Insurance Planning Checklist: Facing the future without a solid insurance plan is like navigating a pirate ship during a hurricane – thrilling, perhaps, but ultimately unwise. This comprehensive guide will steer you towards calmer waters, helping you navigate the often-murky world of insurance and build a portfolio that protects your present and secures your future. We’ll unravel the mysteries of term life versus whole life, the nuances of HMOs versus PPOs, and the surprising ways insurance can actually boost your financial well-being (yes, really!). Prepare to become a financial buccaneer… of the responsible, insured kind.

This checklist covers all the essentials, from understanding your individual needs and building a robust insurance portfolio to incorporating insurance into your broader financial plan. We’ll explore various insurance types, provide practical tips for minimizing costs, and offer strategies for navigating the sometimes-daunting world of estate planning. By the end, you’ll be equipped with the knowledge to confidently chart your financial course, avoiding the treacherous reefs of unforeseen circumstances.

Understanding Your Insurance Needs

Navigating the world of insurance can feel like trying to decipher a pirate’s treasure map – cryptic, confusing, and potentially very rewarding if you crack the code. But fear not, landlubber! This section will illuminate the path to understanding your insurance needs, transforming you from a bewildered novice to a savvy insurance aficionado.

Insurance, at its core, is about protecting yourself from unforeseen financial calamities. Think of it as a financial safety net, catching you before you take a tumble into debt-ridden despair. Various types of coverage exist, each designed to address specific risks. Understanding these options is the first step towards building a robust insurance plan that fits your unique circumstances like a well-tailored suit (or perhaps a comfortable pair of sweatpants, depending on your preferred level of formality).

Types of Insurance Coverage

The insurance landscape is vast, but some common types include health insurance (covering medical expenses), auto insurance (protecting against car accidents), home insurance (safeguarding your dwelling), life insurance (providing financial security for loved ones after your passing), and disability insurance (offering income replacement during periods of incapacity). Each type has its nuances and variations, and the specific coverage you need will depend on your individual circumstances, risk tolerance, and financial goals. For example, a skydiving enthusiast will likely require different insurance coverage than a librarian who spends their weekends knitting.

Assessing Individual Risk Factors

Before diving into specific policies, it’s crucial to understand your personal risk profile. This involves a realistic self-assessment of your potential vulnerabilities. Think of it as a brutally honest conversation with yourself, devoid of rose-tinted glasses.

- Identify your assets: What do you own that you want to protect? This includes your home, car, valuable possessions, and even your future earning potential.

- Assess your liabilities: What debts do you have? Mortgage, student loans, credit card debt – these all need consideration.

- Evaluate your lifestyle: Do you engage in high-risk activities? This impacts your insurance needs significantly.

- Consider your health: Pre-existing conditions can influence the cost and availability of certain types of insurance.

- Analyze your family situation: Do you have dependents who rely on your income? This is a critical factor when considering life insurance.

Common Insurance Gaps

Many people unknowingly leave significant gaps in their insurance coverage, leaving themselves vulnerable to unforeseen financial hardship. These gaps often arise from a lack of awareness or a failure to regularly review and update their policies.

- Underinsured Motor Vehicles: Carrying minimal liability coverage leaves you exposed to substantial financial losses in case of an accident.

- Inadequate Disability Insurance: Many underestimate the risk of becoming disabled and the potential impact on their income.

- Lack of Long-Term Care Insurance: The costs of long-term care can be astronomical, quickly depleting savings.

- Insufficient Life Insurance: Failing to adequately protect your family’s financial future in the event of your death is a common oversight.

Term Life Insurance vs. Whole Life Insurance

Two popular types of life insurance, term and whole life, offer distinct advantages and disadvantages. Choosing between them requires careful consideration of your needs and financial situation.

| Feature | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Premium Costs | Generally lower | Generally higher |

| Death Benefit | Pays out a lump sum upon death within the policy term. | Pays out a lump sum upon death, regardless of when it occurs. |

| Cash Value Accumulation | No cash value | Builds cash value over time, which can be borrowed against or withdrawn. |

Building Your Insurance Portfolio

Let’s face it, insurance isn’t exactly the most thrilling topic. It’s like choosing a really, really boring but incredibly important superhero sidekick. But just like a trusty sidekick, the right insurance can save your bacon (and your bank account) when things go south. Building a solid insurance portfolio is less about excitement and more about smart, strategic planning – think of it as adulting with a safety net.

Building a comprehensive insurance portfolio is a journey, not a sprint. It involves carefully selecting policies that align with your life stage, financial goals, and risk tolerance. The key is to anticipate your future needs and protect yourself against unforeseen circumstances, preventing a financial meltdown that could leave you singing the blues (or worse, facing bankruptcy). The good news is, this process can be surprisingly satisfying once you get the hang of it.

Insurance Needs Across Life Stages

The insurance needs of a recent graduate differ dramatically from those of a retiree. A young adult might prioritize health insurance and renter’s insurance, while a family with children might require life insurance, disability insurance, and possibly long-term care insurance. Retirees, on the other hand, may focus on Medicare supplemental insurance and long-term care insurance to protect their savings and health. Failing to tailor your coverage to your current life stage is like wearing a tutu to a board meeting – it’s just not practical.

- Young Adults (20s-30s): Health insurance, renter’s insurance, possibly life insurance (especially if you have dependents or significant debt).

- Families (30s-50s): Health insurance, life insurance, disability insurance, homeowner’s or renter’s insurance, possibly long-term care insurance for children with special needs.

- Retirees (60s+): Medicare supplemental insurance (Medigap), long-term care insurance, possibly life insurance (depending on estate planning needs).

Regular Review and Adjustment of Insurance Plans

Think of your insurance portfolio as a living document, not a static one. Your needs, financial situation, and risk tolerance will inevitably change over time. Failing to review and adjust your insurance plan periodically is like sailing a ship without a map – you might reach your destination, but it’ll be a bumpy, unpredictable ride. A regular review ensures your coverage remains adequate and cost-effective. We recommend reviewing your policies at least annually, or whenever a significant life event occurs (marriage, birth of a child, job change, etc.).

Factors to Consider When Choosing an Insurance Provider

Choosing the right insurance provider is crucial. It’s like choosing a doctor – you want someone you trust and who will be there for you when you need them most. Don’t just go for the cheapest option; consider these factors:

- Financial Stability: Look for a company with a strong financial rating, ensuring they can pay out claims when you need them.

- Customer Service: Read reviews and check customer satisfaction ratings. A responsive and helpful customer service team can make all the difference when you have a claim.

- Policy Coverage and Exclusions: Carefully review the policy details to understand what’s covered and what’s not. Don’t assume anything!

- Claims Process: Investigate how easy it is to file a claim and how quickly the company processes claims. This is often a critical factor when you actually need to use your insurance.

- Price and Value: Compare quotes from multiple providers to find the best balance between price and coverage. The cheapest isn’t always the best, and the most expensive isn’t always the most comprehensive.

Financial Planning and Insurance: Insurance Planning Checklist

Let’s face it, nobody enjoys thinking about financial doom and gloom. But just like a surprisingly delicious kale smoothie, a well-structured financial plan, bolstered by the right insurance, can be surprisingly beneficial for your long-term well-being. Ignoring it is like skipping sunscreen on a sunny day – you might get away with it, but the consequences could be…sunburnt.

Insurance isn’t just about avoiding catastrophe; it’s a crucial component of a robust financial strategy, acting as a safety net that allows you to pursue your dreams without the constant fear of unforeseen events derailing your progress. Think of it as the sturdy foundation upon which you build your financial castle, protecting you from the metaphorical dragons (unexpected medical bills, lawsuits, etc.) that might otherwise try to burn it to the ground.

Insurance’s Role in Long-Term Financial Security

A comprehensive insurance plan safeguards your financial future by mitigating risks that could otherwise wipe out years of hard work and careful saving. For example, a debilitating illness could lead to crippling medical debt, but adequate health insurance can alleviate much of that burden, allowing you to focus on recovery instead of financial ruin. Similarly, life insurance ensures that your loved ones are financially protected in the event of your untimely demise, preventing them from facing a sudden and potentially devastating financial crisis. Without such a safety net, a single unforeseen event could unravel a lifetime of careful financial planning. Think of it as a financial parachute—you hope you never need it, but you’re awfully glad to have it when you do.

Identifying and Mitigating Financial Risks with Insurance

Several significant financial risks can be effectively mitigated through insurance. Consider the potential costs associated with a car accident, a house fire, or a lawsuit. These unexpected expenses could easily drain your savings and leave you in a precarious financial position. Auto insurance, homeowner’s insurance, and liability insurance act as crucial buffers, helping to cover these costs and preventing financial devastation. Imagine facing a multi-million dollar lawsuit without adequate liability insurance—it’s enough to make even the most seasoned financial planner break into a cold sweat.

Investment Strategies Complementing Insurance Planning

Insurance provides a safety net, but achieving long-term financial security requires a diversified approach that includes smart investment strategies. These strategies, while distinct from insurance, work in tandem to create a resilient financial foundation. For instance, investing in a low-cost index fund provides long-term growth potential, while a high-yield savings account offers liquidity for unexpected expenses. These strategies, when carefully balanced, work hand-in-hand with insurance to protect against both the unexpected and to build wealth over time. Think of it as a well-rounded financial team: insurance is the goalie, protecting your net worth, while investments are the offensive players, scoring goals to build your financial empire. The synergy is undeniable.

Health Insurance Considerations

Navigating the world of health insurance can feel like trying to assemble IKEA furniture without the instructions – confusing, frustrating, and potentially resulting in a wobbly outcome. But fear not, intrepid insurance explorer! This section will illuminate the path to finding a health plan that fits your needs (and doesn’t leave you with a crippling medical bill). We’ll unravel the mysteries of HMOs, PPOs, and POS plans, so you can choose wisely and avoid the dreaded “oops, I didn’t read the fine print” moment.

Types of Health Insurance Plans, Insurance Planning Checklist

Understanding the different types of health insurance plans is crucial for making an informed decision. Each plan offers a unique balance between cost, coverage, and flexibility. Let’s examine three common types: HMOs (Health Maintenance Organizations), PPOs (Preferred Provider Organizations), and POS (Point of Service) plans. These plans vary significantly in how they manage your healthcare access and costs.

Evaluating Health Insurance Options

Choosing a health insurance plan requires careful consideration of several factors. A structured approach is essential to avoid feeling overwhelmed by the sheer volume of information and choices available. This checklist will guide you through the key aspects to evaluate when comparing plans.

- Premium Costs: Consider the monthly premium cost. A lower premium might mean higher out-of-pocket costs later.

- Deductible: This is the amount you pay out-of-pocket before your insurance coverage kicks in. Lower deductibles mean less upfront cost, but usually higher premiums.

- Copay: The fixed amount you pay for a doctor’s visit or other services.

- Coinsurance: The percentage of costs you share with your insurer after you’ve met your deductible.

- Network of Doctors and Hospitals: Check if your preferred doctors and hospitals are included in the plan’s network. Out-of-network care is typically more expensive.

- Prescription Drug Coverage: Review the formulary (list of covered medications) and cost-sharing for prescription drugs.

- Annual Out-of-Pocket Maximum: This is the most you’ll pay out-of-pocket in a year. Once you reach this limit, your insurance covers 100% of covered expenses.

Minimizing Healthcare Costs

While you can’t entirely eliminate healthcare costs, you can take proactive steps to minimize them. These strategies can help you keep your healthcare expenses manageable.

- Preventive Care: Regular checkups and screenings can help prevent costly health problems down the line. Many plans cover these services at no cost.

- Generic Medications: Opt for generic medications whenever possible; they’re often significantly cheaper than brand-name drugs.

- Negotiate Medical Bills: Don’t be afraid to negotiate with healthcare providers to reduce your bill. Many are willing to work with patients on payment plans.

- Shop Around for Healthcare Services: Compare prices for procedures and services before committing to treatment. Cost can vary significantly between providers.

- Health Savings Account (HSA): If eligible, contribute to an HSA to save pre-tax money for qualified medical expenses.

Comparison of Health Insurance Plans

| Plan Type | Benefits | Drawbacks |

|---|---|---|

| HMO | Typically lower premiums, preventive care often covered | Limited choice of doctors and hospitals; referrals often required; out-of-network care usually not covered. |

| PPO | Greater choice of doctors and hospitals; no referrals usually needed; out-of-network care usually covered (at a higher cost) | Higher premiums than HMOs; higher out-of-pocket costs if you don’t use in-network providers. |

| POS | Combines elements of HMOs and PPOs; offers some flexibility in choosing doctors and hospitals | Can be more complex to understand; may have limitations on out-of-network coverage. |

Auto and Home Insurance Planning

Navigating the world of auto and home insurance can feel like trying to assemble flat-pack furniture while juggling flaming torches – challenging, potentially messy, and with a high risk of accidental self-immolation. But fear not, intrepid insurance explorer! This section will illuminate the path to securing affordable and adequate coverage for your prized possessions (your car and your home, not necessarily in that order).

Factors Influencing Auto and Home Insurance Premiums

Several factors contribute to the cost of your auto and home insurance premiums. Think of it as a complex equation, where your personal characteristics and the characteristics of your assets are the variables. For auto insurance, these variables might include your driving record (a clean record is your friend!), your vehicle’s make and model (sports cars tend to be more expensive to insure than sensible sedans), your location (urban areas often have higher premiums due to increased risk), and your age (younger drivers, statistically speaking, are involved in more accidents). For home insurance, factors such as your home’s location (flood zones and earthquake-prone areas are costlier), the age and condition of your home (a well-maintained home is a cheaper home to insure), the value of your belongings (more stuff means higher premiums), and even your security system (alarms and security cameras can lower your premiums) all play a significant role. The better you score on these variables, the lower your premium should be.

Strategies for Reducing Insurance Costs

Lowering your insurance premiums doesn’t require selling your prized possessions and moving to a remote island (though that *does* have its appeal). Several strategies can help you save money without sacrificing essential coverage. For auto insurance, consider increasing your deductible (the amount you pay out-of-pocket before your insurance kicks in). A higher deductible means lower premiums, but be prepared to cover more in the event of an accident. Maintaining a good driving record is paramount – avoid speeding tickets and accidents like the plague. Bundling your auto and home insurance with the same provider often results in significant discounts. For home insurance, consider upgrading your security system, installing smoke detectors and fire alarms, and regularly maintaining your home. These measures demonstrate a commitment to risk reduction, which insurers appreciate. Shopping around and comparing quotes from multiple insurers is also crucial – don’t settle for the first offer you receive.

Common Exclusions and Limitations

Insurance policies, while designed to protect you, aren’t magic shields. They often contain exclusions and limitations – areas where coverage is explicitly denied or restricted. For auto insurance, common exclusions might include damage caused by wear and tear, damage resulting from driving under the influence, or damage to personal property inside your vehicle. Home insurance policies often exclude damage caused by floods, earthquakes, or acts of war (unless you have specific endorsements). Understanding these exclusions is crucial to avoid unpleasant surprises when you need to file a claim. It’s like knowing the fine print of a particularly tricky legal document – essential for survival.

Questions to Ask Your Insurance Provider

Before you sign on the dotted line (or, more likely, click “accept” online), it’s essential to ask your insurance provider clarifying questions. This isn’t about being a skeptical insurance ninja; it’s about ensuring you have a clear understanding of your coverage. What are the specific exclusions and limitations of my policy? What is the claims process, and how long can I expect it to take? What discounts are available to me? What happens if my circumstances change (e.g., I move to a new home or buy a new car)? Asking these questions will ensure you’re fully informed and prepared for any eventuality.

Estate Planning and Insurance

Let’s face it, nobody wants to think about their own mortality, but proper estate planning is about ensuring your loved ones are taken care of, not about morbid fascination with the afterlife. Life insurance plays a surprisingly crucial – and sometimes hilarious – role in this process, acting as a financial safety net for the inevitable unexpected. Think of it as your last, best attempt at being a responsible adult, even in death.

Life insurance, in the context of estate planning, isn’t just about replacing lost income; it’s a strategic tool to ensure a smooth transition of assets and minimize potential headaches for your heirs. It can act as a financial cushion, helping to cover estate taxes, debts, and other expenses, preventing your carefully curated legacy from being picked apart by the tax man (or worse, squabbled over by relatives). Properly utilizing life insurance can prevent a potentially messy and expensive situation for your family, ensuring they receive your hard-earned assets as intended.

Life Insurance’s Role in Estate Planning

Life insurance acts as a powerful tool in estate planning by providing a predetermined sum of money upon the death of the policyholder. This lump sum can be used to cover various expenses associated with estate settlement, such as funeral costs, outstanding debts, estate taxes, and ensuring a comfortable financial future for dependents. Imagine this: your meticulously planned collection of rubber ducks can finally be passed down without the looming threat of auction to pay off debts!

Using Life Insurance to Cover Estate Taxes

Estate taxes can be a significant burden on a family, particularly for high-net-worth individuals. Life insurance can be strategically used to cover these taxes, ensuring that the remaining assets pass to the beneficiaries without being depleted by tax liabilities. Think of it as a preemptive strike against Uncle Sam’s tax-hungry minions. For example, a wealthy individual with a substantial estate might purchase a life insurance policy specifically designed to cover the anticipated estate tax liability, ensuring their heirs receive the full intended inheritance. This is particularly helpful for families who may not have sufficient liquid assets to cover such taxes immediately.

Types of Life Insurance Policies for Estate Planning

Several types of life insurance policies are suitable for estate planning, each with its own characteristics and benefits. Choosing the right policy depends on individual needs and financial circumstances. It’s not a one-size-fits-all situation, so consulting with a financial advisor is highly recommended.

- Term Life Insurance: Provides coverage for a specific period, offering a cost-effective solution for those needing temporary coverage. It’s like renting a financial parachute – useful for a set time, but then you’re on your own.

- Whole Life Insurance: Offers lifelong coverage and builds cash value over time. Think of it as a financial Swiss Army knife – useful for various purposes, including estate planning.

- Universal Life Insurance: Offers flexible premiums and death benefits, allowing adjustments to meet changing needs. It’s like a financial chameleon, adapting to your ever-changing life.

Illustrating the Process of Using Life Insurance in Estate Planning

The following flowchart illustrates a simplified process:

[Imagine a flowchart here. The flowchart would start with “Assess Estate Value and Tax Liability,” branch to “Determine Insurance Needs,” then to “Choose Policy Type,” followed by “Purchase Policy and Name Beneficiaries,” and finally, “Upon Death, Proceeds Pay Estate Taxes and/or Beneficiaries.”] The process involves evaluating the estate’s value to determine the potential tax liability, then selecting a life insurance policy that provides sufficient coverage to offset those taxes. The policy’s beneficiary designation ensures the funds are efficiently transferred to the intended recipients upon the policyholder’s death. This process ensures a smoother transition of assets and minimizes the financial burden on heirs.

Reviewing and Updating Your Plan

Insurance, much like a fine wine (or a particularly stubborn weed), needs regular tending. Ignoring it can lead to a vine of unforeseen problems, or worse, a rather unpleasant surprise when you need it most. Regular review and updates are crucial to ensuring your insurance portfolio remains a robust shield against life’s inevitable curveballs, rather than a flimsy umbrella in a hurricane.

A regularly reviewed insurance plan acts as a financial safety net, adapting to the changing tides of your life. Failing to do so is like sailing a ship without a map – you might reach your destination, but the journey will likely be far bumpier than necessary. Think of it as preventative maintenance for your financial well-being; a small amount of effort now can prevent significant headaches later.

Regular Review Schedule

Establishing a consistent review schedule is key. While the ideal frequency depends on individual circumstances, a yearly review is generally recommended. Major life changes, however, may necessitate more frequent checks. Think of it like your annual physical – you go yearly, but you’d book an extra appointment if you twisted your ankle, right?

Life Events Triggering Review

Several life events significantly impact insurance needs, demanding a prompt review. Marriage, the birth of a child, a change in employment status (promotion, job loss, or career change), purchasing a home, significant inheritance, or even a major change in health status are all strong indicators that your insurance coverage should be re-evaluated. For instance, marriage might require adjustments to life insurance policies and estate plans, while a new home necessitates updated homeowner’s insurance. A new baby? Well, that’s a whole new level of insurance needs, from maternity coverage to life insurance to childcare considerations.

Seeking Professional Advice

Navigating the complexities of insurance can feel like trying to assemble IKEA furniture without the instructions. While DIY insurance planning might seem appealing, seeking professional advice, especially when making significant changes, is strongly recommended. A qualified insurance advisor can provide personalized guidance, ensuring your coverage aligns perfectly with your evolving needs and risk profile. They can also help you avoid costly mistakes and identify potential gaps in your coverage. Think of them as your financial Sherpas, guiding you through the sometimes treacherous terrain of insurance policies.

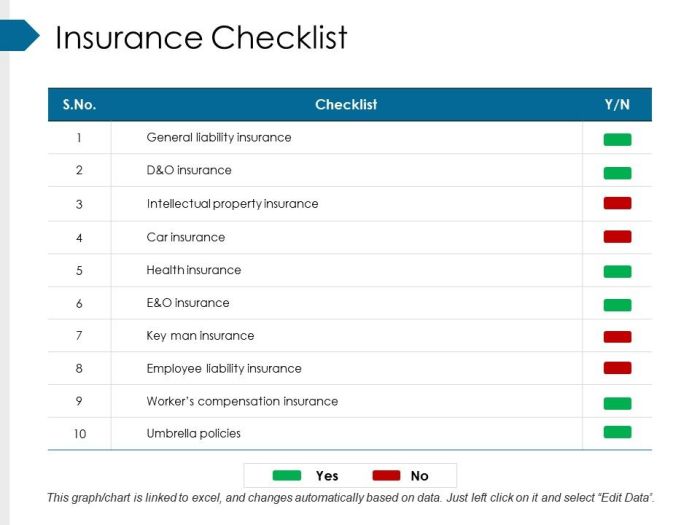

Comprehensive Insurance Portfolio Review Checklist

Regularly reviewing your insurance portfolio is vital to ensuring adequate coverage and avoiding unnecessary expenses. This checklist provides a framework for a thorough review:

- Review Policy Summaries: Carefully examine each policy’s coverage details, deductibles, premiums, and exclusions.

- Assess Current Needs: Evaluate whether your current coverage adequately protects against potential risks considering your current life stage and financial situation.

- Compare Premiums: Shop around and compare premiums from different insurers to ensure you are receiving competitive rates. Don’t be afraid to switch providers if you find a better deal.

- Update Contact Information: Ensure all your contact information is up-to-date on all your policies to avoid delays in claim processing.

- Check for Gaps in Coverage: Identify any potential gaps in your coverage and explore options to fill them. Consider umbrella liability insurance, long-term care insurance, or other specialized coverage as needed.

- Review Beneficiary Designations: Make sure your beneficiaries are up-to-date on all your policies, especially life insurance and retirement accounts. Life changes often necessitate updating beneficiary information.

Final Summary

So, there you have it – your roadmap to insurance enlightenment! Armed with this Insurance Planning Checklist, you’re no longer just facing life’s uncertainties; you’re strategically planning for them. Remember, a little foresight goes a long way in ensuring financial peace of mind. Now go forth, and build that impenetrable financial fortress! (Just don’t forget to review and update your plan periodically – even fortresses need maintenance!).

FAQ

What if I can’t afford comprehensive insurance coverage?

Prioritize essential coverages based on your risk profile and budget. Consider starting with the most crucial aspects (like health and liability) and gradually adding more as your financial situation improves.

How often should I review my insurance policies?

At least annually, or more frequently following significant life changes (marriage, birth, job loss, etc.).

Can I use my insurance policy as collateral for a loan?

It depends on the type of policy. Some policies, particularly cash-value life insurance, can be used as collateral. Consult your insurer for specifics.

What’s the difference between a deductible and a premium?

A premium is your regular payment for insurance coverage. A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in.