Keuangan Pribadi, or personal finance, isn’t just about balancing your checkbook – it’s a thrilling adventure into the wild west of your wallet! This journey, fraught with peril (impulse buys!) and punctuated by moments of pure financial bliss (that unexpected bonus!), will guide you through the treacherous terrain of budgeting, debt management, and investing. Buckle up, because navigating your finances has never been so… entertaining.

We’ll cover everything from crafting a budget that doesn’t feel like a prison sentence to taming the beast that is high-interest debt. We’ll explore investment strategies that won’t leave you pulling your hair out, and even delve into the psychology behind our spending habits (because let’s face it, sometimes our brains are our own worst enemies when it comes to money). Get ready to become the master of your own financial destiny – one witty insight at a time.

Understanding Personal Finance (Keuangan Pribadi) Basics

Let’s face it, personal finance isn’t exactly the most thrilling topic, but mastering it is the key to a stress-free (and potentially luxurious!) future. Think of it as adulting level 100 – you can’t level up without understanding the basics. This isn’t about becoming a financial wizard overnight, but about building a solid foundation for your financial well-being.

Effective personal financial management boils down to a few core principles: understanding your income and expenses, creating and sticking to a budget, saving regularly, and planning for the future. It’s about making conscious choices with your money, rather than letting your money make choices for you (which usually involves a lot of regrettable impulse purchases). The good news? It’s simpler than you think, and the rewards are immense.

Creating a Personal Budget

Creating a budget isn’t about restricting yourself; it’s about gaining control over your finances. Think of it as a roadmap to your financial goals, whether that’s buying a house, traveling the world, or simply having a comfortable retirement. A well-structured budget allows you to prioritize your spending and ensure you’re allocating your money effectively. The process is straightforward and can be adapted to your individual circumstances.

- Calculate your net income: This is your income after taxes and other deductions. Let’s say your monthly salary is $5,000 after tax, that’s your starting point.

- Track your expenses: For at least a month, meticulously record every single expense, big or small. Use a spreadsheet, budgeting app, or even a notebook. This will give you a clear picture of where your money is going.

- Categorize your expenses: Group your expenses into categories like housing, food, transportation, entertainment, etc. This will help you identify areas where you can potentially cut back.

- Allocate funds to savings and debt repayment: Before allocating funds to discretionary spending, set aside a portion for savings and debt repayment. The general rule of thumb is to save at least 20% of your income.

- Review and adjust: Regularly review your budget and make adjustments as needed. Life changes, and your budget should adapt accordingly.

Tracking Income and Expenses Effectively

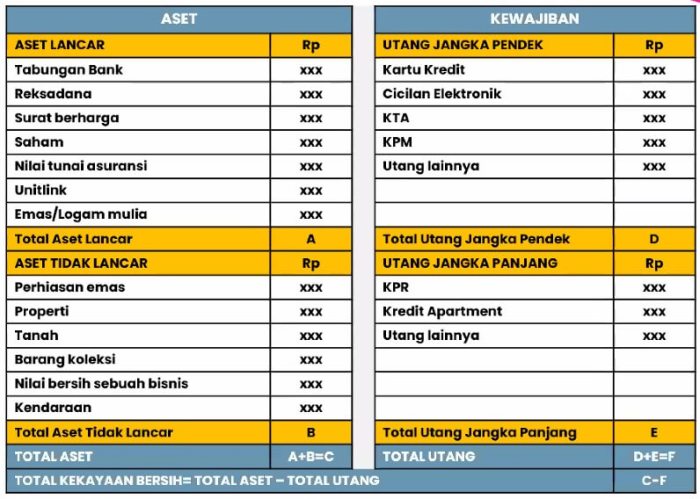

Accurate tracking is the backbone of effective personal finance. Without knowing where your money is going, you’re essentially navigating in the dark. Fortunately, there are numerous tools available to simplify this process.

Using a spreadsheet, budgeting app, or even a simple notebook, consistently record all income and expenses. Categorizing your expenses is crucial for identifying spending patterns and areas for improvement. Consider using digital tools that automatically categorize transactions, saving you time and effort. The key is consistency – even small, seemingly insignificant expenses add up over time.

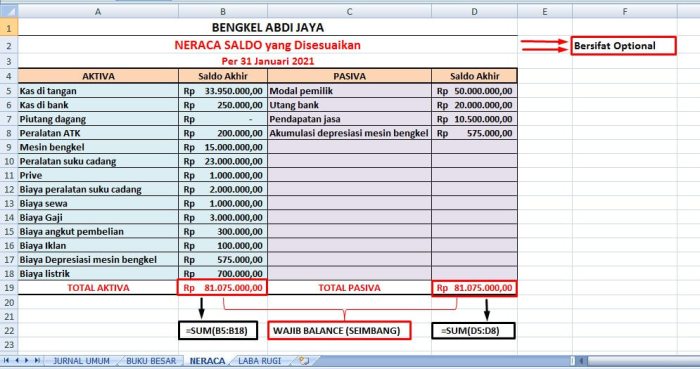

Sample Budget Template

Below is a sample budget template. Remember to adapt it to your own needs and income.

| Income Source | Income Amount | Expense Category | Expense Amount |

|---|---|---|---|

| Salary | $5000 | Rent | $1500 |

| Freelancing | $500 | Groceries | $500 |

| Transportation | $300 | ||

| Utilities | $200 | ||

| Entertainment | $200 | ||

| Savings | $1000 | ||

| Total Income | $5500 | Total Expenses | $3700 |

Managing Debt

Ah, debt. That delightful dance between financial freedom and… well, not financial freedom. Let’s face it, debt can be a real party pooper, but understanding its nuances can help you navigate this tricky terrain with a bit more grace (and less stress-induced hair loss). This section will equip you with the knowledge to tame your debt beast and reclaim your financial sovereignty.

Different types of debt come with different implications, influencing everything from your credit score to your overall financial well-being. Understanding these distinctions is crucial for effective debt management.

Types of Debt and Their Implications

The world of debt isn’t a monochrome landscape; it’s a vibrant tapestry woven with various threads, each with its own texture and implications. Let’s unravel some of these key types:

- Credit Card Debt: This high-interest debt can quickly spiral out of control if not managed carefully. Late payments severely damage your credit score, and the interest charges can feel like a never-ending game of financial whack-a-mole.

- Student Loan Debt: While often necessary for education, student loans can be a significant long-term financial burden. Different repayment plans exist, and understanding your options is vital to avoid overwhelming payments.

- Personal Loans: These loans are typically used for various purposes, from home improvements to debt consolidation. Interest rates vary widely depending on your creditworthiness, so shopping around for the best deal is essential. Think of it as a financial dating app – find the best match for your needs.

- Mortgage Debt: This is typically the largest debt most people will incur, representing a significant commitment over many years. Careful planning and responsible budgeting are key to managing mortgage payments effectively.

Strategies for Paying Off High-Interest Debt

High-interest debt is like a financial leech, constantly draining your resources. Fortunately, several strategies can help you effectively tackle this pesky problem.

- Avalanche Method: Prioritize paying off the debt with the highest interest rate first, regardless of balance. This minimizes the total interest paid over time.

- Snowball Method: Focus on paying off the smallest debt first, regardless of interest rate. This provides a psychological boost and motivates you to continue the process. It’s all about those early wins!

- Debt Snowball with Avalanche Tweaks: Combine the motivational aspects of the snowball method with the financial efficiency of the avalanche method. Prioritize high-interest debts, but pay off the smallest debt first within that high-interest category. This offers a blend of psychological and financial wins.

Debt Consolidation Methods

Debt consolidation aims to simplify your debt repayment by combining multiple debts into a single, more manageable payment. However, it’s crucial to carefully consider the pros and cons of each method.

- Balance Transfer Credit Cards: These cards offer a temporary 0% APR period, allowing you to pay down your debt without accruing interest. Be aware of balance transfer fees and the eventual return to a higher interest rate.

- Personal Loans for Debt Consolidation: A personal loan can consolidate multiple debts into a single monthly payment. The interest rate will depend on your credit score and the loan terms.

- Debt Management Plans (DMPs): A credit counseling agency negotiates with your creditors to lower interest rates and consolidate payments into a single monthly payment. This can negatively impact your credit score initially, but can offer a path to recovery.

Debt Management Flowchart

Visualizing the debt management process can be incredibly helpful. Imagine a flowchart where each decision point guides you toward financial freedom.

The flowchart would begin with “Assess your debts,” branching to “High-interest debt?” If yes, it would lead to “Choose repayment strategy (Avalanche/Snowball),” and then to “Create a budget and stick to it.” If no, it would lead to “Prioritize debts based on minimum payment,” then also to “Create a budget and stick to it.” Both paths ultimately converge at “Monitor progress and adjust as needed,” signifying ongoing debt management.

Saving and Investing

So, you’ve conquered the debt dragon and are ready to build your financial empire? Fantastic! Now it’s time to talk about the fun part: saving and investing your hard-earned cash. Think of it as training your money to work for you, instead of the other way around. We’ll explore various strategies to help you achieve your financial goals, whether it’s buying a beachfront bungalow or securing a comfortable retirement. Get ready to unleash your inner financial wizard!

Short-Term and Long-Term Savings Strategies

Saving isn’t a one-size-fits-all affair. Your approach should depend on your time horizon and financial goals. Short-term goals, like a down payment on a car or a dream vacation, require readily accessible funds. Long-term goals, like retirement, allow for more aggressive investment strategies. Let’s delve into some practical approaches.

- High-Yield Savings Accounts: These accounts offer better interest rates than traditional savings accounts, making them ideal for short-term savings. Think of them as your trusty piggy bank, but with a little extra oomph.

- Certificates of Deposit (CDs): CDs offer fixed interest rates for a specific period. They’re great for locking in a return for a set time, but accessing your money early might incur penalties – so think carefully before committing.

- Money Market Accounts (MMAs): MMAs offer a blend of accessibility and slightly higher interest rates than savings accounts. They’re a good middle ground for those who need some flexibility but also want better returns.

- Retirement Accounts (401(k), IRA): These accounts are designed for long-term savings and often come with tax advantages. The power of compounding interest really shines here, making them excellent vehicles for retirement planning. Early contributions, even small ones, can make a significant difference over time.

Investment Options and Risk Tolerance

Investing involves risk, but the potential rewards can be substantial. Your risk tolerance will influence the type of investments you choose. A conservative investor might prefer lower-risk options, while a more aggressive investor might embrace higher-risk, higher-reward opportunities.

- Stocks: Represent ownership in a company. They offer the potential for high returns but also carry significant risk. Think of it as a rollercoaster – thrilling, but potentially stomach-churning!

- Bonds: Essentially loans to governments or corporations. They generally offer lower returns than stocks but are considered less risky. Imagine them as a more stable, less exciting, but still rewarding investment.

- Mutual Funds: Diversified portfolios of stocks, bonds, or other assets. They offer diversification and professional management, but fees can eat into your returns. Think of them as a well-curated basket of investments, handled by experts.

- Real Estate: Investing in property can offer both rental income and potential appreciation. However, it requires significant capital and can be illiquid. It’s a classic, albeit potentially lengthy, investment journey.

Compound Interest: The Eighth Wonder of the World, Keuangan Pribadi

Compound interest is the magic behind long-term wealth building. It’s the interest you earn on your initial investment, plus the accumulated interest. The longer your money is invested, the more dramatic the effect.

The formula for compound interest is: A = P (1 + r/n)^(nt) where A = the future value of the investment/loan, including interest; P = the principal investment amount (the initial deposit or loan amount); r = the annual interest rate (decimal); n = the number of times that interest is compounded per year; and t = the number of years the money is invested or borrowed for.

Imagine investing $10,000 at a 7% annual interest rate, compounded annually. After 20 years, your investment would grow to approximately $38,697, showcasing the impressive power of compounding. This isn’t magic, it’s mathematics working in your favor!

Investment Vehicle Comparison

The following table compares different investment vehicles based on risk, return, and liquidity. Remember, past performance is not indicative of future results.

| Investment Vehicle | Risk | Return Potential | Liquidity |

|---|---|---|---|

| Stocks | High | High | High |

| Bonds | Low to Moderate | Moderate | Moderate to High |

| Mutual Funds | Low to High (depending on fund type) | Low to High (depending on fund type) | High |

| Real Estate | Moderate to High | Moderate to High | Low |

Financial Planning for Life Stages

Navigating the financial waters of life can feel like trying to sail a bathtub in a hurricane – chaotic, unpredictable, and potentially very wet. But fear not, intrepid financial explorers! With a little planning and a dash of humor, you can chart a course toward financial success, regardless of your life stage. This section will equip you with the maps and compasses you need to navigate the choppy seas of personal finance, one life stage at a time.

Financial planning isn’t a one-size-fits-all affair; your needs change dramatically as you progress through life’s various chapters. What works for a fresh-faced graduate won’t necessarily cut it for a parent juggling childcare costs or a retiree enjoying (hopefully) a well-deserved break. Let’s explore the financial realities of each stage, providing you with strategies to keep your financial ship afloat.

Financial Planning for Young Adults

Young adulthood is often a period of exciting transitions – graduating from college, launching a career, maybe even navigating the thrilling world of independent living. Financially, this phase focuses on building a foundation for the future. This includes establishing good credit, starting an emergency fund, and beginning to save for long-term goals like buying a home or retirement. Paying off student loan debt efficiently is also a crucial aspect, requiring a strategic approach that considers repayment options and minimizing interest payments. Avoid the temptation to live beyond your means, and celebrate small victories along the way! Remember, consistent saving, even in small amounts, compounds over time.

Financial Planning for Families

Ah, the family stage – a whirlwind of diaper changes, school plays, and the never-ending quest for the perfect family vacation. Financially, this period presents unique challenges. The arrival of children significantly increases expenses, requiring careful budgeting and financial prioritization. Saving for children’s education becomes a major concern, necessitating a dedicated savings plan and potentially exploring options like 529 plans. Furthermore, securing adequate life insurance to protect your family’s financial future in the event of an unexpected loss is critical. It’s a balancing act, but with a well-defined budget and a shared understanding of financial goals, families can navigate this phase with grace and financial stability.

Financial Planning for Retirees

Retirement – the golden years, a time for relaxation, travel, and pursuing long-dormant hobbies. But financial planning is still crucial. Adequate retirement savings are paramount, and careful management of these savings is key to ensuring a comfortable retirement. Retirees need to plan for healthcare expenses, which can be substantial, and manage their investments wisely to maintain their living standards. Considering options like reverse mortgages or downsizing could help manage costs. This stage is about enjoying the fruits of your labor, but smart financial planning ensures that those fruits are plentiful and last for years to come.

Strategies for Saving for Retirement and Education

Saving for both retirement and education requires a proactive and disciplined approach. For retirement, contributing regularly to employer-sponsored retirement plans like 401(k)s or 403(b)s is essential, taking full advantage of employer matching contributions. Investing in individual retirement accounts (IRAs) can provide additional tax advantages. For education, 529 plans offer tax-advantaged savings specifically designed for educational expenses. A diversified investment strategy across different asset classes is also crucial to mitigate risk and maximize returns in both cases. Early and consistent saving is key; the power of compounding interest is a true financial miracle.

Estate Planning and Its Importance

Estate planning might sound like a topic best left to the morbidly curious, but it’s actually a crucial aspect of responsible financial planning at any life stage. It involves creating a legal framework for the distribution of your assets after your death, ensuring your wishes are respected and your loved ones are protected. This includes drafting a will, establishing trusts, and designating beneficiaries for retirement accounts and life insurance policies. Proper estate planning can prevent family disputes, minimize estate taxes, and ensure a smooth transition of your assets. Think of it as a financial love letter to your future self and your loved ones.

A Timeline of Key Financial Milestones

Imagine a timeline stretching from your early twenties to your golden years. Early adulthood sees the establishment of credit and savings accounts, followed by homeownership and family formation in the subsequent decades. As your career progresses and your family grows, your financial priorities shift, with education savings and retirement planning taking center stage. Finally, retirement brings a focus on managing assets and ensuring a comfortable and secure future. This timeline is highly personalized, but it provides a framework for understanding the evolving financial priorities throughout life. It’s a journey, not a race, and proper planning helps ensure a smooth and financially secure ride.

Protecting Your Finances

Let’s face it, money makes the world go ’round, but so does the unpredictable. Protecting your hard-earned cash isn’t just about stuffing it under your mattress (though that *could* be a surprisingly effective anti-theft measure… for a while). It’s about building a robust financial shield against life’s little (and big) curveballs. Think of it as financial karate – learning to deflect the blows and counter-attack with savvy strategies.

Insurance: Your Financial Safety Net

Insurance might sound boring, but it’s your financial superhero cape. It’s the ultimate “what if” plan, protecting you from potentially devastating financial losses. Health insurance ensures you can afford treatment without going bankrupt, life insurance provides a financial cushion for your loved ones in case of the unexpected, and property insurance safeguards your home and belongings from damage or theft. Think of it as paying a small premium to avoid a catastrophic financial knockout punch.

Emergency Funds: Your Financial First-Aid Kit

Unexpected expenses are, well, unexpected. Job loss, car repairs, a surprise trip to the vet for your beloved pet hamster – these things happen. An emergency fund acts as your financial first-aid kit, providing a safety net to cover these unplanned events without derailing your financial progress. Aim for 3-6 months’ worth of living expenses tucked away in a readily accessible account. This isn’t for investing; it’s for emergencies – think of it as your financial “get out of jail free” card.

Protecting Yourself from Financial Fraud and Scams

The digital age has made it easier than ever to connect with people, but also for scammers to target your finances. Be wary of unsolicited emails, phone calls, or text messages promising unrealistic returns or requesting personal information. Never click on suspicious links, and always verify the identity of anyone requesting financial details. Regularly monitor your bank accounts and credit reports for any unauthorized activity. Think of it as practicing financial self-defense – staying vigilant and aware of potential threats.

A Well-Diversified Insurance Portfolio: A Visual Representation

Imagine a sturdy, multi-layered shield. The outermost layer is your Health Insurance, a broad, encompassing protection against medical expenses. Behind it lies your Life Insurance, a solid, reliable barrier providing financial security for your dependents. The next layer is your Property Insurance, protecting your home and possessions from unforeseen damage or theft. Finally, at the core, you have your Disability Insurance and Liability Insurance, offering additional protection against unforeseen circumstances. Each layer reinforces the others, creating a robust defense against financial risks. This is not exhaustive; additional layers such as long-term care insurance or umbrella liability insurance could be added for enhanced protection depending on individual needs and circumstances. The stronger the shield, the better prepared you are to weather any financial storm.

Utilizing Financial Tools and Resources

Navigating the world of personal finance can feel like trying to assemble IKEA furniture without the instructions – confusing, frustrating, and potentially leading to a pile of expensive regret. Luckily, there are plenty of tools and resources available to help you avoid a financial meltdown. This section will equip you with the knowledge and resources to conquer your finances, one budgeting app at a time.

Let’s explore the digital arsenal at your disposal, transforming your financial anxieties into informed decisions. From apps that track every penny to websites brimming with free advice, we’ll demystify the process and empower you to take control.

Budgeting Apps and Software

Many budgeting apps and software programs exist, each with its own strengths and weaknesses. Choosing the right one depends on your personal preferences and financial needs. Some popular options include Mint, YNAB (You Need A Budget), Personal Capital, and EveryDollar. Mint, for example, is known for its user-friendly interface and automatic transaction tracking. YNAB, on the other hand, takes a more proactive approach, emphasizing budgeting based on your values and goals. Personal Capital offers a more comprehensive suite of tools, including investment tracking and retirement planning features. EveryDollar provides a zero-based budgeting system, ensuring every dollar is assigned a purpose. The key is to find an app that fits your lifestyle and helps you stay organized.

Resources for Free Financial Education and Advice

Accessing free financial education is surprisingly easy, and it’s a smart move to avoid paying for something you can get for free! Many reputable organizations offer valuable resources online. The National Endowment for Financial Education (NEFE), for instance, provides a wealth of information on various financial topics, from budgeting to investing. The Consumer Financial Protection Bureau (CFPB) offers guidance on consumer rights and financial products. Websites like Investopedia provide comprehensive articles and tutorials on complex financial concepts, explained in a way that even a finance-phobe can understand. Don’t underestimate the power of free knowledge!

Using Online Calculators for Financial Planning

Online calculators can be incredibly helpful in making informed financial decisions. For example, retirement calculators allow you to estimate how much you’ll need to save to maintain your desired lifestyle in retirement, considering factors like your current age, savings, and expected rate of return. Similarly, loan calculators can help you determine your monthly payments and the total interest paid on loans, enabling you to compare different loan options and make the most financially sound choice. These tools provide quick estimates, allowing you to plan ahead without needing a financial wizard’s expertise. For instance, if you input a $200,000 mortgage at a 5% interest rate over 30 years, a calculator will readily show you the estimated monthly payment.

Reputable Financial Websites and Organizations

Finding trustworthy information is crucial in personal finance. Here’s a list of reputable sources you can rely on:

- The Consumer Financial Protection Bureau (CFPB): A government agency dedicated to protecting consumers’ financial rights.

- The National Endowment for Financial Education (NEFE): Offers free financial education resources.

- Investopedia: A comprehensive online resource for financial information.

- Khan Academy: Offers free courses on various subjects, including personal finance.

- NerdWallet: Provides financial advice and product comparisons.

Remember, while these tools are invaluable, they are just that – tools. They should be used to inform your decisions, not dictate them. Always consult with a qualified financial advisor for personalized advice.

The Psychology of Money

Let’s face it, money isn’t just numbers on a screen; it’s a powerful emotional rollercoaster. Understanding the psychological factors influencing our financial decisions is as crucial as understanding compound interest. Ignoring the emotional side of finance is like trying to navigate a ship using only a compass – you might get somewhere, but it’ll be a bumpy, stressful ride.

Behavioral biases significantly impact our financial decision-making. These sneaky little gremlins in our brains often lead us astray, causing us to make choices that aren’t necessarily in our best financial interest. From the thrill of a quick win to the fear of missing out, our emotions often override logic, resulting in less-than-optimal outcomes.

Behavioral Biases and Financial Decisions

Our brains are wired with shortcuts – heuristics – that help us make quick decisions. However, these mental shortcuts can lead to systematic errors in judgment, impacting our financial choices. For instance, the “availability heuristic” makes us overestimate the likelihood of events that are easily recalled, like dramatic news stories about market crashes, leading to overly cautious (or overly risky) investment strategies. Similarly, “loss aversion,” our tendency to feel the pain of a loss more strongly than the pleasure of an equivalent gain, can cause us to hold onto losing investments for too long, hoping for a miracle recovery instead of cutting our losses. Imagine holding onto a stock that’s plummeted 50% because you refuse to acknowledge the loss – a classic example of loss aversion at work!

Setting Financial Goals and Maintaining Motivation

Setting clear, achievable financial goals is paramount. Think of it as mapping out a treasure hunt; without a map (goals), you’re just wandering aimlessly. These goals should be SMART – Specific, Measurable, Achievable, Relevant, and Time-bound. Wanting to “be rich someday” is vague; aiming to save $10,000 for a down payment on a house within two years is concrete and motivating. To stay motivated, regularly review your progress, celebrate milestones, and adjust your strategy as needed. Think of it as rewarding yourself for reaching checkpoints on your financial treasure map!

Overcoming Procrastination and Impulsive Spending

Procrastination and impulsive spending are twin demons that can derail even the best-laid financial plans. To combat procrastination, break down large financial tasks into smaller, manageable steps. Instead of feeling overwhelmed by the thought of creating a budget, start with tracking your spending for just one week. For impulsive spending, try the “waiting period” technique: before making a non-essential purchase, wait 24 hours. Often, the initial urge fades, and you realize you don’t need that sparkly new gadget after all. Imagine the satisfaction of saving that money instead!

Common Financial Mistakes and How to Avoid Them

Understanding common financial pitfalls is half the battle. Here’s a list of frequent errors and how to steer clear:

- Not Budgeting: Failing to track income and expenses leaves you vulnerable to overspending. Solution: Create a realistic budget and stick to it, even if it means cutting back on some luxuries.

- Ignoring Debt: High-interest debt can snowball quickly, consuming your income. Solution: Prioritize paying down high-interest debt first, perhaps using a debt avalanche or snowball method.

- Living Beyond Your Means: Spending more than you earn leads to debt and financial stress. Solution: Adjust your lifestyle to match your income. Consider downsizing, finding cheaper alternatives, or increasing your income.

- Failing to Save and Invest: Not saving for retirement or emergencies leaves you vulnerable to financial hardship. Solution: Start saving early and consistently, even if it’s a small amount. Consider investing to grow your savings over time.

- Ignoring Financial Planning: Lack of planning can lead to missed opportunities and financial instability. Solution: Develop a comprehensive financial plan that includes goals, strategies, and regular reviews.

Ultimate Conclusion: Keuangan Pribadi

So, there you have it: a whirlwind tour through the exciting (and sometimes terrifying) world of personal finance. Remember, managing your money isn’t about deprivation; it’s about empowerment. By understanding the principles of budgeting, investing wisely, and making informed financial decisions, you can build a secure financial future and, dare we say it, even have a little fun along the way. Now go forth and conquer your finances – you got this!

Essential Questionnaire

What’s the difference between saving and investing?

Saving is about setting aside money for short-term goals (like a vacation), while investing is about growing your money over the long term (like retirement).

How much should I be saving each month?

A good rule of thumb is to save at least 20% of your income, but the ideal amount depends on your individual circumstances and goals.

What’s the best way to pay off debt?

The most effective strategy depends on your debt type and amount. Consider the avalanche method (highest interest first) or the snowball method (smallest debt first).

How can I avoid financial scams?

Be wary of unsolicited offers, never share personal information unless you’re absolutely sure of the source, and do your research before investing in anything.