Hedge Fund Performance Review: Let’s face it, the world of hedge funds is a thrilling rollercoaster of astronomical gains and stomach-churning losses. This review delves into the complex metrics, market forces, and regulatory hurdles that determine whether a fund soars like a phoenix or plummets like a lead balloon. We’ll dissect the Sharpe ratio, the Sortino ratio, and other performance indicators with the precision of a brain surgeon performing open-heart surgery on a particularly volatile investment strategy. Prepare for a wild ride!

We’ll explore how macroeconomic factors, from interest rate hikes to geopolitical squabbles (think rogue nations and their penchant for disrupting global markets), influence hedge fund returns. We’ll also examine the crucial role of skilled fund managers – are they wizards or just lucky gamblers? This isn’t your grandma’s investment club; buckle up for some serious financial analysis, seasoned with a dash of wry observation.

Defining Hedge Fund Performance

Measuring the success of a hedge fund isn’t as simple as counting dollars; it’s a nuanced dance involving risk, strategy, and a healthy dose of statistical acrobatics. While ultimately, investors want to see their money grow, the *how* is just as crucial as the *how much*. This section will dissect the various methods used to evaluate hedge fund performance, revealing the secrets behind those often-cryptic numbers.

Hedge Fund Performance Metrics

Several key metrics are employed to assess a hedge fund’s performance. These metrics go beyond simple returns, factoring in the risk taken to achieve those returns. A high return achieved through reckless speculation is far less desirable than a more modest return achieved with prudent risk management. Let’s examine some of the most common metrics:

- Sharpe Ratio: This measures risk-adjusted return. A higher Sharpe ratio indicates better performance relative to the risk taken. The formula is:

(Rp – Rf) / σp

where Rp is the portfolio return, Rf is the risk-free rate of return, and σp is the standard deviation of the portfolio return. A Sharpe ratio above 1 is generally considered good, while a ratio above 2 is excellent.

- Sortino Ratio: Similar to the Sharpe ratio, but it only considers downside deviation (risk of losses), making it a more nuanced measure for hedge funds, many of which aim for consistent returns rather than maximizing overall volatility. The formula is:

(Rp – Rf) / σd

where σd represents the downside deviation.

- Alpha: This measures the excess return of a fund compared to its benchmark. A positive alpha suggests the fund manager’s skill in generating returns above what’s expected given the level of risk. It’s often described as the “manager’s added value”.

- Beta: This measures the volatility of a fund relative to its benchmark. A beta of 1 indicates that the fund moves in line with the benchmark; a beta greater than 1 suggests higher volatility, while a beta less than 1 indicates lower volatility.

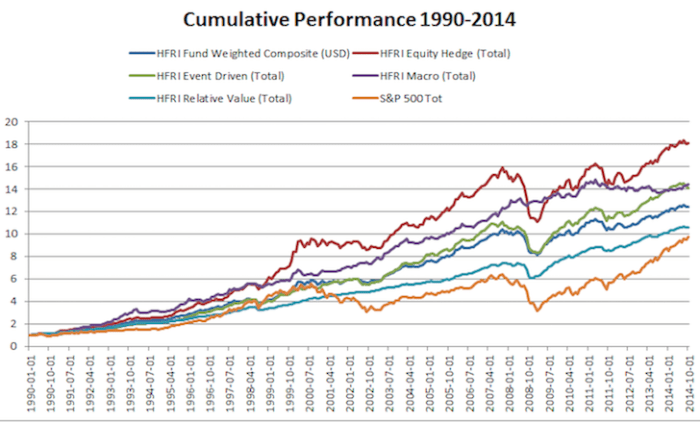

Impact of Hedge Fund Strategies on Performance Measurement

Different hedge fund strategies necessitate different performance evaluation methods. A long-short equity fund, for example, will have a vastly different risk profile and return expectation than a global macro fund. Performance metrics need to be tailored accordingly. For instance, a long-only equity fund might be assessed primarily against a market index, while a merger arbitrage fund would be evaluated on its ability to profit from predictable market inefficiencies. The choice of benchmark and the appropriate risk-adjusted metrics are crucial.

Absolute Return vs. Relative Return Strategies

Absolute return strategies aim to generate positive returns regardless of market conditions, often employing diverse and uncorrelated strategies. Their performance is typically evaluated based on absolute returns and risk-adjusted measures like the Sharpe or Sortino ratio. Relative return strategies, on the other hand, aim to outperform a specific benchmark. Their performance is measured relative to that benchmark, focusing on metrics like alpha and beta. While both seek profits, their approaches and consequent performance evaluation differ significantly. For example, a successful absolute return strategy might show a modest positive return during a market downturn, while a successful relative return strategy might significantly outperform the benchmark even if the absolute return is lower.

Key Performance Indicators (KPIs) in Hedge Fund Evaluation

The following table compares five key KPIs used in hedge fund performance evaluation:

| KPI | Formula | Interpretation | Example |

|---|---|---|---|

| Sharpe Ratio | (Rp – Rf) / σp | Higher values indicate better risk-adjusted return. | A Sharpe ratio of 2 suggests strong performance relative to risk. |

| Sortino Ratio | (Rp – Rf) / σd | Similar to Sharpe, but focuses on downside risk. | A Sortino ratio of 1.5 suggests good performance, considering only downside deviation. |

| Alpha | Rp – (Rf + βp * (Rm – Rf)) | Measures excess return compared to a benchmark. | A positive alpha of 0.5% indicates outperformance. |

| Beta | Cov(Rp, Rm) / Var(Rm) | Measures volatility relative to a benchmark. | A beta of 1.2 suggests higher volatility than the benchmark. |

| Maximum Drawdown | (Peak – Trough) / Peak | Measures the largest percentage decline from peak to trough. | A maximum drawdown of 10% indicates a significant loss. |

Factors Influencing Hedge Fund Returns: Hedge Fund Performance Review

Ah, the elusive question of why some hedge funds swim in champagne while others sink faster than a lead balloon. It’s a complex tapestry woven from macroeconomic threads, market whims, and the sheer, unadulterated skill (or lack thereof) of the fund managers. Let’s unravel this fascinating, and often frustrating, puzzle.

Numerous factors conspire to determine a hedge fund’s performance. Understanding these intricacies is crucial, not only for investors seeking to navigate the treacherous waters of alternative investments but also for the funds themselves, striving to anticipate the market’s every sneeze and cough.

Macroeconomic Factors and Hedge Fund Performance

Macroeconomic conditions act as the stage upon which the hedge fund drama unfolds. Interest rates, inflation, and geopolitical events – these are the major players influencing the overall investment landscape. For example, rising interest rates can impact fixed-income arbitrage strategies, while unexpected geopolitical turmoil (think, say, a surprise invasion of a major oil-producing nation) can send ripples throughout the entire market, impacting even the most diversified portfolios. Inflation, meanwhile, can erode returns and force adjustments in investment strategies across the board. The interconnectedness of the global economy means that even seemingly localized events can have far-reaching consequences for hedge fund returns.

Market Volatility and Hedge Fund Strategies

Market volatility is the double-edged sword of the hedge fund world. While some strategies thrive in turbulent waters, others flounder. For instance, market-neutral strategies, designed to be insensitive to overall market movements, might perform relatively well during periods of high volatility. Conversely, highly leveraged strategies, which amplify both gains and losses, could see spectacular gains during bull markets but equally spectacular losses during crashes. The impact of volatility varies drastically depending on the fund’s specific strategy and risk profile. A long-short equity fund, for example, will likely react differently than a global macro fund during a sudden market correction.

Manager Skill and Investment Process

Let’s face it: even the best macroeconomic forecasts and market predictions are only half the battle. The other half? The skill and experience of the fund manager and the effectiveness of their investment process. A brilliant strategy poorly executed is as useless as a chocolate teapot. This includes elements like rigorous research, risk management (crucial, especially in leveraged funds!), and portfolio construction. Superior stock-picking ability, adept market timing, and effective risk management are all critical ingredients in achieving consistent, above-average returns. Think of it as a culinary masterpiece: the finest ingredients (market conditions) are only as good as the chef (fund manager) preparing them.

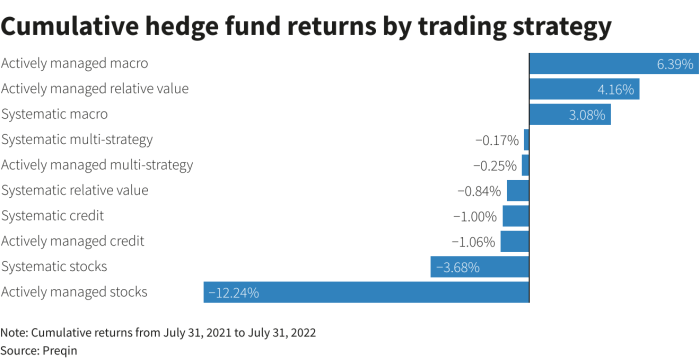

Market Conditions and Hedge Fund Strategy Selection

Specific market conditions often favor certain hedge fund strategies over others. A period of low interest rates, for example, might be more favorable for strategies that rely on leverage, while high inflation could boost the performance of commodities-focused funds. Similarly, periods of heightened geopolitical uncertainty might lead investors to seek the relative safety of market-neutral strategies. The key is identifying these market dynamics and choosing strategies appropriately aligned with the prevailing environment. It’s a bit like choosing the right tool for the job – you wouldn’t use a hammer to screw in a screw, would you? Similarly, selecting the right hedge fund strategy requires understanding the current market landscape.

Benchmarking and Peer Comparison

The quest for alpha in the hedge fund universe often feels like searching for the Holy Grail – elusive, occasionally glimpsed, and frequently the subject of much spirited debate. Benchmarking and peer comparison, therefore, become crucial tools, not just for evaluating performance, but also for understanding the idiosyncrasies of different strategies and the often-whimsical nature of market movements. Think of it as a hedge fund beauty pageant, but instead of sashes and smiles, we have Sharpe ratios and Sortino ratios.

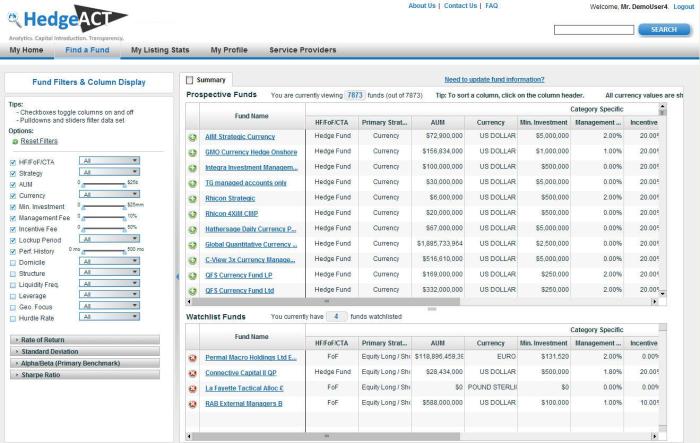

Benchmarking hedge funds presents a unique set of challenges, largely due to the inherent opacity of the industry. Unlike publicly traded stocks, which are subject to rigorous disclosure requirements, hedge funds often shroud their investment strategies and holdings in a veil of secrecy. This lack of transparency makes it incredibly difficult to construct truly representative benchmarks, leading to what some might call a “benchmarking black hole.”

Benchmark Selection Methodology for Various Hedge Fund Strategies

Choosing the right benchmark is paramount. A flawed benchmark is like using a rusty compass to navigate the treacherous seas of finance – it’ll likely lead you astray. The selection process should consider the specific investment strategy employed by the hedge fund. For example, a long-short equity fund might be benchmarked against a broad market index like the S&P 500, adjusted for long and short exposures, while a global macro fund might utilize a composite of indices reflecting different asset classes and currencies. The ideal benchmark should reflect the fund’s investment universe, risk profile, and intended investment style, minimizing the impact of unintended style biases. A suitable benchmark should also be readily available and have sufficient historical data to permit meaningful comparisons.

Comparative Analysis of Major Hedge Fund Categories (Five-Year Period)

The following table presents a hypothetical comparative analysis of three major hedge fund categories – Long/Short Equity, Global Macro, and Event-Driven – over a five-year period. Remember, these figures are illustrative and do not represent the performance of any specific funds. The actual performance of hedge funds can vary wildly depending on the specific manager, their investment style, and market conditions. Think of this table as a simplified snapshot, not a crystal ball predicting future performance.

| Hedge Fund Category | Year 1 (%) | Year 2 (%) | Year 3 (%) | Year 4 (%) | Year 5 (%) | Average Annual Return (%) |

|---|---|---|---|---|---|---|

| Long/Short Equity | 12 | -5 | 8 | 15 | 7 | 7.4 |

| Global Macro | 5 | 10 | -2 | 18 | 3 | 6.8 |

| Event-Driven | 9 | 6 | 11 | -1 | 12 | 7.4 |

Challenges in Accurately Benchmarking Hedge Fund Performance

The lack of transparency mentioned earlier is a major hurdle. Many hedge funds don’t publicly disclose their holdings or strategies, making it nearly impossible to construct truly comparable benchmarks. Furthermore, the inherent illiquidity of many hedge fund investments complicates accurate valuation and performance measurement. Additionally, the use of leverage and complex derivative instruments further complicates the picture, making it difficult to isolate the skill of the manager from the impact of market conditions and leverage effects. It’s a bit like trying to judge a cooking competition where the chefs refuse to reveal their recipes – you can taste the results, but understanding the process remains a mystery.

Risk Management and Performance

The world of hedge funds is a thrilling rollercoaster ride, a high-stakes game of financial dexterity. While the potential for astronomical returns is undeniably alluring, the inherent risks can be stomach-churning. Understanding and effectively managing these risks isn’t just crucial for survival; it’s the key to unlocking consistent, superior performance. Let’s delve into the fascinating, and sometimes terrifying, world of hedge fund risk management.

Types of Risk Faced by Hedge Funds

Hedge funds, unlike your average mutual fund, often navigate uncharted waters, exposing themselves to a broader spectrum of risks. These risks aren’t just theoretical; they’re very real threats that can sink even the most brilliantly conceived strategies. Failure to address these appropriately can lead to significant losses, and quite frankly, a very awkward conversation with your investors.

Risk Management Methods Employed by Hedge Funds

Effective risk management isn’t about avoiding risk entirely – that’s impossible in this game. It’s about intelligently identifying, measuring, and mitigating those risks to keep the ship afloat during storms. Hedge funds employ a variety of sophisticated techniques, ranging from simple diversification to complex quantitative models, all in a desperate attempt to stay ahead of the curve (and ahead of their competitors).

- Diversification: The age-old adage of “don’t put all your eggs in one basket” holds particularly true in the high-stakes world of hedge funds. Diversifying across asset classes, geographies, and investment strategies helps to reduce the impact of any single adverse event. Think of it as spreading your bets across multiple casinos – if one goes bust, you still have others to rely on.

- Stress Testing and Scenario Analysis: Hedge funds often use sophisticated models to simulate various market scenarios, including black swan events. This allows them to assess the potential impact of different risks and adjust their strategies accordingly. It’s like playing a war game, but instead of tanks and soldiers, it’s about predicting market crashes and interest rate hikes.

- Quantitative Risk Models: These complex mathematical models are used to measure and quantify various risks, providing a more precise understanding of the fund’s overall risk profile. It’s the ultimate number-crunching exercise, attempting to predict the unpredictable.

- Derivatives and Hedging Strategies: Hedge funds frequently utilize derivatives to hedge against specific risks, such as interest rate fluctuations or currency movements. Think of it as financial insurance, providing a safety net in case things go south.

- Liquidity Management: Maintaining sufficient liquidity is crucial for weathering unexpected market downturns. This involves carefully managing cash flows and ensuring access to sufficient funds to meet obligations, even during times of stress. It’s like having a hefty emergency fund, but on a significantly larger scale.

Examples of Effective Risk Management Enhancing Performance, Hedge Fund Performance Review

The Long-Term Capital Management (LTCM) debacle serves as a cautionary tale – a highly sophisticated hedge fund imploded due to a lack of effective risk management. Conversely, funds that meticulously manage risk often outperform their less cautious peers over the long term. Effective risk management doesn’t guarantee profits, but it dramatically increases the odds of survival and consistent positive returns. Think of it as a seatbelt – it doesn’t guarantee you won’t crash, but it significantly reduces the severity of the impact.

Risk-Adjusted Return and Risk Management Strategies

Imagine a graph. The x-axis represents the level of risk taken, ranging from low to high. The y-axis represents the risk-adjusted return, a measure of return relative to the risk taken (often expressed as Sharpe Ratio). Different risk management strategies would be represented by different points on this graph. A highly conservative strategy would plot near the origin (low risk, low return), while a highly aggressive strategy would plot further along the x-axis (high risk, potentially high return). However, the optimal strategy isn’t necessarily the one furthest along the y-axis. The sweet spot lies in finding the right balance between risk and return – a point that maximizes risk-adjusted return, representing the best possible risk-reward profile. Effective risk management aims to shift this point upwards and to the left – achieving higher returns with less risk.

Performance Attribution and Decomposition

Unraveling the mysteries of hedge fund performance is like solving a particularly fiendish Sudoku – challenging, rewarding, and potentially lucrative if you get it right. Performance attribution, the process of dissecting a fund’s returns into their constituent parts, is the key to unlocking these secrets. It’s not just about knowing whether the fund made money; it’s about understanding *why*.

Performance attribution helps investors understand the drivers behind a hedge fund’s returns, separating the wheat from the chaff (or, perhaps more accurately, the alpha from the beta). By isolating specific factors, we can assess the manager’s skill, identify areas of strength and weakness, and ultimately make more informed investment decisions. Think of it as a financial autopsy, but hopefully one with a happy ending.

Identifying Key Performance Drivers

A hedge fund’s overall performance is rarely attributable to a single factor. Instead, it’s usually a complex interplay of several elements. These typically include market timing (being in the right place at the right time), security selection (picking winning stocks or other assets), sector allocation (choosing the most profitable sectors), and the impact of leverage (borrowing money to amplify returns – a double-edged sword, naturally). Other factors, such as currency fluctuations and the manager’s unique trading strategies, can also significantly contribute. A successful attribution analysis will carefully weigh the influence of each of these factors, revealing the true source of the fund’s performance.

Techniques for Decomposing Hedge Fund Returns

Several sophisticated techniques exist to break down a hedge fund’s returns. One common method is the Brinson-Fachler model, which attributes returns to asset allocation, security selection, and interaction effects. This approach isolates the contribution of each component, highlighting where the manager added or subtracted value. More advanced methods, often involving regression analysis and factor models, allow for a more nuanced understanding of the fund’s performance drivers, considering macroeconomic factors, specific market events, and even idiosyncratic influences. These techniques are essentially sophisticated detective work, meticulously tracing the path of each dollar earned (or lost).

Examples of Performance Attribution Analysis

Consider a hedge fund that outperformed its benchmark significantly. A performance attribution analysis might reveal that a large portion of the excess return was driven by skillful stock selection within the technology sector, while market timing contributed only marginally. This suggests the manager possesses expertise in identifying undervalued technology companies, a crucial insight for investors. Conversely, a fund that underperformed could be shown to have suffered from poor sector allocation, with significant losses stemming from exposure to a declining industry, regardless of its stock selection skills within that sector. These examples demonstrate how attribution analysis can illuminate both success and failure.

Evaluating Investment Strategy Effectiveness

Performance attribution isn’t just about understanding past performance; it’s a crucial tool for evaluating the effectiveness of a hedge fund’s investment strategy. By identifying the consistent sources of alpha (excess returns), investors can assess the manager’s skill and the long-term viability of the strategy. For instance, a fund consistently generating positive returns primarily through skillful stock selection suggests a robust and potentially sustainable strategy. Conversely, a fund relying heavily on market timing, a notoriously fickle factor, might raise concerns about the strategy’s long-term sustainability. Ultimately, performance attribution provides a clearer picture of whether the manager is truly adding value or just benefiting from favorable market conditions.

Regulatory and Legal Aspects

The world of hedge fund performance reporting isn’t exactly a wild west shootout, but it’s certainly not a picnic in the park either. Navigating the regulatory landscape requires a keen eye for detail and a healthy dose of legal awareness. Failure to comply can lead to penalties ranging from hefty fines to, well, let’s just say it’s not a fun time. Let’s delve into the fascinating (yes, really!) world of hedge fund regulations.

The regulatory landscape impacting hedge fund performance reporting and transparency is a complex and ever-evolving beast. Think of it as a hydra – you cut off one head (a new regulation), and two more sprout up (interpretations and amendments). The primary goal, however, remains consistent: to protect investors from misleading information and ensure fair market practices. This involves a multifaceted approach encompassing transparency requirements, reporting standards, and anti-fraud measures. Various regulatory bodies, depending on the fund’s location and structure, oversee these aspects, creating a global patchwork of rules and guidelines.

Regulatory Changes Affecting Hedge Fund Performance

The introduction of stricter reporting requirements, such as those mandated by the Dodd-Frank Act in the US, has significantly impacted how hedge funds present their performance. These regulations demand more detailed disclosures of risk factors, investment strategies, and performance data. This increased transparency, while potentially beneficial for investors, can also constrain certain investment strategies and lead to a more conservative approach by some fund managers. For example, the increased scrutiny on leverage has forced some funds to reduce their risk profiles, impacting their potential returns. Another example is the increased focus on valuation transparency, especially for illiquid assets, which has forced a greater degree of standardization and potentially reduced the ability of some managers to “smooth” reported returns.

Legal Implications of Misrepresenting Hedge Fund Performance

Misrepresenting hedge fund performance is not a game to be played lightly. The consequences can be severe, including significant financial penalties, reputational damage, and even criminal charges. This is particularly true in cases of intentional fraud or reckless disregard for the accuracy of reported performance. Several high-profile cases have demonstrated the legal repercussions of misrepresenting returns, resulting in hefty fines, investor lawsuits, and the closure of funds. One prominent example involved a manager who used fraudulent accounting practices to inflate reported returns, leading to significant investor losses and severe legal consequences. The message is clear: honesty is the best policy, especially when dealing with other people’s money.

Importance of Compliance with Relevant Regulations

Compliance with relevant regulations is paramount for ensuring accurate and reliable performance reporting. It fosters trust between fund managers and investors, protects investors from potential fraud, and promotes market stability. A robust compliance program involves not only adherence to reporting requirements but also the implementation of internal controls to prevent and detect errors or irregularities. This includes regular audits, independent verification of performance data, and employee training on regulatory compliance. Ignoring these regulations can result in significant legal and financial repercussions, including regulatory fines, investor lawsuits, and damage to the fund’s reputation. In essence, robust compliance isn’t just a “good idea,” it’s a necessity for long-term success and survival in the hedge fund industry.

Outcome Summary

So, there you have it: a whirlwind tour of the hedge fund performance landscape. While predicting the future of these high-stakes investments remains as elusive as a unicorn riding a unicycle, understanding the key performance indicators, risk management strategies, and regulatory complexities is crucial for both investors and fund managers alike. Remember, even the most sophisticated models can’t fully account for the unpredictable nature of global markets – or the occasional rogue chimpanzee deciding to take control of the trading floor. Happy investing (and may the odds be ever in your favor!).

Quick FAQs

What is the difference between a long-short strategy and a market-neutral strategy?

While both aim to reduce market risk, long-short strategies profit from both long and short positions, while market-neutral strategies aim for zero net market exposure, hedging long positions with short ones.

How do hedge funds deal with “black swan” events?

Black swan events are unpredictable, high-impact occurrences. Hedge funds attempt to mitigate their impact through stress testing, diversification, and robust risk management frameworks, though complete avoidance is virtually impossible.

What are some common ethical concerns in hedge fund management?

Ethical concerns include insider trading, conflicts of interest, manipulative trading practices, and misrepresentation of performance data, all leading to potential legal ramifications.