The financial technology (Fintech) landscape is rapidly evolving, driven by technological advancements and changing consumer expectations. This exploration delves into a range of innovative applications across various sectors, from streamlined payment systems to sophisticated investment platforms. We’ll examine the impact of these innovations on financial inclusion, security, and the overall efficiency of financial markets. The examples showcased highlight both the transformative potential and the inherent challenges of Fintech.

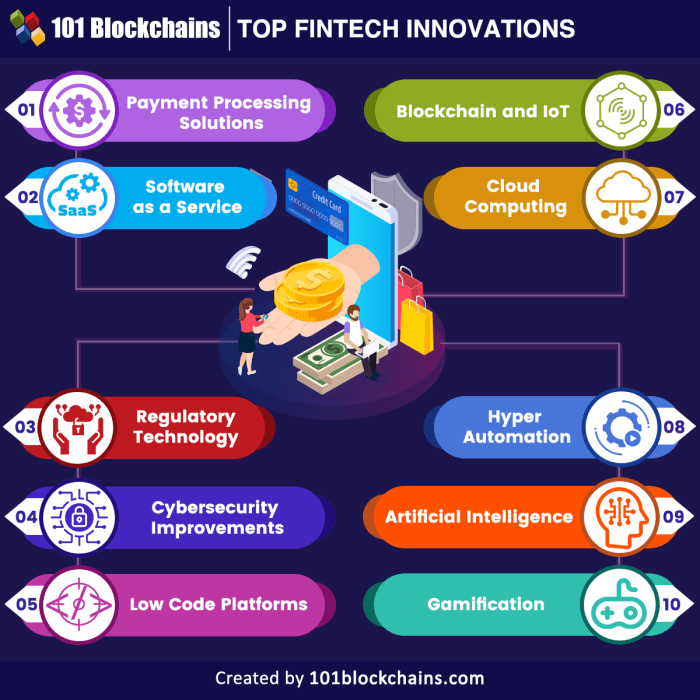

From the rise of mobile payments and the integration of artificial intelligence in credit scoring to the disruptive power of blockchain in lending and investment, we’ll unpack the key trends and their implications for individuals, businesses, and regulators alike. This analysis aims to provide a comprehensive overview of current Fintech innovations and their potential to reshape the future of finance.

Payment Technologies

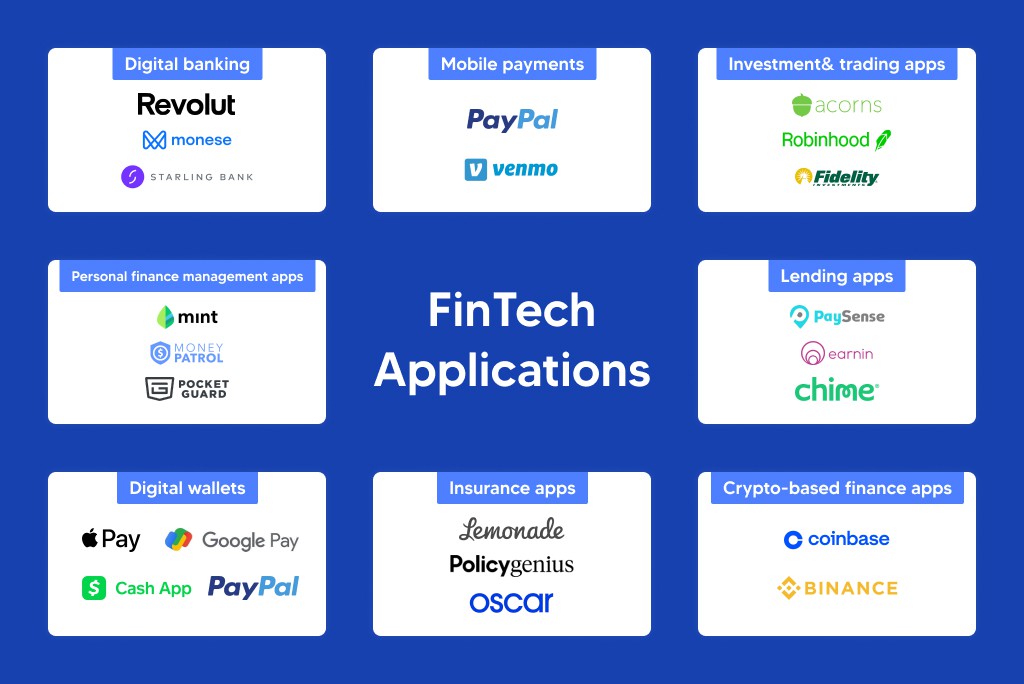

The rapid advancement of payment technologies has revolutionized how we conduct financial transactions, significantly impacting both businesses and consumers. This section explores key aspects of this evolution, focusing on mobile payments, biometric authentication, P2P security, and the design of innovative payment applications.

Mobile Payment Systems and Financial Inclusion

The rise of mobile payment systems has dramatically expanded financial inclusion, particularly in underserved communities. Early systems relied on SMS-based transactions, offering a basic level of digital payment capability. The subsequent introduction of mobile wallets, integrated with smartphones and utilizing near-field communication (NFC) technology, enabled faster and more secure transactions. This has allowed individuals without traditional bank accounts to participate in the formal economy, facilitating access to essential services and fostering economic growth. The impact is particularly visible in developing countries where mobile penetration often surpasses traditional banking infrastructure. For example, the success of M-Pesa in Kenya demonstrates the transformative potential of mobile money in enabling financial inclusion.

Biometric Authentication Methods in Fintech

Several biometric authentication methods are employed in fintech applications to enhance security and user experience. These include fingerprint scanning, facial recognition, and voice recognition. Fingerprint scanning, while widely adopted, is susceptible to spoofing if a high-quality replica is used. Facial recognition, although convenient, raises concerns about data privacy and potential biases in recognition algorithms. Voice recognition offers a unique approach but can be affected by background noise and variations in the user’s voice. Each method presents a trade-off between convenience, security, and privacy considerations. The selection of the most appropriate method often depends on the specific application and risk tolerance.

Security Protocols in Peer-to-Peer (P2P) Payment Platforms

Peer-to-peer (P2P) payment platforms rely on robust security protocols to protect user funds and prevent fraud. These typically involve encryption of transaction data during transmission, multi-factor authentication to verify user identities, and fraud detection systems that analyze transaction patterns to identify suspicious activity. Many platforms also employ advanced technologies like tokenization, replacing sensitive card details with unique tokens to reduce the risk of data breaches. Furthermore, robust Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance measures are crucial in preventing illicit activities. For example, platforms often utilize machine learning algorithms to identify and flag potentially fraudulent transactions in real-time.

User Interface Design for an Augmented Reality Payment App

A novel payment application incorporating augmented reality (AR) could utilize the user’s smartphone camera to overlay digital information onto the real world. The user interface could display a real-time view of their surroundings, with interactive elements highlighting nearby merchants accepting the app’s payment method. Pointing the camera at a product in a store could display pricing and payment options directly on the screen. The payment process itself could be initiated with a simple gesture or voice command. A visual confirmation of the transaction could be displayed as an AR overlay, enhancing the user experience and providing immediate feedback. This could also include loyalty points or promotional offers displayed as AR overlays, further incentivizing app usage.

Comparative Table of Contactless Payment Methods

| Payment Method | Advantages | Disadvantages | Security Features |

|---|---|---|---|

| Near Field Communication (NFC) | Fast, convenient, widely accepted | Requires NFC-enabled devices, potential for skimming | Tokenization, encryption |

| Quick Response (QR) Codes | Widely compatible, low cost for merchants | Requires internet connectivity, potential for QR code manipulation | Encryption, secure server-side processing |

| Bluetooth Low Energy (BLE) | Low power consumption, secure connection | Limited range, requires BLE-enabled devices | Encryption, authentication protocols |

| Biometric Payment | Enhanced security, convenient authentication | Privacy concerns, potential for biometric data breaches | Multi-factor authentication, biometric data encryption |

Lending and Borrowing

The fintech revolution has significantly impacted the lending and borrowing landscape, offering consumers and businesses more accessible and efficient options than ever before. This shift is driven by technological advancements in areas like artificial intelligence, blockchain, and online platforms, leading to both innovative solutions and new regulatory challenges.

Artificial Intelligence in Credit Scoring and Risk Assessment

Artificial intelligence (AI) is transforming credit scoring and risk assessment by analyzing vast datasets to predict borrower behavior more accurately than traditional methods. AI algorithms can process alternative data sources, such as social media activity, online purchase history, and mobile phone usage patterns, to create a more comprehensive credit profile. This allows lenders to assess the creditworthiness of individuals who may be underserved by traditional credit scoring systems, expanding access to credit for a wider population. Moreover, AI can automate the loan application process, speeding up approval times and reducing operational costs for lenders. For instance, some lenders use AI to identify patterns indicative of fraud, minimizing losses from bad loans.

Innovative Lending Platforms Utilizing Blockchain Technology

Blockchain technology offers several potential advantages for lending platforms. Its decentralized and transparent nature can enhance security and reduce fraud. Smart contracts, self-executing contracts with the terms of the agreement between buyer and seller being directly written into lines of code, can automate loan disbursement and repayment, streamlining the process and reducing administrative overhead. Examples of innovative applications include platforms that facilitate peer-to-peer lending using blockchain to ensure secure and transparent transactions. These platforms often utilize tokens or cryptocurrencies for loan origination and repayment, creating a more efficient and potentially lower-cost system compared to traditional banking channels. However, scalability and regulatory uncertainty remain significant challenges for widespread adoption.

Benefits and Challenges of Crowdfunding and Peer-to-Peer Lending

Crowdfunding and peer-to-peer (P2P) lending platforms connect borrowers directly with lenders, bypassing traditional financial intermediaries. Benefits include increased access to capital for borrowers, potentially lower interest rates, and diversified investment opportunities for lenders. Challenges include higher risk for lenders due to the lack of traditional credit checks and the potential for defaults. Regulatory frameworks are still evolving, leading to uncertainty and inconsistent protection for both borrowers and lenders. For example, platforms need to carefully manage risk by implementing robust verification processes and providing adequate information to investors to mitigate the risks associated with this form of lending.

Regulatory Landscape Surrounding Online Lending and its Impact on Innovation

The regulatory landscape surrounding online lending is complex and varies across jurisdictions. Regulations aim to protect consumers from predatory lending practices, ensure data privacy, and maintain financial stability. While regulations are necessary to protect consumers, overly stringent rules can stifle innovation and limit access to credit for underserved populations. A balanced approach is needed to foster innovation while safeguarding consumer interests. The ongoing evolution of regulations necessitates a dynamic approach from both fintech companies and regulators to ensure a healthy and sustainable online lending ecosystem.

Obtaining a Loan Through a Robo-Advisor Platform

Flowchart Description: The flowchart begins with the user initiating a loan application on the robo-advisor platform. The platform then collects necessary data, including financial information and credit history. This data is processed by the AI-powered risk assessment engine. Based on the assessment, the platform either approves or denies the loan application. If approved, the loan terms are presented to the user. Upon acceptance, the funds are disbursed to the user’s account. The repayment schedule is automatically generated and tracked by the platform. Throughout the process, the user receives regular updates and communication from the platform.

Investment and Wealth Management

The intersection of finance and technology has revolutionized investment and wealth management, offering investors a wider array of tools and opportunities than ever before. Fintech innovations are reshaping how individuals and institutions approach portfolio construction, risk management, and overall financial planning. This section explores some key aspects of this transformation.

Algorithmic Trading and Market Efficiency

Algorithmic trading, or automated trading, employs computer programs to execute trades based on pre-defined parameters. These algorithms analyze vast quantities of market data, identifying patterns and executing trades at speeds far exceeding human capabilities. The impact on market efficiency is significant; proponents argue that algorithmic trading increases liquidity, reduces transaction costs, and enhances price discovery by constantly adjusting prices based on real-time information. However, critics raise concerns about the potential for increased market volatility due to the speed and scale of algorithmic trading, as well as the possibility of flash crashes triggered by cascading automated sell-offs. The debate continues regarding the net effect on market stability and fairness.

Robo-Advisors and Investor Suitability

Robo-advisors are automated portfolio management services that provide algorithm-driven investment advice and portfolio construction. Key features include low fees, diversification strategies, and tax-loss harvesting. Robo-advisors are particularly well-suited for investors with smaller portfolios, those who prefer passive investment strategies, and individuals seeking low-cost, automated portfolio management. However, they may not be suitable for investors with complex financial needs, high-net-worth individuals requiring personalized advice, or those seeking active trading strategies. The level of customization offered varies across platforms, and investors should carefully consider their individual circumstances before selecting a robo-advisor.

Traditional Investment Platforms vs. Fintech Platforms

Traditional investment platforms, often associated with brick-and-mortar brokerage firms, typically involve higher fees, limited online access, and less personalized service. In contrast, fintech investment platforms offer lower fees, user-friendly interfaces, mobile accessibility, and often incorporate advanced features like fractional shares and automated investing tools. The choice between the two depends on individual preferences and financial goals. Traditional platforms might appeal to investors seeking in-person advice and a more established presence, while fintech platforms attract those prioritizing cost-effectiveness, technology, and convenience.

Security Measures in Online Brokerage Platforms

Online brokerage platforms employ various security measures to protect user assets. These typically include multi-factor authentication, encryption of sensitive data, robust firewalls, and regular security audits. Many platforms also offer features like account alerts, transaction monitoring, and fraud detection systems to help identify and prevent unauthorized access or fraudulent activities. However, it’s crucial for investors to maintain good security practices, such as using strong passwords, avoiding phishing scams, and regularly reviewing their account statements. The level of security offered can vary between platforms, and investors should research the security measures of any platform before entrusting their funds.

Advantages and Disadvantages of Investing in Cryptocurrencies

The cryptocurrency market presents both significant opportunities and considerable risks. Before investing, it is vital to understand both sides.

- Advantages:

- Potential for high returns: Cryptocurrencies have historically demonstrated periods of rapid price appreciation.

- Decentralization: Cryptocurrencies operate outside traditional financial institutions, offering potential benefits in terms of autonomy and accessibility.

- Technological innovation: The underlying blockchain technology has the potential to disrupt various industries.

- Disadvantages:

- High volatility: Cryptocurrency prices are notoriously volatile, subject to significant price swings in short periods.

- Regulatory uncertainty: The regulatory landscape for cryptocurrencies is still evolving and varies across jurisdictions.

- Security risks: Cryptocurrency exchanges and wallets are potential targets for hacking and theft.

- Lack of intrinsic value: Unlike traditional assets, cryptocurrencies lack inherent value backed by physical assets or government guarantees.

Insurance Technology (Insurtech)

Insurtech represents a significant transformation within the insurance industry, leveraging technological advancements to enhance efficiency, personalize offerings, and improve the overall customer experience. This section explores key aspects of Insurtech, focusing on its applications and ethical considerations.

Telematics in Auto Insurance and Risk Assessment

Telematics, the use of technology to collect and transmit data from vehicles, has revolutionized auto insurance. By integrating devices into vehicles or utilizing smartphone apps, insurers gather data on driving behavior, such as speed, acceleration, braking, and mileage. This data allows for a more accurate assessment of risk, leading to personalized premiums. Drivers with safer driving habits are rewarded with lower premiums, while high-risk drivers may face higher premiums. This system promotes safer driving and fairer pricing, moving away from traditional methods that rely heavily on broad demographic data. For example, a driver consistently maintaining a low speed and avoiding harsh braking would likely receive a lower premium compared to a driver exhibiting erratic driving patterns.

Innovative Insurance Products Leveraging Data Analytics and Machine Learning

Data analytics and machine learning are transforming product development in the insurance sector. Insurers are using these technologies to create highly customized products tailored to individual needs and risk profiles. For example, micro-insurance products, offering small, affordable policies for specific risks, are becoming increasingly prevalent. Machine learning algorithms analyze vast datasets to identify patterns and predict risks more accurately, enabling the creation of more precise and efficient insurance models. Predictive modeling, for instance, allows insurers to anticipate claims and proactively manage risks, leading to improved loss ratios and better financial performance.

Benefits and Challenges of Using Blockchain Technology in Claims Processing

Blockchain technology offers the potential to streamline and secure claims processing. Its decentralized and transparent nature can reduce fraud and improve efficiency by creating an immutable record of claims. The benefits include faster processing times, reduced administrative costs, and increased transparency for both insurers and policyholders. However, challenges remain, including the scalability of blockchain technology for handling large volumes of claims data, the need for widespread industry adoption, and regulatory uncertainties surrounding its implementation. Successfully integrating blockchain requires careful consideration of these hurdles.

Ethical Considerations Surrounding the Use of Personal Data in Insurance Underwriting

The use of personal data in insurance underwriting raises important ethical considerations. Insurers collect vast amounts of data, including driving records, health information, and even social media activity. It’s crucial to ensure data privacy and security, while also maintaining transparency about how this data is used. The potential for bias in algorithms and the risk of discrimination based on personal characteristics need careful attention. Robust data governance frameworks and ethical guidelines are essential to mitigate these risks and build trust with customers. Regulations like GDPR in Europe are setting standards for data protection in the insurance industry.

Workflow of a Fully Automated Claims Process in an Insurtech Company

Imagine a scenario where a car accident occurs. The driver uses a mobile app to report the incident, automatically uploading photos and location data. The app’s AI instantly assesses the damage based on the images and GPS coordinates. The system automatically verifies the policy details and initiates the claims process. A pre-approved repair shop is identified based on location and the type of damage. The repair is scheduled, and payment is automatically processed upon completion. The entire process, from reporting the accident to receiving compensation, occurs without any human intervention, significantly reducing processing time and enhancing customer satisfaction. This is a visual representation of a fully automated claims process.

Financial Inclusion and Accessibility

Fintech’s transformative potential extends significantly to bridging the financial inclusion gap, empowering underserved populations globally with access to essential financial services. This section explores the multifaceted impact of fintech on financial inclusion, encompassing mobile banking’s expansion, financial literacy initiatives, the challenges and opportunities in serving the unbanked, the role of government regulation, and a hypothetical microfinance platform design.

Mobile Banking’s Expansion of Access to Financial Services in Underserved Communities

Mobile banking has revolutionized access to financial services, particularly in underserved communities lacking traditional banking infrastructure. The ubiquity of mobile phones, even in remote areas, provides a readily available platform for basic banking transactions, including deposits, withdrawals, and money transfers. This bypasses the need for physical bank branches, significantly reducing barriers to entry for individuals and businesses previously excluded from the formal financial system. Examples include M-Pesa in Kenya, which has dramatically increased financial inclusion, and similar mobile money systems across Africa and Asia. These systems have empowered individuals to participate in the formal economy, fostering economic growth and improving livelihoods.

Financial Literacy and Education Initiatives

Several fintech initiatives actively promote financial literacy and education, crucial for empowering individuals to effectively utilize financial services. These initiatives often employ digital platforms to deliver accessible and engaging financial education materials, including online courses, interactive tools, and personalized financial planning guidance. For instance, some organizations provide tailored financial literacy programs for specific demographics, such as women entrepreneurs or low-income households. These programs frequently incorporate practical skills training, budgeting tools, and savings strategies to enhance financial capability and responsible financial decision-making. The widespread availability of such resources via smartphones and other digital channels contributes significantly to increased financial literacy levels.

Challenges and Opportunities in Serving Unbanked Populations

Serving unbanked populations presents unique challenges and opportunities. Challenges include limited digital literacy, infrastructure gaps in internet and mobile network access, and concerns about data security and privacy. However, opportunities abound in leveraging fintech to deliver tailored financial solutions, addressing specific needs and contexts. This includes developing user-friendly interfaces for individuals with low digital literacy, offering financial products designed for specific income levels and needs, and implementing robust security measures to build trust and confidence. The successful integration of fintech solutions requires careful consideration of local contexts, cultural nuances, and regulatory frameworks.

The Role of Government Regulations in Fostering Financial Inclusion Through Fintech

Government regulations play a vital role in fostering financial inclusion through fintech. Appropriate regulatory frameworks can encourage innovation while mitigating risks, ensuring consumer protection, and promoting fair competition. Regulations can address issues such as data privacy, cybersecurity, and anti-money laundering, creating a safe and secure environment for both consumers and fintech companies. Conversely, overly restrictive regulations can stifle innovation and limit access to financial services. A balanced approach that fosters innovation while protecting consumers is essential for maximizing the positive impact of fintech on financial inclusion. Examples include governments offering tax incentives to fintech companies targeting unbanked populations or creating regulatory sandboxes to allow for experimentation with new financial technologies.

Hypothetical Microfinance Platform for Small Business Owners in Developing Countries

This hypothetical microfinance platform, “EmpowerBiz,” targets small business owners in developing countries. Key features include a user-friendly mobile application supporting multiple local languages, facilitating loan applications, repayment tracking, and financial management tools. The platform incorporates credit scoring models adapted to the unique contexts of developing countries, utilizing alternative data sources like mobile money transaction history to assess creditworthiness. EmpowerBiz offers various microloan products tailored to different business needs, with flexible repayment schedules and competitive interest rates. The platform also provides access to business training resources, financial literacy materials, and networking opportunities to foster business growth and sustainability. Integration with local mobile money systems ensures seamless transactions and reduces reliance on traditional banking infrastructure. The platform’s data analytics capabilities allow for continuous improvement of services and targeted interventions to support business success.

Final Wrap-Up

In conclusion, Fintech innovations are fundamentally altering the financial services industry, offering increased accessibility, efficiency, and personalized experiences. While challenges remain, particularly regarding security and regulation, the continued development and adoption of these technologies promise a more inclusive and dynamic financial ecosystem. Further exploration into specific applications and their evolving regulatory frameworks will be crucial in harnessing the full potential of Fintech while mitigating potential risks.

Query Resolution

What are the biggest risks associated with Fintech innovations?

Significant risks include data breaches, cybersecurity vulnerabilities, regulatory uncertainty, and the potential for market manipulation in areas like cryptocurrency trading.

How is regulation adapting to the rapid pace of Fintech development?

Regulatory bodies globally are struggling to keep pace. New laws and guidelines are being developed, but often lag behind the rapid technological advancements, leading to a period of uncertainty for both innovators and consumers.

What is the future of Fintech?

The future likely involves further integration of AI, blockchain, and big data, leading to hyper-personalization of financial services, increased automation, and potentially even the emergence of entirely new financial instruments and models.