Navigating the complex world of hedge fund strategies requires a deep understanding of diverse approaches and inherent risks. This review delves into the historical evolution of prominent strategies, examining both their successes and failures. We’ll explore a range of methodologies, from long-short equity and global macro to event-driven and quantitative techniques, providing a comprehensive overview for both seasoned investors and those new to the field.

The analysis will cover key considerations such as risk management, performance measurement, and regulatory compliance, offering insights into the crucial elements that determine the success or failure of hedge fund investments. Through hypothetical portfolio examples and detailed explanations of various strategies, this review aims to equip readers with a robust understanding of this sophisticated investment landscape.

Introduction to Hedge Fund Strategies

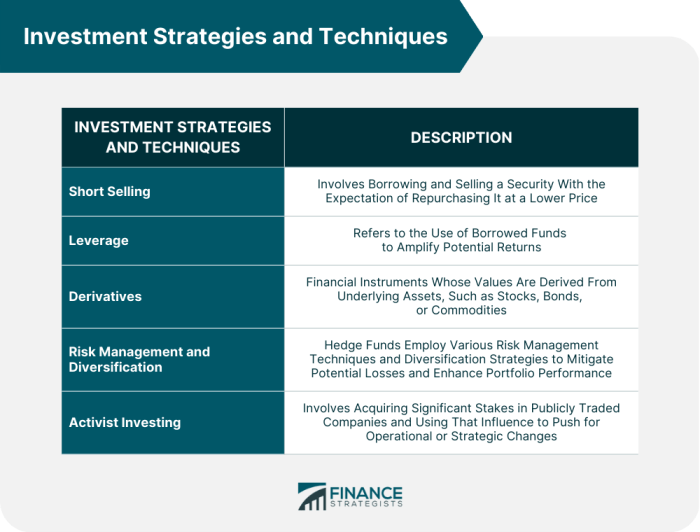

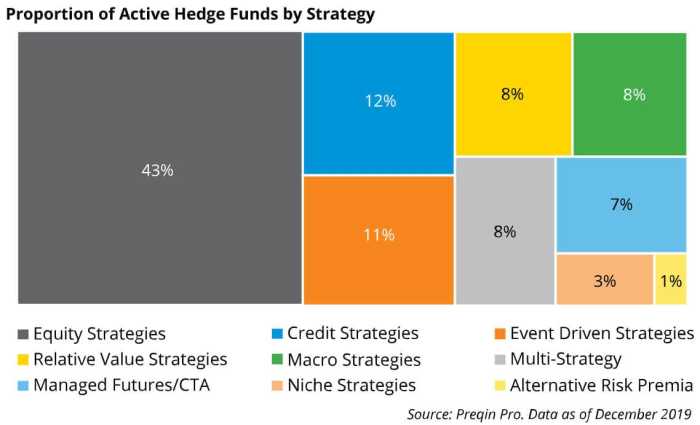

Hedge funds represent a diverse and dynamic segment of the investment world, employing a wide array of strategies to generate returns for their investors. These strategies often involve complex financial instruments and sophisticated trading techniques, aiming to outperform traditional market benchmarks. Understanding the various approaches is crucial for anyone seeking to comprehend the hedge fund landscape.

The evolution of hedge fund strategies is closely tied to changes in financial markets and regulatory environments. Early hedge funds, emerging in the 1940s and 1950s, primarily focused on long-short equity strategies, seeking to profit from both rising and falling asset prices. The subsequent decades saw the development of more specialized strategies, including arbitrage, global macro, and event-driven investing, reflecting innovations in financial engineering and increased market complexity.

Types of Hedge Fund Strategies

Hedge fund strategies can be broadly categorized based on their investment approach and the types of assets they utilize. Some common categories include long-short equity, which involves simultaneously holding long and short positions in stocks; arbitrage, which capitalizes on price discrepancies between related securities; global macro, which makes bets on macroeconomic trends; and event-driven, which profits from corporate events such as mergers and acquisitions. Other strategies include distressed debt, which focuses on investing in financially troubled companies, and relative value, which seeks to identify mispricings within specific asset classes. The specific implementation of each strategy varies widely across different hedge funds.

Examples of Successful and Unsuccessal Hedge Fund Strategies

Several strategies have demonstrated remarkable success throughout history. For instance, Renaissance Technologies, employing quantitative models and sophisticated statistical analysis, has achieved consistently high returns over many years. Similarly, some global macro funds have generated significant profits by accurately predicting major economic shifts. Conversely, many hedge funds have experienced substantial losses, often due to poor risk management, flawed investment strategies, or unforeseen market events. The collapse of Long-Term Capital Management (LTCM) in 1998 serves as a cautionary tale of the risks inherent in complex trading strategies and the importance of robust risk controls. The fund’s sophisticated mathematical models failed to account for the extreme market volatility experienced during the Russian financial crisis, leading to massive losses and ultimately bankruptcy. This highlights the importance of diversification and careful risk assessment in the hedge fund world.

Long-Short Equity Strategies

Long-short equity strategies represent a core approach within the hedge fund universe, aiming to generate alpha by exploiting market inefficiencies and leveraging both long and short positions simultaneously. These strategies seek to profit regardless of overall market direction, offering a potentially lower-risk profile compared to purely long-only equity investments. The core principle involves identifying undervalued (long) and overvalued (short) securities, carefully balancing the portfolio to minimize overall market risk while maximizing potential returns.

Long-short equity strategies involve simultaneously holding long positions in stocks expected to appreciate and short positions in stocks expected to depreciate. The mechanics revolve around careful stock selection based on fundamental analysis, quantitative models, or a combination of both. Effective risk management is crucial, involving techniques such as hedging, diversification, and position sizing to mitigate potential losses. Successful implementation requires deep understanding of market dynamics, company fundamentals, and sophisticated risk management tools.

Long-Short Equity Approach Comparisons

Market neutral and directional long-short strategies represent distinct approaches within this broader category. Market neutral strategies aim to minimize exposure to overall market movements by carefully balancing long and short positions. The goal is to generate returns solely based on stock selection, making them less sensitive to broader market fluctuations. Directional strategies, conversely, take a more active view on the market, overweighting either long or short positions depending on the manager’s outlook. This approach carries higher market risk but offers the potential for greater returns if the market moves in the anticipated direction. The choice between these approaches depends on the manager’s investment philosophy, risk tolerance, and market outlook.

Hypothetical Long-Short Equity Portfolio

The following table Artikels a hypothetical long-short equity portfolio, illustrating the rationale behind each position. This is a simplified example and does not constitute investment advice. Actual portfolio construction would involve far more complex considerations and rigorous risk management.

| Ticker | Position | Rationale | Target Price |

|---|---|---|---|

| AAPL | Long | Strong fundamentals, innovative product pipeline, positive industry outlook. Expected growth in market share and earnings. | $200 |

| AMC | Short | High valuation, questionable long-term viability, significant debt burden, and potential for decreased revenue. | $10 |

| MSFT | Long | Dominant market position in cloud computing, strong cash flow, and consistent growth. | $350 |

| GME | Short | High volatility, driven by speculative trading, potential for decreased retail interest. | $25 |

Global Macro Strategies

Global macro strategies involve making investment decisions based on broad macroeconomic trends and events affecting global economies. These strategies often leverage significant leverage and aim to profit from large market movements across various asset classes, including currencies, bonds, equities, and commodities. Unlike long-short equity strategies that focus on individual company performance, global macro focuses on the bigger picture, anticipating shifts in global economic landscapes.

Global macro trading considers a wide range of factors to inform investment decisions. These factors are interconnected and require sophisticated analysis to predict their impact on markets.

Factors Considered in Global Macro Trading

Successful global macro trading relies on a comprehensive understanding of numerous interacting factors. These range from traditional macroeconomic indicators to geopolitical events and shifts in market sentiment. A thorough assessment of these elements is crucial for formulating effective trading strategies. For example, an unexpected increase in inflation in a major economy might prompt a trader to bet against that nation’s currency, anticipating a central bank interest rate hike to combat inflation. Conversely, a significant geopolitical event, such as a major trade agreement, might influence investment decisions in related sectors or countries.

The Role of Macroeconomic Indicators

Macroeconomic indicators play a pivotal role in informing investment decisions within global macro strategies. These indicators provide valuable insights into the health and direction of economies, allowing traders to anticipate market movements. Examples include gross domestic product (GDP) growth, inflation rates, interest rates, unemployment figures, consumer confidence indices, and various leading economic indicators. Analyzing these indicators, often in conjunction with other data points like government spending or central bank policy statements, allows traders to identify potential opportunities and risks across different asset classes. For instance, a consistently rising inflation rate might signal an upcoming interest rate hike, potentially impacting bond prices and currency values.

Potential Risks and Challenges of Global Macro Strategies

Global macro strategies, while potentially highly lucrative, are inherently risky. The complex interplay of global economic factors and the inherent uncertainty of future events present significant challenges.

- Market Volatility: Global macro strategies are often exposed to significant market volatility, particularly during periods of economic uncertainty or geopolitical instability. Unexpected events can drastically impact asset prices, leading to substantial losses.

- Unforeseen Events: Geopolitical events, such as wars, pandemics, or unexpected policy changes, can have a profound and unpredictable impact on market outcomes, rendering even the most sophisticated analyses potentially inaccurate.

- Leverage Risk: Global macro strategies often employ significant leverage to amplify returns. However, this leverage also magnifies losses, potentially leading to substantial financial losses if trades go against the predicted direction.

- Correlation Breakdown: The assumption of certain correlations between asset classes might break down unexpectedly, leading to significant losses if these relationships are misjudged. For example, historically negatively correlated assets may become positively correlated during times of extreme stress, invalidating trading strategies based on previous correlations.

- Complexity and Information Overload: The sheer volume of data and the complexity of global economic interactions require significant expertise and sophisticated analytical tools to effectively process and interpret information. Misinterpretations can lead to flawed investment decisions.

Event-Driven Strategies

Event-driven strategies in hedge fund investing capitalize on specific corporate events or situations that create temporary market inefficiencies. These strategies often involve detailed fundamental analysis and a deep understanding of legal and regulatory frameworks, aiming to profit from the price discrepancies arising from these events. Unlike long-short equity or global macro strategies, event-driven strategies are more focused on specific, short-term opportunities.

Event-driven strategies encompass a range of approaches, each with its own risk profile and return characteristics. The most common include mergers and acquisitions (M&A) arbitrage, distressed debt investing, and restructuring situations. Successful implementation requires a sophisticated understanding of the relevant legal processes, corporate governance, and market dynamics.

Mergers and Acquisitions Arbitrage

Mergers and acquisitions arbitrage involves profiting from the price discrepancies between the offer price and the target company’s stock price during a merger or acquisition. Investors typically buy the target company’s stock (or other securities) after an acquisition announcement, anticipating that the stock price will eventually converge to the offer price. The potential profit comes from the difference between the offer price and the current market price, less any transaction costs and potential risks of the deal failing to close. Successful M&A arbitrage requires careful assessment of the deal’s likelihood of closing, considering factors such as regulatory approvals, financing conditions, and potential antitrust issues. For example, if Company A offers to buy Company B for $50 per share, but Company B’s stock trades at $45, an arbitrageur might buy Company B’s stock, expecting a profit of $5 per share if the deal closes successfully. However, the deal might fail due to unforeseen circumstances, resulting in a loss for the arbitrageur.

Distressed Debt Investing

Distressed debt investing focuses on acquiring debt securities of financially troubled companies at discounted prices. Investors aim to profit from the eventual recovery of the company’s value or through restructuring processes. This strategy often involves extensive credit analysis and a thorough understanding of the company’s financial situation and restructuring options. A successful distressed debt investor can profit from the recovery of the company’s value, debt repayment, or even equity ownership in the restructured entity. For instance, an investor might purchase bonds of a company facing bankruptcy at 50 cents on the dollar, hoping that the company will restructure its debt or be acquired, leading to a significant increase in the bond’s value. However, the company might liquidate with minimal asset recovery, resulting in a total loss for the investor.

Risk Profiles of Event-Driven Strategies

The risk profiles of different event-driven strategies vary considerably. M&A arbitrage is generally considered lower risk than distressed debt investing, as the potential for complete loss is lower in successful M&A transactions. However, M&A arbitrage also has lower potential returns compared to distressed debt investing, reflecting the lower risk. Distressed debt investing, while offering potentially higher returns, involves higher risk due to the inherent uncertainty surrounding the financial recovery of distressed companies. The risk of deal failure, unexpected legal challenges, or unforeseen economic downturns significantly impacts the success of these strategies. Diversification across various event-driven strategies and thorough due diligence are crucial for mitigating risk.

Quantitative Strategies (Quant)

Quantitative strategies, or quant strategies, represent a significant segment of the hedge fund landscape. These strategies rely heavily on mathematical and statistical models, advanced algorithms, and vast datasets to identify and exploit market inefficiencies and generate alpha. Unlike fundamental strategies that focus on qualitative factors, quant strategies are driven by data-driven insights and rigorous computational analysis.

Quantitative models and algorithms form the core of quant hedge fund management. These models analyze historical and real-time market data to identify patterns, predict future price movements, and execute trades automatically. Sophisticated algorithms are used for tasks ranging from portfolio optimization and risk management to high-frequency trading and arbitrage. The complexity of these models varies greatly, from relatively simple linear regressions to complex machine learning algorithms and neural networks. The goal is consistently to generate statistically significant returns that are not easily replicated by other market participants.

Data Sources and Analytical Techniques

Quant strategies draw upon a diverse range of data sources, significantly expanding beyond traditional market data. This includes high-frequency tick data, order book information, macroeconomic indicators, fundamental company data, alternative data (such as satellite imagery or social media sentiment), and even weather patterns. The analytical techniques employed are equally varied and often involve advanced statistical modeling. This can include time series analysis, regression modeling, factor modeling, machine learning techniques (such as support vector machines, random forests, and neural networks), and optimization algorithms. For example, a quant strategy might use sentiment analysis of social media posts to predict stock price movements or employ machine learning to identify subtle correlations between seemingly unrelated datasets.

Backtesting Quantitative Models

Backtesting is a crucial step in the development and evaluation of quantitative models. It involves testing a model’s performance on historical data to assess its potential profitability and risk characteristics. This process allows managers to identify potential flaws in the model and refine it before deploying it with real capital. Effective backtesting requires a rigorous approach, including the use of appropriate statistical methods to avoid overfitting and data-snooping biases. For instance, a manager might use a “walk-forward” analysis, where the model is trained on a portion of the historical data and then tested on a subsequent, out-of-sample period. This helps to assess the model’s ability to generalize to new, unseen data, which is critical for its success in live trading. Robust backtesting, coupled with stress testing under various market conditions, provides crucial insights into a model’s reliability and potential risks before live deployment.

Relative Value Strategies

Relative value strategies in hedge fund management focus on exploiting perceived pricing discrepancies between related securities. Unlike directional strategies that bet on the overall market movement, relative value approaches aim to profit from the convergence of prices towards a perceived fair value. These strategies often involve complex analytical models and a deep understanding of specific market segments.

Relative Value Arbitrage Strategies Explained

Relative value arbitrage hinges on identifying and capitalizing on temporary mispricings between two or more securities that are economically linked. This linkage can manifest in various forms, such as merger arbitrage (where the target and acquirer’s stock prices don’t reflect the deal’s value), convertible bond arbitrage (exploiting discrepancies between a convertible bond’s price and the underlying stock), or statistical arbitrage (identifying temporary misalignments in prices of similar assets based on quantitative models). The core principle is that market inefficiencies create opportunities for profit as prices eventually adjust to reflect their true economic relationship. Successful execution requires sophisticated modeling, risk management, and a keen understanding of the factors driving the price discrepancies.

Identifying Mispriced Securities and Portfolio Construction

Identifying mispriced securities necessitates a rigorous analytical process. This involves developing robust valuation models tailored to the specific security or asset class. For instance, in merger arbitrage, a detailed discounted cash flow analysis of the target company might be used to determine its intrinsic value, comparing it to the current market price to gauge potential mispricing. In convertible bond arbitrage, the model might consider factors such as interest rates, stock volatility, and the conversion ratio. Once potential mispricings are identified, constructing a relative value portfolio involves carefully selecting securities to create a diversified portfolio that minimizes overall risk while maximizing potential profit. This process often involves hedging techniques to mitigate exposure to various market risks. Diversification across multiple trades is crucial to manage risk and smooth returns.

Hypothetical Relative Value Trade

The following example illustrates a simplified relative value trade in the context of merger arbitrage.

A company, “Acquirer,” is offering to buy “Target” for $50 per share. The current market price of Target is $48, while Acquirer’s stock trades at $100. The arbitrageur believes the deal will close, and the market is undervaluing Target. The arbitrageur buys 10,000 shares of Target at $48, anticipating a profit of $2 per share upon deal completion. Simultaneously, to hedge against potential deal failure, the arbitrageur might short a correlated number of Acquirer shares or employ other hedging strategies depending on the specific deal structure and risk appetite. The potential profit is $20,000 (10,000 shares * $2/share), excluding transaction costs and hedging expenses. The primary risk is deal failure, leading to potential losses. Other risks include unexpected changes in market conditions or regulatory hurdles.

Emerging Market Strategies

Emerging markets represent a compelling, albeit complex, investment landscape. These economies, typically characterized by rapid growth potential and relatively underdeveloped financial systems, offer both significant opportunities and unique challenges for investors seeking diversification and higher returns. Understanding the nuances of these markets is crucial for successful navigation.

Emerging market investing presents a compelling blend of high-growth potential and inherent volatility. While the potential for substantial returns is undeniable, navigating the inherent risks requires a sophisticated understanding of macroeconomic factors, political stability, and the specific characteristics of individual markets. Successful strategies often involve a long-term perspective and a diversified approach to mitigate the impact of market fluctuations.

Challenges and Opportunities in Emerging Markets

Investing in emerging markets presents a unique set of challenges and opportunities. Opportunities stem from the potential for rapid economic growth, often exceeding that of developed economies. This growth translates into higher corporate earnings and potentially significant capital appreciation for investors. However, these markets are also characterized by higher volatility, political instability, and regulatory uncertainty, all of which can negatively impact investment returns. For example, currency fluctuations can significantly impact returns for investors not adequately hedged. Furthermore, the lack of transparency and robust regulatory frameworks in some emerging markets can increase the risk of fraud or mismanagement.

Key Factors Influencing Investment Decisions

Several key factors significantly influence investment decisions within emerging markets. Macroeconomic conditions, including GDP growth rates, inflation, and interest rates, play a crucial role. Political stability and regulatory environments are also critical, as political risk and unpredictable regulatory changes can severely impact investment performance. The quality of corporate governance and the level of transparency within companies are essential considerations. Finally, the valuation of assets relative to their underlying fundamentals is a key determinant of investment attractiveness. For instance, a company with strong fundamentals but a low valuation might represent an attractive investment opportunity, while a high-valuation company with questionable governance might be avoided.

Risk and Return Comparison Across Emerging Markets

The risk-return profiles of different emerging markets vary significantly. Markets such as China and India, while offering high growth potential, are also characterized by higher volatility and regulatory uncertainty compared to, for example, some more stable emerging markets in Latin America or Eastern Europe. A comparison might show that while China’s growth rate might be higher, the volatility could lead to greater short-term losses, whereas a more stable market might offer more consistent, albeit potentially slower, growth. This highlights the importance of diversification across different emerging markets to manage risk effectively. Furthermore, currency risk must be carefully considered, as fluctuations in local currencies can significantly impact returns in dollar terms. For instance, a strong dollar could negatively impact returns from investments in emerging markets denominated in weaker currencies.

Risk Management in Hedge Funds

Effective risk management is paramount for the survival and success of hedge funds. These funds often employ complex strategies and leverage significant capital, making them susceptible to substantial losses if risks are not carefully assessed and mitigated. A robust risk management framework is therefore crucial, encompassing a variety of techniques and a proactive approach to identifying and addressing potential threats.

Risk management techniques employed by hedge funds are multifaceted and tailored to the specific strategies they pursue. These techniques aim to control and minimize potential losses while maximizing returns.

Risk Management Techniques

Hedge funds utilize a range of sophisticated techniques to manage risk. These include, but are not limited to, establishing position limits to prevent overexposure to any single asset or market; employing stop-loss orders to automatically liquidate positions when they fall below a predetermined threshold; using derivatives such as options and futures to hedge against adverse price movements; and conducting regular portfolio stress tests to assess the fund’s resilience to various market shocks. Furthermore, value-at-risk (VaR) models are commonly used to estimate potential losses over a specific time horizon and confidence level. Diversification across asset classes, geographies, and strategies plays a crucial role in mitigating risk.

The Importance of Diversification in Mitigating Risk

Diversification is a cornerstone of effective risk management in hedge funds. By spreading investments across a variety of uncorrelated assets, the impact of losses in any single asset or market is reduced. For example, a hedge fund might invest in equities, bonds, real estate, commodities, and private equity, ensuring that poor performance in one area is offset by positive performance in another. This reduces the overall volatility of the portfolio and lowers the probability of significant losses. Furthermore, diversification across different trading strategies, such as long-short equity, global macro, and event-driven, can further enhance risk mitigation.

The Role of Stress Testing in Assessing Portfolio Vulnerability

Stress testing is a crucial component of risk management. It involves simulating various adverse market scenarios, such as a sudden market crash or a significant increase in interest rates, to assess the potential impact on the portfolio’s value. This allows fund managers to identify vulnerabilities and adjust their investment strategies accordingly. For instance, a stress test might simulate a 20% decline in the equity market and assess the resulting impact on the fund’s net asset value (NAV). The results of such tests inform decisions about position sizing, hedging strategies, and overall portfolio construction. Sophisticated stress tests might also consider correlations between different asset classes and the potential for contagion effects across markets. By anticipating potential problems, hedge funds can proactively mitigate risk and protect their investors’ capital.

Hedge Fund Performance Measurement

Evaluating the performance of hedge funds requires a nuanced approach, going beyond simple return figures. Several metrics exist, each offering unique insights but also possessing inherent limitations. Understanding these metrics and their respective strengths and weaknesses is crucial for investors seeking to make informed decisions.

Performance Metrics for Hedge Funds

Several key metrics are employed to assess hedge fund performance, each providing a different perspective on risk-adjusted returns. These metrics help investors compare funds across various strategies and risk profiles.

| Metric | Formula | Interpretation | Limitations |

|---|---|---|---|

| Sharpe Ratio |

where Rp is the portfolio return, Rf is the risk-free rate, and σp is the portfolio standard deviation. |

Measures excess return per unit of total risk. A higher Sharpe ratio indicates better risk-adjusted performance. | Assumes a normal distribution of returns, which may not always hold true for hedge funds. Sensitive to the choice of risk-free rate. |

| Sortino Ratio |

where Rp is the portfolio return, Rf is the risk-free rate, and σd is the downside deviation (standard deviation of negative returns only). |

Similar to the Sharpe ratio but focuses only on downside risk, making it more suitable for hedge funds that aim to minimize losses. | Still assumes a specific distribution of returns and is sensitive to the choice of risk-free rate. Downside deviation calculation can be complex. |

| Calmar Ratio |

where Rp is the average annual return and Maximum Drawdown is the largest peak-to-trough decline in the fund’s value. |

Measures risk-adjusted return by considering the maximum drawdown experienced by the fund. A higher Calmar ratio suggests better risk-adjusted performance. | Highly sensitive to the time period considered and may not capture the frequency or severity of smaller drawdowns. |

| Sterling Ratio |

Similar to the Sortino ratio but uses average downside deviation instead of standard deviation of negative returns. |

A measure of risk-adjusted return, focusing on downside risk. Higher values indicate better risk-adjusted performance. | Sensitive to the time period used for calculation and assumes a specific distribution of returns. |

| Information Ratio |

where Rp is the portfolio return, Rb is the benchmark return, and σ(Rp – Rb) is the standard deviation of the difference between portfolio and benchmark returns. |

Measures the excess return relative to a benchmark per unit of tracking error. | Sensitive to benchmark selection and assumes a normal distribution of returns. |

Regulation and Compliance in the Hedge Fund Industry

The hedge fund industry, characterized by its complex investment strategies and high-risk, high-reward profile, operates within a constantly evolving regulatory landscape. Maintaining investor confidence and protecting against systemic risk requires robust regulatory frameworks and stringent compliance procedures. This section examines the key regulatory aspects and the vital role of compliance in ensuring the stability and integrity of the hedge fund industry.

The regulatory environment governing hedge funds varies significantly across jurisdictions, reflecting differing approaches to financial market oversight. However, common themes emerge, focusing on investor protection, transparency, and the prevention of market manipulation. Key regulatory bodies, such as the Securities and Exchange Commission (SEC) in the United States and the Financial Conduct Authority (FCA) in the United Kingdom, play crucial roles in setting standards, conducting oversight, and enforcing regulations. These regulations often dictate aspects such as registration requirements, reporting obligations, and restrictions on leverage and investment strategies.

Regulatory Landscape Governing Hedge Funds

Hedge fund regulation is a multifaceted area, encompassing a range of rules and guidelines aimed at managing risk and protecting investors. These regulations often target specific aspects of hedge fund operations, including registration and licensing, investor suitability, reporting requirements, and anti-money laundering (AML) compliance. For instance, many jurisdictions require hedge funds exceeding certain asset thresholds to register with relevant regulatory authorities, providing details on their investment strategies, investor base, and operational structure. This registration process enables regulatory bodies to monitor the activities of these funds and intervene if necessary. Furthermore, regulations often specify requirements for reporting performance data to investors, ensuring transparency and accountability. AML regulations are designed to prevent hedge funds from being used for illicit activities, such as money laundering or terrorist financing. These regulations mandate rigorous due diligence procedures on investors and counterparties, as well as comprehensive record-keeping systems. The complexity of hedge fund strategies often necessitates a high degree of regulatory scrutiny, balancing the need for innovation with the imperative to safeguard investors and the broader financial system. The lack of a standardized global regulatory framework for hedge funds contributes to the challenges in overseeing this sector effectively. Each jurisdiction’s unique regulatory approach can create complexities for globally operating hedge funds, necessitating careful navigation of different regulatory requirements.

Importance of Compliance in Maintaining Investor Confidence

Compliance with regulations is paramount for maintaining investor confidence in the hedge fund industry. Investors entrust substantial capital to hedge funds, expecting transparency, responsible risk management, and adherence to ethical standards. Consistent compliance demonstrates a commitment to these principles, fostering trust and attracting investment. Conversely, non-compliance can severely damage a hedge fund’s reputation, leading to investor withdrawals, reputational damage, and potentially legal repercussions. A robust compliance program, encompassing internal controls, regular audits, and thorough employee training, is essential for mitigating risks and upholding ethical standards. This proactive approach helps to prevent regulatory violations and ensures the long-term sustainability of the hedge fund. Examples of compliance failures resulting in significant financial losses and reputational damage for hedge funds are numerous and widely documented, serving as cautionary tales within the industry.

Impact of Regulations on Hedge Fund Operations

Regulations significantly influence hedge fund operations, impacting various aspects, from investment strategies to operational processes. For example, restrictions on leverage and short selling can limit a hedge fund’s ability to employ certain investment strategies, potentially affecting its overall returns. Increased reporting requirements necessitate greater administrative burden and potentially higher operating costs. Furthermore, stringent compliance programs require dedicated personnel and resources, adding to operational expenses. While some regulations might constrain certain activities, others can enhance the overall stability and integrity of the industry. For example, regulations promoting transparency and investor protection can attract a wider range of investors and enhance market confidence. The ongoing evolution of regulatory frameworks necessitates continuous adaptation by hedge funds to ensure ongoing compliance and effective risk management. This adaptation involves investing in robust compliance infrastructure, employing skilled compliance professionals, and staying abreast of evolving regulatory changes. The interplay between regulation and innovation in the hedge fund industry is dynamic, with regulators striving to balance the need for investor protection with the need to foster innovation and competition.

Closure

From the intricacies of long-short equity strategies to the complexities of global macro trading and the precision of quantitative models, this review has provided a broad overview of the hedge fund universe. Understanding the diverse approaches, inherent risks, and performance metrics is crucial for informed decision-making. By grasping the regulatory landscape and employing sound risk management techniques, investors can better navigate this dynamic and often volatile investment environment. Ultimately, success in hedge fund investing requires a blend of sophisticated analytical skills, a deep understanding of market dynamics, and a robust risk management framework.

Key Questions Answered

What is the typical fee structure for hedge funds?

Hedge funds commonly charge a management fee (typically 1-2% of assets under management) and a performance fee (often 20% of profits exceeding a certain hurdle rate).

How can I invest in a hedge fund?

Access to hedge funds is typically restricted to accredited investors due to the higher risk and complexity involved. Investment may require a significant minimum investment and may involve lock-up periods.

What are some common risks associated with hedge fund investing?

Risks include illiquidity, leverage, manager risk, operational risk, and market risk. Hedge funds can be highly volatile and experience significant losses.

What is the difference between a long and short position?

A long position involves buying an asset with the expectation of its price increasing. A short position involves borrowing and selling an asset, hoping to buy it back at a lower price and profit from the difference.