Know-Your-Customer Requirements Indonesia: Navigating the labyrinthine world of Indonesian KYC regulations can feel like a thrilling treasure hunt (with potentially hefty fines as the booby prize). This guide unravels the mysteries, offering a humorous yet informative journey through the legal landscape, data requirements, due diligence procedures, technological solutions, and the ever-present shadow of AML compliance. Buckle up, it’s going to be a wild ride!

From understanding the specific data points needed for Indonesian citizens versus foreign residents (because, let’s face it, paperwork is always more fun with a dash of international intrigue) to mastering the art of customer due diligence (CDD) – we’ll equip you with the knowledge to confidently navigate the Indonesian regulatory jungle. We’ll even delve into the exciting world of technological solutions, because who doesn’t love a good fintech fix? Prepare to become a KYC ninja!

Indonesian Regulatory Landscape for Know Your Customer (KYC)

Navigating the Indonesian KYC jungle can feel like trying to find a perfectly ripe durian – a delicious reward, but with a potentially pungent process. This guide will help you avoid the prickly bits and get to the sweet KYC compliance. We’ll delve into the regulations, penalties, and international comparisons, all while keeping things (relatively) lighthearted.

Key Regulations and Laws Governing KYC in Indonesia

Indonesia’s KYC framework is a patchwork quilt of regulations, stitched together by various authorities to combat money laundering, terrorist financing, and other financial crimes. The main threads are woven from laws like Law Number 8 of 2010 on the Prevention and Eradication of the Crime of Money Laundering, and regulations issued by Bank Indonesia (BI) and the Financial Services Authority (OJK). These regulations mandate customer due diligence, record-keeping, and suspicious transaction reporting. Specific requirements vary depending on the type of financial institution and the risk profile of the customer. For example, a high-net-worth individual might face more stringent scrutiny than a small-time saver. Think of it as a tiered system of KYC – the higher the risk, the more rigorous the checks.

Penalties for Non-Compliance with KYC Regulations in Indonesia

Failing to meet Indonesian KYC standards isn’t just a paperwork headache; it can lead to some seriously spicy penalties. These range from hefty fines and sanctions to license suspension or revocation, potentially crippling a business. Criminal charges are also possible in severe cases of willful negligence or deliberate evasion. The Indonesian authorities are increasingly cracking down on KYC non-compliance, so it’s crucial to stay on the right side of the law. Ignoring the rules is like ignoring a volcano about to erupt – the consequences can be catastrophic.

Comparison of Indonesian KYC Requirements with Other Southeast Asian Nations

Indonesia’s KYC regime, while robust, isn’t operating in a vacuum. Comparing it to other Southeast Asian nations reveals both similarities and differences. Many countries in the region, such as Singapore and Malaysia, have similarly stringent KYC requirements driven by international standards like the Financial Action Task Force (FATF) recommendations. However, the specific implementation and enforcement mechanisms can vary. For instance, the level of technology adoption in KYC processes might differ, or the penalties for non-compliance might be more or less severe. Think of it as a regional KYC competition – everyone’s striving for excellence, but with their own unique strategies.

Key Regulatory Bodies and Their Roles in Enforcing KYC Compliance

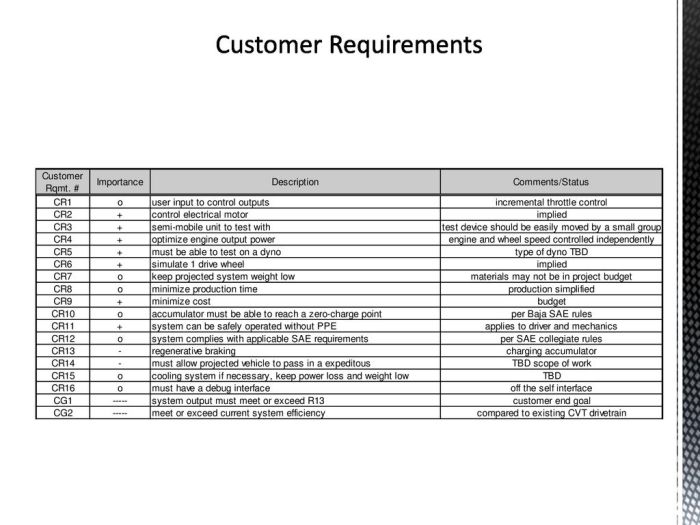

Understanding who’s calling the shots is crucial for successful KYC compliance. Here’s a table summarizing the key players:

| Body Name | Responsibilities | Contact Information | Relevant Legislation |

|---|---|---|---|

| Bank Indonesia (BI) | Oversees KYC compliance for banks and other financial institutions. | [Insert BI contact information here] | Law Number 8 of 2010, BI regulations |

| Financial Services Authority (OJK) | Regulates and supervises non-bank financial institutions, including insurance companies and securities firms, regarding KYC. | [Insert OJK contact information here] | OJK regulations, Law Number 8 of 2010 |

| Ministry of Finance (MOF) | Plays a significant role in policy-making and coordination related to anti-money laundering and combating the financing of terrorism (AML/CFT). | [Insert MOF contact information here] | Law Number 8 of 2010, relevant ministerial regulations |

| Police and Attorney General’s Office | Investigate and prosecute violations of AML/CFT laws, including KYC-related offenses. | [Insert relevant contact information here] | Criminal Code, Law Number 8 of 2010 |

KYC Data Requirements in Indonesia

Navigating the Indonesian KYC landscape can feel like trying to assemble a thousand-piece puzzle blindfolded – challenging, but ultimately rewarding (we promise!). Understanding the specific data requirements is key to avoiding regulatory hiccups and ensuring a smooth operation. This section delves into the nitty-gritty of what data you need to collect, depending on who you’re dealing with and what business you’re in.

The minimum KYC data requirements in Indonesia vary slightly depending on the sector and the customer’s residency status. However, the overarching goal is to verify the identity of your customers to prevent fraud and comply with anti-money laundering (AML) regulations. Think of it as a robust digital handshake – it’s essential for building trust and ensuring everyone plays by the rules.

Minimum Data Points Across Sectors

While specific requirements can be nuanced, a common thread runs through most Indonesian KYC regulations across banking, fintech, and telecommunications. Generally, you’ll need a solid foundation of identifying information, coupled with address verification and potentially additional data points depending on the risk assessment of the transaction.

For example, a simple mobile phone registration might require less information than opening a bank account. This risk-based approach is crucial, balancing compliance with the user experience.

Data Requirements for Indonesian Citizens vs. Foreign Residents

Indonesian citizens generally require a national identity card (KTP) and potentially additional documents for verification. Foreign residents, on the other hand, will need their passport and a valid KITAS (Temporary Stay Permit) or KITAP (Permanent Stay Permit). The complexity increases with higher-risk transactions, mirroring the global trend in KYC.

Imagine the difference between buying a SIM card and applying for a mortgage – the level of scrutiny naturally changes.

Acceptable Identification Documents

The Indonesian government provides a clear framework for acceptable identification documents, ensuring consistency across various sectors. This streamlined approach helps businesses comply easily and prevents confusion.

- KTP (Kartu Tanda Penduduk): The Indonesian national identity card, essentially the equivalent of a driver’s license and national ID card combined. Think of it as the holy grail of Indonesian identification.

- Passport: A universally recognized travel document, vital for verifying the identity of foreign nationals.

- SIM (Surat Izin Mengemudi): An Indonesian driver’s license, which can sometimes be used as supplementary identification.

- KITAS/KITAP (Kartu Izin Tinggal Terbatas/Kartu Izin Tinggal Tetap): Temporary or permanent stay permits for foreign residents in Indonesia.

Data Security and Privacy Implications

The collection and storage of KYC data in Indonesia are governed by strict regulations, including the Personal Data Protection Law. This means businesses must implement robust security measures to protect sensitive customer information from unauthorized access, use, or disclosure. Failure to do so can result in hefty fines and reputational damage.

Think of it like guarding Fort Knox – the security measures need to be top-notch to protect the valuable data within. Regular security audits and employee training are essential to maintaining a secure environment.

KYC Customer Due Diligence Procedures in Indonesia: Know-Your-Customer Requirements Indonesia

Navigating the world of Know Your Customer (KYC) in Indonesia can feel like trying to assemble IKEA furniture without the instructions – challenging, but ultimately rewarding (if you don’t accidentally build a bookshelf that doubles as a hamster cage). This section delves into the specifics of Customer Due Diligence (CDD) procedures, offering a glimpse into the practicalities of complying with Indonesian regulations. Prepare for a journey filled with helpful hints and hopefully, minimal frustration.

Indonesian businesses employ a range of Customer Due Diligence (CDD) procedures, all aimed at verifying the identity of their clients and mitigating risks associated with money laundering, terrorist financing, and other financial crimes. The level of scrutiny often depends on the perceived risk associated with the customer and the transaction.

Typical Customer Due Diligence Procedures

The typical CDD process in Indonesia usually involves a multi-step approach, combining various identification and verification methods. Think of it as a detective novel, with each step revealing more clues about the customer’s identity and financial activities.

- Identity Verification: This involves collecting and verifying identification documents, such as national ID cards (KTP), passports, and driver’s licenses. Often, businesses utilize electronic verification systems to cross-check the authenticity of these documents against official databases.

- Address Verification: Confirming the customer’s residential address is crucial. This might involve checking utility bills, bank statements, or conducting physical site visits for high-risk customers. It’s less exciting than a James Bond chase, but equally important.

- Source of Funds/Wealth Verification: Understanding where the customer’s money comes from is a critical aspect of CDD. This often involves reviewing financial statements, bank references, and employment details. Think of it as a financial background check, but with more paperwork.

- Beneficial Ownership Determination: For legal entities, identifying the ultimate beneficial owners is vital. This requires tracing ownership through corporate structures to uncover the individuals who ultimately control the entity. It’s like peeling back the layers of an onion, but hopefully without the tears.

- Ongoing Monitoring: CDD isn’t a one-time event. Businesses are expected to monitor their customers’ activities on an ongoing basis, looking for any suspicious transactions or changes in circumstances. This is the less glamorous, but equally important, surveillance part of the operation.

Best Practices for Effective CDD, Know-Your-Customer Requirements Indonesia

Effective CDD isn’t just about ticking boxes; it’s about building a robust and compliant system. Here are some best practices that can help Indonesian businesses navigate this complex landscape:

- Risk-Based Approach: Tailoring the CDD process to the level of risk associated with the customer is essential. High-risk customers require more rigorous scrutiny than low-risk ones. Think of it as a sliding scale of due diligence, with high-risk customers requiring a more thorough investigation.

- Technology Integration: Leveraging technology, such as electronic identity verification systems and transaction monitoring software, can significantly improve the efficiency and accuracy of the CDD process. It’s like having a super-powered magnifying glass for your investigative work.

- Employee Training: Ensuring that employees are properly trained on KYC/CDD procedures is critical. Regular training sessions and updates keep everyone on the same page and ensure consistent application of the procedures. Think of it as a continuous professional development program, but for compliance.

- Record Keeping: Maintaining accurate and complete records of all CDD activities is essential for demonstrating compliance with regulations. Think of it as keeping a meticulously detailed diary of your investigative adventures.

- Regular Audits: Conducting regular internal and external audits helps identify weaknesses in the CDD process and ensures ongoing compliance. Think of it as a regular check-up for your compliance system.

KYC/CDD Process Flowchart

Visualizing the KYC/CDD process through a flowchart helps ensure a clear and efficient workflow. Imagine it as a roadmap guiding you through the labyrinthine world of compliance.

The flowchart would start with Customer Application, progressing to Identity Verification, then Address Verification, followed by Source of Funds/Wealth Verification, and Beneficial Ownership Determination. After these steps, a Risk Assessment would be conducted, leading to either Onboarding or Rejection. Finally, the process would conclude with Ongoing Monitoring.

Simplified Due Diligence vs. Enhanced Due Diligence

In Indonesia, as elsewhere, different CDD approaches are used depending on the risk profile of the customer. Think of it as having two different toolkits for different jobs – one for simple tasks and one for more complex investigations.

Simplified Due Diligence (SDD) is appropriate for low-risk customers where the risk of money laundering or terrorist financing is minimal. It involves a streamlined CDD process with reduced documentation requirements. Enhanced Due Diligence (EDD), on the other hand, is applied to high-risk customers or transactions where there’s a greater potential for illicit activity. This involves a more thorough and comprehensive CDD process, often including additional verification steps and ongoing monitoring.

The choice between SDD and EDD depends on a careful risk assessment, considering factors such as the customer’s nature of business, geographical location, and transaction history. It’s a balancing act between efficiency and thoroughness, a delicate dance between speed and security.

Technological Solutions for KYC in Indonesia

The Indonesian archipelago, a vibrant tapestry of islands and cultures, presents unique challenges for Know Your Customer (KYC) compliance. The sheer geographical spread, coupled with a rapidly evolving digital landscape, necessitates innovative technological solutions to streamline processes and ensure compliance with increasingly stringent regulations. Let’s dive into the exciting world of tech-powered KYC in Indonesia!

Technology plays a crucial, and frankly, heroic role in simplifying KYC procedures in Indonesia. It tackles the complexities of verifying identities across diverse populations, managing vast amounts of data securely, and ensuring compliance with evolving regulations – all while trying to avoid turning the process into a bureaucratic nightmare (which, let’s be honest, is a challenge in itself!). The right tech can significantly reduce manual workload, minimize errors, and ultimately, improve the customer experience. Imagine a world where opening a bank account in Indonesia is as seamless as ordering a delicious nasi goreng online – that’s the power of technology we’re talking about.

Biometric Verification and Digital Identity Platforms

Biometric verification, utilizing fingerprints, facial recognition, or iris scans, offers a highly secure and efficient method for identity verification. These technologies significantly reduce the risk of fraud and identity theft, a critical concern in any KYC process. In Indonesia, the integration of biometric verification with digital identity platforms, such as those developed by the government or private sector, allows for seamless verification against national databases, making the process faster and more reliable. For instance, imagine a system where a simple selfie verifies your identity instantly, linking to your official national ID. No more endless paperwork!

Technological Solutions Comparison

Several technological solutions are employed for KYC compliance in Indonesia. Below is a comparison of three prominent examples. Note that the specific features and strengths/weaknesses can vary based on the provider and implementation.

| Solution Name | Provider | Key Features | Strengths/Weaknesses |

|---|---|---|---|

| Veri5 | Example Provider A | Biometric authentication (fingerprint, facial recognition), document verification (e-KTP), liveness detection, risk scoring | Strengths: High accuracy, fast processing, integrates with various systems. Weaknesses: Cost can be significant for smaller businesses, potential for bias in facial recognition algorithms. |

| IDnow | Example Provider B | Automated identity verification, video-based identification, document verification, compliance with various regulations (including Indonesian regulations) | Strengths: Wide range of features, global reach, strong regulatory compliance. Weaknesses: Complexity of implementation, potentially higher costs compared to simpler solutions. |

| Example Solution C | Example Provider C | KYC as a Service (KYCaaS) platform offering API integration, supports various verification methods (e.g., e-KTP, driver’s license), fraud detection capabilities | Strengths: Scalable and flexible, easy integration with existing systems, cost-effective for high-volume transactions. Weaknesses: Reliance on third-party data sources, potential security concerns related to data sharing. |

Challenges and Opportunities in Adopting Technology for KYC in Indonesia

The adoption of technology for KYC in Indonesia presents both exciting opportunities and significant challenges. Challenges include ensuring data privacy and security, addressing the digital divide (access to technology and internet connectivity varies across the country), and navigating the complex regulatory landscape. However, the opportunities are immense. Streamlined KYC processes can drive financial inclusion, improve the efficiency of various industries, and boost investor confidence in the Indonesian economy. The successful implementation of robust and reliable KYC technology can unlock significant economic growth and improve the lives of millions of Indonesians. It’s a win-win situation, if done right!

KYC and Anti-Money Laundering (AML) Compliance in Indonesia

Indonesia’s fight against financial crime is a thrilling rollercoaster ride, and KYC and AML compliance are its inseparable twins. Think of KYC as the diligent bouncer checking IDs at the club, ensuring only legitimate patrons enter. AML, on the other hand, is the sharp-eyed detective inside, watching for suspicious activity like someone trying to sneak in a suitcase full of cash (metaphorically speaking, of course!). Both are crucial for maintaining the integrity of Indonesia’s financial system and preventing the country from becoming a playground for shady characters.

KYC and AML regulations in Indonesia are deeply intertwined. Essentially, robust KYC procedures form the bedrock of effective AML compliance. By thoroughly identifying and verifying customers, businesses significantly reduce their risk of inadvertently facilitating money laundering or terrorist financing. Failing to do so can lead to hefty fines, reputational damage, and even criminal prosecution – definitely not a fun night out.

AML Regulations Relevant to KYC in Indonesia

Indonesia’s AML framework is primarily governed by Law Number 8 of 2010 concerning the Prevention and Eradication of the Crime of Money Laundering. This law mandates various reporting obligations for financial institutions and other designated non-financial businesses and professions (DNFBPs) to identify and report suspicious transactions. The implementing regulations provide detailed guidance on customer due diligence, record-keeping, and suspicious transaction reporting (STR) procedures. The Financial Transaction Reports and Analysis Centre (PPATK) plays a pivotal role in monitoring financial transactions and coordinating investigations. Compliance with these regulations isn’t just about ticking boxes; it’s about actively safeguarding Indonesia’s financial stability.

Integrating KYC and AML Compliance Measures

Integrating KYC and AML compliance effectively requires a multi-pronged approach. Firstly, businesses need to develop comprehensive KYC policies and procedures, tailored to their specific risk profile. This includes establishing clear guidelines for customer identification, verification, and ongoing monitoring. Secondly, implementing robust technology solutions is crucial. KYC/AML software can automate many aspects of the process, such as identity verification, transaction screening, and suspicious activity monitoring, making compliance more efficient and less prone to human error. Thirdly, training employees on KYC/AML procedures and regulations is vital. A well-trained staff is the first line of defense against money laundering attempts. Finally, regular audits and reviews of KYC/AML processes are essential to ensure ongoing compliance and identify areas for improvement. This isn’t a “set it and forget it” situation; continuous vigilance is key.

Red Flags Indicating Potential Money Laundering Activities in Indonesia

Businesses should be alert for various red flags that could signal potential money laundering activities. These can include, but are not limited to:

- Large cash deposits or withdrawals, especially those that are inconsistent with the customer’s known business or financial profile.

- Complex or unusual transaction patterns, such as multiple transactions involving small amounts of money that add up to a significant sum.

- Transactions involving shell companies or other entities with opaque ownership structures.

- Customers who are reluctant to provide identifying information or who provide inconsistent or inaccurate information.

- Transactions linked to known or suspected criminals or terrorist organizations.

- Sudden and significant increases in account activity, especially if not explained by legitimate business activities.

- Transactions involving high-risk jurisdictions known for money laundering or terrorist financing activities.

- Attempts to disguise the origin or destination of funds through layering or structuring transactions.

Identifying these red flags requires careful monitoring and analysis of customer transactions and behavior. Remember, it’s better to be safe than sorry, even if it means occasionally investigating a seemingly innocent transaction. It’s all part of keeping Indonesia’s financial system squeaky clean.

Ongoing Monitoring and Maintenance of KYC Data in Indonesia

Maintaining accurate and up-to-date KYC data isn’t just a box-ticking exercise; it’s the bedrock of a robust compliance program in Indonesia. Think of it as constantly polishing a very shiny, very important, and slightly intimidating Indonesian gemstone – you wouldn’t want it to get dull, would you? Failure to keep KYC information current can lead to hefty fines and reputational damage, so let’s dive into the nitty-gritty.

Ongoing monitoring and maintenance of KYC data in Indonesia involves regular reviews, updates, and verification procedures to ensure the accuracy and completeness of customer information. This is a continuous process, not a one-time event, requiring a dedicated system and staff resources. Think of it as a never-ending game of digital Whac-A-Mole, except instead of moles, it’s outdated information, and instead of a mallet, you have robust processes and technology.

KYC Data Update Procedures

When changes occur in a customer’s information, prompt updates are crucial. The procedures typically involve a customer notification process, followed by verification of the updated information through appropriate documentation. The specific steps may vary depending on the nature of the change and the institution’s internal policies, but generally, it involves the customer providing the updated information, the institution verifying the authenticity of this information, and then updating its internal records. This is far more exciting than it sounds, we promise.

Best Practices for Ensuring Data Accuracy and Completeness

Maintaining the accuracy and completeness of KYC data requires a multi-pronged approach. This includes implementing robust data validation checks during the initial KYC process and regularly reviewing and updating the data based on internal and external triggers. Data quality monitoring tools and regular audits can help identify and address any discrepancies or inconsistencies. Think of it as a rigorous, slightly obsessive-compulsive, but ultimately rewarding commitment to data hygiene.

Examples of Scenarios Requiring KYC Data Updates and Procedures Involved

The importance of keeping KYC information up-to-date cannot be overstated. Here are some scenarios that necessitate updates, along with the corresponding procedures:

Several scenarios necessitate KYC data updates. Failing to address these promptly can lead to significant compliance issues.

- Change of Address: Customers are required to notify the institution of any address changes. The institution verifies the new address through official documentation, such as a utility bill or government-issued ID. This involves a simple update to the customer’s profile.

- Change of Employment Status: A change in employment status (e.g., promotion, job loss) might trigger an update. The institution may request updated employment verification documents to confirm the change. This helps in assessing the customer’s risk profile.

- Marriage or Divorce: Changes in marital status often lead to changes in names and addresses. The institution needs to update the customer’s information to reflect this change, requiring updated documentation such as a marriage certificate or divorce decree. This ensures accurate identification.

- Significant Increase in Transaction Volume: A sudden and significant increase in transaction volume may warrant further investigation and potentially require updated information to understand the source of funds. This involves a review of the customer’s activity and potentially contacting the customer for clarification. This is where the “slightly intimidating Indonesian gemstone” aspect really comes into play.

Final Thoughts

So, there you have it – a whirlwind tour of Know-Your-Customer requirements in Indonesia. While the process might seem daunting at first, armed with the right information and a healthy dose of humor, you can conquer the complexities of Indonesian KYC compliance. Remember, staying compliant isn’t just about avoiding penalties; it’s about building trust, protecting your business, and ensuring a secure financial ecosystem. Now go forth and conquer (the paperwork)!

FAQ Insights

What happens if I don’t comply with KYC regulations in Indonesia?

Expect a range of penalties, from hefty fines to potential legal action. Think of it as a very expensive game of hide-and-seek with the authorities – and you’re definitely not going to win.

Are there simplified KYC procedures for low-risk customers?

Yes, simplified due diligence (SDD) exists for certain low-risk customers, but careful assessment is crucial to ensure you’re not accidentally inviting trouble. Always err on the side of caution.

How often should I update my KYC data?

Regular updates are essential, especially when customer information changes (new address, marriage, etc.). Think of it as a digital spring cleaning – keep your data fresh and avoid any unexpected surprises.

What are some common red flags for money laundering in Indonesia?

Unusual transaction patterns, large cash deposits, and clients with unclear sources of income are all potential red flags. Trust your gut – if something feels off, investigate further.