Impact investing, a rapidly growing field, offers a compelling alternative to traditional investment strategies. It blends financial returns with positive social and environmental impact, appealing to investors seeking both profit and purpose. This exploration delves into the core principles, diverse strategies, and practical considerations of this transformative approach, examining successful case studies and forecasting future trends.

From identifying lucrative opportunities in developing economies to navigating the complexities of impact measurement and risk assessment, we’ll unpack the essential elements of successful impact investing. We will explore various investment vehicles, analyze their respective strengths and weaknesses, and provide a framework for evaluating potential ventures.

Defining Impact Investing

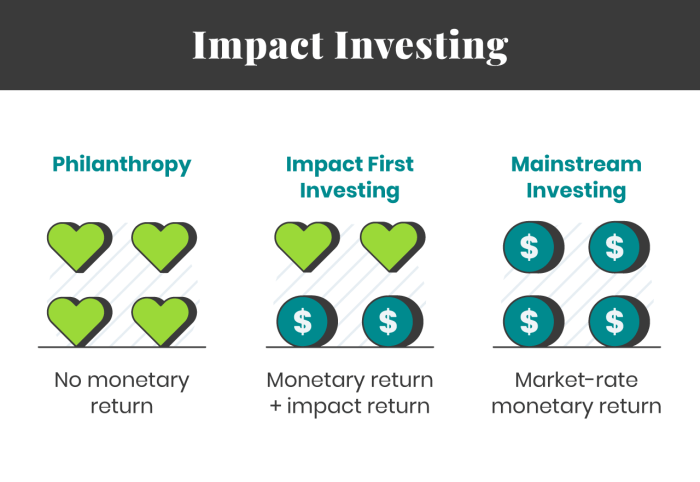

Impact investing is an investment approach that seeks to generate positive, measurable social and environmental impact alongside a financial return. It moves beyond traditional philanthropy by aiming for a dual return – both financial and social/environmental. This approach recognizes that businesses can be powerful forces for good, and that investing can be a catalyst for positive change.

Impact investing differs significantly from traditional investing in its core purpose. While traditional investing primarily focuses on maximizing financial returns, often without explicit consideration for social or environmental consequences, impact investing integrates these considerations into the investment decision-making process. The intention is not simply to avoid harm, but to actively seek out and promote positive change. This shift in focus requires a more holistic assessment of investments, considering both quantitative financial metrics and qualitative social and environmental outcomes.

Core Principles of Impact Investing

Impact investing operates on several key principles. First, it prioritizes the measurement and management of social and environmental impact alongside financial returns. This requires a robust framework for tracking and reporting on the positive outcomes achieved. Second, it emphasizes intentionality – investments are made with the explicit goal of generating positive social or environmental impact. This is distinct from simply investing in companies that happen to have positive externalities. Third, impact investors actively engage with their investees to support their efforts in achieving their social and environmental goals. This often involves providing technical assistance, mentorship, and other forms of support. Finally, impact investors often seek to address systemic challenges, not just individual problems. This means that they are interested in investing in solutions that can be scaled and replicated to have a broader impact.

Differences Between Impact Investing and Traditional Investing

The primary difference lies in the investment objective. Traditional investing prioritizes maximizing financial returns, often with little or no consideration for social or environmental consequences. Impact investing, on the other hand, seeks to generate both positive social/environmental impact and financial returns. This requires a different approach to due diligence, risk assessment, and performance measurement. Traditional investors primarily focus on financial metrics like ROI and risk-adjusted returns, while impact investors consider a broader range of metrics, including social and environmental indicators.

Examples of Impact Investing Strategies

Several strategies are employed within the realm of impact investing. For instance, community development financial institutions (CDFIs) provide loans and other financial services to underserved communities, fostering economic growth and job creation. Green bonds finance environmentally friendly projects, such as renewable energy infrastructure or sustainable agriculture. Social enterprises are businesses that explicitly aim to solve social or environmental problems while generating profits. Microfinance provides small loans to individuals in developing countries, empowering them to start businesses and improve their livelihoods. Finally, impact venture capital funds invest in early-stage companies that are developing innovative solutions to social and environmental challenges.

Comparison of Impact Investing Approaches

The following table illustrates various approaches within impact investing:

| Approach | Target Area | Investment Vehicle | Measurement Method |

|---|---|---|---|

| Community Development | Affordable housing, job creation in underserved communities | Loans, equity investments in CDFIs | Job creation rates, number of affordable housing units created, poverty reduction metrics |

| Green Bonds | Renewable energy, sustainable infrastructure | Bonds issued by governments or corporations | Greenhouse gas emissions reduced, energy generated, water usage |

| Social Enterprise Investments | Diverse social and environmental issues | Equity investments in social enterprises | Social impact metrics tailored to the specific enterprise, financial performance |

| Microfinance | Poverty alleviation, financial inclusion | Microloans to individuals and small businesses | Loan repayment rates, business growth, income levels of borrowers |

Identifying Impact Investing Opportunities

Identifying promising impact investing opportunities requires a strategic approach, combining market research with a deep understanding of social and environmental needs. Successful impact investing hinges on aligning financial returns with positive social or environmental impact, demanding a thorough evaluation process to mitigate risks and maximize positive outcomes.

Key Sectors with Significant Potential for Impact Investing

Several sectors demonstrate substantial potential for impact investing, driven by growing demand and the potential for scalable solutions. These sectors often address critical global challenges, offering both financial returns and significant social or environmental benefits. Examples include renewable energy, sustainable agriculture, affordable housing, access to clean water and sanitation, and financial inclusion initiatives focused on underserved populations. The specific opportunities within each sector will vary depending on geographic location and market conditions.

Examples of Successful Impact Investments in Developing Economies

Numerous successful impact investments in developing economies illustrate the potential for both financial returns and positive social impact. For example, investments in microfinance institutions have empowered women entrepreneurs and fostered economic growth in many regions. Similarly, investments in solar-powered microgrids have brought electricity to remote communities, improving access to education, healthcare, and economic opportunities. Investments in sustainable agriculture practices have increased crop yields, improved food security, and enhanced the livelihoods of smallholder farmers. These examples highlight the transformative potential of impact investing when combined with robust due diligence and ongoing monitoring.

Due Diligence Process for Evaluating Impact Investing Opportunities

The due diligence process for impact investing is more comprehensive than traditional financial due diligence, encompassing both financial and impact assessments. A thorough financial analysis evaluates the financial viability of the investment, including revenue projections, cost structures, and risk assessment. Equally crucial is an impact assessment, which measures the potential social and environmental benefits of the investment, using key performance indicators (KPIs) aligned with the investment’s stated goals. This assessment should include a baseline measurement of the current situation, a projection of the impact of the investment, and a plan for monitoring and evaluation. Furthermore, the due diligence process needs to consider the governance structure, management team, and the overall sustainability of the investee.

Risks and Challenges Associated with Impact Investing

While impact investing offers significant potential, it’s crucial to acknowledge the inherent risks and challenges. Measuring and verifying impact can be complex and challenging, requiring robust data collection and analysis. There’s also a risk of impact washing, where companies overstate their positive social and environmental impact. Market risks, including fluctuating commodity prices and changing regulatory environments, can also impact the financial returns of impact investments. Finally, the lack of standardized impact measurement methodologies can make it difficult to compare different investment opportunities. Careful selection of investees, thorough due diligence, and ongoing monitoring are crucial to mitigating these risks.

Measuring Impact

Measuring the social and environmental impact of investments is crucial for impact investors. It moves beyond traditional financial metrics to assess the positive change generated by their investments. A robust impact measurement system allows investors to understand their contribution to achieving specific social and environmental goals, demonstrate their impact to stakeholders, and improve investment strategies over time.

Impact measurement in this context involves a multifaceted approach, incorporating both qualitative and quantitative data to paint a comprehensive picture of the investment’s effect. This requires a carefully designed framework and the selection of appropriate metrics, tailored to the specific investment and its intended goals.

Methods for Measuring Social and Environmental Impact

Several methods exist for assessing the social and environmental impact of investments. These range from simple, readily available data to more complex methodologies requiring significant data collection and analysis. The choice of method depends on factors such as the nature of the investment, the available resources, and the desired level of detail. Common approaches include using standardized frameworks, conducting surveys and interviews, analyzing operational data, and employing econometric modeling. For instance, a microfinance investment might use a loan default rate as a quantitative measure, complemented by qualitative data from interviews with borrowers about improved livelihoods. An investment in renewable energy could utilize carbon emissions reduction as a key quantitative metric, alongside qualitative data on community acceptance and job creation.

A Framework for Tracking Key Performance Indicators (KPIs)

A well-structured framework is essential for effective impact tracking. This framework should clearly define the investment’s intended goals and the associated KPIs. It should also specify the data collection methods, the frequency of data collection, and the process for analyzing and reporting the results. A sample framework might include:

| KPI Category | Specific KPI | Data Source | Measurement Frequency | Target |

|---|---|---|---|---|

| Environmental | Greenhouse gas emissions reduction (tons of CO2 equivalent) | Company reports, third-party verification | Annually | 20% reduction within 5 years |

| Social | Number of jobs created | Company payroll data | Annually | 100 jobs created within 3 years |

| Economic | Increase in household income (average) | Household surveys | Biennially | 15% increase within 5 years |

This framework provides a clear structure for monitoring progress towards the investment’s goals. Regular review and adjustments are crucial to ensure its ongoing relevance and effectiveness.

Comparison of Impact Measurement Standards and Frameworks

Various standards and frameworks exist to guide impact measurement, each with its strengths and weaknesses. Some prominent examples include the Global Impact Investing Network (GIIN) IRIS+ framework, the Social Return on Investment (SROI) methodology, and the B Corp certification. The GIIN IRIS+ offers a standardized set of metrics and indicators, facilitating comparability across investments. SROI, on the other hand, emphasizes the monetization of social and environmental outcomes. B Corp certification provides a holistic assessment of a company’s social and environmental performance. The selection of a suitable standard or framework depends on the specific context and objectives of the impact investment. Each framework offers different levels of detail and rigor, requiring careful consideration based on the specific investment and available resources.

Qualitative and Quantitative Metrics for Assessing Impact

Effective impact assessment requires a balanced approach, combining both qualitative and quantitative metrics.

Quantitative metrics provide numerical data that can be easily analyzed and compared. Examples include:

- Number of people served

- Reduction in greenhouse gas emissions

- Increase in employment

- Financial returns

Qualitative metrics provide rich contextual information that complements quantitative data. Examples include:

- Testimonials from beneficiaries

- Case studies showcasing impact

- Observations from site visits

- Analysis of community engagement

Combining these types of data provides a more comprehensive and nuanced understanding of the investment’s impact. For example, a quantitative metric showing a 10% increase in farmer income can be enriched by qualitative data from interviews detailing how this increased income improved family health and well-being.

Impact Investing Vehicles

Impact investing utilizes a variety of financial instruments to achieve both financial returns and positive social or environmental impact. The choice of vehicle depends on the specific goals of the investment, the nature of the investee, and the risk tolerance of the investor. Different vehicles offer varying levels of control, liquidity, and risk-return profiles.

Impact investing vehicles span the spectrum of traditional investment classes, each adapted to accommodate the dual goals of financial return and measurable social or environmental impact. Understanding the nuances of each vehicle is crucial for effective impact investing strategies.

Venture Capital in Impact Investing

Venture capital (VC) funds invest in early-stage, high-growth companies. In the context of impact investing, VC funds focus on businesses with a demonstrable positive social or environmental mission. These investments often involve significant risk but offer the potential for high returns if the venture is successful. For example, a VC firm might invest in a renewable energy startup, expecting both financial returns and a reduction in carbon emissions.

- Advantages: High potential returns, significant influence on company direction, opportunity to support innovative solutions.

- Disadvantages: High risk of capital loss, illiquidity, long investment horizons, difficulty in measuring impact precisely in early stages.

Private Equity in Impact Investing

Private equity (PE) firms invest in established companies, often acquiring a controlling stake. Impact PE focuses on companies committed to sustainability, fair labor practices, or other social and environmental goals. PE investments generally offer more control than VC investments but also typically involve higher upfront capital commitments. An example would be a PE firm investing in a sustainable agriculture company to improve farming practices and increase food security.

- Advantages: More control over investee’s operations, potential for significant impact through operational changes, higher potential returns compared to debt financing.

- Disadvantages: High capital commitment, illiquidity, potential for conflicts of interest between financial and social returns, longer investment horizons.

Impact Bonds

Impact bonds, also known as social impact bonds, are innovative financing mechanisms where investors provide upfront capital to fund social programs. The repayment of the investment is contingent upon the achievement of pre-defined social outcomes. For example, an impact bond might fund a job training program for at-risk youth, with repayment dependent on the program’s success in placing participants in sustainable employment. The structure typically involves a government or other payer that commits to making payments only if the program achieves its goals. This aligns incentives among all stakeholders and incentivizes performance.

The structure of an impact bond typically includes investors, a service provider, a government or other payer, and an independent evaluator to measure the social impact.

- Advantages: Aligns incentives for all stakeholders, reduces risk for investors, attracts private capital to social programs, focuses on measurable outcomes.

- Disadvantages: Complexity in structuring and monitoring, difficulty in defining and measuring social outcomes, potential for unforeseen challenges in program implementation.

Blended Finance in Impact Investing

Blended finance combines concessional capital (e.g., grants, subsidized loans) with commercial capital (e.g., equity, debt) to support impact investments. This approach helps to de-risk investments and attract private capital to projects that might otherwise be considered too risky or unprofitable. For instance, a blended finance initiative might use a grant to cover upfront costs or guarantee a portion of a loan to a company developing clean water solutions in a developing country, thereby making the investment more attractive to commercial lenders.

- Advantages: Reduces risk for commercial investors, mobilizes private capital for high-impact projects, leverages public resources to maximize impact.

- Disadvantages: Complexity in structuring and managing blended finance vehicles, potential for conflicts of interest among different stakeholders, challenges in monitoring and evaluating impact across multiple funding sources.

Case Studies of Impact Investments

Impact investing seeks not only financial returns but also positive social or environmental effects. Examining successful case studies reveals the diverse strategies, challenges, and long-term sustainability of this approach, highlighting its potential for transformative change. This section presents detailed examples across various sectors, showcasing the tangible impact achieved and the lessons learned.

Green Bonds Issued by the City of New York

This case study examines the City of New York’s issuance of green bonds to finance environmental projects. The objective was to raise capital for sustainable infrastructure improvements while promoting environmentally responsible investment.

The strategy involved issuing bonds specifically designated for green initiatives, attracting investors interested in both financial returns and environmental impact. These funds were directed towards projects like energy efficiency upgrades in municipal buildings, investments in renewable energy sources, and improvements to public transportation. The impact included reductions in greenhouse gas emissions, improved energy efficiency, and creation of green jobs. Challenges included ensuring transparency and verifiability of the environmental benefits of the projects, as well as managing investor expectations regarding financial returns. The long-term sustainability hinges on continued investor interest in green bonds and the ongoing commitment of the city to invest in sustainable infrastructure. This demonstrates how impact investing can be integrated into large-scale municipal finance, driving significant positive environmental change.

Solar Sister

Solar Sister is a women-led social enterprise that empowers women in Africa by providing access to clean energy and financial independence through the sale of solar products.

The investment objective was to both generate financial returns and create economic opportunities for women in underserved communities. The strategy focused on building a network of independent female entrepreneurs who sell solar products, providing them with training, access to finance, and ongoing support. The impact includes increased access to clean energy, improved health and education outcomes (due to better lighting and power for study), and significant economic empowerment for women. Challenges included navigating complex regulatory environments in various countries and managing the logistics of distributing products across vast geographical areas. The long-term sustainability relies on continued demand for clean energy, the growth of the female entrepreneur network, and the ability to adapt to evolving market conditions. This case illustrates the potential of impact investing to drive social and economic development in emerging markets.

Danone’s Commitment to Sustainable Agriculture

Danone, a global food and beverage company, has made significant investments in sustainable agriculture to ensure the long-term supply of raw materials and support the livelihoods of farmers.

Danone’s objective is to secure a sustainable supply chain while improving the social and environmental performance of its agricultural operations. The strategy involves working directly with farmers to improve their farming practices, providing training and technical assistance, and investing in sustainable agricultural technologies. The impact includes improved yields for farmers, reduced environmental impact from agriculture, and enhanced product quality for Danone. Challenges include ensuring the scalability of sustainable farming practices and managing the complexity of working with diverse farming communities. Long-term sustainability depends on continued collaboration with farmers, advancements in sustainable agricultural technologies, and the integration of sustainability into the core business strategy. This exemplifies how large corporations can leverage impact investing to improve their supply chain resilience and contribute to broader sustainability goals.

The Future of Impact Investing

The impact investing landscape is poised for significant transformation in the coming decade. Driven by increasing awareness of environmental and social challenges, coupled with the growing recognition of the financial viability of sustainable solutions, we are witnessing a convergence of forces that will reshape how capital is deployed and measured. This section explores key emerging trends, opportunities for growth and innovation, and the crucial role of technology in shaping the future of impact investing.

Emerging Trends and Opportunities in Impact Investing

The field of impact investing is experiencing rapid growth and diversification. We are seeing a surge in interest from both traditional and non-traditional investors, including family offices, foundations, and even retail investors seeking to align their investments with their values. This broadening investor base is driving innovation in investment strategies and creating opportunities in previously underserved sectors. For example, the increasing focus on climate change is leading to substantial investments in renewable energy, sustainable agriculture, and climate-resilient infrastructure. Simultaneously, the rise of impact-focused fintech companies is facilitating access to capital for smaller businesses and social enterprises in emerging markets. This expanding reach allows impact investing to address a wider range of social and environmental challenges more effectively.

Technological Advancements in Impact Measurement and Reporting

Technology is playing a pivotal role in enhancing the effectiveness of impact investing. The development of sophisticated data analytics tools and platforms is revolutionizing impact measurement and reporting. These tools allow investors to track and quantify the social and environmental outcomes of their investments with greater precision and transparency. For example, satellite imagery can be used to monitor deforestation rates in areas impacted by agricultural projects, while blockchain technology can enhance the traceability of supply chains, ensuring ethical sourcing and fair labor practices. Furthermore, the rise of impact data aggregators and standardized reporting frameworks is improving the comparability of impact data across different investments, allowing for more robust benchmarking and performance analysis. This increased transparency builds trust and attracts further investment into the sector.

Projected Growth of Impact Investing

A visual representation of the projected growth of impact investing over the next decade could be depicted as an upward-sloping exponential curve. The curve would start at a relatively low point representing the current market size, then sharply ascend, indicating a rapid increase in investment volume. To illustrate, imagine the curve doubling in size every few years, reflecting the rapid adoption of ESG (Environmental, Social, and Governance) factors in investment decisions. This projected growth is supported by several factors, including increasing regulatory pressure to disclose ESG performance, growing awareness of the long-term risks associated with unsustainable business practices, and the increasing availability of impact investment vehicles. For instance, consider the growth of impact bonds, which have seen a substantial increase in issuance and adoption in recent years, demonstrating a growing appetite for outcome-based investments. The curve’s steepness would reflect the accelerating pace of innovation and the growing recognition of the financial returns associated with sustainable practices. The curve would visually represent a projection of impact investing assets under management exceeding several trillion dollars by the end of the next decade, exceeding previous projections based on observed trends.

Closing Summary

Impact investing presents a powerful mechanism for driving positive change while achieving financial goals. By understanding the core principles, carefully assessing opportunities, and employing robust measurement frameworks, investors can contribute to a more sustainable and equitable future. The field’s continued growth and innovation promise even greater potential for impactful and profitable ventures in the years to come, creating a win-win scenario for both investors and the communities they serve.

Questions Often Asked

What is the minimum investment amount for impact investing?

There’s no set minimum. Opportunities range from microloans to large-scale private equity investments, catering to various investment capacities.

How can I verify the actual impact of an impact investment?

Thorough due diligence is crucial. Examine the organization’s impact reporting, third-party verification, and independent audits to assess the credibility of their claims.

What are the tax implications of impact investing?

Tax implications vary depending on the jurisdiction and the specific investment vehicle. Consult with a tax professional for personalized advice.

Are there any certifications or standards for impact investments?

Several organizations offer certifications and standards, but consistency across the board is still developing. Look for transparency and robust reporting methodologies.