Financial Planning untuk Muda isn’t just about saving money; it’s about crafting a vibrant financial future. This guide tackles the unique challenges and opportunities facing young Indonesian adults, from navigating the complexities of budgeting and investing to understanding the crucial role of insurance and debt management. We’ll explore practical strategies, empowering you to take control of your finances and build a secure financial foundation for years to come. Whether you’re a recent graduate, a young professional, or simply aiming for greater financial independence, this guide provides the tools and knowledge you need to thrive.

We’ll delve into effective budgeting techniques, explore various investment options tailored to different risk profiles, and discuss strategies for minimizing debt and maximizing savings. We’ll also address the importance of securing your future through insurance and retirement planning, offering a holistic approach to financial wellness. Get ready to embark on a journey towards financial freedom!

Understanding Financial Needs of Young Adults: Financial Planning Untuk Muda

Navigating the choppy waters of adulting, especially in Indonesia, can feel like trying to balance a plate of *gado-gado* on a motorbike – exhilarating, delicious, and potentially messy. Understanding your financial needs as a young Indonesian is crucial to avoid a financial *jatuh* (fall). This section delves into the specific priorities, challenges, and goals that define the financial landscape for young adults in the archipelago.

Typical Financial Priorities of Young Indonesians

Young adults in Indonesia, much like their global counterparts, face a unique set of financial priorities. However, the Indonesian context adds its own spicy blend of challenges and opportunities. Education remains paramount, with many young people juggling studies with part-time jobs to fund their tuition and living expenses. Building a career, often involving a period of job-hopping as they explore different avenues, is another key priority. Finally, the desire for financial independence, manifesting as the ability to support themselves and contribute to their families, is a driving force. This often translates into saving for a down payment on a motorbike, a small apartment, or starting a small business.

Unique Financial Challenges Faced by Young Indonesians

The financial journey of a young Indonesian isn’t always a smooth ride. High living costs in urban areas, especially in Jakarta, are a significant hurdle. The cost of education, while improving, still presents a substantial barrier for many. Competition for jobs, particularly in sought-after sectors, is fierce. Furthermore, the lack of comprehensive financial literacy programs can leave young adults feeling overwhelmed and unprepared to manage their finances effectively. Finally, the ever-present pressure to contribute financially to their families adds another layer of complexity. Many young adults shoulder significant responsibilities for the well-being of their extended families.

Common Financial Goals for Young Indonesians

The financial aspirations of young Indonesians are diverse and ambitious. A common goal is completing higher education, which can open doors to better job opportunities and higher earning potential. Homeownership, even a small apartment or a house in a less central area, is often a cherished dream, symbolizing stability and success. Many young Indonesians also harbor entrepreneurial dreams, aiming to start their own businesses, whether a small warung (food stall) or an online venture. These goals, while diverse, often share a common thread: the desire for financial security and a better future for themselves and their families.

Financial Planning Needs Across Income Levels

The financial planning needs of young Indonesians vary significantly depending on their income levels. The following table provides a simplified overview:

| Income Level (IDR per month) | Primary Financial Needs | Savings & Investment Goals | Debt Management |

|---|---|---|---|

| Below 5,000,000 | Meeting basic needs (food, shelter, transportation) | Emergency fund (minimal), limited savings | Avoid high-interest debt |

| 5,000,000 – 10,000,000 | Basic needs, some discretionary spending | Emergency fund, savings for larger purchases (motorbike, appliances) | Manage existing debt responsibly |

| 10,000,000 – 20,000,000 | Comfortable living, potential for investments | Emergency fund, savings for down payment on a house or car, investment in mutual funds or stocks | Minimize debt, prioritize debt reduction |

| Above 20,000,000 | High level of discretionary spending, significant investment opportunities | Robust emergency fund, significant investments (property, stocks, bonds), retirement planning | Debt is likely manageable, focus on wealth building |

Budgeting and Expense Management for Young Professionals

Navigating the thrilling world of adulting – especially the financial side – can feel like a rollercoaster. But fear not, young professionals! Mastering budgeting isn’t about deprivation; it’s about empowered spending and achieving your financial goals. This section will equip you with the tools and strategies to tame your expenses and build a brighter financial future.

Effective budgeting for young adults hinges on understanding your unique income streams. Whether you’re juggling a full-time job, freelancing gigs, or a combination of both, a flexible budget is key. This means creating a system that adapts to your fluctuating income, preventing you from overspending during lean months and maximizing savings during those bountiful periods.

Effective Budgeting Strategies for Varying Income Streams, Financial Planning untuk Muda

The foundation of any successful budget is accurate tracking. Many young professionals underestimate the power of meticulously recording every expense, no matter how small. This allows you to identify spending patterns and pinpoint areas for improvement. Apps like Mint or YNAB (You Need A Budget) can automate this process, providing valuable insights into your spending habits. However, even a simple spreadsheet can work wonders!

Practical Tips for Tracking Expenses and Identifying Areas for Savings

Tracking expenses is only half the battle. Analyzing that data is crucial. Look for recurring expenses that can be reduced. For example, are you paying for multiple streaming services you rarely use? Could you switch to a cheaper phone plan? Small changes can accumulate significant savings over time. Consider the 50/30/20 rule: 50% of your income goes to needs, 30% to wants, and 20% to savings and debt repayment. This provides a solid framework, but remember to adjust it to fit your personal circumstances.

Differentiating Between Needs and Wants in Personal Finance

This is where the rubber meets the road. Needs are essential for survival (rent, food, utilities). Wants are everything else (that new video game, that fancy coffee). While indulging in wants occasionally is fine, prioritizing needs ensures financial stability. Think of it this way: needs keep you afloat; wants propel you towards enjoyment. Finding a balance is the art of smart budgeting. A helpful exercise is to list all your expenses, categorize them as needs or wants, and then scrutinize the “wants” category for potential reductions.

Sample Monthly Budget Template

A well-structured budget template provides a clear overview of your income and expenses. This allows you to monitor your progress and make adjustments as needed. The following template offers a flexible structure adaptable to various income levels and lifestyles.

| Income | Amount | Expenses | Amount |

|---|---|---|---|

| Salary | $3000 | Rent/Mortgage | $1000 |

| Freelance Income | $500 | Utilities (Electricity, Water, Gas) | $200 |

| Other Income | $100 | Groceries | $300 |

| Total Income | $3600 | Transportation | $150 |

| Entertainment | $200 | ||

| Savings | $720 | ||

| Debt Repayment | $0 | ||

| Total Expenses | $3600 |

Investing Strategies for Young Investors

So, you’ve conquered budgeting and are ready to watch your money grow. Fantastic! Investing can seem daunting, like trying to decipher a pirate’s treasure map while battling a kraken (your fear of losing money). But fear not, young Padawan! With a little knowledge and a healthy dose of patience, you can navigate the choppy waters of the investment world and build a financially secure future. This section will demystify various investment options and provide a roadmap to your financial success.

Investment Options for Young Adults with Varying Risk Tolerances

Choosing the right investment strategy depends heavily on your risk tolerance – how comfortable you are with the possibility of losing some money in exchange for potentially higher returns. Young investors often have a longer time horizon, meaning they can weather market fluctuations more easily than those closer to retirement. This generally allows for a higher risk tolerance. However, it’s crucial to remember that even with a long time horizon, responsible investment decisions are paramount.

- High-Risk, High-Reward Options: For those with a higher risk tolerance and a longer time horizon, options like individual stocks or smaller-cap mutual funds might be considered. These investments carry a higher potential for growth but also a higher chance of significant losses. Think of it as a rollercoaster – thrilling, but with potential for stomach-churning drops.

- Moderate-Risk Options: A balanced approach might involve a mix of stocks and bonds, or investing in larger-cap mutual funds. This strategy aims to provide a blend of growth potential and relative stability. It’s like a scenic train ride – a comfortable journey with some exciting views along the way.

- Low-Risk, Low-Reward Options: For those prioritizing capital preservation, low-risk options such as high-yield savings accounts, certificates of deposit (CDs), or government bonds are more suitable. While returns are typically lower, the principal is safer. Think of it as a reliable bicycle – steady, predictable, and gets you where you need to go.

Comparison of Mutual Funds, Stocks, and Bonds

Let’s delve into the specifics of some common investment vehicles.

| Investment Vehicle | Benefits | Risks |

|---|---|---|

| Mutual Funds | Diversification, professional management, relatively low minimum investment | Fees, potential for lower returns than individual stocks, lack of control over specific investments |

| Stocks (Equities) | High growth potential, ownership in a company | High volatility, potential for significant losses |

| Bonds (Fixed Income) | Lower risk than stocks, predictable income stream | Lower returns than stocks, interest rate risk |

The Importance of Diversification

Diversification is like spreading your bets in a casino – don’t put all your eggs in one basket! It involves investing in a variety of asset classes (stocks, bonds, real estate, etc.) to reduce the overall risk of your portfolio. If one investment performs poorly, others might offset those losses. Think of it as building a sturdy house with different types of materials – each contributes to the overall strength and resilience. A well-diversified portfolio can help to mitigate risk and potentially enhance returns over the long term.

Opening a Brokerage Account and Making Initial Investments

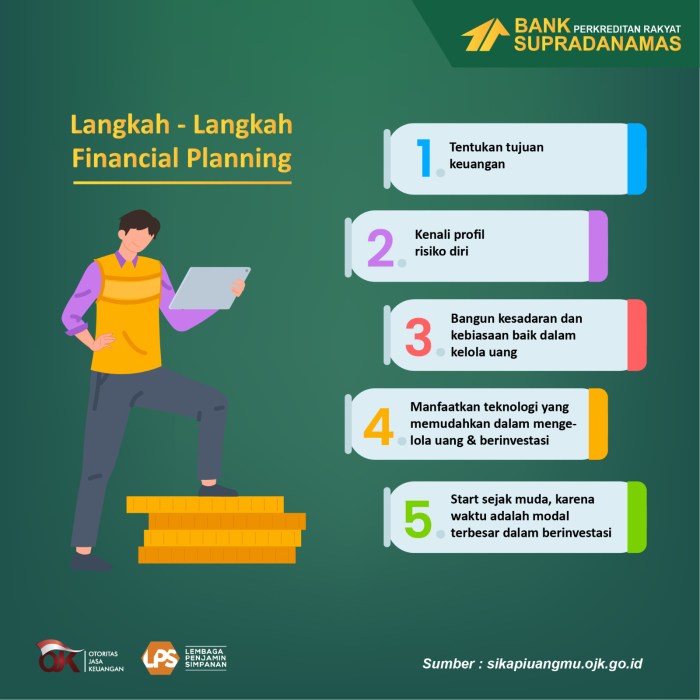

Ready to take the plunge? Here’s a step-by-step guide:

- Choose a Brokerage: Research different brokerage firms, comparing fees, investment options, and user-friendliness. Consider factors like account minimums and research tools.

- Open an Account: You’ll need to provide personal information and possibly answer some financial questionnaires to determine your risk tolerance.

- Fund Your Account: Transfer money from your bank account to your brokerage account. This is usually done electronically.

- Start Investing: Research potential investments and execute your trades. Remember to start small and gradually increase your investments as you gain experience and confidence.

Debt Management and Avoiding Financial Pitfalls

Let’s face it, debt can be a real party pooper. It’s the uninvited guest that crashes your financial freedom fiesta and leaves a mountain of bills in its wake. But fear not, young financial warriors! This section will arm you with the knowledge and strategies to conquer debt and avoid those pesky financial pitfalls that can trip up even the most well-intentioned millennials. We’ll explore the dangers of high-interest debt, equip you with practical debt management strategies, and offer advice on dodging common financial booby traps.

High-interest debt, such as credit card debt and payday loans, is the financial equivalent of a mischievous gremlin that multiplies exponentially. The interest rates on these loans can be astronomical, quickly transforming a small debt into a monstrous financial burden. Ignoring these debts can lead to a vicious cycle of accumulating interest, late fees, and potential damage to your credit score, making it harder to secure loans or even rent an apartment in the future. Think of it like this: paying only the minimum payment on a credit card is like playing a game of financial whack-a-mole – you might knock down a few interest charges, but more will pop up before you can blink.

The Dangers of High-Interest Debt

High-interest debt, primarily credit card debt and payday loans, poses significant risks to financial stability. Credit cards, while convenient, often carry annual percentage rates (APRs) exceeding 20%, sometimes even reaching 30% or more. This means that for every $100 borrowed, you could be paying $20-$30 or more in interest annually. Payday loans, designed for short-term borrowing, typically charge exorbitant fees and interest rates, trapping borrowers in a cycle of debt. For example, a $100 payday loan might require repayment of $115 within two weeks, leading to a high effective annual interest rate. The consequences of neglecting high-interest debt include damaged credit scores, collection agency involvement, and potentially even legal action. This can severely impact future borrowing opportunities and overall financial well-being.

Strategies for Managing and Reducing Existing Debt

Once you’ve identified your debt, it’s time to strategize your attack. Creating a realistic plan is crucial for success. This involves listing all your debts, including the balance, interest rate, and minimum payment. Then, you can choose a debt repayment method.

Here are two popular approaches:

- Snowball Method: This method focuses on paying off the smallest debt first, regardless of its interest rate. The psychological boost of quickly eliminating a debt can motivate you to continue with the larger ones. Imagine the satisfaction of crossing off that tiny student loan first!

- Avalanche Method: This method prioritizes paying off the debt with the highest interest rate first, regardless of its size. While it may not provide the same immediate psychological satisfaction as the snowball method, it ultimately saves you more money on interest in the long run. Think of it as a strategic military operation: take down the biggest threat first.

Avoiding Common Financial Mistakes Made by Young Adults

Young adulthood is a time of exploration and learning, but it’s also a time when many financial missteps are made. Let’s examine some common pitfalls and how to avoid them.

Below are some common mistakes and how to avoid them:

- Impulse Spending: Before buying anything non-essential, wait 24 hours. Often, the urge to buy fades. If you still want it the next day, research for the best price and consider alternatives.

- Ignoring Budgeting: Create a realistic budget that tracks your income and expenses. This will help you identify areas where you can cut back and save more. Budgeting apps can be extremely helpful.

- Overspending on Credit Cards: Only use credit cards for purchases you can afford to pay off in full each month. Avoid using them for everyday expenses.

- Not Saving for Emergencies: Aim to build an emergency fund equal to 3-6 months of living expenses. This will protect you from unexpected financial setbacks.

- Failing to Plan for the Future: Start saving and investing early. Even small amounts saved regularly can accumulate significantly over time, thanks to the magic of compound interest. This is your superpower to fight against inflation.

A Debt Repayment Plan Example

Let’s say you have three debts:

| Debt | Balance | Interest Rate |

|---|---|---|

| Credit Card | $1,000 | 18% |

| Student Loan | $5,000 | 6% |

| Personal Loan | $2,000 | 10% |

Using the Avalanche Method, you would prioritize the credit card debt first due to its high interest rate. You would make minimum payments on the other debts while aggressively paying down the credit card. Once the credit card is paid off, you’d redirect those funds to the next highest interest debt (the personal loan), and so on. The Snowball method would prioritize the credit card debt first due to its smaller size, regardless of interest rate. This approach focuses on the psychological win of paying off a debt, potentially increasing motivation.

Protecting Your Future

Let’s face it, nobody wants to end up living under a bridge in their golden years, fueled solely by regret and instant noodles. Securing your financial future isn’t about becoming a Scrooge McDuck; it’s about smart planning so you can enjoy life’s little (and big!) luxuries without the constant gnawing anxiety of impending financial doom. This section will cover the crucial aspects of insurance and retirement planning, ensuring your future self thanks you profusely (and maybe buys you a fancy retirement villa).

Protecting yourself from unforeseen circumstances and building a comfortable retirement requires a multi-pronged approach. This isn’t rocket science, but it does require a little foresight and a healthy dose of discipline. We’ll break down the key components to help you navigate this essential aspect of financial planning.

Health Insurance: A Safety Net for Your Well-being

Health issues can strike unexpectedly, and medical expenses in Indonesia, while improving, can still be substantial. Health insurance provides a crucial safety net, protecting you from crippling medical bills and allowing you to focus on recovery rather than financial ruin. Consider options ranging from basic government-sponsored programs to comprehensive private insurance plans, carefully weighing the coverage and premiums to find the best fit for your needs and budget. Remember, preventative care is cheaper than emergency room visits – think of it as an investment in your long-term health and financial stability.

Life Insurance: Protecting Your Loved Ones

Life insurance offers a financial safety net for your dependents in the event of your untimely demise. It ensures that your family’s financial stability isn’t compromised, providing crucial support for things like education, mortgage payments, and daily living expenses. There are various types of life insurance, including term life insurance (covering a specific period) and whole life insurance (providing lifelong coverage). Choosing the right policy depends on your individual circumstances, risk tolerance, and the level of financial protection you want to provide for your loved ones. Consider it a loving act of financial responsibility.

Retirement Savings: The Early Bird Catches the Worm (and a Comfortable Retirement)

Starting your retirement savings early is arguably the smartest financial move you can make. The magic of compound interest works wonders over time, transforming small, regular contributions into a substantial nest egg. Even relatively small amounts saved consistently from a young age can accumulate significantly more than larger sums saved later in life. Delaying retirement planning only diminishes the power of compounding and increases the burden of saving later. Think of it as a financial time machine, transporting your younger self’s savings into a comfortable future.

Retirement Investment Options in Indonesia

Several retirement investment options are available to young adults in Indonesia. These include:

- Pension Funds (Dana Pensiun): These are employer-sponsored retirement plans offering tax benefits and a structured savings approach.

- Mutual Funds (Reksa Dana): These offer diversification across various asset classes, providing a relatively low-risk option for long-term growth.

- Individual Retirement Accounts (IRAs – equivalent options in Indonesia): While the exact structure might differ, similar individual savings plans with tax advantages exist and should be explored.

- Government-backed retirement schemes (e.g., BPJS Ketenagakerjaan): These programs provide a safety net, often in conjunction with other savings options.

It’s crucial to research and compare these options to find the best fit for your individual needs and risk tolerance.

The Power of Compound Interest: A Visual Representation

Imagine a graph with two lines. The X-axis represents time (in years), and the Y-axis represents the total accumulated savings. Line A represents saving Rp 1,000,000 annually, starting at age 25, with a modest 7% annual return. Line B represents saving the same amount, but starting at age 35. Over time, Line A, benefiting from more years of compounding, would dramatically surpass Line B. The difference becomes exponentially larger as the years pass, vividly demonstrating the immense advantage of early investment. This isn’t just about the numbers; it’s about giving your money the time to work for you, multiplying your initial investment over decades. The earlier you start, the less you have to save later to achieve the same retirement goal. Let the power of compounding do the heavy lifting!

Seeking Financial Guidance and Resources

Navigating the world of personal finance can feel like trying to assemble IKEA furniture without the instructions – confusing, potentially frustrating, and occasionally resulting in a wobbly end product. But fear not, young Indonesian adults! Help is available, and it doesn’t involve questionable assembly techniques or Allen wrenches. This section will illuminate the path to finding reputable financial guidance and resources, ensuring your financial future is more “solid oak” than “wobbly particleboard.”

Finding reliable financial advice and education is crucial for building a strong financial foundation. The sheer volume of information available online can be overwhelming, making it difficult to discern credible sources from those peddling get-rich-quick schemes (which, spoiler alert, rarely work). Therefore, understanding where to seek advice is paramount.

Reputable Sources of Financial Advice and Education in Indonesia

Indonesia offers a growing number of resources dedicated to improving financial literacy. These range from government initiatives to independent organizations and certified financial planners. Choosing the right source depends on your individual needs and learning style. Some prefer interactive workshops, while others might find online courses more convenient. The key is finding a resource that resonates with you and provides accurate, unbiased information. Avoid sources that promise unrealistic returns or rely heavily on hype rather than substance.

The Role of Financial Advisors and When to Seek Professional Help

Financial advisors act as personal financial guides, offering tailored advice based on your specific circumstances. They can help you create a comprehensive financial plan, encompassing budgeting, investing, and retirement planning. While not strictly necessary for everyone, seeking professional help can be particularly beneficial during significant life events, such as starting a family, buying a house, or facing substantial debt. A qualified advisor can provide objective insights and help you make informed decisions, saving you time and potentially preventing costly mistakes. Think of them as your financial Sherpas, guiding you through the sometimes treacherous terrain of personal finance.

Accessing Financial Literacy Programs and Workshops

Many organizations in Indonesia offer financial literacy programs and workshops designed to empower young adults. These programs often cover a wide range of topics, from basic budgeting to more advanced investment strategies. Some are offered free of charge, while others may involve a small fee. Check with your local bank, community centers, or universities for information on available programs. Government agencies also frequently sponsor initiatives aimed at improving financial literacy across the country. These programs often provide valuable insights and practical tools for managing your finances effectively.

Helpful Websites and Mobile Applications

The digital age has made accessing financial information easier than ever before. Numerous websites and mobile applications provide tools and resources to help you manage your finances.

- Websites: OJK (Otoritas Jasa Keuangan) – the Indonesian Financial Services Authority – provides valuable information on financial products and regulations. Numerous reputable personal finance blogs and websites offer educational content, often with a focus on the Indonesian market. Always verify the credibility of the source before acting on any advice found online.

- Mobile Applications: Many budgeting and investment apps are available for both Android and iOS devices. These apps can help you track your spending, create budgets, and even automate investments. Be sure to read reviews and understand the app’s features and security measures before downloading and using it.

Final Thoughts

Mastering Financial Planning untuk Muda is a marathon, not a sprint. While the path may seem daunting, remember that every small step—from creating a budget to making your first investment—contributes to a brighter financial future. By understanding your financial needs, managing expenses wisely, and investing strategically, you’ll build a strong financial foundation capable of weathering any storm. So, take charge of your financial destiny, and embrace the journey towards a secure and prosperous future. Remember, your future self will thank you!

Frequently Asked Questions

What if I don’t have a regular income?

Even without a steady income, budgeting and saving are crucial. Track your income from all sources (part-time jobs, freelance work, etc.) and prioritize essential expenses. Explore opportunities to increase your income streams.

How much should I save each month?

The ideal savings rate depends on your individual circumstances and goals. Aim for at least 10-20% of your income, but start small and gradually increase your savings as your income grows.

What are some common mistakes young adults make with their finances?

Common mistakes include impulsive spending, neglecting budgeting, ignoring debt, and failing to plan for the future (retirement, emergencies). Avoiding these pitfalls is key to long-term financial success.

Where can I find a reputable financial advisor in Indonesia?

Seek recommendations from trusted sources, verify their credentials, and compare their fees and services before engaging their assistance. Always check for licenses and affiliations with recognized financial institutions.