Investment Management Software: Ah, the symphony of spreadsheets, the ballet of balance sheets! This isn’t your grandpappy’s ledger book; we’re talking sophisticated systems designed to tame the wild beast of finance. From tracking portfolios with the precision of a Swiss watchmaker to predicting market movements with the foresight of a seasoned oracle (well, maybe not *that* far, yet), investment management software is revolutionizing how we handle our money – and possibly, how we sleep at night.

This exploration delves into the core functionalities, diverse types, and key features that set these software solutions apart. We’ll examine how various user roles, from the seasoned portfolio manager to the wide-eyed individual investor, interact with these powerful tools. Prepare for a rollercoaster ride through the exciting world of financial technology, complete with thrilling case studies and enough data to make your head spin (in a good way, of course!).

Defining Investment Management Software

Investment management software: the unsung hero of the financial world, tirelessly crunching numbers and helping investors navigate the sometimes-treacherous waters of the market. It’s far more exciting than it sounds, we promise. Think of it as your financial Swiss Army knife, equipped with tools to manage everything from individual stocks to complex portfolios. Forget spreadsheets; this is where the real magic happens.

Investment management software encompasses a suite of tools designed to streamline and enhance the investment process. At its core, it provides a centralized platform for managing investments, analyzing performance, and mitigating risk. It’s less about magic and more about meticulously organized data, powerful analytics, and a user-friendly interface that even your accountant would appreciate (maybe).

Core Functionalities of Investment Management Software

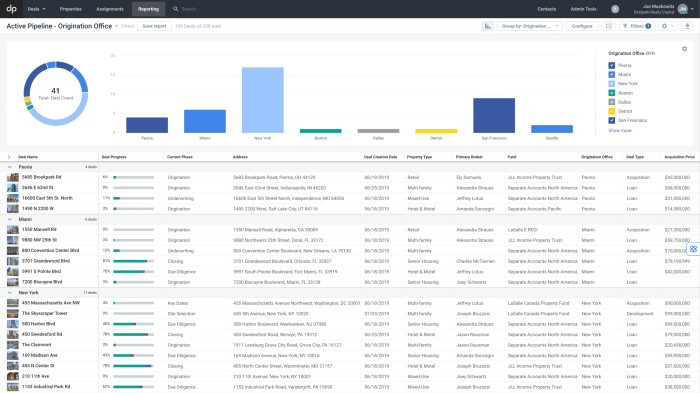

Typical investment management software offers a range of functionalities designed to meet the diverse needs of investment professionals and clients. These include portfolio construction and rebalancing, performance measurement and reporting, risk management tools, and client communication features. Some more advanced systems even incorporate sophisticated predictive modeling and algorithmic trading capabilities. Imagine having a crystal ball (okay, maybe not a crystal ball, but some seriously impressive data analysis).

Types of Investment Management Software

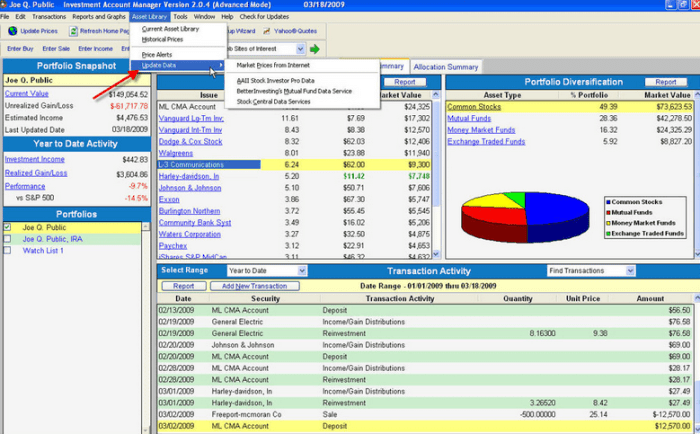

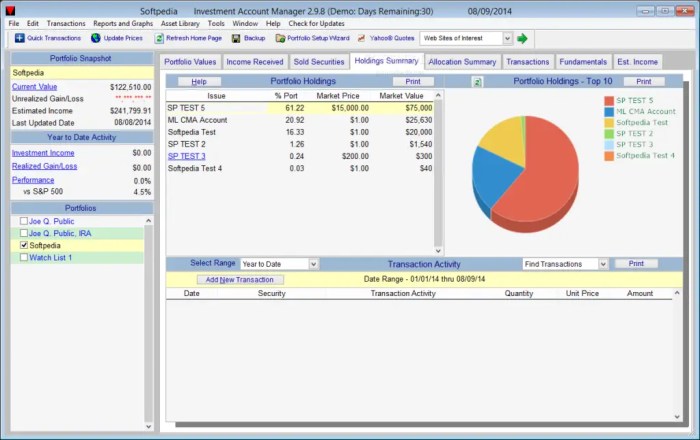

The market offers a variety of investment management software solutions, each catering to specific needs and user profiles. Portfolio management software focuses on tracking assets, calculating returns, and generating reports. Risk management software employs advanced algorithms to assess and mitigate potential risks associated with investments. Trading platforms provide direct access to financial markets, enabling users to execute trades efficiently. Finally, there are integrated solutions that combine functionalities from multiple categories. It’s like choosing between a single-purpose tool and a multi-tool – the choice depends on your needs and budget (and how much you enjoy shiny buttons).

Key Differentiating Features of Investment Management Software

Several key features distinguish different investment management software solutions. These include the level of automation, the sophistication of reporting and analytics capabilities, the range of asset classes supported, the integration with other systems, and the overall user experience. Some software might boast seamless integration with accounting systems, while others offer advanced charting and visualization tools. The choice often comes down to a balance of features, usability, and cost. It’s a bit like choosing a car – you might want a sporty model or a family-friendly SUV, depending on your priorities.

User Interaction with Investment Management Software

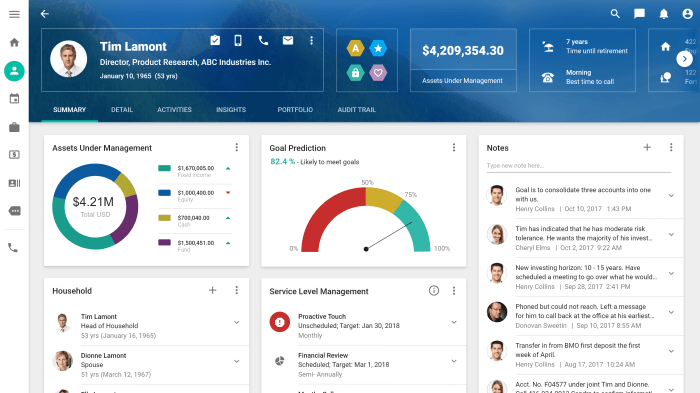

Different user roles interact with investment management software in distinct ways. Portfolio managers utilize the software to construct and manage portfolios, analyze performance, and generate reports for clients. Financial advisors leverage the software to provide personalized advice, track client accounts, and maintain regulatory compliance. Clients, on the other hand, typically access the software through a secure portal to monitor their investments, access reports, and communicate with their advisors. It’s a collaborative ecosystem, designed to keep everyone informed and engaged. Think of it as a well-orchestrated symphony, where each instrument (user role) plays a vital part.

Benefits and Use Cases

Investing wisely is like a well-orchestrated symphony; it requires precision, timing, and a conductor (that’s you!) to harmonize your assets. But managing a portfolio, especially a large or complex one, can feel more like a chaotic mosh pit than a graceful waltz. Investment management software steps in to restore order, providing the tools and insights to turn your investment strategy from a hopeful gamble into a well-tuned performance.

Investment management software offers a plethora of advantages, transforming the often-daunting task of managing investments into a streamlined and efficient process. These benefits extend across the spectrum of investors, from individual portfolio managers seeking to optimize their personal wealth to institutional giants navigating the complexities of global markets. The common thread is increased efficiency, improved decision-making, and ultimately, better investment outcomes.

Advantages for Individual and Institutional Investors

For individual investors, the software provides a centralized hub to track investments across various accounts, automate routine tasks like rebalancing and dividend reinvestment, and access real-time market data and analytics. This empowers individuals to make more informed decisions, potentially improving their returns and reducing stress. Imagine effortlessly monitoring your diverse holdings, from stocks and bonds to real estate and cryptocurrencies, all within a single, user-friendly interface – a far cry from juggling spreadsheets and scattered brokerage statements!

Institutional clients, on the other hand, benefit from the software’s capacity to manage massive portfolios, conduct complex risk analysis, and adhere to stringent regulatory compliance requirements. The ability to automate reporting, streamline workflows, and improve communication with clients significantly enhances operational efficiency. Imagine a scenario where a large pension fund effortlessly manages billions of dollars in assets, accurately tracking performance and adhering to all regulatory standards – a feat only achievable with powerful, dedicated software.

Successful Implementation Case Studies

One notable example involves a mid-sized asset management firm that implemented investment management software to improve portfolio optimization and risk management. The firm experienced a 15% reduction in operational costs and a 5% increase in portfolio returns within the first year. The software’s advanced analytics enabled them to identify previously unseen market opportunities and mitigate potential risks more effectively. Another case study features a large university endowment, where the implementation of the software improved transparency and reporting, leading to enhanced communication with stakeholders and a greater sense of confidence in the management of their funds. These examples highlight the significant impact of investment management software on both operational efficiency and investment performance.

Software vs. Manual Processes

The advantages of using software over manual processes are stark. While manual methods rely on tedious spreadsheets, error-prone calculations, and time-consuming reconciliation, investment management software offers a significant upgrade.

| Feature | Software | Manual Processes |

|---|---|---|

| Accuracy | High, automated calculations minimize errors | Prone to human error, especially with large datasets |

| Efficiency | Streamlined workflows, automation of tasks | Time-consuming, labor-intensive |

| Scalability | Easily handles increasing data volumes and complexity | Difficult to scale, becomes unwieldy with large portfolios |

| Reporting | Real-time reporting, customizable dashboards | Slow, manual report generation, limited insights |

Industries Relying on Investment Management Software

A wide range of industries rely heavily on sophisticated investment management software. This includes asset management firms, hedge funds, private equity firms, insurance companies, pension funds, wealth management advisors, and family offices. These organizations require robust tools to manage their investments effectively, analyze market trends, and comply with regulatory requirements. The sophistication and scale of investment management software are essential for their operations and success. The software allows them to make better, faster, and more informed investment decisions, which directly impacts their profitability and ability to meet their obligations.

Key Features and Modules

Investing in investment management software is a bit like buying a really fancy, super-charged espresso machine: you expect it to make your life easier, more efficient, and maybe even a little bit more glamorous. But unlike that espresso machine that mostly just makes coffee (albeit *amazing* coffee), a good investment management software suite is a complex beast, brimming with features designed to streamline the often-chaotic world of managing investments. Let’s delve into the essential components.

The core functionality of any robust investment management software revolves around a few key modules, each playing a vital role in the overall process. Think of it as a well-oiled machine, where each part contributes to the smooth operation of the whole. Without one, the whole thing sputters and wheezes.

Portfolio Accounting

Portfolio accounting is the bedrock of the entire system. It’s the meticulous record-keeping that tracks every transaction, every asset, every liability – essentially, a comprehensive ledger for all investment activity. This module typically handles tasks such as recording security purchases and sales, calculating accrued income, managing corporate actions (like dividends and stock splits), and maintaining accurate valuations. Imagine trying to manage a portfolio of hundreds of assets without it – it’d be a financial nightmare of epic proportions! A robust portfolio accounting module automates much of this tedious work, ensuring accuracy and freeing up time for more strategic decision-making.

Reporting

The reporting module is where the magic happens (or at least, where the meaningful insights are extracted). This module allows users to generate a wide array of customizable reports, providing a clear and concise overview of portfolio performance, risk exposure, and other key metrics. Think of it as your financial crystal ball, offering glimpses into the future (well, at least a better understanding of the past and present). The ability to generate custom reports is crucial, allowing users to tailor the information presented to specific needs and preferences. For example, a client might need a report summarizing their year-to-date performance, while an internal team might require a more detailed breakdown of asset allocation. The flexibility of the reporting module is key.

Performance Measurement

Measuring performance is not simply about calculating returns; it’s about understanding *why* those returns occurred. This module goes beyond simple calculations, providing tools to analyze portfolio performance against benchmarks, attribution analysis (identifying the drivers of performance), and risk-adjusted return metrics (such as Sharpe ratios). A good performance measurement module allows for in-depth analysis, revealing both successes and areas for improvement. It provides the crucial context needed to make informed decisions, rather than simply reacting to the numbers on the page.

Portfolio Optimization and Risk Management, Investment Management Software

These two are closely intertwined, often functioning as a single module within the software. Portfolio optimization aims to construct portfolios that maximize returns for a given level of risk (or minimize risk for a given level of return). Different approaches exist, ranging from mean-variance optimization (a classic approach that considers expected returns and variances) to more sophisticated techniques incorporating factors like style, sector, and currency exposures. Risk management, on the other hand, focuses on identifying and mitigating potential losses. This might involve stress testing portfolios under various market scenarios, employing diversification strategies, and setting risk limits. The software can assist in both aspects, providing tools and algorithms to help build and manage well-diversified portfolios that align with investor risk tolerances.

Hierarchical Structure of Features

The features of a typical investment management software can be organized hierarchically as follows:

| Module | Sub-Module | Features |

|---|---|---|

| Portfolio Accounting | Transaction Management | Security Purchases/Sales, Dividend & Interest Accrual, Corporate Actions |

| Valuation | Market Data Integration, Pricing Models, Valuation Adjustments | |

| Reporting | Custom Report Generation | Portfolio Summaries, Performance Reports, Risk Reports, Client Statements |

| Standard Reports | Pre-defined templates for common reporting needs | |

| Performance Measurement | Return Calculation | Time-weighted returns, Money-weighted returns, Benchmark comparisons |

| Attribution Analysis | Identifying sources of portfolio performance (e.g., asset allocation, security selection) | |

| Portfolio Optimization & Risk Management | Optimization | Mean-variance optimization, Factor-based optimization |

| Risk Management | Stress testing, Value-at-Risk (VaR) calculations, Risk limits |

Integration and Data Management

Integrating your investment management software with other crucial financial systems is not just a good idea – it’s the difference between a well-oiled machine and a chaotic mess of spreadsheets. Think of it as building a financial ecosystem, where data flows seamlessly, providing a holistic view of your investments and reducing the risk of costly errors (and let’s be honest, nobody wants to spend their Friday nights reconciling spreadsheets).

Data integration allows for a more efficient workflow, minimizing manual data entry and the associated human errors that can lead to disastrous consequences. Imagine the time saved, the stress reduced, and the potential for more accurate forecasting – a financial utopia, if you will. But how do we achieve this blissful state? By carefully considering various data integration methods and, crucially, prioritizing data security.

Data Integration Methods

Several methods facilitate the seamless flow of data between your investment management software and other systems like CRM, accounting software, and portfolio management platforms. These methods vary in complexity and cost, but the right choice depends on your specific needs and technological infrastructure. The most common approaches include:

- API Integration: This method uses Application Programming Interfaces to directly connect systems, allowing for real-time data exchange. It’s like having a secret, super-efficient data tunnel between your systems, ensuring everything stays synchronized. This is generally the most robust and scalable solution.

- File-Based Integration: This involves importing and exporting data via files such as CSV or XML. It’s a simpler, less expensive option, but it’s also less efficient and prone to errors if not managed carefully. Think of it as using a courier service instead of a direct line – it works, but it’s slower and more prone to delays.

- Database Integration: This approach involves direct database connections between systems, allowing for efficient and secure data exchange. It’s ideal for large volumes of data and complex transactions, but requires a more technical setup and ongoing maintenance. This is like having a dedicated high-speed data pipeline, ensuring data flows smoothly and efficiently.

Data Security and Compliance

In the world of finance, security is paramount. Data breaches can have devastating consequences, not just financially, but also reputationally. Therefore, robust security measures are essential when integrating your investment management software. This includes:

- Encryption: Protecting data both in transit and at rest using encryption protocols is vital. Think of this as adding an unbreakable lock to your data vault.

- Access Control: Implementing strict access control measures ensures only authorized personnel can access sensitive data. This is like having a well-guarded gatekeeper at your data fortress.

- Regular Audits: Conducting regular security audits helps identify and address potential vulnerabilities before they can be exploited. This is like having a security detail that constantly patrols your data castle, ensuring its integrity.

- Compliance with Regulations: Adherence to relevant regulations, such as GDPR or CCPA, is crucial to maintain legal compliance and build trust with clients. This is like having all the necessary permits and licenses to operate your data kingdom legally and ethically.

Data Flow within an Investment Management System

The following flowchart illustrates a typical data flow within a well-integrated investment management system:

A simplified representation: Client data (from CRM) –> Portfolio Management (Investment Software) –> Transaction Processing (Accounting Software) –> Reporting & Analytics (Investment Software) –> Regulatory Reporting (Dedicated Compliance Software).

Selecting and Implementing Investment Management Software

Choosing the right investment management software is akin to selecting the perfect steed for a knight errant – the wrong choice can lead to a disastrous quest, while the right one ensures a triumphant journey. This process requires careful consideration of your specific needs and a healthy dose of strategic planning, lest you find yourself saddled with a digital donkey instead of a high-performing warhorse.

Step-by-Step Guide to Selecting Appropriate Investment Management Software

This process should be approached systematically, like a well-orchestrated symphony. Ignoring any step risks a cacophony of errors and inefficiencies.

- Needs Assessment: Begin by thoroughly analyzing your firm’s current investment processes, identifying pain points, and defining your future objectives. What are your biggest challenges? What features are absolutely essential? What would be nice-to-haves? Consider factors like portfolio size, investment strategies, regulatory compliance requirements, and the number of users.

- Software Research: Once you know your needs, research available software solutions. Explore different vendors, comparing their offerings and pricing structures. Look for software that aligns with your firm’s size, investment style, and technological infrastructure. Consider seeking recommendations from other investment firms; a little networking can go a long way.

- Vendor Evaluation: Narrow down your options to a select few. Request demos, and thoroughly test the software’s features. Pay attention to user-friendliness, reporting capabilities, and the overall user experience. Don’t hesitate to ask tough questions about security, scalability, and customer support.

- Proof of Concept (POC): Before committing to a full implementation, conduct a POC. This allows you to test the software in a controlled environment with a subset of your data and users. This minimizes the risk of a full-scale implementation disaster.

- Negotiation and Contract Review: Carefully review the contract terms, paying attention to pricing, service level agreements (SLAs), and termination clauses. Don’t be afraid to negotiate favorable terms. Remember, you’re entering a partnership, not signing away your firstborn.

- Implementation Planning: Develop a detailed implementation plan, including timelines, resource allocation, and data migration strategies. Account for potential challenges and build in contingency plans. A well-defined plan is your roadmap to success.

Best Practices for Implementation and Deployment

Implementing investment management software is a marathon, not a sprint. A rushed implementation often leads to costly mistakes and prolonged integration issues.

- Data Migration Strategy: Develop a comprehensive data migration plan to ensure a smooth and accurate transfer of your existing data into the new system. Thorough data validation is critical to avoid future headaches.

- Phased Rollout: Consider a phased rollout, starting with a pilot group of users before expanding to the entire firm. This allows you to identify and address any issues before they impact the entire organization.

- Change Management: Implement a robust change management program to ensure that users are properly trained and supported throughout the implementation process. Address concerns and provide adequate resources to ease the transition.

- Testing and Validation: Rigorous testing is essential to ensure that the software functions correctly and meets your requirements. Thoroughly test all features and workflows before going live.

Importance of Training and Support

Investing in adequate training and ongoing support is crucial for maximizing the software’s value and minimizing user frustration. Think of it as investing in your team’s success – a worthwhile endeavor.

Effective training programs should cover all aspects of the software, from basic navigation to advanced features. Ongoing support should be readily available to address any questions or issues that arise. Consider offering refresher courses and user manuals for continued efficiency. A well-trained team is a happy and productive team.

Checklist for Evaluating Investment Management Software

This checklist will serve as your compass, guiding you through the selection process.

Before making a decision, ensure you’ve carefully considered the following:

| Factor | Description |

|---|---|

| Functionality | Does the software meet your specific needs? |

| Scalability | Can the software handle your future growth? |

| Security | Are your data and systems adequately protected? |

| Integration Capabilities | Does it integrate with your existing systems? |

| Reporting and Analytics | Does it provide the reports you need? |

| User-Friendliness | Is the software intuitive and easy to use? |

| Vendor Support | Is the vendor responsive and helpful? |

| Cost | Is the software affordable and within budget? |

| Regulatory Compliance | Does the software comply with relevant regulations? |

Future Trends in Investment Management Software

The world of investment management is hurtling towards a future where algorithms dream of portfolios, and blockchain whispers secrets of secure transactions. Prepare yourself for a technological rollercoaster ride, as we explore the exciting – and occasionally terrifying – trends shaping the future of investment management software. Buckle up, because it’s going to be a wild ride!

The integration of artificial intelligence (AI), machine learning (ML), and blockchain technology is poised to revolutionize how investment decisions are made and portfolios are managed. These technologies offer the potential to significantly enhance efficiency, accuracy, and security within the investment management process, leading to better risk management and ultimately, improved returns. Think of it as upgrading from a rusty abacus to a supercharged quantum computer – with a side of impenetrable vault security.

Artificial Intelligence and Machine Learning in Investment Management

AI and ML are no longer futuristic fantasies; they’re actively reshaping investment strategies. These technologies can analyze vast datasets – think petabytes of market data, economic indicators, and news sentiment – to identify patterns and predict market movements with a level of speed and accuracy far surpassing human capabilities. For example, AI-powered algorithms can sift through mountains of news articles to gauge market sentiment towards a specific company, providing investors with a real-time pulse on public opinion. Imagine having a crystal ball (powered by algorithms, of course) that can predict market fluctuations with a high degree of accuracy. This allows for more proactive and informed decision-making, leading to potentially higher returns and reduced risks. Moreover, these algorithms can personalize investment strategies based on individual investor risk profiles and financial goals, offering bespoke solutions that cater to specific needs.

Blockchain Technology and Enhanced Security

Blockchain technology, best known for its role in cryptocurrencies, offers a powerful solution to the persistent challenge of security and transparency in investment management. Its decentralized and immutable nature makes it virtually tamper-proof, ensuring the integrity of transaction records and protecting sensitive data from unauthorized access. For example, blockchain can be used to create a secure and transparent record of asset ownership, reducing the risk of fraud and enhancing investor confidence. Imagine a world where every investment transaction is recorded on a publicly verifiable, yet secure, ledger – a significant leap forward in trust and transparency. This technology could streamline the entire investment process, from onboarding clients to executing trades and managing assets, all while maintaining the highest levels of security.

Future Evolution of Investment Management Software Functionalities

Future investment management software will likely incorporate more sophisticated analytics capabilities, driven by AI and ML. Expect to see advanced risk management tools that incorporate real-time market data and predictive modeling, allowing for more proactive risk mitigation strategies. Furthermore, software will increasingly integrate with other financial platforms and data sources, creating a more holistic and interconnected investment ecosystem. This seamless integration will provide investors with a comprehensive view of their financial landscape, simplifying the management of their investments across multiple accounts and asset classes. Think of it as a central command center for all your financial activities, providing real-time insights and control.

Innovative Features for Future Investment Management Software

Several innovative features are likely to be incorporated into future versions of investment management software. These include: enhanced natural language processing capabilities allowing investors to interact with the software using everyday language; automated portfolio rebalancing based on real-time market conditions and investor goals; and integrated ESG (Environmental, Social, and Governance) scoring and reporting tools, catering to the growing demand for sustainable and responsible investing. These new features will not only improve efficiency but also enhance the overall user experience, making investment management more accessible and intuitive for both professional and individual investors. Imagine a software that understands your financial goals and automatically adjusts your portfolio to maximize returns while minimizing risks – all while being environmentally conscious!

Epilogue

In the end, the choice of investment management software is a deeply personal (and potentially lucrative) one. While the technology itself is constantly evolving, the core principles of careful planning, diligent monitoring, and a healthy dose of informed risk-taking remain paramount. So, whether you’re a seasoned pro or just starting your investment journey, remember that the right software can be your trusted co-pilot on the sometimes bumpy road to financial success. Now go forth and conquer those spreadsheets!

Questions Often Asked: Investment Management Software

What is the typical cost of investment management software?

Costs vary wildly depending on features, scalability, and vendor. Expect a range from affordable subscription models for individuals to hefty enterprise solutions for institutions.

Is investment management software secure?

Reputable vendors prioritize security with robust encryption and access controls. However, due diligence is crucial; investigate a vendor’s security protocols before committing.

How much training is needed to use investment management software?

This depends on the software’s complexity. Some offer intuitive interfaces requiring minimal training, while others necessitate more extensive onboarding and user support.

Can investment management software integrate with my existing accounting software?

Many modern solutions offer seamless integration with popular accounting platforms, streamlining data flow and reducing manual data entry.