Investment Management Companies Review: Venture into the fascinating world of financial stewardship! This exploration delves into the intricacies of investment management companies, revealing their strategies, triumphs, and the occasional hilarious misstep. Prepare for a journey through KPIs, investment strategies, client relationships, and the ever-evolving technological landscape. Buckle up, it’s going to be a wild ride!

We’ll dissect the various types of investment management companies, from the cautiously conservative to the daringly adventurous, examining their approaches to portfolio management and the regulatory hurdles they navigate. We’ll also look at the key performance indicators (KPIs) used to measure their success (or lack thereof!), exploring how these metrics differ across various investment strategies. Think of it as a financial detective story, uncovering the secrets behind successful (and sometimes spectacularly unsuccessful) investment strategies.

Defining Investment Management Companies

Investment management companies, often perceived as the sophisticated cousins of your friendly neighborhood bank, are actually quite fascinating creatures. They navigate the often-turbulent waters of the financial world, expertly (or so they claim!) managing the investments of individuals, corporations, and even other institutions. Think of them as highly specialized financial shepherds, guiding your hard-earned money towards (hopefully) greener pastures.

Investment management companies perform a multitude of roles, from analyzing market trends and selecting appropriate investment vehicles to executing trades and providing regular performance reports. They offer a range of services tailored to different client needs, from basic portfolio management to complex wealth planning strategies involving tax optimization and estate planning. Essentially, they take the heavy lifting out of investing, freeing you up to focus on more pressing matters, like deciding which flavor of artisanal ice cream to indulge in.

Investment Management Company Categories Based on Investment Strategies

The investment strategies employed by management companies are as diverse as the personalities of their clients. A key differentiator lies in their core investment philosophies. Understanding these differences is crucial for investors seeking to align their financial goals with the right management approach.

- Value Investing: Value investors, often likened to shrewd bargain hunters, focus on identifying undervalued assets. They believe that market inefficiencies create opportunities to purchase securities trading below their intrinsic value. Think Warren Buffett – a master of this approach, patiently waiting for the right moment to pounce.

- Growth Investing: Growth investors, on the other hand, are more focused on companies exhibiting high growth potential. They are less concerned with current valuations and more interested in future prospects, often prioritizing companies with innovative products or disruptive technologies. This strategy can be riskier, but the potential rewards are correspondingly higher.

- Passive Investing: Passive investors, the Zen masters of the investment world, aim to mirror a specific market index, such as the S&P 500. They employ strategies like index fund investing, aiming for market-average returns with minimal active management. This approach emphasizes diversification and long-term growth, minimizing the need for constant market timing.

Regulatory Landscape Governing Investment Management Companies

The world of investment management isn’t a free-for-all; it’s heavily regulated, varying considerably across jurisdictions. These regulations aim to protect investors from fraud and mismanagement, ensuring a degree of transparency and accountability within the industry. Failure to comply with these regulations can result in hefty fines, legal battles, and reputational damage – not exactly a recipe for a successful career in finance.

The specifics of these regulations vary widely depending on the location of the investment management company and the types of securities it manages. For instance, in the United States, the Securities and Exchange Commission (SEC) plays a pivotal role, while in Europe, the regulatory landscape is governed by bodies such as the European Securities and Markets Authority (ESMA). These organizations establish and enforce rules concerning investment strategies, client disclosures, and conflict of interest management, among other critical aspects. Compliance is not just a box to tick; it’s the cornerstone of investor trust and market stability. It’s also incredibly complex, so don’t try this at home. Leave it to the professionals (unless you’re a professional, in which case, good luck!).

Key Performance Indicators (KPIs) for Investment Management Companies

Investment management companies, those financial wizards who juggle billions (or, let’s be honest, sometimes millions), need more than just a lucky rabbit’s foot to prove their worth. They need Key Performance Indicators (KPIs), the hard numbers that separate the shrewd investors from the… well, less shrewd. These KPIs aren’t just for boardroom bragging rights; they’re crucial for evaluating investment strategies, attracting clients, and ultimately, making sure everyone involved gets a healthy return (hopefully).

Essential KPIs for Investment Management Companies

A well-chosen selection of KPIs provides a comprehensive view of an investment management company’s performance. Let’s delve into the essential metrics, understanding their calculation and significance.

| KPI Name | Description | Calculation Method | Importance |

|---|---|---|---|

| Return on Investment (ROI) | Measures the profitability of an investment relative to its cost. A simple, yet powerful, indicator of success. | (Net Profit / Cost of Investment) x 100 | Fundamental for assessing overall profitability and attractiveness to investors. A high ROI suggests effective investment strategies. |

| Sharpe Ratio | Evaluates risk-adjusted return, showing how much excess return you receive for each unit of additional risk taken. Higher is better. | (Rp – Rf) / σp where Rp is portfolio return, Rf is risk-free rate, and σp is portfolio standard deviation. | Crucial for comparing investments with different levels of risk. A higher Sharpe Ratio indicates better risk-adjusted performance. |

| Alpha | Measures the excess return of an investment compared to its benchmark. Positive alpha suggests outperformance. | Portfolio Return – (Risk-Free Rate + Beta * (Benchmark Return – Risk-Free Rate)) | Key for actively managed funds, demonstrating the manager’s skill in generating returns above the market. A consistently positive alpha is a strong indicator of skill. |

| Standard Deviation | Measures the volatility or risk of an investment. Higher standard deviation means higher risk. | Square root of the variance of returns. Calculated using historical data. | Essential for understanding the risk profile of an investment. Investors with different risk tolerances will prioritize this differently. |

KPI Comparison Across Investment Strategies

The relevance of different KPIs varies dramatically depending on the investment strategy employed. A passively managed index fund, for example, might focus primarily on tracking the benchmark index, with the Sharpe Ratio serving as a key performance measure. Its alpha will likely be close to zero, as it aims for market-matching returns, not market-beating returns. In contrast, an actively managed hedge fund will emphasize alpha, showcasing the manager’s ability to generate excess returns beyond what’s expected from the market. The Sharpe Ratio is still important, but the focus shifts towards the alpha generated.

Visual Representation of KPI Relationships

Imagine a three-dimensional graph. The X-axis represents the Sharpe Ratio, the Y-axis represents Alpha, and the Z-axis represents Standard Deviation. Each investment strategy would be plotted as a point in this 3D space. A passively managed fund might be clustered near the origin, with a moderate Sharpe Ratio, near-zero alpha, and relatively low standard deviation. Actively managed funds, aiming for higher alpha, might be scattered further along the Y-axis, with varying Sharpe Ratios and standard deviations reflecting different risk profiles. This visualization helps investors quickly compare and contrast investment strategies based on their risk and return characteristics. Points far from the origin represent higher risk and potentially higher returns. Points close to the origin suggest lower risk and lower returns. The location of a point within this space provides a holistic assessment of an investment’s performance profile.

Investment Strategies and Approaches

The world of investment management is a thrilling rollercoaster, a dizzying blend of calculated risk and hopeful anticipation. Investment management companies, those intrepid navigators of the financial seas, employ a diverse array of strategies to chart their course towards profitability (and hopefully, their clients’ as well!). Let’s delve into the fascinating – and sometimes frankly bewildering – world of investment approaches.

Investment strategies aren’t just about picking stocks; they’re about philosophical approaches to market behavior, risk tolerance, and the very nature of value itself. From the cautiously conservative to the daringly aggressive, each strategy offers a unique blend of potential rewards and inherent perils. Understanding these approaches is crucial for both investors seeking to understand their managers and managers seeking to optimize their performance.

Active vs. Passive Management

Active management involves actively trying to beat the market. Think of it as a high-stakes poker game, where fund managers use their expertise and insight to select investments they believe will outperform a benchmark index. This requires significant research, analysis, and a healthy dose of market intuition. Passive management, on the other hand, aims to mirror the performance of a specific market index, such as the S&P 500. It’s like playing a game of solitaire – a more relaxed, less stressful, and arguably more predictable approach. Vanguard, a pioneer of passive investing, is a prime example of a company that has built its success on this strategy. Their index funds often outperform actively managed funds over the long term, due to lower fees and a lack of the constant “chasing of the market” that active managers engage in.

Value vs. Growth Investing

This is where things get philosophical. Value investors, like Warren Buffett, famously search for undervalued companies – diamonds in the rough, if you will. They believe the market often misprices assets, creating opportunities for savvy investors to snap up bargains. Growth investors, conversely, focus on companies with high growth potential, even if they’re currently expensive. They bet on the future, anticipating significant expansion and returns. The success of both strategies hinges on accurate assessment of future performance, a task that’s easier said than done. Consider Berkshire Hathaway’s long-term success with value investing versus the growth-focused strategies employed by some technology-focused mutual funds. Both have had periods of exceptional success, and periods where the approach has fallen short.

Alternative Investments

Beyond stocks and bonds lies a wild west of alternative investments, including hedge funds, private equity, real estate, and commodities. These often come with higher risks and less transparency, but also the potential for higher returns. However, the “higher returns” promise often comes with significant risks. A famous example (though not necessarily a positive one) is the collapse of Long-Term Capital Management, a highly leveraged hedge fund that ultimately failed due to its complex and risky investment strategies. Alternative investments require sophisticated risk management and due diligence, something that isn’t always present.

Common Investment Risks Associated with Different Investment Strategies

Understanding the potential downsides is just as important as understanding the potential upsides. Different strategies come with their own sets of risks.

It’s crucial to remember that past performance is not indicative of future results. The market is unpredictable, and even the most brilliant strategies can falter. Investing involves inherent risks, and it’s essential to diversify your portfolio and consult with a financial advisor to manage those risks effectively.

- Active Management: Higher fees, potential underperformance relative to benchmarks, manager risk (reliance on a specific individual’s skill).

- Passive Management: While generally lower risk, still subject to market downturns; less control over individual holdings.

- Value Investing: Risk of misjudging a company’s true value; potential for prolonged periods of underperformance.

- Growth Investing: High valuation multiples; susceptibility to interest rate hikes; reliance on continued growth, which isn’t guaranteed.

- Alternative Investments: Illiquidity; lack of transparency; higher risk of loss; complex regulatory environments.

Client Relationships and Services

In the cutthroat world of investment management, where fortunes are made and lost faster than you can say “portfolio diversification,” the importance of nurturing client relationships can’t be overstated. Think of it as the difference between a fleeting fling and a long-term, mutually beneficial marriage – you want the latter, especially when millions are on the line. Happy clients are loyal clients, and loyal clients bring in more business (and frankly, fewer headaches).

Client relationship management (CRM) in the investment management industry isn’t just about exchanging pleasantries; it’s a strategic imperative for sustained success. It’s about understanding your clients’ individual needs, anticipating their concerns, and proactively providing solutions that align with their financial goals. It’s about building trust, fostering transparency, and providing exceptional service that keeps them coming back for more (and recommending you to their equally wealthy friends).

Types of Services Offered by Investment Management Companies, Investment Management Companies Review

Investment management companies offer a diverse range of services tailored to meet the unique needs of their clientele. These services are designed to not only manage assets but also to help clients achieve their long-term financial objectives, whether it’s early retirement on a private island or simply ensuring a comfortable future. These services often overlap, creating a holistic approach to wealth management.

- Portfolio Management: This is the bread and butter of the industry – the active or passive management of a client’s investment portfolio to maximize returns while mitigating risk. This involves selecting appropriate asset classes, constructing a diversified portfolio, and regularly monitoring and adjusting the holdings based on market conditions and client goals. Think of it as the skilled captain navigating the turbulent seas of the financial markets.

- Financial Planning: This goes beyond simple investment management, encompassing a broader view of the client’s financial life. It involves developing a comprehensive financial plan that addresses various aspects, such as retirement planning, estate planning, tax optimization, and education funding. It’s like having a financial architect designing a robust and secure future for your client.

- Wealth Management: This is the ultimate all-encompassing service, integrating portfolio management, financial planning, and other specialized services like tax advisory, insurance planning, and philanthropy. Wealth management aims to provide a holistic approach to managing a client’s entire financial life, offering a truly bespoke service. Think of it as the ultimate concierge service for the financially astute.

Onboarding New Clients and Account Management

The process of onboarding new clients is crucial, setting the tone for the entire client-advisor relationship. It involves a thorough understanding of the client’s financial situation, risk tolerance, investment goals, and time horizon. This information is essential for constructing a suitable investment strategy and managing expectations. Think of it as a meticulous pre-flight check before embarking on a financial journey.

Following the initial assessment, the investment strategy is implemented, and regular monitoring and reporting are provided to keep the client informed about the performance of their portfolio. This ongoing communication is key to maintaining a strong relationship and ensuring the client feels valued and understood. Regular reviews allow for adjustments to the strategy based on changing market conditions or the client’s evolving needs. It’s a continuous process of collaboration and adaptation, ensuring the client remains on track to achieve their financial goals. Ignoring this crucial element is like neglecting the engine maintenance on a high-performance car – sooner or later, it’ll cost you dearly.

Technology and Innovation in Investment Management

The world of investment management, once synonymous with hushed whispers and mahogany desks, is undergoing a thrilling, if slightly chaotic, transformation. Technology, once a supporting player, is now the star, wielding algorithms and data like a conductor orchestrates an orchestra. This shift isn’t just about efficiency; it’s about fundamentally changing how investments are made, analyzed, and managed, impacting everything from portfolio construction to client communication. The speed and scale of change are dizzying, leaving some feeling like they’re clinging to a runaway rollercoaster, while others gleefully strap in for the ride.

Technology’s role in modern investment management is multifaceted and profound. AI, machine learning, and big data analytics are no longer futuristic concepts; they’re the backbone of many successful firms. These technologies allow for the processing of vast datasets – far exceeding human capacity – identifying patterns, predicting market movements (with varying degrees of accuracy, of course!), and personalizing client experiences in ways previously unimaginable. Think of it as having a tireless, data-obsessed research assistant working 24/7, constantly sifting through information and offering insights.

Impact of Technological Advancements on Investment Strategies

Technological advancements have dramatically reshaped investment strategies. High-frequency trading algorithms, for example, execute trades at lightning speed, capitalizing on minuscule price fluctuations. AI-powered portfolio optimization tools can construct portfolios that are more diversified and better aligned with individual risk profiles than traditional methods. Machine learning models are used to predict credit defaults, analyze sentiment in news articles and social media, and even identify potential fraud. These tools don’t replace human judgment entirely, but they augment it, enabling faster, more informed decisions. Consider the case of Renaissance Technologies, a highly successful quantitative investment firm that heavily relies on sophisticated algorithms and data analysis for its investment strategies. Their success is a testament to the power of technology in generating alpha.

Impact of Technological Advancements on Client Services

The client experience is also undergoing a technological makeover. Robo-advisors, for instance, offer automated, algorithm-driven portfolio management at a fraction of the cost of traditional advisors. These platforms provide personalized investment advice and portfolio rebalancing based on individual goals and risk tolerance. Furthermore, sophisticated client portals provide real-time access to portfolio performance, transaction history, and personalized financial insights. This level of transparency and accessibility is revolutionizing the way clients interact with their investment managers. Imagine a world where clients can check their portfolio performance on their smartwatch with the same ease as they check the weather!

Comparison of Technological Tools in Investment Management

The following table compares the advantages and disadvantages of several key technological tools used in investment management. It’s important to note that the effectiveness of each tool depends heavily on its implementation and the expertise of the team using it. A poorly implemented AI system can be more harmful than helpful!

| Technological Tool | Advantages | Disadvantages |

|---|---|---|

| AI-powered Portfolio Optimization | Improved diversification, enhanced risk management, personalized portfolio construction. | Requires significant data input, potential for bias in algorithms, complexity of implementation. |

| High-Frequency Trading Algorithms | Speed and efficiency in executing trades, ability to capitalize on small price fluctuations. | High initial investment costs, potential for market instability, regulatory scrutiny. |

| Machine Learning for Fraud Detection | Improved accuracy in identifying fraudulent activities, reduced financial losses. | Requires continuous model retraining, potential for false positives, ethical considerations regarding data privacy. |

| Robo-Advisors | Low cost, accessibility, personalized investment advice. | Limited human interaction, potential for algorithm biases, suitability limitations for complex financial situations. |

Risk Management and Compliance

The world of investment management isn’t just about making money; it’s also about keeping it – and keeping the regulators happy. Investment firms navigate a complex landscape of potential pitfalls, from market volatility to regulatory scrutiny. Effective risk management and stringent compliance are not just good practice; they’re the bedrock of a successful and reputable firm. Let’s delve into the thrilling world of mitigating financial peril and avoiding the wrath of regulatory bodies.

Risk management and compliance are intertwined aspects of running an investment management company. Failure in either area can lead to significant financial losses, reputational damage, and even legal repercussions. A robust framework is crucial to ensure the long-term sustainability and success of the firm.

Key Risk Factors Faced by Investment Management Companies

Investment management companies face a diverse range of risks, broadly categorized as market risk, credit risk, liquidity risk, operational risk, and regulatory risk. Market risk encompasses fluctuations in asset prices, impacting portfolio values. Credit risk arises from the possibility of borrowers defaulting on their obligations. Liquidity risk involves the inability to readily convert assets into cash. Operational risk stems from internal failures, such as system glitches or human error. Finally, regulatory risk arises from changes in laws and regulations that could impact the firm’s operations. For example, a sudden shift in interest rates could significantly impact bond portfolios, illustrating market risk. A major corporate bankruptcy could highlight credit risk, while a sudden surge in redemption requests could expose liquidity risk. A cybersecurity breach could exemplify operational risk, and a change in tax laws could demonstrate regulatory risk. These risks, while distinct, often interact, creating complex scenarios requiring sophisticated risk management techniques.

Compliance Requirements and Regulations for Investment Management Companies

Investment management companies operate under a stringent regulatory environment designed to protect investors and maintain market integrity. These regulations vary across jurisdictions but generally encompass rules on investor protection, anti-money laundering (AML), know-your-customer (KYC) procedures, data privacy, and reporting requirements. For example, the Securities and Exchange Commission (SEC) in the United States imposes detailed regulations on investment advisors, including registration requirements, fiduciary duties, and disclosure obligations. Similarly, the European Union’s Alternative Investment Fund Managers Directive (AIFMD) sets out rules for alternative investment fund managers, covering areas such as risk management, reporting, and investor protection. Non-compliance can lead to substantial fines, legal action, and reputational damage. The penalties for regulatory breaches can be severe, ranging from financial penalties to operational restrictions and even criminal charges.

Risk Management Strategies Employed by Investment Management Companies

To navigate these risks, investment management companies employ a variety of strategies. Diversification, a cornerstone of investment strategy, spreads risk across different asset classes and geographies, reducing the impact of any single event. Stress testing, involving simulating extreme market scenarios, helps assess the resilience of portfolios under adverse conditions. Value-at-risk (VaR) models provide a quantitative measure of potential losses within a given confidence level and time horizon.

VaR is a statistical measure of the potential loss in value of an asset or portfolio over a specific time period and confidence level.

Furthermore, robust internal controls, independent audits, and ongoing monitoring are essential components of a comprehensive risk management framework. These strategies, while not foolproof, significantly enhance the ability of investment management companies to anticipate, assess, and mitigate potential risks, ensuring the protection of investor assets and the firm’s long-term stability.

Competitive Landscape and Future Trends

The investment management industry, a thrilling rollercoaster of fortunes and market fluctuations, is a crowded arena. Navigating this landscape requires a keen eye for both the established titans and the nimble newcomers, all vying for a slice of the investment pie. Understanding the competitive dynamics and emerging trends is crucial for any player hoping to not just survive, but thrive in this exciting, and sometimes slightly chaotic, world.

The competitive landscape is characterized by a fascinating mix of established behemoths and smaller, more specialized firms. Giant multinational corporations with centuries of experience sit alongside innovative fintech startups promising the next big thing. This creates a dynamic tension, fostering both intense competition and opportunities for disruption.

Major Players and Market Share

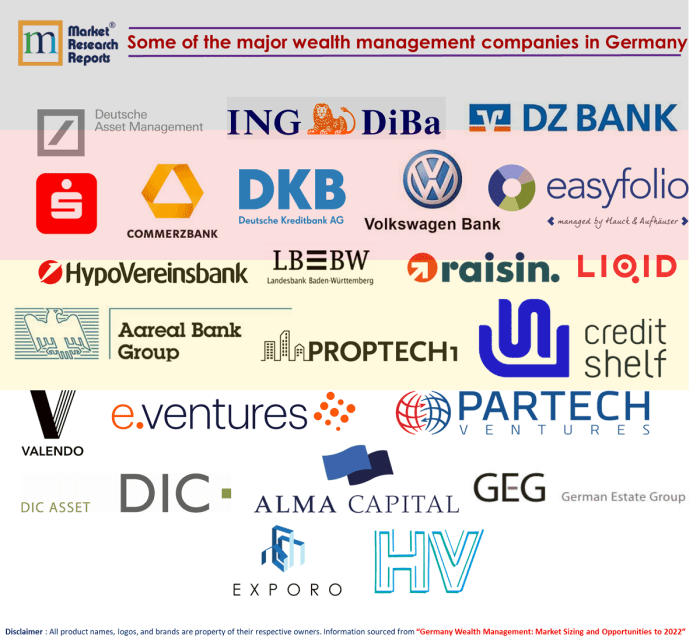

Analyzing market share precisely is a bit like trying to count grains of sand on a beach – incredibly difficult! However, we can identify some of the key players. BlackRock, Vanguard, and Fidelity are consistently ranked among the largest, managing trillions of dollars in assets. Their sheer size gives them considerable influence, allowing them to negotiate better deals and attract top talent. But the landscape isn’t just about the giants; boutique firms specializing in niche areas, like sustainable investing or impact investing, are also carving out significant spaces for themselves. Their agility and focus can often give them an edge over their larger competitors. The market share fluctuates constantly, reflecting the ebb and flow of market trends and investor sentiment.

Emerging Trends in Investment Management

The investment management industry is far from static; it’s a dynamic field constantly evolving. One of the most significant trends is the meteoric rise of Environmental, Social, and Governance (ESG) investing. Investors are increasingly demanding not only financial returns but also positive social and environmental impact from their investments. This has led to a surge in ESG-focused funds and strategies, forcing even traditional firms to adapt and incorporate ESG considerations into their investment processes. Furthermore, the demand for personalized investment solutions is growing exponentially. Clients are seeking tailored portfolios that reflect their individual risk tolerance, financial goals, and ethical preferences. This trend is fueled by advancements in technology, which allow for more sophisticated and customized investment strategies.

Predictions for the Future of Investment Management

Predicting the future is, of course, a risky business (ironically, for an investment management review!). However, based on current trends, we can anticipate several key developments. We expect to see further consolidation in the industry, with larger firms acquiring smaller ones to gain scale and market share. This might resemble a game of financial Jenga, where the removal of one block can have cascading effects. Technology will continue to play a pivotal role, with artificial intelligence (AI) and machine learning (ML) increasingly used for portfolio management, risk assessment, and client service. Finally, the focus on transparency and accountability will likely intensify, driven by increasing regulatory scrutiny and growing investor awareness. Imagine a future where every investment decision is meticulously documented and easily accessible – a world of completely transparent portfolios. This level of transparency, while potentially daunting for some, could lead to increased trust and investor confidence. This increased focus on transparency might be driven by instances like the recent GameStop saga, highlighting the need for better oversight and clarity in the market.

Wrap-Up

So, there you have it – a whirlwind tour of the investment management world! From the meticulously crafted strategies to the sometimes chaotic realities of managing billions, we’ve explored the highs and lows of this dynamic industry. While the future remains unwritten, one thing’s for sure: the investment management landscape will continue to evolve, driven by technology, shifting market dynamics, and the ever-present quest for optimal returns. And, who knows, maybe we’ll all get rich in the process! (But please, consult a financial advisor before making any major investment decisions.)

Answers to Common Questions: Investment Management Companies Review

What is the difference between active and passive investing?

Active investing involves managers actively trying to beat the market, while passive investing aims to match market performance through index funds, requiring less management and typically lower fees.

How do I choose an investment management company?

Consider factors like their investment philosophy, fees, performance history, regulatory compliance, and the suitability of their services to your individual financial goals. Due diligence is key!

What are the risks involved in investing?

All investments carry risk, from market volatility and inflation to unforeseen economic events. Diversification and a long-term perspective can help mitigate some of these risks, but no investment guarantees a profit.