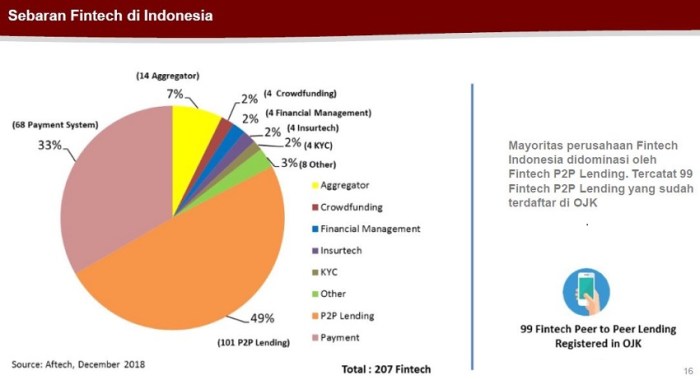

Financial Technology Trends Indonesia: Prepare yourselves for a whirlwind tour of Indonesia’s rapidly evolving fintech landscape! From the dizzying heights of digital payment systems to the slightly less dizzying (but still exciting) world of peer-to-peer lending, we’re diving headfirst into a market bursting with innovation, regulation, and enough acronyms to make your head spin. Buckle up, it’s going to be a wild ride!

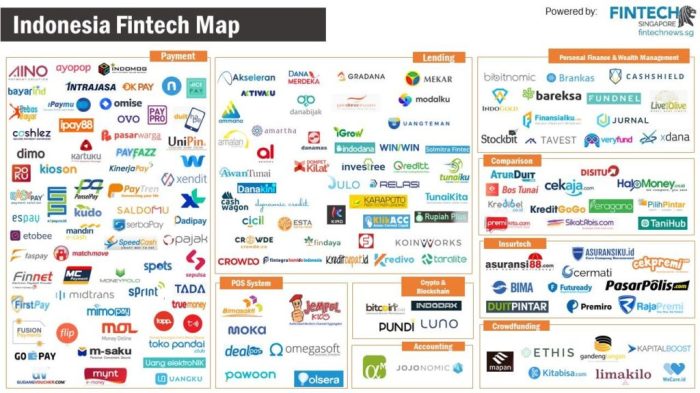

This exploration will examine the key drivers shaping Indonesia’s fintech revolution, including the explosive growth of e-wallets, the rise of insurtech, and the intriguing potential of blockchain technology. We’ll also delve into the regulatory challenges and opportunities that define this dynamic sector, painting a picture of both the triumphs and tribulations of Indonesia’s financial tech journey. Get ready to be amazed (and maybe slightly bewildered) by the sheer scale and speed of this transformation.

Digital Payments in Indonesia

Indonesia’s digital payment landscape is a vibrant, chaotic, and frankly, hilarious spectacle. Imagine a bustling marketplace where everyone’s using a different app to pay for their *nasi goreng*, and the vendors are juggling more QR codes than a magician has rabbits. That’s the reality of Indonesian digital finance – a rollercoaster of innovation, regulation, and sheer, unadulterated enthusiasm.

The growth of digital payments in Indonesia is nothing short of phenomenal, fueled by a young, tech-savvy population and a government pushing for financial inclusion. This rapid expansion has created a fiercely competitive market, with established players battling newcomers for a slice of the pie – a very large, delicious, and increasingly digital pie.

The Current Landscape of Digital Payment Methods

Indonesia’s digital payment ecosystem is a fascinating mix of established players and disruptive newcomers. E-wallets dominate the scene, with mobile banking rapidly gaining ground. Other emerging technologies, such as biometric authentication and blockchain-based solutions, are also starting to make their mark, albeit more cautiously.

Major Players in the Indonesian Digital Payment Market

The following table provides a snapshot of some key players, though the market is incredibly dynamic and rankings shift frequently. Consider this a glimpse into a rapidly evolving ecosystem, not a definitive statement etched in stone.

| Company | Market Share (Estimate) | Key Features | Target Demographics |

|---|---|---|---|

| GoPay (Gojek) | ~30% (estimated) | Wide acceptance, integrated with Gojek’s super app, various payment options, rewards programs. | Broad demographic, particularly strong among younger users and frequent Gojek users. |

| OVO | ~20% (estimated) | Strong partnerships, wide merchant network, integration with Tokopedia (e-commerce platform), cashback offers. | Broad demographic, with significant traction among online shoppers and Tokopedia users. |

| Dana | ~15% (estimated) | Focus on ease of use, competitive fees, partnerships with various businesses, peer-to-peer transfers. | Broad demographic, particularly appealing to users seeking simplicity and affordability. |

| LinkAja | ~10% (estimated) | Government-backed, wide acceptance, focus on interoperability, various bill payment options. | Broad demographic, with a focus on reaching underserved populations. |

Note: Market share estimates are approximate and fluctuate constantly. The competitive landscape is extremely dynamic.

The Regulatory Environment and its Impact on Innovation

Indonesia’s government actively regulates the digital payment sector to ensure consumer protection, prevent fraud, and promote financial stability. This regulatory framework, while necessary, can sometimes stifle innovation. The balancing act between fostering growth and maintaining control is a constant challenge for policymakers. Think of it as a high-wire act performed by a troupe of very serious, yet slightly clumsy, orangutans.

Challenges and Opportunities in the Indonesian Digital Payment Sector

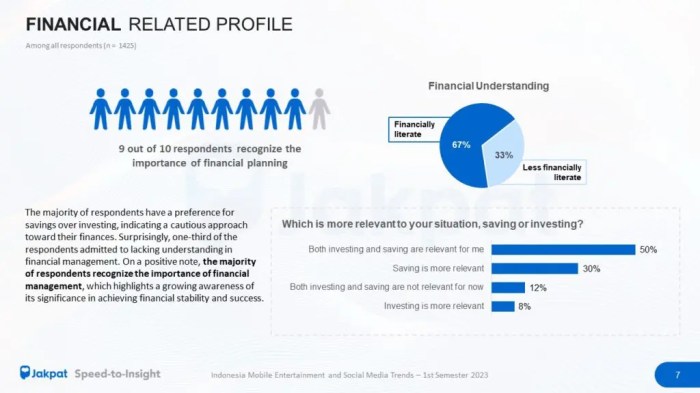

The digital payment sector in Indonesia faces a number of challenges, including the need for improved financial literacy, concerns about data security, and the persistent presence of cash transactions. However, the opportunities are equally significant. The potential for further growth, particularly in underserved areas, is immense. The rise of super apps, the integration of fintech with other sectors, and the adoption of new technologies present exciting avenues for expansion.

Fintech Lending and Borrowing

Indonesia’s fintech lending scene is a rollercoaster – a thrilling ride with breathtaking views and the occasional stomach-churning drop. It’s a vibrant sector experiencing explosive growth, fueled by increasing smartphone penetration and a burgeoning demand for accessible credit. But, like any fast-paced adventure, it comes with its share of risks and regulatory hurdles. This section will delve into the fascinating world of P2P lending in Indonesia, exploring its key players, inherent benefits and drawbacks, and the regulatory landscape attempting to keep everything on track.

Peer-to-peer (P2P) lending platforms have dramatically altered the Indonesian financial landscape, offering an alternative to traditional banking for both borrowers and lenders. These platforms connect individuals seeking loans directly with those willing to provide funds, cutting out the middleman (and often, the hefty fees). This has opened up credit access to previously underserved populations, particularly small and medium-sized enterprises (SMEs) and individuals with limited access to traditional banking services. However, this increased access isn’t without its challenges, which we’ll explore further.

Key Players in Indonesian P2P Lending

The Indonesian P2P lending market boasts a diverse range of platforms, each with its unique approach and target audience. Understanding their business models provides insight into the sector’s overall dynamics. Here are five key players, showcasing the variety within the industry:

- Investree: Focusing on SME lending, Investree utilizes a robust credit scoring system and offers various loan products tailored to specific business needs. Their business model relies on attracting investors seeking relatively high returns and connecting them with creditworthy SMEs.

- Modal Rakyat: This platform specializes in micro-loans, targeting individuals and small businesses with limited access to traditional financing. Their model emphasizes accessibility and ease of use, with a streamlined application process and quick disbursement of funds.

- Amartha: Amartha distinguishes itself through its focus on empowering women entrepreneurs in rural areas. Their model combines technology with a strong community-based approach, providing borrowers with mentorship and support beyond just financial assistance.

- KoinWorks: KoinWorks offers a broader range of financial products, including P2P lending, investment options, and wealth management services. Their business model is built on diversification, aiming to cater to a wider spectrum of users with varying financial needs.

- Akseleran: This platform concentrates on providing financing to SMEs, leveraging technology to streamline the lending process and reduce risk. Their business model emphasizes efficient risk assessment and transparent communication between borrowers and lenders.

Risks and Benefits of Fintech Lending

Fintech lending presents a double-edged sword, offering significant advantages but also carrying considerable risks. For borrowers, the ease of access and speed of loan approval are major attractions. However, high-interest rates and stringent repayment terms can trap borrowers in a cycle of debt if not managed carefully. For lenders, the potential for high returns is alluring, but the risk of default and the complexity of evaluating borrower creditworthiness are significant concerns. A balanced understanding of both sides is crucial.

Regulatory Framework for Fintech Lending in Indonesia

The Indonesian government has implemented regulations aimed at fostering innovation while protecting consumers. The overarching goal is to create a level playing field and prevent predatory lending practices. The effectiveness of these regulations is an ongoing debate, with ongoing efforts to refine and strengthen the framework to address emerging challenges. While the intention is laudable, the speed of innovation often outpaces the regulatory response, necessitating a dynamic and adaptable approach to supervision.

Insurtech in Indonesia

Indonesia’s insurtech scene is exploding – less like a gentle simmer and more like a volcano erupting delicious, profitable lava cakes. The traditional insurance model is, shall we say, *undergoing a transformation*. This isn’t your grandpappy’s insurance policy anymore (unless your grandpappy is a forward-thinking tech mogul, in which case, hats off to him!). Let’s delve into the exciting changes reshaping the Indonesian insurance landscape.

Major Trends Shaping the Indonesian Insurtech Sector

The Indonesian insurtech market is dynamic, brimming with innovative approaches that are both disruptive and, dare we say, delightful. Several key trends are driving this rapid evolution. These aren’t just trends; they’re the tectonic plates shifting the very foundation of the insurance industry.

- Increased Smartphone Penetration and Digital Literacy: Indonesia’s booming smartphone usage is fueling the adoption of digital insurance platforms. More people are comfortable managing their finances and insurance needs online, leading to a surge in digital insurance sales. This isn’t just about convenience; it’s about accessibility for millions previously excluded from traditional insurance networks.

- Government Support and Regulatory Frameworks: The Indonesian government is actively promoting fintech, including insurtech, through supportive regulations and initiatives. This proactive approach fosters innovation and attracts investment, further accelerating the sector’s growth. Think of it as the government giving insurtech a big, enthusiastic thumbs-up.

- Rise of Embedded Insurance: This clever approach seamlessly integrates insurance products into other platforms and services. Imagine buying insurance alongside your online shopping or ride-hailing app. It’s convenience redefined, and it’s making insurance far less of a chore.

- Microinsurance and Inclusive Solutions: Insurtech is extending insurance coverage to underserved populations, offering affordable microinsurance products tailored to their specific needs. This is about financial inclusion, ensuring that everyone, regardless of income, can access the protection they need.

- Data Analytics and AI-Driven Solutions: Insurtech companies are leveraging data analytics and artificial intelligence to improve risk assessment, personalize products, and enhance customer experience. Think of it as insurance getting a serious upgrade, powered by smart algorithms and data-driven insights.

Comparison of Traditional Insurance and Insurtech Solutions, Financial Technology Trends Indonesia

Let’s face it, traditional insurance often feels like navigating a labyrinth blindfolded. Insurtech, on the other hand, offers a much brighter, more streamlined path.

| Feature | Traditional Insurance | Insurtech Solutions |

|---|---|---|

| Accessibility | Limited, often requiring physical visits and paperwork. | Wide reach, accessible via smartphones and online platforms. |

| Affordability | Can be expensive, especially for low-income individuals. | Offers more affordable options, including microinsurance. |

| Efficiency | Slow and bureaucratic processes, often involving lengthy claim settlements. | Faster and more efficient processes, often with automated claims handling. |

Hypothetical Insurtech Product for Underserved Segments

Imagine “Go-Aman,” an insurtech product designed for Indonesian motorbike taxi drivers (ojek) using the Gojek platform. This microinsurance policy would offer affordable coverage for accidents and theft, payable through easy mobile money transactions. Features would include: instant policy activation via the Gojek app, automated claims processing using GPS data and photographic evidence, and personalized premium adjustments based on driving behavior. The benefit? Peace of mind for ojek drivers, a crucial component in their already demanding work. It’s not just insurance; it’s a safety net, cleverly woven into their daily routine.

Blockchain and Cryptocurrency in Indonesia: Financial Technology Trends Indonesia

Indonesia’s relationship with blockchain and cryptocurrency is a rollercoaster ride of potential and regulation – a bit like trying to navigate Jakarta traffic on a scooter. While the government is cautiously optimistic about blockchain’s potential, the cryptocurrency space remains a subject of ongoing scrutiny and evolving rules. This makes it a fascinating case study in how a developing nation grapples with emerging technologies.

The adoption of cryptocurrencies in Indonesia has seen significant growth, fueled by a young, tech-savvy population and a desire for alternative financial tools. However, this growth has been accompanied by regulatory challenges, with the government striving to balance innovation with the need to protect consumers and maintain financial stability. Think of it as a delicate dance between embracing the future and keeping a firm grip on the present.

Regulatory Landscape of Blockchain and Cryptocurrency

Indonesia’s approach to cryptocurrency regulation is a work in progress, marked by a series of pronouncements and evolving guidelines. The government acknowledges the potential benefits of blockchain technology while maintaining a cautious stance on cryptocurrencies, viewing them with a mixture of fascination and apprehension. This approach reflects a global trend, with many countries grappling with how to regulate this rapidly evolving space. The Indonesian government is currently focusing on establishing clear guidelines to manage risks and prevent illicit activities associated with cryptocurrencies, such as money laundering and tax evasion. This regulatory framework aims to create a more predictable and secure environment for both investors and businesses involved in the cryptocurrency ecosystem, hoping to avoid a crypto-wild west scenario.

Blockchain Applications Beyond Cryptocurrency

While cryptocurrencies grab the headlines, the real power of blockchain might lie in its broader applications within the Indonesian financial sector. Imagine a supply chain for Indonesian coffee beans, tracked transparently and securely on a blockchain, eliminating counterfeiting and ensuring fair pricing for farmers. Or picture cross-border remittances, streamlined and cost-effective thanks to blockchain’s efficiency. These are not mere pipe dreams; several Indonesian companies are already exploring these possibilities, leveraging blockchain’s inherent security and transparency to improve efficiency and trust in various sectors. For instance, blockchain could revolutionize land registry, providing an immutable record of land ownership and preventing fraudulent transactions – a significant issue in many developing nations. This technology could also transform the Indonesian microfinance sector, making it more accessible and transparent for borrowers.

Challenges and Opportunities of Blockchain Integration

Integrating blockchain technology into Indonesia’s existing financial infrastructure presents both significant challenges and exciting opportunities. One major hurdle is the need for widespread digital literacy and infrastructure development. Not everyone has access to the technology needed to participate in a blockchain-based system. Furthermore, regulatory clarity and standardization are crucial to fostering trust and encouraging wider adoption. The government needs to strike a balance between promoting innovation and mitigating risks, fostering a supportive ecosystem without compromising financial stability. However, the potential rewards are immense. By embracing blockchain, Indonesia could leapfrog traditional financial systems, creating a more efficient, transparent, and inclusive financial landscape. This could lead to significant economic growth and improved financial inclusion for millions of Indonesians.

Financial Inclusion and Fintech

Indonesia’s sprawling archipelago, with its vibrant mix of urban centers and remote villages, presents a unique challenge and opportunity for financial inclusion. While traditional banking struggles to reach the furthest corners of the nation, fintech solutions are rapidly bridging the gap, bringing financial services to previously underserved populations. This is not just about convenience; it’s about empowering individuals and fostering economic growth across the entire country. The impact is nothing short of revolutionary, transforming lives and boosting Indonesia’s economic potential.

Fintech solutions are significantly boosting financial inclusion in Indonesia, particularly in rural areas. Mobile money platforms, digital lending services, and agent banking networks are proving incredibly effective in reaching individuals who previously lacked access to formal financial services. This increased access translates to improved livelihoods, greater economic participation, and a more robust national economy. The speed and efficiency of these fintech solutions are also a game changer, offering services that are faster, cheaper, and more accessible than traditional methods.

Fintech Initiatives and their Impact on Financial Inclusion

The following table summarizes the impact of three specific fintech initiatives on key financial inclusion metrics. While precise figures are often difficult to obtain due to the dynamic nature of the market, the overall trend is undeniably positive. It’s like watching a financial domino effect, with one positive change leading to many others.

| Fintech Initiative | Metric | Impact | Example/Source (Illustrative) |

|---|---|---|---|

| Mobile Money (e.g., GoPay, OVO) | Account Ownership | Significant increase in account ownership, particularly in rural areas. | Reports from the Indonesian Financial Services Authority (OJK) showing a surge in e-wallet usage in underserved regions. Specific numbers are difficult to pinpoint due to the rapidly evolving landscape. |

| Digital Lending Platforms (e.g., Akulaku, Kredivo) | Access to Credit | Expanded access to credit for small businesses and individuals previously excluded from traditional lending. | Anecdotal evidence of increased entrepreneurial activity in rural areas fueled by accessible microloans. Quantitative data is often proprietary to the lending platforms. |

| Agent Banking Networks (e.g., various banks partnering with local agents) | Financial Service Accessibility | Extended reach of banking services to remote villages through local agents. | Expansion of ATM and cash-in/cash-out points in previously unbanked areas, often cited in press releases from major banks and their agent networks. Precise coverage maps are generally not publicly available. |

Remaining Barriers to Financial Inclusion and Fintech Solutions

Despite significant progress, challenges remain. Digital literacy, internet connectivity, and trust in digital platforms are key obstacles. Furthermore, regulatory frameworks need to keep pace with the rapid innovation in the fintech sector. This isn’t a race, but a collaborative effort requiring continuous improvement and adaptation.

Fintech can address these challenges. Investing in digital literacy programs can empower individuals to confidently use financial technology. Expanding internet infrastructure, particularly in rural areas, is crucial for broader access. Building trust through robust security measures and transparent operations is paramount. Finally, a supportive and agile regulatory environment can foster innovation while protecting consumers.

Geographical Distribution of Fintech Adoption in Indonesia

Imagine a map of Indonesia. The major cities like Jakarta, Surabaya, and Medan would blaze brightly, representing high fintech penetration. These areas benefit from robust infrastructure and a higher level of digital literacy. As you move towards the outer islands and more remote villages, the intensity of the light dims, indicating lower adoption rates. These areas often suffer from limited internet access and lower digital literacy. However, even in these less brightly lit areas, small pockets of fintech activity are emerging, demonstrating the gradual but steady expansion of financial services across the archipelago. The map’s overall appearance is one of vibrant hubs connected by gradually brightening lines, symbolizing the ongoing progress of financial inclusion through fintech.

Final Conclusion

Indonesia’s fintech sector isn’t just a story of technological advancement; it’s a narrative of financial inclusion, economic empowerment, and a nation embracing the future with open arms (and maybe a few nervous glances at the regulatory fine print). While challenges remain, the dynamism and innovation showcased across digital payments, lending, insurtech, and blockchain applications promise a future where financial services are more accessible, efficient, and ultimately, more fun. So, stay tuned – the best is yet to come from this exciting corner of the world!

Frequently Asked Questions

What are the biggest risks associated with Indonesian P2P lending?

The primary risks include default rates, fraud, and the potential for predatory lending practices. Regulatory oversight is crucial to mitigating these risks.

How is the Indonesian government promoting fintech adoption?

The government actively supports fintech through initiatives like regulatory frameworks designed to foster innovation while protecting consumers, and by investing in digital infrastructure.

What role does mobile penetration play in Indonesia’s fintech boom?

High mobile phone penetration is a critical enabler, providing the infrastructure for widespread adoption of mobile banking and e-wallet services.