Insurance Planning Guide offers a comprehensive exploration of securing your financial well-being. Navigating the complex world of insurance can feel overwhelming, but understanding your needs and options is crucial. This guide provides a clear path, breaking down various insurance types, planning strategies, and the importance of working with professionals to build a robust, personalized plan.

From assessing personal risk factors to selecting appropriate coverage for different life stages, we delve into the intricacies of health, auto, home, and disability insurance. We’ll equip you with the knowledge to make informed decisions, manage costs effectively, and avoid common pitfalls. Ultimately, this guide empowers you to take control of your financial future and protect what matters most.

Understanding Insurance Needs

Choosing the right insurance coverage can feel overwhelming, but understanding your needs is the first step towards securing your financial future. This section will guide you through identifying your personal risks and selecting appropriate insurance policies to protect yourself and your loved ones. We’ll explore various insurance types, assess risk factors, and examine common insurance needs across different life stages.

Types of Insurance Coverage

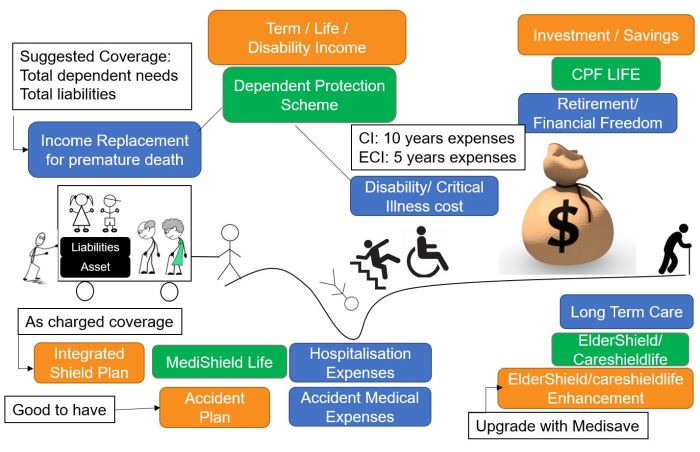

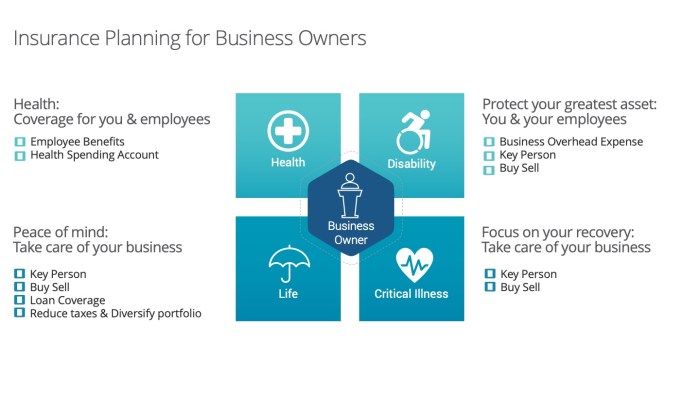

Insurance policies are designed to cover a wide range of potential risks. Common types include health insurance, which covers medical expenses; auto insurance, protecting against vehicle damage and liability; homeowners or renters insurance, safeguarding your property; and life insurance, providing financial support for your dependents after your death. Other specialized policies exist, such as disability insurance, covering income loss due to injury or illness, and long-term care insurance, assisting with the costs of long-term care needs. Understanding the specifics of each type is crucial in determining your overall insurance strategy.

Assessing Personal Risk Factors

A thorough assessment of your personal risk factors is essential for determining the appropriate level and type of insurance coverage. This involves a step-by-step process. First, identify your assets, such as your home, car, and investments. Second, consider your liabilities, including outstanding loans and potential lawsuits. Third, evaluate your income and expenses to understand your financial capacity to absorb unexpected costs. Fourth, assess your health status and family history of illnesses. Finally, consider your lifestyle and occupation, identifying potential risks associated with them. This comprehensive evaluation helps you tailor your insurance plan to your specific circumstances. For example, a high-income earner with a family might need significant life insurance coverage, while someone with a stable job and few assets may require less.

Common Insurance Needs at Different Life Stages

Insurance needs evolve throughout life. Young adults might prioritize health and auto insurance, focusing on protecting their health and vehicles. As individuals enter their 30s and 40s, the focus may shift to life insurance to protect their families and potentially homeowner’s or renter’s insurance. In later life, long-term care insurance and supplemental health insurance become more relevant, addressing the potential for increased healthcare costs and long-term care needs. Understanding these shifting priorities helps individuals proactively manage their insurance needs across their lifespan. For example, a young couple buying their first home would prioritize homeowners insurance and potentially life insurance, while a retiree might focus on health and long-term care insurance.

Comparison of Term Life Insurance and Whole Life Insurance

| Feature | Term Life Insurance | Whole Life Insurance | Key Difference Summary |

|---|---|---|---|

| Coverage Period | Specific term (e.g., 10, 20, 30 years) | Lifetime coverage | Term is temporary; Whole is permanent. |

| Premiums | Generally lower | Generally higher | Term premiums are cheaper, but coverage ends; Whole premiums are higher, but coverage is lifelong. |

| Cash Value | No cash value | Builds cash value over time | Term provides only death benefit; Whole offers a death benefit plus a cash value component. |

| Investment Component | No investment component | Often includes an investment component | Term is purely insurance; Whole has a savings element. |

Types of Insurance Policies

Choosing the right insurance coverage is crucial for protecting your financial well-being and mitigating potential risks. Understanding the different types of policies available and their features is the first step in building a comprehensive insurance plan tailored to your specific needs and circumstances. This section will explore some of the most common types of insurance policies.

Health Insurance Plans

Health insurance plans offer financial protection against medical expenses. These plans vary widely in their coverage, costs, and networks of healthcare providers. A typical health insurance plan includes coverage for doctor visits, hospital stays, surgeries, prescription drugs, and other medical services. The extent of coverage depends on the specific plan, with some plans offering more comprehensive coverage than others. Many plans also feature deductibles, co-pays, and out-of-pocket maximums, which influence the cost-sharing responsibilities of the policyholder. Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) can be used in conjunction with health insurance to further manage healthcare costs. Choosing a plan involves considering factors like premium costs, deductible amounts, co-insurance percentages, and the network of doctors and hospitals included in the plan. A comprehensive understanding of these factors is vital to select a plan that aligns with individual needs and budget.

Auto Insurance Policies

Auto insurance policies provide financial protection in case of accidents or damage to your vehicle. Standard coverage typically includes liability insurance, which covers damages or injuries caused to others in an accident; collision coverage, which covers damage to your vehicle in an accident regardless of fault; and comprehensive coverage, which protects against damage from events like theft, vandalism, or natural disasters. Uninsured/underinsured motorist coverage protects you if you are involved in an accident with a driver who lacks sufficient insurance. Many policies also offer additional options, such as roadside assistance, rental car reimbursement, and medical payments coverage. The cost of auto insurance varies based on factors such as your driving record, age, location, type of vehicle, and the level of coverage chosen. Careful consideration of these factors will help in selecting an appropriate and affordable policy. For example, a young driver with a less-than-perfect driving record might expect to pay higher premiums than an older driver with a clean record.

Homeowner’s and Renter’s Insurance

Homeowner’s insurance protects your home and its contents from damage or loss due to various events such as fire, theft, or natural disasters. It also provides liability coverage if someone is injured on your property. Renter’s insurance, on the other hand, protects your personal belongings within a rented property from similar risks, and also provides liability coverage. While both offer similar protection for personal belongings, homeowner’s insurance additionally covers the structure of the home itself. The level of coverage and the cost of premiums vary depending on factors such as the location of the property, the value of the home or belongings, and the chosen coverage limits. It’s crucial to understand the differences between these two policies to ensure you have the appropriate level of protection for your specific situation. For example, a homeowner in a high-risk area for hurricanes would likely need a higher level of coverage and expect to pay higher premiums compared to a homeowner in a low-risk area.

Disability Insurance

Choosing disability insurance involves careful consideration of several key factors. This type of insurance replaces a portion of your income if you become unable to work due to illness or injury.

- Type of Policy: Consider short-term versus long-term disability insurance, and whether you need an individual or group policy.

- Benefit Amount: Determine the percentage of your income you want the policy to replace. This should be sufficient to cover living expenses.

- Elimination Period: Understand the waiting period before benefits begin. A shorter elimination period means quicker access to benefits, but typically at a higher premium.

- Definition of Disability: Review the policy’s definition of disability, as this will determine your eligibility for benefits.

- Cost and Affordability: Balance the cost of premiums with the level of coverage you need. Consider your current financial situation and long-term financial goals.

Planning for the Future

Securing your financial future through adequate insurance coverage is crucial, but managing those costs and navigating the complexities of insurance plans requires proactive planning. This section provides strategies for effectively managing your insurance expenses, avoiding common pitfalls, and maintaining a well-organized insurance portfolio.

Strategies for Managing Insurance Costs

Effective insurance cost management involves a multifaceted approach. This includes comparing quotes from multiple insurers, carefully reviewing coverage options to avoid unnecessary extras, and exploring potential discounts. Bundling policies (like home and auto) with the same insurer often results in significant savings. Consider increasing deductibles – a higher deductible means lower premiums, but remember this increases your out-of-pocket expenses in case of a claim. Maintaining a good driving record and implementing home security measures can also lead to lower premiums for auto and home insurance respectively. Finally, exploring different insurance plans and providers regularly is essential to find the best value for your needs.

Common Pitfalls to Avoid When Purchasing Insurance

Several common mistakes can lead to inadequate or overpriced insurance coverage. Failing to thoroughly review policy details before signing is a frequent oversight. Another common pitfall is selecting coverage based solely on price without considering the adequacy of the coverage itself. Overlooking the importance of riders and add-ons that provide essential supplementary coverage can leave you vulnerable to unexpected expenses. Not understanding the policy’s exclusions and limitations can lead to unpleasant surprises during a claim. Finally, neglecting to regularly review and update your insurance plan can result in coverage gaps as your needs and circumstances change.

A Step-by-Step Guide on Reviewing and Updating an Insurance Plan

Regularly reviewing your insurance plan is vital to ensure it continues to meet your evolving needs. Begin by gathering all your current insurance policies. Next, carefully analyze each policy, focusing on coverage amounts, deductibles, and premiums. Compare your current coverage with your current assets and liabilities. Consider any life changes, such as marriage, childbirth, or a new home purchase, that might impact your insurance requirements. Then, obtain quotes from multiple insurers to compare prices and coverage options. Finally, update your policies to reflect your revised needs and select the most suitable coverage at the most competitive price. Remember to keep records of all changes made.

Essential Documents for Insurance Records

Maintaining organized insurance records is crucial for efficient claims processing and financial planning. A comprehensive checklist includes copies of all insurance policies, including the declarations page, endorsements, and riders; receipts for premium payments; claims filed and settled; correspondence with insurers; and any related legal documents. Consider storing these documents securely, either physically in a fireproof safe or digitally in a password-protected cloud storage system. Regularly backing up your digital records is also advisable. This organized approach ensures easy access to critical information when needed.

Working with Insurance Professionals

Navigating the world of insurance can be complex, making the guidance of a qualified professional invaluable. Choosing the right insurance agent or broker and understanding how to communicate your needs effectively are crucial steps in securing adequate coverage. This section will Artikel strategies for working successfully with insurance professionals to achieve your insurance goals.

Selecting a Qualified Insurance Agent or Broker

Finding a trustworthy insurance professional is paramount. A qualified agent or broker possesses in-depth knowledge of various insurance products and can help you assess your needs and find suitable policies. Consider checking their licensing and credentials with your state’s insurance department. Seek recommendations from trusted sources, such as friends, family, or financial advisors. Inquire about their experience with clients having similar profiles and needs to yours. Look for professionals who prioritize clear communication and offer personalized service. Remember, a good agent acts as your advocate, not just a salesperson.

Understanding Policy Terms and Conditions

Insurance policies are legally binding contracts. It’s essential to thoroughly review the policy documents, including the declarations page, coverage details, exclusions, and limitations. Don’t hesitate to ask questions if anything is unclear. A comprehensive understanding of your policy will prevent misunderstandings and disputes later on. Pay close attention to the definitions of key terms, especially those related to covered perils, deductibles, and claim procedures. Consider seeking clarification from your agent or broker if necessary. Ignoring the fine print can lead to significant financial repercussions in the event of a claim.

Effectively Communicating Insurance Needs to Professionals

Open and honest communication is key to a successful relationship with your insurance professional. Before your initial meeting, compile a list of your assets, liabilities, and potential risks. Be prepared to discuss your risk tolerance, financial goals, and the level of coverage you’re seeking. Clearly articulate your concerns and expectations. Don’t be afraid to ask for different policy options and comparisons. Active listening and asking clarifying questions are crucial to ensure your needs are accurately understood and addressed. Provide complete and accurate information to avoid delays or complications with your policy.

Filing an Insurance Claim

The process of filing an insurance claim can vary depending on the type of insurance and the specific circumstances. However, a general flowchart can illustrate the key steps involved.

Illustrative Examples

Understanding the practical implications of insurance planning is crucial. The following examples illustrate the potential benefits of comprehensive coverage and the significant financial repercussions of inadequate protection.

Comprehensive Coverage Benefits: The Family Home

Consider a family living in a suburban home valued at $500,000. They have a comprehensive homeowner’s insurance policy with coverage for fire, theft, and liability. A devastating fire, caused by a faulty electrical system, completely destroys their home. Their comprehensive policy covers the full cost of rebuilding their home, including temporary living expenses while the reconstruction takes place. Without this insurance, the family would face catastrophic financial losses, potentially losing their home and accumulating significant debt. This illustrates how comprehensive coverage protects against unforeseen events and safeguards significant assets.

Financial Impact of Inadequate Insurance: The Small Business Owner

A small business owner operating a bakery fails to secure adequate liability insurance. A customer slips and falls in the bakery, sustaining a serious injury. The customer sues the business owner for medical expenses and lost wages. The legal costs and the resulting settlement amount far exceed the business owner’s savings, forcing them to close their business and face personal bankruptcy. This case study highlights the devastating consequences of underestimating the importance of liability insurance, especially for businesses that interact directly with the public.

Asset Protection: Investment Portfolio

An investor with a substantial portfolio of stocks and bonds secures an umbrella liability policy. A disgruntled former business partner files a frivolous lawsuit, claiming financial damages. While the lawsuit is ultimately dismissed, the legal fees incurred are substantial. The umbrella liability policy covers these legal costs, preventing a significant drain on the investor’s investment portfolio. This example demonstrates how insurance can protect not just physical assets but also financial assets from various legal and financial risks.

Long-Term Financial Implications of Neglecting Insurance Planning: A Visual Representation

Imagine a graph with two lines extending over time, representing “Financial Status with Insurance” and “Financial Status without Insurance”. The “Financial Status with Insurance” line shows a relatively steady upward trend, with minor dips representing occasional insurance claims and premiums. The “Financial Status without Insurance” line starts similarly but experiences a sharp, dramatic downward plunge at a point representing an unforeseen major event (like a house fire or major medical emergency). After this plunge, the line remains significantly lower than the “Financial Status with Insurance” line, illustrating the long-term financial burden of unexpected events without adequate insurance. The gap between the two lines visually emphasizes the cumulative financial security provided by consistent insurance planning. This illustrates the compounding effect of insurance over time, providing stability and protection against catastrophic financial losses.

Last Word

Effective insurance planning is not merely about purchasing policies; it’s about proactively safeguarding your financial security and peace of mind. By understanding your insurance needs, selecting appropriate coverage, and regularly reviewing your plan, you can build a strong foundation for the future. This guide has provided the tools and knowledge; now, take the next step towards a secure and confident financial tomorrow.

Questions and Answers

What is the difference between a term life insurance policy and a whole life insurance policy?

Term life insurance provides coverage for a specific period (term), offering a lower premium but no cash value. Whole life insurance provides lifelong coverage with a cash value component that grows over time, resulting in higher premiums.

How often should I review my insurance policies?

It’s recommended to review your insurance policies annually, or whenever there’s a significant life change (marriage, birth of a child, job change, etc.).

What should I do if I disagree with my insurance company’s decision on a claim?

Review your policy carefully, gather all supporting documentation, and contact your insurance company to appeal their decision. If the appeal is unsuccessful, consider seeking legal advice.

Can I get insurance even if I have pre-existing health conditions?

Yes, but the cost and availability of coverage may vary depending on the condition and the insurance provider. It’s crucial to disclose all pre-existing conditions accurately during the application process.