Investasi, the Indonesian word for investment, opens a world of opportunity and, let’s be honest, a healthy dose of potential heartburn. This guide navigates the exciting (and sometimes terrifying) landscape of Indonesian investments, exploring diverse options, risk profiles, and the crucial role of financial institutions. We’ll delve into strategies for both the cautiously optimistic and the thrill-seeking investor, ensuring you’re equipped to make informed decisions, even if those decisions involve a little bit of controlled panic.

From understanding the regulatory framework and comparing various investment vehicles to crafting personalized portfolios tailored to your risk tolerance, we’ll cover everything from the mundane (fees and charges) to the truly exhilarating (case studies of spectacular success). Prepare to embark on a journey of financial enlightenment, punctuated by moments of both exhilaration and perhaps a slight tremor of anxiety. It’s investing, after all – it’s not supposed to be boring!

Understanding Investasi (Investment) in Indonesia

Investing in Indonesia can be a rollercoaster – a thrilling ride with potential for huge gains, but also some stomach-churning dips. Navigating the Indonesian investment landscape requires understanding its unique characteristics, from the diverse investment options to the regulatory framework that governs them. This section aims to provide a clear and (hopefully) entertaining overview.

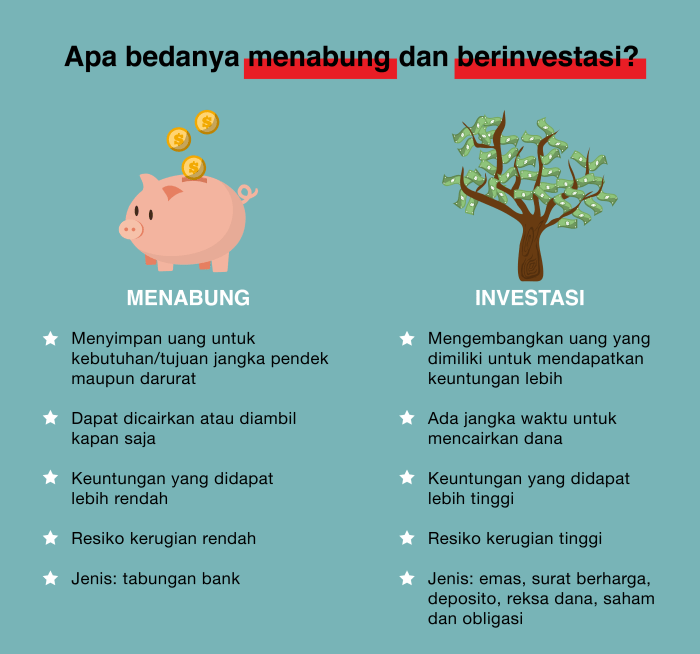

Types of Investasi in Indonesia

Indonesia offers a diverse range of investment opportunities, catering to various risk appetites and financial goals. From relatively low-risk options to high-growth, high-risk ventures, investors can find something to suit their needs. Understanding these options is crucial for making informed decisions.

The Regulatory Landscape of Investasi in Indonesia

The Indonesian government actively regulates the investment sector to protect investors and promote market stability. This regulatory framework involves various institutions, including Otoritas Jasa Keuangan (OJK), the Financial Services Authority, which oversees the financial industry. Compliance with these regulations is paramount for both domestic and foreign investors. Ignoring them could lead to…well, let’s just say it wouldn’t be fun.

Risks and Rewards of Different Investasi Strategies

The inherent relationship between risk and reward is a fundamental principle of investing. Higher potential returns often come with higher risks. In Indonesia, this principle holds true across various investment strategies. For example, investing in the stock market offers the potential for significant gains but also carries the risk of substantial losses. Conversely, investing in government bonds typically offers lower returns but comes with greater stability. Understanding your risk tolerance is key.

Comparison of Investment Options

The following table summarizes the key features of five common investment options in Indonesia. Remember, past performance is not indicative of future results – this is not financial advice, just a helpful overview.

| Investment Type | Risk Level | Potential Return | Liquidity |

|---|---|---|---|

| Government Bonds (Obligasi Pemerintah) | Low | Moderate | High |

| Bank Deposits (Deposito Bank) | Low to Moderate | Low to Moderate | Moderate |

| Stocks (Saham) | Moderate to High | High | High |

| Mutual Funds (Reksadana) | Moderate | Moderate to High | High |

| Real Estate (Properti) | Moderate to High | High | Low |

Investasi Strategies for Different Risk Profiles

Investing in Indonesia offers a vibrant landscape of opportunities, but navigating it requires understanding your own risk tolerance. Think of it like choosing a rollercoaster: some prefer the gentle dips, others crave the heart-stopping drops. This section Artikels investment strategies tailored to three distinct risk profiles: risk-averse, moderate-risk, and aggressive. Remember, these are just examples, and consulting a financial advisor is always recommended before making any investment decisions. Your financial future shouldn’t be a gamble; it should be a well-calculated strategy.

Risk-Averse Investor Portfolio in Indonesia

Risk-averse investors prioritize capital preservation above all else. They’re comfortable with slower, steadier growth, preferring to minimize potential losses. A suitable portfolio for this profile would emphasize stability and security.

This portfolio would allocate a significant portion to low-risk, fixed-income instruments. A possible allocation might look like this:

- 70% Government Bonds (Obligasi Pemerintah): These are considered very low-risk, offering a relatively stable return and backing by the Indonesian government.

- 20% Bank Deposits (Deposito Bank): A classic safe haven, offering a guaranteed return (though often lower than other options) and FDIC insurance up to a certain limit.

- 10% High-Quality Corporate Bonds (Obligasi Perusahaan): Carefully selected corporate bonds from established, reputable companies can offer slightly higher returns while still maintaining a relatively low risk profile.

The rationale is straightforward: minimize volatility and maximize the chances of preserving capital. This approach prioritizes safety and predictability over potentially higher, but riskier, returns.

Moderate-Risk Investor Portfolio in Indonesia

Moderate-risk investors seek a balance between growth and risk. They are willing to accept some volatility in exchange for the potential for higher returns than a risk-averse strategy.

A balanced portfolio for a moderate-risk investor might look something like this:

- 40% Government Bonds (Obligasi Pemerintah): Provides a stable foundation for the portfolio.

- 30% Equity Mutual Funds (Reksadana Saham): Offers diversification across a range of Indonesian equities, mitigating the risk associated with individual stock picking. The fund manager handles the selection and trading, reducing the investor’s workload.

- 20% Corporate Bonds (Obligasi Perusahaan): A mix of high-quality and moderately-rated corporate bonds to enhance returns.

- 10% Real Estate Investment Trusts (REITs): REITs provide exposure to the Indonesian real estate market with relatively lower individual investment thresholds.

This approach aims to achieve a reasonable rate of return while managing risk through diversification across asset classes. The inclusion of equities and REITs introduces the potential for higher growth, balanced by the stability of bonds.

Aggressive Investor Portfolio in Indonesia

Aggressive investors are comfortable with significant risk in pursuit of substantial returns. They are willing to tolerate greater volatility in their portfolio in exchange for the potential for higher long-term growth.

An aggressive portfolio might allocate assets as follows:

- 20% Equity Mutual Funds (Reksadana Saham): A larger allocation to equities increases the potential for higher returns, but also significantly increases the risk.

- 15% Small-Cap Stocks (Saham Small-Cap): Investing in smaller companies carries higher risk but potentially higher rewards. This requires thorough research and a high risk tolerance.

- 15% Emerging Market Equity Funds (Reksadana Saham Pasar Baru): Exposure to rapidly growing economies beyond Indonesia can enhance returns, but also carries significant risk.

- 30% Property Investment (Investasi Properti): Direct property investment, while potentially highly lucrative, is illiquid and requires significant capital. Careful due diligence is crucial.

- 20% Alternative Investments (Investasi Alternatif): This could include commodities, private equity, or other alternative assets, each with its own unique risk and reward profile.

This portfolio emphasizes higher-growth, higher-risk assets. Diversification is still important, but the emphasis is on maximizing potential returns, even if it means accepting greater volatility. This strategy is only suitable for investors with a long-term horizon and a high tolerance for risk.

The Role of Financial Institutions in Investasi

Investing in Indonesia can feel like navigating a bustling Jakarta street market – exciting, potentially lucrative, but also a bit overwhelming if you don’t know the ropes. Thankfully, a whole host of financial institutions are there to help you avoid getting trampled by runaway Rupiahs. These institutions offer a range of services designed to make your investment journey smoother, safer, and (hopefully) more profitable. Let’s explore the key players and their contributions to the Indonesian investasi landscape.

Types of Financial Institutions Involved in Investasi

Financial institutions in Indonesia play a crucial role in facilitating investment, offering a diverse range of services to cater to various investor needs and risk tolerances. Their involvement ensures transparency, regulation, and access to a wider range of investment opportunities. Understanding their roles is key to making informed investment decisions.

- Brokerage Houses: These firms act as intermediaries, connecting investors with the stock market. They execute buy and sell orders on behalf of clients, charging commissions based on trade volume. Think of them as your trusty guides through the sometimes-chaotic world of stock trading. Examples include Indo Premier Sekuritas and Mirae Asset Sekuritas Indonesia.

- Investment Banks: These institutions handle larger-scale transactions, advising corporations on mergers and acquisitions, issuing securities, and managing large investment portfolios. They often cater to high-net-worth individuals and institutional investors. Think of them as the heavyweight champions of the financial world. Examples include Mandiri Sekuritas and CIMB Niaga Sekuritas.

- Asset Management Companies: These companies manage investment funds on behalf of clients, diversifying portfolios across various asset classes. They aim to achieve specific investment objectives, such as capital appreciation or income generation. They’re like your personal financial sherpas, guiding you up the mountain of wealth (hopefully without too many falls!). Examples include Schroders Investment Management and Manulife Asset Management Indonesia.

- Banks: Traditional banks also play a significant role, offering various investment products like mutual funds, bonds, and structured deposits. They often provide more conservative investment options compared to brokerage houses or investment banks. They’re the steady, reliable friends of the financial world, always there to offer a safe haven for your money. Examples include Bank Mandiri and Bank Central Asia (BCA).

Services Provided by Financial Institutions

The services offered by these institutions are as varied as the Indonesian archipelago itself. Each institution offers a unique blend of services tailored to specific investor needs. Understanding these services is crucial for making informed choices about where to invest your hard-earned Rupiah.

- Brokerage Services: Executing buy and sell orders on stock exchanges, providing research reports and market analysis.

- Investment Advisory Services: Providing personalized investment advice based on risk tolerance, financial goals, and market conditions. This can range from simple portfolio reviews to sophisticated wealth management strategies.

- Asset Management Services: Managing investment portfolios, selecting and rebalancing assets, and aiming to achieve specific investment goals.

- Custodial Services: Safeguarding client assets and ensuring their security. Think of them as the highly trained security guards of the financial world.

- Research and Analysis: Providing in-depth market research and analysis to support investment decisions.

Fees and Charges Associated with Financial Institutions

Naturally, these services don’t come for free. The cost of using these institutions varies widely depending on the type of institution, the services used, and the volume of transactions. Understanding these fees is crucial for maximizing your returns.

- Brokerage Commissions: Typically charged as a percentage of the trade value or a fixed fee per trade. These can vary significantly between brokers.

- Advisory Fees: Can be charged as a percentage of assets under management (AUM) or as hourly rates. The fees usually increase with the complexity of the advice provided.

- Asset Management Fees: Usually expressed as an annual percentage of the assets under management. This fee covers portfolio management, research, and administrative costs.

- Custodial Fees: Typically a small annual fee based on the value of assets held in custody.

- Other Fees: These can include account maintenance fees, transaction fees, and other miscellaneous charges.

Long-Term vs. Short-Term Investasi

Choosing between long-term and short-term investment strategies in Indonesia is a bit like choosing between a spicy Rendang that simmers for hours and a quick, satisfying bowl of Soto Ayam – both delicious, but with very different approaches. The best choice depends entirely on your appetite for risk and your time horizon. Let’s delve into the delicious details.

Advantages and Disadvantages of Long-Term and Short-Term Investasi Strategies

Long-term investments, generally defined as those held for more than a year, offer the potential for higher returns due to the power of compounding. Think of it as your money working hard for you while you sleep! However, they also come with greater risk, as market fluctuations can significantly impact your investment over an extended period. Short-term investments, on the other hand, are less risky as they’re less susceptible to market volatility. However, the returns are typically lower. It’s a trade-off between potential gains and the security of your principal.

Examples of Suitable Long-Term and Short-Term Investasi Options in Indonesia

Long-term investment options in Indonesia include stocks (saham), mutual funds (reksa dana), and property (properti). Investing in a promising Indonesian company’s stock could yield substantial returns over the long haul, mirroring the growth of the company itself. Mutual funds provide diversification across various asset classes, mitigating risk. Property investment, while potentially lucrative, requires significant capital and careful consideration of market trends. Short-term options include time deposits (deposito berjangka), government bonds (obligasi pemerintah), and money market funds (pasar uang). These generally offer lower returns but provide greater liquidity, meaning you can access your money relatively quickly.

Key Factors to Consider When Choosing Between Long-Term and Short-Term Investments

The most crucial factor is your investment timeframe. Do you need the money soon, or can you comfortably tie it up for several years? Your risk tolerance also plays a significant role. Are you comfortable with the possibility of short-term losses for the potential of higher long-term gains? Finally, your financial goals are paramount. Are you saving for retirement, a down payment on a house, or a shorter-term goal like a vacation? Each goal requires a different approach.

Comparison of Long-Term and Short-Term Investments

| Characteristic | Long-Term Investment | Short-Term Investment |

|---|---|---|

| Investment Horizon | More than 1 year | Less than 1 year |

| Return Potential | Higher | Lower |

| Risk Level | Higher | Lower |

| Liquidity | Lower | Higher |

Protecting Your Investasi

Investing in Indonesia offers exciting opportunities, but like a thrilling rollercoaster ride, it comes with its share of bumps and dips. Understanding and mitigating risks is crucial to ensuring a smooth – and profitable – journey. Let’s delve into the strategies that can help you safeguard your hard-earned rupiah.

Navigating the Indonesian investment landscape requires a keen eye for potential pitfalls. While the rewards can be substantial, ignoring the risks can lead to significant financial losses. This section Artikels common risks and provides practical strategies for minimizing your exposure.

Common Risks Associated with Investasi in Indonesia

Indonesia’s dynamic economy presents both opportunities and challenges. Understanding these risks is the first step towards effective risk management. These risks aren’t insurmountable; with careful planning and due diligence, many can be effectively mitigated.

- Market Volatility: Indonesia’s stock market, like any other, can experience periods of significant ups and downs. External factors such as global economic conditions and geopolitical events can significantly impact investment performance.

- Regulatory Changes: Government policies and regulations can change, potentially affecting the profitability or even the legality of certain investments. Staying informed about regulatory updates is paramount.

- Inflation: High inflation can erode the purchasing power of your returns, making it crucial to consider inflation-adjusted returns when evaluating investment opportunities.

- Counterparty Risk: This refers to the risk that the other party involved in the investment (e.g., a borrower or business partner) may default on their obligations. Thorough due diligence is essential to mitigate this risk.

- Fraud and Scams: Unfortunately, fraudulent investment schemes exist. Protecting yourself requires careful scrutiny of any investment opportunity before committing your funds.

Strategies for Mitigating Investment Risks, Investasi

A proactive approach to risk management is essential for successful investing. Diversification and thorough due diligence are cornerstones of a robust investment strategy. These strategies, when implemented effectively, can significantly reduce your exposure to various risks.

- Diversification: Don’t put all your eggs in one basket! Spreading your investments across different asset classes (stocks, bonds, real estate, etc.) and sectors reduces your reliance on the performance of any single investment. This strategy helps to cushion the blow if one investment underperforms.

- Due Diligence: Thorough research is paramount. Before investing, meticulously investigate the investment opportunity, including the track record of the company or fund, its financial health, and the management team’s expertise.

- Professional Advice: Seeking advice from a qualified financial advisor can provide valuable insights and guidance, helping you navigate the complexities of the Indonesian investment market and tailor a strategy to your specific risk tolerance and financial goals.

The Importance of Understanding Investment Contracts and Agreements

Before signing on the dotted line, carefully review all investment contracts and agreements. Understanding the terms and conditions is crucial to protecting your interests. Don’t hesitate to seek legal counsel if needed.

Failing to understand the fine print can have serious consequences. Clear comprehension of clauses related to fees, returns, risk factors, and dispute resolution mechanisms is essential. A poorly understood contract can lead to unforeseen costs and disputes.

Conducting Due Diligence: A Step-by-Step Guide

Due diligence is not a one-time event; it’s an ongoing process. The following steps provide a framework for conducting thorough due diligence before making any investment decision.

- Identify Your Investment Goals and Risk Tolerance: Clearly define what you hope to achieve with your investment and your comfort level with risk.

- Research the Investment Opportunity: Thoroughly investigate the investment’s history, financial performance, management team, and any potential risks.

- Verify Information: Don’t rely solely on promotional materials. Cross-reference information from multiple independent sources.

- Seek Professional Advice: Consult with a financial advisor or legal professional to get an independent assessment of the investment.

- Review the Investment Contract: Carefully examine all terms and conditions before committing your funds.

- Monitor Your Investment: Regularly track the performance of your investment and stay updated on any relevant news or developments.

Illustrative Examples of Successful Investasi

Investing in Indonesia can be a rollercoaster, but with the right strategy, you can turn a profit that’ll make your neighbours green with envy (or at least, slightly jealous). Let’s dive into some real-world examples of successful Indonesian investments, showcasing the savvy strategies behind their triumphs. These aren’t just theoretical numbers; these are stories of shrewd planning and calculated risks that paid off handsomely.

Case Study 1: The Rise of the Indonesian Coffee Bean Tycoon

This story follows Budi, a young entrepreneur who identified a gap in the market for high-quality, ethically sourced Indonesian coffee beans. Budi, armed with a keen understanding of both the domestic and international coffee markets, began by investing in a small coffee plantation. He meticulously focused on sustainable farming practices, ensuring high-quality beans while minimizing environmental impact. This approach resonated with ethically conscious consumers, both domestically and abroad. Budi’s initial investment was modest – around 50 million Rupiah – but through strategic partnerships with local farmers and international distributors, he expanded his business exponentially. He reinvested his profits, upgrading his processing facilities and expanding his plantation. Within five years, his annual revenue exceeded 500 million Rupiah, a testament to his shrewd business acumen and dedication to quality. This illustrates the power of identifying a niche market and building a sustainable, ethical business model. His success hinges on combining excellent product quality with responsible business practices.

Case Study 2: The Property Mogul of Jakarta

Next, we have Ani, a savvy investor who recognized the booming property market in Jakarta. Instead of directly purchasing expensive properties, Ani employed a more strategic approach. She began by investing in pre-construction properties in up-and-coming areas of Jakarta, leveraging her understanding of urban development trends. This allowed her to purchase properties at significantly lower prices than established areas. Ani diligently researched zoning regulations and future infrastructure projects, ensuring that her investments were well-positioned for appreciation. Her initial investment was 100 million Rupiah, spread across three different pre-construction properties. As these properties were completed and the surrounding infrastructure developed, their value skyrocketed. Ani successfully sold two properties after a few years, realizing a substantial profit, which she then reinvested in larger, more established properties in prime locations. This showcases the importance of thorough market research and identifying undervalued assets with significant growth potential. The key takeaway is that timing and location are crucial elements in property investment.

Case Study 3: The Tech Startup Success Story

Finally, let’s consider the story of Chandra, a tech-savvy individual who recognized the potential of Indonesia’s burgeoning digital economy. Chandra invested in a promising fintech startup focusing on mobile payment solutions. His investment, initially 20 million Rupiah, was part of a seed funding round. The startup experienced phenomenal growth, driven by increasing smartphone penetration and the rising adoption of digital payments in Indonesia. Chandra’s due diligence involved a thorough assessment of the startup’s team, business model, and market potential. He also leveraged his network to help the startup gain traction. As the startup secured further funding rounds and expanded its user base, the value of Chandra’s initial investment soared. He eventually sold his shares for a significant return, demonstrating the high-reward potential of investing in innovative tech companies with strong growth prospects. This example underscores the importance of identifying disruptive technologies and supporting innovative entrepreneurs. High risk, potentially high reward is the name of the game here.

Last Recap

So, there you have it: a whirlwind tour of the Indonesian investment scene. Remember, investing wisely involves understanding your risk tolerance, diversifying your portfolio, and conducting thorough due diligence. While the prospect of significant returns is undeniably alluring, remember that every investment carries a degree of risk. This guide is designed to empower you to make informed choices, but always remember to seek professional financial advice tailored to your specific circumstances. Happy investing (and may your returns be as impressive as your courage!).

FAQ Explained

What are the tax implications of investing in Indonesia?

Tax implications vary greatly depending on the type of investment. Consult a tax professional for personalized advice, as regulations change frequently.

How can I protect myself from investment scams?

Be wary of unusually high returns, unregistered investment firms, and unsolicited investment offers. Always conduct thorough due diligence and only invest with reputable, licensed institutions.

What is the best investment strategy for a beginner?

Start with a low-risk, diversified portfolio. Consider index funds or government bonds to gain experience before venturing into higher-risk investments.

Where can I find reliable information on Indonesian investment regulations?

The official website of the Indonesian Financial Services Authority (OJK) is a good starting point. You can also consult with financial professionals.