Investasi Reksa Dana Guide: Embark on a hilarious yet informative journey into the world of Indonesian mutual funds! We’ll demystify the jargon, conquer the complexities, and maybe even make you chuckle while you learn how to potentially grow your wealth. Forget boring spreadsheets and dry lectures; get ready for a financial adventure that’s as exciting as it is educational. This guide will equip you with the knowledge to navigate the exciting, sometimes slightly terrifying, world of mutual fund investing, turning your financial anxieties into calculated risks (mostly!).

From understanding your risk tolerance (are you a thrill-seeker or a cautious tortoise?) to selecting the right funds (avoiding those pesky hidden fees!), we’ll cover everything you need to know. We’ll explore different investment strategies, tackle the tax implications (yes, even that!), and provide real-world examples to illustrate the potential – and the occasional pitfalls – of mutual fund investing. Prepare for a rollercoaster ride of financial enlightenment, complete with witty insights and practical advice.

Introduction to Mutual Fund Investment (Investasi Reksa Dana)

Investing in Indonesia can feel like navigating a bustling Jakarta street market – exciting, potentially lucrative, but also a little overwhelming. Fear not, intrepid investor! Mutual funds, or *reksa dana*, offer a relatively straightforward way to participate in the Indonesian market, even if you’re not a seasoned financial guru. Think of them as a delicious, pre-mixed cocktail of investments, expertly blended by professionals.

Mutual funds pool money from multiple investors to buy a diversified portfolio of assets, such as stocks, bonds, and other securities. This diversification is key – it’s like spreading your bets across several horses in a race, rather than putting all your money on one. This reduces your overall risk, making it a less terrifying ride than going it alone.

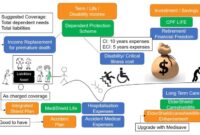

Types of Mutual Funds in Indonesia

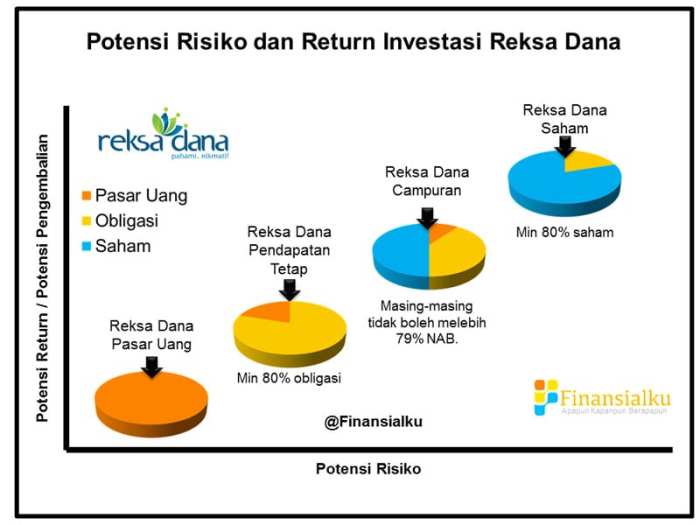

Understanding the various types of mutual funds available is crucial for selecting the right one for your investment goals and risk tolerance. Different funds invest in different asset classes and employ different investment strategies, resulting in varying levels of risk and potential return. Choosing the wrong one can feel like ordering a spicy curry when you have a sensitive stomach.

- Saham (Equity) Funds: These funds primarily invest in stocks, offering the potential for high returns but also higher risk. Think of them as the thrill-seeking bungee jumpers of the investment world. Their performance is directly linked to the stock market’s ups and downs, so expect some volatility.

- Pendapatan Tetap (Fixed Income) Funds: These funds invest in bonds and other fixed-income securities, offering more stability than equity funds. They’re the reliable, steady-going friends of the investment world. They generally offer lower returns but also lower risk.

- Campuran (Balanced) Funds: These funds diversify their investments across both stocks and bonds, aiming for a balance between risk and return. Think of them as the sensible middle ground – a bit of adventure, a bit of security.

- Pasar Uang (Money Market) Funds: These funds invest in short-term debt instruments, offering low risk and relatively stable returns. These are your safe haven investments, perfect for those who prefer a calm and predictable ride.

Risk and Return Profiles of Mutual Funds

The relationship between risk and return is fundamental in investing. Generally, higher potential returns come with higher risk. It’s like the old saying: no pain, no gain (although we hope the “pain” is minimal!).

| Fund Type | Risk Level | Return Potential |

|---|---|---|

| Equity Funds | High | High |

| Balanced Funds | Medium | Medium |

| Fixed Income Funds | Low | Low |

| Money Market Funds | Very Low | Very Low |

Higher risk investments aren’t necessarily *bad* investments; they simply require a longer time horizon and a higher risk tolerance. Don’t invest money you need in the short term in high-risk assets!

Understanding Risk Tolerance and Investment Goals

Investing in mutual funds is a bit like choosing a rollercoaster – some are gentle glides, others are stomach-churning plunges! Before you pick your ride, you need to know your stomach (risk tolerance) and your destination (investment goals). This section will help you navigate this exciting, albeit potentially bumpy, journey.

Understanding your risk tolerance and defining your investment goals are crucial steps before diving into the world of mutual funds. Failing to do so can lead to sleepless nights and potentially significant financial losses. Think of it as planning a road trip – you wouldn’t embark on a cross-country adventure without knowing your destination or the condition of your vehicle, would you?

Risk Tolerance Assessment

Determining your risk tolerance involves understanding your comfort level with potential investment losses. A simple questionnaire can help gauge this crucial aspect. Remember, there’s no right or wrong answer; it’s all about understanding your own financial personality.

Consider this illustrative questionnaire:

- How would you feel if your investment lost 10% of its value in a single year? a) Extremely concerned b) Somewhat concerned c) Not concerned at all

- What is your investment time horizon? a) Less than 1 year b) 1-5 years c) 5-10 years d) More than 10 years

- How much of your savings are you willing to risk? a) Less than 10% b) 10-25% c) 25-50% d) More than 50%

- Are you comfortable with fluctuating investment values? a) No b) Somewhat c) Yes

- What is your primary financial goal? a) Preservation of capital b) Income generation c) Capital appreciation

Based on your answers, you can determine your risk profile: Conservative (mostly ‘a’ answers), Moderate (mix of ‘a’ and ‘b’), or Aggressive (mostly ‘c’ and ‘d’).

Investment Goals and Mutual Fund Selection

Your investment goals directly impact the type of mutual fund that’s right for you. Are you saving for retirement, a down payment on a house, or your child’s education? Each goal has a different time horizon and risk tolerance associated with it. Choosing a fund that aligns with your goals is paramount to success.

Examples of Investment Goals and Suitable Mutual Fund Strategies

Let’s illustrate this with some examples. Imagine three distinct investors:

- Sarah, a 60-year-old nearing retirement, prioritizes capital preservation and income generation. A suitable strategy for Sarah would be investing in a low-risk, income-oriented mutual fund, such as a bond fund or a balanced fund with a significant allocation to bonds.

- David, a 35-year-old with a long-term horizon (e.g., retirement), is comfortable with moderate risk. David might choose a diversified equity fund or a growth-oriented mutual fund that invests in a mix of stocks and bonds.

- Maria, a 25-year-old with a high risk tolerance and a long-term investment horizon, might opt for an aggressive growth fund that invests heavily in stocks of small-cap or emerging market companies. This approach aims for higher returns, but with increased volatility.

Remember, these are just examples. The best mutual fund strategy will depend on your individual circumstances, risk tolerance, and financial goals. Always consult a financial advisor for personalized guidance.

Choosing the Right Mutual Fund

Picking the perfect mutual fund is like choosing the ideal avocado – you want it ripe, ready, and not going to leave you with a bitter aftertaste (financially speaking, of course!). It’s not a decision to be taken lightly, so let’s dive into the delicious details. This section will guide you through the process of selecting a fund that aligns with your risk tolerance and investment goals, ensuring your financial future is as smooth as that perfectly ripe avocado.

Mutual Fund Comparison

Choosing the right mutual fund involves careful consideration of several key factors. A quick comparison of some popular funds (remember, past performance is not indicative of future results!) can help illustrate these factors. Note that this is a simplified example, and you should always conduct thorough research before investing.

| Fund Name | Expense Ratio | Minimum Investment | Fund Manager |

|---|---|---|---|

| Example Growth Fund | 0.75% | $1,000 | Jane Doe, CFA |

| Example Value Fund | 0.50% | $500 | John Smith, CFP |

| Example Index Fund | 0.10% | $0 | Index Tracking Algorithm |

| Example Bond Fund | 0.60% | $100 | Emily Johnson, CAIA |

Fund Manager Selection Criteria

Selecting a fund manager is crucial; they are the captains of your investment ship. Consider their experience, investment philosophy, and track record. A seasoned manager with a consistent history of outperforming benchmarks is generally preferred, but remember that past performance doesn’t guarantee future success. Look for a manager whose investment style aligns with your risk tolerance and investment goals. Transparency and clear communication are also key characteristics to look for in a good fund manager. Think of it like choosing a chef – you want someone experienced, with a proven recipe for success (in this case, a solid investment strategy).

Diversification within a Mutual Fund Portfolio

Diversification is your financial safety net. It’s like having multiple baskets, each holding different kinds of eggs. If one basket falls, you still have others. Within a mutual fund portfolio, diversification involves spreading your investments across different asset classes (stocks, bonds, real estate, etc.) and sectors (technology, healthcare, energy, etc.). This reduces your overall risk, as the losses in one sector might be offset by gains in another. A well-diversified portfolio is less volatile and generally provides better long-term returns than a portfolio concentrated in a single asset class or sector. Think of it as a financial buffet – you wouldn’t want to eat only one dish, right?

Investment Strategies and Portfolio Management: Investasi Reksa Dana Guide

Investing in mutual funds is like building a delicious financial cake – you need the right ingredients (funds) and a recipe (strategy) to create something truly scrumptious. This section explores different strategies and how to manage your mutual fund portfolio for optimal results, avoiding any disastrous financial baking mishaps. Think of it as the secret ingredient to financial success.

Asset allocation, the cornerstone of successful investing, is the process of dividing your investment portfolio across different asset classes, such as stocks, bonds, and cash. The specific allocation depends on your risk tolerance, investment goals, and time horizon. A well-diversified portfolio aims to reduce risk while maximizing returns, much like a skilled baker carefully balances flavors in a cake.

Asset Allocation Strategies for Mutual Fund Investors

Different asset allocation strategies cater to various risk appetites and financial objectives. A conservative investor might prefer a strategy heavily weighted towards bonds, while a more aggressive investor might opt for a higher allocation to stocks.

Here are a few examples, remembering that these are just illustrations and not financial advice:

- Conservative: 70% Bonds, 20% Stocks, 10% Cash. This strategy prioritizes capital preservation and minimizes risk, suitable for investors nearing retirement or with a low risk tolerance. Imagine a rich, decadent chocolate cake – mostly stable and reliable, but perhaps lacking a bit of adventurous flair.

- Moderate: 40% Bonds, 50% Stocks, 10% Cash. This balanced approach offers a blend of growth potential and risk mitigation, appealing to investors with a moderate risk tolerance. Think of a classic vanilla cake – pleasing to most, with a good balance of flavors.

- Aggressive: 20% Bonds, 70% Stocks, 10% Cash. This strategy prioritizes growth but carries higher risk, suitable for long-term investors with a high risk tolerance. This is like a zesty lemon cake – full of vibrant flavor and excitement, but potentially a bit tart for some.

Constructing a Diversified Mutual Fund Portfolio

Building a diversified portfolio involves spreading your investments across different mutual funds to reduce the impact of poor performance in any single fund. This diversification can be achieved by investing in funds with different investment objectives, styles, and asset classes.

The process typically involves:

- Defining investment goals and risk tolerance: Understanding your financial goals and comfort level with risk is paramount. Are you saving for retirement, a down payment, or something else? How much fluctuation in your portfolio can you stomach?

- Selecting mutual funds: Research and select mutual funds that align with your investment goals and risk tolerance. Consider factors like expense ratios, historical performance, and fund manager expertise. Don’t just pick the flashiest label; look under the hood.

- Allocating assets: Distribute your investment capital across the chosen mutual funds based on your chosen asset allocation strategy. This ensures proper balance and diversification.

- Regular monitoring and adjustments: Keep an eye on your portfolio’s performance and make adjustments as needed to maintain your desired asset allocation and risk level. It’s not a “set it and forget it” situation.

The Importance of Regular Portfolio Rebalancing

Over time, the performance of your different mutual funds will likely vary. Some may outperform others, causing your asset allocation to drift from your initial plan. Rebalancing involves selling some of your better-performing assets and reinvesting in underperforming ones to restore your target asset allocation.

Regular rebalancing helps maintain your desired risk level and can potentially enhance long-term returns. Think of it as regularly adjusting the flavors in your financial cake to keep it perfectly balanced and delicious, even as some ingredients naturally become more or less prominent.

Regular rebalancing is not just about restoring your target allocation; it’s a disciplined approach to risk management and capitalizing on market fluctuations.

Understanding Fees and Expenses

Investing in mutual funds can be a smart move, but let’s not forget the little gremlins lurking in the shadows: fees and expenses. These seemingly small charges can significantly eat into your returns over time, turning a potentially lucrative investment into a surprisingly underwhelming one. Understanding these fees is crucial to making informed investment decisions, ensuring your hard-earned money works as hard as possible for you. Think of it as a financial health check-up for your investment portfolio.

Mutual fund fees can be a bit of a maze, but don’t worry, we’ll navigate it together. The main culprits are expense ratios, transaction fees, and potentially other charges depending on the fund and your broker. Let’s unpack each one.

Expense Ratios

Expense ratios represent the annual cost of owning a particular mutual fund, expressed as a percentage of your investment. This covers the fund’s operating expenses, including management fees, administrative costs, and marketing expenses. A lower expense ratio generally means more of your money stays invested and works towards generating returns. For example, a fund with a 1% expense ratio will cost you $10 for every $1000 invested annually. This might seem small, but compounded over years, it can significantly impact your overall returns. Imagine the difference between a 1% expense ratio and a 0.5% expense ratio over a 20-year investment horizon – it adds up! Consider comparing funds with similar investment objectives to find those with the lowest expense ratios. Remember, lower is generally better, but don’t sacrifice sound investment strategy for a few basis points.

Transaction Fees

Transaction fees are charged when you buy or sell shares of a mutual fund. These fees vary depending on the fund and your broker. Some funds may have a front-end load (a fee charged when you buy), a back-end load (a fee charged when you sell), or a 12b-1 fee (an annual fee used to cover marketing and distribution costs). Understanding these fees is crucial to comparing the overall cost of investing in different funds. For example, a fund with a 5% front-end load will immediately reduce your initial investment by 5%. Always compare the total cost of ownership, including transaction fees and expense ratios, before making an investment decision.

Impact of Fees on Overall Investment Returns

The impact of fees on your overall investment returns can be substantial, especially over the long term. Even small differences in expense ratios can significantly affect your final returns. Consider two identical funds, both earning an average annual return of 8%. One fund has a 1% expense ratio, and the other has a 0.5% expense ratio. After 20 years, the difference in returns can be surprisingly significant, illustrating the power of compounding and the importance of minimizing fees. This difference is not merely theoretical; it represents real money that could be growing your investment. Remember, every penny saved on fees is a penny earned in your investment growth.

Tax Implications of Mutual Fund Investments

Investing in mutual funds can be a smart move for growing your wealth, but like any financial adventure, it comes with its own set of tax implications. Understanding these implications is crucial to maximizing your returns and minimizing your tax burden. Think of it as navigating a financial treasure map – you want to find the gold, but you also want to avoid the tax traps! Let’s delve into the Indonesian tax landscape for mutual fund investments.

Taxation on mutual fund investments in Indonesia primarily revolves around capital gains. This means that you’ll only pay taxes on the profits you make when you sell your mutual fund units. The good news? There are different tax rates depending on the type of fund and the holding period, so let’s unpack that.

Capital Gains Tax on Mutual Funds

Capital gains tax on mutual funds in Indonesia is dependent on the type of fund and how long you hold your investment. Generally, short-term gains (held for less than a year) are taxed at a higher rate than long-term gains (held for one year or more). This encourages long-term investing, which is generally a sounder financial strategy. The exact rates can fluctuate, so always check with the latest official regulations from the Indonesian tax authorities (DJP).

Illustrative Examples of Tax Calculations, Investasi Reksa Dana Guide

Let’s illustrate with a couple of hypothetical examples. Imagine you invested 10,000,000 IDR in a regular mutual fund.

Example 1: Short-Term Gain

Suppose after six months, your investment grows to 12,000,000 IDR. Your capital gain is 2,000,000 IDR (12,000,000 – 10,000,000). Let’s assume, for the sake of this example, a short-term capital gains tax rate of 15%. Your tax liability would be 300,000 IDR (2,000,000 x 0.15). After taxes, your net profit would be 1,700,000 IDR.

Example 2: Long-Term Gain

Now, let’s say you held the same investment for two years, and it grew to 12,000,000 IDR. Your capital gain remains 2,000,000 IDR. Assuming a long-term capital gains tax rate of 10% (this is hypothetical; always refer to current tax laws), your tax liability would be 200,000 IDR (2,000,000 x 0.10). Your net profit in this scenario would be 1,800,000 IDR.

This demonstrates the significant advantage of long-term investing. Remember, these are simplified examples. The actual tax rates and calculations may be more complex depending on various factors, including the type of mutual fund and any applicable tax treaties.

Tax Implications of Different Mutual Fund Types

The tax implications can vary depending on the type of mutual fund. For instance, some funds might be subject to different tax treatments compared to others. It’s essential to carefully review the fund’s prospectus and consult with a financial advisor to understand the specific tax implications of your chosen fund. Don’t be afraid to ask questions – a well-informed investor is a happy investor!

Resources and Tools for Mutual Fund Investors

Navigating the world of mutual funds can feel like trying to decipher a pirate’s treasure map – exciting, potentially lucrative, but definitely requiring the right tools. Fear not, fellow investor! This section provides you with the resources and tools necessary to chart your course to financial success (or at least, a slightly less stressful financial future). We’ll arm you with the knowledge to confidently navigate the digital seas of mutual fund information.

Accessing reliable information and utilizing efficient tools is crucial for successful mutual fund investing. The right resources can help you research funds, track performance, and make informed decisions, minimizing the risk of accidental shipwrecks (i.e., significant investment losses).

Reputable Websites and Resources for Mutual Fund Information

The internet is a vast ocean of information, but not all waters are safe for your investment portfolio. Sticking to reputable sources is essential to avoid getting swept away by misleading data or outright scams. The following websites offer reliable and comprehensive information on mutual funds:

- Morningstar: A leading provider of independent investment research, Morningstar offers detailed fund profiles, ratings, and analysis. Think of them as the seasoned cartographers of the investment world.

- Yahoo Finance: Provides comprehensive financial data, including mutual fund quotes, charts, and news. A good all-around resource for quick checks and up-to-date information.

- Fundamentally: A valuable source of in-depth analysis and information on mutual funds. This is a bit more in-depth, like consulting an experienced navigator.

- SEC’s EDGAR Database: The official source for filings by publicly traded companies and mutual funds. While not always the easiest to navigate, it’s the ultimate source of truth for legal and financial documentation. Think of it as the official map of the financial seas.

Using Online Tools for Mutual Fund Research and Tracking

Beyond simply finding information, online tools can streamline your research and tracking processes. These tools can automate data collection, generate reports, and help you stay on top of your investments, saving you valuable time and effort.

- Portfolio Tracking Websites: Many websites and apps (such as Personal Capital or Mint) allow you to aggregate all your investments, including mutual funds, in one place. This provides a holistic view of your financial health.

- Fund Screener Tools: These tools allow you to filter mutual funds based on various criteria (expense ratio, asset class, historical performance, etc.), helping you quickly identify funds that meet your specific investment goals. Imagine having a filter that automatically sorts through thousands of funds, finding the perfect match for your criteria.

- Financial Calculators: Numerous online calculators can help you estimate your potential returns, determine your investment timeline, or assess the impact of fees on your investment growth. These are incredibly useful for planning and projecting your financial future.

Interpreting Key Performance Indicators (KPIs) for Mutual Funds

Understanding key performance indicators is essential for evaluating a mutual fund’s past performance and predicting its future potential. However, remember that past performance is not indicative of future results – it’s just one piece of the puzzle.

- Expense Ratio: This represents the annual cost of owning the fund, expressed as a percentage of your investment. A lower expense ratio generally means more of your money stays invested and grows. For example, a fund with a 1% expense ratio will cost you $10 annually for every $1000 invested.

- Net Asset Value (NAV): The total value of all the assets in a mutual fund divided by the number of outstanding shares. This fluctuates daily, reflecting the market value of the fund’s holdings.

- Sharpe Ratio: Measures risk-adjusted return. A higher Sharpe ratio indicates better risk-adjusted performance. A ratio of 1 is generally considered good, while a ratio above 1 is excellent. This is a more advanced metric but can be very helpful in comparing funds.

- Standard Deviation: Measures the volatility or risk of a fund’s returns. A higher standard deviation indicates greater volatility. Think of it as a measure of the fund’s “roller coaster” factor.

Illustrative Examples of Mutual Fund Investment Scenarios

Investing in mutual funds can feel like navigating a jungle gym of financial jargon, but with a little understanding, it can be surprisingly straightforward and even…fun! Let’s look at some real-world scenarios to illustrate how different investors can approach mutual fund investments.

Young Investor’s Long-Term Plan

Imagine Anya, a 25-year-old with a stable job and a dream of early retirement. She’s decided to start investing in mutual funds, aiming for a comfortable nest egg by age 55. Anya has a high risk tolerance, understanding that long-term growth often involves short-term volatility. She chooses a diversified portfolio primarily consisting of growth-oriented mutual funds focused on technology and emerging markets. This strategy reflects her longer time horizon and higher risk tolerance. She commits to contributing a consistent amount each month, even during market downturns, knowing that time is her greatest ally. She regularly reviews her portfolio but avoids impulsive reactions to short-term market fluctuations. This disciplined approach allows her to benefit from the power of compounding over the years.

Pre-Retirement Portfolio Adjustment

Now let’s meet Ben, a 60-year-old nearing retirement. His investment strategy needs a significant shift. He’s already accumulated a substantial portfolio through years of investing in various mutual funds, but his risk tolerance has decreased considerably. Ben decides to gradually shift his portfolio towards more conservative mutual funds, focusing on bonds and income-generating assets. This reduces the potential for significant losses as he approaches retirement. He might even consider allocating a portion of his investments to money market funds for easy access to liquidity. The goal is to preserve his capital while still generating a steady income stream for his retirement years. He might also consider consulting a financial advisor to create a personalized withdrawal plan.

The Power of Consistent Investing

Consider Carla, who started investing in a balanced mutual fund at age 30. She invested a modest amount each month, consistently, regardless of market conditions. While the market experienced both ups and downs over the years, Carla’s disciplined approach allowed her to benefit from dollar-cost averaging. This strategy reduces the impact of market volatility by buying more shares when prices are low and fewer shares when prices are high. Over 20 years, even with modest contributions, the power of compounding and consistent investing transformed her initial investment into a significantly larger sum, showcasing the long-term benefits of patient, disciplined investing. Her consistent investment demonstrates that time in the market, not timing the market, is key to long-term success.

Risks and Challenges in Mutual Fund Investing

Investing in mutual funds, while offering diversification and professional management, isn’t a guaranteed path to riches. Think of it like this: it’s a thrilling rollercoaster ride, with potential for breathtaking views, but also the occasional stomach-churning drop. Understanding the risks involved is crucial for a smooth (or at least less bumpy) journey. Let’s explore the potential pitfalls and how to navigate them.

Market risk is the biggest beast in the mutual fund jungle. This refers to the inherent volatility of the market itself. A market downturn can significantly impact your investment regardless of the fund’s specific strategy. Even the most carefully selected funds are vulnerable to broader economic forces. Imagine a perfectly healthy lion suddenly getting swept away by a flash flood – that’s market risk in action.

Market Risk and Mitigation Strategies

Market fluctuations are inevitable. However, mitigation strategies can help cushion the blow. Diversification across different asset classes (stocks, bonds, etc.) is key. Don’t put all your eggs in one basket, or even one type of basket! A well-diversified portfolio reduces your reliance on any single market segment’s performance. Furthermore, maintaining a long-term investment horizon helps weather short-term market storms. Remember, Rome wasn’t built in a day, and neither is lasting wealth. Finally, regular rebalancing of your portfolio ensures you maintain your desired asset allocation, preventing any one asset from becoming overly dominant.

Interest Rate Risk

Interest rate risk primarily affects bond funds. When interest rates rise, the value of existing bonds falls, impacting the fund’s net asset value (NAV). Conversely, falling interest rates generally boost bond values. This risk is particularly relevant for investors with shorter time horizons, as they have less time to recover from potential losses. Consider this: if you need the money in a year and interest rates unexpectedly jump, you might find yourself selling bonds at a loss.

Inflation Risk

Inflation erodes the purchasing power of your investments. If the rate of inflation outpaces your fund’s returns, your investment’s real value decreases. Imagine buying a candy bar for $1 today, and then finding that same candy bar costs $2 next year, despite your investment earning a 10% return – you’ve essentially lost ground. Choosing funds that aim for returns exceeding the inflation rate is vital for preserving your wealth’s real value.

Fund-Specific Risks

Beyond market-wide risks, each fund carries its own unique set of challenges. Understanding a fund’s investment objectives and strategies is paramount. A fund focused on small-cap stocks, for example, will likely experience higher volatility than a large-cap fund. Carefully reading the fund’s prospectus, which details its investment approach, risk profile, and expense ratio, is absolutely crucial. This isn’t optional; it’s your investment survival guide.

Importance of Understanding Fund Investment Objectives and Strategies

The fund’s prospectus provides a roadmap to its investment strategy. It Artikels the types of securities the fund invests in, its investment style (e.g., growth, value), and its risk tolerance. By understanding this, you can assess whether the fund aligns with your own risk tolerance and investment goals. Choosing a fund that mismatches your profile is like choosing a tiny sports car for a family of six – it might be exciting for a moment, but ultimately impractical.

Closing Notes

So, there you have it – your crash course (with a side of humor) in Investasi Reksa Dana. Remember, investing involves risk, and while we’ve tried our best to make it fun, it’s crucial to do your own thorough research before making any investment decisions. This guide is meant to be a starting point, not a crystal ball predicting future market movements. Go forth, armed with knowledge and a healthy dose of optimism, and may your investments flourish (and maybe even make you laugh along the way!). Happy investing!

Questions Often Asked

What is the minimum investment amount for most mutual funds in Indonesia?

Minimum investment amounts vary significantly between funds, ranging from a few hundred thousand Rupiah to millions. Check the fund’s prospectus for specifics.

How often should I rebalance my mutual fund portfolio?

A common recommendation is to rebalance annually or semi-annually, but the optimal frequency depends on your investment goals and risk tolerance.

Are there any penalties for withdrawing my investments early?

Yes, some funds may charge exit fees or penalties for early withdrawals. Review the fund’s terms and conditions carefully.

Can I invest in mutual funds through a bank?

Many Indonesian banks offer mutual fund investment options. Check with your bank for available products.