Investment management companies play a crucial role in the global financial landscape, guiding individuals and institutions toward their financial goals. These firms offer a diverse range of services, from portfolio management and financial planning to wealth management and specialized investment strategies. Understanding their operations, regulatory frameworks, and evolving technological integration is vital for both investors and industry professionals alike. This exploration delves into the intricacies of investment management companies, providing a clear and concise understanding of their function and impact.

The industry is constantly adapting to technological advancements, regulatory changes, and shifting investor priorities. This dynamic environment necessitates a thorough understanding of the various investment approaches, performance measurement techniques, and the growing influence of ESG (Environmental, Social, and Governance) factors. By examining these key aspects, we aim to provide a comprehensive picture of the modern investment management landscape.

Defining Investment Management Companies

Investment management companies play a crucial role in the financial ecosystem, acting as intermediaries between investors and capital markets. They provide a range of services designed to help individuals and institutions grow and protect their wealth. Their expertise allows investors to participate in markets they may not otherwise access or understand, mitigating risk and potentially maximizing returns.

Investment management companies employ various strategies and operate under different structures, offering a diverse range of options for investors with varying risk tolerances and financial goals. Understanding these different facets is essential for navigating the complex world of investment management.

Types of Investment Management Companies

Investment management companies come in various forms, each with its own distinct characteristics and investment approaches. These differences stem from their ownership structures, client base, and investment strategies. Understanding these distinctions is key to selecting the right firm for your specific investment needs.

- Mutual Funds: These are open-ended investment companies that pool money from multiple investors to invest in a diversified portfolio of securities. They are generally managed by professional fund managers and offer investors a relatively low-cost way to access a diversified portfolio. Mutual funds often have specific investment mandates, such as focusing on a particular sector or investment style (e.g., value investing, growth investing).

- Hedge Funds: Hedge funds are typically private investment partnerships that employ sophisticated investment strategies, often involving leverage, short selling, and derivatives. They are generally accessible only to accredited investors (those with high net worth and investment experience) due to higher minimum investment requirements and higher risk profiles. Hedge fund strategies vary considerably, from arbitrage to event-driven investing.

- Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds but trade on stock exchanges like individual stocks. This allows for intraday trading and greater liquidity. ETFs often track a specific index, such as the S&P 500, providing investors with broad market exposure at a relatively low cost.

- Private Equity Firms: Private equity firms invest in privately held companies, often providing capital for expansion, acquisitions, or leveraged buyouts. They typically have a long-term investment horizon and aim to generate returns through improving the operational efficiency and value of their portfolio companies. Private equity investments are typically illiquid, meaning they cannot be easily bought or sold.

- Investment Banks: While not solely investment managers, investment banks often manage significant assets for their clients, providing investment advisory services, underwriting securities offerings, and engaging in proprietary trading activities. Their services extend beyond pure asset management to encompass broader financial services.

Investment Management Company Business Models

The business models employed by investment management companies vary significantly, impacting their fee structures, investment strategies, and client relationships. These models influence the overall profitability and sustainability of the firm.

- Fee-Based Model: This model charges clients a fixed annual fee based on a percentage of assets under management (AUM). This structure provides a predictable revenue stream for the firm but may incentivize growth in AUM over performance. For example, a firm might charge 1% annually on $1 million of AUM, resulting in a $10,000 annual fee.

- Commission-Based Model: This model charges clients a commission on each transaction executed. This structure can incentivize higher trading activity, which may not always be in the best interest of the client. The commissions can vary widely depending on the type of transaction and the asset class involved.

- Performance-Based Model: This model ties the manager’s compensation to the investment performance, typically through a share of profits exceeding a certain benchmark. This aligns the interests of the manager and the client but can also lead to greater risk-taking if not properly structured. A common structure involves a base fee plus a percentage of profits above a pre-determined hurdle rate.

- Hybrid Models: Many firms utilize hybrid models that combine elements of fee-based, commission-based, and performance-based models. This allows for greater flexibility in aligning fees with client needs and investment strategies.

Services Offered by Investment Management Companies

Investment management companies provide a wide array of services designed to help individuals and institutions grow and protect their wealth. These services range from basic portfolio management to sophisticated wealth planning strategies tailored to meet specific financial goals and risk tolerances. The breadth and depth of these offerings are constantly evolving to meet the demands of a changing financial landscape.

Investment management firms typically offer a core set of services, with some firms specializing in particular areas. The most common services cater to different client needs and wealth levels, from individual investors to large institutional clients. The complexity and cost of these services naturally scale with the sophistication of the strategies employed and the level of personalized attention required.

Types of Investment Management Services

Investment management companies offer a comprehensive suite of services designed to meet diverse financial needs. These services can be broadly categorized into portfolio management, financial planning, and wealth management, each encompassing a range of specialized offerings. Portfolio management focuses on the selection and oversight of investments, while financial planning provides a roadmap for achieving long-term financial goals. Wealth management integrates these services with additional support, such as tax planning and estate planning, to offer a holistic approach to wealth management.

Service Details, Client Profiles, and Associated Fees

| Service | Target Client Profile | Fee Structure | Example |

|---|---|---|---|

| Portfolio Management | High-net-worth individuals, institutional investors | Percentage of assets under management (AUM), fixed fees | A high-net-worth individual might pay 1% of their portfolio value annually for professional portfolio management services. |

| Financial Planning | Individuals nearing retirement, young professionals, families | Hourly rate, project-based fees, retainer fees | A young professional might pay an hourly rate for financial planning services related to retirement savings. |

| Wealth Management | Ultra-high-net-worth individuals, families with complex financial needs | Percentage of AUM, tiered fees based on AUM, bundled services | An ultra-high-net-worth individual might pay a percentage of their AUM for comprehensive wealth management services, including investment management, tax planning, and estate planning. |

| Tax-Advantaged Investing | Individuals seeking to minimize tax liabilities | Percentage of AUM, or fixed fees | This service focuses on strategies to reduce tax burdens on investments, such as utilizing tax-advantaged accounts like 401(k)s and IRAs. |

Evolution of Investment Management Services

Technological advancements and shifting client needs are reshaping the investment management industry. The rise of robo-advisors, for example, offers automated portfolio management at lower costs, making investment advice accessible to a broader range of clients. Simultaneously, the demand for personalized, holistic wealth management services is increasing, leading firms to integrate more sophisticated data analytics and technology into their offerings. The integration of artificial intelligence (AI) and machine learning (ML) is also allowing for more precise risk management and personalized investment strategies. Furthermore, the increasing focus on environmental, social, and governance (ESG) factors is driving the development of sustainable and responsible investment strategies. For instance, many firms now offer ESG-focused portfolios to cater to clients who prioritize ethical and sustainable investing.

Regulatory Landscape and Compliance

Investment management companies operate within a complex and evolving regulatory framework designed to protect investors and maintain market integrity. These regulations vary significantly across jurisdictions, demanding a robust compliance program to ensure adherence to all applicable laws and guidelines. Non-compliance can result in significant penalties, reputational damage, and even business closure.

The regulatory landscape for investment management firms is multifaceted, encompassing numerous agencies and a broad range of requirements. Understanding these regulations is crucial for firms to operate legally and ethically, fostering trust with clients and stakeholders.

Key Regulatory Bodies

Global oversight of investment management is decentralized, with various national and regional authorities setting the rules. In the United States, the Securities and Exchange Commission (SEC) plays a central role, regulating investment advisers, mutual funds, and other investment products. Similarly, in the United Kingdom, the Financial Conduct Authority (FCA) holds significant regulatory power. Other key global bodies include the European Securities and Markets Authority (ESMA) in Europe, the Australian Securities and Investments Commission (ASIC) in Australia, and the Hong Kong Securities and Futures Commission (SFC) in Hong Kong. These bodies set standards for conduct, reporting, and operational procedures, often collaborating internationally on cross-border issues.

Compliance Requirements and Reporting Obligations

Investment management companies face a wide array of compliance obligations, including but not limited to: registration and licensing requirements, client suitability rules, anti-money laundering (AML) and know-your-customer (KYC) regulations, investment policy adherence, conflict of interest management, record-keeping obligations, and cybersecurity protocols. Reporting requirements vary depending on the jurisdiction and the type of investment product managed. These reports typically include periodic filings disclosing portfolio holdings, performance data, and any material changes in the firm’s operations or investment strategies. Regular audits, both internal and external, are also essential for ensuring ongoing compliance. Failure to meet these requirements can lead to significant fines, legal action, and damage to the firm’s reputation.

Regulatory Compliance Process Flowchart

The regulatory compliance process for an investment management company is typically a cyclical process involving several key stages. A simplified flowchart would illustrate this as follows:

[Imagine a flowchart here. The flowchart would begin with a “Start” box, followed by boxes representing: 1. Policy Development & Implementation (covering KYC/AML, investment strategy, code of conduct etc); 2. Ongoing Monitoring & Surveillance (daily trading, client activity, regulatory updates); 3. Internal Audits & Reviews (regular internal checks for compliance); 4. External Audits (independent reviews to verify compliance); 5. Regulatory Reporting (filing required reports to relevant bodies); 6. Corrective Actions (addressing any identified non-compliance issues); and finally a “End” box. Arrows would connect these boxes, showing the flow of the process. The cyclical nature would be shown by an arrow looping back from “Corrective Actions” to “Ongoing Monitoring & Surveillance”.]

This flowchart visually represents the continuous nature of regulatory compliance, emphasizing the need for ongoing vigilance and proactive management.

Investment Strategies and Approaches

Investment management companies employ a diverse range of strategies to achieve their clients’ investment goals. Understanding these approaches is crucial for investors seeking to align their portfolios with their risk tolerance and desired returns. The choice between different strategies often hinges on factors like market outlook, investment horizon, and the investor’s risk profile.

Investment strategies can be broadly categorized into active and passive management styles, each with its own set of sub-strategies and associated advantages and disadvantages. Furthermore, specific investment philosophies, such as value and growth investing, further refine these approaches.

Active vs. Passive Management

Active management involves actively trying to beat the market by selecting individual securities believed to outperform their benchmarks. Fund managers conduct extensive research, analyze market trends, and make tactical decisions to generate alpha (excess returns above the benchmark). Passive management, conversely, aims to mirror the performance of a specific market index, such as the S&P 500, through index funds or exchange-traded funds (ETFs). Passive strategies generally have lower fees than actively managed funds. A key difference lies in the level of manager intervention; active management involves constant portfolio adjustments, while passive management requires minimal intervention.

Value Investing

Value investing focuses on identifying undervalued securities—companies whose stock prices are believed to be lower than their intrinsic value. Value investors look for companies with strong fundamentals, but which are temporarily out of favor in the market. Warren Buffett’s Berkshire Hathaway is a prime example of a highly successful firm employing a value investing strategy, consistently identifying and acquiring undervalued companies over decades. Their success stems from a long-term, patient approach, focusing on the underlying business rather than short-term market fluctuations.

Growth Investing

Growth investing emphasizes companies with high growth potential, often characterized by strong earnings growth and expansion. These companies may have higher price-to-earnings ratios (P/E) compared to value stocks, reflecting investors’ expectations of future earnings growth. Growth investors are less concerned with current valuations and focus on companies poised for significant expansion, often in emerging sectors. Technology-focused investment firms frequently employ growth investing strategies, targeting companies with innovative products or services.

Advantages and Disadvantages of Different Investment Approaches

Understanding the strengths and weaknesses of various investment approaches is crucial for informed decision-making. The choice often depends on the investor’s risk tolerance, time horizon, and investment goals.

The following table summarizes the key advantages and disadvantages:

| Investment Approach | Advantages | Disadvantages |

|---|---|---|

| Active Management | Potential for higher returns than the market; opportunity to capitalize on market inefficiencies. | Higher fees; requires skilled fund managers; potential for underperformance relative to benchmarks. |

| Passive Management | Lower fees; generally lower risk; tends to match market performance. | Limited upside potential; may underperform during bull markets. |

| Value Investing | Potential for high returns; less susceptible to market sentiment. | Requires extensive research and analysis; potential for longer holding periods. |

| Growth Investing | Potential for high returns; exposure to high-growth sectors. | Higher risk; susceptible to market corrections; valuations can become inflated. |

Performance Measurement and Evaluation

Effective performance measurement is crucial for investment management companies to demonstrate their value to clients and to identify areas for improvement. It allows for a clear understanding of investment strategies’ success, risk management effectiveness, and overall firm performance. This involves tracking key performance indicators (KPIs) and employing appropriate analytical tools.

Key Performance Indicators (KPIs)

Several key performance indicators are commonly used to assess the success of investment management companies. These metrics provide a comprehensive view of investment performance, risk-adjusted returns, and the overall efficiency of the investment process. Understanding these KPIs allows for both internal benchmarking and external comparison against competitors.

- Return on Investment (ROI): A fundamental metric expressing the profitability of an investment relative to its cost. It’s calculated as (Gain from Investment – Cost of Investment) / Cost of Investment. A higher ROI indicates better performance.

- Time-Weighted Rate of Return (TWRR): This metric adjusts for cash inflows and outflows, providing a more accurate reflection of investment manager skill. It’s calculated by geometrically linking the returns of each sub-period.

- Standard Deviation: Measures the volatility or risk associated with an investment’s returns. A higher standard deviation signifies greater risk.

- Sharpe Ratio: This measures risk-adjusted return, showing the excess return per unit of risk. It is calculated as (Rp – Rf) / σp, where Rp is the portfolio return, Rf is the risk-free rate, and σp is the portfolio’s standard deviation.

- Alpha: Represents the excess return generated by an investment manager compared to a benchmark, after adjusting for risk. A positive alpha suggests superior performance relative to the benchmark.

- Beta: Measures the volatility of an investment relative to a benchmark market index. A beta of 1 indicates the investment moves in line with the market, while a beta greater than 1 suggests higher volatility.

Calculating and Interpreting the Sharpe Ratio and Alpha

The Sharpe Ratio and Alpha are critical for evaluating investment performance relative to risk and a benchmark.

Sharpe Ratio Calculation and Interpretation

The Sharpe Ratio is calculated as:

(Rp – Rf) / σp

where:

- Rp = Portfolio return

- Rf = Risk-free rate of return (e.g., the return on a government bond)

- σp = Standard deviation of portfolio returns

A higher Sharpe Ratio indicates better risk-adjusted performance. For example, a Sharpe Ratio of 1.0 suggests that the portfolio generated one unit of excess return for every unit of risk taken.

Alpha Calculation and Interpretation

Alpha is calculated through regression analysis, comparing the portfolio’s returns against a benchmark’s returns. The alpha is the intercept of the regression line. A positive alpha indicates the manager outperformed the benchmark, while a negative alpha suggests underperformance. For instance, an alpha of 2% indicates that the portfolio outperformed the benchmark by 2% annually after adjusting for risk.

Constructing a Performance Report

A comprehensive performance report should clearly communicate investment results and provide context for interpretation. It should include:

- Executive Summary: A brief overview of the investment performance highlighting key achievements and challenges.

- Return Data: Presenting absolute and relative returns (e.g., ROI, TWRR) over various time horizons (e.g., monthly, quarterly, annually).

- Risk Metrics: Displaying key risk measures such as standard deviation, Sharpe Ratio, Beta, and maximum drawdown.

- Benchmark Comparison: Showing the portfolio’s performance against relevant benchmarks (e.g., market indices) to demonstrate relative performance and alpha.

- Attribution Analysis: Breaking down performance into its contributing factors (e.g., sector allocation, security selection).

- Visualizations: Using charts and graphs (e.g., bar charts for returns, line charts for time-series data, scatter plots for risk and return) to illustrate key findings and make the data easily digestible.

- Commentary: Providing an explanation of the performance, highlighting significant events and factors influencing results. This section should also Artikel the investment strategy’s rationale and discuss any deviations from the plan.

For example, a bar chart could visually represent the portfolio’s performance against its benchmark over the past five years, while a line chart could illustrate the portfolio’s cumulative returns over time. A scatter plot could display the relationship between risk and return for the portfolio and its benchmark.

Technological Advancements and their Impact

The investment management industry is undergoing a significant transformation driven by rapid technological advancements. Artificial intelligence (AI), big data analytics, and various fintech solutions are reshaping how investment firms operate, analyze data, and manage portfolios, presenting both considerable opportunities and challenges. This section explores the impact of these advancements on investment management practices.

The integration of AI and big data analytics has revolutionized several aspects of investment management. AI algorithms can process vast datasets far exceeding human capabilities, identifying patterns and insights that might otherwise be missed. This enhanced analytical power leads to more informed investment decisions, improved risk management, and the development of sophisticated trading strategies. Big data analytics allows for the creation of more accurate predictive models, better portfolio diversification, and a deeper understanding of market dynamics. For example, AI-powered sentiment analysis can gauge market sentiment from news articles and social media, providing valuable signals for trading decisions.

AI and Big Data Analytics in Investment Management

AI and big data are transforming investment processes from portfolio construction to risk management. AI algorithms can analyze extensive datasets encompassing market data, economic indicators, and company financials to identify undervalued assets or predict market trends. This enables more precise portfolio optimization, tailored to specific investor risk profiles and objectives. Big data analytics provides a granular view of client behavior and preferences, allowing for personalized investment strategies and enhanced client service. Furthermore, AI can automate many previously manual tasks, increasing efficiency and reducing operational costs. For instance, robo-advisors utilize AI to provide automated portfolio management services to a wider range of investors. The improved speed and accuracy of data analysis facilitated by these technologies also contribute to more effective risk management strategies, enabling quicker identification and mitigation of potential risks.

Fintech Solutions in Investment Management

Fintech solutions are rapidly integrating into the investment management ecosystem, offering a range of tools and services that enhance efficiency and client experience. These solutions encompass robo-advisors, algorithmic trading platforms, blockchain technology for enhanced security and transparency, and sophisticated data visualization tools for improved decision-making. Robo-advisors, for example, leverage AI and algorithms to provide automated portfolio management services at lower costs compared to traditional advisors, making investment management accessible to a broader demographic. Algorithmic trading platforms enable high-frequency trading and the execution of complex trading strategies with speed and precision, providing a competitive advantage in dynamic markets. Blockchain technology can enhance the security and transparency of transactions, reducing the risk of fraud and improving the overall efficiency of the investment process.

Challenges and Opportunities Presented by Technological Advancements

While technological advancements offer significant opportunities, they also present challenges for investment management companies. The increasing reliance on complex algorithms and data-driven decision-making necessitates a skilled workforce capable of understanding and managing these technologies. Data security and privacy concerns are paramount, requiring robust cybersecurity measures to protect sensitive client information. Furthermore, the high cost of implementing and maintaining advanced technologies can pose a barrier for smaller firms. The ethical implications of AI-driven investment strategies also need careful consideration, ensuring fairness and transparency in decision-making processes. However, the potential rewards are substantial. Improved efficiency, enhanced risk management, and the ability to offer personalized services can lead to increased profitability and a stronger competitive position in the market. Companies that successfully navigate these challenges and leverage technological advancements will be best positioned for long-term success in the evolving landscape of investment management.

The Role of ESG (Environmental, Social, and Governance) Investing

The integration of Environmental, Social, and Governance (ESG) factors into investment decision-making is no longer a niche strategy; it’s rapidly becoming the mainstream approach for many investment management companies. Driven by growing investor demand, regulatory pressures, and a heightened awareness of the interconnectedness between business practices and long-term value creation, ESG considerations are fundamentally reshaping the investment landscape. This shift reflects a recognition that financially successful companies are also those that manage their environmental impact, treat their employees and stakeholders fairly, and uphold strong governance practices.

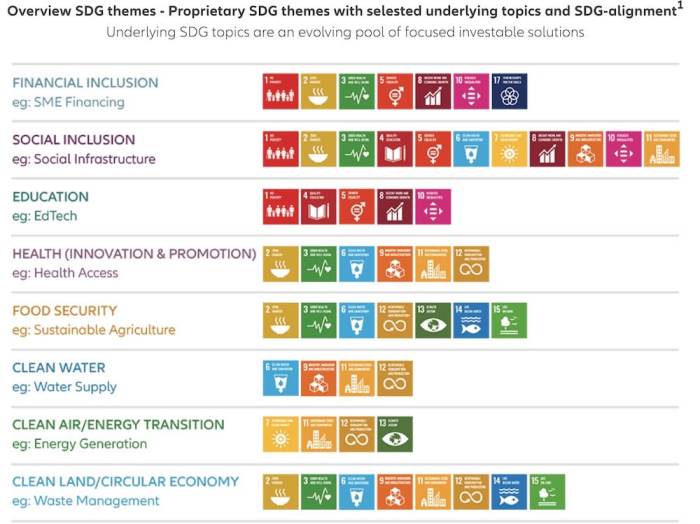

Investment management companies are actively incorporating ESG factors into their investment strategies through various methods. This involves not only screening out companies with poor ESG performance but also actively engaging with portfolio companies to encourage improvements and identify opportunities linked to sustainable practices. The process frequently includes rigorous ESG data analysis, utilizing specialized ESG ratings and data providers to assess companies across a range of environmental, social, and governance metrics. This data is then integrated into the investment process, influencing stock selection, portfolio construction, and engagement strategies.

ESG Integration Methods

Investment management companies employ a variety of methods to integrate ESG considerations. These range from negative screening (excluding companies involved in controversial activities) to positive screening (selecting companies with strong ESG profiles), and more nuanced approaches such as ESG integration (incorporating ESG data into traditional financial analysis) and active ownership (engaging with companies to improve their ESG performance). Some firms even develop bespoke ESG investment strategies focused on specific themes, such as renewable energy or sustainable agriculture.

Examples of Successful ESG Investment Initiatives

Several investment management companies have demonstrated the success of ESG integration. For example, some firms have actively engaged with companies in their portfolios to reduce carbon emissions, leading to demonstrable improvements in energy efficiency and reduced operational costs. This engagement often involves collaborative efforts with other investors to exert collective influence on company management. In another example, an investment firm focused on sustainable agriculture has generated strong financial returns while simultaneously contributing to improved farming practices and increased food security in developing countries. This illustrates how ESG considerations can be aligned with financial goals, demonstrating that positive social and environmental impact can be a source of competitive advantage.

The Growing Importance of ESG Data and Transparency

The reliability and quality of ESG data are crucial for effective ESG investing. The use of robust and consistent data from reputable sources is essential to ensure accurate assessments of companies’ ESG performance. Increased transparency and standardization of ESG reporting are also vital to facilitating better investment decisions and promoting accountability. The growing demand for ESG data has led to the development of numerous ESG rating agencies and data providers, though concerns remain regarding the comparability and accuracy of different ratings. Ongoing efforts to improve data quality and standardization are essential for the continued growth of responsible investing.

Future Trends in Investment Management

The investment management industry is undergoing a period of significant transformation, driven by technological advancements, evolving investor preferences, and a heightened focus on sustainability. Understanding these emerging trends is crucial for firms to remain competitive and adapt to the changing landscape. This section will explore key trends shaping the future of investment management, along with potential challenges and opportunities.

Several powerful forces are reshaping the investment management industry. These include the rise of fintech, the increasing demand for personalized and sustainable investment solutions, and the growing importance of data analytics in investment decision-making. These trends present both significant opportunities and considerable challenges for firms of all sizes.

The Rise of Fintech and Algorithmic Trading

Fintech is revolutionizing investment management, offering innovative solutions for portfolio management, risk assessment, and client interaction. Algorithmic trading, powered by artificial intelligence and machine learning, is becoming increasingly prevalent, enabling faster and more efficient execution of trades. This increased automation allows for the analysis of vast datasets to identify investment opportunities that may be missed by human analysts. For example, quantitative hedge funds are heavily reliant on algorithmic trading strategies, leveraging complex algorithms to identify and exploit market inefficiencies. The increased use of AI and machine learning in trading is likely to continue to grow, further increasing efficiency and potentially reducing costs for investors.

Personalized Investing and Robo-Advisors

The demand for personalized investment solutions is growing, driven by the increasing accessibility of financial information and the desire for tailored investment strategies. Robo-advisors, which utilize algorithms to provide automated investment advice and portfolio management, are playing a significant role in meeting this demand. Robo-advisors offer lower fees than traditional wealth managers, making them accessible to a wider range of investors. However, the personalization offered by robo-advisors is still somewhat limited compared to the human touch of a traditional financial advisor, and they may not be suitable for all investors, especially those with complex financial needs. The future likely involves a hybrid model combining the efficiency of robo-advisors with the personalized service of human advisors.

ESG Investing and Sustainable Finance

Environmental, Social, and Governance (ESG) investing is rapidly gaining traction, reflecting a growing awareness of the importance of sustainability and responsible investing. Investors are increasingly demanding transparency and accountability from companies regarding their ESG performance, leading to the development of new investment products and strategies that incorporate ESG factors. For instance, many institutional investors now actively incorporate ESG criteria into their investment decisions, leading to increased demand for ESG-focused funds and increased scrutiny of companies’ environmental and social practices. The integration of ESG factors into investment analysis is expected to become even more widespread in the coming years.

Data Analytics and Predictive Modeling

The increasing availability of data and the advancement of data analytics techniques are transforming investment management. Investment firms are leveraging big data and machine learning to develop predictive models that can identify investment opportunities and manage risk more effectively. For example, alternative data sources, such as satellite imagery and social media sentiment, are being used to gain insights into market trends and company performance. This data-driven approach is likely to become increasingly important in the future, leading to more sophisticated investment strategies and improved risk management.

Visual Representation of Industry Evolution (5-10 Years)

Imagine a graph with time on the x-axis (next 5-10 years) and “Industry Transformation” on the y-axis. The graph shows a steep upward curve representing the increasing adoption of technology (AI, machine learning, robo-advisors). A second, slightly less steep curve shows the growth of ESG investing. A third, flatter curve represents the ongoing evolution of traditional investment management, indicating its continued relevance but a shrinking market share compared to the technological and ESG driven growth. The overall picture shows a dynamic and rapidly evolving industry, characterized by increased technological integration and a growing emphasis on sustainability.

Wrap-Up

Investment management companies are integral to the global financial system, facilitating growth and providing essential services to a wide range of clients. Their evolution, shaped by technological advancements and regulatory changes, continues to reshape the industry. Understanding their diverse offerings, strategies, and compliance requirements is crucial for investors seeking to navigate the complexities of the modern financial world. The future of investment management promises both significant challenges and exciting opportunities, particularly in areas such as sustainable investing and the integration of innovative technologies.

FAQ Compilation

What is the difference between an active and passive investment strategy?

Active management involves actively selecting investments to outperform a benchmark, while passive management aims to match a benchmark’s performance with lower fees.

How are investment management company fees structured?

Fees vary widely and can include management fees (percentage of assets under management), performance fees (percentage of profits), and transaction fees.

What qualifications are needed to work in investment management?

Qualifications vary by role, but often include degrees in finance or related fields, relevant certifications (e.g., CFA), and experience in the industry.

How can I choose the right investment management company?

Consider factors such as investment philosophy, fees, track record, client service, and regulatory compliance before selecting a firm.