Financial Planning untuk UKM: Think of your UKM as a mischievous but lovable pet – it needs feeding (with capital), training (with smart strategies), and regular checkups (financial analysis). Ignoring its needs leads to chaos; nurturing it properly results in a thriving, profitable beast. This guide will arm you with the tools to manage your UKM’s finances, transforming it from a financial fledgling to a soaring eagle of economic success.

This comprehensive guide navigates the complexities of Indonesian UKM financial planning, covering everything from budgeting and cash flow management to securing funding and navigating tax regulations. We’ll delve into practical strategies, offering real-world examples and actionable steps to help you optimize your UKM’s financial health. Whether you’re a seasoned entrepreneur or just starting out, this guide is your roadmap to financial stability and growth.

Understanding Financial Needs of UKMs

Navigating the thrilling, yet often treacherous, waters of Indonesian small and medium-sized enterprises (UKMs) requires a sturdy financial life raft – and that’s where proper financial planning comes in. Think of it as equipping your business with a trusty GPS instead of relying on a map drawn by a drunken pirate. Let’s chart a course through the financial realities faced by UKMs.

The Indonesian UKM landscape is a vibrant tapestry woven with both incredible potential and unique challenges. From bustling street vendors to burgeoning tech startups, these businesses form the backbone of the Indonesian economy. However, their financial journeys are often paved with unexpected potholes and winding, confusing roads.

Typical Financial Challenges Faced by UKMs in Indonesia

Let’s be frank: money matters are rarely simple, especially for UKMs. Cash flow, that ever-elusive beast, often proves to be the biggest hurdle. Many UKMs struggle with inconsistent revenue streams, leading to difficulties in managing expenses and investing in growth. Access to affordable and appropriate financing can also be a significant challenge, with many relying on personal savings or high-interest loans. Furthermore, a lack of financial literacy and record-keeping can make it incredibly difficult to track progress, identify problems, and plan effectively. It’s like trying to build a skyscraper without blueprints – a recipe for disaster.

Differences in Financial Planning Needs Across UKM Sizes

While all UKMs face financial challenges, their needs vary significantly depending on their size and stage of development. Small UKMs, often sole proprietorships or partnerships, prioritize short-term survival and basic financial management. Medium-sized UKMs, with more established operations, might focus on expansion and strategic investments. Large UKMs, on the other hand, grapple with more complex financial structures, requiring sophisticated planning for long-term growth, diversification, and potential acquisitions. Think of it as a game of Jenga: the smaller the structure, the more immediate the concern of stability; the larger, the more complex the risk management required.

Common Financial Goals for UKMs

Ultimately, the goal of any UKM is to thrive. But what does that look like financially? Here are some common aspirations, expressed in the practical language of balance sheets and profit margins:

| Goal | Description | Example | Metrics |

|---|---|---|---|

| Expansion | Increasing the scale of operations, either geographically or through product/service diversification. | A small warung (food stall) opening a second location or adding a delivery service. | Increased revenue, market share, number of employees. |

| Profitability | Generating sufficient revenue to cover all costs and generate a positive net income. | A batik workshop increasing its profit margin by 15% through improved efficiency. | Gross profit margin, net profit margin, return on investment (ROI). |

| Sustainability | Ensuring long-term financial viability and resilience. | A furniture maker securing a long-term contract with a large retailer. | Consistent revenue streams, strong cash flow, low debt levels. |

| Debt Reduction | Minimizing outstanding loans and improving financial health. | A clothing boutique repaying a business loan ahead of schedule. | Debt-to-equity ratio, interest expense, credit score. |

Budgeting and Cash Flow Management for UKMs

Let’s face it, running a UKM (small and medium-sized enterprise) is like juggling chainsaws while riding a unicycle – exhilarating, terrifying, and potentially very messy if you don’t plan properly. This section dives into the crucial aspects of budgeting and cash flow management, transforming your financial acrobatics into a graceful, profitable dance. We’ll show you how to tame those financial beasts and avoid the financial equivalent of a spectacular, chainsaw-related mishap.

Sample Budget Template for a Food and Beverage UKM

A well-structured budget is your financial compass, guiding you through the sometimes-choppy waters of business. This sample budget, designed for a food and beverage UKM, provides a framework you can adapt to your specific needs. Remember, a budget isn’t a straitjacket; it’s a flexible tool to help you stay on track.

| Income | January | February | March |

|---|---|---|---|

| Sales (Food) | £5,000 | £6,000 | £7,000 |

| Sales (Beverages) | £2,000 | £2,500 | £3,000 |

| Other Income (e.g., Catering) | £500 | £0 | £1,000 |

| Total Income | £7,500 | £8,500 | £11,000 |

| Expenses | |||

| Cost of Goods Sold (COGS) | £2,000 | £2,500 | £3,000 |

| Rent | £500 | £500 | £500 |

| Salaries | £1,500 | £1,500 | £1,500 |

| Utilities | £200 | £200 | £200 |

| Marketing | £300 | £200 | £400 |

| Other Expenses | £300 | £400 | £400 |

| Total Expenses | £4,800 | £5,300 | £5,000 |

| Net Profit | £2,700 | £3,200 | £6,000 |

Best Practices for Effective Cash Flow Forecasting for UKMs

Accurate cash flow forecasting is vital for survival. It’s like having a weather radar for your finances, warning you of potential storms (cash shortages) and allowing you to prepare accordingly. Ignoring cash flow is a recipe for disaster – a financial shipwreck, if you will.

Effective forecasting involves:

- Regularly reviewing your sales data to identify trends and seasonality.

- Tracking your expenses meticulously, categorizing them for better analysis.

- Predicting future income and expenses based on historical data and market conditions.

- Using forecasting software or spreadsheets to streamline the process.

- Regularly comparing your forecast to actual results to refine your predictions.

Strategies for Managing Seasonal Fluctuations in Cash Flow

Many UKMs, especially those in food and beverage, experience seasonal peaks and troughs. Think Christmas rush versus the January blues. Managing these fluctuations requires proactive planning and a healthy dose of financial foresight.

Strategies include:

- Building up a cash reserve during peak seasons to cushion the impact of slower periods.

- Offering seasonal promotions or discounts to stimulate sales during off-peak times.

- Exploring alternative revenue streams during slower periods, such as catering or special events.

- Negotiating flexible payment terms with suppliers to manage expenses effectively.

- Utilizing short-term financing options, such as lines of credit, to bridge cash flow gaps.

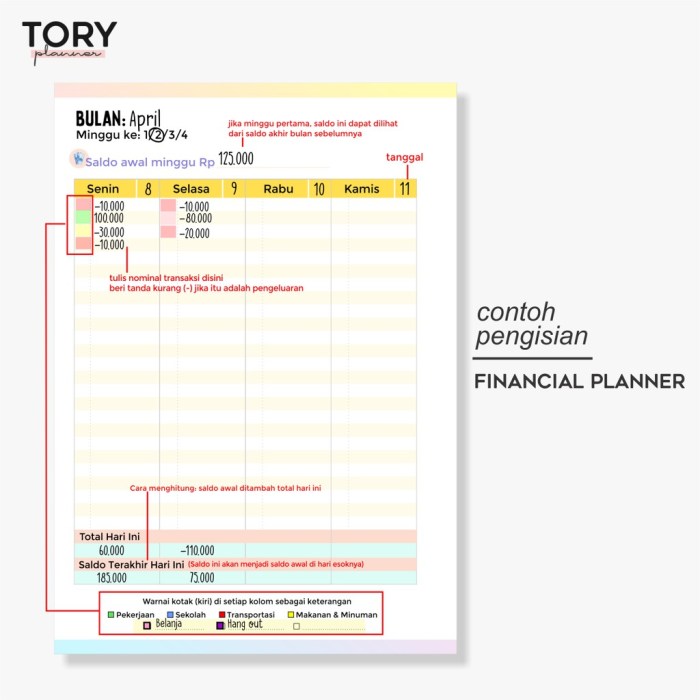

Step-by-Step Guide for Implementing a Simple Budgeting System Using a Spreadsheet

Spreadsheet software (like Excel or Google Sheets) is your budget-building best friend. It’s free, flexible, and far less likely to spontaneously combust than a complicated accounting software.

- Create a template: Set up columns for income, expenses, and monthly totals. Categorize your expenses (rent, salaries, marketing, etc.).

- Input historical data: Enter your past income and expenses for at least the last year to identify trends.

- Forecast future income and expenses: Based on your historical data and anticipated changes, project your income and expenses for the upcoming year.

- Calculate your net profit/loss: Subtract total expenses from total income for each month.

- Regularly review and update: Track your actual income and expenses against your budget, and make adjustments as needed.

Funding and Financing Options for UKMs

Securing the financial lifeblood of your UKM can feel like navigating a treacherous swamp filled with alligators wearing tiny top hats. But fear not, intrepid entrepreneur! This section illuminates the various funding avenues available, helping you choose the perfect financial life raft for your specific needs. We’ll wade through the murky waters of bank loans, government grants, and crowdfunding, emerging triumphant with a clear understanding of which option best suits your risk tolerance and financial goals.

Choosing the right funding source is crucial for UKM success. A mismatch can lead to crippling debt or missed opportunities. Understanding the nuances of each option is paramount to making an informed decision that sets your business up for prosperity (and maybe even a well-deserved vacation).

Bank Loans

Bank loans offer a traditional route to funding, providing a lump sum of money in exchange for repayment with interest over a set period. They are generally suitable for UKMs with a solid track record and a robust business plan demonstrating the ability to repay the loan. However, securing a bank loan can be a lengthy and complex process, requiring extensive documentation and often a personal guarantee.

The cost of a bank loan is determined by the interest rate, loan term, and any associated fees. For example, a £10,000 loan at 5% interest over 5 years would incur a total interest cost of approximately £1,280 (calculated using simple interest; actual figures will vary depending on the type of loan). The higher the risk perceived by the bank, the higher the interest rate will likely be.

Government Grants

Government grants offer a tantalizing alternative – free money! These funds are often earmarked for specific purposes, such as research and development, innovation, or supporting specific industries. Eligibility criteria vary widely depending on the grant and the government agency offering it. While securing a grant can be incredibly beneficial, the application process is usually highly competitive and requires meticulous preparation.

The “cost” of a government grant is primarily the time and effort invested in the application process. It’s a significant investment, but the potential payoff – free capital – makes it worthwhile for many UKMs. Imagine the celebratory cake you could buy with the money saved on interest payments!

Crowdfunding

Crowdfunding offers a unique approach, leveraging the power of the crowd to raise capital. Platforms like Kickstarter and Indiegogo allow UKMs to present their business idea to potential investors and solicit contributions in exchange for rewards or equity. This approach is particularly well-suited for innovative businesses with a strong online presence and a compelling story to tell. However, success is not guaranteed, and the campaign needs significant marketing and promotion to attract sufficient funding.

The cost of crowdfunding includes platform fees, marketing expenses, and the rewards offered to backers. While there are no interest payments, the rewards can represent a significant cost, particularly if the campaign is highly successful. For instance, a UKM offering early access to their product as a reward might find themselves facing significant production costs if the campaign exceeds expectations.

Key Factors in Selecting a Financing Option

Selecting the appropriate financing option requires careful consideration of several key factors. These include the amount of funding needed, the repayment terms, the risk profile of the business, the availability of collateral, and the time commitment involved in the application process. Each funding source has its own strengths and weaknesses, and the optimal choice will depend on the specific circumstances of the UKM. Think of it as choosing the right tool for the job – a hammer isn’t ideal for screwing in a lightbulb (unless you’re exceptionally creative and slightly reckless).

Financial Ratio Analysis and Performance Monitoring

Let’s face it, running a UKM isn’t just about passion; it’s about cold, hard numbers. While the romantic notion of following your dreams is lovely, a healthy bank balance sings a sweeter tune. Understanding your financial ratios is the key to unlocking the secrets to your UKM’s success – and avoiding the dreaded “out of business” sign. This section will help you decipher the financial jargon and turn those numbers into actionable insights.

Financial ratio analysis provides a powerful lens through which to view your UKM’s performance. By calculating and interpreting various ratios, you gain a clear picture of your business’s liquidity, profitability, and solvency. This isn’t about becoming a certified accountant overnight; it’s about gaining a practical understanding of your financial health and making informed decisions based on the data.

Key Financial Ratios for UKM Performance Evaluation

Several key ratios offer a comprehensive overview of your UKM’s financial standing. Understanding these ratios allows you to pinpoint strengths and weaknesses, ultimately guiding strategic decisions for growth and sustainability. Think of it as a financial checkup for your business, revealing areas that need attention and celebrating areas of success.

| Ratio | Formula | Interpretation |

|---|---|---|

| Liquidity Ratio (Current Ratio) | Current Assets / Current Liabilities | Indicates the ability to meet short-term obligations. A ratio above 1 suggests sufficient liquidity; below 1 indicates potential short-term financial difficulties. For example, a ratio of 1.5 suggests that for every £1 of short-term debt, the business has £1.50 in current assets to cover it. |

| Profitability Ratio (Gross Profit Margin) | (Revenue – Cost of Goods Sold) / Revenue | Shows the percentage of revenue remaining after deducting the direct costs of producing goods or services. A higher margin indicates greater efficiency in managing production costs. For instance, a 40% gross profit margin means that for every £1 of revenue, £0.40 is gross profit. |

| Solvency Ratio (Debt-to-Equity Ratio) | Total Debt / Total Equity | Measures the proportion of financing from debt compared to equity. A higher ratio suggests a greater reliance on debt financing, potentially increasing financial risk. A ratio of 0.5 indicates that for every £1 of equity, the business has £0.50 of debt. |

Interpreting Ratios and Identifying Areas for Improvement

Interpreting these ratios involves comparing them to industry benchmarks and your own past performance. A sudden drop in the current ratio might signal a need to improve cash flow management, while a consistently low gross profit margin could indicate the need to re-evaluate pricing strategies or production costs. Remember, these ratios are not isolated figures; they tell a story about your UKM’s financial health. Analyzing trends over time is crucial.

For example, if your current ratio consistently falls below 1, you might need to explore strategies like negotiating better payment terms with suppliers or securing a short-term loan to bridge cash flow gaps. A low gross profit margin might warrant a review of your pricing strategy, exploration of cheaper suppliers, or an increase in efficiency.

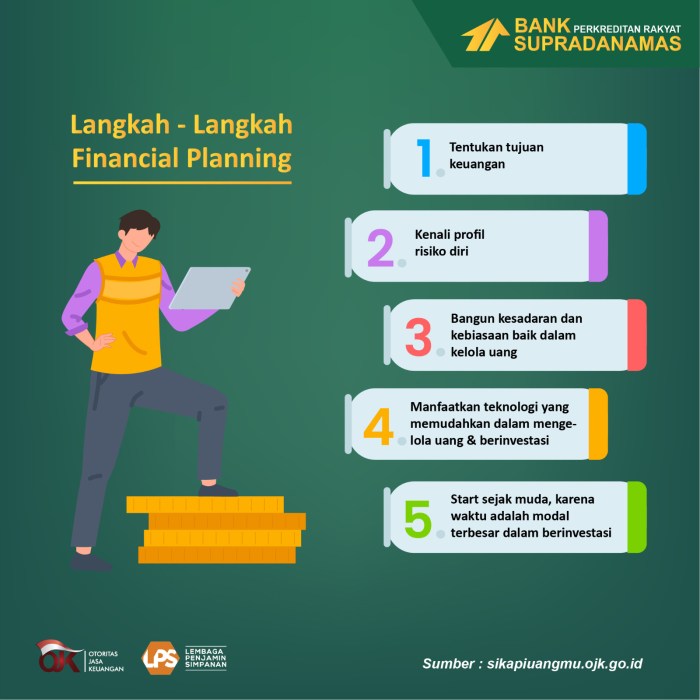

Setting Realistic Financial Targets and Tracking Progress

Setting realistic financial targets is crucial for monitoring progress and ensuring your UKM stays on track. These targets should be Specific, Measurable, Achievable, Relevant, and Time-bound (SMART). Regularly reviewing your financial ratios against these targets helps you identify deviations and take corrective action promptly. Think of it as a navigation system for your financial journey – keeping you on course and alerting you to potential obstacles.

For example, you might set a target to increase your gross profit margin by 5% within the next year. To achieve this, you could explore ways to reduce production costs or increase prices strategically. Regular monitoring of your gross profit margin will show whether you are on track to meet your target and allow you to adjust your strategies as needed.

Tax Planning and Compliance for UKMs

Navigating the Indonesian tax system can feel like a thrilling jungle adventure – full of unexpected twists and turns, but ultimately rewarding if you know the right path. This section will equip you with the map and compass to successfully traverse this fiscal terrain, minimizing your tax burden while staying firmly on the right side of the law. Remember, a little tax planning goes a long way in ensuring your UKM’s financial health.

Understanding your tax obligations as a UKM in Indonesia is crucial for long-term success. Failure to comply can lead to penalties, which are far less fun than a successful business. The good news is that with proper planning, you can minimize your tax liability and even optimize your tax strategy. Let’s delve into the specifics.

Tax Obligations and Regulations for UKMs in Indonesia

Indonesian tax regulations for UKMs are multifaceted, but generally revolve around several key taxes. These include the Value Added Tax (VAT), Income Tax (PPh), and potentially other regional or specific taxes depending on your business activity. The specific tax rates and regulations can change, so staying updated is vital. Consult with a tax professional for personalized advice tailored to your specific situation and to ensure you are always operating within the current legal framework. This is not financial advice; seek professional counsel.

Strategies for Minimizing Tax Liabilities

Minimizing tax liability doesn’t mean dodging taxes; it means employing legal strategies to reduce your overall tax burden. This often involves careful record-keeping, claiming legitimate deductions, and understanding the various tax incentives available to UKMs. Remember, the goal is smart planning, not tax evasion.

One effective strategy is meticulous record-keeping. This allows you to accurately claim allowable deductions, such as business expenses and depreciation of assets. Another crucial aspect is understanding available tax incentives. The Indonesian government offers various incentives to support the growth of UKMs; taking advantage of these can significantly reduce your tax liability. Again, seeking professional advice is key to maximizing these benefits.

Tax-Related Documents for UKMs

Maintaining accurate and organized tax records is paramount. Think of it as your financial shield against any tax-related surprises. A well-maintained set of documents will simplify your tax filings and minimize the risk of penalties.

- Taxpayer Identification Number (NPWP)

- Business Licenses and Permits

- Financial Statements (Income Statement, Balance Sheet)

- Records of all Income and Expenses

- Invoices and Receipts

- Tax Returns (SPT)

Hypothetical Tax Liability Calculation for a UKM

Let’s imagine “Warung Makan Bahagia,” a small food stall, had a gross income of Rp 100,000,000 in a year. After deducting allowable business expenses (rent, ingredients, utilities) totaling Rp 60,000,000, their net taxable income is Rp 40,000,000. Assuming a simplified tax rate of 25% for this hypothetical example (actual rates vary depending on income brackets and business type), their annual income tax liability would be Rp 10,000,000 (Rp 40,000,000 x 25%). This is a simplified illustration; actual tax calculations can be far more complex and should be handled by a tax professional.

Note: This is a simplified example and does not represent actual Indonesian tax laws. Consult a tax professional for accurate calculations and compliance.

Risk Management and Financial Forecasting: Financial Planning Untuk UKM

Navigating the unpredictable waters of UKM finance requires more than just a sturdy ship (your business); it needs a skilled captain (you) equipped with a reliable map (financial forecasting) and a life raft (risk management). Ignoring these crucial elements is like sailing a paper boat in a hurricane – not advisable. Let’s equip you with the tools to weather any financial storm.

Financial risk management and forecasting are intertwined, like a delicious cheese and wine pairing (except instead of deliciousness, we’re talking about financial stability). Forecasting helps you anticipate potential problems, while risk management provides strategies to navigate them. It’s all about proactive planning, not reactive firefighting.

Common Financial Risks Faced by UKMs, Financial Planning untuk UKM

UKMs face a unique set of financial challenges. These aren’t just theoretical possibilities; they’re real-world threats that can sink even the most promising ventures. Understanding these risks is the first step towards effective mitigation.

Imagine a small bakery facing a sudden surge in the price of flour. That’s a supply chain risk. Or perhaps a new competitor opens across the street, stealing away customers. That’s competition risk. Economic downturns, changes in consumer preferences, and even internal operational issues (like a faulty oven!) can all wreak havoc on a UKM’s finances.

Strategies for Mitigating Financial Risks

Mitigating risk isn’t about eliminating all uncertainty – that’s impossible. It’s about reducing the impact of potential negative events. Think of it as wearing a seatbelt; it doesn’t prevent accidents, but it minimizes the damage.

Diversification is key. Don’t put all your eggs in one basket. If your bakery relies solely on selling cakes, consider expanding into cookies or pastries. Building strong relationships with suppliers ensures a stable supply chain. Regular market research helps you adapt to changing consumer preferences. Having a robust emergency fund acts as a financial cushion during unexpected downturns. And, of course, thorough financial planning, including accurate forecasting, is the ultimate risk mitigation tool.

A Simple Financial Forecasting Model for a Retail UKM

Let’s say we have “Bob’s Books,” a small bookstore. A simple forecasting model might involve projecting sales based on historical data, considering seasonal fluctuations (Christmas!), and factoring in potential price changes or marketing campaigns.

For example, if Bob’s Books sold 1000 books last year, and anticipates a 5% increase in sales this year, the projected sales would be 1050 books. However, this is a simplified model. A more sophisticated model would incorporate various other factors, including marketing expenses, rent, salaries, and inventory costs, to arrive at a projected profit or loss.

Projected Profit = Projected Revenue – Projected Costs

Developing Contingency Plans for Unexpected Financial Events

Unexpected events – like a global pandemic, a major fire, or a sudden drop in demand – can significantly impact a UKM’s financial health. A well-developed contingency plan is like having a spare tire; you hope you never need it, but it’s invaluable when you do.

Contingency plans should address various scenarios. What happens if a key supplier goes bankrupt? What if sales plummet unexpectedly? These plans should include strategies for reducing costs, securing additional funding, or adjusting operations to minimize the impact of the unforeseen event. Regularly reviewing and updating these plans is crucial, as circumstances change.

Investment Strategies for UKM Growth

Investing wisely is the secret sauce to turning your UKM from a small fry into a culinary giant. It’s not just about throwing money at the wall and hoping something sticks; it’s about strategic planning and smart choices that propel your business forward. Think of it as a delicious recipe for success, where each ingredient (investment) plays a vital role.

Investing in your UKM’s growth requires a careful assessment of various options and a keen eye on the potential return. Ignoring the financial implications of your decisions is like baking a cake without checking the oven temperature – disaster awaits! Therefore, understanding and utilizing various investment strategies is crucial for sustainable growth.

Suitable Investment Options for UKM Expansion

Several avenues exist for UKMs seeking expansion. These options range from relatively low-risk, low-reward choices to higher-risk, higher-reward ventures. The best option will depend heavily on the UKM’s specific circumstances, risk tolerance, and financial standing. Consider these factors carefully before committing resources.

Return on Investment (ROI) Analysis for UKM Investment Decisions

ROI is the ultimate yardstick for measuring the effectiveness of any investment. Simply put, it tells you how much you’re getting back for every rupiah you put in. Calculating ROI involves comparing the net profit generated by an investment to the cost of that investment. A high ROI signifies a successful investment, while a low or negative ROI suggests that the investment might not have been worthwhile. The formula is straightforward:

ROI = [(Gain from Investment – Cost of Investment) / Cost of Investment] x 100%

By consistently analyzing ROI, UKMs can make informed decisions, optimizing resource allocation and maximizing their chances of success.

Examples of Successful Investment Strategies Implemented by Indonesian UKMs

Understanding successful strategies is vital for learning and avoiding costly mistakes. Here are some examples of Indonesian UKMs that have strategically invested in their growth:

- Case Study 1: “Warung Kopi Susu” Franchise Expansion: This small coffee shop chain strategically invested in franchising, leveraging its brand recognition and established operational model. This low-risk expansion significantly increased its market reach and revenue streams. The lesson learned here is the power of scalable business models. The ROI was exceptionally high due to the relatively low cost of franchise setup compared to opening new, independent branches.

- Case Study 2: “Batik Ayu” E-commerce Platform Development: This batik producer invested heavily in developing a robust e-commerce platform, allowing them to reach a wider customer base beyond their local area. This strategy significantly boosted sales and brand awareness. The key lesson: Embrace digital transformation to expand your market reach. While the initial investment was substantial, the long-term ROI has proven highly rewarding, as online sales now exceed physical store sales.

- Case Study 3: “Bengkel Jaya” Upgrading Equipment and Training: This small auto repair shop invested in upgrading its equipment and providing specialized training to its mechanics. This resulted in increased efficiency, higher-quality service, and the ability to handle more complex repairs, commanding higher prices. The lesson: Investing in human capital and equipment can significantly enhance productivity and profitability. The ROI was clearly demonstrated in increased revenue and reduced operational costs.

Using Technology for Financial Management

Let’s face it, spreadsheets can be as exciting as watching paint dry. But for UKMs, efficient financial management is crucial, and technology offers a lifeline – or at least a much-needed espresso shot to your bookkeeping routine. Embracing technology isn’t just about keeping up with the Joneses; it’s about streamlining operations, gaining valuable insights, and ultimately, boosting your bottom line. Think of it as upgrading from a rusty abacus to a supercharged financial spaceship.

Technology significantly enhances the financial management capabilities of UKMs, offering increased accuracy, efficiency, and access to real-time data. This empowers informed decision-making, allowing for proactive strategies to improve profitability and sustainability. Gone are the days of endless manual calculations and the constant fear of misplaced receipts. Hello, automated reporting and stress-free tax season!

Benefits of Accounting Software and Financial Management Tools

Utilizing accounting software and financial management tools offers several key advantages for UKMs. These tools automate tedious tasks, reducing the time spent on manual data entry and reconciliation. This frees up valuable time for UKM owners to focus on strategic initiatives, rather than getting bogged down in the nitty-gritty of number crunching. Furthermore, these tools provide real-time financial insights, allowing for quicker identification of potential problems and opportunities. Accurate and up-to-date financial data enables better informed decision-making, leading to improved financial performance. Finally, the enhanced organization and accessibility of financial records offered by these tools significantly simplify tax preparation and audits.

User-Friendly Software Options for UKMs

Several user-friendly software options cater specifically to the needs of UKMs. Xero, for example, is known for its intuitive interface and robust features, making it a popular choice among small businesses. QuickBooks offers a range of plans to suit different business sizes and needs, providing a comprehensive solution for financial management. FreshBooks is another strong contender, particularly well-regarded for its ease of use in invoicing and expense tracking. These platforms often integrate seamlessly with other business tools, creating a streamlined workflow. Many offer mobile apps, allowing you to manage your finances on the go – perfect for those impromptu coffee shop brainstorming sessions.

Streamlining Financial Processes with Technology

Technology streamlines various financial processes, significantly boosting efficiency. Automated invoice generation and payment processing reduce manual work and potential errors. Real-time dashboards provide instant access to key financial metrics, allowing for proactive monitoring and adjustments. Automated bank reconciliation minimizes the time spent on manual reconciliation, reducing the risk of discrepancies. Furthermore, cloud-based solutions offer accessibility from anywhere with an internet connection, facilitating collaboration and improving overall workflow. This integrated approach transforms financial management from a tedious chore into a dynamic and insightful process.

Comparison of Financial Management Software Options

The best software for your UKM depends on your specific needs and budget. Consider factors like the number of users, required features, and integration capabilities.

| Software | Pricing | Key Features | Ease of Use | Integration |

|---|---|---|---|---|

| Xero | Subscription-based, varying plans | Invoicing, expense tracking, bank reconciliation, reporting | High | Many third-party apps |

| QuickBooks | Subscription-based, varying plans | Invoicing, expense tracking, payroll, inventory management | Medium-High | Many third-party apps |

| FreshBooks | Subscription-based, varying plans | Invoicing, expense tracking, time tracking, client management | High | Limited compared to Xero and QuickBooks |

Closure

Mastering Financial Planning untuk UKM isn’t about becoming a financial wizard overnight; it’s about adopting a proactive and informed approach to your finances. By understanding your unique needs, implementing effective strategies, and consistently monitoring your performance, you can steer your UKM towards sustainable growth and long-term success. Remember, a well-planned financial future is the cornerstone of a thriving business – and who doesn’t want a thriving business? It’s basically the entrepreneurial equivalent of winning a giant, delicious cupcake.

Essential FAQs

What if my UKM experiences unexpected losses?

Develop contingency plans! This involves identifying potential risks (e.g., supply chain disruptions, economic downturns) and creating strategies to mitigate their impact. This might include having emergency funds or exploring alternative revenue streams.

How often should I review my financial plan?

Regularly! At least monthly, preferably quarterly, to ensure your budget aligns with reality. Adjust as needed; financial planning isn’t a set-it-and-forget-it kind of thing.

Where can I find reliable financial advice specific to Indonesian UKMs?

Seek advice from reputable financial consultants specializing in Indonesian small and medium-sized enterprises. Government resources and business incubators can also offer valuable support and guidance.