Investing for Beginners Guide: Embark on a thrilling adventure into the world of finance! Think of it less as a dry textbook and more as a treasure map to your financial future. We’ll navigate the sometimes-bewildering waters of stocks, bonds, and mutual funds, turning complex concepts into easily digestible nuggets of wisdom. Get ready to ditch the financial fear and embrace the exciting possibilities of building wealth, one savvy investment at a time. This guide isn’t just about making money; it’s about making smart, informed decisions that empower you to achieve your financial goals.

From understanding basic investment concepts to creating a budget that doesn’t feel like a prison sentence, we’ll cover it all. We’ll even unravel the mystery of compound interest – that magical force that turns small, consistent investments into surprisingly large sums over time. Whether you’re dreaming of early retirement or simply want to secure your financial future, this guide will equip you with the knowledge and confidence to take control of your money.

Understanding Basic Investing Concepts

Embarking on your investment journey can feel like navigating a pirate ship in a hurricane – thrilling, potentially lucrative, and absolutely terrifying if you don’t know the ropes. Fear not, aspiring buccaneer! This section will equip you with the fundamental knowledge to chart your course towards financial success (or at least, financial *less*-failure).

Stocks versus Bonds: A Tale of Two Investments

Stocks represent ownership in a company. Think of it as buying a tiny slice of a pizza – a share of the profits (or losses!). Bonds, on the other hand, are like lending money to a company or government. They promise to pay you back your principal plus interest over a set period. Stocks offer higher potential returns but also carry significantly more risk; bonds are generally considered safer but offer lower returns. It’s a bit like choosing between a high-stakes poker game and a guaranteed, albeit smaller, win at bingo.

Diversification: Don’t Put All Your Eggs in One Basket (Unless That Basket is Magical)

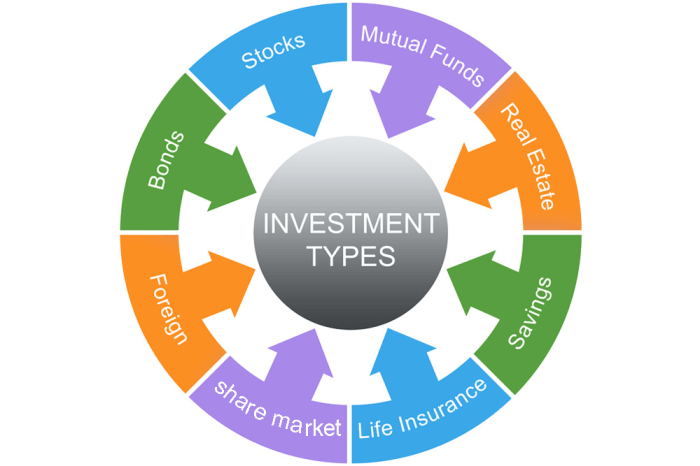

Diversification is the art of spreading your investments across various asset classes to minimize risk. Imagine putting all your money into one company, only to have it go bankrupt. Ouch! Diversification helps cushion the blow if one investment underperforms. A well-diversified portfolio might include stocks, bonds, real estate, and even commodities like gold. It’s like having multiple insurance policies for your financial future, each covering a different kind of risk.

Investment Fees and Expenses: The Hidden Costs of Getting Rich (Slowly)

Investing isn’t free. Various fees can eat into your returns, so it’s crucial to understand them. These include management fees (charged by mutual funds and ETFs), brokerage commissions (fees for buying and selling investments), and expense ratios (annual fees charged by some investment funds). Think of these as the tolls you pay on the road to financial freedom – the smoother the road, the higher the toll.

Asset Classes and Their Risk Profiles: A Risk-Reward Rollercoaster

Different asset classes carry varying levels of risk and potential return. Stocks are generally considered higher risk, higher reward; bonds are lower risk, lower reward. Real estate can offer both appreciation and rental income, but it’s less liquid than stocks. Commodities like gold are often seen as a safe haven during economic uncertainty, but their prices can fluctuate wildly. It’s a bit like choosing your adventure – high-risk, high-reward options are thrilling, but safer options offer a more predictable, if less exciting, outcome.

Investment Vehicle Comparison

Investing involves making choices about where to put your money. Understanding the different vehicles available is key to successful investing. Here’s a comparison table (remember, these are generalizations and actual returns and risks can vary):

| Name | Risk Level | Potential Return | Liquidity |

|---|---|---|---|

| Stocks | High | High | High |

| Bonds | Low | Low | Medium |

| Mutual Funds | Medium | Medium | High |

| ETFs | Medium | Medium | High |

Setting Financial Goals and Creating a Budget

Embarking on your investing journey without a roadmap is like sailing the high seas without a compass – exciting, perhaps, but ultimately likely to lead to… well, let’s just say “uncharted waters.” A solid financial plan, anchored by clearly defined goals and a realistic budget, is your essential navigational tool. Think of it as your personal financial treasure map, guiding you towards your financial El Dorado.

Creating a budget might sound as thrilling as watching paint dry, but it’s the bedrock upon which all your financial aspirations are built. A budget isn’t about restriction; it’s about empowerment. It’s about taking control of your money, instead of letting it control you. It allows you to allocate your resources strategically, ensuring you have enough to invest, save, and still enjoy life’s little (and big) luxuries.

Sample Budget Template for Beginners

A simple budget template can be surprisingly effective. It doesn’t need to be overly complex; clarity and consistency are key. Here’s a basic framework:

| Income | Amount |

|---|---|

| Salary/Wages | |

| Other Income (e.g., side hustle) | |

| Total Income | |

| Expenses | Amount |

| Housing (Rent/Mortgage) | |

| Utilities (Electricity, Water, Gas) | |

| Food | |

| Transportation | |

| Debt Payments (Loans, Credit Cards) | |

| Savings & Investments | |

| Entertainment | |

| Other Expenses | |

| Total Expenses | |

| Net Income (Income – Expenses) |

Remember to track your spending diligently. Many budgeting apps can automate this process, making it less of a chore and more of a game.

Importance of Setting Realistic Financial Goals

Setting financial goals, both short-term and long-term, provides focus and motivation. Short-term goals, like saving for a vacation or paying off a credit card, offer quick wins that boost confidence and keep you engaged. Long-term goals, such as buying a house or securing a comfortable retirement, provide a powerful vision to strive towards. Realistic goals are crucial; aiming for the moon might be inspiring, but crashing back to Earth can be disheartening. Start small, celebrate successes, and gradually increase your ambitions. For example, a short-term goal could be saving $1000 in six months for a down payment on a used car, while a long-term goal might be saving $50,000 for a down payment on a house within five years.

Common Budgeting Pitfalls and Solutions

Budgeting isn’t always a smooth ride. Common pitfalls include underestimating expenses (that sneaky latte habit adds up!), impulse purchases (retail therapy is rarely a long-term solution), and a lack of tracking (out of sight, out of mind, but also out of budget!). Solutions include meticulous expense tracking (using apps or spreadsheets), creating a detailed budget that accounts for all expenses, and employing strategies to curb impulse spending, such as the “24-hour rule” (wait a day before making a non-essential purchase).

Step-by-Step Guide on Creating a Personal Financial Plan

Creating a personal financial plan is a journey, not a destination. It involves several key steps:

- Assess your current financial situation: List your assets (savings, investments, property), liabilities (debts, loans), and income.

- Define your financial goals: Set both short-term and long-term goals, ensuring they are specific, measurable, achievable, relevant, and time-bound (SMART goals).

- Create a budget: Track your income and expenses meticulously to understand your spending habits and allocate funds towards your goals.

- Develop an investment strategy: Choose investment vehicles that align with your risk tolerance and financial goals.

- Regularly review and adjust: Your financial situation and goals will evolve over time, so regular review and adjustments are essential.

Common Financial Goals and Suitable Investment Strategies

Different goals require different approaches.

| Financial Goal | Suitable Investment Strategy |

|---|---|

| Short-term: Emergency fund | High-yield savings account, money market account |

| Short-term: Vacation | High-yield savings account |

| Long-term: Retirement | Index funds, ETFs, retirement accounts (401k, IRA) |

| Long-term: Down payment on a house | Index funds, bonds, real estate investment trusts (REITs) |

| Long-term: Children’s education | 529 plans, education savings accounts |

Remember, this is just a starting point. Professional financial advice can be invaluable in tailoring a plan to your unique circumstances.

Risk Tolerance and Investment Strategies

Embarking on your investing journey is like choosing a rollercoaster – some prefer the gentle dips, others crave the stomach-churning drops. Understanding your risk tolerance is crucial to selecting investments that align with your comfort level and financial goals. Ignoring this crucial step could lead to sleepless nights (and possibly a depleted portfolio).

Risk Tolerance Levels and Investment Implications

Your risk tolerance reflects your capacity to withstand potential investment losses. A high risk tolerance means you’re comfortable with the possibility of significant fluctuations in your investment value, while a low tolerance means you prioritize capital preservation above all else. This directly influences your investment choices. High-risk investments, like individual stocks or cryptocurrency, offer the potential for higher returns but also carry a greater chance of losses. Conversely, low-risk investments, such as government bonds, offer stability but typically yield lower returns. Finding the sweet spot depends entirely on your personality and financial situation.

Conservative, Moderate, and Aggressive Investment Strategies

Conservative strategies focus on minimizing risk. Think of this as the “slow and steady wins the race” approach. These strategies typically involve investments like government bonds, high-yield savings accounts, and certificates of deposit (CDs). Moderate strategies aim for a balance between risk and return. This involves a diversified portfolio including a mix of bonds, stocks, and possibly real estate. Aggressive strategies prioritize high growth potential, even if it means accepting higher risk. These often include a significant allocation to stocks, including potentially more volatile growth stocks and emerging market investments. Imagine this as the “fast and furious” option, potentially rewarding but also with a greater chance of a bumpy ride.

Asset Allocation and Risk Management

Asset allocation is the art (and science!) of spreading your investments across different asset classes – stocks, bonds, real estate, etc. It’s like diversifying your eggs across multiple baskets, reducing the impact of any single investment’s underperformance. A well-diversified portfolio, tailored to your risk tolerance, is a cornerstone of effective risk management. For instance, a conservative investor might allocate a larger percentage to bonds, while an aggressive investor might favour a higher stock allocation. The key is to strategically distribute your capital to achieve your desired risk-return profile.

Examples of Investments Across Risk Levels

Low-risk investments offer relative stability and capital preservation. Examples include government bonds (considered very low-risk), high-yield savings accounts, and money market accounts. Medium-risk investments provide a balance between risk and return. Examples include diversified mutual funds, index funds, and some corporate bonds. High-risk investments offer the potential for significant returns but come with substantial volatility. Examples include individual stocks (especially small-cap stocks), options, and cryptocurrency. Remember, past performance is not indicative of future results – even high-risk investments can lose money.

Investment Strategies, Risk Levels, and Potential Returns

| Investment Strategy | Risk Level | Potential Return | Example Investments |

|---|---|---|---|

| Conservative | Low | Low | Government bonds, high-yield savings accounts, CDs |

| Moderate | Medium | Medium | Diversified mutual funds, index funds, some corporate bonds |

| Aggressive | High | High (but with higher potential for loss) | Individual stocks, options, cryptocurrency |

Opening an Investment Account and Getting Started

Embarking on your investment journey is like setting sail on a financial treasure map – exciting, potentially lucrative, and requiring a bit of preparation. Before you can hunt for buried riches (or, you know, decent returns), you’ll need a sturdy ship: a brokerage account.

Opening a brokerage account is surprisingly straightforward, much like ordering a pizza online (but with potentially far greater long-term rewards). It involves providing personal information, answering a few questions about your investment experience and goals (don’t worry, you don’t need to be a Wall Street whiz), and choosing the type of account that best suits your needs. Think of it as selecting your pizza toppings – the right choice can significantly enhance your overall experience.

Brokerage Account Types

Choosing the right brokerage account is crucial, like picking the perfect pair of running shoes for a marathon – the wrong choice can lead to discomfort (or, in this case, tax penalties). Two popular options are traditional and Roth IRAs. A traditional IRA offers tax deductions on contributions now, but you’ll pay taxes on withdrawals in retirement. A Roth IRA, on the other hand, means you contribute after-tax dollars, but withdrawals in retirement are tax-free. It’s a matter of choosing your tax strategy, present versus future. Consider your current tax bracket and your anticipated tax bracket in retirement to make the best choice for your situation. Other account types, like taxable brokerage accounts, offer more flexibility but lack the tax advantages of IRAs.

Making Your First Investment

Once your account is open and funded (think of it as stocking your ship with supplies before setting sail), you’re ready for the exciting part: making your first investment! This involves researching potential investments, carefully considering your risk tolerance, and placing an order through your brokerage platform. Don’t rush into this; thorough research is key.

Researching and Selecting Investments

Researching investments is like meticulously planning a road trip – you wouldn’t just hop in your car and drive without a map, would you? Begin by identifying your investment goals (short-term or long-term), understanding your risk tolerance, and exploring different asset classes (stocks, bonds, mutual funds, etc.). Consult reliable sources like financial news websites, company reports, and potentially a financial advisor for guidance. Diversification is key; don’t put all your eggs in one basket. Imagine having a portfolio as diverse as a well-stocked pantry – it ensures you have options, no matter the market conditions.

Placing a Buy or Sell Order

Let’s say, after careful research, you decide to invest in a hypothetical company called “Fantastic Widgets Inc.” (ticker symbol: FWI). Through your brokerage platform, you’ll place a “buy” order, specifying the number of shares you want to purchase and the order type (market order, limit order, etc.). A market order executes at the current market price, while a limit order specifies a maximum price you’re willing to pay. Similarly, if you decide to sell your FWI shares later, you’ll place a “sell” order, again specifying the number of shares and the order type. This process is usually quite intuitive and guided by the platform’s interface. For example, if you wanted to buy 100 shares of FWI at the market price, you would simply enter the ticker symbol, the quantity (100), and select “market order.” The order will then be processed, and your investment journey continues!

Monitoring and Managing Your Investments

Investing isn’t a “set it and forget it” kind of affair; it’s more like tending a slightly temperamental garden. Regular monitoring is crucial to ensure your financial blossoms are thriving, not wilting under the weight of unforeseen market squalls. Think of it as proactive financial gardening – much less stressful than discovering your entire portfolio has turned into a patch of weeds!

Regularly reviewing your investment portfolio is akin to checking your garden for pests and diseases. Ignoring it can lead to significant losses and missed opportunities. By staying informed, you can identify potential problems early on and make adjustments to keep your investments growing healthily. This proactive approach will help you avoid the panic-stricken reactions that often accompany unexpected market downturns.

Portfolio Monitoring Frequency

The ideal frequency depends on your investment strategy and risk tolerance. For a long-term, buy-and-hold strategy, quarterly reviews might suffice. However, more active investors might prefer monthly or even weekly checks, particularly in volatile market conditions. Imagine checking your garden daily during a particularly harsh drought; the same principle applies to your investments during market uncertainty. Consistent monitoring allows for timely adjustments.

Managing Investments During Market Fluctuations

Market fluctuations are inevitable; they’re the exciting rollercoaster rides of the financial world. However, successful investors don’t let these ups and downs dictate their emotional responses. Instead, they prepare for them. A well-defined investment strategy, coupled with a realistic understanding of your risk tolerance, forms the bedrock of your resilience. During market dips, resist the urge to panic-sell. Remember that temporary setbacks are often opportunities to buy low.

Portfolio Rebalancing Strategies

Rebalancing involves adjusting your asset allocation to maintain your desired risk level. Let’s say your portfolio is 60% stocks and 40% bonds, but due to market gains, it’s now 70% stocks and 30% bonds. Rebalancing would involve selling some stocks and buying more bonds to return to your target allocation. This helps you avoid becoming overly exposed to any single asset class, and is like pruning your garden to ensure balanced growth. Consider a scenario where a particular stock performs exceptionally well, exceeding your initial investment goal. Rebalancing allows you to take profits and reinvest in other areas, promoting diversified growth.

Staying Disciplined and Avoiding Emotional Decisions

Investing successfully requires emotional detachment. Market volatility can trigger fear and greed, leading to impulsive decisions. A pre-defined investment plan, regularly reviewed but rarely altered based on short-term market noise, acts as your emotional compass, preventing rash actions. Remember, successful investing is a marathon, not a sprint. Imagine a farmer who plants crops and patiently waits for harvest; this is the mindset needed for long-term success.

Investment Review Checklist

To maintain a disciplined approach, consider this checklist for regular portfolio reviews:

| Item | Frequency | Action |

|---|---|---|

| Review asset allocation | Quarterly | Compare current allocation to target allocation. Rebalance if necessary. |

| Check investment performance | Monthly | Analyze returns and compare to benchmarks. |

| Assess risk exposure | Annually | Review your risk tolerance and adjust your portfolio accordingly. |

| Review transaction costs | Annually | Identify areas where you can reduce fees. |

| Monitor economic indicators | Quarterly | Stay informed about market trends and potential risks. |

Resources and Further Learning

Embarking on your investing journey is like setting sail on a vast ocean – exciting, potentially lucrative, and occasionally a bit terrifying. But fear not, intrepid investor! Just as a seasoned captain needs navigational charts, you need reliable resources to guide your financial voyage. This section will equip you with the tools and knowledge to continue your learning and navigate the sometimes-choppy waters of the investment world. We’ll steer clear of the financial equivalent of pirate maps, focusing only on reputable and trustworthy sources.

The world of finance can feel like a dense jungle, but with the right resources, you can confidently navigate its complexities. Remember, continuous learning is key to successful investing. The market is dynamic, and staying informed is crucial to making sound decisions. This section will illuminate the path to becoming a more informed and savvy investor.

Reputable Financial Websites and Educational Resources

Several websites offer valuable, free information for beginner investors. These resources often provide educational materials, market analysis, and tools to help you manage your investments. Choosing reputable sources is paramount; avoid sites promising unrealistic returns or employing aggressive marketing tactics. Look for sites with transparent methodologies and a focus on education rather than sales. A good website will prioritize clear explanations over jargon-filled technicalities.

- Investopedia: A comprehensive resource with articles, tutorials, and a glossary of financial terms. Think of it as the Wikipedia of finance, but (hopefully) with fewer edit wars.

- The Motley Fool: Offers investment advice, stock analysis, and educational content. They’re known for their slightly irreverent and engaging approach to finance.

- Khan Academy: Provides free courses on various financial topics, including investing basics. It’s a great place to solidify fundamental concepts.

Benefits of Seeking Advice from a Financial Advisor

While self-directed investing is possible, a financial advisor can provide personalized guidance and support tailored to your specific financial situation and goals. They can help you develop a comprehensive financial plan, diversify your investments, and navigate complex financial decisions. Think of them as your personal financial Sherpa, guiding you through the sometimes treacherous terrain of the investment world. However, it’s crucial to find a qualified and fee-transparent advisor.

Identifying Credible Sources of Financial Information

Navigating the sea of financial information requires a discerning eye. Not all advice is created equal. Beware of sources promoting get-rich-quick schemes or those that lack transparency about their methodologies or potential conflicts of interest. Look for sources that cite their data and research, and that avoid making overly optimistic or unrealistic promises. Remember, if something sounds too good to be true, it probably is.

Importance of Continuous Learning in Investing

The financial landscape is constantly evolving. New investment vehicles emerge, regulations change, and market conditions shift. Continuous learning ensures you stay ahead of the curve and make informed decisions. This includes staying updated on market trends, economic news, and changes in investment strategies. It’s a marathon, not a sprint, so consistent effort is rewarded.

Books and Online Courses for Beginner Investors

Several excellent resources cater specifically to beginner investors. These resources offer a structured approach to learning, providing a solid foundation in investing principles and practices.

- “The Intelligent Investor” by Benjamin Graham: A classic text that emphasizes value investing and long-term strategies.

- “A Random Walk Down Wall Street” by Burton Malkiel: Explores market efficiency and the importance of diversification.

- Coursera and edX: Offer various online courses on finance and investing, often taught by renowned professors from leading universities.

Understanding Compound Interest: Investing For Beginners Guide

Ah, compound interest. The magic money machine that whispers sweet nothings of wealth into your ear…if you let it. It’s the eighth wonder of the world, and frankly, far more exciting than the pyramids (unless you’re really into ancient Egyptian architecture, in which case, more power to you). This isn’t just about earning interest on your initial investment; it’s about earning interest on your interest, creating a snowball effect that grows exponentially over time. Think of it as a financial avalanche, but instead of destruction, it brings riches!

Compound interest is the interest you earn on both your principal (the original amount you invested) and the accumulated interest from previous periods. Unlike simple interest, which only calculates interest on the principal, compound interest reinvests the earned interest, allowing it to generate even more interest in subsequent periods. This snowball effect is what makes compound interest so powerful, especially over the long term.

Compound Interest Calculation, Investing for Beginners Guide

Let’s say you invest $1,000 at an annual interest rate of 7%, compounded annually. After the first year, you’ll earn $70 in interest ($1,000 x 0.07 = $70), bringing your total to $1,070. In the second year, you’ll earn interest not just on the original $1,000, but on the $1,070. This means you’ll earn $74.90 in interest ($1,070 x 0.07 = $74.90), resulting in a total of $1,144.90. See how the interest earned each year increases? That’s the magic of compounding! This continues year after year, with the interest earned each year adding to the principal, resulting in ever-increasing returns.

Strategies to Maximize Compound Interest

To truly harness the power of compound interest, consider these strategies:

The longer you leave your money invested, the more time it has to grow through compounding. Early investment is key; think of it as giving your money a head start in the marathon of wealth creation.

- Invest Early and Often: The earlier you start investing, the more time your money has to compound. Even small, regular contributions can make a big difference over the long term.

- Choose Investments with Higher Returns: While higher returns come with higher risk, seeking investments with a reasonably higher return (after adjusting for risk) can significantly boost your compound interest gains.

- Minimize Fees and Taxes: High fees and taxes can eat into your returns, reducing the power of compounding. Look for low-cost investment options and tax-advantaged accounts.

- Reinvest Your Earnings: The key to compound interest is reinvesting your earnings. Don’t withdraw your interest; let it work for you.

Visual Representation of Compound Interest

Imagine a steadily growing ball of snow rolling downhill. It starts small, but as it rolls, it gathers more snow, growing larger and larger at an accelerating rate. This visual represents the power of compound interest over time. The initial investment is the small snowball, and each year’s interest is the additional snow it gathers. The steeper the hill (higher interest rate), the faster the snowball grows. The longer the hill (longer investment period), the larger the snowball becomes at the bottom.

The Importance of Early Investment

Starting early allows the power of compounding to work its magic for a longer period. Consider two individuals: one starts investing at age 25 and the other at age 45. Even if they invest the same amount each year and achieve the same annual return, the individual who started at 25 will accumulate significantly more wealth by retirement due to the additional years of compounding. This difference can be substantial, highlighting the importance of starting early. It’s like giving your money a 20-year head start in a race. It’s a huge advantage.

Concluding Remarks

So, there you have it – a crash course in navigating the world of investing. Remember, investing is a marathon, not a sprint. It’s about making informed decisions, staying disciplined, and understanding that the journey itself is as rewarding as the destination. While we’ve covered a lot of ground, remember that continuous learning is key. Stay curious, keep learning, and most importantly, have fun building your financial empire, one well-placed investment at a time! Now go forth and conquer those financial goals!

Popular Questions

What’s the difference between a Roth IRA and a Traditional IRA?

A Roth IRA offers tax-free withdrawals in retirement, while contributions are made after tax. A Traditional IRA offers tax-deductible contributions, but withdrawals are taxed in retirement. The best choice depends on your individual tax situation and predictions about future tax rates.

How much money should I invest as a beginner?

Start small! The key is consistency, not the initial amount. Begin with an amount you’re comfortable with and gradually increase your investments as your income and confidence grow. Even small, regular contributions can make a big difference over time thanks to the magic of compound interest.

What if the market crashes? Should I panic and sell everything?

Resist the urge to panic! Market fluctuations are normal. A long-term investment strategy helps weather these storms. Consider your risk tolerance and rebalance your portfolio if necessary, but avoid rash decisions based on short-term market volatility.

Where can I find reliable financial advice?

Reputable sources include fee-only financial advisors (who don’t earn commissions from selling products), government websites (like the SEC), and well-established financial education organizations. Always be wary of get-rich-quick schemes and promises of guaranteed returns.