Keuangan Pribadi: Let’s face it, personal finance isn’t exactly a laugh riot – unless you’re watching your savings account magically multiply. But fear not, dear reader! This isn’t your grandpa’s dusty finance textbook. We’re diving headfirst into the wild world of budgeting, debt, investing, and saving, armed with wit, wisdom, and maybe a spreadsheet or two. Prepare for a financial adventure that’s as exciting as it is informative (and possibly slightly less stressful than a tax audit).

We’ll unravel the mysteries of income and expense tracking, conquer the debt beast using strategies that are both effective and surprisingly entertaining, and explore the thrilling realm of investing without needing a finance degree. We’ll even help you build that elusive emergency fund, because let’s be honest, unexpected plumbing bills are rarely funny. Get ready to take control of your financial future, one chuckle at a time.

Understanding Personal Finance (Keuangan Pribadi) Basics

Embarking on the thrilling journey of personal finance might seem daunting, like scaling Mount Everest in flip-flops. But fear not, intrepid adventurer! With a little know-how and a healthy dose of humor, conquering your financial landscape is entirely achievable. This section will equip you with the fundamental tools to navigate the sometimes-treacherous, often-rewarding world of managing your money.

Core Principles of Effective Personal Financial Management

Effective personal finance hinges on a few key principles, each as crucial as the next. Think of them as the pillars supporting your financial temple – wobbly pillars lead to a wobbly temple, and nobody wants a wobbly financial temple. These principles, when diligently applied, create a solid foundation for financial well-being. We’ll explore these principles, demystifying the jargon and revealing their practical applications.

Income and Expense Tracking Methods

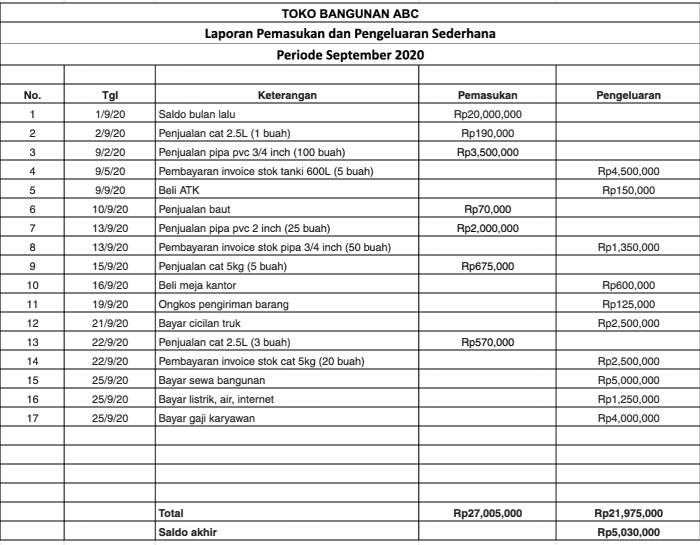

Tracking your income and expenses is akin to being a financial detective – you’re gathering clues to solve the mystery of where your money goes. Ignoring this crucial step is like trying to navigate a city without a map; you’ll likely end up lost and frustrated. Several methods exist, each with its own strengths and weaknesses. Let’s examine some popular choices, highlighting their advantages and disadvantages to help you find the perfect fit for your lifestyle. For example, using a simple spreadsheet offers a clear visual representation of your financial inflows and outflows, while budgeting apps offer automation and insightful reports.

Budgeting and Creating a Realistic Financial Plan

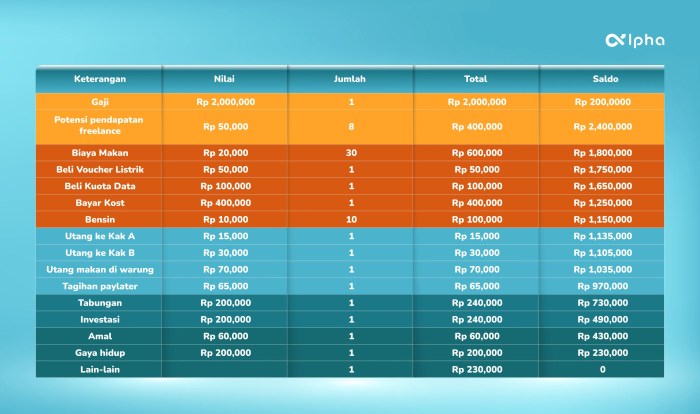

Budgeting isn’t about deprivation; it’s about mindful spending. It’s like creating a delicious recipe for your financial future – you carefully choose the ingredients (income), portion them out (allocate funds), and savor the result (financial security). A realistic budget considers your income, expenses, and financial goals. Creating a plan, however, involves more than just jotting down numbers. It’s about prioritizing your needs and wants, setting SMART goals (Specific, Measurable, Achievable, Relevant, Time-bound), and regularly reviewing and adjusting your plan to reflect life’s inevitable changes. Think of it as a living document, constantly evolving with you.

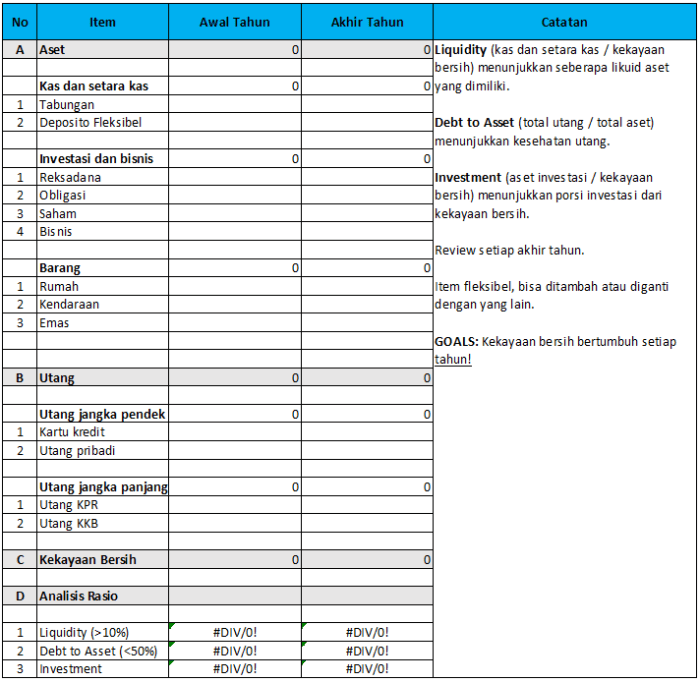

Sample Budget Template

Here’s a sample budget template to get you started. Remember, this is just a starting point; tailor it to your specific needs and preferences. A well-structured budget helps visualize your financial health. It’s like a financial dashboard, giving you a quick overview of your current situation.

| Income | Expenses | Savings | Notes |

|---|---|---|---|

| Salary: $3000 | Rent: $1000 | Emergency Fund: $200 | Rent is high this month! |

| Freelance work: $500 | Groceries: $300 | Investment: $100 | Need to reduce grocery spending. |

| Interest: $20 | Transportation: $200 | Vacation Fund: $100 | Gas prices are killing me! |

| Total Income: $3520 | Total Expenses: $1500 | Total Savings: $400 | Still have $1620 left! |

Debt Management Strategies

Ah, debt. That delightful little financial gremlin that whispers sweet nothings about instant gratification while simultaneously plotting your long-term financial demise. But fear not, intrepid personal finance adventurer! We’re here to equip you with the weaponry to slay this beast and reclaim your financial freedom. This section explores effective strategies for conquering your debts, transforming them from monstrous burdens into manageable milestones.

Tackling debt effectively involves understanding and applying various strategies. Two popular methods, the debt snowball and debt avalanche, offer different approaches to prioritizing repayments. Choosing the right method depends on your personality and financial situation; sometimes, a little psychological boost is more effective than pure mathematical efficiency.

Debt Snowball Method

The debt snowball method focuses on paying off the smallest debts first, regardless of interest rates. This approach prioritizes quick wins to build momentum and motivation. Imagine it as a snowball rolling down a hill – it starts small, but gains considerable size and power as it gathers more snow (debt payments).

The psychological benefits of the debt snowball are significant. Seeing small debts disappear quickly provides a powerful sense of accomplishment, fueling the motivation to tackle larger debts. This method is particularly effective for individuals who need that initial burst of encouragement to stay on track.

Debt Avalanche Method

In contrast, the debt avalanche method targets the debts with the highest interest rates first. This mathematically efficient approach minimizes the total interest paid over time, leading to greater long-term savings. Think of it as a strategic military campaign – focusing fire on the most significant threats first.

While the debt avalanche might seem the most logical choice from a purely financial perspective, it can be less motivating in the short term. Facing down a large, high-interest debt initially can be daunting. However, the long-term financial rewards are substantial, resulting in significant savings on interest payments.

Comparison of Debt Snowball and Debt Avalanche Methods

| Feature | Debt Snowball | Debt Avalanche |

|---|---|---|

| Debt Prioritization | Smallest debt first | Highest interest rate first |

| Motivation | High, due to quick wins | Can be lower initially |

| Long-term Savings | Lower | Higher |

| Best for | Individuals needing motivational boosts | Individuals prioritizing long-term financial gains |

Creating a Debt Repayment Plan

Crafting a comprehensive debt repayment plan is crucial. This involves meticulously listing all debts, including the principal amount, interest rate, minimum payment, and due date. Accurate interest calculations are essential to understand the true cost of your debt and project repayment timelines.

For example, consider a credit card debt of $1,000 with a 15% annual interest rate. If you make only the minimum payment, the interest will significantly prolong the repayment period and increase the total amount paid. A detailed repayment plan, however, allows you to project how much faster you can pay off the debt and how much you’ll save in interest by increasing your monthly payments. This can be done using various online calculators or spreadsheets.

The formula for simple interest is: Interest = Principal x Rate x Time. For compound interest, the calculation is more complex, but readily available through online calculators.

Negotiating with Creditors

Negotiating with creditors to reduce your debt can significantly ease your financial burden. This often involves demonstrating a commitment to repayment and proposing a modified payment plan. Documenting your financial situation and highlighting any extenuating circumstances can strengthen your negotiating position.

A step-by-step guide to negotiating with creditors could include: 1) Contacting creditors and explaining your situation; 2) Proposing a lower monthly payment or a debt settlement; 3) Negotiating a lower interest rate; 4) Documenting all agreements in writing. Remember, politeness and persistence are key. While not all creditors will agree to renegotiate, many are willing to work with responsible borrowers who demonstrate a genuine effort to resolve their debt.

Investing for Beginners

So, you’ve conquered the debt dragon and are ready to build your financial empire? Fantastic! Investing can seem daunting, like navigating a jungle filled with aggressive chimps flinging bananas (representing fluctuating markets), but with a little knowledge and a healthy dose of humor, you’ll be swinging through the financial canopy in no time. This section will demystify the world of investing, making it accessible and even… dare we say… enjoyable.

Investment Options for Varying Risk Tolerances

Choosing the right investments depends entirely on your risk appetite. Are you a thrill-seeker, ready to ride the rollercoaster of high-risk, high-reward ventures? Or are you more of a cautious tortoise, preferring steady, if slower, growth? Understanding your risk tolerance is the cornerstone of successful investing. High-risk investments, like individual stocks, offer the potential for significant gains but also carry the risk of substantial losses. Low-risk investments, such as government bonds, offer stability but typically lower returns. Finding the sweet spot between risk and reward is key.

The Importance of Diversification

Diversification is your financial safety net. Think of it as not putting all your eggs in one basket. By spreading your investments across different asset classes (stocks, bonds, real estate, etc.), you reduce your overall risk. If one investment performs poorly, others might offset the losses. It’s like having multiple sources of income – if one job dries up, you still have others to fall back on. Diversification isn’t about eliminating risk entirely; it’s about managing it intelligently.

Comparison of Investment Vehicles

Let’s examine some popular investment vehicles:

| Investment Type | Potential Return | Risk Level | Recommended Allocation |

|---|---|---|---|

| Stocks (Equities) | High (potentially 7-10% annually, but can vary wildly) | High | Varies depending on age and risk tolerance; younger investors can typically handle a higher allocation. |

| Bonds (Fixed Income) | Moderate (typically 2-5% annually, but depends on interest rates) | Low to Moderate | Provides stability and often used as a counterbalance to higher-risk investments. |

| Mutual Funds | Moderate to High (depending on the fund’s investment strategy) | Moderate | Offers diversification within a single investment. Choose funds aligned with your risk tolerance and investment goals. |

| Real Estate | Variable (can be high but requires significant capital and management) | Moderate to High | A tangible asset that can provide both income and appreciation, but requires research and due diligence. |

Savings and Emergency Funds

Let’s face it, money doesn’t grow on trees (unless you’re incredibly lucky and own a very unusual orchard). Building a robust savings and emergency fund is crucial for navigating life’s inevitable curveballs – and avoiding the financial equivalent of a spectacular faceplant. Think of it as your financial safety net, a cozy cushion against the unexpected.

Building an emergency fund is like creating a personal superhero cape. It protects you from financial villains like job loss, medical emergencies, or that surprise trip to the auto mechanic (who always seems to find more wrong than right). The generally recommended size is three to six months’ worth of living expenses. This acts as a buffer, allowing you to weather financial storms without resorting to drastic measures like maxing out credit cards or taking on high-interest debt. Imagine the peace of mind! No more frantic calls to relatives or desperate pleas to the bank manager.

Emergency Fund Size and Calculation

Determining the appropriate size of your emergency fund requires a realistic assessment of your monthly expenses. This includes rent or mortgage payments, utilities, groceries, transportation, and any other recurring costs. Once you’ve tallied these, multiply the total by three, four, five, or six – depending on your risk tolerance and job security. For example, if your monthly expenses are $2,000, a three-month emergency fund would require saving $6,000. A six-month fund would be $12,000. The higher the number, the greater the protection.

Savings Strategies

Saving money consistently can feel like a marathon, not a sprint. Fortunately, there are strategies to make the journey smoother and more enjoyable.

One highly effective approach is to automate your savings. Many banks and financial institutions offer automated transfer services, allowing you to automatically transfer a predetermined amount from your checking account to your savings account each month. This eliminates the need for manual transfers and ensures consistent saving, even when you’re busy or forgetful. Think of it as a painless, automated self-improvement plan.

Another powerful tool is a high-yield savings account. These accounts offer higher interest rates than traditional savings accounts, allowing your money to grow faster. While the difference might seem small initially, it compounds over time, significantly boosting your savings over the long run. It’s like getting a little extra financial pat on the back.

Financial Goal Setting and Savings Plans

Setting both short-term and long-term financial goals is akin to charting a course on a treasure map. Short-term goals might include saving for a vacation, a new appliance, or paying off a small debt. Long-term goals could be buying a house, funding your children’s education, or securing a comfortable retirement.

Linking these goals to your savings plan provides a clear focus and motivation. For example, if your short-term goal is a $1,000 vacation, you can create a savings plan with monthly contributions aimed at reaching that target within a specific timeframe. Visualizing the end result and knowing how your savings contribute to achieving it provides a powerful incentive to stay on track.

Savings Goal Time Calculation

Calculating the time it takes to reach a savings goal is straightforward. The formula is:

Time = Target Amount / (Monthly Savings Rate)

For instance, if your target amount is $10,000 and you save $500 per month, the calculation is:

Time = $10,000 / $500 = 20 months

This simple calculation empowers you to plan effectively and adjust your savings rate if necessary to achieve your goals within your desired timeframe. Remember, consistency is key!

Protecting Your Financial Future

Let’s face it, nobody wants to end up living under a bridge, fueled solely by regret and slightly stale crackers. Protecting your financial future isn’t just about amassing wealth; it’s about building a sturdy safety net to catch you if life throws a particularly nasty curveball (or, you know, a whole bowling alley’s worth of curveballs). This involves strategically safeguarding your assets and planning for potential pitfalls, ensuring a comfortable and secure future, regardless of what unforeseen circumstances might arise.

The Importance of Insurance: Your Financial Shield, Keuangan Pribadi

Insurance acts as a crucial safety net, protecting you from potentially devastating financial losses. Think of it as a preemptive strike against unforeseen events. Health insurance safeguards against exorbitant medical bills, preventing a single illness from bankrupting you. Life insurance provides financial security for your loved ones in the event of your untimely demise, ensuring their future needs are met. Property insurance shields your home and possessions from damage caused by fire, theft, or natural disasters, preventing you from having to rebuild your life from scratch. Choosing the right insurance coverage is paramount; consider your individual needs and risk tolerance when selecting policies. A comprehensive insurance strategy can provide peace of mind knowing that you’re protected against various financial setbacks.

Estate Planning: Leaving a Legacy (and Avoiding Family Feuds)

Having a will and engaging in comprehensive estate planning is not just for the ultra-wealthy; it’s a responsible step for everyone. A will dictates how your assets will be distributed after your passing, preventing potential family disputes and ensuring your wishes are respected. Estate planning also encompasses other important considerations, such as establishing trusts, designating power of attorney, and planning for long-term care. Failing to plan is, frankly, planning to fail. Proper estate planning ensures a smooth transition of your assets, minimizing stress and conflict for your loved ones during an already difficult time. Consider consulting with a legal professional to create a personalized estate plan tailored to your specific circumstances.

Identifying and Mitigating Financial Risks

Life is unpredictable, and financial risks are ever-present. Unexpected job loss, medical emergencies, and market downturns are just a few examples of potential financial setbacks. Diversifying your investments is a crucial strategy to mitigate risk. Don’t put all your eggs in one basket! Building an emergency fund – ideally three to six months’ worth of living expenses – provides a financial cushion to weather unexpected storms. Continuously monitoring your credit score and managing debt effectively are also vital steps in protecting your financial health. Proactive risk management can significantly reduce your vulnerability to financial hardship. Regularly reviewing your financial plan and adjusting it as needed ensures you stay ahead of potential problems.

Securing Personal Financial Information: A Checklist for Cyber Safety

In today’s digital age, protecting your personal financial information is paramount. A data breach can have devastating consequences, leading to identity theft and financial fraud. The following checklist Artikels essential steps for safeguarding your information:

- Use strong, unique passwords for all online accounts, and consider a password manager to help you keep track.

- Regularly monitor your bank and credit card statements for any unauthorized activity.

- Be cautious of phishing scams and avoid clicking on suspicious links or opening emails from unknown senders.

- Shred sensitive documents before discarding them to prevent identity theft.

- Install reputable antivirus and anti-malware software on all your devices.

- Consider using credit monitoring services to detect any signs of fraudulent activity.

- Be mindful of where you use your debit and credit cards, avoiding potentially compromised terminals.

Taking these precautions can significantly reduce your risk of becoming a victim of financial fraud. Remember, prevention is always better than cure (and far less stressful).

Retirement Planning

Planning for retirement might sound like a distant, dusty attic filled with moth-eaten sweaters and forgotten dreams, but trust us, it’s way more exciting than that! Think of it as building a magnificent retirement castle, brick by brick, ensuring you have a comfortable and fulfilling life after your working years. Ignoring retirement planning is like trying to build a castle with only toothpicks – it’s not going to stand the test of time (or the next hurricane).

Retirement planning involves choosing the right tools to save and invest your money for the future. Understanding these tools is key to building that robust retirement castle.

Retirement Savings Vehicles

Several options exist to help you save for retirement, each with its own set of advantages and disadvantages. Choosing the right vehicle depends on your individual circumstances, risk tolerance, and financial goals. Let’s explore some of the most common choices.

A 401(k) is a retirement savings plan sponsored by your employer. Contributions are often tax-deferred, meaning you don’t pay taxes on the money until you withdraw it in retirement. Many employers offer matching contributions, essentially giving you free money! Think of it as getting a bonus just for saving for your future. IRAs, or Individual Retirement Accounts, are another popular choice. There are two main types: Traditional IRAs and Roth IRAs. Traditional IRAs offer tax-deductible contributions, while Roth IRAs offer tax-free withdrawals in retirement. The choice between them depends on your current and expected future tax brackets. Finally, pensions, though less common nowadays, are essentially guaranteed income streams provided by your employer after retirement. They are like a steady, reliable river flowing into your retirement lake, providing a consistent source of funds.

Factors Influencing Retirement Savings Needs

Several factors influence how much you need to save for retirement. These factors work together like a complex orchestra, each instrument contributing to the overall sound. Ignoring one will result in a less harmonious retirement.

Your desired lifestyle in retirement plays a significant role. Do you dream of lounging on a beach in Bali or tending a vegetable garden in the countryside? The cost of living in your chosen location will greatly influence your savings needs. Your expected lifespan is another crucial factor. The longer you expect to live in retirement, the more you’ll need to save. Inflation is a silent thief, steadily eroding the purchasing power of your savings over time. Planning for inflation is essential to ensure your retirement nest egg remains substantial. Unexpected events, like medical emergencies or family crises, can significantly impact your retirement funds. Having an emergency fund separate from your retirement savings is highly recommended. Finally, your current age and remaining working years will dictate how much time you have to save and grow your nest egg. Starting early is always advantageous, offering the power of compounding interest to work its magic.

Maximizing Retirement Savings and Minimizing Taxes

The goal is to build a substantial retirement nest egg while keeping more of your hard-earned money. This involves smart strategies that maximize savings and minimize the tax bite.

Contributing the maximum amount allowed to your retirement accounts is a crucial step. Take advantage of employer matching contributions in 401(k) plans, effectively getting free money. Diversifying your investments can help mitigate risk and maximize returns. Don’t put all your eggs in one basket! Consider tax-advantaged accounts like Roth IRAs or 401(k)s to reduce your tax burden. Regularly review and adjust your investment strategy to ensure it aligns with your goals and risk tolerance. Consider working with a financial advisor to create a personalized plan tailored to your specific needs. Finally, keeping track of your contributions and withdrawals can help you avoid costly mistakes and ensure you stay on track.

Illustrative Representation of Retirement Account Growth

Imagine two graphs. Both start at a humble zero, representing your initial savings. Graph A, representing a lower contribution level, shows a gentle, steady incline over time. The line slowly rises, like a determined but somewhat leisurely hiker. Graph B, representing a higher contribution level, shows a much steeper, more impressive ascent. The line climbs rapidly, like a seasoned mountaineer scaling a challenging peak. Both lines eventually reach a significant height, representing a comfortable retirement, but Graph B reaches its peak much sooner and significantly higher, showcasing the power of consistent, higher contributions over time. The difference between the two graphs illustrates how even small increases in contributions can dramatically impact your retirement savings. Think of it as a race – both runners reach the finish line, but the one who consistently puts in more effort arrives sooner and in better shape.

Final Wrap-Up: Keuangan Pribadi

So there you have it – a whirlwind tour of your financial life, complete with budgeting tips that don’t involve sacrificing your social life, debt-busting strategies that don’t require selling a kidney, and investment options that don’t require a PhD in economics. Remember, managing your Keuangan Pribadi is a marathon, not a sprint, so celebrate the small victories (like paying off that credit card bill!), and don’t be afraid to ask for help when you need it. Now go forth and conquer your finances…or at least, make a dent in them. You got this!

User Queries

What’s the difference between a 401(k) and an IRA?

A 401(k) is employer-sponsored, often with matching contributions, while an IRA is individually managed and offers tax advantages depending on the type (Traditional or Roth).

How much should I contribute to my emergency fund?

Aim for 3-6 months’ worth of living expenses. More is always better, but start somewhere and build it gradually.

What’s the best way to track my expenses?

Use budgeting apps, spreadsheets, or even a good old-fashioned notebook. Find a method that works for you and stick with it!

Can I negotiate lower interest rates on my debt?

Absolutely! Contact your creditors and explain your situation. They might be willing to work with you.