Financial Planning untuk Muda: It sounds awfully grown-up, doesn’t it? But fear not, young padawans of personal finance! This isn’t about stuffy spreadsheets and boring lectures. Instead, think of it as a thrilling adventure – a quest to conquer your financial demons, slay debt dragons, and amass a treasure chest of savings. We’ll navigate the Indonesian financial landscape, uncovering the secrets to budgeting like a boss, investing wisely, and planning for a future brighter than your brightest batik shirt. Prepare for liftoff!

This guide tackles the unique financial challenges facing young Indonesian adults. From understanding your priorities and managing expenses to mastering saving and investment strategies, we’ll cover it all. We’ll even delve into the murky world of debt, equipping you with the tools to avoid financial pitfalls and build a solid foundation for your future. Think of us as your wise, slightly sarcastic, financial gurus.

Understanding Financial Needs of Young Adults

Navigating the treacherous waters of personal finance as a young adult in Indonesia can feel like trying to assemble IKEA furniture without the instructions – frustrating, confusing, and potentially leading to a lot of wasted time (and money!). But fear not, future financial wizards! This section will illuminate the financial landscape for young Indonesians, shedding light on their priorities, challenges, and the surprisingly significant role of lifestyle choices.

Young adults in Indonesia, much like their counterparts globally, face a unique set of financial pressures. Their priorities often revolve around immediate needs and aspirations, sometimes at the expense of long-term financial planning. This isn’t necessarily a sign of irresponsibility, but rather a reflection of the realities of navigating early adulthood in a dynamic and evolving economy.

Typical Financial Priorities of Young Indonesians

The financial priorities of young Indonesians are diverse, shaped by individual circumstances and cultural influences. However, several common themes emerge. Education and career development often top the list, with many prioritizing further education or professional training to enhance their earning potential. Housing, whether renting or buying, presents a significant expense, especially in urban centers like Jakarta or Surabaya. Transportation, often involving motorcycles or public transport, also consumes a considerable portion of their income. Finally, social life and entertainment, while seemingly frivolous, are integral to their social well-being and often form a significant part of their spending habits. Consider the popularity of ngopi (coffee) and makan (eating out) – these seemingly small expenses can add up quickly.

Common Financial Challenges Faced by Young Indonesian Adults

While aspirations are high, the path to financial stability is often paved with challenges. One of the most significant hurdles is the relatively low starting salaries for many entry-level positions. This often necessitates careful budgeting and prioritization of expenses. The high cost of living in major cities further exacerbates this issue, making it difficult to save and invest. Furthermore, limited access to financial literacy resources and understanding of investment options can hinder long-term financial planning. Debt management, particularly in the form of credit card debt or personal loans, can also pose a significant challenge, potentially leading to a vicious cycle of debt. The unpredictable nature of the gig economy, increasingly prevalent among young Indonesians, adds another layer of complexity to financial planning.

Impact of Lifestyle Choices on Long-Term Financial Stability

Lifestyle choices significantly impact long-term financial stability. While enjoying life is crucial, uncontrolled spending habits can derail even the most meticulously crafted financial plans. For example, consistent reliance on expensive food delivery services or frequent purchases of the latest gadgets can quickly deplete savings. Conversely, adopting frugal habits, such as cooking at home more often or opting for more affordable entertainment options, can free up significant resources for saving and investing. The decision to invest in continuous learning and skill development, while requiring upfront investment, can yield significant returns in the long run, boosting earning potential and enhancing financial security.

Comparison of Financial Situations Across Socioeconomic Backgrounds

The financial realities of young adults vary significantly depending on their socioeconomic background. Young adults from affluent families generally have access to greater financial resources, including parental support and opportunities for investment. They may also have more access to quality education and networks that can lead to better career prospects. In contrast, young adults from less privileged backgrounds often face greater financial constraints, relying heavily on their earnings and potentially facing limited access to education and career opportunities. This disparity highlights the need for inclusive financial literacy programs and policies that cater to the diverse needs of young Indonesians from all walks of life. The gap in access to financial resources and opportunities can create a significant disparity in long-term financial outcomes, emphasizing the importance of equitable access to financial education and support.

Budgeting and Expense Management for Young People

Navigating the thrilling, yet sometimes terrifying, world of personal finance as a young Indonesian adult can feel like trying to assemble IKEA furniture without the instructions – a chaotic, potentially frustrating, but ultimately rewarding experience. This section will equip you with the tools and strategies to conquer your budget, transforming it from a source of stress into a powerful ally in achieving your financial goals. We’ll ditch the complicated jargon and embrace a practical, even humorous, approach.

Budgeting isn’t about deprivation; it’s about mindful spending. It’s about making conscious choices that align with your aspirations, whether it’s that dream motorbike, a down payment on a house (maybe a small one first!), or simply having enough to enjoy a delicious nasi goreng every now and then.

A Sample Monthly Budget Template for Young Indonesian Adults

This template provides a basic framework. Adjust categories and amounts based on your individual needs and income. Remember, flexibility is key!

| Category | Budget (IDR) | Actual (IDR) | Difference (IDR) |

|---|---|---|---|

| Income (Salary/Allowance) | |||

| Housing (Rent/Utilities) | |||

| Food (Groceries/Eating Out) | |||

| Transportation (Fuel/Public Transport) | |||

| Entertainment (Movies/Hobbies) | |||

| Personal Care (Hygiene/Haircuts) | |||

| Education/Training | |||

| Savings (Emergency Fund/Investments) | |||

| Debt Payments (Loans/Credit Cards) | |||

| Other Expenses | |||

| Total Expenses |

Tracking Expenses Using Budgeting Apps or Spreadsheets

Regularly monitoring your spending is crucial. Think of it as a financial fitness tracker – you wouldn’t skip your workout, would you? Using a budgeting app or spreadsheet provides a clear overview of where your money goes.

Apps like Money Lover or Wallet offer user-friendly interfaces for expense tracking and budgeting. Alternatively, a simple spreadsheet (like Google Sheets or Microsoft Excel) can be equally effective. The key is consistency. Record your expenses daily, or at least weekly, to maintain accuracy.

Practical Tips for Reducing Unnecessary Expenses and Maximizing Savings

Saving money doesn’t have to be a chore. It’s about making smart choices that add up over time. Small changes can yield significant results.

For example, consider packing your lunch instead of eating out daily. This simple act can save a considerable amount each month. Another effective strategy is to identify and eliminate subscriptions you rarely or never use. That unused streaming service is silently draining your account! Finally, explore cheaper alternatives for entertainment, like picnics in the park instead of expensive restaurant outings.

Effective Expense Categorization for Better Financial Control

Categorizing expenses allows you to identify spending patterns and areas for potential savings. A well-organized system provides a clear picture of your financial health.

Common categories include housing, food, transportation, entertainment, personal care, education, and savings. You can further sub-categorize (e.g., “Food” can be broken down into “Groceries,” “Eating Out,” and “Coffee”). The more detailed your categorization, the better you understand your spending habits.

Saving and Investing Strategies for Young Adults

So, you’ve mastered budgeting – congratulations, you’re officially more adult than a toddler with a juice box! Now, let’s talk about growing your money. Saving and investing might sound intimidating, like trying to decipher ancient hieroglyphs, but it’s actually surprisingly straightforward (and way more rewarding than deciphering hieroglyphs, trust me). This section will demystify the world of Indonesian savings and investment options for young adults, turning your financial future from a blurry picture into a vibrant masterpiece.

Savings Schemes in Indonesia for Young People

Several savings schemes in Indonesia cater specifically to the needs of young adults. These options offer varying levels of accessibility, liquidity, and returns. Understanding the nuances of each is crucial for making informed decisions about your hard-earned rupiah.

- TabunganKu (Bank BRI): This is a popular savings account known for its simplicity and low minimum balance requirements, making it ideal for beginners. Think of it as your financial training wheels.

- Tabungan Simpel (Bank Mandiri): Similar to TabunganKu, this account emphasizes ease of access and low maintenance fees, making it a great starting point for building a solid savings foundation.

- Reksa Dana Pasar Uang (Money Market Mutual Funds): While technically an investment, these funds often offer higher returns than regular savings accounts with relatively low risk. They’re a good stepping stone between saving and more aggressive investing.

Investment Options: Benefits and Risks

Investing carries inherent risks, but the potential rewards are significant. Let’s explore some popular investment options and their associated ups and downs.

- Mutual Funds (Reksa Dana): Mutual funds pool money from multiple investors to invest in a diversified portfolio of assets. This diversification reduces risk, making them a relatively safe option for beginners. However, returns are not guaranteed, and fees can eat into your profits if not carefully considered.

- Stocks (Saham): Owning stocks means owning a small piece of a company. The potential for high returns is enticing, but stocks are volatile, meaning their value can fluctuate dramatically. This is a higher-risk, higher-reward option that requires research and patience.

- Bonds (Obligasi): Bonds are essentially loans you make to a government or corporation. They offer lower returns than stocks but are generally less risky. They provide a steady stream of income through interest payments, making them a good option for more conservative investors.

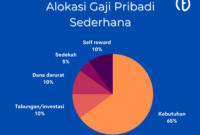

A Simple Investment Plan for Young Adults with Modest Incomes

Let’s assume a young adult earns a modest monthly income of Rp 5,000,000. A simple plan might involve:

- Emergency Fund: Allocate 3-6 months’ worth of living expenses (Rp 15,000,000 – Rp 30,000,000) to a high-yield savings account. This acts as a safety net for unexpected events.

- Regular Savings: Dedicate 10-20% of monthly income (Rp 500,000 – Rp 1,000,000) to a savings account for short-term goals (like a vacation or a down payment).

- Long-Term Investments: Invest the remaining amount (Rp 3,500,000 – Rp 4,000,000) in a mix of low-risk and moderate-risk investments like money market mutual funds and a small portion in stocks or balanced mutual funds. Start small and gradually increase your investment amount as your income grows and your knowledge expands.

Remember: Consistency is key! Even small, regular investments can compound over time, leading to significant growth.

High-Yield Savings Accounts vs. Other Investment Vehicles

High-yield savings accounts offer a safe place to park your money and earn a slightly higher interest rate than regular savings accounts. However, their returns are typically lower than those offered by stocks or mutual funds. They are excellent for emergency funds and short-term goals but might not be the best choice for long-term wealth building. The key is to find the right balance between risk and return, aligning your investment strategy with your financial goals and risk tolerance.

Debt Management and Avoiding Financial Traps

Navigating the treacherous waters of debt is a rite of passage for many young adults in Indonesia, but it doesn’t have to be a shipwreck! Understanding the different types of debt, how to manage them effectively, and the potential pitfalls can save you from years of financial stress and sleepless nights. Let’s dive into the fascinating (and slightly terrifying) world of debt management.

Young adults in Indonesia often find themselves juggling various financial obligations. The pressure to keep up with appearances, coupled with the allure of easy credit, can lead to unexpected debt burdens. This section will equip you with the knowledge to steer clear of these financial shoals.

Common Debt Types for Young Indonesians

Student loans, often necessary for higher education, represent a significant debt for many. Credit card debt, with its tempting convenience and often high-interest rates, is another common trap. Personal loans, used for various purposes like purchasing motorcycles or electronics, can also quickly accumulate if not managed carefully. Finally, unsecured loans from informal lenders (sometimes referred to as “rentenir”) often come with extremely high interest rates and can lead to a cycle of debt that is incredibly difficult to escape.

Effective Debt Management Strategies, Financial Planning untuk Muda

Creating a realistic budget is paramount. Tracking your income and expenses meticulously allows you to identify areas where you can cut back and allocate more funds towards debt repayment. Prioritizing high-interest debts, such as credit card debt, through strategies like the debt avalanche (paying off the highest-interest debt first) or debt snowball (paying off the smallest debt first for motivational purposes) method can significantly reduce the overall interest paid and accelerate debt repayment. Negotiating with creditors for lower interest rates or extended repayment periods can also provide much-needed breathing room. Consider consolidating multiple debts into a single loan with a lower interest rate, simplifying repayment and potentially saving money on interest.

Consequences of High-Interest Debt and Poor Credit Scores

High-interest debt can spiral out of control quickly, consuming a significant portion of your income and limiting your financial flexibility. A poor credit score, resulting from missed payments or high credit utilization, can severely impact your ability to secure loans, rent an apartment, or even get certain jobs. It can also lead to higher insurance premiums and make it more difficult to obtain favorable interest rates on future loans. Imagine the frustration of being denied a loan for your dream home simply because of past financial missteps.

Predatory Lending Practices to Avoid

Beware of lenders who offer loans with excessively high interest rates, hidden fees, or unclear terms and conditions. These are often signs of predatory lending practices. These practices disproportionately affect vulnerable populations, trapping them in a cycle of debt. Always thoroughly research any lender before borrowing money and carefully read all loan documents before signing. If something feels “off,” trust your instincts and seek advice from a trusted financial advisor. Examples of such practices might include loans with exorbitant interest rates masked by seemingly low initial payments, or loans requiring collateral far exceeding the loan amount.

Planning for the Future

So, you’ve mastered budgeting, avoided the siren song of debt, and are diligently saving and investing. Fantastic! Now let’s talk about the big-ticket items that loom on the horizon: education, housing, and, yes, even retirement. While the thought of retirement might seem like a distant, hazy dream (perhaps involving a hammock and copious amounts of margaritas), planning for it now is crucial for a financially secure future. Think of it as pre-paying for your future fun – a smart investment in your long-term happiness.

Higher Education Costs

The cost of higher education is, to put it mildly, astronomical. Tuition fees, books, accommodation – it all adds up faster than you can say “student loan.” However, careful planning can significantly mitigate the financial burden. This involves exploring various funding options, including scholarships, grants, and student loans. It’s also wise to consider the return on investment (ROI) of different educational paths. A degree in underwater basket weaving might be fascinating, but its job market prospects might not exactly be stellar. Prioritizing fields with strong employment potential can ease the financial strain post-graduation. Remember, education is an investment, but like any smart investment, it requires research and a solid strategy.

Saving for a Down Payment on a House

Owning a home – the quintessential symbol of the “adulting” phase. But acquiring that coveted property requires a significant down payment, which can seem daunting, especially when starting out. However, with consistent saving and strategic planning, it’s achievable. This involves setting realistic savings goals, exploring different savings vehicles like high-yield savings accounts or even investing a portion in low-risk options. Consider it a marathon, not a sprint. Small, consistent contributions over time can accumulate into a substantial down payment. Imagine the satisfaction of finally owning your own piece of the earth, a place where you can paint your walls any color you want (even bright pink, if that’s your thing!).

Retirement Planning for Young Adults

Retirement planning in your twenties? Sounds like a joke, right? Wrong! The power of compounding interest is your secret weapon. Starting early allows your investments to grow exponentially over time, even with relatively small contributions. Think of it like this: a small seed planted today will grow into a mighty oak tree in the future. A common strategy is to contribute regularly to a retirement account, such as a 401(k) or IRA, taking advantage of employer matching contributions if available. The earlier you start, the less you need to contribute each month to reach your retirement goals. This is not about deprivation; it’s about securing your financial freedom for the future.

A Hypothetical Retirement Savings Timeline

Let’s imagine Anya, a 25-year-old who starts contributing $200 per month to a retirement account earning an average annual return of 7%. By the time she’s 65, assuming consistent contributions and returns, she could have accumulated a substantial nest egg. This isn’t a guaranteed outcome, of course, as market fluctuations can impact returns, but it illustrates the power of starting early. This is a simplified example, and professional financial advice should be sought for personalized planning.

Investing early is like planting a money tree. The earlier you plant, the bigger the tree will grow.

Utilizing Technology for Financial Management

Navigating the modern financial landscape, especially as a young adult, can feel like trying to solve a Rubik’s Cube blindfolded. Fortunately, technology has emerged as a surprisingly helpful (and sometimes hilarious) sidekick in this chaotic adventure. Let’s explore the digital tools that can transform your financial life from a tangled mess into something resembling organized brilliance.

The Indonesian fintech scene is booming, offering a dizzying array of apps and platforms designed to make managing your money less of a headache and more of a…well, less of a headache. From budgeting apps that track your spending with the precision of a hawk to investment platforms that let you diversify your portfolio with the ease of ordering takeout, the options are plentiful and often surprisingly user-friendly.

Fintech Apps and Platforms in Indonesia

Indonesia boasts a vibrant fintech ecosystem. Several prominent players offer a range of services catering to various financial needs. Examples include OVO, GoPay, Dana, and ShopeePay, which primarily function as e-wallets, enabling seamless digital transactions. Beyond payments, you’ll find investment platforms like Bibit and Bareksa offering robo-advisory services, making investing accessible to beginners. There are also budgeting apps like Moneytor and several others tailored for Indonesian users. The availability and features of these platforms may vary, so researching and comparing options based on your specific needs is key.

Comparison of Budgeting, Investing, and Payment Apps

Choosing the right financial app can feel like choosing a superhero – each has unique strengths and weaknesses. For budgeting, apps often offer features like automated transaction categorization, spending visualizations (think colorful charts and graphs!), and goal-setting tools. Investing apps, on the other hand, may provide robo-advisory services, allowing you to create a diversified portfolio based on your risk tolerance and financial goals, or access to a broader range of investment options compared to traditional banks. Payment apps simplify transactions, but their features can range from basic peer-to-peer transfers to more complex options like bill payments and online shopping integrations. Direct comparison requires careful consideration of individual app features and user reviews. For example, one app might excel at budgeting visualization, while another might offer superior investment options or better integration with local merchants.

Securing Online Financial Accounts and Protecting Against Fraud

The digital world offers incredible convenience, but it also comes with risks. Protecting your online financial accounts requires a multi-layered defense strategy. This includes choosing strong, unique passwords for each account (think memorable phrases, not “password123”), enabling two-factor authentication whenever possible, regularly reviewing your account statements for suspicious activity, and being wary of phishing scams (those emails promising you millions of rupiah if you just click a link…yeah, those). Think of your online financial accounts like your most prized possessions – you wouldn’t leave your house unlocked, would you? Treat your digital accounts with the same level of care.

Advantages and Disadvantages of Using Digital Banking Services

Digital banking offers a compelling blend of convenience and efficiency. You can access your accounts anytime, anywhere, manage your finances with a few taps on your smartphone, and often enjoy lower fees compared to traditional banking. However, relying solely on digital banking can also present challenges. Technical glitches can temporarily disrupt access to your funds, and the risk of online fraud, as previously discussed, remains a concern. Maintaining a healthy balance between digital and traditional banking methods can mitigate these risks while still reaping the benefits of modern technology. For instance, having a small emergency fund in a traditional savings account can provide a safety net in case of digital banking disruptions.

Seeking Professional Financial Advice

Let’s be honest, navigating the world of finance can feel like trying to assemble IKEA furniture without the instructions – frustrating, confusing, and potentially resulting in a wobbly money-holding structure. This is where a financial advisor steps in, acting as your personal financial sherpa, guiding you through the treacherous mountains of budgeting, investing, and debt management. They’re not just there to tell you what to do; they’re your financial accountability partner, helping you reach your financial summit.

A financial advisor acts as a personalized financial guide, offering expert advice tailored to your unique circumstances. They analyze your current financial situation, goals, and risk tolerance to create a customized financial plan. This plan could encompass various aspects, from crafting a realistic budget and managing debt to developing a long-term investment strategy that aligns with your dreams (like that Bali vacation or early retirement!). Think of them as your financial life coach, but instead of motivational posters, they provide spreadsheets and actionable strategies.

The Advantages of Early Financial Guidance

Seeking professional financial advice early in your adult life offers numerous benefits. Starting early allows for a longer investment horizon, enabling the power of compounding to work its magic. Early intervention can also help you avoid costly financial mistakes, such as accumulating unnecessary debt or making poor investment choices. It’s like starting a fitness regime at a younger age – the earlier you begin, the more time you have to build strength and achieve your goals. By understanding your financial situation and establishing sound financial habits early, you set yourself up for a more secure and prosperous future. Imagine the smug satisfaction of having a well-structured financial plan in your twenties while your friends are still figuring out how to use a budgeting app.

Finding a Reputable Financial Advisor in Indonesia

Finding a trustworthy financial advisor in Indonesia requires careful consideration. Begin by researching financial advisory firms with a strong reputation and a proven track record. Look for advisors who hold relevant certifications and licenses, ensuring they possess the necessary expertise and adhere to professional standards. Word-of-mouth referrals from trusted friends or family members can also be invaluable. Online reviews and testimonials can provide additional insights into an advisor’s professionalism and client satisfaction. Remember, choosing a financial advisor is a significant decision; thorough research is crucial to finding the right fit. Don’t settle for the first flashy website you stumble upon; do your due diligence!

Questions to Ask a Potential Financial Advisor

Before committing to a financial advisor, it’s essential to ask clarifying questions. These questions should cover their experience, fees, investment strategies, and conflict of interest policies. Inquiring about their approach to financial planning, client communication practices, and the level of personalization they offer will help you assess their suitability for your needs. Asking about their success rate with clients facing similar financial situations to yours can provide a realistic picture of their capabilities. Thorough questioning ensures that you’re making an informed decision and choosing an advisor who aligns with your financial goals and values. Don’t be afraid to ask tough questions; after all, you’re entrusting them with your financial future.

Last Point

So, there you have it: a roadmap to financial freedom, tailored specifically for young Indonesians. Remember, mastering personal finance isn’t about deprivation; it’s about making informed choices that align with your dreams. It’s about building a future where you’re not just surviving, but thriving. Now go forth and conquer your financial destiny – may your returns be high, and your expenses, low! (And remember to check your credit score occasionally – it’s like a financial health check-up!)

Question & Answer Hub: Financial Planning Untuk Muda

What if I don’t have a regular income?

Even with irregular income, budgeting and saving are crucial. Track every penny, identify areas to cut back, and explore side hustles to supplement your income. Small steps make a big difference!

How can I choose the right financial advisor?

Look for a certified financial planner with experience working with young adults. Check reviews, ask about their fees, and ensure their advice aligns with your goals and risk tolerance. Don’t be afraid to interview several advisors before making a decision.

What are some common Indonesian investment scams to avoid?

Be wary of any investment promising unrealistically high returns with minimal risk. Always thoroughly research any investment opportunity before committing your funds, and only invest with reputable, regulated firms.

Is it too late to start financial planning in my late twenties?

Absolutely not! It’s never too late to start. The sooner you begin, the better, but even starting later is better than not starting at all. Adjust your plan based on your current circumstances and future goals.