Investment Tracking Software: Forget spreadsheets and frantic calculations! Embark on a journey into the wonderfully efficient world of automated portfolio management. We’ll explore how this digital marvel transforms the often-daunting task of tracking your investments into a surprisingly enjoyable (yes, really!) experience, leaving you free to focus on more important things, like deciding whether to invest in that limited-edition banana-flavored gummy bear company.

This guide dives deep into the features, benefits, and considerations of investment tracking software. We’ll cover everything from choosing the right software for your needs to understanding the crucial aspects of data security and integration with other financial tools. Prepare to be amazed by the power and simplicity of modern investment management.

Defining Investment Tracking Software

Investment tracking software: your friendly neighborhood financial overlord (but in a good way!). It’s the digital butler that keeps tabs on your sprawling investment empire, preventing you from accidentally turning your portfolio into a financial Stonehenge. Forget frantic spreadsheet searches; this software streamlines the process, providing a clear, concise, and (dare we say) enjoyable overview of your financial holdings.

Investment tracking software provides a centralized location to monitor and analyze your investments. Core functionalities typically include portfolio valuation, performance tracking, expense management, and reporting capabilities. Imagine having a personal financial analyst working 24/7, tirelessly crunching numbers and presenting the results in a digestible format – that’s the power of this software. No more late-night number crunching; you can spend your evenings enjoying the fruits of your labor (or at least planning for them!).

Types of Investments Tracked

This software isn’t picky; it’s a financial omnivore. It can handle a wide range of investment types, including stocks (both individual and mutual funds), bonds (corporate, government, municipal), real estate (properties, REITs), cryptocurrencies (if you’re feeling adventurous), and alternative investments like commodities or private equity. Essentially, if you’ve invested in it, this software can likely track it. Think of it as a financial chameleon, adapting to your specific portfolio composition.

User Interface Examples and Features

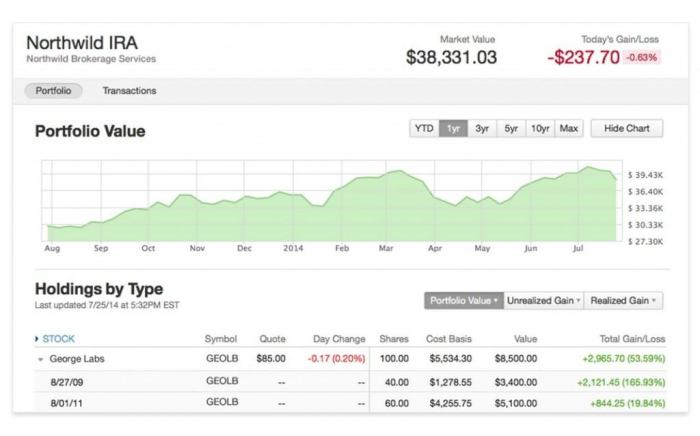

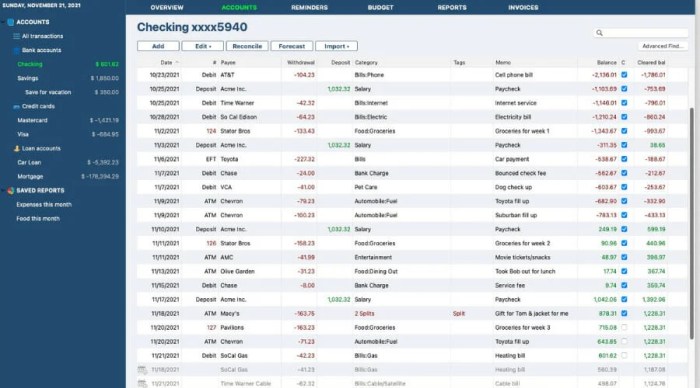

A well-designed interface is crucial for usability. Imagine one software with a clean, minimalist dashboard displaying key metrics like total portfolio value, asset allocation, and recent transactions. Color-coded charts could highlight your top performers and underperformers, providing a visual representation of your investment health. Another software might offer a more detailed view, allowing users to drill down into individual investments, analyzing historical performance, dividends, and capital gains. Some may even integrate with brokerage accounts for automatic data updates, eliminating manual entry. Imagine the time saved!

Comparison of Investment Tracking Software

Here’s a comparison of three hypothetical (but realistically inspired) investment tracking software options: “Money Maestro,” “Finance Fortress,” and “Capital Commander.”

| Feature | Money Maestro | Finance Fortress | Capital Commander |

|---|---|---|---|

| Investment Types Supported | Stocks, Bonds, Mutual Funds, ETFs | Stocks, Bonds, Mutual Funds, ETFs, Real Estate, Crypto | Stocks, Bonds, Mutual Funds, ETFs, Real Estate, Crypto, Private Equity |

| Portfolio Valuation | Real-time, automatic updates | Real-time, automatic updates | Real-time, automatic updates with customizable refresh intervals |

| Reporting Capabilities | Basic performance reports, tax reports | Advanced customizable reports, portfolio summaries | Advanced customizable reports, portfolio summaries, tax optimization suggestions |

| Integration with Brokerages | Limited integration | Integration with major brokerages | Extensive integration with a wide range of brokerages and financial institutions |

Benefits of Using Investment Tracking Software

Let’s face it, manually tracking investments is about as thrilling as watching paint dry. Unless you’re a masochist with a penchant for spreadsheets, investment tracking software offers a much-needed dose of efficiency and sanity to your financial life. It’s like having a tiny, highly caffeinated financial ninja working for you 24/7.

Automated portfolio tracking offers a plethora of advantages, far surpassing the limitations of manual methods. Imagine the time saved – time you could spend on more important things, like deciding which exotic vacation to book with your burgeoning investment returns (or, you know, just relaxing). Beyond time savings, the software’s analytical capabilities empower investors with data-driven insights, transforming guesswork into informed decisions.

Automated Portfolio Tracking Advantages

The beauty of automated portfolio tracking lies in its ability to constantly monitor your investments, providing real-time updates on performance, asset allocation, and overall portfolio health. This eliminates the tedious manual data entry and calculation, reducing the risk of human error (which, let’s be honest, is surprisingly common, even among financial professionals). Software can also generate comprehensive reports, offering a clear picture of your investment progress, making it easy to identify areas needing attention or celebrate spectacular successes. For example, imagine effortlessly seeing your portfolio’s performance against a benchmark index like the S&P 500, or quickly comparing the returns of your individual stocks and bonds. This level of detail provides a level of clarity that’s impossible to achieve with manual tracking.

Investment Decision-Making Improvement

Investment tracking software doesn’t just passively record data; it actively helps you make better investment decisions. By providing clear visualizations of your portfolio’s performance and risk profile, the software allows for strategic adjustments based on market trends and your personal financial goals. For instance, if a particular sector underperforms consistently, the software can highlight this, allowing you to rebalance your portfolio accordingly. Likewise, if your risk tolerance changes, the software can help you adjust your investment strategy to align with your new comfort level. Think of it as having a personal financial advisor constantly analyzing your portfolio and offering data-driven suggestions.

Investment Tracking Software’s Role in Long-Term Financial Planning

Long-term financial planning requires a holistic approach, and investment tracking software plays a crucial role in achieving your long-term financial goals. By providing a clear overview of your investments, the software helps you monitor your progress towards retirement, a down payment on a house, or any other significant financial objective. The ability to simulate different investment scenarios allows you to test the impact of various strategies on your future financial well-being, ensuring you stay on track and make necessary adjustments along the way. For example, you could model the effect of increased contributions or changes in investment allocation on your projected retirement income.

Key Benefits for Individual Investors

The benefits of investment tracking software are numerous, but here are five key advantages that directly impact individual investors:

- Time Savings: No more endless spreadsheet updates or manual calculations. Reclaim your precious time!

- Improved Accuracy: Eliminate human error and ensure your investment data is always accurate and up-to-date.

- Data-Driven Decision Making: Make informed investment choices based on real-time data and insightful analysis.

- Enhanced Portfolio Management: Easily monitor, analyze, and adjust your portfolio to meet your financial goals.

- Stress Reduction: Gain peace of mind knowing your investments are being tracked efficiently and effectively.

Features of Investment Tracking Software

Investing can be a wild ride, a rollercoaster of emotions fueled by fluctuating stock prices and the constant fear of missing out (FOMO). But amidst the chaos, good investment tracking software acts as your trusty co-pilot, navigating the turbulent skies of the market with the precision of an air traffic controller (albeit one that understands dividends and capital gains). This software provides the tools you need to stay organized, informed, and (hopefully) profitable.

Essential Features for Beginners and Advanced Investors

Beginner investors often need straightforward tools to get started, focusing on simple portfolio tracking and basic reporting. Advanced investors, however, require more sophisticated features for complex strategies and in-depth analysis. The best software offers a scalable approach, providing a smooth transition from novice to expert, like a personalized financial boot camp.

| Feature Category | Beginner Features | Advanced Features | Pricing Tier Implications |

|---|---|---|---|

| Portfolio Management | Simple asset entry, basic performance tracking, transaction recording. | Advanced asset allocation tools, support for diverse asset classes (e.g., derivatives, cryptocurrencies), rebalancing tools, scenario planning. | Often included in basic plans, advanced features usually require premium subscriptions. |

| Reporting | Basic portfolio summaries, simple performance charts. | Customizable reports, advanced charting capabilities, benchmark comparisons, tax reporting integrations. | Basic reporting in free or low-cost plans; advanced features are usually premium. |

| Tax Optimization | Basic tax lot accounting (FIFO). | Sophisticated tax lot methods (e.g., LIFO, HIFO), tax gain/loss harvesting suggestions, integration with tax preparation software. | Basic tax features often included in lower tiers, advanced tax optimization is typically a premium feature. |

| Security and Data Privacy | Data encryption at rest and in transit. | Multi-factor authentication (MFA), regular security audits, compliance with relevant data privacy regulations (e.g., GDPR, CCPA). | Essential security features are standard across all tiers; advanced security measures may be limited to higher-priced plans. |

Security and Data Privacy Features: Protecting Your Financial Fortress

Your investment data is, frankly, incredibly valuable. Think of it as the crown jewels of your financial kingdom. Robust security measures are not just a nice-to-have; they are absolutely essential. Features like two-factor authentication (2FA), data encryption (both at rest and in transit), and regular security audits are crucial for preventing unauthorized access and protecting your sensitive information from prying eyes and nefarious hackers. Choosing a software provider that prioritizes security and complies with relevant data privacy regulations is a non-negotiable aspect of responsible investing. Remember, your peace of mind is priceless.

Choosing the Right Investment Tracking Software

Selecting the perfect investment tracking software is like choosing a financial soulmate – it needs to be compatible with your investment style, easy to live with (use), and not break the bank (excessively expensive). Don’t worry, this isn’t a blind date; we’ll guide you through the process.

Factors to Consider When Selecting Investment Tracking Software

Choosing the right software hinges on several key factors. Ignoring these could lead to a relationship as rocky as your portfolio after a market crash. Consider these crucial elements before committing.

- Cost: Free options exist, but often come with limitations. Paid software usually offers more features and better support, but be wary of hidden fees! Think of it like dating – free dating sites might be fun, but a serious relationship might require a little investment.

- Ease of Use: Intuitive navigation and a user-friendly interface are paramount. You don’t want to spend more time deciphering the software than managing your investments. Imagine trying to navigate a complex spreadsheet while trying to analyze the S&P 500 – a recipe for disaster!

- Integration Capabilities: Seamless integration with your brokerage accounts is crucial for automatic data updates. Manually entering data is a tedious task, akin to counting your pennies one by one. Look for software that can connect to multiple platforms.

- Reporting and Analytics: Robust reporting features are essential for analyzing your portfolio’s performance. Comprehensive reports and insightful analytics can help you make informed decisions, unlike relying solely on gut feeling.

- Security: Protecting your financial data is non-negotiable. Ensure the software employs strong security measures to safeguard your sensitive information. Think of it as a high-security vault for your financial treasures.

Software Suitability for Different Investment Strategies

Different investment strategies call for different software features. A day trader needs lightning-fast execution and real-time data, while a long-term investor might prioritize comprehensive reporting and tax optimization tools.

| Investment Strategy | Suitable Software Features | Example Software (Hypothetical) |

|---|---|---|

| Day Trading | Real-time quotes, charting tools, order placement integration | SpeedTrader Pro |

| Value Investing | Fundamental analysis tools, stock screening capabilities, detailed financial statement analysis | ValueInvest Analyzer |

| Index Fund Investing | Portfolio diversification analysis, asset allocation tools, low-cost tracking | IndexTrack Easy |

| Real Estate Investing | Property valuation tools, rental income tracking, expense management | PropertyPro Manager |

A Decision Tree for Selecting Investment Tracking Software

The following decision tree helps navigate the selection process. It’s a structured approach to avoid getting lost in the jungle of software options.

Imagine this decision tree as a flowchart, visually guiding you through the choices. Each decision point presents a question, and the answer leads to the next step. For instance:

1. Is cost a major constraint? Yes leads to free/low-cost options. No leads to exploring premium options.

2. Do you need real-time data? Yes points to software for active traders. No directs you to options suited for long-term investors.

3. How important is automatic data import? Prioritize integration capabilities if yes, and manual entry if no.

4. What is the primary focus of your analysis? This will determine whether fundamental, technical, or other types of analysis tools are crucial.

Data Management and Reporting: Investment Tracking Software

Keeping tabs on your investments shouldn’t feel like navigating a minefield of spreadsheets. Our investment tracking software transforms the tedious task of data management into a surprisingly enjoyable experience (we promise!). It’s all about efficiency, clarity, and the sweet, sweet satisfaction of seeing your portfolio grow.

Data management and reporting are the heart and soul of effective investment tracking. This section will illuminate the powerful tools our software provides for effortlessly importing, exporting, analyzing, and visualizing your financial data. Prepare to be amazed by the simplicity and insightfulness of our reporting features.

Importing and Exporting Investment Data

Our software supports a variety of import methods, ensuring seamless integration with your existing financial records. You can effortlessly upload data from CSV files, spreadsheets (Excel, Google Sheets), and even directly connect to your brokerage accounts (where supported, of course – we’re not magicians!). Exporting your data is equally straightforward, allowing you to share your portfolio information with financial advisors or simply maintain a backup copy for your own peace of mind. Think of it as effortlessly moving your financial data between different platforms, like a financial ninja gracefully teleporting across dimensions.

Generating Performance Reports and Charts

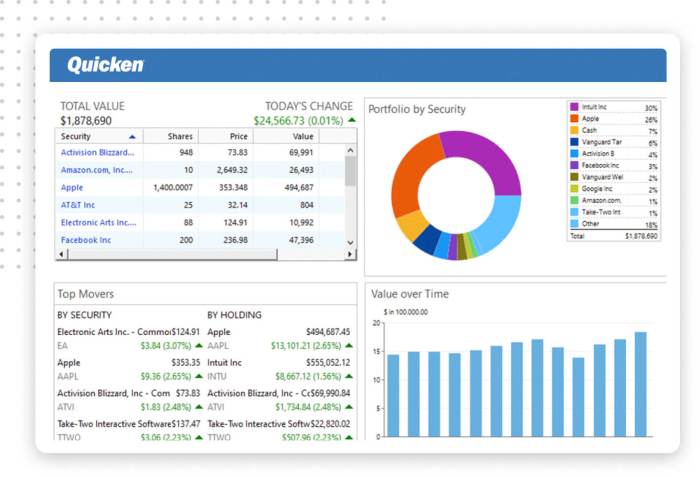

The software automatically generates a range of comprehensive performance reports and charts, providing a clear and concise overview of your investment performance. These reports include key metrics such as total return, annualized return, Sharpe ratio, and maximum drawdown. Charts visualize your portfolio’s growth over time, allowing you to easily identify trends and patterns. For instance, a line graph elegantly displays the growth of your portfolio’s value over time, highlighting periods of high and low performance. A pie chart visually represents the asset allocation within your portfolio, providing a quick overview of your diversification strategy. It’s like having a personal financial analyst, only less expensive and far less prone to giving unsolicited advice about your lifestyle choices.

Creating a Custom Report Showing Portfolio Diversification

Imagine a report that effortlessly reveals the intricate dance of your assets. Our software allows you to create custom reports tailored to your specific needs. To illustrate portfolio diversification, a custom report could display the percentage allocation of your investments across different asset classes (e.g., stocks, bonds, real estate, etc.), along with their individual performance. This allows you to assess the risk and return profile of your portfolio at a glance, ensuring your investment strategy aligns with your risk tolerance. For example, a report might show 60% allocated to stocks, 30% to bonds, and 10% to alternative investments, providing a clear visual representation of your diversification strategy. This empowers you to make informed decisions, optimizing your portfolio for growth and stability.

Sample Report Showing Key Performance Indicators (KPIs), Investment Tracking Software

Below is a sample report showcasing key performance indicators (KPIs) in a responsive HTML table. Note that the data presented here is purely illustrative.

| KPI | Value | Target | Status |

|---|---|---|---|

| Total Portfolio Value | $150,000 | $200,000 | Progressing |

| Annualized Return | 8% | 10% | Needs Improvement |

| Sharpe Ratio | 1.2 | 1.5 | Progressing |

| Maximum Drawdown | -5% | -3% | Needs Improvement |

Security and Privacy Considerations

Protecting your financial data is paramount, especially in the digital age. While the convenience of investment tracking software is undeniable, it’s crucial to understand the security measures in place and the potential risks involved. Choosing a reputable provider is the first step in safeguarding your sensitive information. Let’s delve into the specifics of keeping your investment portfolio secure.

Reputable investment tracking software providers employ a multi-layered approach to security, aiming to create a fortress around your data. This isn’t just about keeping prying eyes out; it’s about ensuring the integrity and availability of your information.

Data Encryption and User Authentication

Data encryption is the cornerstone of secure data handling. Think of it as wrapping your financial information in an impenetrable digital vault. Strong encryption algorithms, like AES-256, scramble your data, making it unreadable to unauthorized individuals even if intercepted. This protection extends to data both in transit (as it travels between your device and the software’s servers) and at rest (when stored on the servers). User authentication methods, such as multi-factor authentication (MFA), add an extra layer of security. MFA typically involves using more than one method to verify your identity, such as a password and a code sent to your phone. This makes it significantly harder for hackers to gain access, even if they manage to obtain your password. Imagine a combination lock with multiple dials – it’s much more secure than a single-dial lock.

Potential Risks Associated with Online Investment Tracking

Despite robust security measures, online investment tracking carries inherent risks. Phishing attacks, where scammers impersonate legitimate organizations to trick users into revealing their credentials, remain a significant threat. Malware infections can compromise your device and potentially steal your data. Data breaches, though rare with reputable providers, are a possibility, and it’s crucial to choose a provider with a proven track record of data security. Finally, human error, such as using weak passwords or falling for phishing scams, can also compromise security.

Best Practices for Securing User Accounts and Protecting Sensitive Data

Protecting your investment data requires a proactive approach. Choose strong, unique passwords that combine uppercase and lowercase letters, numbers, and symbols. Consider using a password manager to help generate and securely store these passwords. Enable multi-factor authentication whenever available. Be wary of suspicious emails and links; never click on links from unknown senders. Keep your software updated with the latest security patches. Regularly review your account activity for any unauthorized access. Think of it like regularly servicing your car – preventative maintenance is key to long-term reliability and security. Additionally, understand the provider’s privacy policy and ensure it aligns with your comfort level regarding data handling and usage.

Integration with Other Financial Tools

Let’s face it, managing your investments shouldn’t feel like navigating a financial maze blindfolded. The beauty of modern investment tracking software lies in its ability to seamlessly connect with other financial tools, creating a streamlined and, dare we say, enjoyable experience. This integration eliminates the tedious task of manually transferring data, saving you time and reducing the risk of errors – because who has time for spreadsheets filled with cryptic numbers?

Investment tracking software’s integration with other financial applications significantly enhances efficiency and accuracy in managing your financial portfolio. Seamless data transfer between platforms ensures a unified view of your financial landscape, providing a clearer picture of your overall financial health. This integration reduces the potential for discrepancies and simplifies the process of tax preparation and financial planning. Imagine a world where your investment gains automatically update in your tax software; sounds like a dream, doesn’t it?

Data Synchronization Mechanisms

Several methods facilitate data synchronization between investment tracking software and other financial tools. These methods range from simple file imports and exports to sophisticated APIs that enable real-time data exchange. The choice of method depends on the capabilities of the specific software involved. A common approach is the use of secure APIs that allow for automated data transfer, ensuring accuracy and minimizing manual intervention. For instance, some software allows for direct import of transaction data from brokerage accounts via their API, eliminating the need for manual data entry.

Benefits of Seamless Data Transfer

The advantages of seamless data transfer are numerous and far-reaching. Primarily, it saves significant time and effort. No more manual data entry, reconciliation, or frustrating attempts to match transactions across different platforms. Accuracy is also greatly improved; automated transfers minimize the risk of human error, ensuring that your financial data is reliable and up-to-date. Finally, a unified view of your finances empowers you to make better informed decisions, improving your overall financial management capabilities. It’s like having a financial superhero sidekick – always accurate, always efficient, and always there to lend a hand (or rather, a data stream).

Examples of Integrations with Popular Financial Tools

Many investment tracking software packages boast impressive integration capabilities. For example, some seamlessly integrate with popular banking apps, allowing users to automatically import their account balances and transactions. Others connect with tax software, pre-filling tax forms with investment-related data, saving hours of tedious work. Integration with budgeting apps can provide a holistic view of your finances, allowing you to see how your investments align with your overall financial goals. Popular examples include integrations with platforms like Mint, TurboTax, and Quicken. Imagine the possibilities – a world where your financial life is not a fragmented mess, but a beautiful, interconnected symphony of data.

Data Flow Between Investment Tracking Software and Other Financial Tools

Below is a simplified flowchart illustrating the typical data flow. Note that the specific implementation will vary depending on the software and the methods used for integration.

+-----------------+ +-----------------+ +-----------------+

| Banking App |---->| Investment |---->| Tax Software |

| (Account Balances)| | Tracking | | (Tax Forms) |

+-----------------+ | Software | +-----------------+

| (Investment Data)|

+-----------------+

In this example, account balance data flows from a banking app to the investment tracking software. The investment tracking software then processes this data along with investment transactions, and finally, exports relevant data to tax software for tax preparation. This illustrates the streamlined data flow that integration facilitates. It’s like a well-oiled machine, working efficiently and silently in the background, allowing you to focus on the more enjoyable aspects of financial management.

Illustrative Examples of Investment Tracking Software in Action

Investment tracking software isn’t just for Wall Street wizards; it’s for anyone who wants to keep tabs on their financial jungle – even if that jungle only consists of a carefully-tended money tree or two. Let’s see how this software can tame the wild west of personal finance.

Tracking a Diversified Portfolio

Imagine Penelope, a shrewd investor with a portfolio as diverse as a box of artisanal chocolates. She uses investment tracking software to monitor her holdings, which include stocks in a tech company (let’s call it “ZoomZoom Inc.”), bonds from a stable utility company (“PowerUp Corp.”), a small allocation in a cryptocurrency (Bitcoin, naturally), and a slice of a real estate investment trust (REIT). The software neatly displays the current value of each asset, its performance since purchase (both in percentage change and absolute dollar amounts), and the overall portfolio value. Penelope’s strategy is to maintain a balance between growth and stability, and the software helps her visualize whether her asset allocation is still aligned with her risk tolerance. For example, if ZoomZoom Inc. skyrockets, the software will highlight the potential for rebalancing to avoid overexposure to a single, high-growth sector. Conversely, if the crypto market takes a tumble, the software allows her to see the impact on her overall portfolio and decide whether to buy the dip or wait it out. Penelope uses the software’s charting features to visualize the performance of each asset over time, identifying trends and making informed decisions about buying, selling, or holding. This clarity helps her sleep soundly at night, knowing her investments are under control.

Analyzing Investment Strategy Performance

Now meet Barnaby, a data-driven investor who’s experimenting with different investment strategies. He’s testing a value investing approach against a growth investing approach, carefully tracking their performance over a five-year period. His software allows him to input the details of each trade for both strategies, automatically calculating metrics like annualized returns, Sharpe ratios, and maximum drawdown. Barnaby uses the software’s reporting features to generate comparative performance charts and tables. The software clearly illustrates that, while the growth strategy had periods of spectacular gains, the value strategy consistently delivered steadier, more predictable returns with lower volatility. This visualization helps Barnaby understand the risk-reward profile of each strategy and makes it easier to choose the one that best aligns with his long-term financial goals. The software’s ability to backtest hypothetical scenarios, based on historical data, helps Barnaby fine-tune his strategies and optimize his approach to maximize returns while minimizing risk. He can even simulate different market conditions to see how his strategies would perform under stress, giving him valuable insights into their resilience.

Final Thoughts

In conclusion, navigating the world of personal finance doesn’t have to be a Herculean task. With the right investment tracking software, you can transform your financial management from a stressful chore into a streamlined, insightful process. So ditch the dusty spreadsheets and embrace the future of investing – your wallet (and your sanity) will thank you.

FAQ Section

What if I don’t have many investments? Is this software still useful?

Absolutely! Even a small portfolio benefits from organized tracking. It builds good habits and provides a clear picture of your financial health, allowing for easier future growth.

Is my data safe with investment tracking software?

Reputable software providers prioritize security with encryption and robust authentication methods. However, always research a provider’s security practices before entrusting your data.

How much does investment tracking software typically cost?

Pricing varies greatly depending on features and functionality. Some offer free plans with limited features, while others have tiered subscriptions with increasing costs for advanced capabilities.

Can I import data from my existing brokerage accounts?

Many software options offer direct import capabilities from various brokerage accounts, simplifying the setup process. Check for compatibility with your specific brokerage before committing.