Successfully launching a product or service into a new market requires meticulous planning and a deep understanding of the target audience. This Market Entry Strategies Guide provides a roadmap for navigating the complexities of international expansion, from identifying your ideal customer profile to mitigating potential risks. We’ll explore various entry strategies, delve into crucial market research, and Artikel the steps needed to build a sustainable presence in your chosen market. This guide equips you with the knowledge to make informed decisions and confidently navigate the challenges of global business.

The process encompasses not only market analysis and strategy selection but also legal considerations, financial planning, team building, and operational logistics. Each stage is critical to maximizing your chances of success, minimizing risk, and achieving a strong return on investment. By carefully considering each element, you can create a robust and adaptable plan to achieve your international business goals.

Understanding Your Target Market

Successfully entering a new market hinges on a deep understanding of your target customer. Without a clear picture of who you’re selling to and why, your marketing efforts will be scattered and ineffective, leading to wasted resources and ultimately, failure. This section Artikels the crucial steps in defining your ideal customer and assessing the market landscape.

Developing an ideal customer profile (ICP) is paramount for focused market entry. Your ICP isn’t just a demographic snapshot; it’s a detailed persona encompassing needs, pain points, purchasing behaviors, and motivations. Consider factors such as age, location, income, education, occupation, technology usage, and lifestyle. A robust ICP allows you to tailor your messaging, marketing channels, and product features to resonate directly with your most likely buyers.

Ideal Customer Profile Characteristics

Three key characteristics differentiate a successful target market from others: a demonstrable need for your product or service, sufficient purchasing power to afford it, and accessibility through existing or readily established marketing channels. Let’s illustrate this with an example. Consider a company launching a premium, organic dog food. Their target market isn’t simply “dog owners”; it’s affluent, health-conscious dog owners who are willing to pay a premium for high-quality ingredients and demonstrably care about their pet’s well-being. This distinguishes them from price-sensitive owners who prioritize affordability over premium ingredients.

Market Size and Growth Potential

Assessing market size and growth potential requires both quantitative and qualitative analysis. Quantitative analysis involves determining the total addressable market (TAM), serviceable available market (SAM), and serviceable obtainable market (SOM). TAM represents the overall market potential, SAM focuses on the portion you can realistically reach, and SOM pinpoints the share you can realistically capture. Qualitative analysis involves examining market trends, economic indicators, and regulatory changes that might influence growth. For example, a market analysis might reveal that the global market for sustainable fashion is growing at 15% annually, with a significant portion of growth originating from millennial and Gen Z consumers. This information would inform the market entry strategy for a sustainable clothing brand.

Competitive Landscape Analysis

Understanding the competitive landscape is crucial. Identify your key competitors, analyze their strengths and weaknesses, and determine your competitive advantage. This involves examining their pricing strategies, marketing tactics, product features, and customer base. A competitive analysis might reveal that your main competitor has a strong brand reputation but lacks innovative product features. This information can be used to inform your differentiation strategy, allowing you to highlight your innovative aspects and carve a unique niche within the market.

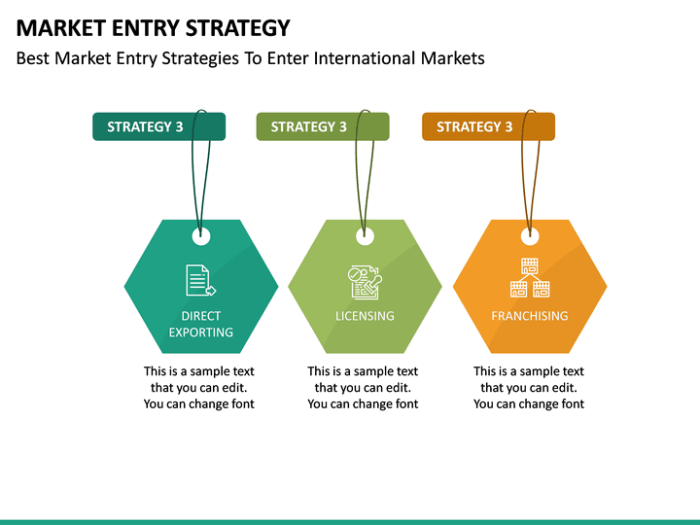

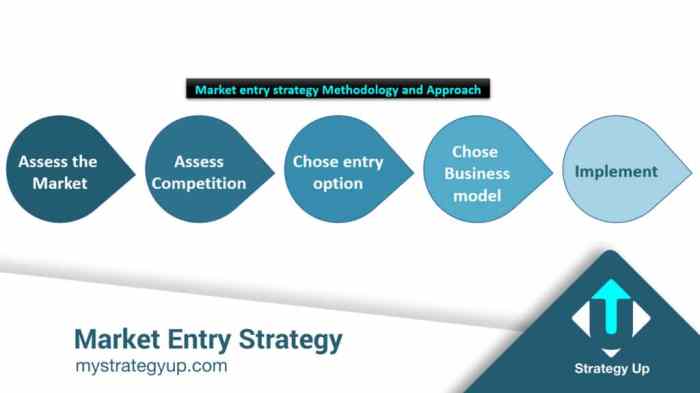

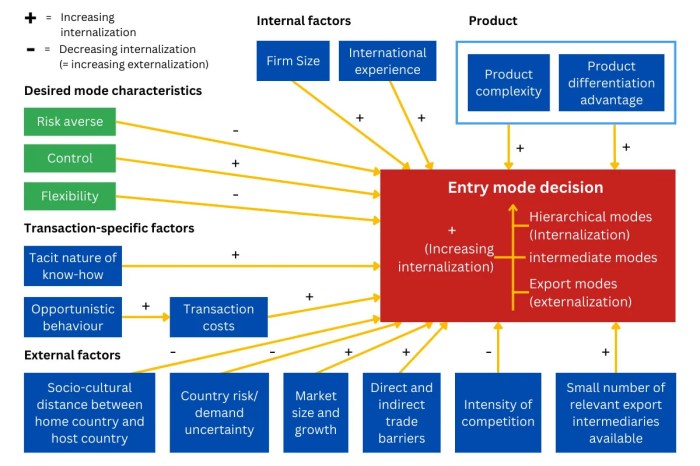

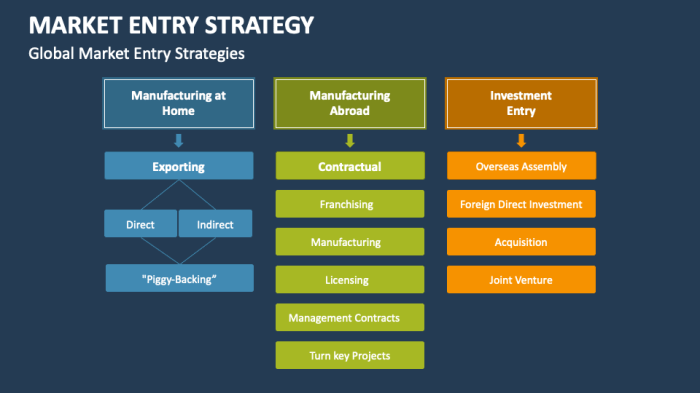

Choosing a Market Entry Strategy

Selecting the right market entry strategy is crucial for success in international markets. The choice depends on a complex interplay of factors including your company’s resources, risk tolerance, the characteristics of the target market, and the competitive landscape. This section will explore several common strategies, comparing their advantages and disadvantages to aid in your decision-making process.

Direct Export

Direct export involves selling your products or services directly to customers in the target market without intermediaries. This offers greater control over pricing, branding, and distribution, allowing for a more tailored approach to the market. However, it demands significant upfront investment in market research, logistics, and potentially establishing local sales and distribution channels.

Companies like Tesla, with its direct-to-consumer sales model in various international markets, exemplify successful direct export. They manage their own sales, service, and distribution networks, maintaining tight control over brand image and customer experience. This strategy, while demanding, allows for higher profit margins if executed successfully.

Indirect Export

Indirect export utilizes intermediaries such as export management companies or distributors to handle the complexities of international sales. This approach minimizes the initial investment and risk involved, making it particularly attractive for smaller businesses or those with limited international experience. However, it relinquishes some control over pricing, branding, and distribution, and profit margins may be lower due to the intermediary’s commission.

Many smaller businesses leverage indirect export. Imagine a small artisan crafts producer using an export management company to handle logistics and sales to retailers in Europe. The intermediary manages shipping, customs, and marketing, allowing the producer to focus on production. This reduces risk and administrative burden.

Joint Ventures

Joint ventures involve partnering with a local company to enter a foreign market. This strategy combines the resources, expertise, and market knowledge of both partners, mitigating risks and accelerating market entry. However, it requires careful selection of a reliable partner and can lead to conflicts in decision-making and operational strategies.

The success of numerous joint ventures in the automotive industry demonstrates this strategy’s effectiveness. For instance, a collaboration between a foreign automaker and a local manufacturer allows for shared production facilities, leveraging local expertise and infrastructure while gaining access to a new market. This reduces the financial and logistical burden of establishing a completely new operation.

Foreign Direct Investment (FDI)

Foreign direct investment involves establishing a wholly-owned subsidiary or building a manufacturing facility in the target market. This offers maximum control and potential for long-term growth, but requires substantial capital investment and carries the highest level of risk. It also necessitates navigating complex legal and regulatory frameworks in the host country.

Companies like McDonald’s, with its extensive network of globally franchised and wholly-owned restaurants, are a prime example of successful FDI. This strategy requires significant investment, but it allows for consistent brand control and potentially higher long-term returns. It demonstrates a high commitment to the market.

Decision-Making Framework for Market Entry Strategy Selection

Choosing the optimal strategy requires a systematic approach. A decision-making framework should consider several key factors:

A useful framework involves assessing resource availability (financial, human, technological), risk tolerance (willingness to accept potential losses), market characteristics (size, growth potential, competition), and control preferences (level of influence desired over operations and branding). This holistic assessment allows for a reasoned choice.

| Factor | Direct Export | Indirect Export | Joint Venture | Foreign Direct Investment |

|---|---|---|---|---|

| Resource Requirements | High | Low | Medium | High |

| Risk Level | High | Low | Medium | High |

| Control Level | High | Low | Medium | High |

| Speed of Entry | Medium | Fast | Medium | Slow |

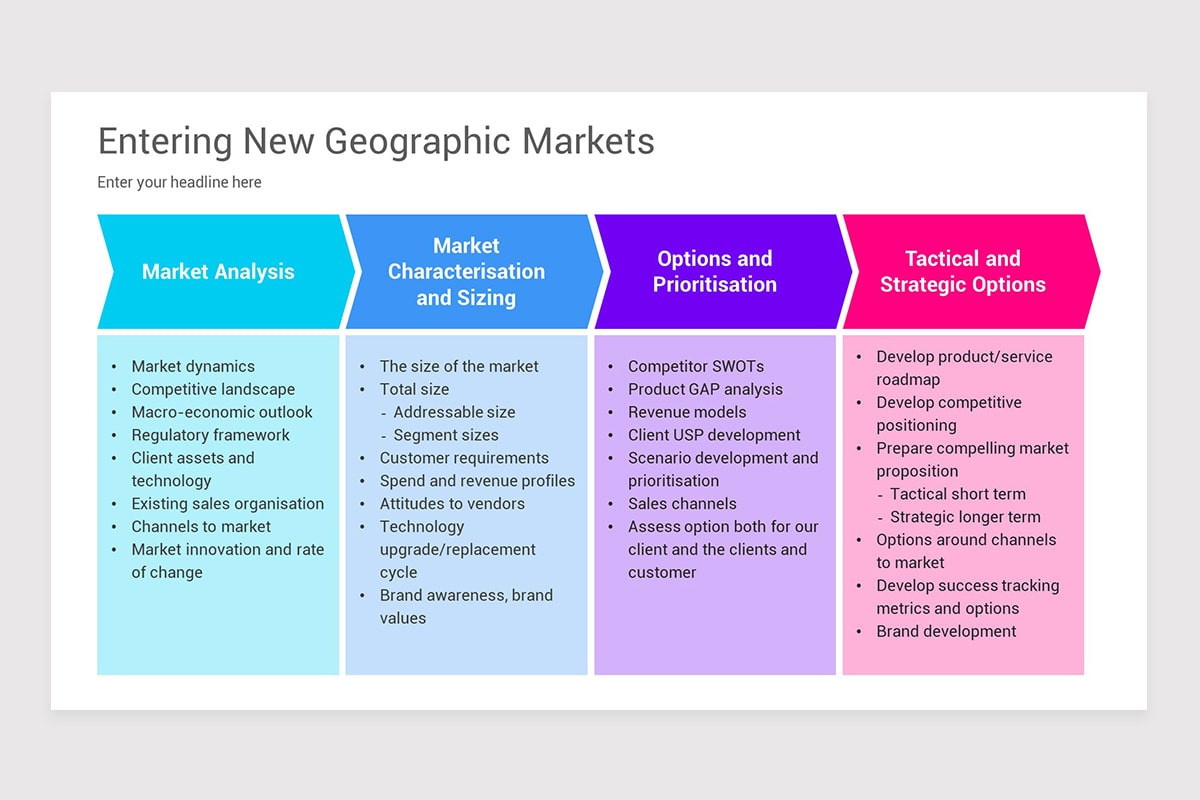

Market Research and Analysis

Thorough market research is crucial for validating your target market assumptions and informing your market entry strategy. A well-structured research plan minimizes risks and maximizes your chances of success. This section Artikels the key steps involved in conducting effective market research and analyzing the findings to gain actionable insights.

Effective market research involves a systematic approach to gathering and analyzing data relevant to your target market and competitive landscape. This process allows you to refine your understanding of customer needs, identify opportunities, and mitigate potential challenges before fully committing to market entry.

Creating a Comprehensive Market Research Plan

A comprehensive market research plan should clearly define your research objectives, identify your target audience, Artikel the data collection methods, and establish a timeline for completion. The plan should also specify the budget allocated for the research and the metrics used to evaluate the success of the research. A well-defined plan ensures that the research is focused, efficient, and produces relevant results. For example, a plan for a new coffee shop might include surveys to assess customer preferences, competitor analysis to understand pricing and offerings, and analysis of local demographics to understand potential customer base size.

Primary Data Sources for Market Research

Three primary data sources for conducting thorough market research are surveys, focus groups, and interviews.

Surveys allow for large-scale data collection, providing quantitative insights into consumer preferences and market trends. Focus groups offer qualitative data, providing deeper understanding of consumer motivations and behaviors through guided discussions. Individual interviews, while more time-consuming, provide in-depth insights into individual experiences and perspectives, allowing for a more nuanced understanding of the target market. The choice of data source depends on the research objectives and available resources. For example, a survey could be used to assess brand awareness, while focus groups could be used to understand customer perceptions of a new product.

Analyzing Market Trends and Predicting Future Demand

Analyzing market trends involves identifying patterns and shifts in consumer behavior, technological advancements, and competitive dynamics. This can be achieved by analyzing historical sales data, reviewing industry reports, and monitoring social media trends. Predicting future demand requires considering various factors, including economic forecasts, demographic shifts, and technological innovations. For example, analyzing past sales data of electric vehicles coupled with government incentives and technological advancements can help predict future demand for this type of vehicle. Techniques like regression analysis and forecasting models can be used to quantify these predictions. For instance, a simple linear regression model could be used to predict future sales based on historical data and anticipated growth rates.

Organizing Market Research Findings

Organizing market research findings into a clear and concise report is crucial for effective decision-making. The report should summarize key findings, highlight significant trends, and offer actionable recommendations. The use of visuals, such as charts and graphs, can significantly enhance the clarity and impact of the report. A well-structured report facilitates informed decision-making regarding market entry strategies.

| Metric | Current Market Size | Projected Growth (5 years) | Key Trends |

|---|---|---|---|

| Market Revenue | $100 million | 15% | Increasing demand for eco-friendly products |

| Market Share (Competitor A) | 30% | Stable | Strong brand loyalty |

| Market Share (Competitor B) | 20% | Slight decline | Facing challenges with product innovation |

| Consumer Preference | High demand for convenience | Growing preference for online purchases | Increased focus on sustainability |

Developing a Go-to-Market Plan

A well-defined go-to-market plan is crucial for a successful market entry. It Artikels the strategic steps needed to launch your product or service effectively, reach your target audience, and achieve your sales goals within the new market. This plan should be a dynamic document, adaptable to changing market conditions and feedback.

Step-by-Step Launch Plan

A phased approach minimizes risk and allows for iterative improvements. Consider breaking down the launch into distinct stages, each with clear objectives and measurable milestones. For example, a typical plan might involve initial market testing with a limited product release, followed by a wider rollout based on the initial feedback. A detailed timeline, assigning responsibilities and outlining key performance indicators (KPIs) for each phase, is essential.

Marketing and Sales Strategies

Marketing and sales strategies must be aligned with the target market’s characteristics and preferences. This might involve a mix of digital marketing (, social media, online advertising), traditional marketing (print advertising, public relations), and direct sales efforts. For example, a business targeting a younger demographic might prioritize social media marketing and influencer collaborations, while a business targeting older demographics might focus on more traditional advertising methods and direct mail campaigns. Sales training for the team focused on the nuances of the new market is crucial.

Pricing Strategy and Rationale

The pricing strategy should consider several factors, including production costs, competitor pricing, perceived value, and target market income levels. Common strategies include cost-plus pricing (adding a markup to the cost of production), value-based pricing (setting prices based on perceived value to the customer), and competitive pricing (matching or undercutting competitors’ prices). A thorough market analysis is needed to justify the chosen strategy. For example, a premium product entering a market with high disposable income might employ value-based pricing, while a budget-friendly product might opt for competitive pricing.

Product/Service Adaptation

Adapting your product or service to meet the specific needs of the target market is critical for success. This might involve modifications to product features, packaging, or even the brand messaging itself. For instance, a food product might need to adjust its ingredients or flavor profile to suit local tastes, or a software application might need to be translated into the local language and adapted to local regulatory requirements. Thorough market research will reveal the necessary adaptations.

Legal and Regulatory Compliance

Entering a new market necessitates a thorough understanding of the local legal and regulatory landscape. Failure to comply can result in significant financial penalties, operational disruptions, and reputational damage. This section Artikels key considerations for ensuring legal compliance during your market entry.

Navigating the legal complexities of international business requires careful planning and proactive engagement with legal professionals. A comprehensive understanding of relevant laws and regulations is paramount to successful market entry and long-term sustainability.

Key Legal and Regulatory Requirements

Understanding the specific legal and regulatory requirements for your industry and target market is crucial. This includes, but is not limited to, laws related to business registration, taxation, labor laws, environmental regulations, consumer protection, and data privacy. For example, the General Data Protection Regulation (GDPR) in Europe imposes stringent requirements on how companies handle personal data. Similarly, the Foreign Corrupt Practices Act (FCPA) in the United States prohibits bribery of foreign officials. Thorough due diligence is required to identify all applicable regulations.

Obtaining Necessary Licenses and Permits

The process for obtaining necessary licenses and permits varies significantly across countries and industries. It often involves submitting applications, providing documentation, and potentially undergoing inspections. For instance, operating a food processing facility will require different licenses and permits than establishing an online retail business. Delays in obtaining these authorizations can significantly impact your market entry timeline, therefore proactive planning and engagement with relevant authorities are essential.

Potential Legal Risks and Mitigation Strategies

Several legal risks can impede market entry. These include intellectual property infringement, contract disputes, product liability claims, and non-compliance with local regulations. Mitigation strategies involve comprehensive risk assessments, robust contract negotiation, securing adequate insurance coverage, and establishing effective compliance programs. For example, registering trademarks and patents protects intellectual property rights. Regular legal audits and compliance training for employees minimize the risk of non-compliance.

Legal Compliance Best Practices for International Business

Best practices for legal compliance include establishing a dedicated compliance department or assigning responsibility to a qualified individual, conducting regular compliance audits, implementing robust internal controls, and providing comprehensive compliance training to employees. Maintaining thorough records, seeking legal counsel when necessary, and staying updated on changes in regulations are also critical. Furthermore, engaging with local legal experts familiar with the specific regulatory environment ensures compliance with all applicable laws and minimizes potential risks. Building strong relationships with regulatory bodies can also foster a positive and collaborative environment.

Financial Planning and Investment

Entering a new market requires careful financial planning and a robust investment strategy. This section Artikels the key elements of developing a financial roadmap for your market entry initiative, including projecting costs, identifying funding sources, and mitigating potential financial risks. A well-structured financial plan is crucial for securing funding, managing resources effectively, and ensuring the long-term viability of your market entry strategy.

Financial Projections

Creating a detailed financial projection involves forecasting your revenue, expenses, and profitability over a specific period, typically the first three to five years of operation in the new market. This projection should be based on realistic assumptions about market size, customer acquisition costs, pricing strategies, and operating expenses. For example, a company launching a new software product might project revenue based on anticipated user growth, subscription pricing, and churn rate. Expenses would include development costs, marketing and sales efforts, customer support, and operational overhead. Profitability is determined by comparing projected revenue to projected expenses. Regularly reviewing and adjusting your projections based on actual performance is crucial for effective financial management.

Funding Sources

Securing adequate funding is vital for successful market entry. Several sources can provide the necessary capital, including:

- Internal Funding: This involves using the company’s own resources, such as retained earnings or existing cash reserves.

- Debt Financing: This entails obtaining loans from banks or other financial institutions. Loan terms and interest rates will vary depending on the company’s creditworthiness and the market conditions.

- Equity Financing: This involves raising capital by selling a portion of the company’s ownership to investors, such as venture capitalists or angel investors. This can provide significant funding but also dilutes the ownership stake of existing shareholders.

- Government Grants and Subsidies: Many governments offer grants and subsidies to businesses entering new markets, particularly in sectors considered strategically important.

- Crowdfunding: This involves raising funds from a large number of individuals through online platforms. It can be a useful way to build brand awareness and generate early-stage funding.

The optimal funding mix will depend on factors such as the company’s financial position, risk tolerance, and the specific requirements of the market entry strategy.

Financial Risk Management

Market entry involves inherent financial risks. These risks can include:

- Market Failure: The target market may not be as large or receptive as anticipated.

- Competitive Pressure: Existing competitors may aggressively defend their market share, leading to lower-than-expected profits.

- Operational Challenges: Unexpected costs or delays in setting up operations in the new market.

- Regulatory Hurdles: Unexpected changes in regulations or compliance requirements.

- Exchange Rate Fluctuations: For international market entries, fluctuations in exchange rates can significantly impact profitability.

To mitigate these risks, companies should develop contingency plans, diversify their funding sources, conduct thorough market research, and closely monitor their financial performance. Sensitivity analysis, which involves testing the impact of changes in key assumptions on the financial projections, can also be a valuable tool for risk management.

Budget Breakdown

| Cost Category | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Market Research | $10,000 | $5,000 | $2,000 |

| Product Development | $50,000 | $10,000 | $5,000 |

| Marketing & Sales | $20,000 | $30,000 | $40,000 |

| Operational Expenses | $30,000 | $40,000 | $50,000 |

| Total Expenses | $110,000 | $85,000 | $97,000 |

| Projected Revenue | $80,000 | $150,000 | $200,000 |

| Net Income/(Loss) | ($30,000) | $65,000 | $103,000 |

Note: This is a simplified example. A real-world budget would be significantly more detailed.

Building a Local Team and Partnerships

Successfully entering a new market often hinges on building a strong local presence. This involves assembling a skilled team who understand the nuances of the local culture, regulations, and business practices, and forging strategic partnerships that leverage existing networks and expertise. A well-structured approach to both team building and partnership development is crucial for navigating the complexities of international expansion.

Ideal Characteristics of a Local Team

A successful local team possesses a blend of technical skills and cultural understanding. Members should ideally have proven experience in the target market, a deep understanding of local consumer behavior and business etiquette, and strong networking capabilities within the relevant industry. Beyond technical proficiency, strong communication skills, adaptability, and a proactive approach to problem-solving are essential for navigating the challenges of a new market. Fluency in the local language is almost always a critical requirement, enabling seamless communication with clients, partners, and government agencies. The team’s composition should reflect a diversity of skills and perspectives, ensuring a comprehensive approach to market penetration.

Recruiting and Hiring a Local Team

The recruitment process for a local team requires a nuanced approach. It begins with defining clear roles and responsibilities, outlining the necessary skills and experience for each position. Leveraging local recruitment agencies familiar with the target market’s talent pool is often beneficial. Online job boards and professional networking platforms can also be effective tools. The interview process should incorporate assessments of both technical skills and cultural fit. Background checks and reference verification are crucial steps to ensure the integrity and reliability of potential hires. A well-defined onboarding process is vital to ensure smooth integration into the company culture and efficient training.

Benefits and Challenges of Strategic Partnerships

Strategic partnerships offer significant advantages in market entry. They provide access to established distribution networks, local market expertise, and pre-existing customer bases. Partnerships can also mitigate risks associated with navigating unfamiliar regulatory landscapes and cultural norms. However, partnerships also present challenges. Finding a compatible partner with aligned goals and values is crucial. Negotiating equitable terms and managing potential conflicts of interest require careful planning and strong communication. Differences in corporate culture and business practices can lead to friction if not addressed proactively. Effective communication and clear contractual agreements are essential for a successful partnership.

Examples of Successful Partnerships

Many multinational companies have successfully leveraged strategic partnerships for market entry. For instance, Starbucks’ expansion into China involved a joint venture with a local partner, providing access to established distribution channels and valuable local market knowledge. Similarly, many technology companies partner with local telecommunications providers to facilitate the launch of their products and services in new markets. These partnerships often involve sharing resources, expertise, and risk, resulting in faster market penetration and increased profitability. The success of these collaborations highlights the importance of careful partner selection and a clearly defined partnership agreement.

Operational Considerations

Successfully launching your product or service in a new market requires meticulous planning and execution of operational strategies. This section details the logistical aspects of establishing operations, anticipates potential challenges, and Artikels solutions for smooth market entry. A well-defined operational structure is crucial for efficient resource allocation, streamlined processes, and ultimately, market success.

Setting up operations in a new market involves a multifaceted approach encompassing logistics, infrastructure, and resource management. This includes establishing appropriate warehousing and distribution channels, securing necessary licenses and permits, and recruiting and training a local workforce. Effective management of these elements will significantly impact the speed and efficiency of market penetration.

Logistics and Infrastructure Setup

Establishing a robust logistical framework is paramount. This involves identifying and securing suitable warehousing facilities, considering factors such as location, size, and accessibility. Efficient transportation networks, including road, rail, and potentially air freight, must be evaluated and integrated into the overall supply chain strategy. For example, a company launching a perishable goods product might prioritize cold storage facilities and refrigerated transportation, while a technology company might focus on secure data centers and reliable internet connectivity. The selection of logistics providers will also be critical, requiring thorough due diligence and contract negotiation. Efficient inventory management systems will be needed to track goods and ensure timely delivery to customers.

Potential Operational Challenges and Mitigation Strategies

Numerous operational challenges can arise during market entry. These might include unforeseen regulatory hurdles, difficulties in recruiting qualified personnel, infrastructure limitations (e.g., unreliable power supply, inadequate transportation networks), and unexpected fluctuations in local demand. To mitigate these challenges, proactive risk assessment and contingency planning are essential. For instance, having backup power generators to address power outages, building strong relationships with local authorities to navigate regulatory complexities, and implementing flexible production schedules to adapt to fluctuating demand are crucial strategies. Furthermore, building strong relationships with local partners can provide valuable insights and support in navigating unfamiliar operational landscapes.

Supply Chain and Distribution Network Management

A well-defined supply chain is critical for delivering products or services efficiently and cost-effectively. This involves mapping out the entire process, from sourcing raw materials to delivering the finished product to the end customer. Consideration must be given to inventory management, warehousing, transportation, and customs clearance. For example, a company might choose to establish a local manufacturing facility to reduce transportation costs and lead times, or it might opt for a direct-to-consumer model to bypass traditional distribution channels. Regular monitoring of key performance indicators (KPIs) such as delivery times, inventory levels, and customer satisfaction will be essential for identifying areas for improvement and ensuring the smooth functioning of the supply chain.

Proposed Operational Structure

The proposed operational structure can be visualized as a three-tiered system. The first tier comprises the headquarters (located in [Headquarter Location]), responsible for strategic planning, financial management, and overall operational oversight. The second tier consists of a regional office located in the target market ([Target Market Location]), responsible for local sales, marketing, and customer service. This office will also manage the local warehouse and distribution network. The third tier encompasses the local distribution network, consisting of [Number] strategically located distribution centers, supported by a network of [Type of Transportation] and [Number] local delivery partners. This structure allows for efficient communication and coordination between headquarters and local operations, ensuring a streamlined and responsive approach to market demands. This decentralized approach allows for greater agility and responsiveness to local market conditions while maintaining centralized control over key strategic decisions. This design prioritizes efficiency and adaptability, enabling the company to respond effectively to changing market dynamics.

Risk Management and Contingency Planning

Entering a new market presents inherent risks. A robust risk management strategy is crucial for mitigating potential problems and ensuring the success of your market entry. This involves identifying potential threats, developing proactive solutions, and establishing monitoring mechanisms to proactively address emerging challenges. A well-defined plan allows for swift adaptation to unforeseen circumstances, preserving resources and maintaining momentum.

Potential risks associated with market entry are diverse and depend heavily on the specific market and chosen strategy. However, some common risks include political instability, economic downturns, changes in regulations, competition, supply chain disruptions, currency fluctuations, and difficulties in navigating cultural nuances. A comprehensive risk assessment should consider all these factors and more, specific to the target market.

Identifying Potential Risks

A thorough risk assessment should involve a systematic review of all potential threats. This might involve utilizing SWOT analysis (Strengths, Weaknesses, Opportunities, Threats), PESTLE analysis (Political, Economic, Social, Technological, Legal, Environmental), or other relevant frameworks. The process should identify both internal and external risks. Internal risks could include inadequate financial resources, insufficient expertise within the team, or poor project management. External risks, as mentioned previously, encompass factors outside the company’s direct control. Prioritizing risks based on likelihood and potential impact is essential for effective resource allocation.

Developing Contingency Plans

Once potential risks are identified, developing specific contingency plans is essential. These plans should Artikel proactive steps to mitigate identified risks. For example, a contingency plan for political instability might involve diversifying operations across multiple locations or establishing strong relationships with local stakeholders. A plan for currency fluctuations could involve hedging strategies or flexible pricing models. Each contingency plan should be tailored to a specific risk, detailing clear actions, responsibilities, and timelines. Regular review and updates to these plans are necessary to reflect changing circumstances.

Risk Monitoring and Management

Continuous monitoring is critical to effectively manage risks. This involves regularly tracking key indicators related to the identified risks. For instance, monitoring economic indicators for early warning signs of a downturn, tracking regulatory changes, or monitoring competitor activity. Regular reporting and analysis of this data allow for proactive adjustments to the market entry strategy and contingency plans. This proactive approach allows for swift responses to emerging challenges, minimizing negative impacts.

Examples of Successful Risk Mitigation Strategies

Many multinational companies have successfully navigated market entry challenges through effective risk management. For example, companies entering emerging markets often partner with local businesses to navigate complex regulatory environments and build trust with local consumers. This mitigates political and regulatory risks. Similarly, companies facing supply chain disruptions might diversify their sourcing locations, reducing dependence on a single supplier and mitigating potential supply chain disruptions. Investing in thorough market research to understand local preferences and consumer behavior can help mitigate risks associated with product development and marketing. These proactive measures demonstrate the importance of strategic risk management in achieving successful market entry.

Summary

Entering a new market is a significant undertaking, demanding careful consideration of numerous factors. This guide has provided a framework for developing a comprehensive market entry strategy, encompassing market research, strategy selection, legal compliance, financial planning, team building, and operational considerations. By meticulously addressing each stage, businesses can significantly increase their chances of success, minimize potential risks, and effectively navigate the challenges of international expansion. Remember, continuous monitoring and adaptation are key to long-term success in any new market.

FAQs

What is the difference between direct and indirect export?

Direct export involves selling directly to customers in the target market, while indirect export utilizes intermediaries such as distributors or agents.

How can I identify the best funding sources for market entry?

Funding sources vary depending on the scale of the project and can include venture capital, angel investors, bank loans, government grants, or bootstrapping.

What are some common legal risks in international business?

Common risks include intellectual property infringement, contract disputes, regulatory non-compliance, and trade restrictions.

How do I adapt my product/service for a new market?

Adaptation may involve changes to product design, packaging, marketing messaging, pricing, and distribution channels to align with local preferences and regulations.