benefits and avoiding frustration. This section examines how different tools cater to various user groups, from beginners to seasoned investors and small business owners.

Different financial planning tools offer varying levels of complexity and guidance, directly impacting their suitability for different user profiles. Beginner-friendly tools often prioritize intuitive interfaces and simplified features, while advanced tools provide greater control and customization for experienced users. This nuanced approach ensures that users of all skill levels can find a tool that meets their specific requirements and promotes financial well-being.

Beginner Investors

Beginner-friendly tools typically prioritize ease of use and clear explanations. They often feature guided tutorials, interactive dashboards, and simplified terminology. Mint, for example, excels at providing a clear overview of personal finances through automated account aggregation and budgeting tools. Its intuitive interface makes it easy to track spending, set financial goals, and monitor progress, even for users with limited financial experience. Similarly, Personal Capital offers a robust free version with many features suitable for beginners, such as net worth tracking and retirement planning tools presented in an easily digestible format. These tools help beginners build a foundation of financial literacy and confidence.

Experienced Investors

Experienced investors usually require more sophisticated tools that offer advanced features and customization options. These users often need in-depth analysis capabilities, portfolio tracking with detailed performance metrics, and access to complex investment strategies. Tools like Quicken Premier provide extensive reporting and tax optimization features, appealing to users with complex financial situations. Similarly, sophisticated platforms like Wealthfront and Betterment, while offering automated portfolio management, also allow for greater control and customization of investment strategies for those with more experience and specific investment goals. These tools cater to users who are comfortable with more advanced financial concepts and actively manage their portfolios.

Small Business Owners

Small business owners require tools that integrate financial management for both personal and business finances. These tools need to handle invoicing, expense tracking, and profit/loss analysis alongside personal financial planning. While some personal finance tools offer basic business features, dedicated small business accounting software like Xero or QuickBooks often integrate better with other business tools and provide more comprehensive reporting capabilities. These platforms allow for a more holistic view of the business’s financial health and facilitate better financial decision-making. The ability to seamlessly track business income and expenses alongside personal finances is crucial for small business owners to maintain a clear financial picture.

Illustrative Examples of Tool Usage

Financial planning tools are most effective when applied to real-world scenarios. Understanding how these tools function within the context of specific financial goals significantly enhances their value. The following examples demonstrate the practical application of different tools for achieving common financial objectives.

These examples showcase how different tools can be used to achieve specific financial goals, highlighting their strengths and weaknesses in various situations. We will focus on two common goals: saving for a down payment and retirement planning, and will explore the step-by-step processes and potential outcomes.

Saving for a Down Payment Using a Budgeting App

Let’s imagine Sarah, a young professional, aims to save $50,000 for a down payment on a house within three years. She uses a budgeting app like Mint or Personal Capital. The app allows her to track her income and expenses automatically, providing a clear picture of her current financial situation.

Step-by-step process: Sarah links her bank accounts and credit cards to the app. The app categorizes her transactions, allowing her to identify areas where she can cut back on spending. She sets a savings goal of $50,000 within 36 months, and the app calculates the required monthly savings amount. The app also provides visual representations of her progress, motivating her to stay on track. She utilizes the app’s budgeting features to create a realistic budget, allocating funds towards her down payment goal. Regularly reviewing her budget and adjusting it based on her progress ensures she remains on target.

Potential Outcomes and Benefits: By using the budgeting app, Sarah gains a clear understanding of her spending habits and identifies areas for improvement. The app’s automated tracking and visual progress updates keep her motivated and accountable. The app’s budgeting tools help her create a realistic plan and track her progress towards her down payment goal. The transparency and accountability provided by the app increase her chances of successfully saving for her down payment.

Retirement Planning with a Dedicated Retirement Planning Software

John, a 45-year-old with a moderate income, wants to ensure a comfortable retirement. He decides to use a dedicated retirement planning software like Fidelity’s Retirement Planning Tool or a similar platform offered by his financial institution. This software allows him to input his current savings, projected income, and desired retirement lifestyle.

Step-by-step process: John enters his current age, income, savings, and desired retirement age. He selects a desired retirement income level and the software calculates the necessary savings amount needed to reach his goal. The software then provides different investment scenarios, considering factors like risk tolerance and investment growth rates. John can adjust parameters (such as retirement age or desired income) to see how it impacts his required savings. The software might suggest adjustments to his current savings rate or investment strategy to achieve his goal.

Potential Outcomes and Benefits: John receives a personalized retirement plan, outlining the necessary steps to achieve his financial goals. The software provides various scenarios, helping him understand the impact of different investment strategies and savings rates. The visual representation of his projected retirement income and the ability to adjust parameters provides valuable insights into his retirement planning. This tool allows for proactive adjustments to his financial strategy, improving his chances of a comfortable retirement.

Closing Notes

Ultimately, the best financial planning tool depends on individual needs and preferences. While some tools excel in budgeting, others shine in investment tracking or tax preparation. By carefully considering the factors Artikeld in this comparison – features, pricing, security, and user experience – you can confidently select the tools that best support your financial journey. Remember that effective financial planning is a continuous process, and the right tools can make it significantly more efficient and rewarding.

Commonly Asked Questions

What is the best financial planning tool for beginners?

Tools with intuitive interfaces and comprehensive tutorials, often offering free or low-cost plans, are ideal for beginners. Look for features that focus on basic budgeting and savings goals.

Are my financial data secure with these tools?

Reputable financial planning tools employ robust security measures, including encryption and secure data storage. However, always review a tool’s privacy policy and security certifications before sharing sensitive information.

Can I integrate these tools with my existing bank accounts?

Many tools offer integration with various banking and investment accounts, streamlining data entry and providing a holistic view of your finances. Check for specific integrations before selecting a tool.

How much does it typically cost to use these tools?

Pricing models vary widely, ranging from free (often with limited features) to subscription-based services with varying monthly or annual fees. Some offer one-time purchase options.