Hedge Fund Performance Review: Prepare yourself for a rollercoaster ride through the exhilarating (and sometimes terrifying) world of high-finance! We’ll dissect the metrics, the madness, and the occasional millionaire-making miracle that defines the hedge fund landscape. Buckle up, it’s going to be a wild ride.

This review delves into the complexities of evaluating hedge fund success, exploring key performance indicators, influential market factors, and the ever-present specter of risk. We’ll unravel the mysteries behind alpha generation, the challenges of benchmarking, and the art (and science) of performance attribution. Get ready to decode the cryptic world of hedge fund returns.

Defining Hedge Fund Performance

Assessing the performance of a hedge fund is less straightforward than, say, judging the success of a bakery based on the number of croissants sold. While delicious pastries have a clear metric, hedge funds operate in a complex, multifaceted world of risk and reward, demanding a more nuanced approach to evaluation. This requires a toolbox of sophisticated metrics, each with its strengths and, inevitably, its weaknesses.

Hedge Fund Performance Metrics

Several key metrics are employed to gauge the performance of hedge funds. These tools help investors understand not only the returns generated but also the risk taken to achieve those returns. Misinterpreting these metrics can lead to disastrous investment decisions, so understanding their nuances is paramount.

Sharpe Ratio, Sortino Ratio, Alpha, and Beta

The Sharpe Ratio measures risk-adjusted return, essentially quantifying how much extra return an investor receives for each unit of risk taken. A higher Sharpe ratio indicates better performance. The formula is:

Sharpe Ratio = (Rp – Rf) / σp

where Rp is the portfolio return, Rf is the risk-free rate of return, and σp is the standard deviation of the portfolio return.

The Sortino Ratio is a refinement of the Sharpe Ratio, focusing only on downside risk (negative deviations from the mean). This is particularly useful for hedge funds aiming for consistent returns with minimal downside volatility. It uses downside deviation instead of standard deviation in the denominator.

Alpha represents the excess return of an investment compared to a benchmark (often a market index). A positive alpha suggests the fund manager’s skill generated returns above what would be expected given the level of risk. Beta, on the other hand, measures the volatility of an investment relative to the benchmark. A beta of 1 means the investment moves in line with the market; a beta greater than 1 signifies higher volatility than the market.

Limitations of Performance Metrics

While these metrics offer valuable insights, they have limitations. The Sharpe and Sortino ratios rely on historical data, which may not be predictive of future performance. Furthermore, they assume a normal distribution of returns, which isn’t always the case with hedge funds, particularly those employing complex strategies. Alpha can be misleading if the benchmark isn’t appropriate for the fund’s strategy. Finally, these metrics don’t fully capture all aspects of performance, such as liquidity, manager skill, or the impact of specific market events.

Evaluating Different Hedge Fund Strategies

Different hedge fund strategies require different evaluation metrics. For example, a long-short equity strategy might be best evaluated using the Sharpe Ratio, focusing on overall risk-adjusted return. A market-neutral strategy, aiming for low volatility, might be better assessed using the Sortino Ratio, which emphasizes downside risk mitigation. A distressed debt fund, investing in financially troubled companies, may require a more qualitative assessment, considering factors beyond simple numerical metrics. A global macro fund, making bets on large-scale economic trends, might be judged on its ability to predict and profit from significant market shifts, potentially using a customized performance metric reflecting those specific goals.

Comparison of Performance Metrics

| Metric | Calculation | Interpretation | Limitations |

|---|---|---|---|

| Sharpe Ratio | (Rp – Rf) / σp | Higher is better; measures risk-adjusted return. | Assumes normal distribution; relies on historical data. |

| Sortino Ratio | (Rp – Rf) / σd | Higher is better; focuses on downside risk. | Assumes a specific distribution; relies on historical data. |

| Alpha | Rp – (Rf + βp * (Rm – Rf)) | Positive alpha indicates outperformance. | Sensitive to benchmark selection; doesn’t capture all risk factors. |

| Beta | Cov(Rp, Rm) / Var(Rm) | Measures volatility relative to the market. | Relies on historical data; can be influenced by market regime changes. |

Factors Influencing Hedge Fund Returns

The world of hedge fund performance is a fascinating rollercoaster, a thrilling blend of high-stakes strategy and the unpredictable whims of the market. Understanding what drives these returns—and, just as importantly, what can send them plummeting—is crucial for both investors and fund managers alike. Let’s delve into the key factors that shape the fortunes (and misfortunes) of these financial titans.

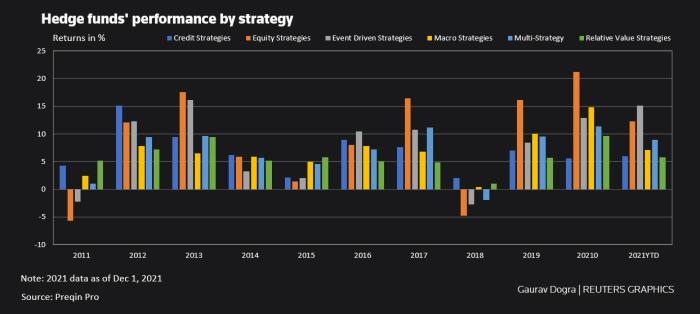

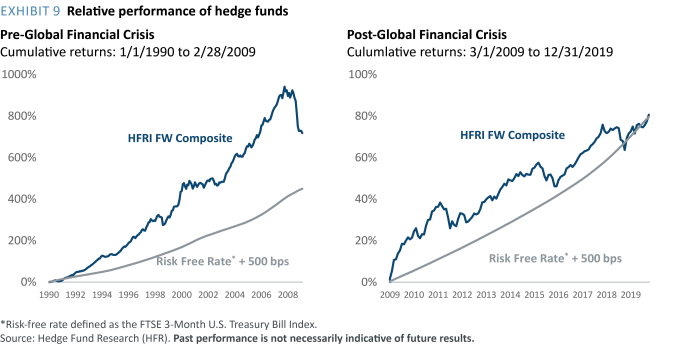

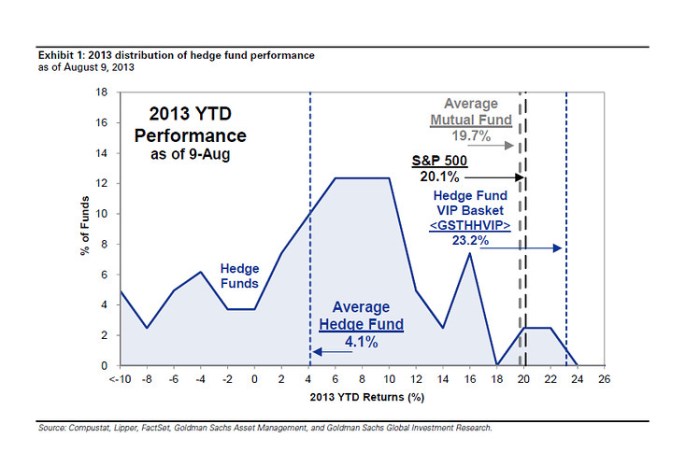

Market Cycles and Hedge Fund Performance

Market cycles, those rhythmic ebbs and flows of investor sentiment and economic activity, exert a powerful influence on hedge fund returns. During bull markets, many strategies, particularly those with a long bias, tend to flourish. However, the picture becomes far more nuanced during bear markets. While some strategies, such as short-selling or market-neutral approaches, might thrive in a downturn, others can suffer significant losses. The ability of a fund manager to anticipate and adapt to these shifts is a key determinant of success – or spectacular failure. Think of it as navigating a treacherous ocean; some ships are designed for calm waters, others for storms, and a few, remarkably, can handle both with aplomb.

Manager Skill and Alpha Generation

The elusive “alpha”—that excess return generated above and beyond the market benchmark—is the holy grail of hedge fund management. While market cycles provide the backdrop, manager skill is the brushstrokes that paint the masterpiece (or, occasionally, the disastrous Jackson Pollock). A skilled manager possesses a keen understanding of market dynamics, a knack for identifying undervalued assets, and the discipline to stick to their strategy even when the market throws a curveball. Conversely, a less-skilled manager might chase trends, overextend their positions, or simply get caught flat-footed by unexpected market events. The difference between a successful manager and an unsuccessful one can be the difference between a fortune and a fiasco.

Macroeconomic Factors and Hedge Fund Returns

Macroeconomic factors—those broad economic trends that affect the entire market—can have a profound impact on hedge fund returns. Interest rate changes, inflation, geopolitical events, and regulatory shifts can all significantly influence investment opportunities and risk profiles. For example, a sudden rise in interest rates can negatively impact bond-heavy strategies, while a global pandemic might create opportunities for certain event-driven or distressed debt funds. These macro factors are the unpredictable winds that can either propel a hedge fund to success or send it crashing.

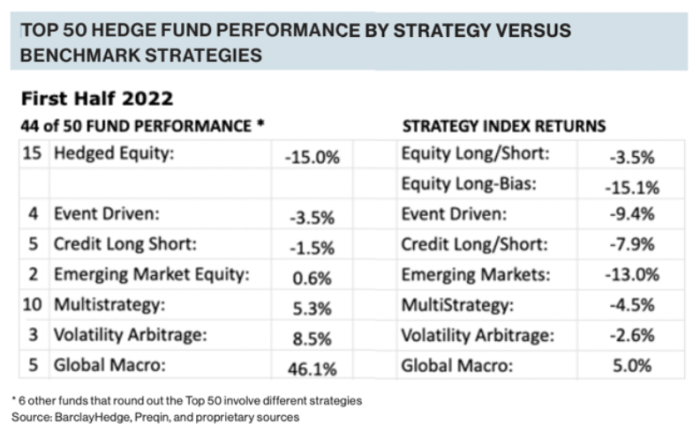

Comparative Performance of Different Hedge Fund Strategies

Different hedge fund strategies exhibit varying degrees of sensitivity to market conditions. For instance, long-short equity strategies often aim for consistent returns regardless of market direction, while global macro funds tend to be more volatile, profiting from large-scale macroeconomic shifts. Arbitrage strategies, on the other hand, often seek to exploit pricing inefficiencies and are less susceptible to broad market swings. Understanding these nuances is critical for investors seeking to diversify their portfolios and mitigate risk. It’s like having a team of specialists—each expert in a different aspect of the market, each contributing their unique skillset to navigate the complexities of the financial world.

Examples of Macroeconomic Factors and Their Impact

- Interest Rate Hikes: Increased interest rates can negatively impact bond prices, hurting fixed-income strategies, while potentially benefiting short-selling opportunities.

- Inflationary Pressures: High inflation erodes purchasing power and can lead to increased volatility, impacting various strategies depending on their exposure to inflation-sensitive assets.

- Geopolitical Uncertainty: Events such as wars or trade disputes can create market uncertainty, leading to increased volatility and potential opportunities for some strategies (e.g., those focused on geopolitical risk).

- Regulatory Changes: New regulations can significantly impact certain industries or investment strategies, creating both challenges and opportunities for adaptation.

- Unexpected Economic Slowdowns/Recessions: These can drastically impact market performance, benefiting some strategies (like distressed debt) while harming others (like growth equity).

Benchmarking Hedge Fund Performance

Benchmarking hedge funds – a task that sounds as straightforward as herding cats wearing roller skates. The inherent complexity of these investment strategies, coupled with the often-opaque nature of their reporting, makes finding a suitable yardstick a Herculean, if not slightly comical, undertaking. Let’s delve into the wonderfully messy world of hedge fund benchmarking.

Challenges in Selecting Appropriate Benchmarks for Hedge Funds

The difficulties in selecting appropriate benchmarks stem from the sheer diversity of hedge fund strategies. Unlike mutual funds, which often invest in publicly traded securities and can be easily benchmarked against broad market indices, hedge funds employ a vast array of strategies, from long/short equity to global macro, arbitrage, and even distressed debt. Each strategy has its own unique risk profile, investment horizon, and performance drivers, making a one-size-fits-all benchmark utterly inappropriate. Furthermore, many hedge funds utilize leverage, derivatives, and other complex instruments, further complicating the benchmarking process. Finally, the lack of transparency in hedge fund holdings makes it challenging to construct a truly representative benchmark. Imagine trying to find the perfect pair of shoes for a centipede – it’s just not going to happen easily.

Benchmarking Approaches for Diverse Hedge Fund Strategies

Different benchmarking approaches are needed to accommodate the wide range of hedge fund strategies. For example, a long/short equity fund might be benchmarked against a broad market index, such as the S&P 500, or a more specific index that reflects the fund’s investment style (e.g., Russell 2000 for small-cap focused funds). Global macro funds, on the other hand, might be benchmarked against a basket of currencies or commodities, reflecting the broader macroeconomic factors that influence their performance. Event-driven funds might use a bespoke index constructed from a selection of merger and acquisition targets. The key is to select a benchmark that captures the fund’s primary risk exposures and investment universe. This isn’t a simple “one size fits all” scenario; it’s more akin to choosing the perfect wine pairing for a multi-course meal.

Hypothetical Benchmark for a Specific Hedge Fund Strategy

Let’s consider a hypothetical distressed debt fund that invests in the debt of financially troubled companies. A suitable benchmark for this fund could be a custom-constructed index of distressed debt securities, weighted by market capitalization and adjusted for credit quality. This index would need to be regularly updated to reflect changes in the distressed debt market and the fund’s portfolio holdings. The justification for this choice is that it directly reflects the fund’s investment universe and risk profile. It’s like using a specialized measuring tape to gauge the length of a particularly quirky piece of furniture – precision is key.

Interpreting Hedge Fund Performance Relative to its Benchmark

Once a benchmark has been selected, the fund’s performance can be evaluated relative to it. This involves calculating metrics such as alpha (the excess return above the benchmark) and beta (the sensitivity of the fund’s returns to the benchmark’s returns). A positive alpha suggests that the fund manager has generated excess returns through skill, while a high beta indicates that the fund’s returns are highly correlated with the benchmark. For instance, if a fund consistently outperforms its benchmark (positive alpha) while maintaining a low beta (less sensitivity to market fluctuations), it suggests superior risk-adjusted performance. Analyzing these metrics provides a clearer picture of the fund’s performance relative to its peers and the overall market. This is like comparing apples to apples (or, in this case, hedge funds to their appropriate benchmarks), a task much easier than comparing apples to oranges.

Risk Management in Hedge Fund Performance

Navigating the thrilling, yet treacherous, world of hedge fund investing requires a delicate balance between ambition and prudence. While the potential for sky-high returns is undeniably alluring, the inherent risks can be equally daunting, resembling a financial tightrope walk above a pit of hungry crocodiles. Effective risk management isn’t just a good idea; it’s the lifeblood of a successful hedge fund, separating the survivors from the spectacularly imploded.

Various Risk Factors Associated with Hedge Fund Investments

Hedge funds, by their very nature, often employ complex and leveraged strategies, exposing them to a multitude of risks. These risks are far more nuanced than those associated with traditional investments, demanding a sophisticated and multifaceted approach to mitigation. Ignoring these risks is akin to sailing a yacht without a compass in a hurricane.

Examples of Risk Management Techniques Employed by Hedge Funds

A well-structured risk management framework is the cornerstone of any successful hedge fund. This framework typically involves a combination of quantitative and qualitative techniques. Quantitative techniques rely on statistical models and data analysis to identify and measure risk exposures. For instance, Value at Risk (VaR) models are commonly used to estimate potential losses over a specific time horizon and confidence level. Qualitative techniques, on the other hand, involve subjective assessments of market conditions, geopolitical events, and other factors that may impact the fund’s performance. Stress testing, scenario analysis, and diversification are all examples of widely used qualitative risk management techniques. A robust risk management system acts as a safety net, preventing catastrophic falls from the financial high-wire.

Comparison of Different Risk-Adjusted Performance Measures

Measuring hedge fund performance solely based on raw returns is like judging a chef solely on the amount of food they produce – the quality matters more! Risk-adjusted performance measures provide a more comprehensive evaluation, factoring in the risk taken to achieve those returns. The Sharpe Ratio, for instance, measures risk-adjusted return by dividing excess return (return above the risk-free rate) by the standard deviation of returns. A higher Sharpe Ratio indicates better risk-adjusted performance. Other commonly used measures include the Sortino Ratio (which focuses on downside deviation), and the Treynor Ratio (which considers beta, a measure of systematic risk). Choosing the right measure depends on the specific investment strategy and risk profile of the fund. These ratios help us discern the true culinary skill, not just the sheer volume of food produced.

Types of Risk and Their Mitigation Strategies

| Type of Risk | Description | Mitigation Strategies | Example |

|---|---|---|---|

| Market Risk | Fluctuations in market prices due to overall market movements. | Diversification, hedging (e.g., options, futures), stress testing. | A sudden drop in the stock market affecting a portfolio heavily invested in equities. |

| Liquidity Risk | Inability to quickly convert assets into cash without significant price concessions. | Maintaining sufficient cash reserves, investing in liquid assets, establishing pre-arranged lines of credit. | Difficulty selling a large position in a thinly traded security. |

| Credit Risk | Risk of default by borrowers or counterparties. | Diversification of borrowers, thorough due diligence, credit derivatives. | A borrower failing to repay a loan. |

| Operational Risk | Risk of losses due to inadequate or failed internal processes, people, and systems. | Robust internal controls, regular audits, employee training, technology upgrades. | A trading error resulting in significant losses. |

Hedge Fund Performance Attribution

Unraveling the mysteries of hedge fund returns is like solving a particularly complex Rubik’s Cube – colorful, challenging, and potentially very rewarding. Performance attribution is the key to understanding which elements contributed to a fund’s success (or, let’s be honest, sometimes its spectacular failure). It’s about dissecting those returns, pinpointing the sources of profit (or loss), and ultimately, learning what makes a hedge fund tick (or sputter).

Performance attribution involves decomposing a hedge fund’s overall return into its constituent parts. This isn’t just about adding up the numbers; it’s about understanding the *why* behind those numbers. By identifying the specific drivers of performance – be it market movements, skillful stock picking, or even a healthy dose of luck – we can gain invaluable insights into a fund’s strategy and its effectiveness. This process helps managers fine-tune their approaches, investors assess risk, and everyone involved sleep a little easier (or at least, a little less nervously).

Methods for Performance Attribution

Several methods exist for dissecting hedge fund returns, each with its own strengths and weaknesses. Choosing the right method depends on the fund’s specific strategy and the level of detail required. A simple approach might suffice for a broadly diversified fund, while a more sophisticated methodology might be necessary for a highly specialized strategy. The goal is to find the right tool for the job, not to over-engineer the analysis to the point of absurdity.

Brinson-Fachler Attribution

This widely used method breaks down returns into allocation effects (sector/asset class choices), selection effects (picking individual securities within an asset class), and interaction effects (the interplay between allocation and selection). Think of it as separating the impact of choosing the right *ingredients* from the skill in *cooking* them. While relatively straightforward to implement, it can struggle with complex strategies involving leverage or derivatives.

Attribution Using Factor Models

Factor models, such as the Fama-French three-factor model, attribute returns to exposure to specific market factors (e.g., market risk, size, value). This allows for a comparison of a fund’s performance against its exposure to these known factors, isolating the manager’s skill (alpha) from market-driven returns (beta). This method excels in identifying sources of systematic risk and potential alpha generation but may overlook idiosyncratic factors specific to the fund’s strategy.

Time-Series Regression

This statistical approach involves regressing the fund’s returns against a set of benchmark indices or factors. The regression coefficients reveal the fund’s sensitivity to each factor. This provides a quantitative measure of exposure to different market risks and the manager’s ability to generate alpha. While powerful, this method can be sensitive to data issues and model misspecification. Imagine trying to fit a square peg into a round hole – it can be done, but it’s rarely pretty.

Common Performance Attribution Methods

It’s important to choose a method appropriate for the specific hedge fund strategy. Overly complex methods for simple strategies are overkill; conversely, simplistic methods for complex strategies risk missing crucial details.

- Brinson-Fachler Attribution

- Factor Model Attribution (e.g., Fama-French)

- Time-Series Regression

- Style Analysis

- Holding-Period Returns Attribution

Identifying Alpha and Beta using Performance Attribution, Hedge Fund Performance Review

Alpha represents the excess return generated by a fund manager’s skill, above and beyond what would be expected given the fund’s risk profile (beta). Performance attribution helps isolate alpha by removing the impact of market factors (beta). For example, if a fund significantly outperforms its benchmark even after accounting for its exposure to market risk, the difference is likely attributable to the manager’s skill in selecting investments or timing the market. Conversely, a consistent underperformance after adjusting for market factors points towards a need for strategic review. The beauty of this process is that it separates luck from skill, a distinction often lost in the noise of raw return figures.

Visualizing Hedge Fund Performance

Data visualization is the key to unlocking the often-cryptic world of hedge fund performance. A well-crafted chart can transform complex financial data into easily digestible insights, even for those who would rather wrestle a greased pig than decipher a spreadsheet. Let’s explore how to effectively showcase hedge fund returns using the power of visual storytelling.

Creating Visually Appealing Performance Charts

A compelling chart illustrating a hedge fund’s performance over time requires careful consideration. A simple line chart is usually the most effective. The horizontal (x) axis should represent time (e.g., months, quarters, or years), while the vertical (y) axis displays the cumulative return, typically expressed as a percentage. Clear axis labels are crucial; “Cumulative Return (%)” and “Year” are straightforward and unambiguous. A legend, if multiple funds or strategies are compared, should be concise and easily understood. For instance, a legend might differentiate between “Fund A,” “Fund B,” and a relevant market benchmark like the S&P 500. Consider using distinct colors and line styles to avoid visual clutter. A well-designed chart should immediately communicate the fund’s overall trend – upward, downward, or sideways – and highlight any significant periods of outperformance or underperformance.

Illustrating Correlation with a Market Index

A scatter plot is ideal for visualizing the correlation between a hedge fund’s performance and a market index. The x-axis represents the return of the market index (e.g., monthly returns of the S&P 500), and the y-axis shows the corresponding returns of the hedge fund over the same period. Each point on the chart represents a specific period’s performance for both the fund and the index. A strong positive correlation would be shown by points clustered closely around a line sloping upwards from left to right, indicating that the hedge fund tends to move in the same direction as the market. A negative correlation would show points clustered around a line sloping downwards. A weak or no correlation would be indicated by points scattered randomly across the chart. For example, a chart showing a strong positive correlation between a long-only equity hedge fund and the S&P 500 would be expected, while a market-neutral strategy should show a weak or no correlation.

Effective Use of Different Chart Types

Different chart types serve different purposes. While line charts are best for showing trends over time, bar charts can effectively compare the performance of multiple funds or strategies over a specific period. For example, a bar chart could compare the annual returns of three different hedge funds for the past five years. Pie charts, although less suitable for showing performance *over time*, can be useful for illustrating the allocation of assets within a hedge fund portfolio. However, overuse of pie charts can lead to visual overload, especially when dealing with many asset classes. Choosing the right chart type depends heavily on the specific data and the message you wish to convey. The key is clarity and avoiding any visual trickery that might mislead the viewer.

Case Studies of Hedge Fund Performance

The world of hedge funds is a thrilling rollercoaster – sometimes a gentle climb, other times a stomach-churning freefall. Let’s examine some real-world examples to illustrate the highs and lows, the triumphs and disasters, offering valuable lessons for both aspiring and seasoned investors. Buckle up!

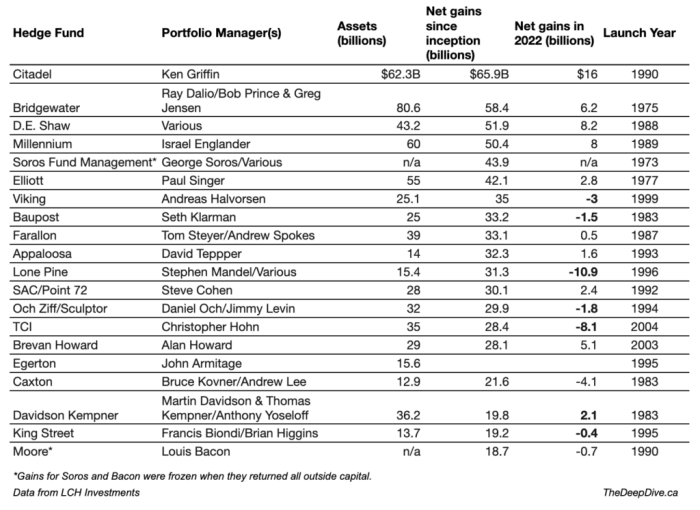

High-Performing Hedge Fund: Renaissance Technologies

Renaissance Technologies, famously secretive, consistently delivers exceptional returns. Their quantitative, statistically-driven approach, relying heavily on complex mathematical models and advanced algorithms, is the engine of their success. They meticulously analyze vast datasets, identifying subtle patterns and inefficiencies in various markets, from equities to futures. Risk management is integral to their strategy; diversification across asset classes and sophisticated risk models are employed to mitigate potential losses. While precise figures are hard to come by due to their private nature, historical performance suggests annualized returns well exceeding 30% for many years, though this has moderated in recent times. This remarkable track record highlights the power of rigorous data analysis and disciplined risk management in achieving sustained success. The success is not just down to their models but also to a highly talented team of mathematicians, physicists, and computer scientists. Their approach is a testament to the adage that “knowledge is power,” but also that “knowledge needs careful handling”.

Hedge Fund Experiencing Significant Losses: Long-Term Capital Management (LTCM)

LTCM, a once-celebrated hedge fund founded by Nobel laureates, serves as a cautionary tale. Their sophisticated arbitrage strategies, leveraging complex mathematical models and high leverage, initially generated impressive returns. However, unforeseen market events, particularly the Russian financial crisis of 1998, exposed the inherent risks in their approach. Their highly leveraged positions amplified losses, leading to a catastrophic collapse. LTCM’s failure underscores the limitations of even the most sophisticated models when confronted with extreme market volatility and the crucial role of stress testing and robust risk management in mitigating black swan events. Their leverage was so high that even relatively small market movements resulted in enormous losses. For instance, a relatively small move in the bond market could wipe out their capital quickly. They suffered losses exceeding $4.6 billion in a matter of months, ultimately requiring a government-orchestrated bailout.

Comparison of Two Hedge Funds with Different Strategies

Let’s compare two contrasting approaches: a value investing hedge fund and a quant-driven hedge fund. A value investing hedge fund, such as some divisions of Berkshire Hathaway (though not strictly a hedge fund), focuses on identifying undervalued assets and holding them for the long term. Their returns are generally less volatile than those of a quant fund, but also tend to be less spectacular in bull markets. A quant fund, on the other hand, employs sophisticated algorithms to identify and exploit short-term market inefficiencies. Their returns can be highly volatile, with periods of significant gains followed by substantial losses. Imagine a hypothetical value fund with an average annual return of 10% over ten years with a standard deviation of 5%, versus a quant fund achieving an average annual return of 15% but with a standard deviation of 15%. While the quant fund shows a higher average return, the substantially higher risk makes it a very different proposition for investors. The choice between these approaches hinges on individual risk tolerance and investment horizon.

Wrap-Up: Hedge Fund Performance Review

So, there you have it – a whirlwind tour through the often-chaotic, always-intriguing world of hedge fund performance. While predicting the future remains an elusive art, understanding the past and present provides invaluable insight. Remember, even the most sophisticated models can’t account for the unpredictable whims of the market (or the occasional rogue trader). Invest wisely, and may your returns be ever in your favor!

Q&A

What is a Sharpe Ratio, and why is it important?

The Sharpe Ratio measures risk-adjusted return, essentially telling you how much extra return you’re getting for each unit of risk you take. A higher Sharpe Ratio is generally better, indicating superior risk-adjusted performance.

How do I choose the right hedge fund for my investment portfolio?

That’s a question best answered by a qualified financial advisor! Factors to consider include your risk tolerance, investment goals, and the fund’s historical performance and strategy. Don’t rely solely on past performance as a predictor of future success.

What are some common red flags to watch out for in hedge fund marketing materials?

Beware of overly optimistic projections, a lack of transparency regarding fees and strategies, and claims of guaranteed returns (which are practically unheard of in the world of investing). Always conduct thorough due diligence.