Financial Planning Tools Comparison: Embark on a hilarious yet informative journey through the wild world of budgeting apps, investment platforms, and retirement calculators! We’ll dissect the features, pricing, and overall user experience of various tools, ensuring you emerge not only financially savvy but also thoroughly entertained. Prepare for a rollercoaster of spreadsheets and side-splitting comparisons!

This comprehensive guide navigates the often-confusing landscape of personal finance software. We’ll explore the best tools for budgeting, investing, retirement planning, debt management, and even tax preparation. Each section features detailed comparisons, highlighting the pros and cons of popular choices, all presented with a healthy dose of wit and clarity. Get ready to laugh your way to financial freedom (or at least a slightly better understanding of your bank account).

Introduction to Financial Planning Tools

Let’s face it, personal finance can be a wild rollercoaster – one minute you’re riding high, the next you’re plummeting faster than a penny stock after a bad earnings report. Thankfully, we live in an age where technology can help us navigate this financial frontier with a bit more grace (and maybe even a chuckle). Financial planning tools are your trusty sidekicks in this journey, offering a range of features designed to help you tame your finances and achieve your monetary goals.

Financial planning tools offer a plethora of benefits, from simplifying budgeting to streamlining investments. They provide a clear picture of your financial health, empowering you to make informed decisions and avoid those pesky money mishaps that can leave you feeling like you’ve just lost a game of financial Jenga. Whether you’re a seasoned investor or just starting your financial journey, these tools can significantly improve your financial well-being and reduce stress. Imagine: no more frantic last-minute tax filings or agonizing over unexpected expenses. Sounds dreamy, doesn’t it?

Categories of Financial Planning Tools

Financial planning tools come in various flavors, each catering to specific financial needs. Understanding these categories helps you choose the right tool to fit your unique financial situation and goals. Choosing the wrong tool is like trying to use a sledgehammer to crack a nut – it might work, but it’s incredibly inefficient and potentially damaging.

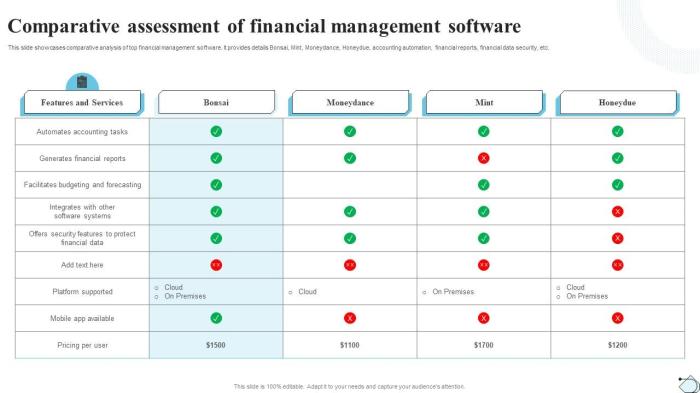

Examples of Popular Financial Planning Tools

The following table provides a glimpse into the world of popular financial planning tools, categorized for your convenience. Remember, this is just a small sampling – the market is constantly evolving with new and innovative tools emerging all the time.

| Tool Name | Category | Key Features | Pricing Model |

|---|---|---|---|

| Mint | Budgeting App | Budgeting, expense tracking, bill payment reminders, credit score monitoring | Free (with optional paid features) |

| Personal Capital | Investment Platform & Financial Dashboard | Investment tracking, retirement planning, fee analysis, net worth tracking | Free (with optional paid advisory services) |

| YNAB (You Need A Budget) | Budgeting App | Zero-based budgeting, goal setting, flexible budgeting categories | Paid subscription |

| Fidelity Go | Robo-advisor | Automated investment management, low fees, goal-based investing | Free for balances under a certain amount; fees apply for higher balances. |

| Acorns | Micro-investing App | Round-up investing, automated investing, fractional shares | Subscription-based fees |

| FireCalc | Retirement Calculator | Monte Carlo simulations, withdrawal rate calculations, early retirement planning | Free |

Budgeting Tools Comparison

Ah, budgeting. The very word conjures images of spreadsheets, agonizing calculations, and the faint scent of impending doom. But fear not, fellow financial adventurers! We’re here to navigate the wild, wonderful world of budgeting apps, transforming that impending doom into a delightful sense of fiscal responsibility (or at least, controlled chaos). This section will compare and contrast several popular budgeting tools, helping you find the perfect app to tame your spending habits.

Budgeting App Comparison: A Trifecta of Tracking Triumphs

Choosing a budgeting app can feel like choosing a life partner – a long-term commitment requiring careful consideration. Let’s examine three popular contenders: Mint, YNAB (You Need A Budget), and Personal Capital. Each offers a unique approach to financial organization, catering to different personalities and preferences.

- Mint: Mint, the all-around crowd-pleaser, boasts a user-friendly interface and automatic transaction tracking.

- Pros: Simple setup, visually appealing dashboard, free to use, integrates with most financial accounts.

- Cons: Can feel overwhelming for those with complex finances, limited customization options, relies heavily on automatic categorization which can sometimes be inaccurate.

- YNAB (You Need A Budget): YNAB takes a more proactive approach, encouraging users to assign every dollar a job. It’s less about tracking and more about intentional spending.

- Pros: Powerful budgeting philosophy, excellent reporting features, helps build good spending habits, strong community support.

- Cons: Steeper learning curve, requires more manual input, subscription-based.

- Personal Capital: This app caters to the more sophisticated investor, offering robust investment tracking alongside budgeting features.

- Pros: Comprehensive investment tracking, advanced reporting, free to use (with some premium features available), excellent for high-net-worth individuals.

- Cons: Can be overkill for those without significant investment portfolios, interface may seem cluttered to beginners.

The Importance of Budgeting and How Tools Facilitate It

Budgeting isn’t just about restricting yourself; it’s about empowerment. A well-crafted budget allows you to understand your financial situation, identify areas for improvement, and achieve your financial goals, whether it’s buying a house, retiring early, or simply avoiding a mountain of credit card debt. These budgeting apps streamline this process by automating data entry, providing clear visualizations of spending habits, and offering helpful tools for goal setting. They essentially transform the daunting task of budgeting into a manageable and even enjoyable activity. Think of it as a personal finance GPS, guiding you towards your financial destination.

Hypothetical Budget Using YNAB

Let’s imagine a hypothetical budget using YNAB’s zero-based budgeting method. This approach ensures every dollar is assigned a purpose, preventing overspending.

| Income | Amount |

|---|---|

| Salary | $5,000 |

| Side Hustle | $500 |

| Total Income | $5,500 |

| Expense Category | Amount |

|---|---|

| Housing | $1,500 |

| Food | $500 |

| Transportation | $300 |

| Utilities | $200 |

| Debt Payments | $500 |

| Savings | $1,000 |

| Entertainment | $500 |

| Total Expenses | $5,500 |

“A budget is telling your money where to go instead of wondering where it went.” – Dave Ramsey

Investment Planning Tools Comparison

Choosing the right investment platform can feel like navigating a minefield of jargon and confusing fees. Fear not, intrepid investor! This comparison will illuminate the key differences between two popular platforms, helping you choose the one that best suits your financial personality (and portfolio!).

Investment Platform Feature Comparison

Let’s delve into the fascinating world of investment platforms, comparing and contrasting two prominent players in the market: Fidelity and Vanguard. These platforms offer a range of investment options, but their approaches differ significantly in several key areas.

Investment Options

Both Fidelity and Vanguard provide access to a wide array of investment vehicles, allowing for diversification across various asset classes. However, the specific offerings and user experience differ. Fidelity boasts a more extensive selection of individual stocks and options, appealing to more active traders. Vanguard, on the other hand, shines with its low-cost index funds and ETFs, making it a haven for the passive investor who prefers a “set it and forget it” approach. Both platforms offer access to mutual funds, bonds, and other investment products, but their strengths lie in different areas.

Fee Structures

Navigating the world of investment fees can feel like trying to solve a Rubik’s Cube blindfolded. Both Fidelity and Vanguard have transparent fee structures, but the details matter. Fidelity offers a tiered fee structure, with fees varying based on account size and trading activity. Vanguard, known for its low-cost philosophy, generally boasts lower expense ratios on its mutual funds and ETFs. While Fidelity might offer some commission-free trades, the overall cost will depend on your trading style. Vanguard’s commitment to low costs tends to be more predictable and beneficial for long-term investors.

Account Minimums, Financial Planning Tools Comparison

The minimum investment required to open an account varies between platforms. While both Fidelity and Vanguard cater to a range of investors, their minimums differ. Fidelity generally has lower account minimums for brokerage accounts, making it more accessible to beginners. Vanguard, however, might have higher minimums for certain products, particularly for some of their specialized investment options.

| Platform Name | Investment Options | Fee Structure | Account Minimums |

|---|---|---|---|

| Fidelity | Stocks, Bonds, Mutual Funds, ETFs, Options, Futures (and more!) | Tiered, based on account size and trading activity; some commission-free trades available. | Generally low for brokerage accounts; varies by product. |

| Vanguard | Stocks, Bonds, Mutual Funds (particularly index funds), ETFs | Generally low expense ratios on mutual funds and ETFs; transparent and predictable fees. | May have higher minimums for certain products. |

Retirement Planning Tools Comparison

Planning for retirement can feel like navigating a minefield blindfolded – but fear not, intrepid saver! Retirement calculators are here to illuminate the path, albeit with varying degrees of helpfulness. These digital oracles offer a glimpse into your potential golden years, but their predictions are only as good as the data you feed them. Let’s examine some popular options and see how they stack up.

Retirement Calculator Features and Functionality

Choosing the right retirement calculator depends on your needs and level of financial sophistication. Some offer simple projections based on basic inputs, while others delve into complex scenarios, considering inflation, taxes, and even potential longevity. Understanding the input parameters and output results is crucial for making informed decisions. A calculator that only considers a fixed rate of return, for example, may paint a rosy picture that doesn’t account for the volatility of the market.

Comparison of Three Retirement Calculators

We’ll compare three hypothetical calculators – “Simple Sally,” “Sophisticated Stan,” and “Predictive Penelope” – to illustrate the range of features available. These are not actual products but represent common calculator types.

| Feature | Simple Sally | Sophisticated Stan | Predictive Penelope |

|---|---|---|---|

| Input Parameters | Current age, retirement age, current savings, annual savings rate, assumed rate of return. | All of Simple Sally’s parameters, plus: inflation rate, tax rate, estimated healthcare costs, potential inheritance, social security benefits, withdrawal strategy (fixed amount, percentage of portfolio, etc.). | All of Sophisticated Stan’s parameters, plus: Monte Carlo simulation for varied market scenarios, personalized risk tolerance assessment, adjustment for potential longevity based on family history. |

| Output Results | Estimated retirement nest egg, simple annual income projection. | Detailed breakdown of savings growth, estimated retirement income, potential shortfall or surplus, sensitivity analysis showing impact of parameter changes. | Probability of achieving retirement goals under different scenarios, personalized recommendations for adjusting savings or investment strategy, visual representations of potential outcomes. |

| Strengths | Easy to use, quick results. Ideal for beginners. | Comprehensive analysis, allows for detailed planning. Good for intermediate users. | Highly sophisticated, accounts for market uncertainty and individual circumstances. Suitable for advanced users. |

| Weaknesses | Overly simplistic, doesn’t account for many real-world factors. | Can be complex to use, requires significant input data. | Requires significant financial literacy, may be overwhelming for beginners. Output can be complex to interpret. |

Retirement Planning Strategies Explored

These calculators allow exploration of several retirement strategies. For example, using “Sophisticated Stan,” one could model the impact of increasing annual savings by a certain percentage, or adjusting the assumed rate of return to reflect a more conservative or aggressive investment approach. “Predictive Penelope,” with its Monte Carlo simulations, could illustrate the probability of success under various market conditions, helping users to make adjustments to their strategy. For instance, a user might discover that increasing their savings rate by 2% annually significantly improves their chances of meeting their retirement goals, even if market returns are lower than anticipated. Alternatively, a user might see that shifting to a more conservative investment portfolio reduces the risk of falling short, even if it slightly reduces the potential growth of their savings.

Debt Management Tools Comparison: Financial Planning Tools Comparison

Ah, debt. That delightful financial friend who never seems to leave, despite your best intentions. Luckily, in this age of technological marvels, we have a plethora of debt management tools to help us wrestle this financial kraken into submission. This comparison will delve into the features and nuances of these digital debt-slayers, helping you choose the perfect weapon in your financial arsenal.

Debt management tools vary significantly in their approach to tackling debt. Some focus primarily on tracking and visualizing your debt, while others offer more sophisticated features like automated repayment planning and even personalized financial advice. The best tool for you will depend heavily on the type and amount of debt you’re managing, as well as your personal comfort level with financial technology.

Features of Debt Management Tools

Many debt management tools offer a range of features designed to simplify the process of tracking, analyzing, and paying down debt. These features typically include comprehensive debt tracking, allowing users to input all their debts, from credit cards to student loans; creation of personalized repayment plans, often utilizing various debt repayment strategies like the debt snowball or avalanche method; and, in some cases, access to financial advice or educational resources. The level of sophistication varies widely between tools, with some offering basic tracking and simple repayment calculators, while others provide more advanced features like budgeting tools, credit score monitoring, and personalized financial coaching.

Debt Type Specific Tools

The ideal debt management tool often depends on the specific type of debt. For instance, tools designed for managing credit card debt might emphasize features like tracking spending habits and identifying areas for potential savings. Tools for student loans, on the other hand, may focus on repayment plan options and income-driven repayment strategies. Some tools even cater to specific niches, such as medical debt or consolidating multiple types of debt. The key is to find a tool that aligns with your specific debt profile and financial goals. Choosing the wrong tool is like trying to swat a fly with a sledgehammer – it might work, but it’s inefficient and potentially damaging.

Creating a Debt Repayment Plan Using a Debt Management Tool

Let’s imagine you’re using a hypothetical tool called “Debt Destroyer 5000” (patent pending). First, you would meticulously input all your debts – the principal balance, interest rate, minimum payment, and due date for each. The Debt Destroyer 5000 would then generate a comprehensive overview of your total debt and monthly payments. Next, you’d select a repayment strategy, perhaps the debt avalanche method (paying off the highest interest debt first). The tool would then calculate a personalized repayment plan, showing you how much to allocate to each debt each month to achieve debt freedom faster. Finally, you can link your bank accounts for automated payments, eliminating the manual effort and reducing the risk of missed payments. Remember, while technology can assist, consistent discipline is the true key to conquering your debt.

Tax Planning Tools Comparison

Navigating the often-bewildering world of taxes can feel like trying to solve a Rubik’s Cube blindfolded. Fortunately, tax planning software aims to illuminate the path, transforming the dreaded tax season into something…slightly less dreadful. This comparison will shed light on the features and functionalities of two popular tax planning programs, helping you choose the tool that best suits your needs and—dare we say it—even makes tax preparation mildly enjoyable.

Tax Software Feature Comparison: TurboTax and TaxAct

Two leading contenders in the tax software arena are TurboTax and TaxAct. Both offer a range of features designed to simplify tax preparation, but their approaches and strengths differ. TurboTax, known for its user-friendly interface and extensive support resources, often caters to a broader range of users, from simple returns to complex situations. TaxAct, on the other hand, often positions itself as a more budget-conscious option, still providing robust features but at a potentially lower price point.

Tax Liability Estimation and Optimization

Both TurboTax and TaxAct utilize sophisticated algorithms to calculate your estimated tax liability. They accomplish this by prompting you to input relevant financial data, such as income, deductions, and credits. The software then processes this information, factoring in applicable tax laws and regulations, to generate an estimate of your owed taxes or potential refund. Beyond simple estimation, these tools offer strategies for tax optimization. For example, they may suggest deductions you might have overlooked or help you determine the most advantageous filing status. Imagine it as having a personal tax advisor, but without the hefty consulting fees (mostly!).

User Interface Comparison

Let’s imagine the user interfaces. TurboTax’s interface could be described as a brightly lit, welcoming living room. Clear navigation menus, intuitive prompts, and helpful tooltips guide you through the process. It’s designed to feel approachable, even comforting, like a warm hug on a cold tax day. In contrast, TaxAct’s interface might resemble a well-organized, modern office. It’s efficient and functional, prioritizing clear data entry and streamlined workflows. While not as visually engaging as TurboTax, its clean design promotes focused work and efficient navigation. Think of it as a productive workspace where you can get the job done without unnecessary distractions.

Factors to Consider When Choosing a Financial Planning Tool

Selecting the right financial planning tool can feel like choosing a financial soulmate – a long-term commitment requiring careful consideration. The wrong choice can lead to frustration, wasted time, and maybe even a few tears shed over misplaced spreadsheets. But fear not, dear reader, for we’re here to guide you through this crucial decision.

The perfect financial planning tool isn’t a one-size-fits-all proposition. It’s as unique as your financial fingerprint, shaped by your specific needs, goals, and comfort level with technology. Ignoring this fundamental truth is like trying to fit a square peg into a round hole – it’s just not going to work.

Cost Considerations

The price of a financial planning tool can range from completely free (often with limited features) to eye-watering subscription fees. Before you fall head over heels for a tool packed with bells and whistles, consider your budget. Ask yourself: What features are truly essential? Are you willing to pay a premium for advanced features, or will a more basic, affordable option suffice? Remember, the cheapest option isn’t always the best, and the most expensive isn’t necessarily the most effective. Finding the sweet spot requires careful evaluation of your needs against the cost. For example, a free budgeting app might meet your needs perfectly, while a sophisticated investment planning platform may be overkill (and expensive!) if you’re just starting out.

Feature Evaluation

Financial planning tools offer a vast array of features, from simple budgeting to complex tax optimization. Before committing, identify the features that align with your financial goals. Do you need robust budgeting tools? Are you looking for investment tracking capabilities? Do you require retirement planning projections? A comprehensive checklist (provided below) can help you assess which features are must-haves versus nice-to-haves. For instance, if you’re heavily invested in the stock market, a tool with real-time portfolio tracking and performance analysis would be a high priority. Conversely, if your financial life is relatively straightforward, a simpler tool might be all you need.

Security and Privacy

Your financial data is sensitive and confidential. Choose a tool that employs robust security measures to protect your information from unauthorized access. Look for features like encryption, two-factor authentication, and reputable security certifications. Read reviews and check the company’s privacy policy to ensure your data is handled responsibly and securely. Imagine the horror of a data breach exposing your hard-earned savings – it’s a nightmare scenario best avoided.

Ease of Use and User Interface

Even the most powerful financial planning tool is useless if it’s too complicated to use. Choose a tool with an intuitive interface and user-friendly design. Look for clear instructions, helpful tutorials, and responsive customer support. If the tool feels overwhelming or confusing, you’re less likely to use it consistently, rendering it essentially useless. A clean, simple design with easy navigation is key to long-term usage and success.

Personal Financial Goals and Needs

This is arguably the most crucial factor. Your choice should directly reflect your unique financial situation and aspirations. Are you saving for a down payment on a house? Planning for retirement? Paying off debt? The tool you select should directly support these objectives. For example, someone aiming for early retirement might prioritize a tool with robust investment planning and retirement projection features, whereas someone focused on debt reduction might prefer a tool with strong budgeting and debt tracking capabilities.

Checklist for Evaluating Financial Planning Tools

Before making a decision, use this checklist to compare different tools:

- Cost: What are the subscription fees (if any)? Are there any hidden costs?

- Features: Does it offer the specific features you need (budgeting, investment tracking, tax planning, etc.)?

- Security: What security measures are in place to protect your data?

- Ease of Use: Is the interface intuitive and easy to navigate?

- Customer Support: What kind of customer support is available (phone, email, chat)?

- Integration: Does it integrate with other financial accounts or apps?

- Mobile Accessibility: Is there a mobile app available?

Remember, the perfect financial planning tool is the one that best fits your individual needs and helps you achieve your financial goals. Happy planning!

Final Thoughts

So, there you have it – a whirlwind tour of the financial planning tool universe! From meticulously crafted budgets to effortlessly managed investments, the right tool can significantly simplify your financial life. Remember, the key is finding a tool that fits your unique needs and personality (and maybe one with a particularly charming user interface). Happy planning, and may your financial journey be filled with laughter and prosperity (and maybe fewer spreadsheets than you anticipated).

Top FAQs

What if I don’t have any savings to start investing?

Many investment platforms offer options for starting small, even with minimal capital. Consider platforms that support fractional shares or have low minimum investment requirements.

Are these tools secure?

Reputable financial planning tools employ robust security measures to protect user data. Look for tools with encryption, two-factor authentication, and strong privacy policies. However, always exercise caution and avoid sharing sensitive information unnecessarily.

How often should I review my financial plan?

Ideally, review your financial plan at least annually, or more frequently if there are significant life changes (e.g., job change, marriage, birth of a child).

Can these tools help with tax optimization?

Some tax planning tools can help estimate tax liability and identify potential deductions and credits. However, it’s always advisable to consult with a qualified tax professional for personalized advice.