Embarking on your investment journey can feel daunting, but understanding fundamental strategies is key to building a secure financial future. This guide demystifies the world of investing, offering clear explanations and practical steps for beginners to navigate the complexities of stocks, bonds, and other asset classes. We’ll explore how to set realistic financial goals, assess your risk tolerance, and choose investment vehicles that align with your objectives.

From defining basic investment concepts and outlining the importance of diversification to developing a personalized investment plan and understanding various investment accounts, this guide provides a comprehensive framework for building a successful investment portfolio. We’ll also cover crucial topics like managing risk, maintaining investment discipline, and recognizing when to seek professional financial advice.

Understanding Basic Investment Concepts

Investing can seem daunting, but grasping fundamental concepts is the first step towards building a secure financial future. This section will clarify key investment terms and strategies, helping you navigate the world of finance with greater confidence. We’ll explore the differences between stocks and bonds, the importance of diversification, and the various fees associated with investing.

Stocks versus Bonds

Stocks represent ownership in a company. When you buy stock, you become a shareholder, and you may receive dividends (a share of the company’s profits) and potentially see the value of your shares increase over time. However, stock prices can also fluctuate significantly, leading to potential losses. Bonds, on the other hand, are essentially loans you make to a company or government. You receive regular interest payments and get your principal back at the bond’s maturity date. Bonds are generally considered less risky than stocks, but their returns are typically lower. The risk-reward profile differs significantly between these two asset classes.

Diversification in Investment Portfolios

Diversification is a cornerstone of successful investing. It involves spreading your investments across different asset classes (like stocks and bonds), sectors (such as technology or healthcare), and geographies to reduce the impact of any single investment performing poorly. Imagine having all your money in one company’s stock; if that company fails, you lose everything. Diversification mitigates this risk. A diversified portfolio might include a mix of US and international stocks, government and corporate bonds, and potentially other assets like real estate or commodities. The goal is to reduce overall portfolio volatility while aiming for consistent long-term growth.

Common Investment Fees and Expenses

Investing isn’t free. Several fees and expenses can eat into your returns. These include brokerage commissions (fees charged for buying and selling investments), expense ratios (annual fees charged by mutual funds or exchange-traded funds), and management fees (fees charged by professional money managers). Understanding these costs is crucial for maximizing your investment returns. For example, a high expense ratio on a mutual fund can significantly impact your long-term returns compared to a low-cost index fund tracking the same market. Always compare fees before investing.

Comparison of Asset Classes

The following table compares different asset classes based on risk, potential return, and liquidity. Liquidity refers to how easily an asset can be converted into cash.

| Asset Class | Risk Level | Potential Return | Liquidity |

|---|---|---|---|

| Stocks | High | High | High |

| Bonds | Medium | Medium | High |

| Real Estate | Medium to High | Medium to High | Low |

| Commodities (e.g., Gold) | High | Variable | Medium |

| Cash | Low | Low | High |

Setting Financial Goals and Risk Tolerance

Investing wisely requires a clear understanding of your financial aspirations and your comfort level with risk. Without these key elements, your investment journey can become haphazard and potentially unproductive. This section will guide you through the process of defining your financial goals and assessing your risk tolerance, crucial steps in building a successful investment strategy.

Financial Goal Setting Worksheet

Creating a financial goal setting worksheet helps you visualize your aspirations and prioritize your investment strategies. A well-structured worksheet allows you to break down long-term goals into manageable steps, making the process less daunting. Below is a sample worksheet you can adapt to your own circumstances:

| Goal | Timeline (Years) | Amount Needed | Current Savings | Investment Strategy |

|---|---|---|---|---|

| Down payment on a house | 5 | $50,000 | $10,000 | Index funds, high-yield savings account |

| Retirement | 30 | $1,000,000 | $0 | Diversified portfolio of stocks and bonds |

| Child’s college education | 18 | $100,000 | $5,000 | 529 plan, mutual funds |

This worksheet provides a framework. Remember to regularly review and update it as your circumstances change.

Determining Personal Risk Tolerance

Understanding your risk tolerance is paramount before making any investment decisions. Risk tolerance reflects your comfort level with the possibility of losing money in pursuit of higher returns. A higher risk tolerance generally allows for investments with greater potential returns, but also a greater chance of losses. Conversely, a lower risk tolerance suggests a preference for investments with lower potential returns but also lower risk. Consider your personality, financial situation, and time horizon when assessing your risk tolerance. For example, a young investor with a long time horizon might be more comfortable with higher-risk investments than an older investor nearing retirement.

Aligning Investments with Long-Term Financial Goals

Successful investing involves aligning your investment choices with your long-term financial goals. Long-term goals, such as retirement or a down payment on a house, typically benefit from a longer-term investment strategy that can weather market fluctuations. Short-term goals, like an upcoming vacation, may require more conservative investments to minimize risk. For instance, investing in a high-yield savings account for a short-term goal ensures liquidity and capital preservation. Long-term goals, conversely, may benefit from a more diversified portfolio including stocks and bonds to achieve higher growth potential.

Questions to Ask Before Investing

Before committing to any investment, it is crucial to thoroughly evaluate the opportunity. The following statements represent key considerations:

- The investment’s potential returns are carefully weighed against the associated risks.

- The investment’s alignment with personal financial goals and risk tolerance is assessed.

- The investment’s fees and expenses are thoroughly understood and deemed reasonable.

- The investment’s historical performance is reviewed, understanding that past performance does not guarantee future results.

- The investment’s liquidity is considered, ensuring the ability to access funds when needed.

- The investment’s diversification within a broader portfolio is analyzed to minimize risk.

Choosing the Right Investment Vehicles

Selecting the appropriate investment vehicle is crucial for achieving your financial goals. The best choice depends on your investment timeline, risk tolerance, and financial resources. Understanding the differences between various account types and investment options is key to making informed decisions.

Investment Account Types

Different investment accounts offer varying levels of tax advantages and investment flexibility. Brokerage accounts, retirement accounts (like 401(k)s and IRAs), and education savings plans (like 529 plans) each serve distinct purposes.

- Brokerage Accounts: These offer flexibility in investing in a wide range of assets, but investment gains are typically taxed annually. They are suitable for investors with shorter-term goals or those who prefer more control over their investments.

- Retirement Accounts (401(k)s and IRAs): Designed for long-term retirement savings, these accounts often offer tax advantages, such as tax-deferred growth or tax deductions for contributions. 401(k)s are employer-sponsored, while IRAs are individual retirement accounts with contribution limits. Early withdrawals often incur penalties.

- Education Savings Plans (529 Plans): These accounts are specifically designed for saving for education expenses. Earnings grow tax-free if used for qualified education expenses, offering a significant advantage for families planning for college.

Index Funds versus Actively Managed Mutual Funds

Index funds and actively managed mutual funds represent different investment strategies. Index funds passively track a specific market index (like the S&P 500), aiming to match its performance. Actively managed funds employ professional managers who actively select investments, attempting to outperform the market.

- Index Funds: Generally offer lower expense ratios (fees) than actively managed funds, leading to potentially higher returns over the long term. Their performance is directly tied to the index they track.

- Actively Managed Funds: Aim for higher returns than the market average but may incur higher expense ratios and potentially underperform the market. Success depends heavily on the skill of the fund manager.

Investment Vehicles for Beginners with Low Capital

Starting with limited capital doesn’t preclude investing. Focusing on low-cost, diversified investments is key.

- Fractional Shares: Many brokerage platforms allow purchasing fractional shares of stocks or ETFs, making investing accessible even with small amounts of money.

- Low-Cost Index Funds and ETFs: These offer broad market exposure at minimal cost, reducing the risk associated with investing in individual stocks.

- High-Yield Savings Accounts and Money Market Accounts: While offering lower returns than other investments, these provide a safe place to park funds and earn interest, serving as a foundation for future investments.

Examples of Low-Cost ETFs Suitable for Beginners

Several low-cost ETFs provide diversified exposure to the market, making them suitable starting points for beginners. Note that past performance is not indicative of future results. Always conduct thorough research before investing.

- Vanguard Total Stock Market ETF (VTI): Tracks the entire U.S. stock market, offering broad diversification.

- Schwab Total Stock Market Index (SWTSX): Similar to VTI, providing broad U.S. stock market exposure at a low cost.

- iShares Core S&P 500 ETF (IVV): Tracks the S&P 500 index, providing exposure to 500 of the largest U.S. companies.

Developing an Investment Plan

Creating a personalized investment plan is crucial for achieving your financial goals. It provides a roadmap, outlining your investment strategy, risk tolerance, and timeline. A well-defined plan helps you stay focused and disciplined, even during market volatility.

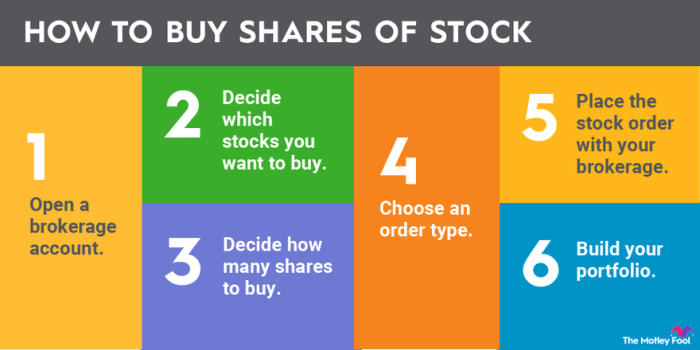

Step-by-Step Guide to Developing an Investment Plan

Developing a comprehensive investment plan involves a series of deliberate steps. These steps help you translate your financial aspirations into a tangible, actionable strategy. Following these steps will ensure a more structured approach to investing.

- Define Your Financial Goals: Clearly articulate your short-term and long-term objectives. Are you saving for retirement, a down payment on a house, or your child’s education? Assigning specific timeframes and monetary targets to each goal provides clarity and direction.

- Assess Your Risk Tolerance: Determine your comfort level with potential investment losses. Consider your age, financial situation, and emotional response to market fluctuations. A younger investor generally has a higher risk tolerance than an older investor nearing retirement.

- Determine Your Asset Allocation: Based on your risk tolerance and time horizon, allocate your investments across different asset classes (stocks, bonds, real estate, etc.). A higher risk tolerance might justify a larger allocation to stocks, while a lower tolerance might favor a greater proportion of bonds.

- Select Investment Vehicles: Choose specific investments that align with your asset allocation strategy. This could include individual stocks, mutual funds, exchange-traded funds (ETFs), or bonds. Consider diversification to minimize risk.

- Implement Your Plan: Begin investing according to your chosen asset allocation and investment vehicles. Regularly monitor your progress and make adjustments as needed.

- Review and Rebalance Your Portfolio: Periodically review your portfolio’s performance and rebalance it to maintain your target asset allocation. This ensures you’re not overly exposed to any single asset class.

Calculating Asset Allocation Based on Age and Risk Tolerance

Asset allocation is a crucial aspect of investment planning. It’s the process of dividing your investment portfolio across different asset classes to optimize returns while managing risk. A common approach involves considering age and risk tolerance. Younger investors, with longer time horizons, can generally tolerate more risk and allocate a larger portion of their portfolio to equities (stocks). Older investors, closer to retirement, often prefer a more conservative approach, with a larger allocation to fixed-income securities (bonds).

A simplified example: A 30-year-old with a high-risk tolerance might allocate 80% of their portfolio to stocks and 20% to bonds. A 60-year-old with a low-risk tolerance might allocate 20% to stocks and 80% to bonds. These are just examples; individual circumstances vary greatly.

Portfolio Review and Rebalancing

Regular portfolio review and rebalancing are essential for maintaining your investment strategy and achieving your financial goals. Market fluctuations can cause your asset allocation to drift from your target. Rebalancing involves selling some assets that have performed well and buying others that have underperformed to restore your desired allocation. This disciplined approach helps mitigate risk and capitalize on market opportunities. A yearly review is generally recommended, but more frequent reviews might be appropriate depending on market conditions and individual circumstances.

Maintaining Discipline and Avoiding Emotional Investment Decisions

Emotional decision-making is a significant obstacle to successful investing. Fear and greed can lead to impulsive actions, often resulting in poor investment outcomes. To avoid this, it is crucial to stick to your investment plan, even during market downturns. Regularly reviewing your financial goals and risk tolerance can help you stay focused and make rational decisions. Consider seeking advice from a qualified financial advisor if you struggle with emotional investment decisions. Remember that long-term investing requires patience and discipline.

Resources and Further Learning

Embarking on your investment journey is a significant step, and continuous learning is key to success. This section provides valuable resources to help you expand your knowledge and refine your investment strategies. Remember, investing is a lifelong learning process, and staying informed is crucial for making sound financial decisions.

This section Artikels reputable websites, recommended books, the importance of professional financial advice, and answers to common beginner questions. Utilizing these resources will significantly enhance your understanding and confidence in managing your investments.

Reputable Financial Websites and Educational Resources

Numerous online resources offer reliable information for beginner investors. These platforms provide educational materials, tools, and often access to investment accounts. Carefully evaluate the source’s credibility and objectivity before relying on any information. Look for sites affiliated with established financial institutions or non-profit organizations.

- Investopedia: This website offers a comprehensive glossary of investment terms, articles, and educational resources covering various investment topics.

- Khan Academy: Provides free courses on finance and investing, covering fundamental concepts in an accessible manner.

- The Motley Fool: Offers investment advice, stock analysis, and educational content, though it’s important to remember that their recommendations are opinions, not financial guarantees.

- SEC.gov (U.S. Securities and Exchange Commission): The official website of the SEC, providing regulatory information and investor education materials.

Recommended Books for Beginner Investors

Reading books can provide a deeper understanding of investment principles and strategies. Choose books written by reputable authors with a proven track record in finance. Prioritize books that focus on fundamental concepts and avoid those promising quick riches.

- “The Intelligent Investor” by Benjamin Graham: A classic text considered by many to be the bible of value investing.

- “A Random Walk Down Wall Street” by Burton Malkiel: Explains the principles of market efficiency and the importance of long-term investing.

- “The Little Book of Common Sense Investing” by John C. Bogle: Advocates for low-cost index fund investing as a simple, effective strategy.

The Importance of Seeking Professional Financial Advice

While self-education is valuable, seeking professional financial advice is often crucial, especially when dealing with complex financial situations or significant sums of money. A certified financial planner (CFP) can provide personalized guidance tailored to your specific circumstances, risk tolerance, and financial goals. They can help you create a comprehensive financial plan, manage your investments, and navigate challenging financial decisions. Remember that financial advisors charge fees for their services.

Frequently Asked Questions by Beginner Investors and Their Answers

Many beginners share similar concerns and questions. Understanding these common queries and their answers can alleviate anxieties and guide you toward informed decision-making.

- Question: How much money do I need to start investing? Answer: You can start investing with relatively small amounts of money. Many brokerage accounts have no minimum investment requirements, and some allow you to invest fractions of shares.

- Question: What is the best investment strategy for beginners? Answer: A diversified portfolio of low-cost index funds is often recommended for beginners due to its simplicity and potential for long-term growth. This approach reduces risk by spreading investments across various asset classes.

- Question: How much risk should I take? Answer: Your risk tolerance depends on your age, financial goals, and comfort level with potential losses. Younger investors generally have a longer time horizon and can tolerate more risk. Older investors often prefer lower-risk investments to protect their capital.

- Question: How often should I review my investment portfolio? Answer: Regularly reviewing your portfolio (at least annually, or more frequently if market conditions are volatile) allows you to monitor performance, rebalance as needed, and adjust your strategy based on changing circumstances and goals.

Illustrative Examples of Investment Strategies

Understanding investment strategies is best done through practical examples. This section will illustrate a sample portfolio for a young investor and explore potential returns and risks associated with different approaches. Remember, these are examples only and should not be considered personalized financial advice. Consult a financial advisor for guidance tailored to your specific circumstances.

Sample Portfolio for a 25-Year-Old Beginner with Moderate Risk Tolerance

A 25-year-old with a moderate risk tolerance can benefit from a portfolio that balances growth potential with reasonable risk. A suitable allocation might be 70% stocks and 30% bonds. This allows for significant growth potential while mitigating some of the volatility inherent in the stock market.

Stocks (70%): This portion could be diversified across different sectors and market caps. For example:

- Index Funds (40%): Investing in a broad market index fund like the S&P 500 provides diversified exposure to large-cap U.S. companies, reducing risk associated with individual stock picking. Examples include Vanguard S&P 500 ETF (VOO) or Schwab Total Stock Market Index (SWTSX).

- Growth Stocks (15%): These companies are expected to grow at above-average rates, offering higher potential returns but also increased volatility. Examples could include investments in technology companies or those in rapidly expanding sectors. Careful research is crucial here.

- International Stocks (15%): Diversification beyond the U.S. market can reduce overall portfolio risk. This could involve investing in international index funds or ETFs focusing on developed or emerging markets.

Bonds (30%): Bonds offer lower returns but greater stability than stocks. This portion could include:

- Bond ETFs (30%): Investing in a bond ETF provides diversification across various bond types and maturities, reducing risk compared to individual bond purchases. Examples include iShares Core U.S. Aggregate Bond ETF (AGG).

Calculating Potential Returns and Risks

Calculating precise returns and risks is impossible, as markets are inherently unpredictable. However, we can illustrate potential scenarios using historical data and estimations.

Scenario 1: Moderate Growth

Let’s assume an average annual return of 7% for the stock portion and 3% for the bond portion over a 10-year period. With a 70/30 allocation, the weighted average return would be approximately 5.8%. This means a $10,000 investment could grow to approximately $17,000 over 10 years.

Scenario 2: Market Correction

In a market downturn, stock values may decline significantly. Let’s assume a -10% return for stocks and a -2% return for bonds in a single year. With the 70/30 allocation, the portfolio might experience an approximately -8.6% loss in that year. This illustrates the importance of diversification and a long-term investment horizon.

It’s crucial to remember that these are simplified examples. Actual returns can vary significantly due to market fluctuations and other economic factors.

Portfolio Growth Over Time

A visual representation would show two lines on a graph, representing portfolio growth over time. The x-axis would represent time (in years), and the y-axis would represent portfolio value.

Line 1: Moderate Growth Scenario This line would show a steady upward trend, reflecting consistent growth at an average annual rate of approximately 5.8%. The line would demonstrate compounding, with the rate of growth accelerating over time. The line would exhibit some minor fluctuations reflecting short-term market volatility but generally maintain an upward trajectory.

Line 2: Market Correction Scenario This line would show a steeper upward trend initially, similar to Line 1. However, it would experience a noticeable dip representing the year of market correction (-8.6% loss), followed by a recovery and continued upward growth. This line illustrates the resilience of a diversified portfolio in the face of short-term market setbacks, showcasing the importance of a long-term perspective.

The comparison of these two lines would clearly demonstrate the potential for long-term growth even with periods of market volatility, highlighting the benefit of a well-diversified portfolio and a long-term investment strategy.

Final Wrap-Up

Mastering investment strategies is a journey, not a destination. By understanding basic concepts, setting clear goals, and choosing appropriate investment vehicles, beginners can confidently start building their financial future. Remember, consistent learning, disciplined investing, and seeking professional guidance when needed are crucial for long-term success. This guide provides a solid foundation, but continuous learning and adaptation to market changes are essential for navigating the dynamic world of investment.

FAQ Guide

What is the best investment for a beginner?

There’s no single “best” investment. The ideal choice depends on your risk tolerance, financial goals, and time horizon. Low-cost index funds or ETFs are often recommended for beginners due to their diversification and simplicity.

How much money do I need to start investing?

Many brokerage accounts have no minimum investment requirements. Some platforms even allow investing with small amounts of money through fractional shares.

What is dollar-cost averaging?

Dollar-cost averaging is an investment strategy where you invest a fixed dollar amount at regular intervals, regardless of market fluctuations. This helps mitigate the risk of investing a lump sum at a market high.

How often should I rebalance my portfolio?

The frequency of portfolio rebalancing depends on your investment strategy and risk tolerance. A common approach is to rebalance annually or semi-annually to maintain your target asset allocation.

Where can I learn more about investing?

Numerous reputable online resources, books, and educational courses offer valuable insights into investing. Consider exploring websites like Investopedia and seeking guidance from a qualified financial advisor.