Successfully launching a product or service into a new market requires a well-defined strategy. This involves meticulous planning, thorough research, and a deep understanding of the target market’s unique characteristics. From identifying ideal customer profiles to navigating the complexities of international trade regulations, each step presents both opportunities and challenges. This guide explores the multifaceted nature of market entry, offering a framework for navigating this crucial business phase.

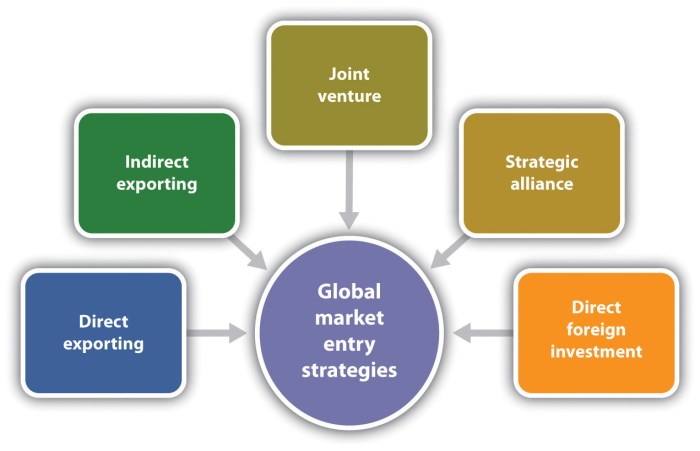

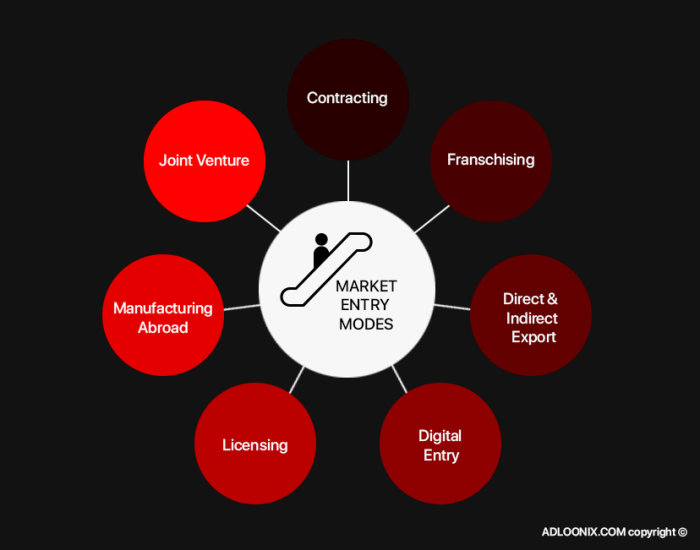

Understanding the various market entry modes – direct investment, joint ventures, franchising, and exporting – is paramount. Each approach carries its own set of advantages and disadvantages, requiring careful consideration based on the specific context and resources available. Furthermore, a robust financial model, encompassing revenue projections, expense management, and risk assessment, is essential for securing funding and ensuring long-term viability.

Defining Target Market

Successfully entering a new market hinges on accurately identifying and targeting the right customer base. A well-defined target market allows for efficient resource allocation, focused marketing efforts, and ultimately, higher chances of market penetration and profitability. This section details the process of defining our target market for this market entry strategy, focusing on key characteristics, market size, segment comparison, and the creation of a representative customer persona.

Ideal Customer Profile Characteristics

The ideal customer profile (ICP) for our market entry strategy centers around individuals demonstrating a high propensity for adopting innovative solutions within their respective industries. Key characteristics include a demonstrated need for efficiency improvements, a willingness to invest in technology to achieve these improvements, a digitally savvy approach to operations, and a positive attitude towards collaboration and data-driven decision-making. Furthermore, the ICP will likely be located in regions with robust digital infrastructure and a strong entrepreneurial ecosystem. These characteristics allow us to focus our marketing and sales efforts on those most likely to benefit from our product and actively seek such solutions.

Market Size and Growth Potential

The market for [Insert Product/Service Category] is experiencing significant growth, projected to reach [Insert Market Size Data with Source Citation, e.g., $XX billion by 2028, according to a report by Grand View Research]. This growth is fueled by [Explain Driving Factors, e.g., increasing demand for automation, rising adoption of cloud-based solutions, and the need for improved data analytics]. Focusing on the [Specific Niche within the Category] segment further refines our target market, providing a more concentrated area for initial market penetration with a projected annual growth rate of [Insert Growth Rate Data with Source Citation]. This concentrated approach minimizes initial market entry costs and maximizes the impact of our marketing efforts.

Comparative Analysis of Target Segments

We have identified three potential target segments within our chosen market: Segment A (e.g., Small and Medium-sized Enterprises (SMEs) in the manufacturing sector), Segment B (e.g., Large corporations in the logistics industry), and Segment C (e.g., Start-ups in the technology sector).

| Segment | Strengths | Weaknesses |

|---|---|---|

| Segment A (SMEs in Manufacturing) | High number of potential customers, relatively lower initial investment needed to acquire them, strong potential for word-of-mouth marketing. | Potentially lower budget for technology investments, longer sales cycles due to decision-making processes, greater resistance to adopting new technologies. |

| Segment B (Large Corporations in Logistics) | High budget for technology investments, potential for large-scale contracts, established procurement processes. | Longer sales cycles, complex decision-making processes involving multiple stakeholders, higher competition from established players. |

| Segment C (Start-ups in Technology) | Early adopters of new technologies, agile decision-making processes, potential for rapid growth and scalability. | Limited budgets, higher risk tolerance, potential for faster churn rates. |

Based on this analysis, Segment A presents a compelling balance of potential and accessibility for initial market entry. While Segment B offers significant potential rewards, the complexities involved suggest a phased approach. Segment C, although attractive due to early adoption, presents higher risk given the budget constraints and potential for higher churn.

Ideal Customer Persona

Our ideal customer persona, “Sarah,” is a 35-year-old Operations Manager at a mid-sized manufacturing company. Sarah is responsible for optimizing production processes and is constantly seeking ways to improve efficiency and reduce costs. She is digitally literate, actively uses data analytics tools, and is open to adopting new technologies that can streamline workflows. Sarah values solutions that are easy to implement, integrate seamlessly with existing systems, and provide a clear return on investment. She is also a member of several industry online communities and actively participates in relevant webinars and conferences. Understanding Sarah’s needs, challenges, and preferences allows us to tailor our marketing messaging and product development to resonate with her and her peers.

Market Research & Analysis

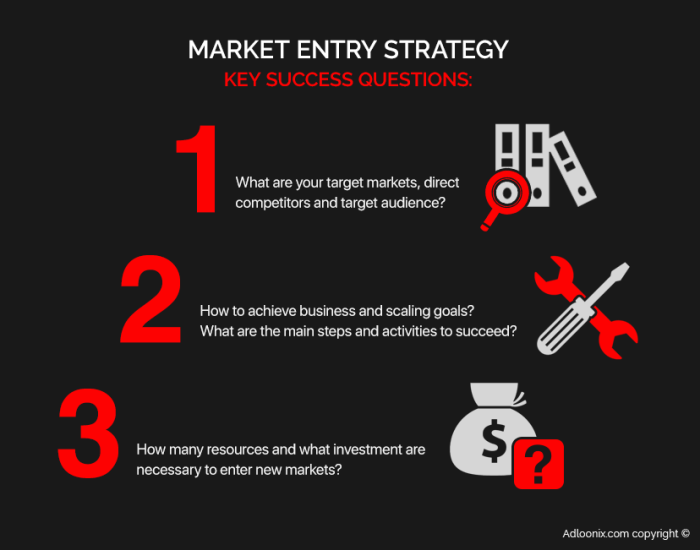

Thorough market research is crucial for a successful market entry strategy. Understanding the competitive landscape, identifying market trends, and analyzing the external environment are essential steps to inform strategic decision-making and mitigate potential risks. This section details the key aspects of market research and analysis relevant to a successful market entry.

Competitive Landscape Analysis

Analyzing the competitive landscape involves identifying key players within the target market and assessing their market share, strengths, and weaknesses. This understanding helps determine the competitive intensity and potential for differentiation. For example, in the highly competitive smartphone market, companies like Apple and Samsung hold significant market share, employing distinct strategies focusing on premium features and broader accessibility respectively. A detailed competitive analysis would include a comparison of their product offerings, pricing strategies, marketing approaches, and distribution channels, allowing for identification of opportunities to differentiate a new entrant. This analysis will inform the development of a competitive advantage.

SWOT Analysis of the Target Market

A SWOT analysis provides a concise overview of the target market’s internal strengths and weaknesses, and the external opportunities and threats. For instance, a new entrant in the organic food market might identify strong consumer demand for sustainable products (opportunity) but also face challenges related to higher production costs and potential price sensitivity among consumers (threats). Internal weaknesses could include a lack of brand recognition, while a strength might be a unique and innovative product offering. This framework allows for a balanced assessment of the market’s overall attractiveness.

Current Market Trends and Their Potential Impact

Understanding current market trends is paramount for successful market entry. For example, the growing trend towards e-commerce and online shopping significantly impacts retail businesses. Companies failing to adapt to this shift risk losing market share to competitors with robust online presences. Similarly, the increasing focus on sustainability and ethical sourcing influences consumer preferences across various sectors. Analyzing these trends allows for the development of strategies that align with market demands and capitalize on emerging opportunities. For instance, a company could leverage the sustainability trend by offering eco-friendly products or implementing sustainable practices in their operations.

PESTLE Analysis

A PESTLE analysis considers the broader macro-environmental factors influencing market entry.

- Political factors: These include government regulations, trade policies, and political stability. For example, changes in import tariffs can significantly impact the cost of goods and profitability.

- Economic factors: These encompass economic growth, inflation rates, interest rates, and consumer spending patterns. A recessionary environment, for example, may reduce consumer spending, impacting sales projections.

- Social factors: These relate to cultural trends, demographics, and lifestyle changes. For example, an aging population may increase demand for healthcare services.

- Technological factors: These include technological advancements, automation, and digitalization. Rapid technological change necessitates continuous innovation and adaptation.

- Legal factors: These include labor laws, consumer protection laws, and intellectual property rights. Compliance with relevant regulations is crucial for avoiding legal issues.

- Environmental factors: These include climate change, environmental regulations, and resource availability. Growing environmental concerns drive demand for sustainable and eco-friendly products and practices.

A comprehensive PESTLE analysis helps anticipate potential challenges and opportunities associated with market entry, enabling proactive planning and mitigation strategies.

Entry Modes

Choosing the right market entry strategy is crucial for success in a new market. The optimal approach depends on factors such as the company’s resources, the target market’s characteristics, and the level of risk the company is willing to assume. Several key entry modes exist, each with its own set of advantages and disadvantages. This section will explore some of the most common strategies.

Comparison of Market Entry Strategies

Selecting the appropriate market entry strategy requires careful consideration of various factors. The following table compares three prominent strategies: direct investment, joint venture, and franchising.

| Strategy | Advantages | Disadvantages | Example |

|---|---|---|---|

| Direct Investment (Wholly Owned Subsidiary) | Complete control, high profit potential, enhanced brand image, access to local resources and knowledge. | High capital investment, high risk, potential for regulatory hurdles, requires significant managerial expertise and local market knowledge. | Toyota establishing manufacturing plants in the United States. |

| Joint Venture | Shared risk and resources, access to local expertise and networks, quicker market entry, potential for cost savings. | Potential for conflicts of interest, loss of some control, sharing of profits. | A collaboration between a US technology company and a Chinese manufacturer to produce and sell smartphones in China. |

| Franchising | Lower capital investment, rapid expansion potential, reduced risk, leverage of established brand recognition. | Limited control over franchisees, potential for damage to brand reputation if franchisees don’t maintain standards, dependence on franchisee success. | McDonald’s global expansion through franchising agreements. |

Advantages and Disadvantages of Exporting

Exporting, the simplest form of international market entry, involves selling goods or services produced in the home country to customers in another country.

Advantages of exporting include relatively low initial investment, reduced risk compared to direct investment, and the ability to test a foreign market before committing significant resources. However, disadvantages include potential trade barriers (tariffs, quotas, etc.), logistical challenges (shipping, customs clearance), and dependence on intermediaries (exporters, distributors) which may limit control and profitability. Companies may also face challenges in adapting their products or services to the specific needs and preferences of foreign markets.

Establishing a Wholly Owned Subsidiary

Establishing a wholly-owned subsidiary involves setting up a new company in a foreign market that is entirely owned and controlled by the parent company. This requires significant capital investment and resources.

The steps involved typically include: market research and analysis, securing necessary permits and licenses, selecting a suitable location, establishing legal and financial structures, recruiting and training local staff, and setting up operations. Thorough planning and execution are vital for success, and considerations must be made for local labor laws, taxation, and other regulatory frameworks.

Legal and Regulatory Considerations for Market Entry Modes

Legal and regulatory considerations vary significantly depending on the chosen market entry mode and the target market.

Direct investment requires compliance with local laws related to foreign investment, company registration, taxation, labor laws, environmental regulations, and intellectual property protection. Joint ventures involve negotiating and adhering to a legally binding agreement outlining the responsibilities, rights, and obligations of each partner. Franchising necessitates compliance with franchise laws, trademark regulations, and contract law. Exporting requires understanding and adhering to international trade regulations, customs laws, and potentially sanitary and phytosanitary regulations. Ignoring these considerations can lead to significant legal and financial repercussions.

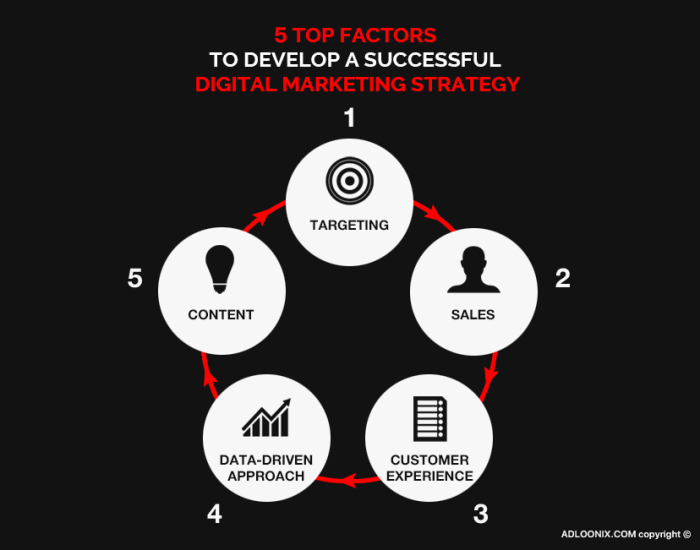

Marketing & Sales Strategies

Successfully launching a product into a new market requires a well-defined marketing and sales strategy. This strategy must align with the chosen market entry mode and target market characteristics to ensure efficient resource allocation and maximize return on investment. A robust plan encompasses the marketing mix (product, price, place, promotion) and a clear sales approach for initial market penetration.

Marketing Mix Strategy

The marketing mix, also known as the 4 Ps, provides a framework for developing a comprehensive marketing plan. Each element—product, price, place, and promotion—must be carefully considered and tailored to the specific target market and competitive landscape. For example, a premium product entering a price-sensitive market might require adjustments to the pricing strategy or a focus on value-added services to justify a higher price point. Conversely, a low-cost product might need a strong promotional campaign to build brand awareness and overcome price-based competition.

Sales Strategy for Market Penetration

A successful sales strategy for initial market penetration focuses on building relationships with key customers and establishing a strong distribution network. This might involve direct sales to large accounts, partnerships with local distributors, or leveraging online sales channels. Effective sales training for the sales team, focusing on product knowledge and closing techniques, is also crucial. Consider implementing a phased approach, starting with a pilot program in a specific region before expanding nationwide. For example, a new technology company might initially target early adopters and technology influencers to generate buzz and build credibility.

Examples of Effective Promotional Campaigns

Promotional campaigns must resonate with the target market’s values and preferences. For example, a social media campaign targeting millennials might utilize influencer marketing and interactive content, while a campaign targeting older demographics might focus on traditional media like television or print advertising. Successful campaigns often incorporate a mix of online and offline channels to maximize reach and impact. A recent example is the successful launch of a new plant-based meat alternative that employed a multi-channel approach, including social media influencers, targeted advertising, and in-store promotions. This created a significant buzz and resulted in high initial sales.

Distribution Channel Strategy

Choosing the right distribution channels is critical for market access and product availability. Options include direct sales, distributors, wholesalers, retailers, and e-commerce platforms. The choice depends on factors such as product characteristics, target market reach, and cost-effectiveness. For instance, a luxury brand might utilize exclusive retail partnerships, while a mass-market product might leverage a wide network of retailers and online marketplaces. Companies often use a multi-channel approach to maximize reach and cater to diverse customer preferences. A successful example of a multi-channel distribution strategy is Amazon, which utilizes its own website, third-party sellers, and physical stores to reach a broad customer base.

Financial Projections & Funding

Securing adequate funding and developing realistic financial projections are critical for successful market entry. A robust financial model, encompassing revenue forecasts, expense budgeting, and profitability analysis, is essential to attract investors and guide strategic decision-making. This section Artikels the key components of a comprehensive financial plan for market entry.

Three-Year Financial Projections

A detailed financial model, typically covering three years, projects revenue streams, operating expenses, and resulting profitability. This model should be based on realistic market size estimations, pricing strategies, and sales forecasts derived from the market research and analysis conducted previously. For example, a company launching a new software-as-a-service (SaaS) product might project annual recurring revenue (ARR) growth based on anticipated customer acquisition rates and average revenue per user (ARPU). Year 1 might show a slower growth rate due to initial market penetration efforts, accelerating in years 2 and 3 as brand awareness and market share increase. Operating expenses, including salaries, marketing, and infrastructure costs, should be carefully budgeted, with clear justifications for each expense category. Profitability is then determined by subtracting total expenses from total revenue for each year. A detailed profit and loss (P&L) statement, cash flow projection, and balance sheet are essential components of this model. For instance, a positive net income in Year 3 could demonstrate the viability and growth potential of the venture to potential investors.

Funding Sources

Several avenues exist for securing the necessary capital for market entry. Equity financing involves selling a portion of the company’s ownership in exchange for investment capital. This could involve angel investors, venture capitalists, or crowdfunding platforms. Debt financing, on the other hand, involves borrowing money that must be repaid with interest. This could include bank loans, lines of credit, or government-backed small business loans. The choice between equity and debt financing depends on factors such as the company’s risk profile, growth trajectory, and the preferences of the founders. For example, a high-growth startup with strong potential might opt for equity financing to accelerate expansion, while a more established business with a lower risk profile might prefer debt financing to maintain control.

Break-Even Analysis

A break-even analysis determines the point at which total revenue equals total costs, resulting in zero profit or loss. This is a crucial metric for assessing the viability of the business model. The break-even point can be calculated using the following formula:

Break-Even Point (Units) = Fixed Costs / (Unit Price – Variable Costs)

For example, if a company has fixed costs of $100,000 per year, a unit price of $100, and variable costs of $60 per unit, the break-even point would be 2,500 units ($100,000 / ($100 – $60)). This indicates that the company needs to sell 2,500 units to cover all costs and achieve profitability. This analysis helps determine the sales volume required to achieve financial sustainability.

Risk Assessment and Mitigation

Market entry involves inherent risks. A comprehensive risk assessment identifies potential challenges, such as competition, regulatory hurdles, economic downturns, and unforeseen technological disruptions. For each identified risk, mitigation strategies should be Artikeld. For example, a risk of intense competition could be mitigated through a strong differentiation strategy, emphasizing unique product features or superior customer service. Regulatory hurdles might be addressed by engaging legal counsel and proactively complying with all relevant regulations. Economic downturns can be mitigated by building a flexible business model and maintaining a strong cash reserve. Technological disruptions can be addressed by continuous innovation and adapting to emerging technologies. A well-defined risk mitigation plan increases the likelihood of overcoming challenges and achieving market entry success.

Operational Plan

A robust operational plan is crucial for successful market entry. This section details the essential components of our operational structure, encompassing staffing, facilities, technology, supply chain management, customer relationship management, and contingency planning. A well-defined operational plan mitigates risks and ensures smooth execution of our market entry strategy.

Staffing Requirements

Our initial operational team will consist of a Country Manager, responsible for overall market operations, a Sales Manager to lead the sales team and develop sales strategies, and a Marketing Manager to execute marketing initiatives. We will also require a minimum of five sales representatives, with potential for expansion based on market performance. All personnel will receive comprehensive training on product knowledge, sales techniques, and customer service protocols. We will prioritize hiring local talent to leverage their market understanding and cultural insights. Further staffing needs will be assessed based on operational scale and market demand.

Facilities and Technology

We will initially lease a small office space in a strategic location within the target market, providing sufficient space for the team and operational needs. Essential technology infrastructure includes high-speed internet access, a robust computer network, CRM software for customer relationship management, and inventory management systems. We will also invest in communication tools, such as video conferencing and project management software, to facilitate efficient internal communication and collaboration. As the business grows, we will evaluate the need for larger facilities and advanced technological solutions.

Supply Chain Management

Our supply chain strategy involves establishing partnerships with reliable local suppliers for raw materials and components. This approach minimizes transportation costs and lead times, while also supporting local businesses. For distribution, we will initially utilize a third-party logistics provider (3PL) to manage warehousing, order fulfillment, and delivery. This allows us to focus on core business activities while leveraging the expertise of a seasoned logistics partner. As our sales volume increases, we will evaluate the feasibility of establishing our own distribution network. A key performance indicator (KPI) will be on-time delivery rate, aiming for a 98% success rate.

Customer Relationship Management

Effective customer relationship management (CRM) is paramount. We will implement a CRM system to track customer interactions, manage sales leads, and provide personalized customer service. This system will enable us to proactively address customer inquiries, resolve issues promptly, and build strong customer relationships. We will also establish multiple customer support channels, including phone, email, and online chat, ensuring accessibility and responsiveness. Customer satisfaction surveys will be regularly conducted to monitor performance and identify areas for improvement.

Contingency Planning

Our contingency plan addresses potential operational disruptions, such as supply chain disruptions, natural disasters, or economic downturns. For supply chain disruptions, we will maintain a safety stock of essential materials and explore alternative suppliers. In the event of natural disasters, we will have a business continuity plan that includes data backups, remote work capabilities, and alternative communication channels. For economic downturns, we will have a flexible budget and cost-cutting measures in place to mitigate financial impacts. Regular risk assessments will be conducted to identify and mitigate potential threats to our operations.

Legal & Regulatory Compliance

Navigating the legal landscape is crucial for successful market entry. Understanding and adhering to all relevant regulations minimizes risk and ensures long-term viability in the target market. Failure to comply can result in significant penalties, operational disruptions, and reputational damage. This section Artikels key legal and regulatory considerations.

Licensing and Permitting Requirements

Securing the necessary licenses and permits is a fundamental step in market entry. The specific requirements vary significantly depending on the industry, the target market’s jurisdiction, and the nature of the business operations. For example, food and beverage companies will face stringent health and safety regulations, while technology firms may need to comply with data privacy laws. The process typically involves submitting applications, providing documentation (e.g., business plans, financial statements, proof of insurance), and potentially undergoing inspections. Delays in obtaining licenses can significantly impact launch timelines, so proactive planning and engagement with relevant authorities are essential. A comprehensive checklist of required permits and licenses, along with timelines for application and approval, should be developed early in the planning process.

Intellectual Property Protection

Protecting intellectual property (IP) rights – such as patents, trademarks, and copyrights – is paramount. Before entering a new market, a thorough IP audit should be conducted to identify all valuable IP assets. This involves registering trademarks and patents in the target market to prevent infringement and protect the company’s brand and innovations. Furthermore, strategies for enforcing IP rights should be established, including processes for identifying and addressing potential infringements. Consideration should be given to the local legal system’s effectiveness in protecting IP and the potential need for local legal counsel. For instance, a company launching a new software application would need to secure copyright protection and potentially patent key aspects of its functionality in the target market to prevent competitors from replicating it.

Industry-Specific Regulations

Many industries are subject to specific regulations that go beyond general business licensing. For example, pharmaceutical companies must comply with rigorous clinical trial regulations and drug approval processes. Financial institutions are governed by strict banking regulations and anti-money laundering laws. Understanding and adhering to these industry-specific regulations is critical for legal compliance and maintaining a strong reputation. Failure to comply can lead to substantial fines and even business closure. Thorough research and consultation with industry experts and legal professionals are crucial to ensure full compliance. A detailed compliance matrix, mapping specific regulations to company operations, can aid in tracking progress and identifying potential risks.

Epilogue

Entering a new market presents a significant undertaking, demanding strategic foresight and meticulous execution. By thoroughly analyzing the target market, selecting the optimal entry mode, and developing a comprehensive marketing and sales plan, businesses can significantly increase their chances of success. Continuous monitoring, adaptation, and a commitment to understanding the evolving market landscape are crucial for sustained growth and profitability in the long term. This guide serves as a starting point, encouraging further exploration and adaptation to the specific nuances of each unique market opportunity.

FAQ Section

What is the difference between a joint venture and a strategic alliance?

A joint venture involves the creation of a new entity, with shared ownership and control, while a strategic alliance is a collaborative agreement between independent companies without the creation of a new entity.

How can I assess the cultural nuances of a new market?

Conduct thorough cultural research, consult cultural experts, and consider employing local partners with deep cultural understanding.

What are some common pitfalls to avoid during market entry?

Underestimating market research, neglecting cultural differences, inadequate funding, and insufficient market adaptation are common pitfalls.

How do I protect my intellectual property in a foreign market?

Seek legal counsel specializing in international intellectual property rights and register your trademarks and patents in the target market.