Investing for Beginners Guide: Embark on a thrilling adventure into the world of finance! This guide demystifies the often-intimidating realm of investing, transforming complex concepts into easily digestible information. Whether you dream of early retirement, a down payment on a dream home, or simply securing your financial future, this guide provides the foundational knowledge to navigate the exciting—and sometimes bewildering—landscape of investments. Prepare to learn about stocks, bonds, budgeting, and risk management in a way that’s both informative and surprisingly entertaining.

We’ll cover everything from understanding basic investment concepts like diversification and fees, to creating a personalized budget and identifying your risk tolerance. We’ll also explore different investment strategies, the importance of thorough research, and how to manage your portfolio effectively. Most importantly, we’ll arm you with the knowledge to avoid common pitfalls and make informed decisions that align with your financial goals. Get ready to take control of your financial destiny!

Understanding Basic Investing Concepts

Embarking on your investing journey can feel like navigating a pirate ship during a hurricane – thrilling, potentially lucrative, and utterly terrifying if you don’t know the ropes. Fear not, future finance tycoon! This section will equip you with the basic nautical charts (investment concepts) needed to steer clear of the financial reefs and shoals.

Stocks versus Bonds: A Tale of Two Investments

Stocks represent ownership in a company. Think of it like buying a tiny slice of a pizza; if the pizza place (company) thrives, your slice (stock) becomes more valuable. Bonds, on the other hand, are like lending money to a company or government. You’re essentially a creditor, and they promise to pay you back with interest over a set period. Stocks offer higher potential returns but also carry higher risk; bonds are generally safer but offer more modest returns. It’s like choosing between a high-stakes poker game and a reliable savings account – the thrill versus the security.

Diversification: Don’t Put All Your Eggs in One Basket (Unless You’re a Really Good Juggler)

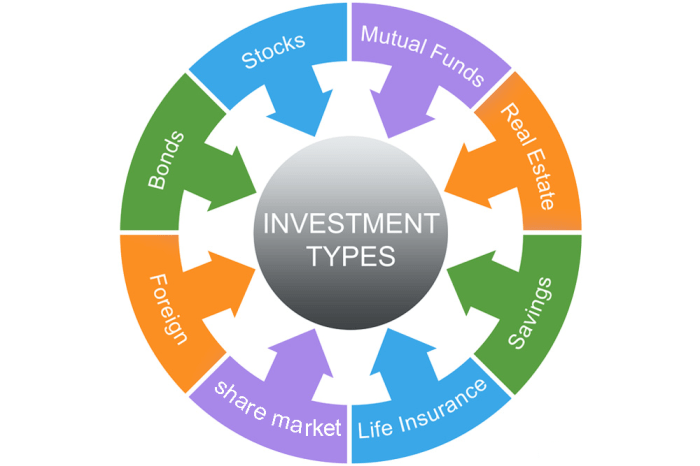

Diversification is the art of spreading your investments across different asset classes (stocks, bonds, real estate, etc.) and sectors (technology, healthcare, energy, etc.). This reduces your risk. Imagine putting all your money into one company, only to have it go bankrupt – ouch! Diversification is your financial safety net, preventing a single bad investment from sinking your entire portfolio. A well-diversified portfolio resembles a delicious, well-balanced meal, not a plate piled high with only one type of food.

Common Investment Fees and Expenses

Investing isn’t free. Several fees can nibble away at your returns, including brokerage commissions (fees for buying and selling investments), expense ratios (annual fees charged by mutual funds and ETFs), and management fees (charged by professional money managers). These fees can significantly impact your long-term returns, so understanding them is crucial. Think of these fees as the toll you pay to travel the road to financial success – the higher the toll, the less money you have left at your destination.

Investment Account Types: A Comparison

Choosing the right investment account is like selecting the perfect weapon for your financial battles. Each type has its own strengths and weaknesses, influencing your tax situation and investment options.

| Account Type | Fees | Tax Implications | Investment Options |

|---|---|---|---|

| Brokerage Account | Commissions, fees vary by broker | Taxes owed on capital gains and dividends | Stocks, bonds, ETFs, mutual funds |

| Traditional IRA | May vary by provider, some are free | Tax-deferred growth; taxes paid upon withdrawal in retirement | Stocks, bonds, ETFs, mutual funds |

| Roth IRA | May vary by provider, some are free | Tax-free growth and withdrawals in retirement; contributions may be tax deductible | Stocks, bonds, ETFs, mutual funds |

| 401(k) | May vary by employer and plan; some plans have administrative fees | Tax-deferred growth; taxes paid upon withdrawal in retirement | Employer-sponsored investment options; may include stocks, bonds, and mutual funds |

Setting Financial Goals and Creating a Budget

Embarking on your investing journey is akin to planning an epic adventure – you wouldn’t set off without a map, would you? Similarly, a well-defined financial plan, complete with a budget that wouldn’t make a miser blush, is crucial for successful investing. This section will equip you with the tools to chart your financial course, ensuring your investment voyage is smooth sailing (or at least, avoids the iceberg of debt).

Creating a budget and setting financial goals are not just about restricting your spending; it’s about strategically allocating your resources to achieve your dreams, whether it’s a down payment on a charming cottage or a luxurious retirement sipping margaritas on a beach. Let’s dive into the nitty-gritty.

Sample Budget Template for Beginners

A budget is your financial roadmap, guiding you towards your goals. Here’s a simple template to get you started, focusing on saving for investments:

| Income | Amount |

|---|---|

| Salary/Wages | $XXXX |

| Other Income (e.g., side hustle) | $XXXX |

| Total Income | $XXXX |

| Expenses | Amount |

| Housing (Rent/Mortgage) | $XXXX |

| Utilities (Electricity, Water, Gas) | $XXXX |

| Groceries | $XXXX |

| Transportation | $XXXX |

| Debt Payments (Loans, Credit Cards) | $XXXX |

| Entertainment | $XXXX |

| Savings for Investments | $XXXX |

| Emergency Fund | $XXXX |

| Total Expenses | $XXXX |

| Net Income (Income – Expenses) | $XXXX |

Remember to replace the “XXXX” placeholders with your actual figures. The key is to track your spending diligently and adjust as needed.

Strategies for Identifying and Prioritizing Financial Goals

Effective goal setting involves a blend of ambition and realism. It’s about identifying what truly matters to you and creating a timeline for achieving those aspirations. Prioritize your goals based on their importance and urgency. For example, building an emergency fund might take precedence over investing for retirement in the short term. Consider using the SMART method: Specific, Measurable, Achievable, Relevant, and Time-bound. For instance, instead of “Save for retirement,” aim for “Save $50,000 for retirement by age 40.”

The Importance of Emergency Funds Before Investing

Before you even think about investing, it’s crucial to establish a robust emergency fund. This acts as your financial safety net, protecting you from unexpected expenses like medical bills or car repairs. Investing without an emergency fund is like sailing a ship without a life raft – a risky proposition! Aim for 3-6 months’ worth of living expenses in a readily accessible account. This prevents you from having to sell investments prematurely during a market downturn to cover unexpected costs.

Step-by-Step Guide on Tracking Income and Expenses, Investing for Beginners Guide

Tracking your income and expenses might sound tedious, but it’s the bedrock of effective budgeting. Here’s a simple, step-by-step guide:

- Choose a Method: Use budgeting apps (Mint, YNAB), spreadsheets, or even a simple notebook. Find what works best for you.

- Record All Income: This includes salary, bonuses, side hustles – every penny counts!

- Categorize Expenses: Group your expenses into categories (housing, food, transportation, etc.) for better analysis.

- Review Regularly: Analyze your spending patterns weekly or monthly to identify areas for improvement. This allows for timely adjustments.

- Adjust as Needed: Your budget isn’t set in stone. Life throws curveballs, so be prepared to adjust your spending plan as necessary.

Remember, consistency is key! Regularly tracking your income and expenses will provide invaluable insights into your financial habits and help you stay on track towards your goals.

Risk Tolerance and Investment Strategies

Embarking on your investing journey is like choosing a rollercoaster – some prefer the gentle slopes of a carousel, while others crave the heart-stopping drops of a behemoth. Understanding your risk tolerance is key to selecting the right ride, or rather, the right investment strategy. This section will help you navigate the thrilling (and sometimes terrifying) world of investment risk.

Your risk tolerance, simply put, is your comfort level with the possibility of losing money. It’s a crucial factor in determining which investments are suitable for you. High-risk investments offer the potential for high returns, but also carry a greater chance of significant losses. Low-risk investments, conversely, provide more stability but generally offer lower returns. Finding the sweet spot between risk and reward is the name of the game.

Risk Tolerance Levels and Investment Suitability

Different risk tolerance levels align with different investment options. Imagine a spectrum: on one end, the ultra-cautious investor; on the other, the thrill-seeking daredevil. Let’s explore some points along this spectrum:

- Conservative Investors (Low Risk Tolerance): These investors prioritize capital preservation above all else. Suitable investments include high-yield savings accounts, certificates of deposit (CDs), and government bonds. Think of them as the carousel riders – steady, predictable, and low on thrills.

- Moderate Investors (Medium Risk Tolerance): This group seeks a balance between risk and reward. They might allocate a portion of their portfolio to stocks, but also maintain a significant holding in less volatile assets like bonds. Their rollercoaster is a fun, family-friendly one – some ups and downs, but nothing too extreme.

- Aggressive Investors (High Risk Tolerance): These investors are comfortable with significant market fluctuations in pursuit of higher returns. Their portfolio might consist heavily of stocks, including small-cap and emerging market equities, and potentially even options or futures. Think of them as the front-row riders on the biggest, baddest rollercoaster in the park – buckle up!

Factors Influencing Risk Tolerance

Several factors contribute to an individual’s risk tolerance. Understanding these factors is crucial for making informed investment decisions.

- Time Horizon: Younger investors with longer time horizons can generally tolerate more risk, as they have more time to recover from potential losses. Think of it as having more time to ride the rollercoaster multiple times and average out the ups and downs.

- Financial Situation: Individuals with a strong financial safety net (emergency fund, low debt) are better equipped to handle potential investment losses. They can weather the storm more easily.

- Personal Circumstances: Major life events, such as upcoming retirement or the birth of a child, can influence risk tolerance. These events often prompt a more conservative approach.

- Personality: Some individuals are naturally more risk-averse than others. This inherent personality trait significantly impacts investment choices.

Investment Strategies: Value Investing vs. Growth Investing

Value investing and growth investing represent two distinct approaches to stock selection. While both aim to generate profits, their strategies differ significantly.

- Value Investing: Value investors seek undervalued companies – those whose stock prices are lower than their intrinsic worth. They look for companies with strong fundamentals but temporarily depressed share prices. Think of it as finding a hidden gem at a garage sale – a potentially great investment at a bargain price.

- Growth Investing: Growth investors focus on companies with high growth potential, even if their current valuations are high. They are willing to pay a premium for companies expected to experience rapid earnings growth. This is like investing in a promising startup – high risk, but potentially high reward.

Researching and Selecting Investments

Embarking on the thrilling journey of investment selection can feel like navigating a pirate’s treasure map – exciting, potentially lucrative, and fraught with the risk of encountering a kraken (or, you know, a market crash). But fear not, aspiring buccaneers! With the right tools and knowledge, you can chart a course towards financial success. This section will equip you with the navigational skills to research and select investments wisely, avoiding those treacherous financial reefs.

The process of researching individual stocks involves more than just throwing darts at a board (though that *could* be a surprisingly effective strategy… maybe). It requires a thorough understanding of the company, its industry, and the broader economic landscape. Think of it as a detective investigation, but instead of solving murders, you’re solving the mystery of a company’s future profitability.

Understanding a Company’s Financial Statements

Financial statements are the bread and butter (and maybe even the dessert) of investment research. They provide a window into a company’s financial health, revealing everything from its profitability to its debt levels. Ignoring them is like trying to navigate by the stars without a telescope – you might get lucky, but the odds are stacked against you. The three primary financial statements – the income statement, the balance sheet, and the cash flow statement – offer a comprehensive view of a company’s financial performance. The income statement shows revenues, expenses, and ultimately, the company’s profit or loss. The balance sheet provides a snapshot of the company’s assets, liabilities, and equity at a specific point in time. Finally, the cash flow statement tracks the movement of cash both into and out of the company. Analyzing these statements allows you to assess a company’s financial strength, its ability to generate profits, and its overall financial stability. For example, a consistently high debt-to-equity ratio might indicate a risky investment, while strong cash flows suggest a healthy and resilient company.

Reliable Sources for Investment Information

To avoid getting lost in a sea of misinformation, it’s crucial to rely on reputable sources. Think of these as your trusty navigational charts. These sources include the company’s own filings (like their 10-K reports), financial news outlets like the Wall Street Journal or Bloomberg, and reputable financial analysis websites such as Yahoo Finance or Google Finance. Always cross-reference information from multiple sources to ensure accuracy and avoid biased reporting. Remember, not all that glitters is gold, and not all online financial gurus are actually… gurus.

Checklist for Evaluating Potential Investments

Before you dive headfirst into an investment, take a moment to assess the situation. This checklist provides a structured approach to evaluating potential investment opportunities:

A comprehensive evaluation involves more than just a gut feeling. It requires a methodical approach, considering various factors to mitigate risk and maximize potential returns.

- Understand the Company’s Business Model: What does the company do? Is its business model sustainable and profitable?

- Analyze Financial Statements: Review the income statement, balance sheet, and cash flow statement to assess the company’s financial health.

- Assess Management Quality: Is the management team experienced and competent? Do they have a track record of success?

- Evaluate Competitive Landscape: Who are the company’s competitors? What is its competitive advantage?

- Consider Industry Trends: Is the industry growing or declining? What are the long-term prospects?

- Determine Valuation: Is the company’s stock price fairly valued relative to its earnings and assets? Consider using metrics like the price-to-earnings (P/E) ratio.

- Assess Risk Tolerance: Does this investment align with your personal risk tolerance and investment goals?

Managing Your Investment Portfolio

Investing isn’t a “set it and forget it” proposition; it’s more like tending a slightly temperamental garden. Regular maintenance and strategic adjustments are crucial to blossoming returns (and avoiding wilting losses!). Think of your portfolio as a living, breathing entity that requires your attention. Ignoring it is like forgetting to water your prize-winning roses – you might end up with a very prickly situation.

Successful portfolio management involves a delicate dance between understanding your risk tolerance, reacting to market fluctuations, and consistently striving towards your financial goals. It’s less about predicting the future (which, let’s face it, is impossible) and more about adapting to its ever-changing whims. This section will guide you through the essential practices of portfolio management, transforming you from a novice gardener to a seasoned horticulturalist of your financial landscape.

Portfolio Rebalancing

Rebalancing is the process of realigning your investment portfolio to its original asset allocation. Let’s say you initially planned a 60/40 stock/bond portfolio. Over time, due to market performance, your stocks might become 70% of your portfolio, while bonds dwindle to 30%. Rebalancing involves selling some of your better-performing assets (stocks in this case) and buying more of the underperformers (bonds) to restore the 60/40 balance. This disciplined approach helps you maintain your desired level of risk and prevents you from becoming overly concentrated in any single asset class. Think of it as pruning your garden – removing the overgrown branches to allow the others to thrive. This strategy helps prevent excessive risk and capitalize on market fluctuations. For example, a sudden surge in technology stocks might inflate their proportion in your portfolio. Rebalancing would involve selling a portion of these stocks and reinvesting in other asset classes to maintain your target allocation and mitigate potential losses if the tech sector experiences a downturn.

Regular Investment Performance Review

Regularly reviewing your investment performance is akin to taking stock of your garden’s health. Are your investments growing as expected? Are there any unexpected weeds (losses) sprouting up? By tracking your portfolio’s progress, you can identify areas that need attention and make necessary adjustments. This involves monitoring key metrics like returns, risk, and expenses. Use online brokerage tools or spreadsheets to track your investments, paying close attention to the overall performance of your portfolio and the performance of individual assets. For instance, if a particular investment consistently underperforms or carries excessive risk, it might be time to consider replacing it with a more suitable alternative.

Adjusting Investment Plans Based on Changing Market Conditions

The market is a fickle beast. What works wonders one year might flop spectacularly the next. Adapting your investment strategy to changing market conditions is crucial for long-term success. This doesn’t mean panicking and making rash decisions based on short-term market fluctuations; instead, it involves making informed adjustments based on a thorough understanding of economic trends, geopolitical events, and your own risk tolerance. For instance, during periods of high inflation, you might consider shifting towards investments that are less sensitive to inflation, such as inflation-protected securities or real estate. Conversely, during economic downturns, you might strategically increase your allocation to assets that tend to perform well during recessions, such as high-quality bonds.

Portfolio Monitoring and Adjustment: A Visual Representation

Imagine a circular chart, divided into segments representing different asset classes (stocks, bonds, real estate, etc.). Each segment’s size corresponds to its percentage allocation in your portfolio. This is your initial portfolio allocation, representing your carefully planned strategy. Over time, market fluctuations cause these segments to grow or shrink disproportionately. This change is represented by the segments shifting in size, some growing larger and others smaller. A second, similar chart illustrates the portfolio after a period of time. The difference in the size of segments between the two charts vividly shows the imbalance caused by market movements. The rebalancing process is depicted by arrows showing the transfer of funds from overweighted segments to underweighted ones, bringing the portfolio back to its original target allocation. Finally, a third chart shows the portfolio after rebalancing, with segments restored to their intended proportions, reflecting a more balanced and resilient investment strategy. This visual representation illustrates the dynamic nature of portfolio management and the importance of regular monitoring and adjustment.

Understanding Taxes and Investment Returns

Ah, taxes—the unavoidable truth of the financial world, a bit like death and…well, more death. But fear not, intrepid investor! Understanding how taxes interact with your investments isn’t as daunting as it sounds. In fact, with a little knowledge, you can even use the tax system to your advantage (legally, of course – we don’t condone tax evasion, even if it sounds thrilling). This section will demystify the relationship between taxes and your hard-earned returns, helping you navigate this sometimes-murky territory with a smile (and maybe a slightly smaller tax bill).

Taxes significantly impact your investment returns, reducing the overall profit you get to keep. Different types of investments are taxed differently, and understanding these differences is crucial for maximizing your after-tax returns. Failing to account for taxes can lead to unpleasant surprises come tax season – surprises that rarely involve a celebratory cake.

Capital Gains versus Dividends

Capital gains and dividends are two common ways investors receive returns on their investments, but they are taxed differently. Capital gains refer to the profit you make when you sell an asset for more than you paid for it (like stocks or bonds). Dividends, on the other hand, are payments made by companies to their shareholders, often from their profits.

- Capital Gains: These are taxed at different rates depending on how long you held the asset. Short-term capital gains (assets held for one year or less) are taxed at your ordinary income tax rate, which can be quite substantial. Long-term capital gains (assets held for more than one year) generally have lower tax rates. For example, let’s say you bought stock for $1,000 and sold it for $2,000 after holding it for two years. Your $1,000 capital gain would be taxed at the long-term capital gains rate, which varies depending on your income bracket.

- Dividends: Qualified dividends (from certain US companies held for a specified period) are taxed at lower rates, similar to long-term capital gains. Unqualified dividends are taxed at your ordinary income tax rate. Imagine receiving a $500 dividend from a company you’ve invested in. If it’s a qualified dividend, you’ll pay a lower tax rate on it than if it were considered unqualified.

Tax-Advantaged Investment Accounts

The good news is that there are ways to reduce your tax burden on investments. Tax-advantaged accounts allow you to grow your investments tax-deferred or tax-free, depending on the type of account. These accounts are like magical vaults where your investments can flourish without the constant threat of the tax man (or woman!).

- 401(k)s: Employer-sponsored retirement plans where contributions are often tax-deductible, and investment earnings grow tax-deferred. Think of it as a retirement savings account where your money grows without being taxed until you withdraw it in retirement.

- IRAs (Individual Retirement Accounts): Traditional IRAs offer tax-deductible contributions and tax-deferred growth, while Roth IRAs offer tax-free withdrawals in retirement (contributions are not tax-deductible). The Roth IRA is like a superhero version of a retirement account, offering tax-free growth and withdrawals, but with a slight trade-off on the front end.

- 529 Plans: These are education savings plans that offer tax advantages for college expenses. Contributions are often not tax-deductible at the federal level, but earnings grow tax-free if used for qualified education expenses. It’s like a college fund that shields your savings from taxes, making it easier to fund your child’s higher education.

Common Investing Mistakes to Avoid

Investing, while potentially lucrative, is a minefield of pitfalls, especially for beginners. Navigating this landscape requires not only knowledge but also a healthy dose of self-awareness and discipline. Many novice investors fall prey to common mistakes that can significantly impact their returns, or worse, lead to substantial losses. Understanding these pitfalls and developing strategies to avoid them is crucial for long-term investment success. Think of it as learning to avoid the landmines before embarking on your treasure hunt!

Emotional Investing

Emotional investing, driven by fear and greed, is a major culprit in investment failures. The rollercoaster of market fluctuations can trigger impulsive decisions, leading to buying high (during periods of exuberance) and selling low (during market dips). For example, imagine an investor who panics and sells all their stocks during a market correction, only to see the market rebound sharply shortly afterward. This emotional response can erase years of potential gains. A more disciplined approach involves sticking to a well-defined investment strategy, regardless of short-term market volatility. Remember, the market is cyclical; downturns are inevitable, but they are also opportunities for long-term growth.

Blindly Following Investment Trends

The allure of “get-rich-quick” schemes and the pressure to jump on the bandwagon of the latest hot investment are strong temptations. However, blindly following investment trends without conducting thorough research can be disastrous. The dot-com bubble of the late 1990s and the cryptocurrency boom of recent years serve as stark reminders of this danger. Many investors piled into these markets without understanding the underlying fundamentals, resulting in significant losses when the bubbles burst. A sound investment strategy involves careful due diligence, understanding risk tolerance, and diversification across various asset classes.

Ignoring Diversification

Putting all your eggs in one basket is a recipe for disaster, even if that basket seems incredibly promising. Diversification involves spreading your investments across different asset classes (stocks, bonds, real estate, etc.) and sectors to mitigate risk. If one investment performs poorly, the others can potentially offset the losses. For example, an investor with a portfolio heavily weighted in technology stocks might experience significant losses during a tech sector downturn. A diversified portfolio, however, would likely experience less severe losses due to the presence of other asset classes.

Lack of a Long-Term Plan

Investing is a marathon, not a sprint. Many beginners make the mistake of chasing short-term gains, leading to frequent trading and high transaction costs. A long-term investment plan, aligned with your financial goals and risk tolerance, is essential for sustained growth. This plan should Artikel your investment objectives, timeline, and asset allocation strategy. It should also include regular reviews and adjustments to adapt to changing circumstances.

Failing to Regularly Review and Rebalance

Once you’ve established your investment portfolio, it’s crucial to regularly review and rebalance it. Market conditions change, and your asset allocation may drift from your original plan over time. Rebalancing involves adjusting your portfolio to maintain your desired asset allocation, selling some assets that have outperformed and buying others that have underperformed. This helps to manage risk and capitalize on market opportunities. For instance, if your stock allocation has grown significantly, you might sell some stocks and invest in bonds to bring your portfolio back to its target allocation.

Resources for Further Learning

Embarking on your investing journey is like learning a new language – you’ll need a good dictionary (and maybe a tutor!). This section provides a treasure trove of resources to help you expand your financial vocabulary and become a fluent investor. Don’t worry, it won’t involve memorizing complex formulas (unless you really want to – some people find that oddly satisfying).

The world of finance can feel intimidating, but with the right tools and guidance, you can navigate it with confidence (and maybe even a chuckle or two). Remember, even seasoned investors are constantly learning, so embrace the journey!

Reputable Financial Websites and Educational Resources

Accessing reliable information is crucial for successful investing. Websites from established financial institutions and educational organizations offer valuable insights and tools. Beware of “get-rich-quick” schemes; they’re usually as reliable as a chocolate teapot.

- Investopedia: This comprehensive website offers a wealth of information on various investment topics, explained in a clear and accessible manner. Think of it as the Wikipedia of finance, but with fewer edit wars (hopefully).

- Khan Academy: This non-profit organization provides free educational resources, including excellent videos and articles on personal finance and investing basics. It’s like having a personal finance tutor, but without the awkward small talk.

- The Securities and Exchange Commission (SEC): The SEC’s website provides crucial information about investor protection and regulations. It’s not exactly bedtime reading, but it’s essential for understanding the legal landscape of investing.

- Your Broker’s Educational Resources: Many brokerage firms offer educational materials and webinars to their clients. This is a convenient way to learn about specific investment products and strategies offered by your broker.

Books and Courses for Beginner Investors

While online resources are fantastic, sometimes a good old-fashioned book (or a structured course) can provide a more focused and in-depth learning experience. Choose resources that match your learning style and preferred pace.

- “The Intelligent Investor” by Benjamin Graham: A classic text considered by many to be the bible of value investing. Be warned: it’s not exactly a page-turner, but the wisdom within is invaluable.

- “A Random Walk Down Wall Street” by Burton Malkiel: This book explores the principles of market efficiency and provides a solid foundation for understanding investment strategies. It’s a less daunting read than Graham’s classic, but still packed with insights.

- Online Courses (Coursera, edX, Udemy): Numerous platforms offer courses on investing, personal finance, and related topics. These courses often provide structured learning paths and interaction with instructors and fellow learners.

Benefits of Seeking Professional Financial Advice

While self-education is crucial, seeking professional advice can provide invaluable support and guidance, especially when dealing with complex financial situations. Think of it as having a seasoned navigator guiding you through potentially treacherous financial waters.

- Personalized Investment Strategies: Financial advisors can create tailored investment plans based on your individual goals, risk tolerance, and financial circumstances. They can help you avoid common pitfalls and make informed decisions.

- Objective Perspective: It’s easy to get emotionally attached to investments. A financial advisor can provide an objective perspective, helping you make rational decisions even during market volatility.

- Access to Specialized Knowledge: Financial advisors have expertise in areas like tax planning, estate planning, and retirement planning that can significantly benefit your overall financial well-being. They can navigate the complexities of these areas, saving you time and potential headaches.

Last Recap: Investing For Beginners Guide

So, there you have it – your crash course in the fundamentals of investing! While this guide provides a solid foundation, remember that the world of finance is ever-evolving. Stay curious, continue learning, and don’t be afraid to seek professional advice when needed. Investing is a marathon, not a sprint, and with consistent effort and smart choices, you’ll be well on your way to achieving your financial aspirations. Happy investing!

Clarifying Questions

What’s the difference between a Roth IRA and a Traditional IRA?

A Roth IRA offers tax-free withdrawals in retirement, while contributions are made after tax. A Traditional IRA allows for tax-deductible contributions, but withdrawals are taxed in retirement.

How often should I rebalance my portfolio?

A general guideline is to rebalance annually or semi-annually, but the ideal frequency depends on your investment strategy and risk tolerance. Significant market fluctuations may warrant more frequent adjustments.

What is dollar-cost averaging?

Dollar-cost averaging is an investment strategy where you invest a fixed dollar amount at regular intervals, regardless of market fluctuations. This helps mitigate the risk of investing a lump sum at a market high.

Where can I find reliable financial news?

Reputable sources include the Wall Street Journal, Bloomberg, the Financial Times, and reputable financial news websites. Always be critical of information found online.