Financial Planning untuk Pemula: Let’s face it, adulting is hard. Bills? Mortgages? Retirement? It sounds like a villain’s monologue from a particularly grim superhero movie. But fear not, aspiring fiscal wizards! This guide will gently (and humorously) navigate you through the sometimes-bewildering world of personal finance, equipping you with the knowledge to conquer your financial foes (aka, debt and uncertainty).

We’ll unravel the mysteries of budgeting, investing, and debt management, transforming you from a financial novice into a savvy spender and saver. We’ll cover everything from understanding basic financial concepts like assets and liabilities to crafting a personalized financial plan that aligns with your goals – whether that’s buying a llama farm or simply avoiding ramen noodle dinners for the rest of your life. Get ready for a financial adventure!

Understanding Basic Financial Concepts for Beginners

Embarking on your financial journey can feel like navigating a dense jungle with only a flimsy map and a compass that points vaguely towards “financial freedom.” Fear not, intrepid adventurer! This section will equip you with the basic tools to confidently chart your course towards a financially secure future. We’ll demystify some key concepts, making them as clear as a perfectly balanced budget (which, admittedly, is a rare sight, but we’ll aim for it!).

Assets, Liabilities, and Net Worth: The Holy Trinity of Personal Finance

Understanding the difference between assets, liabilities, and net worth is fundamental. Think of it like this: your assets are everything you own that has value, your liabilities are what you owe, and your net worth is the difference between the two – your overall financial health. For a young adult, this might look something like this:

Assets could include a car (even if it’s a slightly battered second-hand beauty), savings accounts (even if the balance is currently a modest sum), investments (perhaps a small portfolio of stocks or even cryptocurrency if you’re feeling adventurous!), and any valuable possessions (like that vintage record player you scored at a flea market).

Liabilities, on the other hand, are the things that keep you up at night (financially speaking, at least). This could include student loan debt, credit card balances, car loans, and any other outstanding payments.

Net worth is simply the sum of your assets minus your liabilities. If your assets exceed your liabilities, congratulations! You’re in positive territory. If not, don’t despair – that just means you have a clear target to work towards. Remember, net worth isn’t a static number; it fluctuates with your financial choices.

Budgeting: Your Financial Roadmap

A budget isn’t just a restrictive document; it’s your personalized roadmap to financial success. It’s a powerful tool that allows you to track your income and expenses, identify areas for improvement, and work towards your financial goals. Creating a budget is like designing your own personalized financial GPS; it will keep you from getting hopelessly lost in a maze of unexpected expenses.

Here’s a sample budget using a simple table:

| Income | Expenses | Category | Notes |

|---|---|---|---|

| $2,500 (monthly salary) | $500 | Rent | Includes utilities |

| $200 (part-time job) | $300 | Groceries | Aim for affordable options |

| $100 | Transportation | Public transport or fuel efficient car | |

| $200 | Entertainment | Budget friendly activities | |

| $100 | Savings | Emergency fund or investments | |

| $100 | Debt Repayment | Prioritize high interest debt |

Remember, this is just a template; your actual budget will reflect your individual income and expenses.

Common Budgeting Methods: Finding Your Perfect Match

Several budgeting methods can help you stay on track. Let’s explore three popular approaches:

The 50/30/20 method suggests allocating 50% of your after-tax income to needs (housing, food, transportation), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment. This method is simple and easy to understand, making it a great starting point for beginners.

Zero-based budgeting involves meticulously tracking every dollar of your income and allocating it to specific expenses, ensuring that your income equals your expenses. This approach encourages mindful spending and can help you identify unnecessary expenses.

The envelope system involves allocating cash to different expense categories (e.g., groceries, entertainment) and placing it in separate envelopes. Once the cash in an envelope is gone, that’s it for that category until the next budgeting period. This method emphasizes visual tracking and can be particularly effective for controlling impulse spending. Each method has its own strengths and weaknesses; the best one for you will depend on your personality, spending habits, and financial goals. Experiment and find the method that keeps you motivated and on track!

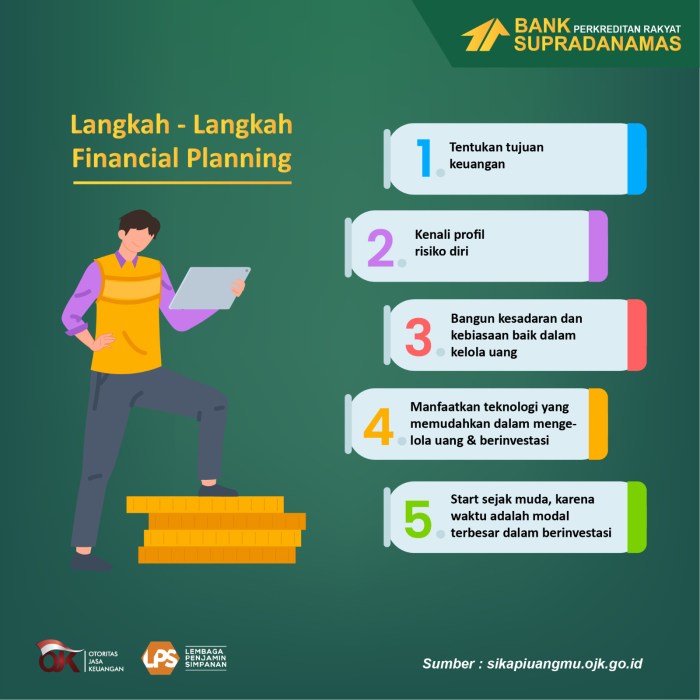

Setting Financial Goals and Creating a Plan

So, you’ve conquered the basics of personal finance – congratulations! Now comes the fun part: actually *doing* something with your newfound knowledge. Think of this stage as architecting your financial future – a dazzling mansion of financial freedom, rather than a cramped shack of debt. Let’s build that mansion, one SMART goal at a time.

Setting financial goals isn’t just about wishing for a Lamborghini; it’s about creating a roadmap to get there. And that roadmap requires clarity, specificity, and a healthy dose of realism. That’s where the SMART goals framework comes in – a magical formula to transform your financial dreams into achievable realities.

SMART Financial Goals for Recent Graduates

Let’s craft three SMART financial goals specifically tailored for a recent graduate, avoiding the pitfalls of vague aspirations. We’ll use the SMART acronym: Specific, Measurable, Achievable, Relevant, and Time-Bound.

- Specific: Pay off $5,000 in student loan debt. (Not just “reduce student loan debt.”)

- Measurable: Save $10,000 for a down payment on a car within two years. (Not just “save for a car.”) Progress can be tracked monthly.

- Achievable: Increase monthly savings rate to 15% of net income within six months. (Not just “save more money.”) This needs to be realistic based on income and expenses.

Notice how each goal is clearly defined, measurable with specific numbers and timelines, achievable within a reasonable timeframe, relevant to a recent graduate’s needs, and time-bound with concrete deadlines. This isn’t about wishing on a star; it’s about creating a practical plan.

Step-by-Step Plan to Achieve a SMART Goal

Let’s focus on achieving the “Pay off $5,000 in student loan debt” goal. A well-structured plan is crucial here; otherwise, you’ll end up feeling like you’re running on a financial treadmill.

- Assess current debt: Determine the exact amount of student loan debt, interest rates, and minimum monthly payments.

- Create a budget: Track all income and expenses meticulously to identify areas where you can cut back. Think of it as a financial detox – weeding out unnecessary expenses.

- Develop a repayment strategy: Explore options like the debt snowball or debt avalanche method. The snowball method prioritizes paying off the smallest debt first for motivation, while the avalanche method focuses on the debt with the highest interest rate to save money long-term.

- Automate payments: Set up automatic payments to ensure consistent repayment and avoid late fees – avoiding late fees is like finding extra money under your mattress!

- Seek additional income: Consider a side hustle or part-time job to accelerate debt repayment. Think of it as a financial turbocharger.

- Monitor progress: Track your progress regularly to stay motivated and adjust your strategy if needed. A little self-monitoring goes a long way.

The Importance of Long-Term Financial Planning

While paying off student loans is important, long-term financial planning, particularly retirement savings, is crucial. Failing to plan for retirement is like sailing a ship without a map – you might get somewhere, but it’s probably not where you want to be.

Starting early is key because of the power of compound interest – your earnings earn more earnings. It’s like money magic!

Examples of long-term investment options include:

- 401(k)s and 403(b)s: Employer-sponsored retirement plans often offering matching contributions – free money, essentially.

- Individual Retirement Accounts (IRAs): Tax-advantaged accounts allowing for contributions and tax-deferred growth. There are Traditional and Roth IRAs, each with its own tax benefits.

- Index Funds and Exchange-Traded Funds (ETFs): Diversified investments tracking market indices, offering relatively low-cost exposure to a wide range of assets.

Remember, long-term financial planning isn’t just about accumulating wealth; it’s about securing your financial future and enjoying a comfortable retirement. So start planning today, even if it’s just a small amount. Your future self will thank you profusely.

Managing Debt and Building Credit

Embarking on your financial journey is like learning to ride a bicycle – initially wobbly, but with practice, you’ll be zooming down the financial highway! This section tackles the often-dreaded, but absolutely conquerable, world of debt and credit. We’ll demystify the process, making it less terrifying and more…dare we say…fun?

Understanding the difference between good debt and bad debt is crucial. Think of it like choosing your friends – some lift you up, others…well, let’s just say they’re not ideal companions. Good debt helps you build wealth, while bad debt digs you into a financial hole faster than you can say “interest rate.”

Good Debt versus Bad Debt

The key differentiator lies in the asset’s potential for appreciation and the interest rate. Good debt is usually associated with assets that increase in value over time, offsetting the cost of borrowing. Bad debt, on the other hand, often involves high interest rates and doesn’t generate any appreciable return.

Good Debt Examples: A mortgage (your home hopefully appreciates), student loans (investing in your future earning potential), or a small business loan (generating income and potentially increasing business value). These debts are generally characterized by low interest rates and contribute to long-term wealth building.

Bad Debt Examples: High-interest credit card debt, payday loans, or personal loans with exorbitant interest rates. These debts often consume a significant portion of your income without any corresponding asset appreciation. They’re like financial vampires, sucking the life out of your budget.

Strategies for Paying Off High-Interest Debt

Facing mountains of high-interest debt can feel overwhelming, but don’t despair! Several effective strategies can help you conquer this financial beast. Remember, consistency is key. It’s a marathon, not a sprint (unless you’re exceptionally fast and financially savvy, then maybe it’s a sprint!).

| Strategy | Description | Pros/Cons |

|---|---|---|

| Debt Avalanche | Prioritize paying off the debt with the highest interest rate first, regardless of balance. | Pros: Fastest way to reduce overall interest paid. Cons: Can be demotivating if the highest-interest debt has a large balance. |

| Debt Snowball | Prioritize paying off the smallest debt first, regardless of interest rate, to build momentum and motivation. | Pros: Provides quick wins and boosts morale. Cons: May take longer to pay off debt and result in higher overall interest paid. |

| Balance Transfer | Transfer high-interest debt to a credit card with a lower introductory APR. | Pros: Lower interest payments during the introductory period. Cons: Introductory period is temporary; fees may apply; requires good credit. |

Improving Credit Score

Your credit score is a numerical representation of your creditworthiness. Lenders use it to assess your risk, impacting your ability to secure loans, mortgages, and even rent an apartment. A good credit score opens doors to better financial opportunities; a poor one can slam them shut. Let’s unlock those doors!

Improving your credit score involves consistent, responsible financial behavior. Think of it as building a strong reputation with the credit bureaus – the financial watchdogs of the world. They’re watching, so let’s make them proud!

Actionable Steps:

- Pay Bills on Time: This is the single most important factor affecting your credit score. Late payments are like flashing a giant “risky borrower” sign.

- Keep Credit Utilization Low: Aim to keep your credit card balances below 30% of your credit limit. Think of it as leaving room to breathe – for both you and your credit score.

- Maintain a Mix of Credit Accounts: A diverse credit history (credit cards, loans) demonstrates responsible credit management. Don’t go overboard, though! A balanced portfolio is key.

- Don’t Open Too Many New Accounts: Applying for multiple credit accounts in a short period can negatively impact your score. Patience, young Padawan!

- Monitor Your Credit Report Regularly: Check your credit report for errors and unauthorized activity. It’s like a financial checkup; do it regularly!

Saving and Investing for Beginners

Embarking on your financial journey is like planning an epic quest – you need supplies, a map, and a healthy dose of bravery (and maybe a trusty steed, but that’s a metaphor for a good financial advisor!). This section focuses on two crucial aspects of your financial adventure: saving and investing. Think of saving as building your castle’s sturdy foundation, while investing is like adding magnificent towers and sprawling gardens. Both are essential for a truly prosperous kingdom.

Emergency Fund Importance and Recommended Amount, Financial Planning untuk Pemula

Having an emergency fund is like having a secret stash of gold coins hidden away in your castle’s deepest dungeon. You never want to use it, but if a dragon attacks (or your car breaks down, or you lose your job), you’ll be incredibly glad you have it. A generally recommended amount for an emergency fund is 3-6 months’ worth of living expenses. This covers essential costs like rent, utilities, groceries, and transportation, providing a financial safety net during unforeseen circumstances. For example, if your monthly expenses are $2,000, aiming for $6,000-$12,000 in your emergency fund would provide a solid buffer. Remember, this isn’t money for a vacation; it’s your financial shield against life’s unexpected curveballs.

Investment Options for Beginners: A Comparison

Choosing your investment strategy is like picking the right weapons for your quest. Each weapon has its strengths and weaknesses. Here’s a comparison of some popular options:

- Stocks: Think of stocks as owning a tiny piece of a company. Their value can fluctuate wildly, offering high potential returns but also significant risk. Beginners should approach stocks with caution and perhaps start with a small, diversified portfolio.

- Bonds: Bonds are like lending money to a company or government. They generally offer lower returns than stocks but are considered less risky. They’re a good option for stability and preserving capital.

- Mutual Funds: Mutual funds are like baskets of different investments (stocks, bonds, etc.) managed by professionals. They offer diversification, reducing risk, and are a good starting point for beginners who want a hands-off approach.

Beginner Investment Portfolio Allocation Strategy (Moderate Risk)

A well-balanced portfolio is like a skilled warrior’s arsenal – a combination of weapons for different situations. For a beginner with moderate risk tolerance, a suitable allocation might be:

This portfolio balances growth potential with risk mitigation. The 40% allocation to mutual funds provides diversification and professional management, reducing the overall portfolio risk. The 30% allocation to bonds offers stability and income, acting as a counterbalance to the potentially volatile stock market exposure. The remaining 30% in stocks allows for participation in potential market growth, but the lower percentage limits exposure to significant losses. This is just a suggestion; your actual allocation should be based on your individual circumstances and financial goals. Consult a financial advisor for personalized advice.

Protecting Your Finances

Let’s face it, nobody wants to end up on the streets because of a sudden illness or a rogue squirrel short-circuiting their power grid (it happens!). Protecting your financial well-being isn’t just about saving and investing; it’s about building a safety net to catch you when life throws a curveball – or a particularly aggressive squirrel. This section will explore essential strategies to safeguard your hard-earned cash.

Protecting your financial future involves a multi-pronged approach, combining proactive measures with a healthy dose of paranoia (just kidding… mostly). This involves securing yourself against unexpected events, planning for the future, and implementing safeguards against financial trickery. Think of it as building a financial fortress, complete with moats (savings accounts), drawbridges (emergency funds), and highly trained guard dogs (your financial advisors… hopefully).

Insurance: Your Financial Shield

Insurance, while not the most exciting topic, is your first line of defense against unexpected financial blows. Think of it as a financial superhero cape, shielding you from catastrophic costs. Health insurance protects against crippling medical bills, life insurance provides a financial safety net for your loved ones in case of your untimely demise (hopefully a long time from now!), and car insurance safeguards you against the financial wreckage of accidents. Consider your individual needs and risk tolerance when selecting insurance coverage; a comprehensive policy offers broader protection, but might come with a higher premium. For example, a young, healthy individual might opt for a more basic health plan, while someone with pre-existing conditions might require more extensive coverage. Similarly, someone with a high-risk occupation might need more substantial life insurance.

Estate Planning: A Legacy of Financial Security

Creating a will might not be the most thrilling weekend activity, but it’s crucial for ensuring your assets are distributed according to your wishes after you’re gone. Without a will, the state decides who gets what, and that might not align with your desires. Imagine your prized collection of rubber ducks falling into the wrong hands! A will clearly Artikels who inherits your belongings and assets, minimizing potential family disputes. Additionally, establishing a power of attorney allows you to appoint someone you trust to manage your finances if you become incapacitated. This ensures your financial affairs are handled responsibly, even if you are unable to do so yourself. Consider consulting a legal professional to ensure your will and power of attorney documents are legally sound and reflect your wishes accurately.

Protecting Against Financial Scams and Fraud

In today’s digital age, financial scams are as common as unsolicited emails promising Nigerian princes’ riches. Staying vigilant is crucial. Be wary of unsolicited phone calls, emails, or text messages requesting personal financial information. Legitimate institutions will never ask for such details via these channels. Always verify the identity of anyone requesting your financial information by contacting the institution directly through official channels. Regularly monitor your bank and credit card statements for any unauthorized activity. Consider setting up fraud alerts with your financial institutions to receive immediate notifications of suspicious transactions. Remember, if something sounds too good to be true, it probably is. Don’t fall for get-rich-quick schemes or promises of unbelievably high returns. A healthy dose of skepticism can save you a lot of heartache (and money).

Seeking Professional Advice

Let’s face it: navigating the world of personal finance can feel like trying to assemble IKEA furniture without the instructions – frustrating, confusing, and potentially leading to a wobbly outcome. While DIY financial planning is commendable, sometimes seeking professional help is not just beneficial, it’s downright sensible. Think of it as upgrading from a rusty spork to a full silverware set – your financial future will thank you.

Professional financial guidance can be invaluable, particularly when dealing with complex situations or lacking the time/expertise to manage your finances effectively. Just as you wouldn’t perform brain surgery on yourself (we hope!), entrusting certain financial aspects to experts can save you time, money, and a whole lot of stress. The right advice can make the difference between a comfortable retirement and… well, let’s just say “comfortable” might not be the word.

Types of Financial Professionals

Different financial professionals offer distinct services. Choosing the right one depends on your specific needs. For example, a financial advisor might help you develop a long-term investment strategy, while an accountant focuses on tax planning and compliance. Understanding their roles is crucial for making an informed decision.

- Financial Advisors: These professionals help you create a comprehensive financial plan, encompassing investments, retirement planning, and estate planning. They often charge fees based on assets under management or hourly rates. Think of them as your financial Sherpas, guiding you up the mountain of financial success (hopefully without the altitude sickness).

- Accountants: Accountants are essential for tax preparation and financial record-keeping. They can help you minimize your tax burden legally and ensure you’re compliant with all relevant regulations. Consider them the financial detectives, uncovering deductions you might have missed.

- Certified Financial Planners (CFPs): CFPs are financial advisors who have met specific education and experience requirements and passed a rigorous exam. They provide holistic financial planning services and must adhere to a fiduciary standard, meaning they are legally obligated to act in your best interest.

Resources for Free or Low-Cost Financial Guidance

Navigating the financial world doesn’t always require breaking the bank. Several resources offer free or low-cost financial guidance, making expert help accessible to everyone.

Many non-profit organizations and government agencies provide free financial education workshops and resources. These often cover topics such as budgeting, saving, and debt management. Additionally, some universities and community colleges offer free or low-cost financial literacy programs. Online resources, such as reputable financial websites and government websites, also provide valuable information and tools. Think of these as your free financial textbooks – no need to pay exorbitant prices for wisdom.

Final Wrap-Up: Financial Planning Untuk Pemula

So, there you have it – your crash course in Financial Planning untuk Pemula! While becoming a financial guru overnight might be a tall order (unless you’ve discovered a time-traveling money machine, in which case, please share!), armed with this knowledge, you’re now better equipped to navigate the often-treacherous waters of personal finance. Remember, small steps lead to big financial victories. So, go forth and conquer your financial future – one budget, one investment, one debt-free day at a time! And may your returns always be positive (and your expenses, delightfully low).

User Queries

What’s the difference between a financial advisor and a financial planner?

While the terms are often used interchangeably, financial advisors generally offer broader advice encompassing investments, insurance, and retirement planning, while financial planners focus more narrowly on creating and implementing financial plans to achieve specific goals.

How often should I review my budget?

At least monthly! Life throws curveballs; reviewing your budget ensures you’re staying on track and adapting to changing circumstances.

Is it okay to invest if I have debt?

It depends on the type of debt and interest rates. High-interest debt (like credit card debt) should generally be prioritized before investing, but low-interest debt (like student loans) might allow for parallel investment strategies.

What if I make a mistake with my financial planning?

Don’t panic! Mistakes are learning opportunities. Re-evaluate your plan, adjust as needed, and keep moving forward. It’s a marathon, not a sprint (unless you’re sprinting towards financial freedom!).