Financial Planning Tools Comparison: Embark on a hilarious yet informative journey through the wild world of budgeting apps, investment platforms, and retirement calculators! We’ll dissect the strengths and weaknesses of these digital financial gurus, revealing which ones are truly worth your hard-earned cash (and which ones might just steal your socks). Prepare for witty insights and surprisingly useful information – because managing your money doesn’t have to be a snooze-fest.

This comprehensive comparison will navigate you through the labyrinth of financial planning tools, offering a clear understanding of their features, pricing, and suitability for various user profiles. From the penny-pinching student to the seasoned entrepreneur, we’ll uncover the perfect tool to match your financial aspirations (and your sense of humor).

Introduction to Financial Planning Tools

Navigating the world of personal finance can feel like trying to assemble IKEA furniture without the instructions – confusing, frustrating, and potentially leading to a wobbly end result. Fortunately, a plethora of financial planning tools exist to help you avoid a financial meltdown and build a solid foundation for your future. These digital assistants range from simple budgeting apps to sophisticated investment platforms, offering a variety of features designed to streamline your financial life. Think of them as your personal financial Sherpas, guiding you through the sometimes treacherous terrain of money management.

The landscape of financial planning tools is incredibly diverse, catering to individual needs and business requirements. From simple spreadsheets to AI-powered robo-advisors, the options are almost overwhelming. This abundance, however, allows for a personalized approach, ensuring you can find the perfect tool to match your financial goals and tech-savviness. It’s like choosing the right tool for the job – you wouldn’t use a sledgehammer to crack a nut (unless you’re feeling particularly dramatic).

Categories of Financial Planning Tools

Financial planning tools fall into several broad categories, each offering unique functionalities. Understanding these categories is crucial for choosing the right tool for your specific needs. A poorly chosen tool can be as unhelpful as a rusty spork at a banquet.

- Budgeting Apps: These apps, such as Mint or YNAB (You Need A Budget), help you track your income and expenses, providing a clear picture of your spending habits. They often offer features like automated categorization, budgeting tools, and bill reminders, helping you stay on top of your finances. Imagine them as your personal financial detectives, uncovering hidden spending patterns.

- Investment Platforms: Platforms like Robinhood, Fidelity, and Schwab provide access to various investment options, including stocks, bonds, and mutual funds. They offer features like portfolio tracking, research tools, and automated investing options. Think of these as your financial launchpads, propelling you towards your investment goals.

- Retirement Calculators: These tools, often integrated into larger financial planning platforms or available as standalone apps, help you estimate how much you’ll need to save for retirement based on your current income, expenses, and desired retirement lifestyle. They’re like crystal balls (slightly less mystical, but still quite helpful) for your retirement planning.

- Tax Software: Software like TurboTax or H&R Block simplifies tax preparation, helping you navigate the complexities of tax laws and maximize your deductions. These are your financial knights in shining armor, rescuing you from tax season chaos.

Key Differentiating Features of Financial Planning Tools

The features offered by different financial planning tools vary significantly. Some focus on simplicity and ease of use, while others offer advanced features for experienced investors. Choosing the right tool often depends on your level of financial literacy and your specific needs. A tool that’s overly complex for a beginner can be as intimidating as a physics textbook to a kindergartener.

- User Interface: A user-friendly interface is crucial for a positive user experience. Some tools boast intuitive designs, while others can be confusing and overwhelming. A simple, clean interface is paramount, preventing you from getting lost in a sea of charts and graphs.

- Data Security: Protecting your financial data is paramount. Look for tools that employ robust security measures to safeguard your information. Think of data security as the sturdy lock on your financial vault – you want it to be impenetrable.

- Integration Capabilities: The ability to integrate with other financial accounts and apps can streamline your financial management. Seamless integration is like having a well-oiled machine – everything works together smoothly.

- Cost: Financial planning tools range from free to subscription-based. Consider the cost versus the features offered when making your selection. Free tools may lack certain features, while premium tools may offer more advanced functionalities. The price should align with your budget and needs.

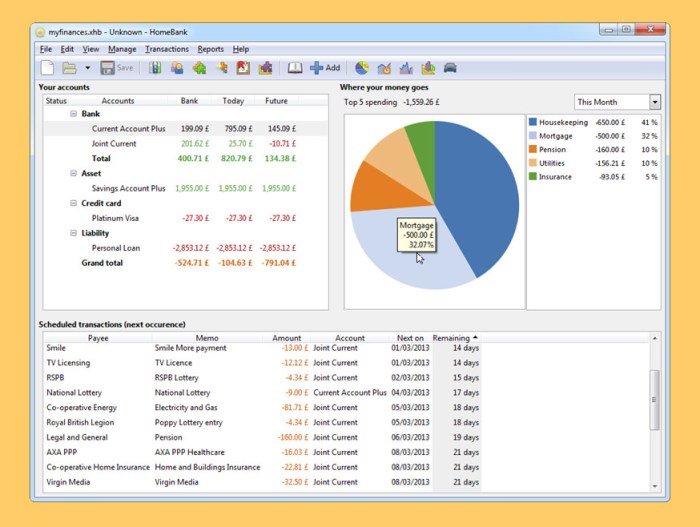

Comparison of Budgeting Tools

Budgeting apps: the digital saviors of our sometimes-chaotic financial lives. They promise order, clarity, and maybe even a little extra cash at the end of the month (a promise often kept, if you use them correctly!). Let’s dive into the world of budgeting apps, comparing three popular choices to help you find your perfect financial match.

Budgeting App Feature Comparison

Choosing the right budgeting app can feel like choosing a life partner – you need compatibility! To help navigate this crucial decision, we’ve compiled a comparison of three popular budgeting apps, considering their key features, pricing models, and user feedback. Remember, the “best” app depends entirely on your individual needs and financial personality.

| App Name | Key Features | Pricing | User Reviews Summary |

|---|---|---|---|

| Mint | Free credit score monitoring, automated transaction categorization, budgeting tools, bill payment reminders. | Free (with ads), premium subscription available for advanced features. | Generally positive, praising ease of use and free credit score access. Some users report occasional glitches and limited customization options. |

| YNAB (You Need A Budget) | Zero-based budgeting, goal setting, robust reporting, excellent customer support. | Subscription-based, with varying plan options. | Highly rated, users appreciate the methodology and helpful community, but the learning curve can be steep for some. |

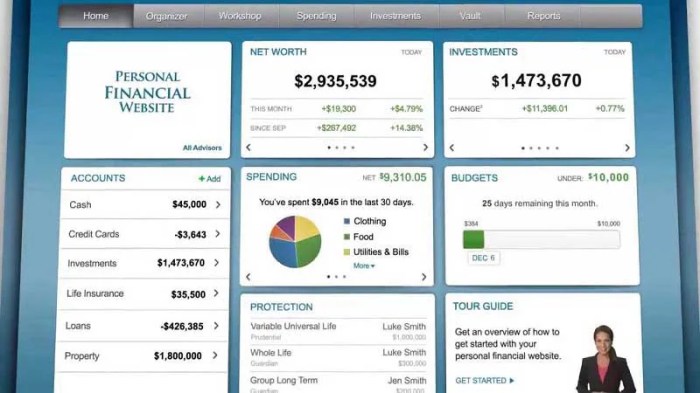

| Personal Capital | Comprehensive financial dashboard, investment tracking, retirement planning tools, budgeting features. | Free (with limitations), premium subscription for advanced features and financial advice. | Positive reviews from users who appreciate the holistic financial management capabilities. Some find the interface overwhelming and the free version too limited. |

Suitability for Different User Profiles

Each budgeting app caters to different needs and financial lifestyles.

Mint, with its free version and user-friendly interface, is ideal for students or young adults just starting to manage their finances. Its simplicity makes it easy to track income and expenses without feeling overwhelmed. Families might find Mint’s bill payment reminders and shared account features beneficial, although more advanced features require a paid subscription. Entrepreneurs might find Mint useful for basic expense tracking, but its features may be insufficient for in-depth financial analysis.

YNAB, with its emphasis on zero-based budgeting, is a fantastic choice for users who want a structured approach to managing their money. Families could benefit from YNAB’s collaborative features and goal-setting tools. Entrepreneurs might appreciate its ability to track business expenses, though the subscription cost might be a factor. Students might find the learning curve challenging, requiring a steeper investment of time and effort.

Personal Capital, with its advanced features and investment tracking, is best suited for individuals with more complex financial situations. Families with significant investments or retirement planning needs will find its comprehensive tools invaluable. Entrepreneurs can use Personal Capital to monitor their business finances and investment portfolios, but the cost and complexity might be unnecessary for those with simpler financial needs. Students might find the app too advanced for their current financial needs.

Best Budgeting Tool for Income and Expense Tracking

While all three apps excel at tracking income and expenses, YNAB stands out for its zero-based budgeting methodology. This approach forces users to allocate every dollar to a specific purpose, promoting mindful spending and preventing overspending. The detailed reporting features further enhance its efficacy for thorough income and expense monitoring. While Mint and Personal Capital offer solid tracking capabilities, YNAB’s focus on intentional spending makes it the most effective for comprehensive income and expense management.

Investment Planning Tools Analysis: Financial Planning Tools Comparison

Investing your hard-earned cash can feel like navigating a minefield of jargon and confusing choices. Luckily, a plethora of investment planning tools exist to help you avoid stepping on any metaphorical landmines (and losing your shirt). This section dives into the functionalities of several platforms, comparing their strengths and weaknesses to help you find the perfect fit for your financial journey. Buckle up, it’s going to be a wild ride!

Let’s explore the exciting world of investment platforms, examining their capabilities and user-friendliness. We’ll be comparing apples and oranges (and maybe even some kumquats), but fear not; we’ll provide clear, concise comparisons to help you make informed decisions.

Investment Platform Functionalities

Two popular investment platforms offer distinct approaches to portfolio management, asset allocation, and trading: Fidelity and Betterment. Fidelity, a long-standing giant in the brokerage world, provides a comprehensive suite of tools for seasoned investors. Betterment, on the other hand, caters to a more automated, hands-off approach with its robo-advisor services.

Fidelity offers robust trading capabilities, allowing for direct stock purchases, options trading, and access to a vast range of investment products. Their portfolio management tools are powerful but require a degree of financial literacy to use effectively. Asset allocation is largely left to the investor, providing maximum control but also requiring significant research and understanding. Their user interface is quite comprehensive, perhaps even overwhelming for novice investors, but offers a deep level of customization.

Betterment, conversely, shines with its automated portfolio management. Their robo-advisor system utilizes algorithms to create and manage a diversified portfolio based on your risk tolerance and financial goals. Asset allocation is handled automatically, simplifying the investment process for beginners. Trading capabilities are limited, focusing primarily on ETFs and mutual funds. Betterment’s user interface is clean, intuitive, and easy to navigate, even for those new to investing. Think of it as a user-friendly dashboard compared to Fidelity’s more comprehensive control panel.

Investment Platform Comparison

The following table summarizes the key features, fees, and security measures of Fidelity and Betterment, providing a side-by-side comparison to aid your decision-making process. Remember, fees and specific features can change, so always check the latest information on the provider’s website.

| Platform Name | Features | Fees | Security Measures |

|---|---|---|---|

| Fidelity | Extensive trading options, robust portfolio management tools, research resources, educational materials. | Varies depending on trading activity and account type; may include commissions, fees for certain services. | Industry-standard security protocols, encryption, account monitoring, fraud prevention measures. |

| Betterment | Automated portfolio management, tax-loss harvesting, rebalancing, goal-based investing. | Management fees based on assets under management (AUM). | Robust security measures including encryption, two-factor authentication, and regular security audits. |

Robo-Advisors versus Traditional Brokerage Accounts

The choice between a robo-advisor like Betterment and a traditional brokerage account like Fidelity often depends on your investment experience and comfort level with managing your investments. Both have their own unique advantages and disadvantages.

Robo-advisors offer a streamlined, automated approach, ideal for beginners or those who prefer a hands-off investment strategy. Their low fees and user-friendly interfaces make them attractive to a wide range of investors. However, their limited trading capabilities and lack of personalized financial advice might be drawbacks for more experienced investors seeking greater control.

Traditional brokerage accounts, on the other hand, offer a higher degree of control and access to a broader range of investment products. They are better suited for experienced investors who are comfortable making their own investment decisions. However, they typically involve higher fees and require a greater understanding of financial markets. Think of it like this: Robo-advisors are like having a reliable, automated chauffeur, while traditional brokerage accounts are like owning a powerful sports car – you’re in complete control, but you need to know how to drive it!

Retirement Planning Tools Examination

Planning for retirement can feel like navigating a minefield blindfolded – unless you’ve got the right tools. Retirement calculators, while not crystal balls, offer a much-needed roadmap to help you visualize your golden years (and whether you’ll actually have any gold). They provide a structured way to estimate your retirement needs and assess the viability of your current savings strategy. Let’s examine some popular options and see how they stack up.

Functionality of Three Retirement Calculators

This section details the functionality of three distinct retirement calculators, highlighting their unique features and approaches to retirement planning. We’ll focus on their ease of use, data input requirements, and the types of outputs they generate. Remember, these are just tools; your actual retirement experience may vary (hopefully for the better!).

- Fidelity Retirement Calculator: This calculator boasts a user-friendly interface, requiring inputs such as current age, desired retirement age, current savings, and estimated annual contributions. It offers various scenarios based on different investment return assumptions and inflation rates. The output includes an estimated retirement income, potential shortfall, and suggested adjustments to savings strategies. It’s straightforward, making it a great choice for beginners. For example, inputting a current age of 35, a retirement age of 65, current savings of $50,000, and annual contributions of $5,000, with a conservative investment return assumption, might reveal a potential shortfall and suggest increasing contributions or delaying retirement.

- AARP Retirement Calculator: AARP’s calculator takes a slightly more comprehensive approach. Besides the standard inputs, it also considers factors like Social Security benefits, pensions, and healthcare expenses. This granular approach allows for a more accurate projection of retirement income. The output is presented in a clear, concise manner, highlighting areas where adjustments might be needed. For instance, including an estimated annual pension of $10,000 alongside other inputs could significantly alter the projected retirement income and reduce any potential shortfall. This level of detail makes it ideal for those with more complex financial situations.

- Schwab Retirement Calculator: This calculator emphasizes the impact of various investment strategies on retirement outcomes. Users can input their risk tolerance, and the calculator generates projections based on different portfolio allocations (e.g., stocks vs. bonds). This allows users to explore the trade-offs between risk and return in their retirement planning. The results often include charts and graphs, visualizing the potential growth of their savings under different scenarios. Let’s say you input a high-risk tolerance; the calculator might project a higher potential return but also highlight a greater chance of volatility.

Comparison of Retirement Calculation Methods and Future Income Projections

The following bullet points compare the methods employed by these calculators to estimate retirement needs and project future income. Remember, the accuracy of these projections depends heavily on the accuracy of the input data and the assumptions made about future market performance.

- Fidelity: Employs a relatively simple compounding interest calculation, projecting future savings based on consistent contributions and assumed investment returns. It incorporates inflation adjustments to future expenses. It provides a straightforward estimate of retirement income based on the projected savings.

- AARP: Uses a more sophisticated model that incorporates multiple income streams (savings, Social Security, pensions) and factors in anticipated healthcare costs. Inflation is also factored into both income and expenses projections. The output is a more comprehensive estimate of overall retirement income, considering all potential sources.

- Schwab: Offers multiple scenarios based on different asset allocation strategies and risk profiles. It simulates various market conditions to demonstrate the potential range of outcomes. The projections include the impact of inflation on both investment growth and expenses, allowing users to assess their risk tolerance and its potential effect on retirement income.

Factors Considered by Each Calculator

Understanding the factors considered by each calculator is crucial for interpreting their outputs effectively. These factors can significantly influence the projected retirement income and highlight potential areas of concern.

- Inflation: All three calculators account for inflation, but the methods vary in complexity. Fidelity and AARP use standard inflation rates, while Schwab might allow for more customized inflation inputs or scenarios.

- Investment Returns: Each calculator allows users to input or select assumed investment returns, reflecting different risk tolerances and investment strategies. Schwab’s calculator, in particular, emphasizes the impact of different investment choices on long-term outcomes.

- Life Expectancy: While not explicitly stated as a direct input in all cases, life expectancy is implicitly factored into the calculations. The longer the projected retirement period, the larger the required savings will be. This is more prominent in the AARP calculator due to its consideration of long-term healthcare costs.

Tax Planning Software Overview

Navigating the labyrinthine world of taxes can feel like trying to solve a Rubik’s Cube blindfolded. Fortunately, tax planning software offers a helping hand (or perhaps a highly caffeinated, tax-code-conquering robot hand). These digital wizards can simplify the process, helping you minimize your tax burden and avoid the dreaded audit. Let’s explore a couple of popular options and see how they stack up.

Tax software isn’t just for crunching numbers; it’s about strategic planning. A well-chosen program can help you identify deductions you might have missed, optimize your investment strategies for tax efficiency, and even predict your future tax liability. Choosing the right software depends heavily on your individual needs and comfort level with technology. Some programs are geared towards simple returns, while others cater to the complexities of self-employment or investment portfolios.

Tax Software Comparison

Below is a comparison of two popular tax planning software options, highlighting their features, pricing, and target user base. Remember, the best software for you depends on your specific circumstances, so do your research!

| Software Name | Key Features | Pricing | Target User |

|---|---|---|---|

| TurboTax | Wide range of products for various needs; import capabilities from other financial institutions; extensive support resources; state tax filing options; guided interviews to help navigate the process; audit support. | Varies greatly depending on the chosen product, from free basic versions to several hundred dollars for premium versions with additional features. | Individuals with various tax situations, from simple to complex; those who prefer guided, step-by-step processes; those who value extensive customer support. |

| TaxAct | Offers a variety of products catering to different complexity levels; user-friendly interface; federal and state tax filing; various import options; strong audit support; relatively inexpensive. | Similar pricing structure to TurboTax, ranging from free to several hundred dollars depending on the selected package and features. | Individuals seeking affordable and user-friendly tax software; those with moderately complex tax situations; those comfortable with a less hands-on approach. |

Best Software for Self-Employed Individuals

For self-employed individuals, the complexities of business expenses, estimated taxes, and various deductions make choosing the right software crucial. In this case, TurboTax Self-Employed often emerges as the victor.

While both TurboTax and TaxAct offer features for the self-employed, TurboTax Self-Employed provides a more comprehensive and intuitive experience for navigating the unique challenges faced by freelancers and business owners. Its robust features, including detailed expense tracking and guidance on self-employment tax calculations, significantly outweigh the potentially higher price tag for many self-employed individuals. The peace of mind knowing you’re utilizing a program designed specifically to handle the nuances of self-employment is invaluable, especially when dealing with the often-confusing world of Schedule C.

Illustrative Examples of Tool Usage

Let’s face it, financial planning tools aren’t exactly known for their thrilling user interfaces. But fear not, dear reader! With the right tools and a dash of strategic planning, even the most daunting financial goals can become surprisingly manageable. The following scenarios demonstrate how different tools can help you conquer your financial Everest.

The beauty of these tools lies in their ability to provide a clear picture of your financial situation, allowing you to make informed decisions. They are like financial Sherpas, guiding you towards your summit.

Saving for a Down Payment

This scenario focuses on a young professional, Amelia, aiming to save $50,000 for a down payment on a house within three years. Amelia’s current savings are modest, and she needs a structured approach.

To achieve this goal, Amelia will utilize a budgeting tool (e.g., Mint or YNAB) and a savings goal tracker (integrated into many banking apps or standalone tools like Personal Capital).

- Step 1: Budgeting with Mint: Amelia meticulously tracks her income and expenses using Mint, identifying areas where she can cut back. She discovers she can save an extra $1,000 per month.

- Step 2: Savings Goal Tracking: She sets a savings goal of $50,000 in her banking app, which projects her progress based on her monthly savings. This visual representation motivates her.

- Step 3: Adjustments and Refinements: Every few months, Amelia reviews her budget and savings progress using Mint. She adjusts her spending as needed, celebrating milestones and making adjustments to her savings plan. This keeps her on track.

Expected Outcome: Amelia successfully saves $50,000 within three years, achieving her goal of a down payment. Potential Challenges: Unexpected expenses (car repairs, medical bills) could derail her plan, requiring adjustments to her budget and savings rate.

Paying Off Debt

Our next protagonist, Bob, is burdened with $20,000 in high-interest credit card debt. He needs a strategic plan to eliminate this debt efficiently.

Bob employs a debt payoff calculator (available online or in personal finance apps) and a budgeting tool (e.g., YNAB or EveryDollar) to tackle his debt aggressively.

- Step 1: Debt Payoff Calculator: Bob inputs his debt details (balance, interest rate) into a debt payoff calculator to explore different payoff strategies (snowball, avalanche). He chooses the avalanche method (prioritizing the highest interest debt).

- Step 2: Budgeting with YNAB: Bob uses YNAB to allocate funds specifically for debt repayment. He tracks his progress closely and ensures he stays within his budget to maximize his debt repayment.

- Step 3: Consistent Effort: Bob maintains his strict budget and consistently pays more than the minimum payment on his highest-interest debt. He celebrates each debt payoff, reinforcing his commitment.

Expected Outcome: Bob successfully pays off his credit card debt within a reasonable timeframe (e.g., 2-3 years), significantly reducing his financial stress. Potential Challenges: Temptation to overspend, unexpected financial emergencies, and potential for interest rate increases could pose obstacles.

Planning for Retirement

Finally, we meet Carol, a 45-year-old professional who wants to ensure a comfortable retirement. She needs a long-term financial plan to achieve her goals.

Carol utilizes a retirement planning tool (e.g., Fidelity’s retirement planning tools or a financial advisor’s software) and an investment tracking tool (e.g., Personal Capital).

- Step 1: Retirement Projection: Using a retirement planning tool, Carol inputs her current savings, expected income, and desired retirement lifestyle to project her retirement needs. The tool suggests necessary adjustments to her savings and investment strategy.

- Step 2: Investment Portfolio Management: She uses an investment tracking tool to monitor her investment portfolio’s performance and adjust her asset allocation as needed to balance risk and return. This ensures her investments are aligned with her retirement goals.

- Step 3: Regular Review and Adjustment: Carol reviews her retirement plan annually, adjusting it based on life changes (marriage, children, salary increases) and market fluctuations. She regularly consults with a financial advisor for guidance.

Expected Outcome: Carol achieves a comfortable retirement, meeting her financial goals. Potential Challenges: Market volatility, unexpected healthcare costs, and longevity risk (living longer than anticipated) could impact her retirement plans, requiring ongoing adjustments.

Factors to Consider When Choosing a Tool

Selecting the right financial planning tool can feel like navigating a minefield of spreadsheets and algorithms. Fear not, intrepid budgeter! With a little careful consideration, you can find the perfect tool to tame your finances and achieve your financial goals. Choosing wisely means understanding your needs and matching them to the tool’s capabilities. Let’s explore the key factors to consider.

Choosing a financial planning tool is a bit like choosing a significant other – it’s a long-term commitment, so you want to make sure it’s a good fit. A tool that works wonders for a high-net-worth individual might leave you feeling utterly bewildered, and vice-versa. Understanding your personal financial situation and aspirations is paramount.

Cost Considerations

The price range of financial planning tools varies dramatically, from free basic budgeting apps to sophisticated software packages costing hundreds of dollars annually. Consider your budget and the features you need before making a purchase. A free tool might suffice for basic budgeting, while a more comprehensive tool with investment tracking and tax planning features might justify a higher cost if those features align with your financial complexity. For example, a freelancer might find a free budgeting app sufficient, while a small business owner might benefit from a more robust accounting and financial forecasting tool, even if it comes with a subscription fee.

Feature Set Analysis

Different tools offer different features. Some focus on budgeting, others on investment tracking, and some offer a comprehensive suite of tools. Consider which features are most important to you. Do you need investment tracking, tax planning capabilities, retirement projections, or debt management tools? A tool with too many unnecessary features can be overwhelming, while a tool lacking essential features will leave you frustrated. For instance, if you’re primarily focused on paying off debt, a tool with strong debt tracking and payoff calculators would be more beneficial than one with advanced investment analysis features.

Security and Data Privacy

Your financial data is sensitive and confidential. Ensure the tool you choose employs robust security measures to protect your information. Look for tools with encryption, two-factor authentication, and a strong privacy policy. Consider the tool’s reputation and read reviews to assess its security track record. Remember, entrusting your financial information to a tool requires a level of trust; verify its security credentials before committing. Consider the potential consequences of a data breach and choose a tool that prioritizes data security.

User Experience and Interface

The best tool in the world is useless if you can’t figure out how to use it. Choose a tool with a user-friendly interface and intuitive navigation. Consider the tool’s learning curve and whether it aligns with your technical skills. A confusing or poorly designed interface can lead to frustration and ultimately hinder your progress towards your financial goals. Look for tools with helpful tutorials, FAQs, and responsive customer support. A well-designed tool should enhance your financial management, not complicate it.

Personal Financial Needs and Goals Alignment, Financial Planning Tools Comparison

Before choosing a financial planning tool, carefully assess your individual financial situation and goals. Are you trying to build an emergency fund, pay off debt, plan for retirement, or invest for the long term? The tool you select should directly support these objectives. For example, if your primary goal is retirement planning, a tool with strong retirement projection capabilities is essential. If you’re focused on debt reduction, a tool with robust debt management features is crucial. Ignoring this critical step could lead to investing in a tool that ultimately fails to address your specific needs.

Closing Summary

So, there you have it – a whirlwind tour of the financial planning tool landscape. While choosing the right tool might feel like navigating a minefield of spreadsheets and jargon, remember that the ultimate goal is simple: to take control of your finances and achieve your financial goals. With the right tools (and a healthy dose of humor), you can conquer your financial future, one witty budgeting app at a time. Now go forth and prosper (and maybe buy yourself a celebratory cupcake – you deserve it!).

FAQ Summary

What if I don’t understand the jargon in these tools?

Most tools offer tutorials and support documentation. Don’t be afraid to explore these resources or seek help from customer support. Remember, even financial whizzes started somewhere!

Are these tools secure?

Reputable tools employ robust security measures, but always check reviews and security certifications before entrusting your sensitive financial data. Think of it as choosing a trustworthy financial bodyguard for your money.

Can I use multiple tools together?

Absolutely! Many people use a combination of tools to manage different aspects of their finances. The key is finding a system that works for you, and that might involve a little creative financial juggling.

What if a tool I like goes out of business?

Data portability is crucial. Before committing to a tool, check if it offers easy export options for your data. This allows you to switch tools without losing all your precious financial information.