Investment Analysis Software: Forget spreadsheets and cryptic formulas! This isn’t your grandpappy’s portfolio management. We’re diving headfirst into the thrilling world of software designed to make your investments sing (and hopefully not cry). From individual investors nervously eyeing their 401ks to institutional giants managing billions, everyone needs a helping hand (or a helpful algorithm) to navigate the wild west of finance. Prepare for a journey through the features, functionalities, and frankly, the sheer fun of optimizing your financial future.

This exploration will cover everything from data input and management (because even the most sophisticated software needs clean data) to financial modeling and valuation (where the magic happens). We’ll also tackle risk assessment, portfolio management, reporting, and the crucial aspect of integrating with other systems. Think of this as your personal guide to navigating the complex world of investment software, ensuring you’re not just investing your money, but also your time wisely.

Defining Investment Analysis Software

Investment analysis software: the digital Swiss Army knife for your portfolio! It’s a powerful tool that helps you navigate the often-bewildering world of finance, transforming raw data into actionable insights. Think of it as your personal financial Sherpa, guiding you towards (hopefully) wealthier peaks.

Investment analysis software typically offers a core set of functionalities designed to help investors make informed decisions. These usually include portfolio tracking, performance analysis, risk assessment, and financial modeling capabilities. Beyond the basics, however, the specific features and sophistication vary wildly, catering to the needs of different user profiles.

Types of Investment Analysis Software by User Type

The software landscape is diverse, mirroring the varied needs of individual investors, financial advisors, and institutional investors. Individual investors might use simpler, more user-friendly programs focused on portfolio tracking and basic analysis, while financial advisors often require more advanced features for managing multiple client portfolios and generating reports. Institutional investors, on the other hand, need highly specialized software capable of handling massive datasets and complex investment strategies.

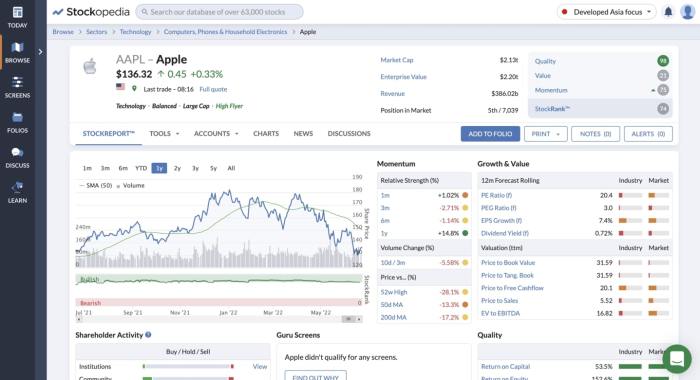

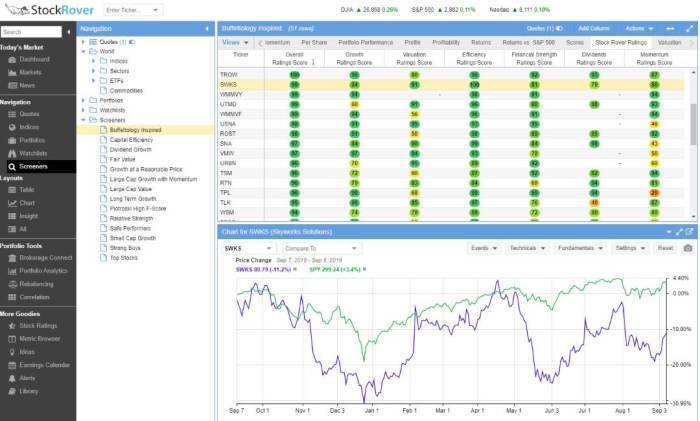

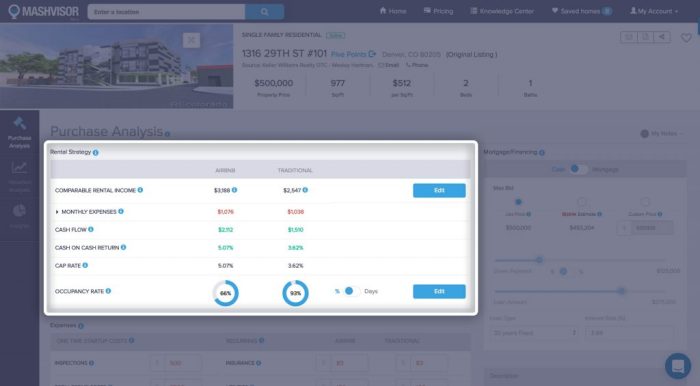

Key Differentiating Features of Investment Analysis Software

Several key features differentiate investment analysis software packages. These include the types of assets supported (stocks, bonds, mutual funds, real estate, etc.), the level of analytical sophistication (basic charting vs. advanced statistical modeling), the reporting capabilities (simple summaries vs. detailed performance reports), and the integration with other financial platforms (brokerage accounts, tax software). The user interface and overall ease of use are also crucial considerations, especially for less tech-savvy users. Some software may offer advanced features like algorithmic trading, backtesting capabilities, and options analysis – features rarely needed by the average investor, but critical for professionals.

Comparison of Investment Analysis Software Packages

Below is a comparison of three popular investment analysis software packages. Remember, the “best” software depends entirely on your individual needs and investment style. Don’t just pick the flashiest; pick the one that best fits your workflow.

| Software | Strengths | Weaknesses | Best Suited For |

|---|---|---|---|

| Software A (e.g., a hypothetical robust platform) | Advanced analytics, robust reporting, excellent customer support | Steep learning curve, expensive | Institutional investors, sophisticated individual investors |

| Software B (e.g., a user-friendly option) | Intuitive interface, affordable, good for beginners | Limited analytical capabilities, fewer asset types supported | Individual investors, small financial advisors |

| Software C (e.g., a platform with strong community support) | Strong community support, extensive online resources, moderate price | Moderate analytical capabilities, can be less intuitive than others | Individual investors, those who value community support |

Data Input and Management

Feeding your investment analysis software the right data is like giving a gourmet chef the finest ingredients – the outcome depends entirely on the quality of the input. Without meticulously managed data, even the most sophisticated software will produce results as reliable as a magic eight ball. This section dives into the crucial aspects of data input and management, transforming your raw financial figures into a feast for your analytical prowess.

Investment analysis software thrives on data, and the sources are as varied as the investment strategies themselves. From the meticulously curated databases of Bloomberg Terminal to the freely available data from government agencies like the SEC (Securities and Exchange Commission) and the Federal Reserve, the options are plentiful. Many software packages also allow for direct connections to brokerage accounts, providing a seamless stream of real-time portfolio data. Think of it as having your own personal financial data butler, tirelessly collecting information while you focus on the more important things, like deciding whether to invest in artisanal cheese futures.

Data Sources Used by Investment Analysis Software

The diversity of data sources reflects the multifaceted nature of investment analysis. Reliable data sources include financial news providers like Reuters and Bloomberg, government agencies (SEC’s EDGAR database for company filings, for example), and dedicated financial data providers such as FactSet and Refinitiv. Direct connections to brokerage accounts are also increasingly common, allowing for real-time portfolio updates. Finally, many software packages allow users to import data from custom spreadsheets or databases, catering to the needs of individual investors with unique data requirements. This variety allows for comprehensive analysis encompassing various asset classes and market conditions.

Importing and Cleaning Financial Data

Importing data is usually a straightforward process, often involving simple drag-and-drop functionality or a dedicated import wizard. However, the real challenge lies in data cleaning. This crucial step involves identifying and correcting errors, inconsistencies, and missing values. Imagine trying to bake a cake with some ingredients missing or incorrectly measured – the result would be a culinary disaster. Similarly, flawed data can lead to inaccurate investment decisions. Most software packages offer built-in data cleaning tools, such as functions to handle missing values, remove duplicates, and standardize data formats. Regular checks for data integrity are paramount to ensure the reliability of any analysis conducted.

Managing and Organizing Large Datasets

Managing large datasets requires a strategic approach. Think of it as organizing a massive library – without a system, finding the right book (or data point) can become an insurmountable task. Effective organization relies on clear naming conventions for files and folders, consistent data formats, and the use of software features like tagging and filtering. Regular data backups are also crucial to prevent data loss, a scenario that could leave you with nothing but a lingering sense of regret and a hefty repair bill.

Importing Data from a CSV File

Let’s assume we’re using a hypothetical investment analysis software called “InvestPro 2000.” The following steps illustrate the typical process of importing a CSV file containing stock prices:

- Open InvestPro 2000: Launch the software and navigate to the data import module.

- Select CSV Import: Choose the “Import from CSV” option from the available import methods.

- Locate File: Browse your computer to find the CSV file containing your stock price data. Ensure the file is correctly formatted with a header row containing column names like “Date,” “Symbol,” “Open,” “High,” “Low,” “Close,” and “Volume.”

- Data Preview and Mapping: InvestPro 2000 will display a preview of the data. Verify that the column headers are correctly mapped to the corresponding data fields within the software. Adjust mappings if necessary.

- Import Data: Initiate the import process. InvestPro 2000 will then import and process the data. A progress bar will indicate the import status.

- Data Validation: Once the import is complete, review the imported data for any errors or inconsistencies. InvestPro 2000 might offer built-in validation tools to detect and flag potential problems.

Financial Modeling and Valuation

Predicting the future is a fool’s errand, unless you’re using sophisticated investment analysis software. Then, it’s just a slightly less foolish errand. This section dives into the heart of the matter: financial modeling and valuation, where we transform hazy crystal balls into (relatively) clear spreadsheets. We’ll explore how these tools help us wrestle with the unpredictable nature of markets and make informed investment decisions, even if those decisions occasionally lead to a mild case of “what ifs.”

Investment analysis software offers a range of financial modeling techniques to project a company’s future performance. These models are not magic; they’re based on assumptions and historical data, and the quality of the output depends heavily on the quality of the input. Think of it as baking a cake: even the best recipe can’t save you from using stale ingredients.

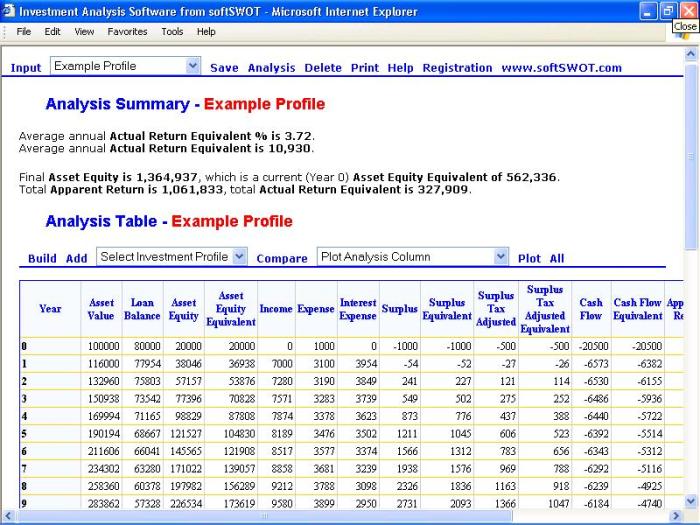

Discounted Cash Flow (DCF) Analysis Implementation

DCF analysis, the cornerstone of many valuation approaches, estimates the value of an investment based on its expected future cash flows, discounted back to their present value. The software typically guides users through the process, requiring inputs such as projected revenue, expenses, capital expenditures, and the discount rate (which reflects the risk associated with the investment). For example, let’s imagine a hypothetical tech startup, “Innovate-or-Die Inc.” The software might prompt you to input projected revenue growth of 20% annually for the next five years, then declining to a more sustainable 5% thereafter. Operating expenses are estimated as a percentage of revenue, and capital expenditures are projected based on anticipated expansion plans. The discount rate, reflecting the inherent risk in a tech startup, might be set at 15%. The software then calculates the present value of these future cash flows, providing an estimated intrinsic value for Innovate-or-Die Inc. This calculation would be displayed in a clear, user-friendly format, likely with sensitivity analysis options to show how the valuation changes with variations in key assumptions. A critical aspect of this process within the software is the ability to easily adjust these variables and observe the immediate impact on the final valuation. This allows for robust “what-if” scenario planning.

Valuation Method Comparison

Investment analysis software typically offers a variety of valuation methods beyond DCF, such as relative valuation (comparing a company’s metrics to those of its peers), asset-based valuation (estimating the value of a company’s assets), and precedent transactions (analyzing the prices paid for similar companies in past acquisitions). The software might provide a comparative analysis of these different methods, highlighting their strengths and weaknesses for a particular investment. For instance, while DCF analysis is theoretically sound, it heavily relies on future projections, which can be quite uncertain. Relative valuation, on the other hand, provides a market-based perspective, but is sensitive to market sentiment and comparable company selection. Asset-based valuation is more suitable for companies with significant tangible assets, while precedent transactions are best suited when there is a readily available history of comparable acquisitions. The software’s comparative tools help users understand the limitations and applicability of each method, allowing for a more comprehensive and nuanced valuation.

Building a Simple Financial Model for a Hypothetical Company

Let’s say we’re using a fictional software called “Crystal Ball Pro Max 5000” (with optional diamond-encrusted mouse). To build a simple financial model for “Widget Wonders,” a hypothetical widget manufacturer, we’d start by inputting historical financial statements (income statement, balance sheet, cash flow statement). The software might automatically populate some fields based on historical trends, but we’d still need to make key assumptions about future growth, expenses, and capital expenditures. For example, we might project a 10% annual revenue growth for the next three years, based on market research and Widget Wonders’ recent performance. Operating margins are estimated based on historical data and industry benchmarks. Capital expenditures are projected based on planned investments in new machinery. Once these inputs are entered, Crystal Ball Pro Max 5000 would automatically generate projected financial statements for the next several years, along with key performance indicators (KPIs) such as return on equity (ROE) and return on assets (ROA). The software would also facilitate the creation of a DCF model, using the projected cash flows to estimate Widget Wonders’ intrinsic value. The entire process, from data input to valuation, is streamlined and visually intuitive, thanks to Crystal Ball Pro Max 5000’s user-friendly interface (and optional diamond-encrusted mouse). Sensitivity analysis tools would allow users to easily test the impact of different assumptions on the final valuation, adding another layer of robustness to the analysis. Remember, even the best software can’t replace sound judgment.

Risk Assessment and Portfolio Management: Investment Analysis Software

Investing is a thrilling rollercoaster; one minute you’re soaring high, the next you’re plummeting faster than a lead balloon. Smart investors, however, don’t rely on sheer luck. They harness the power of risk assessment and portfolio management, using sophisticated software to navigate the financial wilderness. This section delves into the vital tools and techniques that transform investment decisions from gut feelings into informed strategies.

Investment analysis software provides a robust toolkit for navigating the inherent uncertainties of the market. By incorporating various risk metrics and employing sophisticated optimization techniques, these tools empower investors to make well-informed decisions, aiming for maximum returns while keeping a watchful eye on potential pitfalls. Let’s explore the key features.

Common Risk Metrics

Investment analysis software typically calculates a range of risk metrics to provide a comprehensive picture of an investment’s volatility. These metrics offer a quantitative assessment of the potential for losses, allowing investors to compare different assets and make informed choices. For instance, standard deviation measures the dispersion of returns around the average, with higher standard deviation indicating greater risk. Beta, on the other hand, measures the volatility of an asset relative to the overall market. A beta of 1 indicates that the asset’s price will move with the market, while a beta greater than 1 suggests higher volatility than the market. Value at Risk (VaR) estimates the potential loss in value over a specific time period with a given confidence level, providing a crucial measure of downside risk. Sharpe ratio, a popular metric, measures risk-adjusted return, considering the excess return relative to the risk-free rate divided by the standard deviation of returns. A higher Sharpe ratio indicates better risk-adjusted performance.

Portfolio Optimization and Diversification Methods

Diversification is the age-old investment mantra: “Don’t put all your eggs in one basket!” Software facilitates this by employing sophisticated optimization techniques to construct diversified portfolios. Modern Portfolio Theory (MPT) forms the foundation of many portfolio optimization strategies. MPT aims to construct a portfolio that maximizes returns for a given level of risk, or minimizes risk for a given level of return. This is often achieved through mean-variance optimization, which considers the expected return and variance (risk) of each asset. Software packages often use advanced algorithms to solve these optimization problems, considering constraints such as asset allocation limits or specific investment goals. Other methods, such as efficient frontier analysis, graphically represent the optimal portfolios, highlighting the trade-off between risk and return.

Scenario and Sensitivity Analysis

Predicting the future is a fool’s errand, but understanding potential outcomes is a wise investor’s game. Scenario analysis involves simulating different market conditions (e.g., economic recession, bull market) and assessing the impact on the portfolio’s performance. This allows investors to gauge the resilience of their portfolio under various circumstances. Sensitivity analysis, on the other hand, examines the impact of changes in individual input variables (e.g., interest rates, inflation) on the portfolio’s overall performance. By systematically altering these variables, investors can identify the most influential factors and adjust their strategy accordingly. For example, a sensitivity analysis might reveal that a portfolio’s performance is highly sensitive to changes in interest rates, prompting investors to adjust their bond holdings.

Portfolio Allocation Strategy Example

Let’s imagine a hypothetical investor with $100,000 to allocate across three asset classes: Stocks (high growth, high risk), Bonds (moderate growth, low risk), and Real Estate (moderate growth, moderate risk). A balanced approach might involve allocating 50% to Stocks (representing growth potential and diversification across different sectors like technology and consumer goods), 30% to Bonds (providing stability and income), and 20% to Real Estate (offering diversification and potential for long-term appreciation). The rationale is to strike a balance between risk and return, leveraging the potential upside of stocks while mitigating risk with bonds and real estate. This allocation could be further refined by considering individual stock selection within the equity portion, ensuring geographic and sector diversification. The specific allocation would depend on the investor’s risk tolerance, time horizon, and financial goals. This is merely an illustration; a comprehensive analysis using investment analysis software would provide a more nuanced and personalized strategy.

Reporting and Visualization

Investment analysis software isn’t just about crunching numbers; it’s about presenting those numbers in a way that doesn’t induce immediate narcolepsy. Effective reporting and visualization are crucial for turning raw data into actionable insights, transforming you from a number-crunching automaton into a financial forecasting maestro (or at least, a slightly more confident one). Think of it as the difference between a spreadsheet full of indecipherable figures and a compelling narrative that even your grandma could understand (assuming Grandma’s got a knack for finance, of course).

The power of effective reporting lies in its ability to distill complex financial information into easily digestible formats, allowing investors to quickly grasp key trends and make informed decisions. This isn’t about burying the reader in a blizzard of data; it’s about presenting the most crucial information clearly and concisely. We’re talking about transforming data into a compelling story, a financial fairy tale with a happy ending (hopefully).

Types of Reports Generated

Investment analysis software typically generates a variety of reports tailored to different needs. These can range from simple summary reports showcasing key performance indicators (KPIs) to comprehensive portfolio analyses detailing asset allocation, risk profiles, and projected returns. More sophisticated software might even offer customized report templates, allowing users to tailor the output to their specific requirements. Imagine the possibilities! You could even create a report that sings your investment strategy to the tune of your favorite polka. (Okay, maybe not that last part.) But seriously, the flexibility is impressive. Consider these common report types: performance summaries, portfolio valuations, risk assessments, and sensitivity analyses. Each offers a unique perspective on investment performance and potential.

Effective Data Visualization Techniques

A picture is worth a thousand words, and in the world of investment analysis, this adage rings truer than ever. Effective data visualization transforms complex numerical data into easily understandable charts and graphs, highlighting key trends and patterns that might otherwise go unnoticed. Instead of drowning in spreadsheets, imagine clear, concise visuals. Let’s explore some techniques:

- Line charts are perfect for showcasing trends over time, such as the growth of an investment portfolio or the fluctuation of a specific stock’s price. Think of it as a visual timeline of your investment’s journey.

- Bar charts excel at comparing different data points, such as the performance of various asset classes within a portfolio. Imagine easily comparing the returns of stocks versus bonds.

- Pie charts effectively illustrate the proportion of different components within a whole, such as the asset allocation of an investment portfolio. It’s like a delicious financial pie, showing you exactly how your assets are sliced up.

- Scatter plots reveal correlations between two variables, such as risk and return. See how your investment’s risk level affects its potential return, all in one glance.

- Heatmaps can visually represent large datasets, identifying areas of high or low concentration. Imagine seeing your portfolio’s performance at a glance, with different asset classes highlighted based on their performance.

These are just a few examples; the best visualization technique depends on the specific data and the message you’re trying to convey. The key is clarity and conciseness – avoid overwhelming the reader with too much information at once.

Best Practices for Creating Clear and Concise Investment Reports

Creating effective investment reports is an art form. It’s about telling a story with data, not just presenting a list of numbers. Here are some key best practices:

- Know your audience: Tailor the report’s complexity and level of detail to the reader’s knowledge and understanding. A report for seasoned investors will differ greatly from one intended for novice investors.

- Use clear and concise language: Avoid jargon and technical terms that the reader might not understand. Think plain English, not financial hieroglyphics.

- Focus on key findings: Highlight the most important information and avoid overwhelming the reader with unnecessary details. Think highlights, not a wall of text.

- Use visuals effectively: Charts and graphs can make complex data much easier to understand. But don’t overdo it – use visuals strategically to support your narrative.

- Proofread carefully: Errors in grammar and spelling can undermine the credibility of your report. Double-check everything before sending it out.

Sample Investment Report: Analysis of “GreenThumb Gardening Co.”

This report summarizes the analysis of a potential investment in GreenThumb Gardening Co., a company specializing in sustainable gardening products.

- Investment Thesis: GreenThumb offers significant growth potential due to increasing consumer demand for eco-friendly products and a strong management team with a proven track record.

- Valuation: Based on a discounted cash flow analysis, the intrinsic value of GreenThumb is estimated at $25 per share, representing a 20% upside from the current market price of $20.80.

- Risk Assessment: The primary risks include competition from established players and potential fluctuations in raw material costs. However, GreenThumb’s strong brand recognition and diversified supply chain mitigate these risks to a considerable degree.

- Recommendation: Based on our analysis, we recommend a “Buy” rating for GreenThumb Gardening Co. The company’s strong fundamentals, growth prospects, and reasonable valuation make it an attractive investment opportunity.

Integration with Other Systems

Imagine your investment analysis software as a highly caffeinated, incredibly efficient financial ninja. But even ninjas need backup. Integration with other systems is the secret weapon that transforms this already powerful tool into a true force of nature, allowing for a seamless flow of data and a more holistic view of your financial landscape. This section will explore the exciting possibilities and the occasional, predictable pitfalls of connecting your investment analysis software to other financial platforms.

The benefits of integrating your investment analysis software with other systems are numerous and, frankly, quite delightful. Imagine the time saved by automatically importing transaction data from your accounting software, eliminating the tedious and error-prone manual entry process. This not only boosts efficiency but also reduces the risk of human error, ensuring the accuracy of your analyses and, ultimately, your investment decisions. Furthermore, integration facilitates a more comprehensive view of your financial situation, connecting your investment portfolio with your overall financial plan, allowing for a more informed and strategically sound approach to wealth management. However, the path to seamless integration is not always paved with gold. Challenges can arise from differing data formats, software compatibility issues, and the potential need for custom development. Choosing the right integration strategy requires careful consideration and planning.

Data Exchange Formats for Interoperability, Investment Analysis Software

Data exchange between different software systems relies on various formats to ensure compatibility. Common formats include CSV (Comma Separated Values), a simple and widely used text-based format; XML (Extensible Markup Language), a more structured format offering greater flexibility and metadata capabilities; and JSON (JavaScript Object Notation), a lightweight format popular for web-based applications. The choice of format often depends on the specific software involved and the complexity of the data being exchanged. For example, a simple transfer of transaction data might utilize CSV, while a more complex integration involving multiple data types might benefit from the flexibility of XML or JSON. Choosing the right format is crucial for smooth data transfer and avoiding costly data conversion headaches.

Potential Integrations and Their Advantages

The possibilities for integration are as vast as the universe (well, almost). Below is a list of potential integrations, showcasing their functionalities and the advantages they bring to the table.

- Accounting Software (e.g., QuickBooks, Xero): Automatic import of transaction data, eliminating manual entry and minimizing errors. This streamlines the process of updating your investment portfolio and allows for a more accurate reflection of your financial position. The advantage? More time for important things, like celebrating successful investments (or strategizing after a minor setback).

- Financial Planning Software (e.g., MoneyGuidePro, RightCapital): A unified view of your entire financial picture, connecting your investments with your overall financial goals and projections. This allows for more informed and strategic financial planning, ensuring your investments align with your broader objectives. Think of it as a financial orchestra, where every instrument (software) plays its part in harmony.

- CRM (Customer Relationship Management) Systems (e.g., Salesforce, HubSpot): For financial advisors, integration with CRM systems allows for better client management and personalized investment recommendations. Tracking client interactions and portfolio performance within a single system enhances efficiency and improves client service. It’s like having a super-powered Rolodex that never forgets a face (or a portfolio).

Security and Compliance

Protecting your financial future shouldn’t involve a thrilling game of digital hide-and-seek with malicious actors. Investment analysis software, being the digital custodian of your potentially life-changing financial data, demands robust security measures and unwavering compliance with relevant regulations. This section delves into the crucial aspects of safeguarding your data and ensuring your software operates within the legal framework.

Investing in secure software is not just about protecting your bottom line; it’s about protecting your peace of mind. Data breaches can lead to significant financial losses, reputational damage, and legal repercussions. Compliance with regulatory requirements is not merely a box to tick; it’s a demonstration of your commitment to responsible financial management and adherence to best practices.

Key Security Considerations for Investment Analysis Software

Security for investment analysis software requires a multi-layered approach. This includes strong authentication mechanisms, such as multi-factor authentication (MFA), to prevent unauthorized access. Regular security audits and penetration testing are essential to identify and address vulnerabilities before malicious actors can exploit them. Furthermore, robust encryption protocols should protect data both in transit and at rest, ensuring confidentiality even in the event of a data breach. Finally, implementing a comprehensive incident response plan is crucial for minimizing the impact of any security incident. Imagine a well-trained SWAT team ready to spring into action—that’s the level of preparedness your security measures should strive for.

Regulatory Compliance Requirements for Investment Analysis Software

Compliance varies significantly depending on jurisdiction and the specific type of investment activities the software supports. However, common regulations include those related to data privacy (like GDPR in Europe or CCPA in California), anti-money laundering (AML), and know your customer (KYC) regulations. Failure to comply can result in hefty fines, legal action, and severe reputational damage. Think of it as navigating a minefield of legal requirements – one wrong step could cost you dearly. It’s advisable to consult with legal professionals specializing in financial technology to ensure full compliance.

Data Encryption and Access Control

Data encryption is paramount. Employing strong encryption algorithms, such as AES-256, ensures that even if data is intercepted, it remains unreadable without the correct decryption key. Access control mechanisms, based on the principle of least privilege, restrict access to sensitive data based on user roles and responsibilities. Imagine a highly secure vault, with different levels of access granted only to authorized personnel—that’s the level of control you need for your investment data. Regular reviews of user permissions and access logs are also crucial to detect and prevent unauthorized activity.

Mitigating Risks Related to Data Breaches and Unauthorized Access

Prevention is better than cure, but a comprehensive plan for dealing with breaches is essential. This includes regular backups of data, stored securely offsite, to allow for quick recovery in the event of a data loss. A robust incident response plan, including procedures for containing the breach, investigating the cause, and notifying affected parties, is crucial. Employee training on security awareness is also vital, as human error is often a major contributing factor to security incidents. Think of this as having a detailed fire drill plan for your digital assets; you hope you’ll never need it, but being prepared is essential.

Concluding Remarks

So, there you have it – a whirlwind tour of Investment Analysis Software. While the world of finance might seem daunting, with the right tools and a dash of understanding, you can confidently navigate the complexities of investing. Remember, the goal isn’t just to make money, it’s to make smart, informed decisions. And hopefully, this exploration has equipped you with the knowledge to do just that. Now go forth and conquer those spreadsheets (or let the software do it for you!).

General Inquiries

What is the typical cost of Investment Analysis Software?

Costs vary wildly depending on features, user type (individual vs. institutional), and vendor. Expect a range from free (with limitations) to tens of thousands of dollars annually for enterprise-level solutions. Shop around!

Is Investment Analysis Software suitable for beginners?

Absolutely! Many packages offer user-friendly interfaces and tutorials, making them accessible to those new to investing. However, understanding basic financial concepts is always beneficial.

How secure is my data with Investment Analysis Software?

Reputable vendors prioritize data security through encryption, access controls, and regular security audits. However, always check a vendor’s security policies before entrusting your financial data.

Can I integrate Investment Analysis Software with my existing accounting software?

Many programs offer integration capabilities with popular accounting software through APIs or data import/export functions. Check the software’s compatibility features.