Labor Market Research Report: Delving into the fascinating world of employment trends, this report unravels the complexities of the job market, offering insights into everything from unemployment rates to industry-specific analyses. We’ll explore the methodologies behind these crucial studies, examining data sources, statistical techniques, and the art of presenting findings in a way that’s both informative and engaging. Prepare for a journey into the heart of economic forecasting and the ever-evolving landscape of work.

This report provides a comprehensive overview of labor market research, covering diverse methodologies, key indicators, and analytical techniques. We’ll examine various report types, from national overviews to niche industry specifics, detailing how data is collected, analyzed, and ultimately used to forecast future trends. The aim is to equip readers with a solid understanding of this critical field, enabling them to critically assess labor market data and its implications.

Defining the Scope of Labor Market Research Reports

The world of labor market research reports is a surprisingly vibrant and varied ecosystem, far from the dusty image some might conjure. These reports, like well-trained worker bees, diligently gather and analyze data to paint a picture of the employment landscape. Understanding the different types is key to finding the perfect report for your specific needs, whether you’re a CEO plotting world domination or a student crafting a killer thesis. Let’s dive in!

Labor market research reports come in many flavors, each with its own unique characteristics and purpose. Think of them as a delicious buffet of employment insights, offering everything from broad national overviews to hyper-specific analyses of niche industries. The key differences lie in the geographical scope, the industry focus, and the intended audience.

Types of Labor Market Research Reports

The types of reports available are as diverse as the jobs themselves. Some focus on the big picture, while others zoom in on specific sectors or regions. Each type employs different methodologies and data sources, resulting in a unique perspective on the employment landscape. Choosing the right report is crucial for making informed decisions.

Key Characteristics of Different Report Types

National reports provide a broad overview of the entire country’s labor market, offering insights into overall employment trends, unemployment rates, and wage growth. Regional reports, on the other hand, delve into specific geographic areas, such as states, cities, or even smaller regions, providing a more granular analysis of local labor dynamics. Industry-specific reports focus on particular sectors, examining employment trends, skills gaps, and future outlook within that industry. Finally, occupational reports provide detailed information about specific jobs, including their outlook, required skills, and typical wages.

Comparison of Labor Market Report Types

The following table summarizes the key differences between four common types of labor market reports. Remember, these are just examples; many variations exist.

| Report Type | Data Sources | Methodology | Typical Audience |

|---|---|---|---|

| National Labor Market Report | Government agencies (e.g., Bureau of Labor Statistics), surveys, macroeconomic data | Statistical analysis, econometric modeling, trend analysis | Government policymakers, economists, investors, researchers |

| Regional Labor Market Report (e.g., State-level) | State employment agencies, local surveys, regional economic data | Statistical analysis, regional economic modeling, comparative analysis | State government, regional businesses, local planners, researchers |

| Industry-Specific Labor Market Report (e.g., Technology Sector) | Industry associations, company data, specialized surveys, job postings | Industry analysis, skills gap analysis, competitive analysis | Companies in the industry, investors, recruiters, career counselors |

| Occupational Report (e.g., Data Scientists) | Job postings, salary surveys, educational requirements, professional organizations | Job analysis, skills assessment, career path analysis, salary benchmarking | Job seekers, career counselors, employers, educational institutions |

Data Sources and Collection Methods

Delving into the fascinating world of labor market research requires a detective’s eye for detail and a statistician’s love for numbers. This section, much like a well-crafted mystery novel, unravels the secrets behind gathering the crucial information needed to understand the ebb and flow of employment trends. We’ll explore the diverse sources of data, the methods used to collect it, and the artistry of sampling techniques. Buckle up, it’s going to be a wild ride!

Data collection in labor market research is a bit like assembling a magnificent jigsaw puzzle: each piece, whether a survey response or an administrative record, contributes to the bigger picture. The accuracy and reliability of the final image depend heavily on the quality and methodology of data acquisition. We’ll explore both primary and secondary data sources, illuminating the strengths and weaknesses of each approach.

Primary Data Sources and Collection Procedures

Primary data, the fresh-off-the-press information, is gathered directly from the source – the individuals or organizations being studied. This approach allows for targeted data collection, tailored to the specific research questions. However, primary data collection can be resource-intensive and time-consuming, a bit like panning for gold – you might find nuggets, but it takes effort.

- Surveys: These involve distributing questionnaires (online, paper, or phone) to a sample of the population. Careful questionnaire design is crucial to avoid confusing respondents and ensure accurate data. For example, a survey might be designed to measure job satisfaction among nurses, using a Likert scale to gauge responses on various aspects of their work. The data collected can then be statistically analyzed to identify trends and correlations.

- Interviews: These offer a more in-depth understanding than surveys, allowing for probing questions and follow-up clarifications. However, interviews are more time-consuming and costly. For example, in-depth interviews with unemployed individuals can provide rich qualitative data about their job search experiences and barriers to employment. This approach is particularly useful for understanding the nuances of individual experiences.

- Focus Groups: These involve guided discussions with small groups of individuals, providing insights into shared opinions and perspectives. Focus groups can be particularly effective in exploring complex issues and generating hypotheses for further research. For example, a focus group with recent college graduates could explore their job market expectations and challenges.

Secondary Data Sources

Secondary data, on the other hand, is pre-existing information collected by others. Think of it as finding the treasure map instead of digging for the treasure itself. While it’s often readily available and less expensive, the researcher must carefully evaluate its suitability for their specific research question.

- Government Statistics: These are a treasure trove of information, including employment rates, unemployment rates, wage data, and industry-specific statistics from sources like the Bureau of Labor Statistics (BLS) in the US or equivalent national statistical offices. These data sets provide a broad overview of the labor market and are often used as a baseline for further analysis.

- Administrative Records: Data from employers (payroll records, hiring data), educational institutions (graduation rates, skills certifications), and social security agencies (earnings history) offer rich insights into labor market dynamics. These records can provide longitudinal data, tracking individuals over time, and offer valuable insights into career trajectories and earnings patterns.

- Academic Databases and Research Papers: These offer a wealth of existing research and analysis that can inform the current study and provide context. However, it’s essential to critically evaluate the methodology and conclusions of previous research.

Sampling Techniques

Selecting the right sample is crucial to ensure the research findings are representative of the broader population. Choosing the wrong sampling method is like trying to understand the ocean by only looking at a single drop of water – you’ll miss the big picture.

- Probability Sampling: Every member of the population has a known chance of being selected. This includes methods like simple random sampling (each member has an equal chance), stratified sampling (dividing the population into subgroups and sampling from each), and cluster sampling (sampling groups of individuals).

- Non-probability Sampling: The probability of selection is unknown. This includes methods like convenience sampling (selecting readily available individuals), quota sampling (selecting individuals to meet pre-defined quotas), and snowball sampling (referrals from existing participants). While easier to implement, these methods may introduce bias.

Key Indicators and Metrics

Analyzing the labor market is a bit like trying to herd cats – chaotic, unpredictable, and occasionally hilarious. But unlike herding cats, we have tools to help us understand this seemingly unruly beast. These tools are key indicators and metrics, providing a structured way to interpret the swirling data and glean meaningful insights. Understanding these indicators is crucial for anyone seeking to comprehend the health and dynamism of the labor market.

Several key indicators provide a multifaceted view of the labor market’s performance. Each indicator offers a unique perspective, and using them in combination paints a far richer picture than any single metric could alone. Think of it as a detective solving a crime; one clue might be misleading, but multiple clues, viewed together, reveal the truth.

Unemployment Rate

The unemployment rate is perhaps the most widely known and discussed labor market indicator. It represents the percentage of the labor force that is actively seeking employment but unable to find it. The calculation is straightforward: (Number of unemployed individuals / Total labor force) x 100. A low unemployment rate generally suggests a healthy economy, while a high rate indicates potential economic weakness. However, it’s important to note that the unemployment rate can sometimes mask nuances, for example, it doesn’t account for discouraged workers who have given up searching for employment. A persistently high unemployment rate, however, is usually a significant cause for concern. For instance, the high unemployment rates during the Great Recession of 2008-2009 clearly signaled a major economic downturn.

Employment-to-Population Ratio

This indicator provides a broader perspective than the unemployment rate. It calculates the percentage of the working-age population that is employed. The formula is: (Number of employed individuals / Working-age population) x 100. Unlike the unemployment rate, this metric also accounts for individuals who are not actively seeking employment, such as stay-at-home parents or retirees. A declining employment-to-population ratio might suggest issues with labor force participation, potentially due to demographic shifts or economic discouragement. For example, a decrease in this ratio could indicate a shrinking workforce due to an aging population, or a lack of suitable job opportunities for certain demographics.

Labor Force Participation Rate

This metric measures the percentage of the working-age population that is either employed or actively seeking employment. It’s calculated as: (Total labor force / Working-age population) x 100. This indicator gives insights into the overall engagement of the working-age population in the labor market. A declining participation rate might reflect factors such as early retirement, increased educational pursuits, or discouragement from the job market. Conversely, a rising rate often indicates a more dynamic and expanding workforce. For instance, a rise in this rate could reflect an increase in women entering the workforce, or an improvement in economic prospects encouraging greater participation.

Relationships Between Key Indicators

| Indicator | Calculation | Interpretation | Relationship to Other Indicators |

|---|---|---|---|

| Unemployment Rate | (Unemployed / Labor Force) x 100 | Percentage of labor force seeking but unable to find work | Inversely related to Employment-to-Population Ratio and often correlated with Labor Force Participation Rate. |

| Employment-to-Population Ratio | (Employed / Working-age Population) x 100 | Percentage of working-age population employed | Directly related to the number of employed individuals; often inversely related to the Unemployment Rate. |

| Labor Force Participation Rate | (Labor Force / Working-age Population) x 100 | Percentage of working-age population in the labor force (employed or seeking employment) | Related to both Employment-to-Population Ratio and Unemployment Rate, providing context for changes in employment levels. |

Analyzing Labor Market Trends

Unraveling the mysteries of the labor market – it’s like solving a giant, ever-shifting puzzle made of spreadsheets and human behavior. Fortunately, we have more than just intuition to guide us; we have data, and with the right analytical tools, we can find patterns that reveal the future (or at least, a pretty good guess).

The identification of trends and patterns in labor market data relies heavily on a combination of statistical methods and a dash of detective work. We’re not just looking at numbers; we’re searching for stories hidden within those numbers – stories of economic growth, technological disruption, and, of course, the ever-elusive perfect job.

Statistical Techniques in Labor Market Analysis

Analyzing labor market data often involves more than simply calculating averages. Sophisticated statistical techniques are crucial for understanding the nuances of this complex system. These techniques help us move beyond simple observations to uncover underlying relationships and predict future outcomes.

For instance, time series analysis is invaluable for tracking changes in employment rates over time. This might involve identifying seasonal fluctuations (summer jobs, anyone?), long-term trends (the rise of the gig economy), or even the impact of specific policy changes. Imagine a line graph, rising and falling gently over the years, representing the unemployment rate. Steeper slopes indicate rapid changes, while flatter sections show periods of relative stability. Specific events, like a major recession, might be marked with a dramatic dip in the line.

Regression analysis allows us to explore the relationships between different variables. For example, we might use it to examine the correlation between education levels and earnings. A scatter plot would visually represent this relationship, with each dot representing an individual’s education level and income. A line of best fit would then be drawn through the data, indicating the overall trend. A strong positive correlation would be shown by the dots clustering closely around a line that slopes upward from left to right.

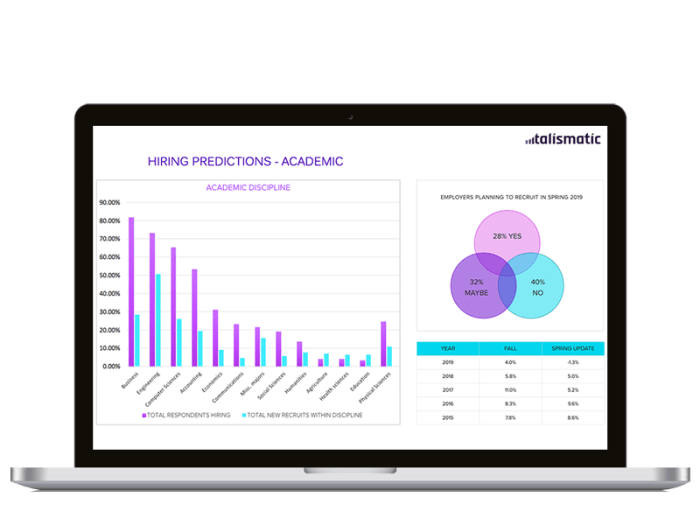

Another powerful technique is econometric modeling, which uses statistical methods to test economic theories and make forecasts. For example, we could build a model to predict the impact of an increase in the minimum wage on employment levels, taking into account factors like industry, region, and skill levels. This might involve using complex equations and software to simulate various scenarios and assess potential outcomes. The results could be presented in tables showing projected employment levels under different wage scenarios, or as a series of bar charts comparing different economic sectors.

Presenting Findings: Visualizing the Labor Market

Data, without visualization, is like a delicious cake hidden in a dark cupboard – no one can appreciate its beauty. Graphs and charts are essential tools for presenting labor market findings in a clear and concise manner.

A simple bar chart, for instance, could effectively compare unemployment rates across different states or regions. Each bar would represent a different geographical area, with the height of the bar corresponding to its unemployment rate. This immediately highlights areas of high or low unemployment.

Pie charts are useful for showing the proportion of the workforce employed in different sectors. Each slice of the pie would represent a sector (e.g., manufacturing, services, agriculture), with the size of the slice reflecting its share of total employment. This gives a quick visual representation of the relative importance of different sectors.

More complex charts, such as area charts, can be used to display multiple variables over time. For example, an area chart could show the changing proportions of employment in different age groups, with each age group represented by a different colored area under a line. The combined areas would always add up to 100%, representing the total workforce. This helps to highlight shifts in the age composition of the workforce over time.

Regional and Industry-Specific Analyses

Unraveling the mysteries of the labor market isn’t just about crunching numbers; it’s about understanding the unique quirks of different regions and industries. Think of it as a delicious economic tapestry, woven with threads of geographical location and professional specialization. This section delves into the fascinating differences in labor market trends across various geographic areas and industries, revealing the hidden forces that shape employment opportunities.

Geographic location and industry type significantly influence labor market conditions. While national trends provide a broad overview, a deeper dive into regional and industry-specific data paints a much more nuanced picture. Factors such as population density, industry concentration, technological advancements, and government policies all play a crucial role in shaping employment landscapes. By examining these localized trends, we can gain a more comprehensive understanding of the overall labor market dynamics and identify potential opportunities and challenges.

Regional Labor Market Variations

Analyzing regional variations reveals fascinating disparities. For example, a booming tech sector in Silicon Valley might experience a severe talent shortage, while a manufacturing hub in the Midwest grapples with automation-driven job losses. These contrasting situations highlight the importance of regional analysis in understanding the complex interplay of factors influencing employment. Consider the contrasting experiences of coastal cities, often characterized by high concentrations of tech and finance jobs, versus rural areas, where agricultural and manufacturing sectors may dominate. The resulting differences in wages, unemployment rates, and job growth are significant.

Industry-Specific Labor Market Characteristics

Each industry possesses its own unique set of characteristics that shape its labor market. The tech industry, for instance, often demands highly specialized skills and boasts high salaries, leading to intense competition for talent. In contrast, the hospitality sector might exhibit higher turnover rates and lower average wages. These differences necessitate tailored approaches to labor market analysis, ensuring that specific industry needs are addressed. Understanding the interplay between technological change, globalization, and regulatory frameworks within each sector is vital to comprehending its unique labor market dynamics.

Comparative Analysis of Labor Market Characteristics Across Industries

The following table illustrates the differences in labor market characteristics across three distinct industries: Technology, Healthcare, and Retail.

| Industry | Average Wage | Unemployment Rate | Projected Job Growth (Next 5 Years) |

|---|---|---|---|

| Technology | High (e.g., $100,000+) | Low (e.g., 2%) | High (e.g., 15%) |

| Healthcare | Moderate (e.g., $60,000-$90,000) | Low (e.g., 3%) | High (e.g., 12%) |

| Retail | Low (e.g., $30,000-$50,000) | Moderate (e.g., 5%) | Low (e.g., 2%) |

Note: These figures are illustrative examples and may vary depending on specific geographic location and job roles within each industry. Actual data would require more in-depth research using reliable sources such as the Bureau of Labor Statistics (BLS) or similar national statistical agencies. The projected job growth reflects general trends and may be subject to change due to economic fluctuations and other unforeseen factors.

Future Outlook and Projections: Labor Market Research Report

Predicting the future of the labor market is, shall we say, a bit like predicting the weather in Scotland – you might get it right, but don’t bet the farm on it. Nevertheless, we must attempt to peer into the crystal ball (or, more realistically, utilize sophisticated econometric models) to offer some informed speculation about future labor market trends. This section details our methodologies and limitations in this inherently uncertain endeavor.

Forecasting future labor market conditions involves a complex interplay of factors, requiring a multi-faceted approach. We employ a combination of quantitative and qualitative techniques, blending rigorous statistical analysis with expert judgment to arrive at our projections.

Methodology for Labor Market Forecasting

Our projections rely primarily on econometric modeling, utilizing historical labor market data and incorporating various macroeconomic indicators. These models, while sophisticated, are not magic 8-balls. They rely on assumptions about future economic growth, technological change, and demographic shifts – assumptions that, by their very nature, are subject to revision. We also incorporate qualitative assessments from industry experts and surveys of business leaders to gain a more nuanced understanding of potential future trends. For example, we might use a model that incorporates past trends in unemployment, GDP growth, and technological adoption rates to predict future unemployment rates. This model is then refined by incorporating insights from industry experts regarding anticipated technological disruptions and potential shifts in labor demand.

Factors Considered in Labor Market Projections

Several key factors are considered in our projections. Technological advancements, for instance, can automate tasks, displacing workers in some sectors while creating new opportunities in others. The rise of artificial intelligence and automation, for example, is projected to impact various industries, potentially leading to job displacement in manufacturing and data entry, but creating new roles in AI development and maintenance. Demographic shifts, such as aging populations and changing birth rates, also significantly impact the labor supply and demand. An aging population, for instance, might lead to a shrinking workforce in some countries, while an increasing youth population might lead to increased competition for jobs in others. Finally, economic growth is a crucial driver of labor market activity. Periods of strong economic growth generally lead to higher employment rates, while recessions can result in significant job losses. We carefully consider the projected pace of economic growth and its potential impact on various sectors. For example, a prediction of strong growth in the renewable energy sector might lead to a projection of increased employment in that sector.

Limitations of Labor Market Projections

It’s crucial to acknowledge the inherent limitations of any labor market forecast. These projections are not certainties; they are probabilities, subject to significant uncertainties and unforeseen events. Unforeseen shocks, such as global pandemics or geopolitical instability, can dramatically alter the trajectory of the labor market. Furthermore, the accuracy of our projections depends heavily on the accuracy of the underlying assumptions about future economic conditions, technological progress, and demographic trends. Finally, the complexity of the labor market, with its myriad of interacting factors, makes it challenging to capture all relevant influences in our models. Therefore, our projections should be interpreted as plausible scenarios, not definitive predictions. Consider them educated guesses, not divinely inspired pronouncements.

Presentation and Reporting of Findings

Presenting labor market research findings effectively is akin to performing open-heart surgery on a particularly stubborn data set – precision and flair are paramount. The goal isn’t just to convey information; it’s to captivate your audience and leave them begging for more (more data, that is). The right presentation can transform complex statistics into compelling narratives, ensuring your insights are not only understood but also remembered. The wrong one, however, can send your audience scrambling for the nearest exit – or at least, their smartphones.

Effective presentation hinges on understanding your audience. A presentation to a board of directors will differ wildly from one geared towards a group of entry-level job seekers. Tailoring your language, visuals, and level of detail is crucial for maximum impact. For example, a presentation for HR professionals might focus on talent acquisition strategies and workforce planning, while a presentation to policymakers might highlight broader economic trends and policy implications. Think of it as choosing the right tool for the job: you wouldn’t use a sledgehammer to crack a nut (unless you’re particularly fond of dramatic effect).

Methods for Presenting Labor Market Research Findings

Different audiences require different approaches. For executive summaries, brevity and impact are key. Use bullet points, concise sentences, and highlight only the most significant findings. A more detailed report for researchers, on the other hand, requires a thorough methodology section, comprehensive data tables, and in-depth analysis. Visual aids play a crucial role in both scenarios, transforming complex data into easily digestible information. Imagine trying to explain unemployment rates across various demographics using only text – it would be a textual wasteland!

Structuring a Labor Market Research Report for Maximum Clarity and Impact

A well-structured report follows a logical flow, guiding the reader through the research process from start to finish. A typical structure includes an executive summary (the TL;DR version), introduction, methodology, findings, analysis, conclusions, and recommendations. Each section should be clearly defined, with headings and subheadings that reflect the content. Think of it as a well-organized filing cabinet – everything has its place, and finding what you need is a breeze. A poorly structured report, conversely, is akin to rummaging through a chaotic attic – you’ll find what you’re looking for eventually, but it’ll take far longer than necessary, and you might find a few unexpected (and unwanted) surprises along the way.

Effective Use of Visual Aids, Labor market research report

Visual aids, such as charts and graphs, are essential for conveying complex data effectively. A well-designed bar chart, for instance, can clearly show the difference in unemployment rates between different age groups. A line graph can illustrate the trend of employment growth over time. Pie charts are ideal for showing proportions, such as the distribution of employment across different sectors. However, avoid overwhelming the audience with too many visuals. Each visual should have a clear purpose and should be easy to understand. For example, a bar chart comparing unemployment rates across regions should use clear labels, a consistent scale, and a legend that is easy to understand. A poorly designed chart, on the other hand, can be more confusing than helpful, leading to misinterpretations and a general sense of bewilderment. The goal is clarity, not artistic expression (unless your artistic expression involves exceptionally clear data visualization). Consider using contrasting colors for different data series and ensure the fonts are legible. Avoid using too many colors or patterns, as this can make the chart difficult to read. Imagine a chart with a rainbow of colors and patterns – it would be visually stunning, but probably impossible to interpret.

End of Discussion

In conclusion, understanding the labor market requires more than just crunching numbers; it demands a nuanced appreciation for the interplay of economic forces, technological advancements, and demographic shifts. This report has served as a guide through the intricacies of labor market research, revealing the power of data-driven insights in shaping economic policy and informing individual career choices. By mastering the tools and techniques presented here, readers can navigate the complexities of the job market with greater confidence and foresight. The future of work is dynamic, and understanding its trajectory is paramount – this report provides the essential roadmap.

Quick FAQs

What are the ethical considerations in labor market research?

Ethical considerations include ensuring data privacy, obtaining informed consent from participants, and avoiding biased sampling methods. Transparency in methodology and data interpretation is also crucial.

How can I use this research in my own business?

Understanding labor market trends allows businesses to make informed decisions about hiring, compensation, and workforce planning. It helps anticipate skill shortages, target recruitment efforts, and adapt to changing market demands.

What are some limitations of labor market projections?

Projections are inherently uncertain, as they rely on assumptions about future economic conditions, technological advancements, and policy changes. Unexpected events can significantly impact the accuracy of forecasts.