Impact investing, a rapidly growing field, blends financial returns with positive social and environmental outcomes. It moves beyond traditional investment models, focusing on generating measurable, beneficial change alongside profit. This guide delves into the core principles, strategies, and challenges of this transformative approach, exploring various investment vehicles and the crucial role of impact measurement.

We’ll examine different impact investing strategies, from venture philanthropy to community development finance, analyzing their unique characteristics and potential for significant societal impact. The discussion will cover due diligence, risk management, and the importance of engaging all stakeholders—investors, entrepreneurs, and the communities they serve—to achieve sustainable and scalable results. Ultimately, this exploration aims to provide a clear understanding of how impact investing can drive both financial success and positive global change.

Defining Impact Investing

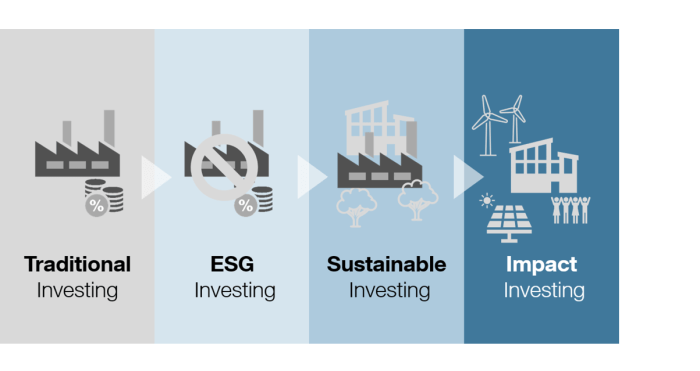

Impact investing is an investment approach that aims to generate positive, measurable social and environmental impact alongside a financial return. It moves beyond traditional philanthropy by seeking a dual return: both financial profitability and demonstrable improvements in the lives of people and the planet. This approach recognizes that financial success and social good are not mutually exclusive, but rather, can be synergistic.

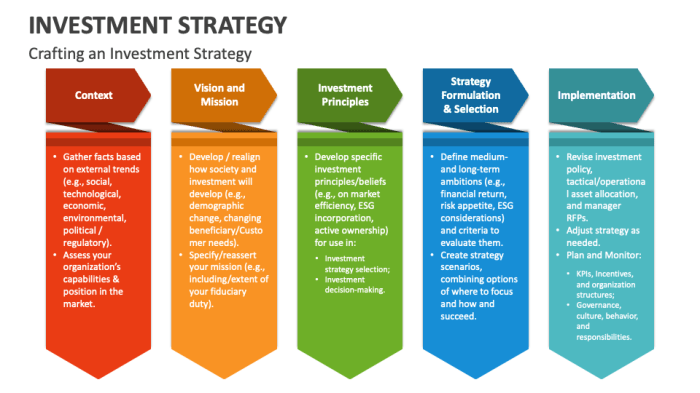

Impact investing differs significantly from traditional investing in its core principles. While traditional investing primarily focuses on maximizing financial returns, often with little consideration for the social or environmental consequences, impact investing explicitly integrates social and environmental considerations into the investment decision-making process. The selection of investments is guided by a commitment to achieving specific, measurable, attainable, relevant, and time-bound (SMART) impact goals. This means impact investors actively seek out opportunities that will contribute positively to society and the environment, while still aiming for a competitive financial return.

Impact Investing Goals

Impact investing encompasses a wide range of goals, reflecting the diverse challenges facing society and the environment. Investors can choose to focus on specific areas based on their values and priorities. For example, environmental sustainability goals might involve investments in renewable energy projects, sustainable agriculture, or initiatives aimed at reducing carbon emissions. Social justice goals could encompass investments in affordable housing, access to education, or initiatives promoting financial inclusion. Other common impact areas include healthcare access, economic development in underserved communities, and women’s empowerment. These goals are not mutually exclusive; many impact investments address multiple issues simultaneously. For example, an investment in a company that produces sustainable building materials could simultaneously contribute to environmental sustainability and create jobs in a low-income community.

Comparison of Impact Investing Approaches

The following table compares different approaches to impact investing, highlighting their key characteristics and differences:

| Approach | Focus | Investment Strategy | Impact Measurement |

|---|---|---|---|

| Venture Philanthropy | High-growth social enterprises | Equity investments, grants, technical assistance | Qualitative and quantitative metrics, focusing on social impact alongside financial returns |

| Community Development Finance Institutions (CDFIs) | Low-income communities and underserved populations | Loans, grants, and other financial products | Metrics focused on job creation, economic development, and access to financial services |

| Microfinance | Micro-entrepreneurs and low-income individuals | Small loans, often targeting women | Metrics focused on loan repayment rates, business growth, and poverty reduction |

| Social Impact Bonds (SIBs) | Social programs with measurable outcomes | Payments contingent on achieving pre-defined social outcomes | Rigorous outcome measurement using pre-agreed indicators |

Strategies for Impact Measurement

Measuring the social and environmental impact of investments is crucial for impact investors. It allows them to demonstrate their contribution to positive change, attract further investment, and improve their investment strategies over time. Effective measurement requires a multifaceted approach, encompassing various methodologies and careful consideration of potential challenges.

Methods for Measuring Social and Environmental Impact

Several methods exist for quantifying the social and environmental impact of investments. These range from qualitative assessments to quantitative data analysis, often used in combination to provide a holistic view. Qualitative methods might involve stakeholder interviews and surveys to gather feedback on the perceived impact of a project. Quantitative methods, on the other hand, utilize numerical data to measure specific outcomes. For example, a clean energy investment might be measured by the amount of greenhouse gas emissions avoided, while a microfinance initiative could be evaluated by the increase in borrowers’ income or the number of jobs created. The choice of method depends heavily on the specific investment and its intended impact.

Challenges in Quantifying Impact and Developing Robust Metrics

Quantifying impact presents significant challenges. Attributing specific outcomes solely to an investment can be difficult, as external factors often play a role. For instance, improved health outcomes in a community might be due to a combination of factors, including the impact of an investment in a health clinic, but also improved sanitation or government initiatives. Another challenge lies in establishing baselines and counterfactuals—what would have happened without the investment? Moreover, developing metrics that are both meaningful and easily measurable can be complex. Social impact, in particular, is often multifaceted and difficult to capture with simple numerical indicators. Finally, ensuring data accuracy and consistency across different projects and investments is paramount for meaningful comparison and analysis.

Examples of Impact Reporting Frameworks and Standards

Several frameworks and standards guide impact reporting, promoting transparency and comparability. The Global Impact Investing Network (GIIN) offers the IRIS+ framework, a comprehensive set of standardized metrics for measuring impact across various sectors. The Sustainability Accounting Standards Board (SASB) provides industry-specific standards for environmental, social, and governance (ESG) reporting. These frameworks often include metrics for social and environmental outcomes, such as greenhouse gas emissions reductions, job creation, improved access to healthcare, and changes in community well-being. Utilizing established frameworks helps ensure that impact reports are credible, consistent, and comparable across different investments.

Impact Measurement and Management Process Flowchart

A flowchart illustrating the impact measurement and management process would begin with defining the investment’s intended impact. This involves clearly stating the desired social and environmental outcomes. Next, a baseline assessment is conducted to measure the current state of affairs before the investment. Appropriate metrics are then selected, based on the intended impact and available data. Data is collected throughout the investment’s lifespan, using various methods (e.g., surveys, interviews, quantitative data). This data is then analyzed to determine the actual impact achieved. Finally, this information is used to refine the investment strategy, improve future investments, and report on the achieved impact to stakeholders. The entire process should be iterative, allowing for continuous improvement and adaptation. The flowchart would visually represent this sequential process with boxes and arrows connecting each stage.

Investment Vehicles in Impact Investing

Impact investing seeks to generate positive, measurable social and environmental impact alongside a financial return. The choice of investment vehicle significantly influences the type and scale of impact achieved, as well as the risk and return profile for the investor. Understanding the nuances of different vehicles is crucial for effective impact investing.

Types of Impact Investment Vehicles

Impact investments can be channeled through various vehicles, each possessing unique characteristics and suitability for different impact goals and investor profiles. The most common include debt financing, equity investments, and grants. While they share the common goal of generating positive impact, their mechanisms and implications differ substantially.

- Debt Financing: This involves providing loans to enterprises or organizations working towards social or environmental goals. Interest payments are the primary return mechanism. The repayment structure provides a degree of security for investors. Examples include microloans to entrepreneurs in developing countries or green bonds financing renewable energy projects.

- Equity Investments: These involve purchasing ownership stakes in companies with a strong impact profile. Returns are generated through capital appreciation and dividends. Equity investments typically carry higher risk but also potentially higher returns than debt financing. Examples include investments in sustainable agriculture companies or businesses promoting inclusive economic growth.

- Grants: These are typically non-repayable contributions aimed at supporting the initial development or scaling of high-impact initiatives. They prioritize social or environmental impact over financial return. Grants often support early-stage ventures or organizations with limited access to traditional financing. Examples include philanthropic foundations providing funding for community development projects or environmental conservation efforts.

Comparison of Impact Investment Vehicles

The suitability of each vehicle depends on several factors, including the stage of the investee organization, the investor’s risk tolerance, and the desired level of control.

| Vehicle | Risk | Return Potential | Impact Measurement | Investor Control | Example |

|---|---|---|---|---|---|

| Debt Financing | Lower | Moderate | Relatively straightforward | Limited | Microfinance loans to small businesses |

| Equity Investments | Higher | High | More complex | Significant | Investment in a solar energy company |

| Grants | None (no financial return expected) | None (no financial return expected) | Focus on qualitative impact | None | Funding for a community health clinic |

Examples of Successful Impact Investments

Numerous successful impact investments showcase the effectiveness of these various vehicles. For instance, Kiva, a micro-lending platform, has facilitated millions of loans using a debt financing model, empowering entrepreneurs in developing countries and promoting economic inclusion. Similarly, companies like Patagonia, known for their commitment to environmental sustainability, have successfully attracted equity investments that both support their mission and deliver financial returns. Finally, the Gates Foundation’s grant-making activities have significantly contributed to advancements in global health and development.

Due Diligence and Risk Management in Impact Investing

Impact investing, while offering the potential for both financial returns and positive social or environmental impact, requires a robust due diligence process and a keen awareness of unique risks. This section explores the specific considerations for evaluating impact investments, the inherent risks involved, and strategies for mitigating them effectively. A strong understanding of these aspects is crucial for ensuring both the financial viability and the intended social or environmental impact of the investment.

Specific Due Diligence Considerations for Impact Investments

Beyond traditional financial due diligence, impact investing necessitates a deeper dive into the social and environmental aspects of the investee. This includes a thorough assessment of the target’s business model, its alignment with the investor’s impact goals, and the effectiveness of its strategies for achieving those goals. Due diligence should encompass a rigorous review of the organization’s management team, its operational capacity, its financial sustainability, and its ability to deliver measurable, positive impact. Key aspects include validating the social or environmental claims made by the investee, assessing the potential for unintended negative consequences, and evaluating the long-term sustainability of the impact. For example, a due diligence process for an investment in a renewable energy company would not only assess its financial projections but also verify the environmental impact of its operations and the social benefits to the local community.

Unique Risks Associated with Impact Investing and Mitigation Strategies

Impact investing carries unique risks that differ from traditional investments. These risks often stem from the complexity of measuring social and environmental impact, the potential for unforeseen circumstances affecting the intended impact, and the often-emerging nature of the investee organizations. For example, a social enterprise operating in a volatile political environment faces different risks than a well-established company in a stable market. Mitigation strategies involve diversifying the impact investment portfolio across various sectors and geographies, employing rigorous impact measurement frameworks, and actively engaging with the investee to monitor progress and address challenges. Scenario planning and stress testing, considering both financial and non-financial factors, can also help prepare for potential disruptions.

Incorporating Environmental, Social, and Governance (ESG) Factors into the Investment Process

Integrating ESG factors is fundamental to responsible impact investing. ESG considerations go beyond simply measuring impact; they are woven into the entire investment process, from initial screening and due diligence to ongoing monitoring and reporting. This involves assessing a company’s environmental footprint, its social impact on stakeholders (employees, communities, etc.), and its governance structure. A strong ESG profile is not merely a “nice-to-have” but a critical factor in evaluating the long-term viability and sustainability of an investment. Integrating ESG factors can help identify potential risks and opportunities early on, improving investment decision-making and contributing to better overall portfolio performance.

Key Risk Factors and Mitigation Strategies Across Impact Investing Sectors

| Impact Investing Sector | Key Risk Factors | Mitigation Strategies | Example |

|---|---|---|---|

| Renewable Energy | Technological risks, policy uncertainty, fluctuating energy prices | Diversification across technologies and geographies, thorough due diligence on technological viability and regulatory landscape, hedging strategies | Investing in multiple renewable energy projects (solar, wind, hydro) in different regions. |

| Affordable Housing | Market volatility, regulatory changes, tenant risk, construction delays | Robust market analysis, strong partnerships with local governments and community organizations, thorough due diligence on construction companies and property management, risk-based pricing | Developing a portfolio of affordable housing projects in different locations, with a focus on stable, high-demand areas. |

| Microfinance | High default rates, operational challenges in remote areas, lack of financial transparency | Careful client selection, strong risk management systems, robust monitoring and evaluation, diversification across loan portfolios and geographical areas | Implementing rigorous credit scoring systems, conducting thorough field assessments, and working with local partners to mitigate operational challenges. |

| Sustainable Agriculture | Climate change impacts, commodity price volatility, market access challenges | Climate-resilient farming practices, diversification of crops, strong partnerships with buyers, market analysis and risk mitigation strategies | Investing in projects that use drought-resistant crops and implement sustainable water management techniques. |

Sectors and Themes in Impact Investing

Impact investing channels capital towards ventures generating measurable social and environmental benefits alongside financial returns. Several key sectors consistently attract significant investment, driven by both growing market demand and the potential for substantial positive impact. Understanding these sectors and emerging trends is crucial for both investors and entrepreneurs seeking to maximize their impact.

Key Sectors Attracting Impact Investments

The impact investing landscape encompasses a diverse range of sectors, each presenting unique opportunities and challenges. Some of the most prominent include renewable energy, affordable housing, education, and healthcare. These sectors often overlap, with projects frequently addressing multiple Sustainable Development Goals (SDGs) simultaneously. For example, a project providing affordable housing might also create local jobs and improve community health.

Emerging Trends and Opportunities

Several emerging trends are shaping the future of impact investing. The increasing focus on climate change is driving significant investment in renewable energy and climate-resilient infrastructure. Technological advancements are creating new opportunities for innovation in sectors like education and healthcare, enabling more efficient and effective delivery of services. Furthermore, a growing emphasis on measuring and reporting impact is enhancing transparency and accountability within the sector. This includes the rise of blended finance models, which combine philanthropic capital with commercial investments to reduce risk and increase the scale of impact.

Examples of Innovative Impact Investing Strategies

Innovative strategies are constantly emerging within various sectors. In renewable energy, community-owned solar projects empower local communities to generate their own clean energy and share in the profits. In affordable housing, impact investors are exploring innovative financing models, such as social impact bonds, to incentivize the development of high-quality, affordable housing units. In education, technology-enabled learning platforms are providing access to quality education in underserved areas, while in healthcare, telemedicine initiatives are expanding access to healthcare services in remote regions.

Impact Investing Sectors: A Comparative Overview

| Sector | Investment Opportunity | Potential Impact | Example |

|---|---|---|---|

| Renewable Energy | Investing in solar, wind, and other renewable energy projects | Reduced greenhouse gas emissions, increased energy access, job creation | Investing in a community-owned solar farm that provides clean energy to a rural community and creates local jobs. |

| Affordable Housing | Developing and financing affordable housing projects | Improved living conditions, reduced homelessness, increased community stability | Providing financing for a non-profit developer building affordable housing units with energy-efficient features. |

| Education | Investing in educational technology platforms, teacher training programs, and scholarships | Improved educational outcomes, increased access to education, reduced inequality | Funding a tech company developing educational apps for underserved students in developing countries. |

| Healthcare | Investing in telemedicine platforms, preventative healthcare programs, and medical technology | Improved access to healthcare, reduced healthcare costs, improved health outcomes | Investing in a company developing a telemedicine platform that connects patients in rural areas with healthcare professionals. |

Scaling Impact

Scaling the impact of successful impact investments requires a strategic and multifaceted approach. It moves beyond simply increasing the size of a single project to encompass expanding reach, replicating successful models, and creating systemic change. This involves careful planning, leveraging technology, and adapting to diverse contexts.

Effective scaling necessitates a deep understanding of the initial investment’s impact, the factors contributing to its success, and the potential barriers to broader adoption. Strategies should focus on both increasing the number of beneficiaries and deepening the impact for each individual or community served. This often requires partnerships with other organizations, governments, and the private sector to create a sustainable and scalable ecosystem.

Technology’s Role in Expanding Reach and Efficiency

Technology plays a crucial role in scaling impact by increasing efficiency, expanding reach, and improving data collection and analysis. For example, mobile technology can facilitate communication with beneficiaries in remote areas, enabling targeted interventions and real-time monitoring of progress. Digital platforms can streamline processes, reducing administrative costs and freeing up resources for program delivery. Data analytics can identify areas for improvement and optimize resource allocation, leading to more impactful interventions. The use of online learning platforms can increase access to training and education, especially in underserved communities. Furthermore, blockchain technology can enhance transparency and accountability in the management of impact investments.

Examples of Successful Scaling Strategies

Several successful impact investments have demonstrated effective scaling strategies. For instance, a microfinance institution might scale its operations by partnering with other financial institutions to expand its reach geographically and increase its loan portfolio. This allows them to serve a larger number of entrepreneurs and small businesses, leading to greater economic empowerment. Similarly, a social enterprise that has developed a successful educational program might franchise its model to other organizations, enabling them to replicate the program in different regions and contexts. This replication can lead to widespread adoption and a significant increase in the number of beneficiaries. Another example might involve a clean energy company that develops a scalable technology for producing renewable energy. By licensing or partnering with other companies, they can significantly increase the adoption of their technology, leading to a reduction in greenhouse gas emissions on a larger scale.

Designing an Impact Scaling Plan: A Step-by-Step Approach

Developing a comprehensive impact scaling plan is crucial for maximizing the effectiveness of an investment. This process involves a series of well-defined steps.

First, a thorough assessment of the existing impact is needed. This includes identifying key performance indicators (KPIs) and measuring the current reach and depth of impact. Second, a detailed analysis of the factors that have contributed to the initial success of the investment is crucial. This helps to understand what aspects of the program are most effective and replicable. Third, a clear definition of the scaling goals is essential. This includes specifying the desired increase in reach, the target beneficiaries, and the timeframe for achieving the goals. Fourth, a comprehensive strategy for achieving the scaling goals must be developed. This may involve partnerships, technology adoption, and process improvements. Fifth, a robust monitoring and evaluation system should be established to track progress and make necessary adjustments along the way. Finally, the plan should be regularly reviewed and updated to reflect changes in the context and the availability of resources.

The Role of Stakeholders in Impact Investing

Impact investing, by its very nature, involves a complex web of interconnected stakeholders, each playing a crucial role in achieving both financial returns and positive social or environmental impact. Understanding the roles and responsibilities of each stakeholder, and fostering effective communication and collaboration amongst them, is essential for the success of any impact investing initiative. This section will examine the key players and their contributions to the impact investing ecosystem.

Key Stakeholders in Impact Investing

Several key players contribute to the success of impact investing initiatives. These stakeholders, while distinct, are highly interdependent. Their collaborative efforts determine the overall effectiveness and reach of the investment. A breakdown of the key players and their functions follows.

- Investors: These individuals or organizations provide the capital for impact investments. Their roles include conducting due diligence, assessing risk, setting impact goals, and monitoring performance. Examples range from individual angel investors to large institutional investors like foundations and pension funds. They are driven by a blend of financial returns and positive social or environmental impact.

- Entrepreneurs/Businesses: These are the entities receiving the investment. Their roles include developing innovative solutions to social or environmental challenges, implementing sustainable business practices, measuring and reporting their impact, and ensuring financial viability. Successful entrepreneurs in this space often demonstrate a strong commitment to both profit and purpose.

- Communities: These are the beneficiaries of the positive social or environmental impact generated by the investment. Their roles involve participating in the design and implementation of projects, providing feedback on outcomes, and ensuring that the investment aligns with their needs and priorities. Effective engagement with communities is vital for ensuring the long-term sustainability and success of the project.

- Impact Measurement Firms/Consultants: These organizations specialize in developing and implementing impact measurement frameworks, collecting data, and analyzing results. They provide independent verification of the impact generated by the investment, building credibility and trust among stakeholders. Their role is crucial for ensuring transparency and accountability.

- Governments and Regulators: These entities create the policy and regulatory environment in which impact investing operates. Their roles include providing incentives for impact investing, setting standards for impact measurement, and ensuring compliance with relevant laws and regulations. Supportive government policies are crucial for fostering a thriving impact investing ecosystem.

Stakeholder Collaboration and Communication

Effective communication and collaboration are paramount for the success of impact investing initiatives. Open dialogue, shared goals, and transparent reporting are crucial for building trust and ensuring alignment among stakeholders. Regular meetings, shared data platforms, and collaborative decision-making processes can foster a strong and productive relationship between all involved parties. Without these elements, the potential for conflict and inefficiency increases, potentially jeopardizing the overall impact and financial returns of the investment.

Stakeholder Relationship Visualization

Imagine a network diagram. At the center is the “Impact Investment Project,” representing the core business or initiative. Radiating outwards are interconnected nodes representing each stakeholder group: Investors, Entrepreneurs, Communities, Impact Measurement Firms, and Governments/Regulators. Lines connecting these nodes represent the flows of information, capital, resources, and feedback between them. The thickness of the lines could visually represent the strength of the relationship and the frequency of interaction. For instance, a thick line between the “Entrepreneur” and “Investor” nodes indicates frequent communication and strong collaboration, while a thinner line between “Communities” and “Investors” might signify a need for improved engagement and feedback mechanisms. This network highlights the interconnectedness and mutual dependence of each stakeholder group in achieving a successful and impactful outcome.

Conclusive Thoughts

Impact investing represents a powerful shift in how we approach finance, recognizing the inextricable link between profit and positive social and environmental outcomes. By understanding the strategies Artikeld here—from meticulous impact measurement to robust risk management and stakeholder engagement—investors can harness the potential of impact investing to generate both financial returns and meaningful, lasting change. The journey toward a more sustainable and equitable future hinges on the collective adoption of these innovative investment approaches.

Essential FAQs

What is the difference between impact investing and socially responsible investing (SRI)?

While both consider social and environmental factors, impact investing actively seeks to measure and manage the positive impact of investments, whereas SRI primarily focuses on avoiding investments deemed harmful.

How can I find impact investment opportunities?

Several online platforms and impact investing networks connect investors with suitable opportunities. Consult financial advisors specializing in impact investing for personalized guidance.

What are the potential risks associated with impact investing?

Impact investments, like any investment, carry risks. These can include illiquidity, longer investment horizons, and challenges in accurately measuring impact. Thorough due diligence is crucial.

Are there tax benefits associated with impact investing?

Tax benefits vary depending on jurisdiction and the specific investment. Consult a tax professional to understand any applicable tax incentives.