Keuangan Pribadi, or personal finance, isn’t just about balancing your checkbook (though that’s part of the fun!). It’s a thrilling adventure into the wild world of budgeting, saving, investing, and maybe even escaping the clutches of debt. Think of it as a financial Indiana Jones expedition, except instead of ancient artifacts, you’re searching for financial freedom. Buckle up, because this journey promises laughter, learning, and maybe even a few unexpected riches.

This guide navigates the sometimes-bewildering landscape of Indonesian personal finance, offering practical advice, relatable examples, and a healthy dose of humor to keep you engaged. We’ll unravel the mysteries of budgeting, explore diverse income streams, conquer debt like a boss, and even plan for a retirement so luxurious you’ll need a bigger yacht.

Understanding Personal Finance (Keuangan Pribadi) Basics

Navigating the world of personal finance in Indonesia, with its unique blend of traditional values and modern aspirations, can feel like trying to assemble flat-pack furniture without instructions – frustrating, but ultimately rewarding. This section will demystify the basics, offering a humorous yet practical guide to managing your rupiah.

Defining Personal Finance in the Indonesian Context

Personal finance in Indonesia, or *Keuangan Pribadi*, isn’t just about balancing your budget; it’s deeply intertwined with cultural values like *gotong royong* (mutual assistance) and family obligations. While saving for your own future is crucial, supporting family members often plays a significant role in financial planning. This means that budgeting needs to accommodate both personal aspirations and familial responsibilities, a delicate balancing act that requires careful consideration. Understanding this cultural context is key to effectively managing your finances.

The Importance of Budgeting in Achieving Financial Goals

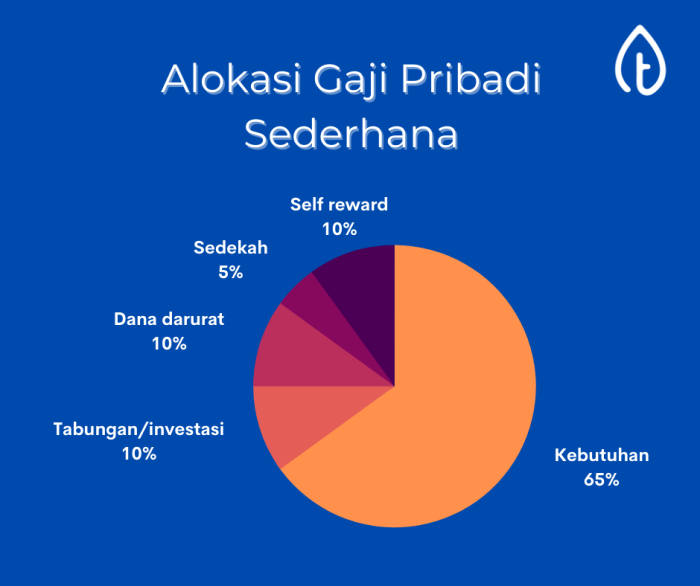

Budgeting, often viewed as a tedious chore, is actually your secret weapon in achieving financial freedom. Think of it as your personal financial GPS, guiding you towards your goals – whether it’s buying a motorbike, funding your *anak*’s education, or finally taking that dream vacation to Bali (without ending up broke afterwards!). A well-structured budget helps you track your income and expenses, identify areas for improvement, and make informed financial decisions. It’s the foundation upon which you build a secure and prosperous financial future.

Creating a Personal Budget: A Step-by-Step Guide

Creating a budget doesn’t require an advanced degree in economics; it simply requires honesty and organization. Follow these steps to create your own personalized financial roadmap:

1. Track your income: List all sources of income, including salary, side hustles, and even that occasional *angpao* from your uncle.

2. Categorize your expenses: Divide your expenses into needs (essentials like food and rent) and wants (that new *batik* shirt you’ve been eyeing).

3. Use a budgeting tool: Spreadsheets, budgeting apps, or even a simple notebook can work wonders.

4. Regularly review and adjust: Life throws curveballs; your budget should be flexible enough to adapt to unexpected events.

| Income | Expenses | Category | Notes |

|---|---|---|---|

| Rp 10,000,000 (Salary) | Rp 2,000,000 | Rent | Apartment in Jakarta |

| Rp 1,000,000 (Freelancing) | Rp 1,500,000 | Food | Includes groceries and eating out |

| Rp 500,000 | Transportation | Motorcycle fuel and maintenance | |

| Rp 1,000,000 | Utilities | Electricity, water, internet | |

| Rp 2,000,000 | Savings | Emergency fund and investment | |

| Rp 1,000,000 | Entertainment | Movies, dining out, etc. | |

| Rp 1,000,000 | Family Support | Contribution to parents |

Differentiating Needs and Wants in Personal Finance, Keuangan Pribadi

The difference between needs and wants is crucial for effective budgeting. Needs are essential for survival and well-being (food, shelter, clothing, healthcare). Wants, on the other hand, are things that enhance your life but aren’t strictly necessary (new gadgets, fancy coffee, that aforementioned *batik* shirt). While indulging in wants occasionally is perfectly fine, prioritizing needs ensures financial stability and prevents unnecessary debt. Understanding this distinction is paramount to responsible financial management. A simple rule of thumb: If you can’t survive without it, it’s a need; if you can, it’s a want.

Managing Income and Expenses

Navigating the world of personal finance in Indonesia can feel like trying to catch a slippery fish in a crowded market – chaotic but ultimately rewarding. Understanding how to manage your income and expenses is the cornerstone of building a healthy financial future, so let’s dive in! This section will equip you with the tools and knowledge to wrangle your finances and achieve your financial goals.

Income Streams in Indonesia

Indonesia offers a diverse range of income opportunities, from traditional employment to the burgeoning gig economy. Understanding these avenues can help you diversify your income and build financial resilience. Let’s explore some key possibilities.

- Salaried Employment: This remains the most common income source, encompassing roles across various sectors. Salaries typically offer stability and benefits like health insurance and retirement contributions.

- Entrepreneurship: Indonesia boasts a vibrant entrepreneurial spirit, with many individuals launching their own businesses, from small-scale street food vendors to larger online retailers. This offers high earning potential but also carries greater risk.

- Freelancing and the Gig Economy: The rise of online platforms has created numerous opportunities for freelancers in areas like writing, design, and programming. This provides flexibility but requires self-discipline and proactive client acquisition.

- Investments: Investing in stocks, bonds, or property can generate passive income, though it requires understanding of market risks and financial literacy.

- Rental Income: Owning and renting out property can provide a steady stream of passive income, although this requires a significant initial investment and ongoing management.

Expense Tracking Strategies

Effective expense tracking is crucial for understanding your spending habits and identifying areas for improvement. Several methods exist, each with its own strengths and weaknesses.

Choosing the right method depends on your personal preferences and tech-savviness. Some individuals thrive with spreadsheets, while others prefer the convenience of budgeting apps.

- Spreadsheet Software (e.g., Microsoft Excel, Google Sheets): Offers great flexibility and customization. Pros: Highly customizable, detailed record-keeping. Cons: Requires manual data entry, can be time-consuming.

- Budgeting Apps (e.g., Mint, YNAB): Automate many aspects of tracking and offer insightful visualizations. Pros: Convenient, automated features, visual representation of spending. Cons: May require subscriptions, data privacy concerns.

- Manual Tracking (e.g., Notebook, Journal): A simple, low-tech approach. Pros: No technology required, promotes mindful spending. Cons: Prone to errors, less efficient for large volumes of transactions.

Saving and Investing for Short-Term and Long-Term Goals

Saving and investing are not just about accumulating wealth; they are about securing your financial future and achieving your dreams. The key is to differentiate between short-term and long-term objectives.

Short-term goals might include a down payment on a motorbike, while long-term goals could encompass a house down payment or early retirement. Your approach to saving and investing will differ based on your timeframe.

- Short-Term Goals: Focus on high-liquidity savings accounts or money market funds. These provide easy access to your funds when needed.

- Long-Term Goals: Consider investing in assets with higher growth potential, such as stocks, mutual funds, or property. These typically involve higher risk but offer greater potential returns over time.

Sample Monthly Expense Report

Below is a sample monthly expense report illustrating a simple way to track expenses. Remember to tailor your categories to your specific needs.

| Date | Description | Category | Amount (IDR) |

|---|---|---|---|

| 2024-01-15 | Groceries | Food | 500000 |

| 2024-01-20 | Electricity Bill | Utilities | 200000 |

| 2024-01-25 | Restaurant Meal | Dining Out | 150000 |

| 2024-01-30 | Gasoline | Transportation | 100000 |

| 2024-01-31 | Movie Tickets | Entertainment | 200000 |

Debt Management and Financial Planning

Ah, debt. That four-letter word that can send shivers down the spine of even the most financially savvy among us. But fear not, dear reader! Understanding debt and planning for a debt-free future is entirely achievable, even if it feels like climbing Mount Everest in flip-flops. This section will equip you with the knowledge and strategies to conquer your debt and finally achieve financial freedom. Think of it as your personal debt-busting manual, complete with witty commentary and actionable advice.

Debt, in its simplest form, is money you owe to someone else. It’s like borrowing a friend’s car – you’re responsible for returning it (with interest, usually). However, unlike a friend who might understand a late return, banks and lenders have strict rules and consequences for missed payments. Understanding the different types of debt and their implications is crucial for effective management.

Types of Debt and Their Implications

Different debts behave differently, like mischievous gremlins with varying degrees of naughtiness. Credit card debt, for example, often boasts sky-high interest rates, turning a small purchase into a monstrous debt snowball. Personal loans, on the other hand, typically have fixed interest rates and repayment schedules, making them more predictable (but still potentially problematic if not managed carefully). Mortgages, the behemoths of the debt world, are long-term loans secured against property. While they can be manageable, they tie up significant assets and require careful budgeting. Finally, there are student loans, which are often necessary for education but can significantly impact your finances for years to come. The key is understanding the specific terms and conditions of each debt type to make informed decisions.

Strategies for Managing and Reducing Debt

Once you’ve identified your debt gremlins, it’s time to strategize. Debt consolidation involves combining multiple debts into a single loan, often with a lower interest rate, simplifying repayments and potentially saving you money. Think of it as herding your unruly debt gremlins into a single, more manageable pen. Negotiating with creditors is another powerful weapon. Many lenders are willing to work with borrowers facing financial hardship, potentially reducing interest rates or extending repayment periods. This requires assertive but respectful communication, highlighting your commitment to repayment while explaining your circumstances.

A Step-by-Step Plan for Paying Off Debt

Let’s craft a simple, yet effective, debt repayment plan. We’ll use the snowball method, focusing on paying off the smallest debt first for psychological motivation.

- List your debts: Create a list of all your debts, including the balance, interest rate, and minimum payment.

- Prioritize your debts: Order your debts from smallest to largest balance, regardless of interest rate. This is the snowball method.

- Make minimum payments: Pay the minimum payment on all debts except the smallest one.

- Attack the smallest debt: Throw as much extra money as possible at the smallest debt until it’s paid off.

- Repeat: Once the smallest debt is gone, roll that payment amount into the next smallest debt, creating a larger snowball effect.

Example: Let’s say you have three debts: Credit Card A (Rp 5,000,000), Personal Loan B (Rp 10,000,000), and Credit Card C (Rp 2,000,000). You’d start with Credit Card C, paying it off as quickly as possible. Once it’s paid, you’d add that payment amount to your payments on Credit Card A, accelerating its repayment. This psychological boost keeps you motivated!

Resources for Financial Literacy and Debt Counseling in Indonesia

Navigating the world of personal finance can feel overwhelming, but help is available. Numerous organizations in Indonesia offer financial literacy programs and debt counseling services. These resources can provide valuable guidance, support, and tools to help you regain control of your finances. Researching and utilizing these services can significantly improve your chances of successfully managing and eliminating debt. Many banks and financial institutions also offer free or low-cost financial education workshops. Remember, seeking help is a sign of strength, not weakness.

Investing and Retirement Planning

Investing and planning for retirement in Indonesia might sound daunting, like navigating a labyrinth made of Rupiah, but fear not! With a little knowledge and a dash of humor, you can turn your financial future from a scary monster into a friendly, money-making dragon. This section will explore various investment options, the importance of diversification, and the nuts and bolts of creating a retirement plan. Remember, the earlier you start, the more time your money has to grow, and the more comfortable your golden years will be. Think of it as a long-term game of financial Jenga – you want to build a strong, stable tower that can withstand life’s little (and big) financial earthquakes.

Indonesia offers a diverse range of investment options, each with its own risk-reward profile. Choosing the right mix is crucial, and remember, even experienced investors sometimes make mistakes! It’s like choosing your team in a fantasy football league – you need a balance of high-potential players (high-risk investments) and reliable stalwarts (low-risk investments) to ensure a winning portfolio.

Investment Options in Indonesia

Several investment avenues are available to Indonesian investors, each carrying varying degrees of risk and potential return. Understanding these differences is paramount to making informed decisions. It’s like choosing between a spicy chili (high-risk, high-reward) and a mild cucumber (low-risk, low-reward) – your palate (risk tolerance) will determine your choice.

- Stocks (Saham): Investing in stocks represents ownership in a company. High potential returns, but also high risk due to market volatility. Think of it as betting on a horse race – some horses win big, others… well, not so much.

- Bonds (Obligasi): Bonds are essentially loans you make to a government or corporation. They offer lower returns than stocks but are generally considered less risky. It’s like lending money to a friend – you’ll get your money back with interest, but the returns might not be as exciting.

- Mutual Funds (Reksa Dana): Mutual funds pool money from multiple investors to invest in a diversified portfolio of assets. They offer diversification and professional management, but come with management fees. Think of it as joining a club – you share the risk and rewards with others, and someone else does the heavy lifting.

- Real Estate (Properti): Investing in property can provide both rental income and capital appreciation. However, it’s often illiquid and requires significant capital investment. This is like building your own castle – it takes time and resources, but the payoff can be substantial.

- Gold (Emas): Gold is a traditional safe haven asset that can protect your portfolio during times of economic uncertainty. Returns are generally modest, but it acts as a hedge against inflation. Think of it as your financial security blanket – it might not be thrilling, but it offers comfort and stability.

Diversification of Investment Portfolio

Diversification is the key to managing risk. Spreading your investments across different asset classes reduces the impact of any single investment performing poorly. Imagine your investment portfolio as a basket of eggs – if you put all your eggs in one basket (one investment), and that basket falls, you lose everything. Diversification is like spreading your eggs across multiple baskets – if one basket falls, you still have eggs in the others.

Retirement Planning Process

Planning for retirement requires considering several crucial factors, including life expectancy, inflation, and desired lifestyle. It’s like planning a long road trip – you need to know your destination (desired retirement lifestyle), the distance (number of years until retirement), and the fuel efficiency of your vehicle (your savings and investment strategy).

A crucial element is factoring in inflation, which erodes the purchasing power of money over time. Think of it like this: if a loaf of bread costs Rp 10,000 today, it might cost Rp 20,000 in 20 years. Your retirement savings need to account for this increase to maintain your living standards.

Sample Retirement Plan

Let’s create a hypothetical retirement plan for Budi, who is 30 years old and aims to retire at 60. Budi wants a retirement income equivalent to his current salary of Rp 10,000,000 per month. We’ll assume a conservative annual inflation rate of 5% and a modest investment return of 7%.

Budi needs to estimate his retirement expenses, considering inflation. Using a financial calculator or online tools, he can determine the required lump sum at retirement to generate his desired income. This calculation will take into account the inflation-adjusted expenses and the expected investment return during retirement. It’s a bit like solving a complex mathematical puzzle, but the reward is a comfortable retirement.

Then, Budi needs to determine the monthly savings needed to reach that lump sum within 30 years. This calculation will use the future value of an annuity formula. The amount needed will be significantly less if he starts saving earlier. It’s like compounding interest – the earlier you start, the more powerful the magic of compounding becomes.

| Factor | Value |

|---|---|

| Current Age | 30 |

| Retirement Age | 60 |

| Current Monthly Salary | Rp 10,000,000 |

| Inflation Rate | 5% |

| Investment Return | 7% |

This is a simplified example. A comprehensive retirement plan should consider other factors, such as health insurance, potential inheritance, and unexpected expenses. It’s like having a backup plan for your backup plan – it’s always better to be prepared for the unexpected.

Protecting Your Financial Future

Let’s face it, nobody wants to spend their golden years worrying about money. Securing your financial future isn’t just about saving diligently; it’s about building a robust safety net that protects you from life’s unexpected curveballs. Think of it as financial aikido – using life’s inevitable bumps to your advantage, rather than being knocked flat on your back.

Protecting your financial future involves mitigating risks through insurance and proactive planning, ensuring your hard-earned wealth is safeguarded and passed on smoothly. This isn’t about being morbid; it’s about being smart.

Insurance in Indonesia: Your Financial Shield

Insurance acts as a crucial buffer against unforeseen circumstances. It’s the financial equivalent of a really good bodyguard, always there to protect you from potentially devastating costs. In Indonesia, a range of insurance options cater to various needs, from the unexpected hospital bill to securing your family’s future. Understanding these options is key to building a comprehensive financial safety net.

Types of Insurance Available in Indonesia

Several types of insurance are widely available in Indonesia. Health insurance, for instance, offers coverage for medical expenses, preventing crippling debt from illness or accidents. Life insurance provides a financial safety net for your dependents in case of your untimely demise. Consider it a financial hug for your loved ones. Other types include vehicle insurance (protecting your prized possession and others), property insurance (safeguarding your home from the unexpected), and even travel insurance (because even the most meticulously planned vacation can go sideways). Choosing the right mix depends on your individual circumstances and risk tolerance. Remember, a little insurance goes a long way.

Estate Planning and the Importance of a Will

Creating a will and a comprehensive estate plan might seem like something for the very wealthy or elderly, but it’s a crucial step for everyone, regardless of net worth. A will dictates how your assets will be distributed after your passing, ensuring your wishes are honored and avoiding potential family disputes. Estate planning goes beyond the will, encompassing strategies for managing your assets and minimizing taxes during your lifetime and after. It’s about leaving a legacy, not just a mess. Without a will, the Indonesian government will decide how your assets are distributed, and that might not align with your wishes.

Finding Reputable Financial Advisors in Indonesia

Navigating the world of financial planning can be daunting. Seeking advice from a qualified and reputable financial advisor can significantly simplify the process. Look for advisors with certifications from recognized professional bodies and a proven track record. Check online reviews and testimonials before engaging their services. Remember, a good advisor will work with you to understand your specific needs and create a personalized plan that fits your financial goals and risk tolerance. Don’t be afraid to ask questions; a good advisor will be happy to explain things clearly.

Financial Goals and Tracking Progress

So, you’ve conquered the basics of personal finance – budgeting, saving, and even dipping your toes into investing. Fantastic! But without a roadmap, even the most meticulously planned financial journey can end up feeling like a chaotic scavenger hunt for your retirement. That’s where setting clear financial goals and diligently tracking your progress comes in. Think of it as upgrading from a rusty bicycle to a GPS-equipped sports car on the road to financial freedom.

Setting SMART Financial Goals is Key to Success. Without clearly defined objectives, your financial efforts can feel aimless and frustrating. SMART goals provide a structured approach, ensuring you’re not just dreaming about a yacht, but actually charting a course to acquire one (or at least a very nice inflatable pool raft).

Defining SMART Financial Goals

SMART stands for Specific, Measurable, Achievable, Relevant, and Time-bound. Let’s break down what that means in the context of personal finance. A vague goal like “get rich” is useless; a SMART goal provides clarity and direction. For example, instead of “save more money,” a SMART goal might be: “Save $10,000 (Specific, Measurable) for a down payment on a house (Relevant) within two years (Time-bound), by increasing my savings rate to 20% of my income (Achievable).” Note that “Achievable” requires honest self-assessment of your income and expenses. Don’t set yourself up for failure by aiming for the moon if you only have a ladder.

Tracking Progress with a Visual Representation

Regularly monitoring your progress is crucial. Imagine trying to navigate a city without a map – you’d likely get lost! A simple bar graph can be a powerful visual tool. Let’s say your goal is to save $10,000 in two years. Your bar graph would have a horizontal axis representing the 24 months (two years) and a vertical axis representing the amount saved (in dollars, from $0 to $10,000). Each month, you’d add a bar representing your savings for that month. As the bars grow, you’ll see your progress visually, providing a powerful motivational boost and a clear picture of whether you’re on track. If you’re falling behind, you can adjust your strategy accordingly – perhaps by cutting back on non-essential expenses or finding additional income streams. This visual representation turns abstract numbers into a tangible, easily understandable picture of your progress.

Regular Review and Adjustment of Financial Plans

Life throws curveballs. Job loss, unexpected medical expenses, a sudden urge to buy a llama – these can all impact your financial plans. Regularly reviewing your financial plan (at least annually, but ideally quarterly) is vital. This isn’t just about checking your progress; it’s about adapting to changing circumstances. Maybe your income has increased, allowing you to accelerate your savings goals. Or perhaps you need to adjust your spending habits to account for unforeseen expenses. Flexibility is key – your financial plan should be a living document, not a rigid, unchanging rulebook.

Examples of Long-Term and Short-Term Financial Goals

Long-term goals typically have a timeline of five years or more. Examples include: buying a house (timeline: 3-5 years), funding your child’s education (timeline: 10-18 years), or retiring comfortably (timeline: 20-30 years). Short-term goals usually have a timeline of less than a year. Examples include: paying off credit card debt (timeline: 6-12 months), saving for a vacation (timeline: 3-6 months), or purchasing a new appliance (timeline: 1-3 months). Each goal needs its own SMART breakdown to ensure effective tracking and achievement. Remember, consistency and regular review are your secret weapons.

Final Summary: Keuangan Pribadi

So, there you have it: a whirlwind tour through the exciting world of Keuangan Pribadi. From crafting a budget that actually works to investing wisely and planning for a financially secure future, we’ve covered the essentials (and maybe even a few things you didn’t know you needed to know). Remember, managing your finances doesn’t have to be a chore; it can be an empowering journey towards a richer, more fulfilling life. Now go forth and conquer your financial destiny – responsibly, of course!

Essential FAQs

What’s the best way to track my expenses without losing my mind?

Experiment! Spreadsheet software, budgeting apps, or even a good old-fashioned notebook can work. The key is finding a method that suits your personality and tech skills.

How can I get started investing with a small amount of money?

Many investment platforms in Indonesia offer low minimum investment amounts. Start small, diversify, and learn as you go. Remember, even small steps contribute to long-term growth.

What if I’m drowning in debt? Where can I find help?

Seek professional help! Many financial counseling services in Indonesia offer guidance and support for debt management. Don’t be afraid to ask for assistance.