Hedge Fund Strategies Review: Prepare yourself for a rollercoaster ride through the thrilling, sometimes terrifying, world of high-finance! We’ll dissect the intricacies of long-short equity, navigate the choppy waters of global macro, and even tiptoe through the minefield of event-driven strategies. Buckle up, because this isn’t your grandma’s investment club.

This comprehensive review explores the diverse strategies employed by hedge funds, from the classic long-short equity plays to the more exotic quantitative models. We’ll examine the evolution of these strategies, the risks involved, and the methods used to measure and manage performance. Get ready for a journey into the heart of the hedge fund universe – a world of both immense potential and considerable peril.

Introduction to Hedge Fund Strategies

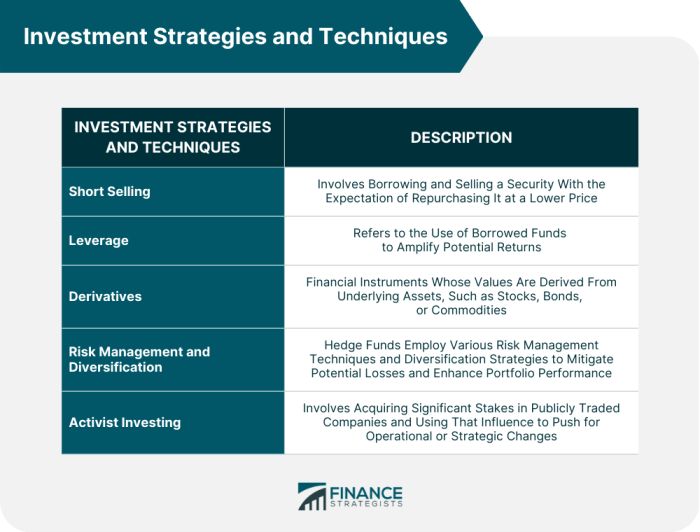

The hedge fund industry, a realm of high finance often shrouded in mystery and (let’s be honest) a bit of swagger, is essentially a collection of alternative investment funds employing diverse strategies to generate returns for their (typically very wealthy) investors. Think of it as the financial equivalent of a highly specialized, and often highly secretive, culinary school, where chefs (fund managers) compete to create the most delectable (profitable) dishes (investment strategies). Unlike your average mutual fund, hedge funds are typically less regulated and can engage in a wider range of investment tactics, including short selling and leverage. This flexibility, however, comes with significantly higher risk.

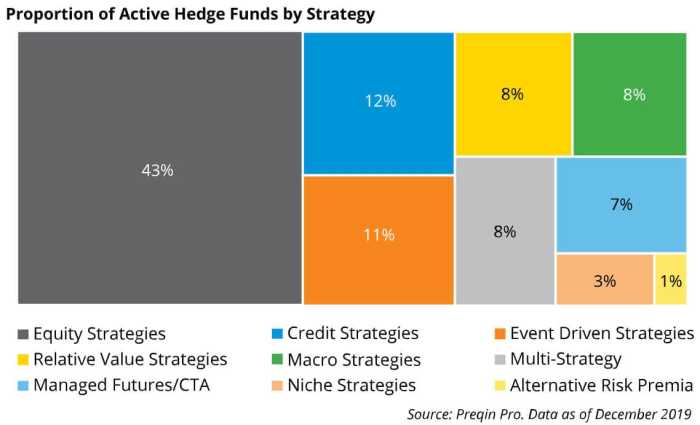

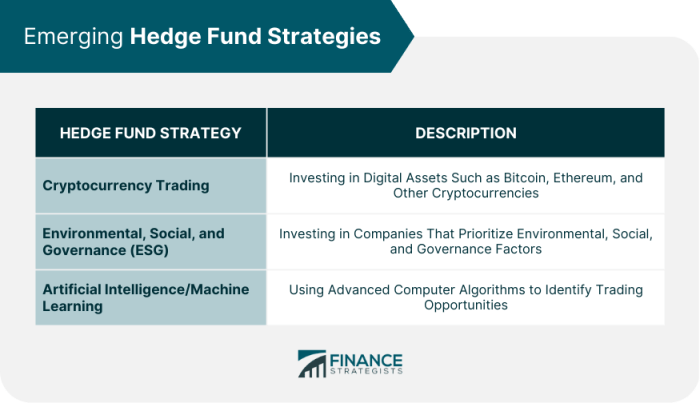

The evolution of hedge fund strategies over the past two decades has been a fascinating, and sometimes bumpy, ride. Initially dominated by relatively straightforward strategies like long/short equity and convertible arbitrage, the landscape has become significantly more complex. The rise of quantitative strategies, fueled by advancements in computing power and data analytics, has been particularly noteworthy. We’ve also seen the emergence of increasingly specialized strategies, often catering to niche market opportunities or exploiting specific market inefficiencies. The global financial crisis of 2008 acted as a significant catalyst, prompting both innovation and a shakeout within the industry.

Hedge Fund Categories and Investment Approaches

Several key categories of hedge funds employ distinct investment approaches. These categories aren’t mutually exclusive; many funds blend elements of multiple strategies. Understanding these approaches is crucial to appreciating the industry’s diversity and inherent risks.

- Long/Short Equity: This classic strategy involves simultaneously holding long positions (betting on price increases) in some stocks and short positions (betting on price decreases) in others. The goal is to profit from both rising and falling markets, theoretically reducing overall risk. A successful long/short equity manager expertly identifies undervalued and overvalued securities.

- Global Macro: These funds attempt to profit from large-scale economic trends, such as changes in interest rates, currency fluctuations, or commodity prices. They often employ leverage and take significant directional bets on global markets. Think of it as trying to predict the weather patterns of the global economy.

- Relative Value Arbitrage: This strategy focuses on exploiting perceived mispricings between related securities. For instance, a relative value arbitrage fund might profit from the price discrepancies between a company’s bonds and its stock. This is less about market timing and more about identifying statistical anomalies.

- Quantitative (Quant) Strategies: These funds rely heavily on mathematical models and computer algorithms to identify trading opportunities. They often employ sophisticated statistical techniques and high-frequency trading to execute trades at optimal prices. Imagine a super-intelligent computer constantly analyzing market data and making lightning-fast decisions.

- Distressed Debt: These funds invest in the debt of financially troubled companies, aiming to profit from restructuring or bankruptcy proceedings. It’s a high-risk, high-reward strategy requiring a deep understanding of corporate finance and legal processes. Think of it as vulture investing, but with a sophisticated spreadsheet.

Long-Short Equity Strategies

Long-short equity strategies, the financial equivalent of a sophisticated game of chess, involve simultaneously taking long positions (betting on price increases) and short positions (betting on price decreases) in different equities. This seemingly contradictory approach aims to generate alpha, or excess returns, regardless of overall market direction. Think of it as expertly navigating a choppy sea, profiting from both the crests and troughs of the waves.

The mechanics are relatively straightforward, yet the execution requires significant skill and precision. Managers identify undervalued companies for long positions and overvalued companies for short positions, aiming for a portfolio where the potential gains from the longs outweigh the potential losses from the shorts. The key is finding a compelling disparity between market perception and intrinsic value – a treasure hunt for mispriced assets.

Long-Short Equity Approaches

Different approaches to long-short equity strategies exist, each with its own unique flavor and risk profile. Some managers focus on a highly concentrated portfolio of a few carefully selected stocks, while others prefer a more diversified approach with numerous holdings. The investment horizon also varies considerably, with some strategies focusing on short-term trades while others adopt a longer-term perspective. Furthermore, the degree of market neutrality – the extent to which the portfolio’s performance is uncorrelated with the overall market – varies across strategies. A perfectly market-neutral strategy aims for zero beta, meaning its returns are unaffected by broad market movements.

Risk Management in Long-Short Equity Strategies

Risk management is paramount in long-short equity strategies, as the simultaneous long and short positions can create complex interactions. Effective risk management involves rigorous due diligence, robust position sizing, and sophisticated hedging techniques. Diversification across sectors, market caps, and geographical regions is crucial to mitigate exposure to specific risks. Moreover, sophisticated statistical models and stress tests are frequently employed to assess and manage potential losses. The use of stop-loss orders and other protective measures helps to limit downside potential. For example, a manager might limit their exposure to any single stock to a maximum of 5% of the overall portfolio, or implement dynamic hedging strategies to offset potential market declines. Effective risk management is not just about minimizing losses, but also about maximizing the potential for consistent, profitable returns.

Comparison of Long-Short Equity Strategies

The following table compares four different long-short equity strategies, highlighting their key characteristics. Note that these are illustrative examples and actual strategies may differ significantly.

| Strategy Name | Investment Style | Market Exposure | Typical Holding Period |

|---|---|---|---|

| Quantitative Long-Short | Statistical models identify mispriced securities; often high turnover | Low to Moderate | Short-term to medium-term |

| Fundamental Long-Short | In-depth fundamental analysis drives stock selection; lower turnover | Low to High (depending on manager’s approach) | Medium-term to long-term |

| Event-Driven Long-Short | Focuses on specific corporate events (mergers, acquisitions, bankruptcies); high alpha potential, but higher risk | Moderate to High | Short-term to medium-term |

| Sector-Specific Long-Short | Concentrated on a particular industry or sector; higher risk due to sector-specific volatility | Moderate to High | Medium-term to long-term |

Global Macro Strategies

Global macro strategies, the daredevil acrobats of the hedge fund world, attempt to profit from large-scale shifts in global economies. These strategies are less about picking individual stocks and more about betting on the direction of entire markets, currencies, or commodities. Think less “picking apples” and more “predicting the next apple harvest for the entire planet.” It’s a high-stakes game, but the potential rewards are, shall we say, substantial.

Global macro trading decisions are influenced by a complex interplay of factors, a veritable economic kaleidoscope. The swirling colors represent diverse data points, each contributing to the overall picture. A slight shift in one color can drastically alter the whole scene, leading to potentially lucrative – or disastrous – outcomes.

Factors Influencing Global Macro Trading Decisions

Several key factors drive global macro trading decisions. These factors interact in complex ways, requiring sophisticated analytical models and a healthy dose of intuition. A successful global macro trader is a bit like a weather forecaster, predicting the economic storms and sunshine before they arrive.

- Monetary Policy: Central bank actions, such as interest rate changes and quantitative easing, significantly impact global markets. A surprise rate hike by the Federal Reserve, for instance, could send ripples throughout global financial markets, creating opportunities for savvy traders.

- Fiscal Policy: Government spending and taxation policies also play a vital role. A large infrastructure spending program in a major economy could boost demand for commodities and related stocks.

- Geopolitical Events: International conflicts, political instability, and trade wars can create significant market volatility, offering both risks and opportunities for global macro traders. The unexpected invasion of Ukraine in 2022, for example, triggered significant market shifts.

- Economic Data: Key economic indicators, like GDP growth, inflation, and unemployment rates, provide valuable insights into the overall health of economies. A better-than-expected GDP report might signal a bullish outlook for certain markets.

- Currency Movements: Fluctuations in exchange rates present opportunities for currency trading, a core component of many global macro strategies. A weakening dollar, for example, might make US assets more attractive to foreign investors.

Key Macroeconomic Indicators Used in Global Macro Strategies

The global macro trader’s toolkit is filled with a variety of economic indicators, each providing a different piece of the puzzle. Understanding these indicators and their interrelationships is crucial for successful trading.

- Gross Domestic Product (GDP): A measure of a country’s overall economic output.

- Inflation Rates (CPI, PPI): Measures of the rate of increase in prices of goods and services.

- Interest Rates: The cost of borrowing money, set by central banks.

- Unemployment Rates: The percentage of the labor force that is unemployed.

- Current Account Balance: The difference between a country’s exports and imports.

- Commodity Prices: Prices of raw materials such as oil, gold, and agricultural products.

Hypothetical Global Macro Trading Strategy: The “Emerging Markets Bonanza”

This strategy focuses on emerging market economies showing strong growth potential but facing currency devaluation risks.

Strategy: Invest in a diversified portfolio of emerging market equities and bonds, hedging currency risk using appropriate derivatives.

Potential Risks: Geopolitical instability, currency fluctuations, and sudden shifts in investor sentiment could lead to significant losses. Emerging markets are often more volatile than developed markets.

Potential Rewards: High growth potential in emerging markets could generate substantial returns, exceeding those in more mature economies. Successful currency hedging could further enhance profitability.

“The key to success in global macro is not just understanding the numbers, but also anticipating the narrative. What story is the market telling you?”

Event-Driven Strategies

Event-driven strategies, my friends, are where the real fun begins. Forget slow and steady; we’re talking about capitalizing on sudden, often dramatic, corporate events. Think of it as financial wildfire – get in early, get out rich, or get singed. The key is identifying opportunities before everyone else smells the smoke.

Event-driven strategies hinge on exploiting market inefficiencies created by specific corporate actions. These aren’t your typical buy-and-hold investments; they’re short-term plays with potentially high rewards (and, let’s be honest, equally high risks). The thrill of the chase, the adrenaline of the close…it’s enough to make a quant’s heart skip a beat (or maybe just their algorithm).

Examples of Event-Driven Investment Opportunities

Several compelling scenarios present themselves in the world of event-driven investing. These opportunities require a keen eye for detail and a stomach for volatility.

- Merger Arbitrage: This classic strategy involves betting on the successful completion (or failure!) of a merger or acquisition. Investors buy the target company’s stock and simultaneously short the acquirer’s, profiting from the price convergence (or divergence) as the deal unfolds. Think of it as a high-stakes poker game, where the pot is the merger premium.

- Distressed Debt Investing: This involves purchasing the debt of financially troubled companies at a significant discount to face value. The hope is that the company will restructure, leading to a recovery in debt value, or that liquidation will yield a better return than the purchase price. This is less about poker and more about playing the odds in a high-stakes game of financial Jenga.

- Restructuring: Companies facing financial difficulties often undergo restructuring. This can involve debt exchanges, asset sales, or other measures to improve their financial position. Event-driven investors may profit by buying debt or equity at discounted prices before the restructuring is completed, anticipating an increase in value.

- Activism: Activist investors take significant stakes in companies and push for changes, such as management shake-ups, divestitures, or share buybacks. Their actions can dramatically impact the company’s stock price, creating opportunities for other investors to profit.

Identifying and Evaluating Event-Driven Investment Opportunities

Identifying promising event-driven opportunities requires diligent research and a knack for spotting anomalies. It’s not enough to simply read press releases; you need to dig deeper, analyze financial statements, and understand the nuances of the situation.

The evaluation process typically involves assessing the probability of success and the potential return, factoring in the risks involved. This can be a complex undertaking, requiring sophisticated modeling techniques and a deep understanding of relevant legal and regulatory frameworks. For example, one would need to assess the likelihood of regulatory approvals in a merger arbitrage situation, or the potential recovery rate of assets in a distressed debt scenario. The devil, as always, is in the details.

Merger Arbitrage and Distressed Debt Strategies: A Comparison

Merger arbitrage and distressed debt investing represent two distinct but related event-driven strategies.

| Feature | Merger Arbitrage | Distressed Debt |

|---|---|---|

| Focus | Merger or acquisition completion | Financially troubled companies |

| Investment Vehicles | Equity, sometimes derivatives | Debt securities |

| Return Drivers | Convergence of target and acquirer prices | Debt recovery or liquidation proceeds |

| Risk Profile | Deal failure risk, regulatory risk | Credit risk, liquidation risk, operational risk |

“In event-driven investing, timing is everything. Being early is key, but being wrong is worse.”

Quantitative Strategies (Quant)

Quantitative strategies, or quant strategies, represent a fascinating intersection of high finance and advanced mathematics. Forget the image of a lone wolf trader hunched over charts; quant strategies rely on sophisticated algorithms and statistical models to identify and exploit market inefficiencies. These strategies, while potentially incredibly lucrative, also require a deep understanding of both financial markets and complex mathematical concepts – a blend that can be as exhilarating as it is challenging.

Quantitative analysis plays a crucial role in hedge fund management by providing a systematic and data-driven approach to investment decision-making. Instead of relying on intuition or gut feeling, quant funds utilize rigorous statistical analysis to identify patterns, predict market movements, and manage risk. This analytical approach allows for the development of complex trading strategies that can react to market changes far faster than any human could. The result? Potentially higher returns and more consistent performance, at least in theory. Of course, the devil, as always, is in the details.

Quantitative Models Used in Hedge Fund Trading

A wide array of quantitative models power the engines of quant hedge funds. These models are constantly evolving, reflecting advancements in both computational power and our understanding of financial markets. The choice of model depends heavily on the specific investment strategy being pursued.

- Statistical Arbitrage Models: These models exploit temporary price discrepancies between related securities, often using pairs trading or factor models to identify and profit from mean reversion. For example, a model might identify two companies in the same industry that are temporarily trading at a price ratio that deviates from their historical average. The model would then predict that the ratio will revert to its mean, allowing for a profitable trading strategy.

- Factor Models: These models seek to identify specific factors that drive asset returns, such as value, momentum, or size. By constructing portfolios based on these factors, quant funds aim to achieve superior risk-adjusted returns. A classic example is a value factor model, which identifies undervalued stocks based on metrics like price-to-earnings ratio and invests in those stocks anticipating their prices to rise.

- Machine Learning Models: The rise of machine learning has revolutionized quant trading. Algorithms can analyze vast datasets of market data, news sentiment, and economic indicators to identify complex patterns and predict future price movements. These models are constantly learning and adapting, improving their predictive power over time. Imagine a model that can analyze millions of news articles to predict the impact of a specific regulatory change on a particular stock – that’s the power of machine learning in quant trading.

Advantages and Disadvantages of Quantitative Strategies

While the allure of automated, data-driven trading is undeniable, quant strategies are not without their drawbacks. A balanced perspective requires acknowledging both sides of the coin.

- Advantages: Quantitative strategies offer the potential for high returns, consistent performance, reduced emotional biases, and the ability to manage large portfolios efficiently. They can also exploit market inefficiencies quickly and effectively, potentially outperforming traditional active management strategies.

- Disadvantages: The reliance on complex models and algorithms introduces significant risks. Model errors, unforeseen market events (like a global pandemic!), and the potential for overfitting can lead to substantial losses. Furthermore, the high computational costs and the need for specialized expertise can create high barriers to entry. Finally, the very success of a quant strategy can lead to its own downfall; as more investors adopt similar strategies, the market inefficiencies they exploit may disappear, rendering the strategy ineffective.

Risk Management in Hedge Funds

Navigating the thrilling, yet often treacherous, world of hedge fund management requires more than just a keen eye for market trends and a nose for lucrative opportunities. It demands a robust and adaptable risk management framework, capable of weathering the inevitable storms that buffet even the most seasoned investors. Think of it as building a financial ark – you need to be prepared for anything, even if you hope you’ll never need it.

Risk management in hedge funds isn’t just about minimizing losses; it’s about maximizing returns while maintaining a sustainable level of risk. It’s the art of balancing ambition with prudence, a delicate dance between aggressive strategies and protective measures. Get it wrong, and the consequences can be…unpleasant, to say the least.

Effective Risk Management Techniques

Hedge funds employ a variety of sophisticated techniques to manage risk. These techniques are often tailored to the specific investment strategies employed, reflecting the unique challenges and opportunities of each approach. For instance, a fund focused on long-short equity strategies will have different risk exposures than a global macro fund. Therefore, a flexible and adaptable approach is crucial. Examples of effective techniques include Value at Risk (VaR) models, which estimate potential losses under normal market conditions, and stress testing, which simulates the impact of extreme events. Furthermore, robust risk reporting and oversight are paramount, providing a clear picture of the fund’s risk profile. Diversification across asset classes and geographies also plays a significant role in mitigating risk, reducing the impact of any single adverse event. Imagine having all your eggs in one basket – not a wise strategy, even if that basket is made of solid gold.

The Importance of Diversification

Diversification is the cornerstone of effective risk management. By spreading investments across various asset classes (equities, bonds, real estate, commodities, etc.), geographies, and sectors, hedge funds can significantly reduce their overall portfolio risk. This doesn’t eliminate risk entirely – after all, even a diversified portfolio can suffer losses – but it significantly reduces the likelihood of catastrophic losses. Think of it as spreading the risk across a field of flowers instead of concentrating it on a single, vulnerable bloom. A single frost might damage a few flowers, but it’s unlikely to wipe out the entire field.

Stress Testing and Scenario Analysis

Stress testing and scenario analysis are critical components of a comprehensive risk management framework. Stress tests involve simulating the impact of extreme market events (e.g., a sudden market crash, a significant geopolitical event, or a sharp increase in interest rates) on the fund’s portfolio. Scenario analysis, on the other hand, explores a broader range of potential outcomes, considering various combinations of factors and their potential impact. These techniques help hedge fund managers identify potential vulnerabilities and develop contingency plans to mitigate potential losses. It’s like running a war game for your portfolio – preparing for the worst-case scenarios allows you to react more effectively should they materialize.

Risk Metrics in Hedge Fund Management

The following table illustrates some of the key risk metrics used in hedge fund management. These metrics provide valuable insights into the fund’s risk profile and help investors assess the level of risk they are taking.

| Metric | Description | Calculation | Interpretation |

|---|---|---|---|

| Value at Risk (VaR) | Estimates the potential loss in value of an asset or portfolio over a specific time period and confidence level. | Various methods exist, often involving statistical models and historical data. | Lower VaR indicates lower risk. |

| Sharpe Ratio | Measures risk-adjusted return, comparing excess return to the standard deviation of returns. | (Rp – Rf) / σp where Rp is portfolio return, Rf is risk-free return, and σp is portfolio standard deviation. | Higher Sharpe ratio indicates better risk-adjusted performance. |

| Sortino Ratio | Similar to Sharpe Ratio, but only considers downside deviation. | (Rp – Rf) / σd where σd is downside deviation. | Higher Sortino ratio indicates better risk-adjusted performance, focusing on downside risk. |

| Maximum Drawdown | Measures the largest peak-to-trough decline in the value of an investment. | Calculated as the percentage difference between a peak and subsequent trough. | Lower maximum drawdown indicates less volatility. |

Performance Measurement and Attribution

Measuring the performance of a hedge fund isn’t as simple as calculating the percentage change in its net asset value (NAV). The inherent complexity of hedge fund strategies, often involving leverage, short positions, and diverse asset classes, demands a more nuanced approach. Accurate performance measurement is crucial for investors to assess risk-adjusted returns and make informed decisions, while for fund managers, it’s vital for evaluating strategy effectiveness and identifying areas for improvement. This section delves into the intricacies of performance measurement and attribution in the fascinating world of hedge funds.

The methods used to measure hedge fund performance are multifaceted, going beyond simple return calculations. Commonly used metrics include the time-weighted rate of return (TWRR), which isolates the impact of manager skill from the timing of investor cash flows, and the money-weighted rate of return (MWRR), which considers the impact of both manager skill and investor cash flows. Furthermore, the Sharpe ratio, Sortino ratio, and Calmar ratio provide insights into risk-adjusted returns, helping investors understand the relationship between risk and reward. These ratios offer a more complete picture than raw returns alone, especially when comparing funds with different risk profiles.

Time-Weighted Rate of Return (TWRR) Calculation

The TWRR is calculated by geometrically linking the returns over sub-periods, eliminating the distortion caused by cash inflows and outflows. This method is generally preferred as it focuses solely on the investment manager’s skill in generating returns. A simple example: If a fund returns 10% in the first quarter and 5% in the second, the TWRR is calculated as (1+0.10)*(1+0.05)-1 = 15.5%. This is in contrast to a simple arithmetic average, which would be 7.5%, ignoring the compounding effect. More complex calculations are needed when dealing with multiple cash flows within a period.

Attribution of Returns to Specific Factors

Attributing returns to specific factors is a crucial aspect of performance analysis, allowing managers to understand which strategies contributed most to success (or failure). This process typically involves decomposing overall returns into components attributable to various factors such as market exposure (beta), stock selection (alpha), sector allocation, and style factors (value, growth, etc.). Regression analysis is a frequently used statistical technique for this purpose. For example, a fund might find that 60% of its returns are due to market exposure, 20% to stock selection, and 20% to sector allocation. This breakdown provides valuable insights for future investment decisions.

Performance Benchmarks in the Hedge Fund Industry

A variety of benchmarks are used to evaluate hedge fund performance, each with its strengths and weaknesses. Common benchmarks include broad market indices (like the S&P 500), sector-specific indices, and customized benchmarks designed to reflect the specific investment universe of a particular fund. The choice of benchmark depends heavily on the investment strategy employed by the fund. A long-short equity fund, for instance, might be compared to a benchmark that reflects both long and short market exposures, while a global macro fund might be compared to a broader range of global economic indicators. The use of appropriate benchmarks is essential for providing a fair and meaningful comparison of hedge fund performance. However, the lack of transparency and the heterogeneity of strategies within the hedge fund industry often make finding truly comparable benchmarks a challenge.

Hedge Fund Due Diligence

Investing in hedge funds can be a thrilling rollercoaster ride—a blend of high potential returns and the stomach-churning possibility of significant losses. Before you buckle up, thorough due diligence is absolutely crucial. Think of it as your pre-flight check before embarking on a transatlantic flight; you wouldn’t skip it, would you?

Due diligence for hedge funds involves a rigorous investigation into the fund’s operations, investment strategy, and risk management practices. It’s not just about checking boxes; it’s about developing a deep understanding of the fund’s capabilities and potential pitfalls. The goal is to identify red flags early on and make informed investment decisions, minimizing the chances of a bumpy ride.

Key Aspects of Hedge Fund Due Diligence

The process of performing due diligence on a hedge fund encompasses several critical areas. A comprehensive assessment necessitates a multi-faceted approach, delving into the fund’s management team, investment strategy, operational infrastructure, and risk management procedures. Overlooking any of these aspects could lead to unforeseen consequences.

Critical Information Gathering

Gathering the right information is paramount in hedge fund due diligence. This involves obtaining and meticulously reviewing a wide range of documents and conducting thorough interviews. Think of it as assembling a detailed puzzle—each piece is crucial to forming a complete picture.

- Fund Documents: This includes the offering memorandum, private placement memorandum, partnership agreement, and audited financial statements. These documents provide a foundational understanding of the fund’s structure, fees, and performance history.

- Investment Strategy Documentation: A detailed description of the fund’s investment strategy, including its target market, investment process, and risk management approach. This section should clarify the fund’s approach to generating alpha (excess returns over a benchmark).

- Track Record Analysis: A thorough review of the fund’s historical performance, considering both periods of strong and weak market conditions. Analyzing performance in different market cycles is essential for understanding the fund’s resilience and adaptability.

- Management Team Background Checks: Investigating the background, experience, and reputation of the fund managers and key personnel. This involves verifying credentials, assessing experience, and evaluating the team’s overall competence and integrity.

- Operational Due Diligence: Assessing the fund’s operational infrastructure, including its accounting, administration, compliance, and technology systems. This ensures that the fund has robust processes in place to manage its operations effectively and minimize operational risks.

- Risk Management Assessment: Evaluating the fund’s risk management framework, including its risk identification, measurement, monitoring, and mitigation processes. This involves understanding how the fund manages both market and operational risks.

Evaluating Investment Strategy and Track Record, Hedge Fund Strategies Review

Evaluating a hedge fund’s investment strategy and track record requires a nuanced approach, going beyond simple performance figures. It’s about understanding the “why” behind the numbers. For example, a consistently high-performing fund might be employing strategies that are highly sensitive to specific market conditions, posing significant risks in other environments.

Analyzing the track record necessitates considering various factors such as:

- Consistency of Returns: Look for funds that demonstrate consistent returns over time, rather than relying on isolated periods of exceptional performance.

- Correlation with Market Indices: Assess the fund’s correlation with major market indices. A low correlation suggests that the fund is generating returns that are relatively independent of broad market movements, a desirable trait for diversification.

- Sharpe Ratio and Sortino Ratio: These risk-adjusted performance measures provide insights into the fund’s risk-return profile. A higher Sharpe or Sortino ratio generally indicates better risk-adjusted performance.

- Drawdowns: Examine the magnitude and frequency of drawdowns (periods of negative returns). Significant or frequent drawdowns signal higher risk and potential for substantial losses.

Illustrative Case Studies

The world of hedge funds is a thrilling rollercoaster of fortunes won and lost, a dramatic narrative played out in the high-stakes arena of global finance. To truly grasp the complexities and nuances of various hedge fund strategies, let’s delve into a couple of compelling case studies – one a shining example of success, the other a cautionary tale of spectacular failure. These stories, while specific, offer invaluable lessons applicable across the broader landscape of hedge fund management.

Renaissance Technologies’ Medallion Fund: A Triumph of Quantitative Strategies

Renaissance Technologies’ Medallion Fund stands as a legendary example of a successful quantitative hedge fund. Its strategy, shrouded in secrecy, is largely based on sophisticated mathematical models and advanced statistical techniques applied to a wide array of data sources. The fund’s exceptional performance over decades highlights the power of rigorous quantitative analysis when combined with exceptional talent and robust risk management. The fund’s consistent outperformance, even during market downturns, is testament to its effectiveness.

The implementation involved employing a team of highly skilled mathematicians, physicists, and computer scientists. They developed proprietary algorithms and models that analyzed vast datasets to identify subtle patterns and predict market movements. This involved creating and continuously refining algorithms, adjusting for market changes, and adapting to new data streams.

- Exceptional Talent Acquisition and Retention: Renaissance Technologies attracted and retained top-tier scientific talent, offering competitive salaries and fostering a collaborative environment.

- Proprietary Technology and Algorithms: The development and constant refinement of sophisticated algorithms gave the fund a significant edge over competitors.

- Rigorous Risk Management: A robust risk management framework ensured that the fund’s exposure to various market risks remained within acceptable limits.

- Data-Driven Decision Making: Decisions were based on rigorous quantitative analysis, minimizing emotional biases and subjective judgments.

- Secrecy and Information Advantage: The fund’s secretive nature provided a competitive advantage by preventing others from replicating its strategies.

Long-Term Capital Management (LTCM): A Spectacular Collapse

In stark contrast to Renaissance Technologies’ success, Long-Term Capital Management (LTCM) serves as a cautionary tale of a hedge fund strategy gone spectacularly wrong. LTCM, founded by Nobel laureates in economics, employed sophisticated models based on statistical arbitrage and relative value trading. Their strategy, while theoretically sound, failed catastrophically due to a confluence of factors, ultimately requiring a government-brokered bailout.

The implementation involved leveraging high levels of debt to amplify returns, relying on the assumption of market efficiency and predictable deviations from it. However, unforeseen events, such as the Russian financial crisis of 1998, exposed the flaws in their models and the dangers of excessive leverage.

- Overreliance on Historical Data and Models: The models failed to account for the possibility of extreme events and “black swan” occurrences.

- Excessive Leverage: The high levels of debt amplified both gains and losses, leading to catastrophic losses during the crisis.

- Correlation Breakdown: The fund’s models assumed certain correlations between assets that broke down during the crisis, leading to unexpected losses.

- Inadequate Risk Management: The fund’s risk management framework failed to adequately assess and mitigate the risks associated with its highly leveraged positions.

- Lack of Diversification: The fund’s concentrated positions in specific markets magnified the impact of adverse events.

Final Review

So, there you have it: a whirlwind tour of the hedge fund landscape. From the meticulously crafted quantitative models to the gutsy bets of global macro trading, we’ve explored the strategies that define this high-stakes world. While fortunes can be made (and lost!), remember that even the most sophisticated strategies require careful risk management and a healthy dose of…well, luck. Happy investing (responsibly!).

Detailed FAQs: Hedge Fund Strategies Review

What is the Sharpe Ratio and why is it important?

The Sharpe Ratio measures risk-adjusted return, essentially telling you how much extra return you’re getting for each unit of extra risk you take. A higher Sharpe Ratio is generally better.

What’s the difference between a long and short position?

A long position is betting that an asset’s price will go up, while a short position is betting it will go down. It’s like placing two bets on the same horse, one hoping it wins, the other hoping it loses (though, in reality, the market’s a bit more complex than a horse race).

What is a “black swan” event in hedge fund terms?

A “black swan” event is an unpredictable, high-impact event that is extremely difficult to foresee, such as a global pandemic or a major geopolitical upheaval. These events can drastically impact even the most carefully constructed hedge fund strategies.