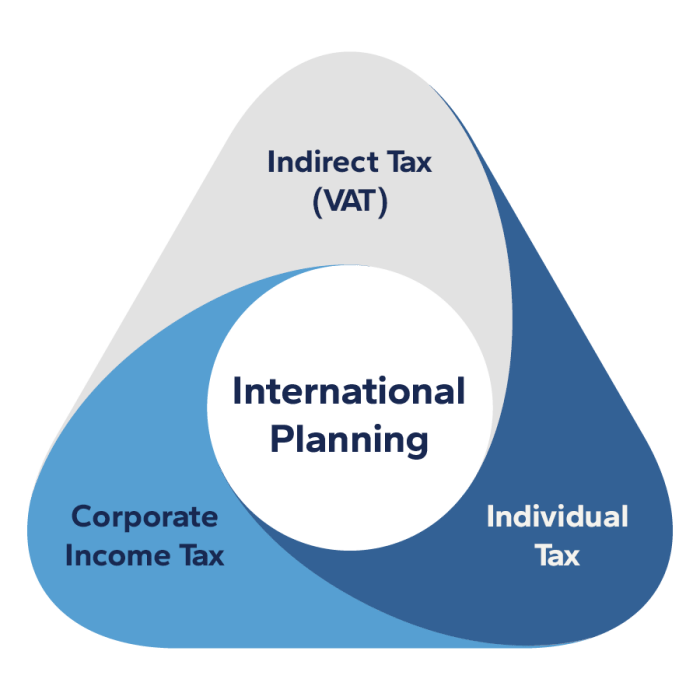

Navigating the complex world of international taxation can be daunting for businesses operating across borders. Effective international tax planning is crucial not only for minimizing tax liabilities but also for ensuring compliance with diverse legal frameworks. This guide delves into the core principles and strategies, offering insights into optimizing tax efficiency while maintaining ethical and legal standards.

From understanding tax treaties and double taxation avoidance to mastering transfer pricing strategies and navigating the intricacies of tax havens, we will explore various approaches to international tax planning. We will also examine the impact of globalization and emerging technological advancements on this ever-evolving field, providing a comprehensive overview to equip businesses with the knowledge needed to thrive in a globalized economy.

Introduction to International Tax Planning

International tax planning involves strategically structuring business operations and financial transactions to minimize global tax liabilities while remaining compliant with all applicable laws. It’s a complex field requiring expertise in multiple jurisdictions and a deep understanding of international tax treaties and conventions. Effective planning not only reduces tax burdens but also enhances overall business efficiency and profitability.

International tax planning is crucial for businesses operating across borders due to the varying tax laws and regulations in different countries. These differences can significantly impact a company’s overall tax liability, making strategic planning essential to optimize financial outcomes. Key considerations include understanding the tax implications of cross-border transactions, such as the transfer of goods, services, and intellectual property; navigating different tax systems and their potential for double taxation; and complying with reporting requirements in multiple jurisdictions. Failure to adequately address these factors can lead to significant financial penalties and reputational damage.

Common International Tax Structures

Several common international tax structures are employed by multinational corporations to manage their global tax exposure. These structures aim to leverage differences in tax rates and regulations across jurisdictions to reduce the overall tax burden. The choice of structure depends heavily on the specific circumstances of the business, its operations, and its risk tolerance.

One example is the use of foreign subsidiaries. Establishing subsidiaries in low-tax jurisdictions allows companies to shift profits to these locations, reducing their overall tax liability in higher-tax countries. This strategy often involves careful consideration of transfer pricing – the pricing of goods and services exchanged between related entities – to ensure compliance with tax regulations in all relevant jurisdictions. A poorly structured transfer pricing arrangement can attract scrutiny from tax authorities and result in significant adjustments and penalties.

Another common structure is the use of tax havens. These are countries or territories with exceptionally low or no corporate income tax rates. While offering potential tax advantages, using tax havens requires careful consideration of the OECD’s Base Erosion and Profit Shifting (BEPS) initiative, which aims to curb aggressive tax avoidance strategies. Companies utilizing tax havens must ensure their arrangements comply with international standards to avoid penalties and reputational damage. The use of holding companies in tax-efficient jurisdictions is also a common strategy. These companies typically own the intellectual property or other valuable assets of the multinational corporation, receiving royalty payments from operating subsidiaries in higher-tax jurisdictions. This allows for the accumulation of profits in a low-tax environment.

Finally, it’s crucial to understand that the complexity of international tax planning necessitates the expertise of qualified tax professionals. Navigating the intricate web of international tax laws and regulations requires a deep understanding of both domestic and international tax codes, as well as a thorough awareness of the constantly evolving landscape of international tax policy. Engaging experienced professionals is vital for ensuring compliance and optimizing tax efficiency.

Tax Treaties and Double Taxation Avoidance

International tax planning often involves navigating the complex landscape of tax treaties and double taxation avoidance. These agreements play a crucial role in minimizing the tax burden for businesses and individuals operating across multiple jurisdictions, fostering international trade and investment. Understanding their mechanics and limitations is essential for effective tax planning.

Tax treaties are bilateral agreements between countries designed to prevent double taxation—a situation where the same income or capital is taxed twice in two different countries. This can occur when a company or individual is resident in one country but earns income in another. These treaties aim to establish clear rules for determining the taxing rights of each country, ensuring fairness and promoting international cooperation.

Methods of Double Taxation Avoidance

Several methods are employed to avoid double taxation. The most common are the exemption method and the credit method. The exemption method relieves residents from paying tax on foreign-source income in their home country. The credit method allows residents to credit the tax already paid to a foreign country against their home country tax liability, preventing double taxation. A hybrid approach, combining aspects of both, is also possible, often tailored to specific types of income or circumstances. The choice of method significantly impacts the overall tax liability.

Challenges in Interpreting and Applying Tax Treaties

Despite their beneficial purpose, interpreting and applying tax treaties can present significant challenges. Ambiguity in treaty language, differences in domestic tax laws, and varying interpretations by tax authorities in different countries often lead to disputes. The constant evolution of global tax systems and the emergence of new business models further complicate the situation. These complexities necessitate careful analysis and expert advice to ensure compliance and minimize tax risks. Resolving disputes often involves lengthy negotiations or arbitration processes.

Comparison of Tax Treaties

The following table compares key provisions in tax treaties between the US, UK, and China. Note that this is a simplified comparison, and the actual treaties are far more detailed and nuanced. The specific provisions and their interpretation can vary significantly depending on the specific circumstances and the involved tax authorities.

| Provision | US-UK Treaty | US-China Treaty | UK-China Treaty |

|---|---|---|---|

| Permanent Establishment (PE) Definition | Generally follows OECD Model Tax Convention, with specific clauses addressing agency and construction activities. | Similar to OECD Model, but with specific interpretations relevant to Chinese business practices. Areas of potential dispute exist regarding the definition of “dependent agent”. | Generally aligns with OECD Model, with clauses specific to the UK and Chinese legal frameworks. |

| Dividend Taxation | Typically allows for a reduced withholding tax rate on dividends paid between qualifying companies. | Includes provisions for reduced withholding tax rates, but with specific conditions and limitations. | Provides for reduced withholding tax rates, but the specific rates and conditions vary depending on the ownership structure. |

| Interest and Royalty Taxation | Similar to dividends, reduced withholding tax rates apply to interest and royalty payments under specific conditions. | Specific limitations and conditions on reduced rates for interest and royalty payments, often requiring compliance with anti-treaty shopping measures. | Includes provisions for reduced withholding tax rates, but with specific conditions and limitations on eligibility. |

| Dispute Resolution | Provides for mechanisms for resolving disputes between tax authorities of the US and UK, typically involving mutual agreement procedures. | Includes provisions for dispute resolution, often involving arbitration in certain circumstances. | Similar to the US-UK treaty, with mechanisms for resolving tax disputes between the UK and Chinese tax authorities. |

Transfer Pricing Strategies

Transfer pricing, the pricing of goods, services, and intangible assets exchanged between related entities within a multinational corporation (MNC), is a critical aspect of international tax planning. Properly structuring transfer pricing minimizes global tax liabilities while ensuring compliance with tax laws in each jurisdiction. Mismanagement, however, can lead to significant tax disputes and penalties. This section delves into the core principles and best practices of transfer pricing strategies.

Arm’s-Length Transfer Pricing Principle

The overarching principle guiding transfer pricing is the arm’s-length principle. This principle dictates that transactions between associated enterprises should be conducted as if they were between independent parties dealing at arm’s length. In essence, the prices charged should reflect what unrelated companies would agree upon under comparable circumstances. Tax authorities worldwide use this principle to assess the fairness and legitimacy of intercompany transactions. Deviation from the arm’s-length principle can result in adjustments by tax authorities, leading to increased tax liabilities in one or more jurisdictions. The OECD’s Transfer Pricing Guidelines provide detailed guidance on applying the arm’s-length principle.

Best Practices for Documenting Transfer Pricing Policies

Comprehensive and meticulous documentation is crucial for demonstrating compliance with the arm’s-length principle. This documentation should clearly Artikel the company’s transfer pricing policies, methodologies, and the rationale behind the chosen pricing approaches. A robust transfer pricing documentation package typically includes a detailed description of the business functions performed by each entity, an analysis of comparable uncontrolled transactions (CUTs), and a thorough explanation of how the chosen transfer pricing method was applied. Maintaining such documentation not only facilitates tax audits but also provides a clear record of the company’s transfer pricing practices for internal management and decision-making. Failure to adequately document transfer pricing policies can lead to increased scrutiny from tax authorities and potential penalties.

Transfer Pricing Strategy for a Hypothetical Multin Corporation

Let’s consider a hypothetical multinational corporation, “GlobalTech,” with a parent company in the United States and subsidiaries in Ireland (manufacturing) and Singapore (sales and marketing). GlobalTech manufactures specialized software in Ireland and sells it to its Singapore subsidiary, which then markets and distributes the software in the Asia-Pacific region. A suitable transfer pricing strategy for GlobalTech would involve using the Comparable Uncontrolled Price (CUP) method for the software transfer from the Irish subsidiary to the Singapore subsidiary. This method compares the price of the software to similar software sold by unrelated parties in comparable transactions. The selection of comparable transactions is critical and requires a rigorous analysis of factors such as software functionality, market conditions, and customer profiles. The documentation would need to demonstrate that the chosen CUP accurately reflects the arm’s-length price. Furthermore, GlobalTech needs to establish clear intercompany agreements outlining the terms and conditions of the software transfer, including the pricing methodology, payment terms, and intellectual property rights.

Examples of Transfer Pricing Methods and Their Applicability

Several transfer pricing methods exist, each suited to different types of transactions. The Comparable Uncontrolled Price (CUP) method, as described above, is most appropriate when comparable uncontrolled transactions are readily available. The Cost Plus method is suitable for situations where a manufacturer sells goods to a related distributor. In this case, the price is determined by adding a markup to the cost of production. The Resale Price Method is appropriate when a distributor sells goods to an unrelated party. The price is determined by deducting a margin from the resale price. The Transactional Net Margin Method (TNMM) and Profit Split Method are used when comparable uncontrolled transactions are scarce. TNMM compares the net profit margin of a controlled transaction to the net profit margin of comparable uncontrolled transactions. The Profit Split Method allocates profits between associated enterprises based on their relative contributions to the overall value creation. The choice of method depends on the specific circumstances of the transaction and the availability of comparable data. The selection of the most appropriate method should be clearly justified in the transfer pricing documentation.

Tax Havens and Offshore Structures

The utilization of tax havens and offshore structures in international tax planning is a complex issue, fraught with both potential benefits and significant risks. Understanding these aspects is crucial for businesses and individuals engaging in international transactions. This section will delve into the mechanics of these strategies, examining their advantages and disadvantages, as well as the legal and ethical considerations involved.

Tax havens, jurisdictions with exceptionally low or no tax rates, offer attractive opportunities for reducing a company’s overall tax burden. However, the opacity often associated with these jurisdictions raises concerns regarding transparency and compliance with international regulations. Offshore structures, which encompass various legal entities and arrangements established outside a company’s primary jurisdiction of operation, are frequently used in conjunction with tax havens to achieve specific tax planning objectives. The choice of structure and jurisdiction depends heavily on the specific circumstances and goals of the taxpayer.

Benefits and Risks of Using Tax Havens

Using tax havens can lead to lower tax liabilities, potentially boosting profitability and enhancing competitiveness. However, this comes with considerable risks. Reputational damage is a major concern; association with a tax haven can negatively impact a company’s public image and attract unwanted scrutiny from regulators and the public. Furthermore, the increasing international cooperation in tax enforcement means that the chances of audits and penalties are significantly higher than in the past. The legal and regulatory landscape surrounding tax havens is constantly evolving, leading to uncertainty and potential for future liabilities. Ultimately, the decision to utilize a tax haven requires careful consideration of the potential benefits weighed against the inherent risks.

Comparison of Offshore Tax Structures

Several offshore structures are commonly employed, each with its own set of advantages and disadvantages. Trusts, for example, are fiduciary arrangements where assets are managed by a trustee for the benefit of beneficiaries. Foundations, on the other hand, are legal entities established under civil law, often providing more flexibility in governance and asset management. The choice between these, and other structures like companies and partnerships, depends on factors such as asset protection needs, desired level of control, and tax implications specific to the jurisdiction. A thorough understanding of the legal framework governing each structure is crucial for successful implementation.

Legal and Ethical Considerations of Offshore Tax Planning

The use of offshore tax planning strategies must always comply with both domestic and international laws. This includes adhering to all relevant tax regulations, reporting requirements, and anti-money laundering (AML) and combating the financing of terrorism (CFT) legislation. Ethical considerations are paramount. While minimizing tax liabilities is legitimate, engaging in aggressive tax avoidance schemes designed to exploit loopholes or evade taxes is unethical and potentially illegal. Transparency and compliance are essential to maintaining a strong ethical standing and avoiding potential legal repercussions.

Advantages and Disadvantages of Using Offshore Jurisdictions

The decision to utilize offshore jurisdictions involves carefully weighing several factors.

Below is a list summarizing the advantages and disadvantages:

- Advantages: Lower tax rates, increased asset protection, enhanced privacy, access to specialized financial services, and potential for greater investment flexibility.

- Disadvantages: Increased complexity and administrative burden, potential reputational damage, higher compliance costs, increased scrutiny from tax authorities, and potential legal and ethical risks.

Tax Optimization for Specific Industries

International tax planning requires a nuanced approach, varying significantly depending on the industry. Different sectors face unique challenges and opportunities when navigating international tax laws and regulations. This section will examine tax optimization strategies for specific industries, highlighting key considerations and providing examples.

Tax Optimization Strategies for Technology Companies

Technology companies, characterized by intangible assets like intellectual property (IP), software, and data, often employ specific tax strategies. These strategies center around optimizing the location of IP ownership and licensing agreements to minimize tax burdens. For example, a company might locate its IP holding subsidiary in a low-tax jurisdiction, licensing its IP to operational subsidiaries in higher-tax countries. This allows for a reduction in overall tax liability by shifting profits to a more favorable tax environment. Another common strategy involves utilizing tax treaties to reduce withholding taxes on royalties and other payments related to IP licensing. Careful structuring of research and development (R&D) activities across different jurisdictions is also crucial, taking advantage of tax incentives and credits offered by various governments to encourage innovation. Finally, effective transfer pricing methodologies are essential for technology companies to ensure that the pricing of intercompany transactions accurately reflects arm’s-length dealings, avoiding potential disputes with tax authorities.

Tax Planning Considerations for Companies in the Pharmaceutical Industry

The pharmaceutical industry presents unique tax challenges due to high R&D expenditure, complex supply chains, and the patenting of new drugs. Tax planning in this sector often involves maximizing R&D tax credits and incentives offered by various countries. The location of manufacturing and distribution activities is a critical factor, influencing the overall tax burden. Companies often leverage tax treaties to mitigate double taxation on profits earned in multiple jurisdictions. Furthermore, transfer pricing plays a significant role, especially in the pricing of patented drugs and related products transferred between related entities. The regulatory environment, which includes pricing regulations and healthcare policies, also significantly impacts the overall tax strategy. Careful consideration of intellectual property rights and their location is essential to minimize taxes and protect valuable assets.

International Tax Laws and Their Impact on the Financial Services Sector

The financial services sector operates in a highly regulated international environment, facing complex tax laws and regulations. International tax planning for financial institutions focuses on compliance with regulations related to cross-border transactions, including interest payments, dividends, and capital gains. Tax treaties play a crucial role in determining the tax treatment of income derived from international investments. The classification of financial instruments and the application of withholding taxes are critical aspects of tax planning. Moreover, the location of financial entities and the structuring of financial products significantly influence tax liabilities. The increasing emphasis on tax transparency and the sharing of tax information among countries necessitates careful planning and compliance to avoid penalties and reputational damage. Regulations like the Common Reporting Standard (CRS) significantly impact how financial institutions manage and report cross-border financial information.

Tax Implications Across Industries and Jurisdictions

The following table compares the tax implications of operating in three different industries (Technology, Pharmaceutical, and Financial Services) across two jurisdictions (Ireland and the United States). Note that these are simplified examples and actual tax rates and regulations can be far more complex. This table should be viewed as illustrative, not prescriptive. Professional tax advice is always recommended.

| Industry | Jurisdiction | Corporate Tax Rate (Illustrative) | Specific Tax Considerations |

|---|---|---|---|

| Technology | Ireland | 12.5% | Favorable IP regime, potential for R&D tax credits. |

| Technology | United States | 21% | Higher corporate tax rate, state-level taxes also apply. |

| Pharmaceutical | Ireland | 12.5% | Potential for R&D tax credits, but regulatory complexities. |

| Pharmaceutical | United States | 21% | Higher corporate tax rate, significant R&D incentives available. |

| Financial Services | Ireland | 12.5% | Strict regulatory environment, compliance with EU directives. |

| Financial Services | United States | 21% | Complex regulatory framework, compliance with federal and state regulations. |

International Tax Compliance and Reporting

Accurate and timely international tax reporting is paramount for businesses operating across borders. Failure to comply with international tax regulations can lead to significant financial penalties, reputational damage, and even legal repercussions. This section details the importance of accurate reporting, the requirements for compliance, and the consequences of non-compliance, concluding with a simplified guide to international tax return preparation.

Importance of Accurate International Tax Reporting

Accurate international tax reporting is crucial for maintaining a positive relationship with tax authorities in all relevant jurisdictions. It ensures that businesses are paying the correct amount of tax, avoiding potential audits and penalties. Furthermore, transparent and accurate reporting fosters trust with stakeholders, including investors, lenders, and customers, enhancing the company’s overall credibility and reputation. Inaccurate reporting can severely damage this trust, leading to significant financial and reputational losses. Maintaining accurate records also simplifies the tax process, reducing the time and resources spent on tax compliance.

Requirements for Complying with International Tax Regulations

Compliance with international tax regulations varies depending on the specific jurisdictions involved and the nature of the business activities. However, some general requirements include maintaining meticulous records of all international transactions, understanding and applying relevant tax treaties, correctly classifying income and expenses according to international accounting standards, and adhering to specific reporting deadlines. Businesses often need to file tax returns in multiple countries, each with its own unique rules and regulations. Seeking professional advice from international tax specialists is highly recommended to ensure complete compliance. Utilizing specialized tax software can also streamline the process and reduce the risk of errors.

Consequences of Non-Compliance with International Tax Laws

Non-compliance with international tax laws can result in a range of severe consequences. These include substantial financial penalties, interest charges, and back taxes. In more serious cases, businesses may face legal action, including criminal prosecution. Reputational damage can also be significant, potentially leading to loss of investor confidence, difficulty securing loans, and damage to the brand image. Furthermore, non-compliance can result in the freezing of assets or even business closure in some jurisdictions. The penalties for non-compliance can vary greatly depending on the severity and nature of the violation, as well as the specific tax laws of the jurisdictions involved. For instance, a company might face a significant fine for a minor reporting error, while intentional tax evasion could lead to much more severe penalties.

Preparing an International Tax Return: A Simplified Scenario

Let’s consider a simplified scenario: a small business operating in the US and Canada, selling goods online to customers in both countries. A step-by-step guide to preparing their international tax return might look like this:

- Gather all necessary documentation: This includes sales invoices, expense receipts, bank statements, and any relevant tax treaties between the US and Canada.

- Determine the tax residency status: This is crucial for determining which country’s tax laws apply to the business’s income.

- Calculate income and expenses separately for each jurisdiction: This involves allocating sales and expenses based on where the income was generated and expenses were incurred.

- Apply relevant tax treaties: Tax treaties often provide mechanisms to avoid double taxation. Understanding and applying these treaties is crucial for accurate tax calculation.

- Prepare separate tax returns for each jurisdiction: This will involve using the appropriate forms and following the specific instructions for each country.

- File the tax returns by the relevant deadlines: Missing deadlines can result in penalties.

This is a simplified example; the complexity of preparing an international tax return significantly increases with the number of jurisdictions involved, the nature of the business activities, and the complexity of the transactions. Professional tax advice is strongly recommended for businesses with complex international operations.

Impact of Globalization on International Tax Planning

Globalization has profoundly reshaped the landscape of international tax planning. The increased interconnectedness of economies, facilitated by advancements in technology and communication, has created both opportunities and challenges for multinational corporations and tax authorities alike. This interconnectedness necessitates sophisticated strategies to navigate the complexities of multiple tax jurisdictions and varying regulatory frameworks.

The rise of global value chains, where different stages of production are located in various countries, has significantly complicated tax planning. Companies must now carefully consider transfer pricing, the allocation of profits among related entities in different jurisdictions, to minimize their overall tax burden while adhering to international tax regulations. Simultaneously, governments are grappling with the erosion of their tax bases as businesses exploit differences in tax laws across countries.

The Role of International Organizations in Shaping International Tax Rules

International organizations like the Organisation for Economic Co-operation and Development (OECD) and the United Nations (UN) play a crucial role in establishing international tax norms and standards. The OECD, in particular, has been at the forefront of developing guidelines and recommendations on issues such as base erosion and profit shifting (BEPS), transfer pricing, and the taxation of digital economies. These organizations foster international cooperation among governments to address tax avoidance and promote a more equitable and efficient international tax system. Their influence is primarily achieved through the development of model tax treaties, recommendations, and reports which individual countries then adopt or adapt into their national tax legislation. The effectiveness of these organizations hinges on the willingness of member states to implement and enforce the agreed-upon standards.

Emerging Trends in International Tax Planning

Several emerging trends are reshaping international tax planning. The digitalization of the global economy presents significant challenges for tax authorities as traditional tax rules struggle to capture the profits of multinational technology companies. The rise of cryptocurrencies and other digital assets introduces new complexities for tax compliance and enforcement. Increased scrutiny from tax authorities and a growing emphasis on transparency are forcing companies to adopt more robust tax planning strategies that are aligned with ethical and legal standards. Furthermore, the increasing focus on environmental, social, and governance (ESG) factors is influencing corporate tax strategies, with some companies prioritizing sustainable practices over aggressive tax optimization. For example, the increasing popularity of carbon taxes incentivizes companies to reduce their carbon footprint, impacting their overall tax liability and strategic planning.

A Timeline of International Tax Regulation Evolution (1973-2023)

The evolution of international tax regulations over the past 50 years can be summarized as follows:

| Period | Key Developments |

|---|---|

| 1973-1989 | Focus on bilateral tax treaties to avoid double taxation. Limited international cooperation on broader tax issues. |

| 1990-2008 | Increased awareness of tax avoidance strategies employed by multinational enterprises. Early discussions on international tax cooperation begin to gain momentum. |

| 2009-2015 | OECD’s BEPS project launched in response to concerns about base erosion and profit shifting. Focus on developing international standards to combat aggressive tax planning. |

| 2016-2023 | Implementation of BEPS minimum standards. Ongoing discussions on the taxation of the digital economy. Increased focus on transparency and information exchange. Development of the two-pillar solution by the OECD aiming to establish a global minimum corporate tax rate and a new framework for taxing multinational enterprises. |

Future of International Tax Planning

The landscape of international tax planning is in constant flux, driven by globalization, technological advancements, and a growing demand for greater tax fairness. Predicting the future with certainty is impossible, but analyzing current trends and emerging challenges allows us to anticipate significant shifts in the coming years. This section explores potential changes in international tax laws and regulations, the impact of technology, and proposes a hypothetical policy designed to address current shortcomings.

The increasing complexity of international business transactions and the rise of digital economies are placing immense pressure on existing international tax frameworks. Governments worldwide are grappling with the challenge of taxing multinational corporations fairly, particularly those operating predominantly in the digital sphere. This necessitates a reassessment of traditional tax rules and the development of innovative solutions to ensure effective tax collection.

Potential Changes in International Tax Laws and Regulations

Significant changes are anticipated in international tax legislation. The OECD’s Base Erosion and Profit Shifting (BEPS) project, while already underway, will continue to evolve, leading to stricter rules on transfer pricing, controlled foreign corporations (CFCs), and harmful tax practices. We can expect a greater emphasis on substance over form, meaning that tax authorities will increasingly scrutinize the economic reality of transactions rather than simply relying on legal structures. Furthermore, the ongoing debate surrounding the taxation of digital services suggests a potential shift towards taxing businesses based on their user presence or revenue generated within a particular jurisdiction, rather than solely on their physical presence. This could lead to the introduction of new digital services taxes or amendments to existing corporate income tax laws to better capture profits from digital businesses. The European Union’s efforts to harmonize corporate tax rules, while facing ongoing challenges, also point toward greater regulatory convergence in the future.

Impact of Technological Advancements on International Tax Planning

Technological advancements are fundamentally reshaping international tax planning. The rise of big data analytics and artificial intelligence (AI) is empowering tax authorities to identify and address tax evasion more effectively. Sophisticated algorithms can analyze vast datasets to detect anomalies and patterns indicative of aggressive tax planning. This increased scrutiny necessitates a shift towards more transparent and compliant tax practices. Conversely, technology also provides opportunities for businesses to optimize their tax planning strategies. Advanced tax software and automation tools can streamline compliance processes, reduce errors, and improve the accuracy of tax calculations. Blockchain technology, with its inherent transparency and immutability, holds the potential to enhance tax administration and reduce opportunities for tax fraud. However, the use of technology in tax planning also raises ethical concerns and necessitates a careful consideration of data privacy and security.

A Hypothetical International Tax Policy Promoting Fairness

A hypothetical international tax policy addressing current challenges and promoting fairness could incorporate several key elements. First, it would establish a global minimum corporate tax rate, preventing a “race to the bottom” among countries competing to attract businesses with low tax rates. This minimum rate would ensure a level playing field for businesses and prevent multinational corporations from shifting profits to low-tax jurisdictions. Second, it would introduce a more robust system for allocating taxing rights based on the location of users or consumers of digital services. This could involve a formula-based approach, taking into account factors such as user numbers, revenue generated, and data processed within a jurisdiction. Third, it would enhance international cooperation and information sharing among tax authorities to combat tax evasion and avoidance more effectively. This could involve greater use of automatic exchange of information mechanisms and the establishment of a global tax authority with enhanced powers of enforcement. Finally, it would provide greater transparency in international tax matters, requiring multinational corporations to publicly disclose their tax strategies and payments on a country-by-country basis. Such transparency would help build public trust and ensure greater accountability.

Epilogue

Mastering international tax planning requires a multifaceted approach, encompassing a deep understanding of legal frameworks, economic principles, and ethical considerations. By carefully considering tax treaties, transfer pricing methodologies, and the potential risks and rewards associated with various offshore structures, businesses can significantly enhance their tax efficiency. Staying abreast of evolving regulations and leveraging technological advancements will remain crucial in navigating the dynamic landscape of international taxation.

Question Bank

What are the potential penalties for non-compliance with international tax regulations?

Penalties for non-compliance can vary significantly depending on the jurisdiction and the severity of the violation. They can include financial penalties, interest charges, legal action, and even criminal prosecution in some cases.

How often should a business review its international tax strategy?

Regular review is crucial, ideally annually, or whenever significant changes occur within the business, such as expansion into new markets, mergers, or acquisitions. Tax laws and regulations are constantly evolving, necessitating proactive adaptation.

Can small businesses benefit from international tax planning?

Absolutely. Even small businesses operating internationally can benefit from strategic tax planning to minimize their tax burden and ensure compliance. Seeking professional advice is often beneficial.