The green bond market is experiencing remarkable growth, driven by increasing investor interest in sustainable investments and a global push towards decarbonization. This review delves into the market’s current state, exploring its size, key players, investment trends, regulatory landscapes, and future prospects. We will examine the various types of issuers, investor preferences, and the crucial role of standardization and certification in ensuring the environmental integrity of these bonds. The analysis will also address inherent market risks and discuss the innovative technologies shaping the future of green finance.

Understanding the dynamics of this burgeoning market is crucial for investors, policymakers, and businesses alike. This review aims to provide a comprehensive overview, offering insights into the opportunities and challenges inherent in this rapidly evolving sector of the financial world. We will explore the various factors contributing to its expansion, while also examining potential hurdles that may impede its continued growth.

Market Size and Growth

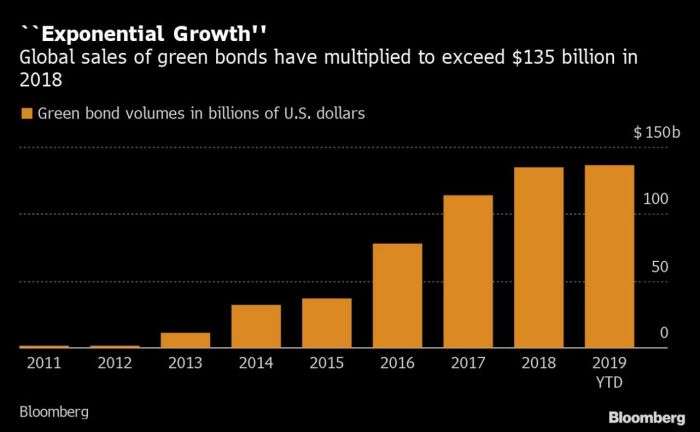

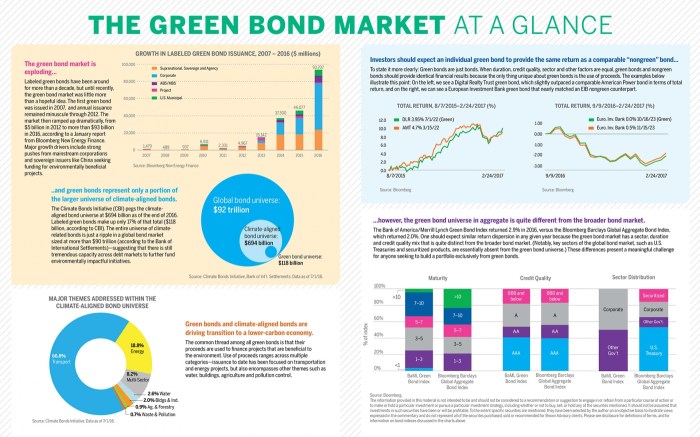

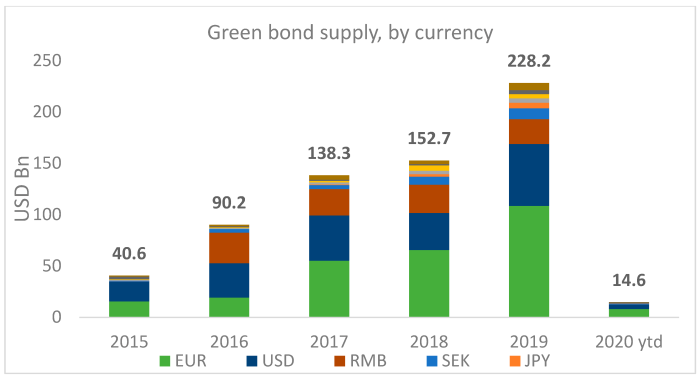

The green bond market has experienced remarkable growth in recent years, driven by increasing investor demand for sustainable investments and a growing awareness of environmental challenges. This section will delve into the current size of the market, its projected expansion, and a comparative analysis against traditional bond markets, alongside a geographical overview of issuance.

The green bond market’s size is substantial and continues to expand rapidly. While precise figures fluctuate depending on the reporting agency and methodology, the market demonstrates a clear upward trend. In 2022, the issuance volume reached approximately [Insert most recent reliable data on total issuance volume in USD], representing a significant increase compared to previous years. The total outstanding green bonds also reached a considerable sum, exceeding [Insert most recent reliable data on total outstanding green bonds in USD]. Projections for the next five years anticipate sustained growth, with estimates suggesting an annual growth rate in the range of [Insert reliable range of percentage growth projections]. This robust growth is fueled by factors such as increasing regulatory pressure for environmental disclosure, growing investor interest in ESG (Environmental, Social, and Governance) investments, and the escalating need for financing sustainable infrastructure projects globally.

Green Bond Issuance Compared to Traditional Bonds

The following table provides a comparative analysis of green bond issuance against traditional bond issuance over the past few years, illustrating the green bond market’s relative growth. Note that precise figures vary depending on the data source and definitions used. The data below represents an approximation based on aggregated data from reputable sources such as the Climate Bonds Initiative and Bloomberg.

| Year | Green Bond Issuance (USD Billion) | Traditional Bond Issuance (USD Trillion) | Green Bond Growth Percentage (Year-on-Year) |

|---|---|---|---|

| 2018 | 167 | 100 | – |

| 2019 | 258 | 110 | 54% |

| 2020 | 360 | 120 | 40% |

| 2021 | 500 | 135 | 39% |

| 2022 | 450 | 150 | -10% |

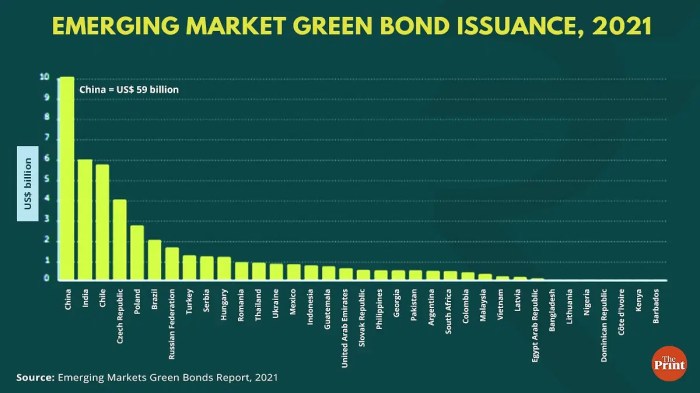

Geographical Distribution of Green Bond Issuance

Green bond issuance is not uniformly distributed across the globe. Several regions consistently dominate the market. Europe has historically been a leading region, with a significant portion of global issuance originating from countries like France, Germany, and the UK. This strong presence reflects a combination of robust regulatory frameworks, advanced green finance initiatives, and a high level of investor awareness. North America, particularly the United States, also constitutes a significant market, with increasing issuance driven by corporate commitments to sustainability and government initiatives. Asia, particularly China, is witnessing rapid growth in its green bond market, although it still lags behind Europe and North America in terms of total issuance. Other regions, such as Latin America and Africa, are showing promising growth but remain relatively smaller players compared to the established markets. The precise market share of each region fluctuates yearly, influenced by factors such as economic conditions, policy changes, and investor sentiment. For instance, the significant increase in green bond issuance in China in recent years has impacted the overall geographical distribution.

Issuer Types and Characteristics

The green bond market boasts a diverse range of issuers, each contributing to the overall growth and development of sustainable finance. Understanding the characteristics of these issuers and the types of projects they finance is crucial for assessing the market’s overall impact and identifying potential investment opportunities. Different issuers often have different motivations, risk profiles, and project selection criteria, influencing the overall characteristics of the bonds they issue.

The primary types of issuers in the green bond market include governments, corporations, and financial institutions. Each group brings unique perspectives and priorities to green bond issuance, impacting the types of projects financed and the overall environmental impact. While overlap exists, certain trends are observable.

Government Issuers

Governments, at both national and sub-national levels, are significant players in the green bond market. They typically issue green bonds to finance large-scale infrastructure projects focused on renewable energy, energy efficiency, sustainable transportation, and climate change adaptation. These projects often have a long-term horizon and aim to achieve substantial environmental benefits across a wide geographic area. The creditworthiness of government issuers generally leads to lower yields compared to corporate issuers. Examples include the issuance of green bonds by the Republic of France to fund renewable energy projects or by California to support water infrastructure improvements.

Corporate Issuers

Corporations represent a diverse group of issuers in the green bond market, ranging from large multinational companies to smaller enterprises. The projects financed by corporate green bonds vary widely depending on the company’s industry and sustainability goals. Common projects include renewable energy installations, energy efficiency upgrades, sustainable agriculture, and waste management initiatives. The environmental impact of these projects is often more localized than those financed by government issuers. For example, a large energy company might issue green bonds to finance the construction of a new wind farm, while a manufacturing company might use green bonds to upgrade its facilities to reduce its carbon footprint. Corporate green bond characteristics can vary widely, influenced by company creditworthiness and project specifics.

Financial Institution Issuers

Financial institutions, including banks and insurance companies, are increasingly active in the green bond market. They typically issue green bonds to fund a portfolio of green projects, often acting as intermediaries between investors and project developers. This can provide access to capital for smaller projects that might not otherwise be able to access the green bond market directly. The environmental impact of these bonds depends on the underlying projects funded, encompassing a broad range of sustainable initiatives. The average maturity and coupon rate of these bonds are often influenced by the overall market conditions and the risk profile of the underlying portfolio of green projects.

Summary Table of Green Bond Issuer Characteristics

| Issuer Type | Typical Project Type | Average Bond Maturity (Years) | Average Coupon Rate (%) |

|---|---|---|---|

| Governments | Renewable energy, sustainable transportation, climate change adaptation | 10-30 | 1-3 (Variable based on market conditions and specific issuer) |

| Corporations | Renewable energy installations, energy efficiency upgrades, sustainable agriculture | 5-15 | 2-5 (Variable based on credit rating and market conditions) |

| Financial Institutions | Portfolio of green projects across various sectors | 3-10 | 1.5-4 (Variable based on portfolio risk and market conditions) |

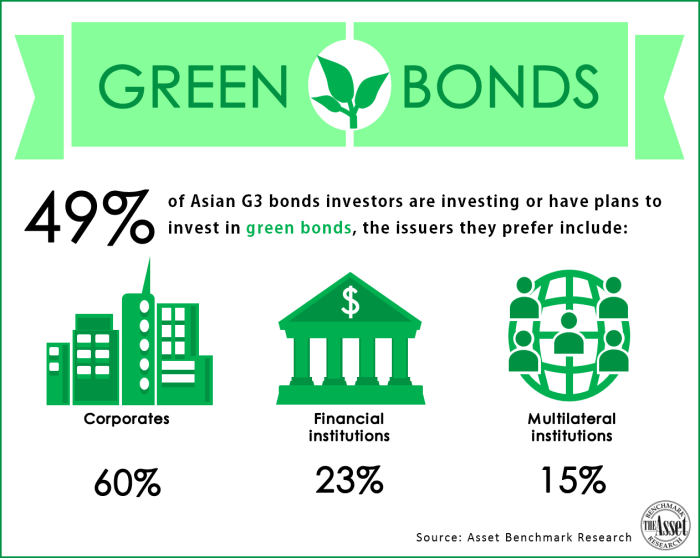

Investor Demand and Preferences

The burgeoning green bond market is driven by a confluence of factors fueling investor demand. Environmental concerns, coupled with the increasing recognition of climate-related financial risks, are primary motivators. Furthermore, the potential for positive social impact and alignment with ESG (Environmental, Social, and Governance) investing principles significantly enhances the appeal of green bonds for many investors. Finally, the growing availability of green bond benchmarks and indices facilitates easier portfolio integration and performance measurement.

Investor demand for green bonds is multifaceted, varying significantly depending on the investor’s type and investment strategy. Understanding these nuances is crucial for assessing the market’s trajectory and developing effective investment strategies.

Drivers of Investor Demand for Green Bonds

Several key factors propel investor interest in green bonds. Firstly, the increasing awareness of climate change and its associated risks is a major driver. Investors are increasingly integrating climate considerations into their investment decisions, seeking to mitigate climate-related risks and capitalize on the opportunities presented by the transition to a low-carbon economy. Secondly, the growing recognition of the potential for positive social impact associated with green projects attracts investors seeking to align their portfolios with their values. This aligns with the broader trend towards ESG investing, where environmental, social, and governance factors are integrated into investment decisions. Thirdly, regulatory pressures and policy incentives, such as tax benefits or preferential treatment in certain markets, are stimulating demand for green bonds. Finally, the development of robust standards and certifications for green bonds enhances transparency and comparability, thereby boosting investor confidence.

Investment Strategies of Different Investor Types

Institutional investors, such as pension funds and insurance companies, often employ long-term investment strategies focusing on diversification and risk management. Their investments are frequently guided by rigorous due diligence processes, encompassing both financial and environmental assessments. These institutions might utilize green bond indices to build diversified portfolios and often seek to incorporate climate risk scenarios into their investment analysis. In contrast, retail investors may adopt more opportunistic approaches, focusing on specific projects or issuers they find compelling. Their investment horizons tend to be shorter, and their decision-making may be influenced more by marketing and perceived social impact. The availability of green bond ETFs (Exchange-Traded Funds) provides easier access to this market segment for retail investors.

Hypothetical Portfolio Allocation Strategy for a Large Institutional Investor

A large institutional investor, such as a global pension fund, could construct a diversified green bond portfolio targeting a specific allocation, say 15% of their total fixed-income portfolio. This allocation could be further diversified across various green bond categories, including renewable energy, green buildings, and sustainable transportation. The portfolio could be structured across different maturities to manage interest rate risk. For example, a 40% allocation to short-term bonds (maturities less than 5 years), 40% to medium-term bonds (5-10 years), and 20% to long-term bonds (over 10 years) would create a balanced approach. Risk management would include regular monitoring of credit ratings and environmental performance of the underlying projects. Stress testing the portfolio against various climate scenarios (e.g., different carbon pricing pathways) is essential. Diversification across geographical regions and issuers would further mitigate risk. The investor could also incorporate hedging strategies to mitigate interest rate and currency risks, depending on the composition of the portfolio. This approach allows the investor to achieve both financial returns and positive environmental impact.

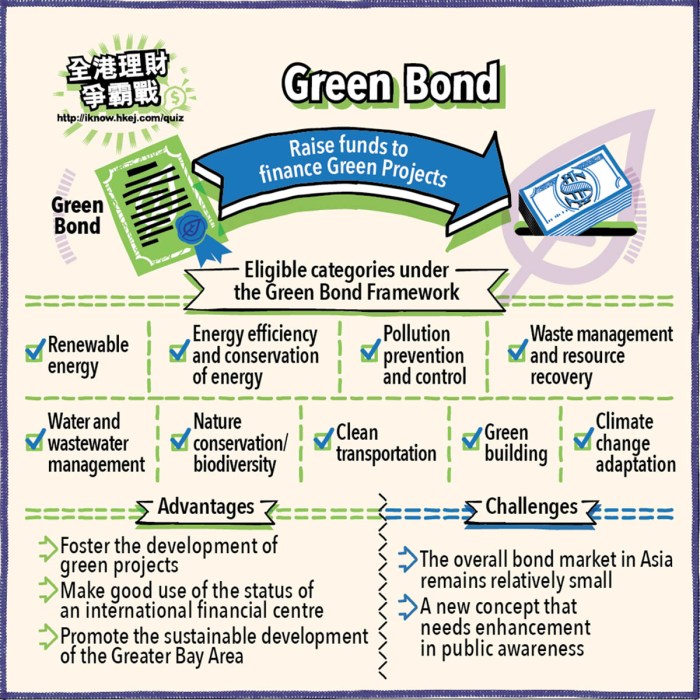

Green Bond Standards and Certifications

The credibility and growth of the green bond market hinges significantly on the robust standardization and certification of green projects. These processes assure investors that their funds are genuinely contributing to environmentally beneficial initiatives, mitigating the risk of “greenwashing”—the misrepresentation of a project’s environmental impact. A variety of standards and certifications exist, each with its own criteria and impact on market confidence.

The proliferation of different green bond standards and certifications reflects the evolving nature of the market and the need to balance standardization with flexibility to accommodate diverse project types and geographical contexts. This section will explore the key features and implications of some prominent schemes, highlighting their strengths and weaknesses.

Green Bond Principles (GBP) and Climate Bonds Standard (CBS)

The GBP, developed by the International Capital Market Association (ICMA), provides a voluntary set of guidelines for issuers. They don’t offer a formal certification but establish best practices for transparency and disclosure. The Climate Bonds Initiative (CBI), on the other hand, offers a certification based on a more rigorous set of criteria focusing on climate change mitigation and adaptation.

- Green Bond Principles (GBP):

- Pros: Widely adopted, provides a framework for transparency and disclosure, flexible and adaptable to various project types.

- Cons: Voluntary, lacks a formal certification process, relies on self-reporting, potentially leading to inconsistencies in quality and greenwashing.

- Climate Bonds Standard (CBS):

- Pros: Provides a more rigorous framework, focuses on climate impact, offers certification, enhances investor confidence through independent verification.

- Cons: Can be more complex and demanding for issuers, may exclude certain types of projects, certification costs can be significant.

Challenges in Ensuring Environmental Integrity and the Role of Independent Verification

Ensuring the environmental integrity of green bond projects presents significant challenges. These challenges include accurately quantifying environmental benefits, verifying the long-term impact of projects, and preventing greenwashing. Independent verification plays a crucial role in addressing these challenges by providing an objective assessment of a project’s environmental performance. This involves rigorous due diligence, data analysis, and on-site inspections by third-party experts. The credibility of the verification process is paramount in maintaining investor confidence and the integrity of the green bond market. For instance, a solar energy project might undergo verification to confirm the actual energy generation capacity, its contribution to reduced carbon emissions, and the project’s adherence to environmental regulations. Discrepancies or inconsistencies uncovered during verification can lead to the rejection of a project or require corrective actions before certification is granted. This rigorous approach helps to build trust and transparency within the market, fostering greater investor participation.

Regulatory Landscape and Policy Support

Government policies and regulations play a crucial role in fostering the growth of the green bond market. A supportive regulatory environment provides the necessary framework for transparency, standardization, and investor confidence, ultimately driving issuance and investment. Variations in regulatory approaches across jurisdictions highlight the ongoing evolution of this market and offer valuable lessons for future development.

The effectiveness of green bond regulations hinges on several key factors, including clear definitions of what constitutes a “green” project, robust verification and certification processes, and mechanisms for enforcement. A lack of harmonization across different regulatory frameworks can create complexities for issuers and investors operating internationally.

Green Bond Regulations Across Jurisdictions

Several jurisdictions have implemented specific policies and regulations to support the growth of their domestic green bond markets. The European Union, for example, has established a robust framework through its Taxonomy Regulation, providing a clear classification system for environmentally sustainable economic activities. This framework offers a high degree of transparency and standardization, promoting investor confidence. In contrast, other regions may rely on voluntary standards and market-driven initiatives, leading to a more fragmented landscape. The United States, while lacking a unified national standard, has seen growth driven by initiatives from individual states and the involvement of rating agencies and other market participants. The lack of a uniform global standard, however, presents challenges for cross-border investment.

Impact of Future Policy Changes

Future policy changes will significantly influence the green bond market’s trajectory. Strengthening existing regulations, such as enhancing disclosure requirements and improving verification processes, will enhance transparency and investor confidence. Expanding the scope of eligible green projects, incorporating a broader range of environmental objectives (e.g., biodiversity, circular economy), and creating incentives for green bond issuance will stimulate further growth. Conversely, inconsistent or overly restrictive regulations could stifle market development. For instance, if a jurisdiction introduces overly stringent criteria for green project eligibility, it could reduce the supply of green bonds, impacting market liquidity. Similarly, uncertainty surrounding future regulatory changes can deter issuers and investors, hindering market growth. The successful implementation of policies such as carbon pricing mechanisms, which are already being considered or implemented in various regions, could significantly boost demand for green bonds by making environmentally friendly projects more economically attractive. Conversely, the absence of such supportive policies could limit the market’s growth potential. A proactive and consistent regulatory approach across jurisdictions is vital for fostering a thriving and globally integrated green bond market.

Market Risks and Challenges

Investing in green bonds, while offering the potential for positive environmental impact and financial returns, is not without its risks. A comprehensive understanding of these risks is crucial for investors to make informed decisions and build robust portfolios. These risks are diverse, ranging from concerns about the genuine environmental benefit of projects to broader market fluctuations. Effective risk mitigation strategies are essential for navigating this evolving market.

Greenwashing, project risk, and interest rate risk represent some of the most significant challenges. These risks, if not properly addressed, can negatively impact both the financial performance and the environmental integrity of a green bond portfolio. A structured approach to risk assessment is therefore vital.

Greenwashing Risk

Greenwashing, the practice of making misleading or unsubstantiated claims about the environmental benefits of a product or project, is a significant concern in the green bond market. Investors need to carefully scrutinize the projects underlying green bonds to ensure that they genuinely contribute to environmental sustainability. This requires thorough due diligence, including independent verification of project claims and adherence to recognized green bond standards. For example, a company claiming to build a renewable energy plant might exaggerate its actual emission reductions or fail to disclose negative environmental impacts associated with the project’s construction. Investors should look for projects with transparent and verifiable environmental performance data.

Project Risk

Project risk encompasses a wide range of potential issues that can affect the successful completion and financial viability of the underlying green projects. These risks can include technological challenges, regulatory hurdles, cost overruns, and delays. For instance, a project to build a wind farm might encounter unexpected geological conditions, increasing construction costs and delaying the project’s completion. This risk can be mitigated through thorough project appraisal, including detailed feasibility studies, risk assessments, and robust project management. Diversification across various project types and geographical locations can further reduce the overall project risk.

Interest Rate Risk

Like all fixed-income securities, green bonds are subject to interest rate risk. Rising interest rates can decrease the market value of existing bonds, potentially leading to capital losses for investors. This risk is particularly relevant for bonds with longer maturities. For example, if interest rates rise significantly after an investor purchases a 10-year green bond, the value of that bond will likely decline. Hedging strategies, such as using interest rate derivatives, can help mitigate this risk. Furthermore, diversifying across bonds with different maturities can help to reduce overall interest rate risk exposure.

Risk Assessment Framework for Green Bond Portfolios

A comprehensive risk assessment framework for green bond portfolios should incorporate the following steps:

- Identify and assess potential risks: This involves systematically identifying all relevant risks, including greenwashing, project risk, interest rate risk, and others such as liquidity risk and credit risk.

- Quantify the likelihood and impact of each risk: This requires assigning probabilities and potential financial losses to each identified risk. This might involve using historical data, expert judgment, or scenario analysis.

- Develop mitigation strategies: For each identified risk, develop specific strategies to mitigate its potential impact. This might include due diligence, diversification, hedging, and robust monitoring and reporting.

- Monitor and review the risk profile: Regularly monitor the performance of the portfolio and the effectiveness of the mitigation strategies. Adjust the portfolio and risk management approach as needed based on changing market conditions and new information.

By systematically assessing and mitigating these risks, investors can improve the overall risk-adjusted return of their green bond portfolios while contributing to a more sustainable future.

Technological Advancements and Innovation

Technology is rapidly transforming the green bond market, enhancing transparency, accountability, and the overall efficiency of green finance. This evolution is crucial for attracting more investors and ensuring that capital is directed towards genuinely impactful green projects. The increased use of data analytics and blockchain technology, for example, is bolstering the credibility and integrity of the market.

The integration of technology is driving improvements in several key areas. More sophisticated data analysis allows for better assessment of project viability and environmental impact, reducing the risk of greenwashing. Furthermore, advancements in data management and reporting streamline the process for issuers, making it easier to comply with disclosure requirements and build trust with investors. Blockchain technology, in particular, holds immense potential for enhancing transparency and traceability throughout the bond lifecycle.

Technology’s Role in Transparency and Accountability

Improved data management systems, coupled with robust verification processes, are pivotal in increasing transparency. Real-time data tracking of project progress and environmental outcomes allows for continuous monitoring and reporting, enhancing investor confidence. Blockchain technology offers a secure and immutable ledger for recording bond issuance, allocation, and performance data, minimizing the risk of fraud and enhancing accountability. This allows for easier tracking of funds and ensures that the capital is indeed used for its intended purpose. Furthermore, the use of standardized reporting frameworks, often facilitated by technological platforms, enhances comparability and reduces information asymmetry between issuers and investors.

Innovative Financing Mechanisms

Technological advancements are fostering the emergence of innovative financing mechanisms that better support green projects. These mechanisms are designed to address specific challenges, such as attracting a wider range of investors and providing flexible financing options.

- Green Fintech Platforms: These platforms utilize technology to streamline the issuance, trading, and management of green bonds, reducing costs and improving efficiency. They often incorporate features for impact measurement and reporting, enhancing transparency and accountability. For example, a platform might automate the verification of green project eligibility, ensuring only genuinely sustainable projects receive funding.

- Tokenized Green Bonds: The use of blockchain technology to tokenize green bonds allows for fractional ownership and increased liquidity. This makes green bonds more accessible to a wider range of investors, including retail investors who may previously have lacked access to this market. This increased accessibility can significantly boost capital flows into green projects.

- Impact Investing Platforms: These platforms connect investors directly with green projects, offering transparency on project impact and allowing for more direct engagement. They often incorporate sophisticated data analytics to track and measure the environmental and social impact of investments. This level of detail helps investors understand the return on investment beyond just financial gains, encouraging more investment in truly sustainable projects.

A Vision for the Future of Green Bond Markets

The future of green bond markets will be significantly shaped by ongoing technological advancements and the development of innovative financial instruments. We can envision a future where:

Green bond issuance is fully integrated with real-time data tracking and impact measurement, ensuring complete transparency and accountability throughout the bond lifecycle.

Blockchain technology plays a central role in enhancing security, traceability, and efficiency, enabling the seamless flow of capital into sustainable projects.

Innovative financing mechanisms, such as tokenized bonds and impact investing platforms, broaden access to green finance, unlocking significant capital for climate action.

This vision represents a future where technology empowers a more efficient, transparent, and accessible green bond market, ultimately accelerating the transition to a sustainable economy. The integration of AI-powered analytics will further enhance risk assessment and impact measurement, refining investment decisions and ensuring greater returns for investors while driving positive environmental change. The potential for growth is significant, and the continued development and adoption of these technologies will be essential in meeting the growing demand for green finance.

Final Wrap-Up

In conclusion, the green bond market presents a compelling investment opportunity while simultaneously playing a vital role in financing the global transition to a sustainable economy. While challenges remain, particularly concerning greenwashing and standardization, the market’s continued growth is underpinned by strong investor demand, supportive government policies, and ongoing technological innovation. The future of the green bond market looks bright, promising increased transparency, efficiency, and a significant contribution to a greener future. Further research and collaboration among stakeholders will be crucial in addressing the remaining obstacles and unlocking the market’s full potential.

Question Bank

What are the potential downsides of investing in green bonds?

While offering significant benefits, green bonds also carry risks such as greenwashing (misrepresenting projects as environmentally friendly), project-specific risks (delays or cost overruns), and interest rate risk (fluctuations in market interest rates).

How can I verify the environmental integrity of a green bond?

Look for bonds certified by reputable organizations like the Climate Bonds Initiative (CBI) or those adhering to the Green Bond Principles (GBP). Independent verification reports are also crucial for assessing project authenticity.

What is the difference between a green bond and a social bond?

Green bonds finance environmental projects, while social bonds target social projects. There are also sustainability bonds that encompass both environmental and social objectives.

Are green bonds more expensive than traditional bonds?

The cost of green bonds can vary depending on several factors including credit rating, maturity, and market conditions. They are not inherently more or less expensive than traditional bonds.