Investment Portfolio Optimization Techniques: Dare to dream of riches without the accompanying nightmares of crippling losses? This isn’t alchemy, my friend, but a journey into the fascinating world of maximizing returns while minimizing risk. We’ll navigate the sometimes-treacherous waters of Modern Portfolio Theory, factor-based investing, and even the surprisingly impactful realm of behavioral finance—all while keeping our eyes firmly fixed on the prize: a well-optimized portfolio that sings the sweet song of financial success (or at least, a less-dissonant tune).

This exploration will delve into the core principles of portfolio construction, covering everything from diversification strategies and risk management to advanced optimization algorithms and tax-efficient investment approaches. We’ll examine various techniques, comparing their strengths and weaknesses, and offering practical advice for building and maintaining a portfolio that aligns with your individual financial goals and risk tolerance. Prepare for a rollercoaster ride of financial enlightenment – buckle up!

Introduction to Investment Portfolio Optimization

Investing wisely isn’t just about throwing darts at a stock market board (though that *could* be fun). It’s about strategically building a portfolio that aligns with your financial goals and risk tolerance. This involves a process called portfolio optimization, which, let’s face it, sounds a lot more sophisticated than it actually is (mostly).

Portfolio optimization is the art (and science!) of constructing an investment portfolio that maximizes expected return for a given level of risk, or minimizes risk for a given level of expected return. Think of it as finding the sweet spot between making big bucks and avoiding a financial meltdown. It’s like baking the perfect cake – you need the right ingredients (assets) in the right proportions to achieve the desired outcome (financial success, not a crumbly disaster).

The Importance of Diversification

Diversification is the cornerstone of a well-optimized portfolio. It’s the age-old adage of “don’t put all your eggs in one basket.” Instead of relying on a single investment, a diversified portfolio spreads investments across various asset classes (like stocks, bonds, real estate, etc.) and sectors (technology, healthcare, energy, etc.). This reduces the impact of any single investment performing poorly. Imagine investing solely in a company that manufactures novelty socks; if the sock market suddenly collapses (a plausible, if slightly unsettling, scenario), your entire portfolio would be in jeopardy. Diversification acts as a safety net, cushioning the blow of market fluctuations. A diversified portfolio, therefore, mitigates risk by reducing the volatility of overall returns.

Key Goals of Portfolio Optimization

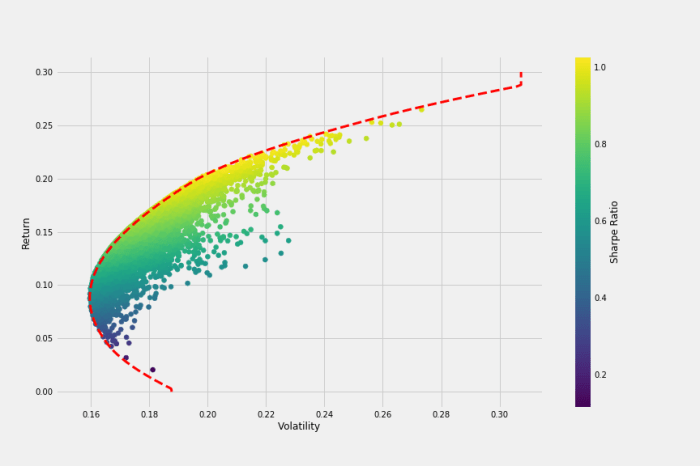

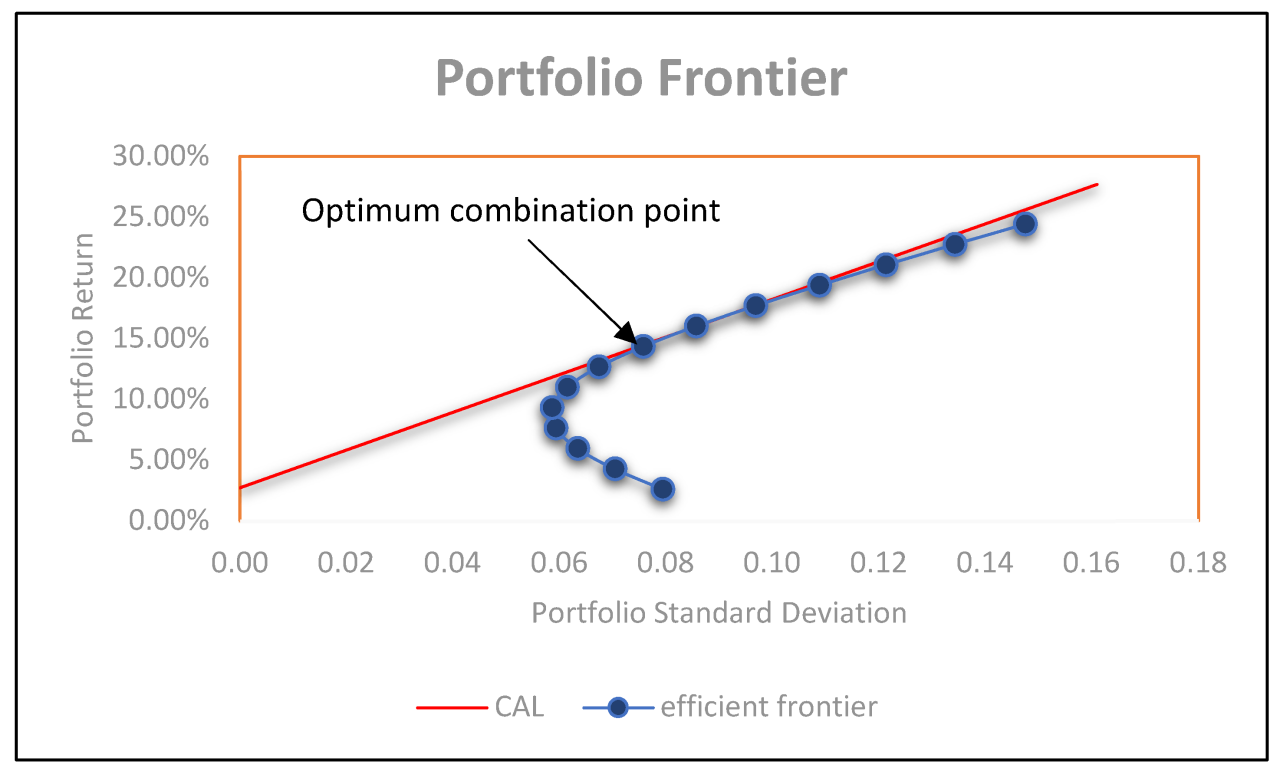

The primary goals of portfolio optimization are, unsurprisingly, to maximize returns while minimizing risk. This isn’t a simple “more is better” scenario; it’s about finding the optimal balance between the two. Different investors will have different risk appetites and goals, leading to different optimal portfolios. For example, a young investor with a long time horizon might be comfortable with a higher-risk portfolio aiming for potentially higher returns, while someone nearing retirement might prefer a lower-risk portfolio to preserve their capital. This delicate dance between return and risk is often represented graphically using the efficient frontier, a curve showing the optimal portfolios offering the highest expected return for each level of risk. The specific location on this frontier depends entirely on the individual investor’s risk tolerance and financial objectives. It’s a bit like choosing the perfect rollercoaster: some people crave the adrenaline rush of the steepest drops, while others prefer a gentler, more predictable ride.

Modern Portfolio Theory (MPT)

Modern Portfolio Theory, or MPT, isn’t just some dusty academic concept; it’s the sophisticated, slightly smug older sibling of investment strategies. Think of it as the investment world’s answer to finding the perfect balance between thrill and stability – a bit like choosing between a rollercoaster and a comfortable armchair, but with significantly more math. It revolutionized how we think about risk and return, replacing the naive approach of simply picking the highest-yielding asset with a more nuanced understanding of diversification and risk management.

MPT’s core principle is that investors should construct portfolios to maximize expected return for a given level of risk, or minimize risk for a given level of expected return. Sounds simple, right? Well, the devil, as always, is in the details. This elegant theory rests on a few key assumptions, some of which are hilariously unrealistic in the real world (but hey, models are models!). These assumptions include rational investors, efficient markets (where prices reflect all available information – a big ask!), and the ability to perfectly estimate the expected return and standard deviation of assets. Let’s just say, reality often throws a wrench (or a whole toolbox) into these perfectly-oiled theoretical gears.

Portfolio Variance and Covariance Calculation

Calculating portfolio variance and covariance is where the fun (and the spreadsheets) begin. Portfolio variance measures the overall volatility of a portfolio’s returns. It’s a measure of how much the portfolio’s returns are likely to fluctuate around their expected value. A higher variance indicates greater risk. Covariance, on the other hand, measures how two assets’ returns move together. A positive covariance means they tend to move in the same direction, while a negative covariance suggests they move in opposite directions. This is crucial for diversification; negatively correlated assets can help smooth out the bumps in your portfolio’s ride.

The formula for portfolio variance (σp2) for a two-asset portfolio is:

σp2 = w12σ12 + w22σ22 + 2w1w2Cov(1,2)

where:

* w1 and w2 are the weights of asset 1 and asset 2 in the portfolio, respectively.

* σ12 and σ22 are the variances of asset 1 and asset 2, respectively.

* Cov(1,2) is the covariance between asset 1 and asset 2.

Calculating covariance involves a similar, albeit slightly more complex, formula. Let’s just say it involves sums of products of deviations from the mean – enough to make even the most seasoned mathematician reach for a strong coffee.

Efficient Frontier Illustration

The efficient frontier is the graphical representation of the optimal portfolios according to MPT. It shows the set of portfolios that offer the highest expected return for a given level of risk, or the lowest risk for a given level of expected return. Portfolios that fall below the efficient frontier are considered suboptimal, because there are other portfolios that offer either higher returns for the same risk or lower risk for the same return. Think of it as the “sweet spot” in the risk-return trade-off.

Below is a hypothetical example illustrating the efficient frontier. Note that real-world data is much messier and more exciting!

| Asset | Expected Return | Standard Deviation | Portfolio Weight (Example) |

|---|---|---|---|

| Stock A | 15% | 20% | 0.6 |

| Stock B | 10% | 15% | 0.4 |

| Stock C | 8% | 10% | 0.2 |

| Bond D | 5% | 5% | 0.8 |

This table presents hypothetical data. A true efficient frontier would require calculating the portfolio return and standard deviation for many different combinations of asset weights, and then plotting these combinations on a graph. The resulting curve represents the efficient frontier. The exact shape and position of the efficient frontier will vary depending on the characteristics of the assets included in the portfolio and their correlations. The process is iterative and often requires sophisticated software to efficiently handle the calculations.

Risk Management in Portfolio Optimization

Investing is a bit like a rollercoaster – thrilling, potentially lucrative, and occasionally terrifying. While the goal is to maximize returns, the reality is that risk is an unavoidable companion. Effective portfolio optimization doesn’t just chase returns; it skillfully navigates the thrilling, terrifying, and sometimes downright nauseating landscape of risk. This section explores the tools and strategies to make that journey smoother (and hopefully, more profitable).

Risk, in the investment world, isn’t simply the chance of losing money; it’s the uncertainty surrounding the potential outcomes. Understanding and managing this uncertainty is paramount to building a successful portfolio. Different investors have different appetites for risk, and tailoring the portfolio to this tolerance is crucial. Let’s delve into the methods for quantifying and mitigating risk.

Measures of Risk

Several metrics help us quantify the inherent risk within a portfolio. Each provides a different perspective, allowing for a more holistic understanding of potential downsides.

- Standard Deviation: This classic measure reflects the volatility of returns. A higher standard deviation implies greater price fluctuations – more excitement, more potential for both substantial gains and painful losses. Imagine a stock with a high standard deviation as a rollercoaster with steep drops and exhilarating climbs; a low standard deviation stock would be more like a gentle, predictable Ferris wheel.

- Beta: Beta measures the volatility of a security relative to the overall market. A beta of 1 means the security moves in line with the market; a beta greater than 1 indicates higher volatility than the market (a riskier bet!), and a beta less than 1 suggests lower volatility (a more conservative choice). Think of beta as a measure of how much a particular investment “jumps” compared to the whole market’s jumpiness.

- Value at Risk (VaR): VaR is a statistical measure estimating the potential loss in value of an asset or portfolio over a specific time period and confidence level. For example, a VaR of $10,000 at a 95% confidence level means there’s a 5% chance of losing at least $10,000 over the given period. VaR provides a more concrete number to help visualize potential losses, unlike the more abstract measures of standard deviation and beta. It’s like having a seatbelt on your rollercoaster – you still experience the thrill, but you have a safety net (hopefully).

Risk Tolerance and Portfolio Construction

Risk tolerance is a crucial element in investment decision-making. It reflects an individual’s willingness to accept risk in pursuit of higher returns. Different tolerance levels dictate the composition of the portfolio.

| Risk Tolerance Level | Portfolio Composition | Example |

|---|---|---|

| Conservative | High proportion of low-risk assets (e.g., government bonds, high-quality corporate bonds) | A portfolio primarily consisting of government bonds and a small allocation to large-cap stocks. |

| Moderate | A balanced mix of low-risk and moderate-risk assets (e.g., a mix of bonds and stocks) | A portfolio with 60% allocated to stocks (diversified across sectors and market caps) and 40% to bonds. |

| Aggressive | High proportion of high-risk assets (e.g., small-cap stocks, emerging market equities) | A portfolio heavily weighted towards growth stocks and emerging market investments. This investor is comfortable with significant price swings for the potential of higher returns. |

Managing Systematic and Unsystematic Risk

Systematic risk (also known as market risk) is inherent to the overall market and cannot be diversified away. Unsystematic risk (specific risk) is associated with individual assets and can be mitigated through diversification. Effective risk management requires strategies to address both.

- Systematic Risk Management: Strategies for managing systematic risk include hedging (using derivatives to offset potential losses), asset allocation (diversifying across different asset classes), and adjusting the portfolio’s beta to match the investor’s risk tolerance. For example, during times of market uncertainty, an investor might reduce their portfolio beta by shifting funds from equities to bonds.

- Unsystematic Risk Management: Diversification is the cornerstone of unsystematic risk management. By spreading investments across various assets, sectors, and geographies, the impact of a single asset’s poor performance is lessened. Imagine having all your eggs in one basket – a risky proposition! Diversification is like having multiple baskets, spreading the risk.

Factor-Based Investing: Investment Portfolio Optimization Techniques

Factor-based investing, darling of the quantitative finance world, moves beyond simply picking stocks based on gut feeling or the latest market whisper. Instead, it leverages statistically significant factors – essentially, characteristics of assets that historically have been associated with higher returns – to build portfolios. Think of it as building a financial Jenga tower, but instead of wooden blocks, you’re using carefully selected factors to create a more stable and potentially profitable structure. It’s all about identifying those factors that, over time, tend to outperform, and then cleverly tilting your portfolio towards them.

Factor-based investing aims to exploit persistent market inefficiencies by constructing portfolios systematically exposed to these identified factors. By doing so, it aims to generate superior risk-adjusted returns compared to traditional market-cap-weighted indices. This systematic approach reduces emotional decision-making and helps to maintain discipline, two key ingredients often missing in the chaotic world of individual stock picking.

Value Factor

Value investing, a strategy as old as the hills (or at least as old as Benjamin Graham), focuses on identifying undervalued assets. These are companies that, for whatever reason – market sentiment, temporary setbacks, or even just a bit of market myopia – are trading at prices significantly below their intrinsic value. Value investors look for companies with low price-to-earnings ratios (P/E), high dividend yields, and strong balance sheets. They believe the market temporarily misprices these assets, creating an opportunity to buy low and sell high (eventually, of course). A classic example is Warren Buffett’s decades-long success built largely on this principle. He consistently found undervalued companies and held them for the long term, reaping significant rewards as the market eventually recognized their true worth.

Growth Factor

Growth investing, on the other hand, focuses on companies exhibiting rapid earnings and revenue growth. These are the high-flyers, the innovators, the disruptors. Growth stocks often command high P/E ratios because investors are willing to pay a premium for their anticipated future growth. While riskier than value stocks, they offer the potential for significant returns if the company continues to deliver on its growth trajectory. Think of companies like Amazon in its early days or Tesla in its ascent – high-growth stocks that have rewarded early investors handsomely, albeit with significant volatility along the way. Identifying true growth potential requires careful analysis of a company’s competitive advantage, management team, and market opportunity.

Momentum Factor

Momentum investing is all about riding the wave. This strategy focuses on stocks that have shown strong price appreciation in the recent past. The underlying idea is that winning stocks tend to keep winning (at least for a while). This isn’t necessarily about fundamental analysis; it’s more about identifying trends and capitalizing on them. Of course, momentum can reverse quickly, so skillful risk management is crucial. Think of it as surfing – you need to know when to jump on the wave and, just as importantly, when to get off before it crashes. While seemingly simple, identifying the right momentum stocks and timing the entry and exit points requires sophisticated quantitative models and careful monitoring of market trends.

Hypothetical Factor-Tilted Portfolio

A hypothetical portfolio could allocate 40% to value stocks (representing a tilt towards undervalued companies with strong fundamentals), 30% to growth stocks (representing exposure to high-growth potential), and 30% to a momentum strategy (to capture short-term trends). This allocation reflects a diversified approach that seeks to balance the potential for higher returns with appropriate risk management. The specific stocks within each category would be chosen based on rigorous quantitative screening and factor analysis, ensuring the portfolio aligns with the desired factor exposures. This is a simplified example; a real-world portfolio would likely involve a more complex allocation, incorporating various risk mitigation strategies and rebalancing mechanisms. Furthermore, the specific asset allocation would be adjusted based on prevailing market conditions and investor risk tolerance. This hypothetical portfolio demonstrates a practical application of factor-based investing principles to achieve a diversified exposure to multiple factors, aiming for a higher risk-adjusted return.

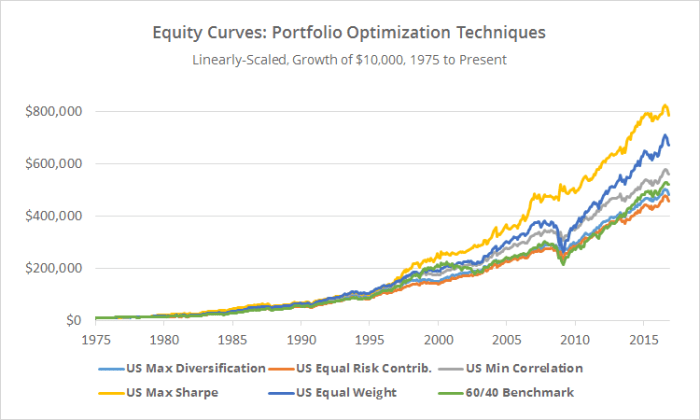

Optimization Techniques and Algorithms

So, you’ve mastered the theoretical underpinnings of portfolio optimization – congratulations! Now, let’s get our hands dirty with the nitty-gritty: the algorithms that actually *do* the optimizing. Think of these algorithms as the tireless, number-crunching robots tirelessly working to build your perfect investment portfolio, while you sip margaritas on a beach (metaphorically speaking, of course. Unless…?).

The selection of an appropriate optimization algorithm is crucial; it directly impacts the efficiency and effectiveness of your portfolio construction process. Choosing the wrong algorithm is like trying to build a skyscraper with toothpicks – it might look impressive initially, but it’s likely to crumble under pressure.

Mean-Variance Optimization and Quadratic Programming

Mean-variance optimization (MVO), the cornerstone of Modern Portfolio Theory (MPT), aims to find the portfolio that maximizes expected return for a given level of risk (or minimizes risk for a given level of return). Mathematically, this often translates into a quadratic programming (QP) problem. QP problems are a class of mathematical optimization problems where the objective function is quadratic and the constraints are linear. This is elegantly represented in the following formula:

Minimize: wTΣw – μTw

Subject to: ATw = b, w ≥ 0

Where: w represents the vector of portfolio weights, Σ is the covariance matrix of asset returns, μ is the vector of expected asset returns, A is the constraint matrix, and b is the vector of constraint values. Solving this, you find the optimal weights for your assets. Sounds simple, right? Well, the devil’s in the details (and the computational complexity).

Comparison of Optimization Algorithms

Several algorithms can tackle QP problems and other portfolio optimization challenges. Each has its strengths and weaknesses, making the choice highly dependent on the specific problem and the size of the portfolio.

| Algorithm | Computational Complexity | Strengths | Weaknesses |

|---|---|---|---|

| Quadratic Programming (Interior Point Methods) | Polynomial time (relatively fast for moderate-sized portfolios) | Efficient for moderately sized portfolios, handles constraints well. | Can struggle with very large portfolios; sensitive to initial parameter choices. |

| Linear Programming (Simplex Method) | Exponential time in the worst case (can be slow for large portfolios) | Simple to understand and implement; works well for linear constraints. | Can be computationally expensive for large portfolios; not directly suited for quadratic objective functions (requires approximations). |

| Evolutionary Algorithms (Genetic Algorithms) | Generally slower than QP methods | Robust to noisy data; can handle non-convex optimization problems and complex constraints effectively. | Computationally intensive; requires careful parameter tuning; results can be less precise than QP. |

| Simulated Annealing | Computationally intensive | Can escape local optima; relatively robust to noisy data. | Slow convergence; requires careful parameter tuning; solution quality can vary. |

The table above offers a glimpse into the algorithm landscape. Note that the “computational complexity” is a simplification, and actual performance depends on various factors including specific implementation and hardware. For instance, a portfolio with 10 assets might be easily handled by most algorithms, while a portfolio with 1000 assets would demand a more sophisticated approach, likely favoring interior point methods for QP or a robust evolutionary algorithm. Remember that the choice of algorithm should be a carefully considered decision, based on the specific needs of your portfolio and your computational resources. Don’t underestimate the power of a well-chosen algorithm; it’s the engine that drives your portfolio optimization success.

Portfolio Rebalancing Strategies

Rebalancing your investment portfolio might sound like a chore, akin to reorganizing your sock drawer (a surprisingly complex task, if you think about it). But just like a well-organized sock drawer brings peace of mind, a regularly rebalanced portfolio can significantly improve your investment journey, potentially leading to better returns and reduced risk. It’s all about maintaining your desired asset allocation, a crucial element in achieving your financial goals. Think of it as steering your financial ship—regular adjustments keep you on course.

Portfolio rebalancing is the process of adjusting your investment portfolio’s asset allocation back to your target percentages. Over time, market fluctuations will cause your portfolio’s asset allocation to drift from your original plan. For example, if you initially allocated 60% to stocks and 40% to bonds, a bull market might increase your stock allocation to 70%, while a bear market might shift it down to 50%. Rebalancing involves selling some of the assets that have outperformed and buying more of those that have underperformed to return your portfolio to its target allocation. This disciplined approach offers several advantages, including potentially mitigating risk and capitalizing on market opportunities.

Time-Based Rebalancing

Time-based rebalancing involves adjusting your portfolio at predetermined intervals, regardless of market performance. This could be annually, semi-annually, or even quarterly. The simplicity of this strategy is its greatest appeal. It requires minimal monitoring and decision-making, making it ideal for investors who prefer a hands-off approach. However, it can lead to more frequent trading, incurring transaction costs. Consider a scenario where an investor rebalances annually. If the market experiences significant swings within that year, the portfolio might deviate considerably from the target allocation, potentially missing out on gains or suffering unnecessary losses before the rebalancing date.

Level-Based Rebalancing

Level-based rebalancing, also known as threshold rebalancing, triggers adjustments only when the deviation from the target allocation reaches a predefined threshold. For instance, an investor might rebalance when the allocation of any asset class deviates by more than 5% from its target. This approach reduces the frequency of trades compared to time-based rebalancing, minimizing transaction costs. However, it requires more active monitoring of the portfolio to identify when the thresholds are breached. Imagine a scenario with a 10% threshold: if a stock’s allocation rises to 20% from a 10% target, a rebalance is triggered. This method is less reactive to short-term market fluctuations than time-based rebalancing.

Risk-Based Rebalancing

Risk-based rebalancing focuses on adjusting the portfolio’s risk profile rather than solely on maintaining target allocations. This strategy often involves increasing allocations to less risky assets during periods of high market volatility and shifting towards higher-risk assets during calmer periods. This approach is more dynamic and requires a deeper understanding of market conditions and risk tolerance. For example, if market volatility increases significantly, an investor might rebalance by reducing exposure to equities and increasing allocation to bonds to protect capital. Conversely, if market volatility decreases, they might increase their equity allocation to capture potential growth opportunities. This adaptive strategy attempts to optimize risk-adjusted returns.

Scenario: Impact of Rebalancing Strategies

Let’s imagine an investor with a $100,000 portfolio, initially allocated 60% to stocks (represented by a hypothetical index tracking the S&P 500) and 40% to bonds (represented by a hypothetical investment-grade bond index). We’ll simulate three years of returns, assuming simplified annual returns of 15%, -5%, and 10% for stocks and 2%, 1%, and 3% for bonds respectively. We will compare the performance under no rebalancing, annual time-based rebalancing, and a 10% level-based rebalancing strategy.

| Year | Stocks (No Rebalance) | Bonds (No Rebalance) | Stocks (Annual Rebalance) | Bonds (Annual Rebalance) | Stocks (10% Level Rebalance) | Bonds (10% Level Rebalance) |

|---|---|---|---|---|---|---|

| 1 | $75,000 | $42,000 | $60,000 | $40,000 | $60,000 | $40,000 |

| 2 | $69,750 | $42,420 | $65,700 | $40,800 | $65,700 | $40,800 |

| 3 | $76,725 | $43,862 | $72,270 | $41,608 | $72,270 | $41,608 |

Note: This is a highly simplified example. Actual market returns are far more complex and unpredictable. Transaction costs are not included in this illustration for simplicity. The exact performance will vary greatly depending on the specific investments chosen and the actual market conditions.

Tax-Efficient Portfolio Management

Ah, taxes. The unavoidable truth that even the most cunning investment strategies can’t entirely escape. While we can’t eliminate taxes altogether (alas!), we *can* significantly reduce their impact on our hard-earned returns. This section explores strategies for keeping more of your investment gains, because let’s face it, who doesn’t love a bigger slice of the pie?

Tax efficiency isn’t just about minimizing your tax bill; it’s about maximizing your *after-tax* returns. Understanding how taxes affect different investment types and employing savvy strategies can make a substantial difference over the long term, potentially turning a decent portfolio into a truly spectacular one. Think of it as a hidden layer of portfolio optimization – maximizing returns not just before taxes, but after!

The Impact of Taxes on Investment Returns

Taxes can significantly eat into investment returns, depending on the type of investment and your tax bracket. For instance, capital gains taxes are levied on profits from selling assets like stocks or bonds. These taxes can range from 0% to a hefty 20% or more, depending on the holding period and your income level. Dividends also face taxation, adding another layer of complexity. The longer you hold an asset, the more likely it is to qualify for a lower tax rate. This illustrates why long-term investment strategies often prove more tax-efficient. Consider the difference between a $10,000 gain taxed at 15% versus 20% – that’s a $500 difference, enough for a rather nice dinner!

Strategies for Minimizing Tax Liabilities

Several strategies can help mitigate the tax burden on your investments. One key approach is tax-loss harvesting, which involves selling losing investments to offset gains, thereby reducing your overall taxable income. This is a bit like a financial judo move: using your losses to neutralize your gains. Another strategy involves strategically choosing investments that generate tax-advantaged income, such as municipal bonds, which often offer tax-exempt interest. This is like finding a secret passageway around the tax collector! Careful asset allocation, favoring lower-taxed investments, is also crucial. It’s about building a portfolio that’s both robust and tax-smart.

Tax-Advantaged Investment Vehicles

Several investment vehicles offer tax advantages. Retirement accounts like 401(k)s and IRAs allow for pre-tax contributions, reducing your current taxable income. The tax benefits only become apparent upon retirement, but it’s a smart way to defer taxes and let your money grow tax-sheltered. Think of it as a financial time machine, sending your taxes to the future! Roth IRAs offer a different approach: contributions are made after tax, but withdrawals in retirement are tax-free. This is like paying taxes now to avoid them later. 529 plans offer tax advantages for college savings, allowing earnings to grow tax-deferred. This is a clever way to save for education and minimize the tax impact. Each vehicle has its own rules and nuances, so careful planning is essential.

ESG and Sustainable Investing in Portfolio Optimization

Integrating Environmental, Social, and Governance (ESG) factors into investment strategies is no longer a niche pursuit; it’s rapidly becoming mainstream, even if some investors still approach it with the skepticism of a squirrel facing a particularly shiny bicycle. This shift reflects a growing awareness that a company’s impact on the planet and society can significantly influence its long-term financial performance. Ignoring these factors is like navigating by the stars while wearing a blindfold – you might eventually get there, but it’ll be a bumpy ride.

ESG integration involves analyzing a company’s environmental footprint (carbon emissions, waste management, etc.), its social impact (labor practices, human rights, community relations), and its governance structure (board diversity, executive compensation, anti-corruption measures). This information, often sourced from ESG rating agencies and sustainability reports, is then incorporated into the portfolio construction process, influencing the selection and weighting of assets. Think of it as adding a crucial layer of due diligence, ensuring your investments align not only with your financial goals but also with your values (or at least, the values of your increasingly environmentally conscious clients).

ESG Integration Methods

There are several approaches to integrating ESG factors. Some investors employ a negative screening approach, excluding companies involved in controversial activities like fossil fuels or weapons manufacturing. This is akin to carefully selecting your ingredients – only using the best, and discarding anything questionable. Others use positive screening, actively seeking out companies with strong ESG profiles. This is like creating a gourmet dish – focusing on the highest-quality, ethically sourced ingredients to create something exceptional. A more sophisticated approach involves ESG integration throughout the entire investment process, from stock selection to risk management. This is the culinary equivalent of a Michelin-star restaurant – meticulously planned, flawlessly executed, and deeply satisfying.

Benefits and Challenges of ESG Integration

The potential benefits of ESG integration are numerous. Studies suggest that companies with strong ESG profiles may experience lower risk, higher profitability, and improved operational efficiency. Investors may also see enhanced reputation, improved client relationships, and increased alignment with societal values. However, challenges remain. The lack of standardization in ESG data and metrics can make comparisons difficult. Some critics argue that ESG investing sacrifices returns for social responsibility, a claim that is often debated. Moreover, the potential for “greenwashing,” where companies exaggerate their ESG credentials, poses a significant risk. Navigating these challenges requires careful due diligence, robust data analysis, and a healthy dose of skepticism.

Examples of ESG Investment Strategies and Their Impact

Consider a portfolio focused on renewable energy companies. This strategy, driven by the growing demand for sustainable energy, has often outperformed broader market indices in recent years. Another example involves investing in companies committed to diversity and inclusion. Studies suggest that companies with diverse leadership tend to be more innovative and financially successful. Conversely, a portfolio excluding companies with poor environmental records might experience lower returns in the short term, but potentially mitigate long-term risks associated with climate change. The impact of ESG strategies on portfolio performance is complex and context-dependent, influenced by factors such as the specific strategy employed, the time horizon, and the overall market environment. Ultimately, it’s a balancing act – aligning values with financial goals in a way that doesn’t compromise either.

Behavioral Finance and Portfolio Optimization

Investing, as we’ve humorously discovered throughout this exploration, isn’t just about crunching numbers; it’s a battle against our own irrational brains. Behavioral finance acknowledges this inconvenient truth, recognizing that human emotions and cognitive biases significantly impact investment decisions, often leading to suboptimal portfolio performance. Ignoring this reality is like trying to win a chess match while blindfolded – you might get lucky, but the odds are stacked against you. This section delves into the fascinating (and sometimes frustrating) intersection of psychology and portfolio optimization.

Behavioral biases are systematic errors in judgment that can lead to poor investment choices. These aren’t random mistakes; they’re predictable patterns driven by our inherent human frailties. Understanding these biases is the first step towards mitigating their impact on our financial well-being, transforming us from impulsive investors into more rational, data-driven portfolio managers.

Common Behavioral Biases Affecting Investment Decisions

Several cognitive biases consistently derail even the most well-intentioned investors. These biases often interact in complex ways, creating a perfect storm of irrationality. Let’s examine some of the most common culprits, illustrating how they can lead to suboptimal investment strategies.

- Overconfidence Bias: This is the unshakeable belief that one’s own investment skills are superior to others. Overconfident investors often take on excessive risk, believing they can consistently outperform the market. A classic example is an investor who repeatedly trades based on gut feeling, ignoring market data and expert advice. This can lead to higher transaction costs and underperformance.

- Loss Aversion: The pain of a loss is felt more intensely than the pleasure of an equivalent gain. This can lead investors to hold onto losing investments for too long (hoping for a recovery) and sell winning investments too early (to lock in profits and avoid potential losses). Consider an investor holding onto a declining stock, hoping to “break even,” even though the underlying fundamentals have deteriorated significantly.

- Herding Behavior: This is the tendency to follow the crowd, even if it means ignoring one’s own judgment. Investors often jump on the bandwagon of popular investments, creating bubbles and exacerbating market volatility. The dot-com bubble of the late 1990s is a prime example of herding behavior leading to disastrous investment outcomes.

- Confirmation Bias: This involves selectively seeking out information that confirms pre-existing beliefs and ignoring contradictory evidence. An investor with a strong belief in a particular company might only read positive news articles, ignoring negative reviews or financial warnings. This can lead to ignoring red flags and making poor investment choices.

Strategies to Mitigate the Impact of Behavioral Biases, Investment Portfolio Optimization Techniques

While completely eliminating behavioral biases is likely impossible (we are, after all, human!), we can employ strategies to reduce their influence on our investment decisions. These strategies involve a combination of self-awareness, disciplined processes, and external support.

- Develop a well-defined investment plan: A clear plan, based on sound financial principles and risk tolerance, provides a framework for decision-making, reducing the impact of emotional impulses. This plan should include specific investment goals, asset allocation targets, and rebalancing strategies.

- Diversify your portfolio: Diversification reduces risk and helps to mitigate the impact of individual investment losses. This is a crucial strategy for managing loss aversion and preventing over-reliance on a single investment.

- Use stop-loss orders: These orders automatically sell a security when it reaches a predetermined price, helping to limit potential losses and prevent emotional decisions during market downturns.

- Seek professional advice: A financial advisor can provide objective guidance and help to keep emotions in check. This is particularly helpful for investors who struggle with self-discipline or lack the expertise to make informed decisions independently.

- Regularly review and rebalance your portfolio: This helps to ensure that your portfolio remains aligned with your investment goals and risk tolerance. It also provides an opportunity to identify and address any behavioral biases that may have crept into your investment decisions.

Examples of Behavioral Finance Principles in Portfolio Construction

The principles of behavioral finance can be directly applied to portfolio construction to create more robust and resilient investment strategies. Let’s examine a few examples.

- Loss aversion and portfolio construction: Recognizing loss aversion, investors might construct portfolios with a slightly higher allocation to less volatile assets to reduce the emotional distress associated with significant losses. This might involve increasing the allocation to bonds or other less risky investments.

- Overconfidence and diversification: To counter overconfidence, investors can consciously diversify their portfolios across a wider range of asset classes and geographies, reducing the risk of over-reliance on a few seemingly “sure things”.

- Herding behavior and contrarian investing: Understanding herding behavior, some investors employ contrarian strategies, buying assets that are out of favor and selling those that are overvalued. This requires careful research and a tolerance for short-term underperformance.

Portfolio Monitoring and Evaluation

Regularly monitoring and evaluating your investment portfolio isn’t just a good idea; it’s the difference between a relaxing retirement and a frantic scramble for spare change. Think of it as a portfolio checkup – you wouldn’t skip your annual physical, would you? Ignoring your investments can lead to missed opportunities, unnecessary risks, and potentially, a significantly smaller nest egg than you’d hoped for.

Portfolio monitoring and evaluation involves the ongoing assessment of your investment performance against your stated goals and risk tolerance. It’s a proactive approach that allows for timely adjustments, helping you stay on track and adapt to changing market conditions. Without it, you’re essentially navigating the financial seas blindfolded, hoping for the best. And let’s face it, hoping isn’t a winning investment strategy.

Key Performance Indicators (KPIs) for Portfolio Assessment

Several key performance indicators provide a comprehensive view of your portfolio’s health. These metrics allow you to objectively measure progress towards your financial goals and identify areas needing attention. Ignoring these indicators is like driving a car without looking at the speedometer – you might get there eventually, but the journey will likely be bumpy, and you might end up in a ditch.

- Return on Investment (ROI): This classic metric measures the percentage gain or loss on an investment relative to its initial cost. A simple calculation, but incredibly insightful. For example, if you invested $1,000 and it’s now worth $1,200, your ROI is 20%.

- Sharpe Ratio: This sophisticated metric considers both the portfolio’s return and its risk (volatility). A higher Sharpe ratio indicates better risk-adjusted returns. A Sharpe ratio of 1 is generally considered good, while a ratio above 2 is excellent. This helps you compare portfolios with different levels of risk.

- Standard Deviation: This measures the volatility or risk of your portfolio. A higher standard deviation signifies greater price fluctuations and, consequently, higher risk. Imagine a rollercoaster – a high standard deviation is a wild ride, while a low one is a more gentle cruise.

- Beta: This measures the volatility of your portfolio relative to the overall market. A beta of 1 means your portfolio moves in line with the market, while a beta greater than 1 indicates higher volatility than the market. Understanding beta helps you gauge your portfolio’s sensitivity to market swings.

- Alpha: Alpha represents the excess return generated by your portfolio compared to a benchmark index (like the S&P 500), after adjusting for risk. A positive alpha suggests skillful investment management, while a negative alpha indicates underperformance.

Framework for Ongoing Portfolio Review and Adjustment

A robust framework for portfolio review is essential to ensure your investments remain aligned with your goals and risk tolerance. Think of it as your investment’s personal trainer, keeping things on track and making necessary adjustments along the way. Regular reviews help you avoid costly mistakes and capitalize on opportunities.

- Establish Clear Goals and Risk Tolerance: Before you even start investing, define your objectives (retirement, down payment, etc.) and your comfort level with risk. This forms the foundation of your investment strategy.

- Regular Review Schedule: Set a regular schedule for portfolio reviews (quarterly, semi-annually, or annually, depending on your investment strategy and risk tolerance). Consistency is key.

- Performance Evaluation: Assess your portfolio’s performance using the KPIs discussed earlier. Compare your actual returns to your expected returns, considering both market conditions and your investment strategy.

- Rebalancing: Adjust your portfolio’s asset allocation to maintain your desired risk level and align with your goals. Rebalancing involves selling some assets that have outperformed and buying others that have underperformed, bringing your portfolio back to its target allocation.

- Adjustments Based on Market Conditions and Life Changes: Market conditions and life events (marriage, job change, etc.) can significantly impact your investment strategy. Regular reviews allow you to adapt accordingly.

Final Review

Optimizing your investment portfolio isn’t just about maximizing returns; it’s about building a financial future that reflects your aspirations and risk appetite. From the elegant mathematics of Modern Portfolio Theory to the nuanced considerations of behavioral finance and ESG investing, we’ve journeyed through a landscape of strategies and techniques. Remember, the path to financial success is paved with informed decisions and a willingness to adapt. So, go forth and conquer the world of investment portfolio optimization – your future self will thank you (and maybe even buy you a celebratory margarita).

FAQ Overview

What is the Sharpe Ratio and why is it important?

The Sharpe Ratio measures risk-adjusted return, essentially telling you how much extra return you’re getting for each unit of extra risk you take. A higher Sharpe Ratio is generally better, indicating a more efficient portfolio.

How often should I rebalance my portfolio?

Rebalancing frequency depends on your investment strategy and risk tolerance. Common approaches include annual, semi-annual, or even quarterly rebalancing, but there’s no one-size-fits-all answer.

What are some common behavioral biases that can hurt investment performance?

Overconfidence, herd mentality, loss aversion, and anchoring are just a few. Being aware of these biases is the first step toward mitigating their negative impact.

Can I use these techniques for smaller portfolios?

Yes, many of these techniques can be adapted for smaller portfolios, although the complexity of some algorithms might be less relevant for smaller investment amounts.