Navigating the world of personal finance can feel daunting, but understanding the fundamentals of Keuangan Pribadi empowers you to take control of your financial future. This guide provides a comprehensive overview of budgeting, debt management, saving, investing, and protecting your financial well-being, equipping you with the knowledge and tools to make informed decisions and achieve your financial goals. From creating a personalized budget to strategizing for long-term investments, we’ll explore practical steps to build a secure and prosperous financial life.

We’ll delve into various budgeting methods, comparing their effectiveness and helping you choose the approach that best suits your lifestyle. We’ll also cover strategies for tackling debt, maximizing savings, and diversifying investments to achieve your long-term financial aspirations. This journey will also touch upon the importance of insurance, estate planning, and protecting yourself from financial scams, ensuring a holistic approach to your personal finances.

Understanding Personal Finance (Keuangan Pribadi) Basics

Effective personal finance management is crucial for achieving financial stability and security. It involves understanding your income, expenses, and developing strategies to meet your financial goals. This section will explore the fundamental principles of personal finance, guiding you toward better financial health.

Core Principles of Personal Finance Management

Sound personal finance rests on several key principles. These include budgeting, saving, investing, and debt management. Budgeting involves tracking income and expenses to ensure spending aligns with earnings. Saving provides a financial cushion for emergencies and future goals. Investing allows your money to grow over time, potentially exceeding inflation. Finally, responsible debt management involves minimizing high-interest debt and strategically using credit. Ignoring any of these principles can significantly hinder your financial progress.

Components of a Personal Budget

A personal budget is a comprehensive plan that Artikels your expected income and expenses over a specific period, typically monthly or annually. Key components include income sources (salary, investments, etc.), fixed expenses (rent, loan payments, insurance), variable expenses (groceries, entertainment, transportation), and savings goals (emergency fund, retirement, etc.). A well-structured budget helps you visualize your financial situation and identify areas for improvement.

Creating a Personal Financial Plan: A Step-by-Step Guide

Developing a personal financial plan is a crucial step toward achieving long-term financial goals. This involves several steps:

- Assess your current financial situation: Determine your income, expenses, assets, and liabilities.

- Set financial goals: Define short-term (e.g., paying off debt) and long-term (e.g., buying a house, retirement) goals.

- Create a budget: Track your income and expenses to identify areas for savings and improvement.

- Develop a savings and investment strategy: Allocate funds towards savings and investments based on your goals and risk tolerance.

- Manage debt effectively: Prioritize paying down high-interest debt and explore debt consolidation options if necessary.

- Regularly review and adjust your plan: Your financial situation changes over time; regular review ensures your plan remains relevant and effective.

Common Financial Mistakes and How to Avoid Them

Many individuals make common financial mistakes that hinder their progress. These include overspending, failing to budget, neglecting savings, accumulating high-interest debt, and impulsive buying. Avoiding these mistakes requires discipline, planning, and a commitment to responsible financial habits. Creating a budget, setting financial goals, and tracking spending are crucial steps in mitigating these risks. For example, instead of making impulsive purchases, consider waiting 24 hours before buying non-essential items to avoid regret.

Sample Budget Template

This table provides a basic framework for a personal budget. Remember to tailor it to your specific needs and income.

| Income | Expenses | Savings | Debt |

|---|---|---|---|

| Salary: | Rent/Mortgage: | Emergency Fund: | Credit Card Debt: |

| Investments: | Utilities: | Retirement Savings: | Student Loan Debt: |

| Other Income: | Groceries: | Other Savings: | Other Debt: |

| Transportation: | |||

| Entertainment: | |||

| Total Income: | Total Expenses: | Total Savings: | Total Debt: |

Budgeting and Expense Tracking

Effective budgeting and diligent expense tracking are fundamental to achieving sound personal finances. Understanding where your money goes is the first step towards controlling it and achieving your financial goals, whether it’s saving for a down payment, paying off debt, or simply having more financial peace of mind. This section will explore various budgeting methods, tools, and strategies to help you gain better control of your spending.

Different Budgeting Methods

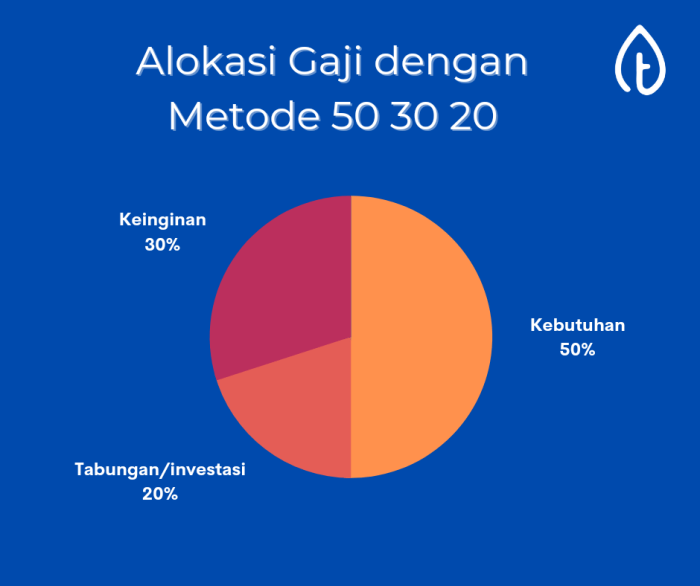

Several budgeting methods can help you manage your finances. Choosing the right method depends on your individual preferences and financial situation. Two popular methods are the 50/30/20 rule and zero-based budgeting.

The 50/30/20 rule is a simple budgeting guideline that suggests allocating your after-tax income as follows: 50% to needs, 30% to wants, and 20% to savings and debt repayment. Needs include essential expenses like housing, food, and transportation. Wants encompass non-essential items like entertainment and dining out. Savings and debt repayment prioritize building your financial security and reducing debt. This method provides a clear framework but may require adjustments based on individual circumstances.

Zero-based budgeting involves allocating every dollar of your income to a specific expense category. This approach ensures that all spending is planned and leaves no room for unplanned expenses. It requires meticulous tracking and planning but offers a high degree of control over your finances. For example, if you earn $5,000 per month after taxes, every dollar of that $5,000 is assigned to a specific category, leaving a zero balance at the end of the budgeting period.

Budgeting Apps and Tools

Numerous budgeting apps and tools are available, each with unique features and functionalities. Popular options include Mint, YNAB (You Need A Budget), and Personal Capital. These apps automate many aspects of budgeting, such as tracking transactions, categorizing expenses, and generating reports. Mint, for instance, offers a free, comprehensive overview of your finances by linking to your bank accounts and credit cards. YNAB emphasizes goal-setting and conscious spending, encouraging users to allocate funds before expenses occur. Personal Capital provides more advanced features, including retirement planning tools, suitable for individuals with more complex financial needs. The effectiveness of these tools depends on individual user engagement and the app’s suitability to their specific needs and financial complexity.

Expense Tracking System

A detailed expense tracking system is crucial for effective budgeting. This system should categorize expenses, record transactions, and provide a clear picture of your spending habits.

- Expense Categories: Establish comprehensive categories to classify your expenses. Examples include Housing (rent/mortgage, utilities), Transportation (fuel, public transport, vehicle maintenance), Food (groceries, dining out), Healthcare (insurance, medical expenses), Personal Care (haircuts, toiletries), Entertainment (movies, concerts), Debt Repayment (loan payments, credit card payments), Savings (emergency fund, retirement contributions), and Miscellaneous (unexpected expenses).

- Methods for Recording Transactions: Use a spreadsheet, budgeting app, or a notebook to meticulously record every transaction. Note the date, description, category, and amount of each expense. Many apps automatically categorize transactions, but manual review and correction are often necessary for accuracy.

- Frequency of Recording: Aim to record transactions daily or at least weekly to maintain accuracy and avoid forgetting expenses.

Categorizing Expenses: Examples

Categorizing expenses accurately is key to understanding your spending patterns. For instance, a grocery bill should be categorized under “Food,” while a restaurant meal falls under “Dining Out” (a subcategory of Food). Similarly, a gym membership goes under “Healthcare” or “Personal Care,” and movie tickets are classified under “Entertainment.” Careful categorization helps identify areas where you might be overspending.

Common Household Expenses and Their Impact

Several common household expenses significantly impact personal finances. These include:

| Expense Category | Potential Impact | Example |

|---|---|---|

| Housing (Rent/Mortgage) | Largest expense for many; impacts savings capacity significantly. | A high mortgage payment can leave less money for other needs and savings. |

| Transportation (Car Payment/Fuel) | Can be substantial; impacts disposable income. | High fuel costs can reduce funds available for entertainment or savings. |

| Food (Groceries/Dining Out) | Significant expense; controllable through meal planning and mindful choices. | Frequent dining out can lead to considerable overspending. |

| Healthcare (Insurance/Medical Bills) | Often unpredictable; necessitates emergency funds. | Unexpected medical expenses can strain finances without adequate savings. |

| Debt Repayment (Loans/Credit Cards) | High interest payments can hinder financial progress. | High-interest credit card debt can significantly reduce disposable income. |

Debt Management and Reduction

Effective debt management is crucial for achieving long-term financial stability. High-interest debt, such as credit card balances and certain loans, can significantly impact your financial health if not addressed proactively. Understanding strategies for managing and reducing this debt is essential for building a secure financial future.

Strategies for managing and reducing high-interest debt involve a multi-pronged approach focusing on minimizing further debt accumulation, actively reducing existing balances, and improving overall financial habits. This includes prioritizing high-interest debt repayment, exploring options for lower interest rates, and developing a comprehensive debt repayment plan.

Negotiating Lower Interest Rates

Negotiating lower interest rates with creditors can significantly reduce the total cost of your debt over time. Many creditors are willing to work with borrowers facing financial hardship or demonstrating a commitment to responsible repayment. This typically involves contacting your creditor directly, explaining your situation, and proposing a lower interest rate. Providing a history of on-time payments and demonstrating a plan for repayment can strengthen your negotiating position. Documentation showing your improved financial standing, such as a budget or improved credit score, can also be beneficial. Success depends on your creditworthiness and the creditor’s policies.

Creating a Debt Repayment Plan

A well-structured debt repayment plan is fundamental to effectively managing and reducing debt. This plan should Artikel your current debts, including the principal balance, interest rate, and minimum payment for each. Popular methods include the debt snowball method (paying off the smallest debt first for motivation) and the debt avalanche method (paying off the highest-interest debt first for cost savings). The plan should also incorporate your monthly income and expenses to ensure realistic payment amounts. Regularly reviewing and adjusting the plan as needed is crucial for staying on track. A simple spreadsheet or budgeting app can be invaluable for tracking progress and making necessary adjustments.

Debt Consolidation

Debt consolidation involves combining multiple debts into a single loan with potentially more favorable terms, such as a lower interest rate or a longer repayment period. The benefits include simplified payment management, potentially lower interest rates, and a streamlined repayment process. However, drawbacks include potentially higher overall interest paid if the consolidation loan has a longer repayment term, and the risk of incurring additional fees. Careful consideration of the terms of the consolidation loan is essential before proceeding. It’s vital to compare offers from multiple lenders to find the most suitable option.

Calculating the Total Cost of Debt

Calculating the total cost of debt involves determining the total amount repaid, including both principal and interest, over the loan’s lifespan. This helps illustrate the true cost of borrowing.

For example: A $10,000 loan with a 10% annual interest rate over 5 years would have a monthly payment of approximately $212.47. Over 5 years (60 months), the total repayment would be approximately $12,748.20. This means the total interest paid would be approximately $2,748.20.

This calculation demonstrates the significant impact of interest on the overall cost of debt. Understanding this calculation helps in making informed decisions about borrowing and repayment strategies.

Saving and Investing

Building a secure financial future requires a strategic approach to both saving and investing. Saving provides a safety net and a foundation for future growth, while investing allows your money to work for you and potentially generate significant returns over the long term. Understanding the nuances of both is crucial for achieving your financial goals.

Types of Savings Accounts

Different savings accounts offer varying levels of accessibility and interest rates. Common options include regular savings accounts, high-yield savings accounts, money market accounts, and certificates of deposit (CDs). Regular savings accounts offer easy access to funds but typically provide lower interest rates. High-yield savings accounts offer higher interest rates but may have slightly more stringent requirements. Money market accounts often provide higher interest rates than regular savings accounts and may offer check-writing privileges. Certificates of deposit (CDs) offer a fixed interest rate for a specified term, providing higher returns but limiting access to your funds until maturity. The choice depends on your individual needs and risk tolerance.

The Importance of an Emergency Fund and Building One

An emergency fund is a crucial component of personal finance. It acts as a safety net to cover unexpected expenses, such as medical bills, job loss, or car repairs, preventing you from accumulating debt. A general guideline is to aim for 3-6 months’ worth of living expenses in your emergency fund. Building one involves setting a savings goal, allocating a portion of your income each month, and consistently contributing until the target is reached. Automating transfers from your checking account to your savings account can significantly simplify this process. Consider using a high-yield savings account to maximize interest earned on your emergency fund.

Investment Options Comparison

Several investment options cater to diverse risk tolerances and financial goals. Stocks represent ownership in a company and offer the potential for high returns but also carry higher risk. Bonds are debt instruments issued by corporations or governments, generally considered less risky than stocks but offering lower potential returns. Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets, offering diversification and professional management. The choice depends on your risk tolerance, investment timeline, and financial goals. For instance, a younger investor with a longer time horizon might allocate a larger portion of their portfolio to stocks, while an older investor nearing retirement might prefer a more conservative approach with a higher allocation to bonds.

Long-Term Financial Planning and Retirement Savings

Long-term financial planning involves setting clear financial goals, such as retirement, and developing a strategy to achieve them. Retirement savings require consistent contributions over many years to accumulate sufficient funds to support your lifestyle in retirement. Retirement accounts, such as 401(k)s and IRAs, offer tax advantages that can significantly enhance your savings. Regular contributions, even small ones, compounded over time, can lead to substantial growth thanks to the power of compound interest. It’s important to regularly review and adjust your retirement plan to account for changes in your income, expenses, and financial goals.

A Diversified Investment Portfolio

A well-diversified portfolio aims to minimize risk by spreading investments across different asset classes. A sample portfolio might include:

40% Stocks: This portion provides potential for significant long-term growth and is allocated across various sectors (e.g., technology, healthcare, consumer goods) and company sizes (large-cap, mid-cap, small-cap) to reduce risk associated with any single sector or company underperforming.

30% Bonds: This component offers stability and income, reducing the overall portfolio volatility. This could include a mix of government bonds and corporate bonds with varying maturities.

20% Real Estate: Investing in real estate, either directly through property ownership or indirectly through REITs (Real Estate Investment Trusts), offers diversification and potential for rental income and appreciation.

10% Cash: This portion provides liquidity for unexpected expenses or investment opportunities and acts as a buffer during market downturns.

This allocation is an example and should be adjusted based on individual risk tolerance, time horizon, and financial goals. The rationale is to balance the potential for higher returns (stocks) with the need for stability and lower risk (bonds and cash). Real estate adds further diversification, potentially offering a hedge against inflation. This is a simplified representation; a more sophisticated portfolio might include other asset classes like commodities or alternative investments.

Protecting Your Financial Future

Securing your financial future involves proactive steps to safeguard your assets and well-being against unforeseen circumstances. This includes protecting yourself from financial risks and planning for long-term stability. A robust financial safety net requires a multifaceted approach encompassing insurance, estate planning, and fraud prevention.

The Importance of Insurance

Insurance provides a crucial safety net against unexpected events that could significantly impact your finances. Different types of insurance address specific risks. Health insurance protects against high medical costs, while life insurance provides financial security for your dependents in the event of your death. Car insurance safeguards you against financial losses resulting from accidents or damage to your vehicle. Consider the potential financial consequences of these events without adequate insurance; the costs can quickly become overwhelming. Choosing the right coverage levels depends on your individual circumstances, risk tolerance, and financial capabilities. It is wise to regularly review your insurance policies to ensure they continue to meet your needs.

Benefits of a Will and Estate Planning

A will Artikels your wishes for the distribution of your assets after your death. Without a will, the distribution process is governed by state laws, which may not align with your preferences. Estate planning, encompassing wills, trusts, and power of attorney documents, ensures a smooth transfer of assets and minimizes potential family conflicts or legal disputes. Proper estate planning also considers minimizing estate taxes and protecting your assets from creditors. Engaging a legal professional specializing in estate planning is recommended to ensure your wishes are legally sound and effectively implemented.

Creating a Financial Safety Net

Building a financial safety net involves establishing an emergency fund and diversifying your assets. An emergency fund, ideally covering 3-6 months of living expenses, provides a buffer against unexpected job loss, medical emergencies, or home repairs. Diversifying your investments across different asset classes, such as stocks, bonds, and real estate, reduces the risk of significant losses from any single investment. Regularly reviewing and adjusting your savings and investment strategy is crucial to adapt to changing circumstances and financial goals. For example, a young professional might prioritize building their emergency fund and contributing to retirement accounts, while someone closer to retirement may focus on preserving capital and generating income.

Protecting Against Identity Theft and Fraud

Identity theft and fraud are significant financial threats. Protecting yourself involves vigilance and proactive measures. This includes regularly monitoring your credit reports for suspicious activity, using strong and unique passwords for online accounts, being cautious about phishing scams (fraudulent emails or texts), and shredding sensitive documents before disposal. Consider using credit monitoring services and installing robust anti-virus software on your devices. In the event of suspected identity theft, report it immediately to the relevant authorities and credit bureaus. An example of a common phishing scam involves emails that appear to be from legitimate institutions, urging you to click a link to update your account information. These links often lead to malicious websites that steal your personal data.

Common Financial Scams and Avoidance Strategies

Numerous financial scams target unsuspecting individuals. These include investment scams promising unrealistic returns, advance-fee loans that require upfront payments, and lottery or prize scams. Be wary of unsolicited investment opportunities, verify the legitimacy of any financial institution or individual before engaging with them, and never provide personal or financial information to unknown sources. Remember, legitimate investment opportunities rarely promise extraordinarily high returns with minimal risk. For example, an investment scam might involve a promise of guaranteed high returns on a new, untested technology, often without proper documentation or regulatory oversight. Due diligence and critical thinking are crucial in avoiding such scams.

Financial Goals and Planning

Effective financial planning hinges on establishing and diligently pursuing clearly defined financial goals. This involves not only identifying what you want to achieve financially but also creating a roadmap to reach those objectives, adapting as needed along the way. Understanding the time value of money is crucial for long-term planning, ensuring your goals remain realistic and achievable.

Setting SMART Financial Goals

SMART goals provide a framework for creating achievable financial targets. The acronym stands for Specific, Measurable, Achievable, Relevant, and Time-bound. A vague goal like “saving more money” becomes significantly more powerful when transformed into a SMART goal: “Save $10,000 (Specific, Measurable) for a down payment on a house within two years (Achievable, Relevant, Time-bound).” This clarity allows for focused action and effective progress tracking. Breaking down large goals into smaller, manageable steps further enhances attainability.

Tracking Progress Towards Financial Goals

Regular monitoring is essential to ensure you’re on track to meet your financial targets. This can involve using budgeting apps, spreadsheets, or even a simple notebook to record income, expenses, and progress toward savings goals. Regularly reviewing your progress – perhaps monthly or quarterly – allows for early identification of any deviations from your plan, enabling timely adjustments. Visual aids like charts and graphs can make tracking more engaging and readily understandable. Comparing actual performance against projected performance helps maintain motivation and identify areas needing improvement.

Adjusting Financial Plans Based on Life Changes

Life throws curveballs. Marriage, job loss, unexpected medical expenses – these events can significantly impact your financial plans. Flexibility is key. A robust financial plan should include contingency planning for unforeseen circumstances. For example, an emergency fund can help weather job loss, while life insurance can protect against unexpected death or disability. Regularly reviewing and adjusting your financial plan, perhaps annually or whenever a significant life change occurs, ensures it remains relevant and effective. Seeking professional financial advice can be invaluable during periods of significant change.

Sample Timeline for Achieving a Long-Term Financial Goal

Let’s illustrate a timeline for buying a house within five years:

- Year 1: Increase savings rate; explore mortgage options; improve credit score.

- Year 2: Begin actively searching for properties; save for a larger down payment; secure pre-approval for a mortgage.

- Year 3: Refine house hunting criteria; attend open houses; get familiar with the home buying process.

- Year 4: Make an offer on a property; negotiate terms; secure financing.

- Year 5: Close on the house; move in.

This timeline provides a framework; adjustments may be necessary depending on individual circumstances and market conditions.

Calculating the Time Value of Money

The time value of money (TVM) principle recognizes that money available today is worth more than the same amount in the future due to its potential earning capacity. This is crucial for long-term financial planning. A simple illustration: Investing $1,000 today at a 5% annual interest rate will be worth approximately $1,628.90 after 10 years. This is calculated using the future value formula:

FV = PV (1 + r)^n

Where:

FV = Future Value; PV = Present Value; r = interest rate; n = number of years.

Understanding TVM helps in making informed decisions about saving, investing, and borrowing. For instance, it highlights the benefits of starting to save early for retirement, as the compounding effect of interest significantly magnifies the growth of your investments over time.

Final Thoughts

Mastering Keuangan Pribadi is a continuous journey of learning, adapting, and refining your financial strategies. By implementing the principles and strategies Artikeld in this guide, you’ll gain a clearer understanding of your financial situation, enabling you to make informed decisions that align with your goals. Remember, consistent effort and proactive planning are key to building a strong financial foundation and securing a brighter financial future. Embrace the process, stay informed, and enjoy the rewards of financial well-being.

FAQ Explained

What is the difference between saving and investing?

Saving focuses on preserving capital and earning modest returns, often in low-risk accounts. Investing involves taking on more risk in pursuit of higher returns over the long term, typically in assets like stocks and bonds.

How often should I review my budget?

Ideally, review your budget monthly to track progress, identify areas for improvement, and adjust as needed based on changes in income or expenses.

What is a good credit score?

A good credit score generally falls within the range of 700-850, though the specific range varies depending on the scoring model used.

What are some common financial scams to watch out for?

Be wary of unsolicited investment opportunities, phishing emails requesting personal financial information, and high-pressure sales tactics promising unrealistic returns.