Financial Planning Tools Comparison: Embark on a whimsical yet insightful journey through the often-bewildering world of personal finance software. We’ll dissect budgeting apps, investment platforms, and retirement calculators, not with a furrowed brow and a calculator, but with a twinkle in our eye and a spreadsheet in hand. Prepare for a surprisingly entertaining exploration of how technology can (maybe) make your money worries a little less…worrying.

This comprehensive guide navigates the complex landscape of financial planning tools, providing a detailed comparison of various software designed to assist individuals in managing their finances effectively. From the intricacies of budgeting apps to the sophisticated algorithms of robo-advisors, we’ll unravel the features, benefits, and drawbacks of each tool type, empowering you to make informed decisions about your financial future. Expect witty observations, helpful insights, and maybe even a chuckle or two along the way.

Introduction to Financial Planning Tools

Navigating the sometimes-treacherous waters of personal finance can feel like trying to assemble IKEA furniture blindfolded – frustrating, confusing, and potentially resulting in a wobbly end product. Fortunately, a plethora of financial planning tools are available to help you avoid a financial meltdown and build a solid, stable (and hopefully, stylish) financial future. These tools range from simple budgeting apps to sophisticated investment platforms, each designed to tackle a specific aspect of your financial life.

Financial planning tools aren’t just for the financially savvy; they’re for anyone who wants to take control of their money. Whether you’re a seasoned investor or just starting to think about saving, these tools can provide invaluable assistance in organizing your finances, making informed decisions, and ultimately, achieving your financial goals. Think of them as your financial Sherpas, guiding you towards the summit of financial success (or at least a comfortable retirement).

Types of Financial Planning Tools

Financial planning tools come in many shapes and sizes, each catering to different needs and levels of financial expertise. Understanding the different categories can help you choose the right tool(s) for your specific situation. Choosing the wrong tool is like using a sledgehammer to crack a walnut – inefficient and potentially damaging.

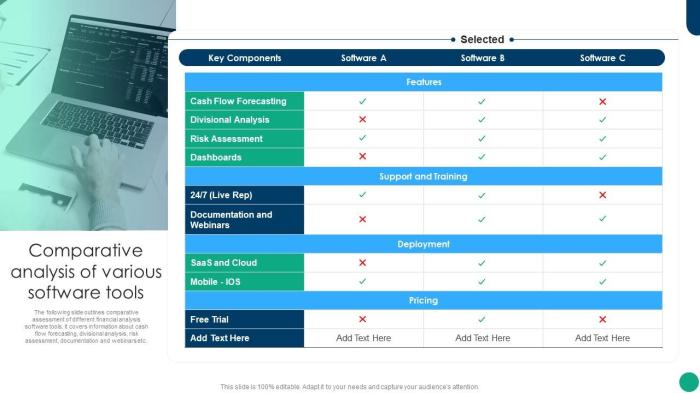

Financial Planning Tool Comparison

Below is a comparison table highlighting key features of different tool types. Remember, the “best” tool depends entirely on your individual needs and preferences. Some people prefer a simple, no-frills approach, while others crave the bells and whistles of a more comprehensive platform.

| Tool Type | Cost | User-Friendliness | Key Functionalities |

|---|---|---|---|

| Budgeting Apps (e.g., Mint, YNAB) | Free (often with paid premium options) | Generally high; intuitive interfaces | Expense tracking, budgeting, bill reminders, financial goal setting |

| Investment Platforms (e.g., Fidelity, Schwab, Robinhood) | Variable; often commission-based or with account minimums | Varies widely; some are very user-friendly, others less so | Investment management, brokerage services, research tools, portfolio tracking |

| Retirement Calculators (many available online) | Usually free | Generally high; simple input/output | Estimate retirement needs, project savings growth, explore different saving scenarios |

| Tax Software (e.g., TurboTax, H&R Block) | Variable; depends on complexity of return | Varies; guided interfaces simplify the process | Tax preparation, filing, optimization strategies |

Budgeting Tools Comparison

Choosing the right budgeting app can feel like navigating a minefield of spreadsheets and confusing jargon. Fear not, intrepid financial adventurer! This comparison will illuminate the strengths and weaknesses of three popular budgeting tools, helping you select the perfect digital sidekick for your financial journey. We’ll examine their features, highlight their quirks, and leave you armed with the knowledge to make an informed decision. Buckle up, it’s going to be a wild ride!

Popular Budgeting Apps: A Feature Overview

Let’s delve into the specifics of three popular budgeting apps: Mint, YNAB (You Need A Budget), and Personal Capital. Each boasts a unique approach to managing your finances, catering to different budgeting styles and technological preferences. Understanding their individual strengths and weaknesses is key to selecting the right fit for your needs.

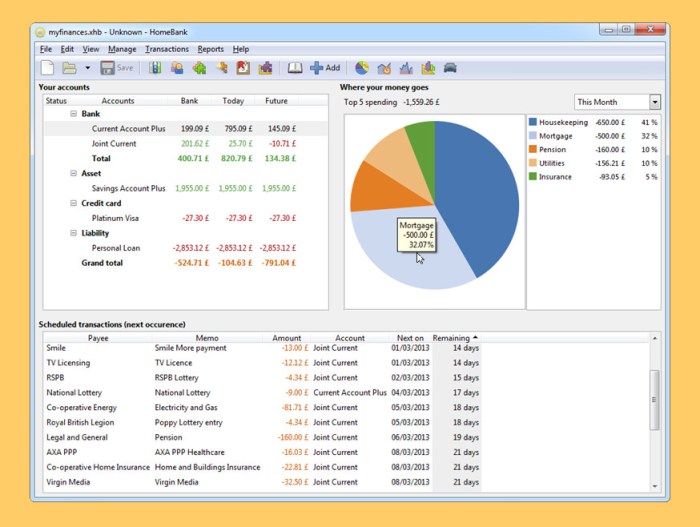

Mint, a free option, offers a user-friendly interface and automatic transaction importing. Its strength lies in its simplicity and ease of use, making it ideal for beginners. YNAB, on the other hand, employs a zero-based budgeting method, requiring users to allocate every dollar. This more structured approach can be incredibly powerful for those seeking greater control over their finances, though it demands a steeper learning curve. Finally, Personal Capital provides a comprehensive financial dashboard, including investment tracking, retirement planning tools, and advanced reporting features, making it a strong choice for those with more complex financial needs. However, its free features are limited, and the premium version comes with a price tag.

Expense Categorization Methods

The way a budgeting app categorizes your expenses significantly impacts your ability to track spending and identify areas for improvement. Each app utilizes a slightly different approach.

Understanding these differences is crucial for choosing a tool that aligns with your personal budgeting preferences and goals. A well-organized categorization system is the backbone of effective budgeting.

- Mint: Mint uses a pre-defined category system that’s relatively straightforward. Users can customize categories to some extent, but the options are limited compared to other apps. It relies heavily on automated categorization, which can sometimes lead to inaccuracies.

- YNAB: YNAB employs a more flexible system, allowing users to create custom categories and subcategories to a high degree of granularity. This allows for precise tracking and detailed analysis of spending habits. The system encourages a mindful approach to assigning categories, which can initially seem tedious but ultimately promotes greater financial awareness.

- Personal Capital: Personal Capital provides a robust categorization system, incorporating both pre-defined and customizable options. Its advanced features, including investment tracking, often lead to more nuanced categorization based on asset types and investment strategies. This level of detail can be overwhelming for beginners but invaluable for sophisticated investors.

Pros and Cons of Each Budgeting Tool

A balanced perspective is crucial; each app has its strengths and weaknesses. Let’s weigh the pros and cons to gain a clearer understanding of their suitability for different users.

This comparison isn’t about declaring a “winner,” but rather equipping you with the information you need to choose the best tool for your unique financial circumstances and personality.

| Feature | Mint | YNAB | Personal Capital |

|---|---|---|---|

| Pros | Free, user-friendly, automatic transaction import | Zero-based budgeting, highly customizable, strong community support | Comprehensive financial dashboard, investment tracking, advanced reporting |

| Cons | Limited customization, potential for categorization errors, fewer advanced features | Steeper learning curve, subscription required, can be time-consuming | Limited free features, subscription required, can be overwhelming for beginners |

Investment Planning Tools Deep Dive: Financial Planning Tools Comparison

Investing your hard-earned cash can feel like navigating a minefield of jargon and confusing choices. Luckily, a plethora of tools exist to help you chart a course towards financial freedom, or at least a slightly less stressful retirement. Let’s delve into the exciting world of investment planning tools, where your money can finally work as hard as you do (hopefully harder!).

Investment planning tools broadly fall into two categories: robo-advisors and brokerage platforms. Each offers a unique approach to managing your investments, catering to different levels of experience and risk tolerance. Choosing the right tool depends heavily on your personal financial goals and comfort level with managing your own investments. Think of it like choosing between a self-drive car (brokerage platform) and a chauffeur-driven limousine (robo-advisor) – both get you to your destination, but the journey is quite different.

Robo-Advisors: The Automated Investment Gurus

Robo-advisors are automated investment platforms that use algorithms to create and manage investment portfolios based on your risk tolerance, financial goals, and time horizon. They typically require a minimal amount of input from you, making them ideal for beginners or those who prefer a hands-off approach. Imagine a financial advisor who never sleeps and charges a fraction of the price – that’s the allure of a robo-advisor.

Brokerage Platforms: The DIY Investment Powerhouses

Brokerage platforms offer a wider range of investment options and greater control over your portfolio. These platforms provide the tools and resources to buy and sell individual stocks, bonds, mutual funds, and other investment products. They’re perfect for experienced investors who want to actively manage their investments and have a more hands-on approach. Think of it as having your own personal trading floor at your fingertips (minus the expensive suits and questionable coffee).

Comparison of Three Prominent Robo-Advisors

To illustrate the differences between robo-advisors, let’s compare three popular choices. Remember, this is a snapshot in time, and fees and features can change, so always check the latest information on their websites.

| Feature | Robo-Advisor A (Example: Betterment) | Robo-Advisor B (Example: Wealthfront) | Robo-Advisor C (Example: Schwab Intelligent Portfolios) |

|---|---|---|---|

| Investment Strategy | Diversified portfolio of ETFs based on risk tolerance | Similar to A, but with a focus on tax-loss harvesting | Similar to A and B, with a focus on low-cost index funds |

| Fees | Advisory fee based on assets under management (AUM), typically 0.25% | Advisory fee based on AUM, typically 0.25% | No advisory fee for accounts below a certain balance; higher fees for larger accounts |

| Minimum Investment | Generally low, often $0 or a small initial deposit | Generally low, often $0 or a small initial deposit | Generally low, often $0 or a small initial deposit |

Retirement Planning Tools Analysis

Planning for retirement can feel like navigating a minefield of complex financial jargon and unpredictable market forces. Fortunately, a plethora of retirement planning tools exist to help us avoid premature graying and panicked late-night calculations. These digital oracles offer projections, visualizations, and – dare we say it – a glimmer of hope for a comfortable golden age. Let’s delve into the fascinating (and sometimes bewildering) world of retirement planning software.

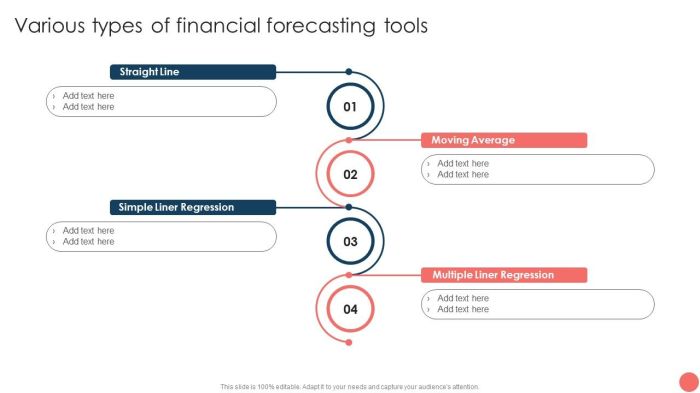

Retirement planning tools vary significantly in their approach to projecting your future financial health. Understanding these methodologies is crucial to selecting a tool that aligns with your risk tolerance and financial sophistication. Some tools employ simplistic calculations, while others incorporate sophisticated Monte Carlo simulations to account for market volatility. The choice depends on your individual needs and comfort level with financial modeling.

Retirement Projection Methodologies

Different retirement planning tools utilize varying methodologies to project your future retirement income. Some rely on deterministic models, assuming a fixed rate of return on investments. Others use stochastic models, like Monte Carlo simulations, which incorporate randomness and account for the inherent uncertainty of market fluctuations. The accuracy of these projections hinges on the quality of the input data and the sophistication of the underlying algorithms. For instance, a tool using a deterministic model with a conservative return rate will yield a more conservative retirement projection compared to one employing a Monte Carlo simulation that considers a wider range of possible market outcomes. A deterministic model might simply project a straight-line growth based on a fixed annual return, while a Monte Carlo simulation will run thousands of iterations, each with slightly different market conditions, generating a distribution of possible outcomes. This provides a more nuanced and realistic picture of your potential retirement nest egg, but also requires more complex input parameters and interpretation of results.

User Interface and Ease of Use

Let’s compare the user interfaces of three popular retirement calculators: “Planner A,” “Planner B,” and “Planner C.” “Planner A” boasts a clean, intuitive interface with a clear progression of input fields and easily digestible charts. It guides users through each step, providing helpful hints and explanations. “Planner B,” on the other hand, presents a more cluttered interface with a steep learning curve. While it offers more advanced features, navigating its complex menus can be daunting for novice users. “Planner C” strikes a balance, providing a user-friendly experience while still offering a comprehensive range of features and customization options. It excels in visualizing the projected retirement income through interactive graphs and charts. While all three tools aim to achieve the same goal, the path to achieving that goal differs significantly based on the user experience provided. Ultimately, the best tool depends on the user’s technical proficiency and comfort level with financial planning software.

Handling of Input Variables, Financial Planning Tools Comparison

The accuracy of retirement projections relies heavily on the handling of various input variables. Let’s consider how three different tools manage inflation and investment returns. “Planner A” allows users to input a fixed inflation rate and investment return, providing a straightforward projection. “Planner B” offers more flexibility, allowing users to input variable inflation and return rates over time, reflecting potential economic fluctuations. “Planner C” goes a step further, incorporating Monte Carlo simulations to model the impact of fluctuating inflation and investment returns on retirement projections. This sophisticated approach offers a more realistic, albeit potentially more complex, assessment of future financial security. For example, if “Planner A” assumes a constant 3% inflation and 7% investment return, it will produce a deterministic projection. “Planner B” might allow for adjustments, perhaps a higher inflation rate in the early years followed by a decline. “Planner C” will generate a range of possible outcomes based on various combinations of inflation and return rates, providing a probability distribution of potential retirement income levels.

Debt Management Tools Examination

Tackling debt can feel like wrestling a greased piglet – slippery, frustrating, and potentially leaving you covered in mud (metaphorically speaking, of course). But fear not, intrepid debt-slayers! A variety of digital tools are here to help you strategize your way to financial freedom, turning that slippery piglet into a neatly packaged ham (again, metaphorically).

Debt management tools offer a range of features designed to simplify the often-daunting process of paying down debt. These tools typically involve tracking your debts, creating repayment plans, and providing insights into your progress. Some even offer extra features like budgeting tools to help prevent future debt accumulation. Think of them as your personal debt-busting sidekicks, ready to help you conquer those outstanding balances.

Debt Management Tool Examples and Their Functionality

Several excellent debt management tools exist, each with its unique strengths. For example, Mint provides a comprehensive overview of your financial situation, including debts, allowing you to track your progress and visualize your repayment journey. Personal Capital offers similar functionality, but with a more sophisticated approach to investment tracking, making it ideal for those with investment accounts alongside debt. Finally, tools like EveryDollar, developed by Dave Ramsey, focus on a budgeting-first approach, helping users allocate funds strategically to accelerate debt repayment. These tools help users by centralizing debt information, simplifying payment tracking, and providing visualizations to motivate progress. They vary in their sophistication and features, but the core goal remains the same: to help users gain control over their debt.

Debt Repayment Strategies: Snowball vs. Avalanche

Two popular debt repayment strategies frequently employed by debt management tools are the debt snowball and the debt avalanche methods. The debt snowball method prioritizes paying off the smallest debts first, regardless of interest rates. This approach provides early wins, boosting motivation. The debt avalanche method, on the other hand, focuses on paying off the debts with the highest interest rates first, minimizing the total interest paid over time.

Illustrative Scenario: Debt Repayment Comparison

Let’s illustrate the differences between these strategies with a hypothetical scenario. Imagine you have three debts:

| Debt | Balance | Interest Rate | Monthly Payment |

|---|---|---|---|

| Credit Card A | $1,000 | 20% | $50 |

| Credit Card B | $5,000 | 15% | $250 |

| Student Loan | $10,000 | 5% | $200 |

Applying a total monthly payment of $500, the debt snowball method would prioritize paying off Credit Card A first, followed by Credit Card B, and finally the Student Loan. The debt avalanche method would prioritize the Student Loan (lowest interest rate), followed by Credit Card B, and finally Credit Card A. While the avalanche method will save money on interest in the long run, the snowball method offers faster psychological wins, which can be crucial for maintaining motivation throughout the debt repayment journey. The optimal strategy depends on individual circumstances and psychological factors.

Tax Planning Tools Overview

Navigating the often-bewildering world of taxes doesn’t have to feel like scaling Mount Everest in flip-flops. Thankfully, a plethora of tax planning tools exist to help individuals and businesses alike tame this fiscal beast. These tools range from simple calculators to sophisticated software packages, each offering a unique blend of features designed to simplify the complex process of tax preparation and optimization.

Tax planning tools are essentially digital assistants that help you understand and manage your tax obligations. They offer a variety of functionalities, from basic tax calculations to advanced tax strategy simulations, ultimately helping you minimize your tax liability while remaining fully compliant with the law. Think of them as your personal tax Sherpas, guiding you through the treacherous terrain of tax codes and regulations.

Types of Tax Planning Tools

Tax planning tools come in various forms, catering to different needs and levels of financial expertise. Some are user-friendly, perfect for individuals filing simple returns, while others are more robust and geared towards businesses or individuals with complex financial situations. The choice depends on individual requirements and comfort level with financial software. For example, a simple tax calculator might suffice for someone with straightforward income, while a comprehensive tax planning software suite would be more beneficial for a self-employed individual with multiple income streams and deductions.

Key Features of Tax Planning Software and Online Resources

Many tax planning tools share core functionalities, although the depth and breadth of these features vary significantly. Common features include tax calculation engines that automatically populate forms based on user input, tax optimization suggestions based on individual circumstances, and the ability to import data from other financial accounts. More advanced software may also include features such as tax projection tools that allow users to simulate the impact of various financial decisions on their future tax liability. For instance, a user could see how contributing to a retirement account would affect their tax burden in the current year and in future years. Some software even offers year-round tax planning capabilities, helping users proactively manage their tax liability throughout the year rather than just at tax time.

Estimating Tax Liability and Optimizing Tax Strategies

One of the most significant benefits of tax planning tools is their ability to accurately estimate tax liability. By inputting relevant financial data, users can receive a precise calculation of their expected tax burden, eliminating the guesswork and anxiety often associated with tax season. Moreover, these tools often suggest strategies for tax optimization, identifying potential deductions, credits, and other tax-saving opportunities that users might otherwise miss. For example, a tax planning tool might alert a user to the potential benefits of itemizing deductions instead of taking the standard deduction, based on their specific financial situation. The tool could then calculate the potential tax savings from this strategy. This proactive approach helps individuals and businesses make informed financial decisions that minimize their overall tax liability and maximize their after-tax income.

Illustrative Examples of Tool Use

Let’s ditch the dry theory and dive into the real-world application of these financial planning tools. We’ll examine three fictional individuals, each facing unique financial challenges and aspirations, and see how different tools can help them navigate the sometimes-treacherous waters of personal finance. Prepare for a financial case study extravaganza!

We will analyze how each individual uses various financial planning tools to achieve their specific goals. The tools used will be tailored to their unique circumstances, highlighting the versatility and importance of choosing the right tools for the job. Think of it as a financial tool “choose your own adventure,” but without the unfortunate demise at the end.

Sarah, the Aspiring Homeowner

Sarah, a 28-year-old marketing professional, dreams of owning a cozy cottage in the countryside. She currently rents an apartment and has a moderate income but lacks a significant down payment. Her primary financial goal is saving for a down payment and managing her debt.

To achieve her goal, Sarah utilizes a budgeting tool like Mint or YNAB (You Need A Budget) to meticulously track her income and expenses. This allows her to identify areas where she can cut back and increase her savings rate. She then uses an investment planning tool, perhaps a robo-advisor like Betterment or Wealthfront, to invest her savings aggressively in a diversified portfolio aiming for higher returns, while still maintaining a balance with risk tolerance. Finally, she employs a debt management tool, possibly a debt snowball calculator, to prioritize paying down her existing student loans to improve her credit score and qualify for a favorable mortgage. Her careful budgeting, strategic investment, and debt reduction plan work in synergy to accelerate her progress toward homeownership.

David, the Retirement-Focused Investor

David, a 55-year-old engineer nearing retirement, is focused on securing a comfortable retirement. He has a significant amount of savings but is unsure how to best allocate his assets to maximize returns while minimizing risk. His primary financial goal is optimizing his investment portfolio for retirement income.

David utilizes a retirement planning tool, like Fidelity’s retirement planning calculator or a similar tool offered by his financial institution, to project his future retirement income based on different savings and withdrawal scenarios. This helps him understand the impact of various investment strategies on his retirement lifestyle. He also uses an investment planning tool to rebalance his portfolio to align with his risk tolerance and time horizon. Perhaps he utilizes a tool that allows him to simulate different market conditions and assess the potential impact on his retirement nest egg. He regularly reviews his portfolio and adjusts his strategy as needed, ensuring his retirement plans remain on track. He might even explore using a financial advisor for more personalized guidance.

Emily, the Debt Consolidation Champion

Emily, a 32-year-old teacher, is burdened by high-interest credit card debt. Her primary financial goal is to eliminate her debt as quickly as possible and build a strong financial foundation.

Emily uses a debt management tool to consolidate her high-interest debt into a lower-interest loan. This could involve a balance transfer credit card or a personal loan with a favorable interest rate. She also uses a budgeting tool to track her expenses and create a realistic repayment plan. This plan likely incorporates the debt snowball or debt avalanche method, prioritizing either the smallest debt or the highest-interest debt, respectively. To maintain motivation and track her progress, she might utilize a debt reduction app that visually represents her progress toward debt freedom. The combination of debt consolidation and meticulous budgeting helps Emily gain control of her finances and accelerate her journey toward a debt-free future.

Final Summary

So, there you have it – a whirlwind tour of the financial planning tool universe! While choosing the *perfect* tool might feel like finding a unicorn that also balances your checkbook, remember that the best tool is the one that best suits *your* unique needs and quirks. Don’t be afraid to experiment, and remember, even a slightly off-kilter financial plan is better than no plan at all. Happy budgeting, investing, and (hopefully) retiring in style!

FAQ

What if I don’t have a lot of money to invest?

Many robo-advisors and investment platforms offer low minimum investment requirements, some even allowing you to start with just a few dollars. Look for options with low fees to maximize your returns.

How often should I review my financial plan?

Ideally, you should review your financial plan at least annually, or more frequently if there are significant life changes (new job, marriage, etc.).

Are there free financial planning tools?

Yes, many budgeting apps and basic retirement calculators are available for free. However, more advanced features often come with a subscription fee.

What’s the difference between a robo-advisor and a traditional financial advisor?

Robo-advisors use algorithms to manage investments, typically with lower fees than traditional advisors who offer personalized, human-led financial guidance.