Market Entry Strategies Guide: So you’re thinking of taking your brilliant business global? Fantastic! But before you start envisioning overflowing coffers and a private island, let’s get real. This isn’t a game of Monopoly; it’s a strategic chess match against competitors, regulations, and the occasional rogue shipping container. This guide will equip you with the tools to navigate this exciting (and sometimes terrifying) landscape, turning your ambitious dreams into a profitable reality. We’ll explore everything from identifying your ideal customer to crafting a bulletproof marketing plan that’ll leave your rivals green with envy. Prepare for a rollercoaster ride of market analysis, strategic planning, and hopefully, triumphant success.

This guide systematically covers the crucial steps involved in successfully entering a new market. We delve into detailed market research, helping you understand your target audience, competitive landscape, and potential pitfalls. We then explore various entry strategies, from exporting to direct investment, weighing their pros and cons to help you choose the best fit for your company’s resources and objectives. Finally, we cover essential aspects such as financial projections, legal compliance, operational planning, and risk management, ensuring you’re well-prepared for every eventuality.

Defining Your Target Market

Launching a product into a new market is like throwing a dart blindfolded – exhilarating, terrifying, and potentially very messy. To avoid ending up with a dart stuck in your own foot (or worse, your competitor’s prize-winning dartboard), meticulous target market definition is crucial. This isn’t just about guessing; it’s about using data-driven insights to pinpoint the people most likely to love your product and make your venture a roaring success.

Identifying key characteristics of your ideal customer profile is akin to creating a detailed character sketch of your perfect customer. This involves more than just age and location; it’s about understanding their needs, motivations, frustrations, and even their preferred social media platform (yes, even that matters!). Think of it as writing a compelling dating profile for your product – you want to attract the right matches, not a swarm of unsuitable suitors.

Ideal Customer Profile Characteristics

Defining your ideal customer profile requires a deep dive into demographics, psychographics, and buying behavior. Demographics encompass the readily quantifiable aspects like age, gender, income, education, and location. Psychographics delve into the more nuanced aspects such as lifestyle, values, attitudes, interests, and opinions. Understanding buying behavior involves analyzing purchasing patterns, brand loyalty, and preferred channels of communication. For example, a company selling high-end organic dog food might target affluent, environmentally conscious dog owners aged 35-55 who are active on Instagram and prioritize natural ingredients. A successful profile goes beyond simple descriptors; it paints a vivid picture of your ideal customer’s daily life, aspirations, and frustrations, allowing you to tailor your marketing efforts effectively.

Market Size and Growth Potential

Determining the size and growth potential of your target market is essential for assessing the viability of your venture. This involves analyzing market research reports, industry publications, and government data to estimate the current market size and project future growth. Let’s say you’re launching a new type of sustainable packaging for food. You might find that the market for eco-friendly packaging is currently valued at X billion dollars and is projected to grow by Y% annually over the next five years, fueled by increasing consumer awareness of environmental issues and government regulations. This information is vital for securing funding, setting realistic sales targets, and making informed business decisions. Don’t just rely on broad market figures; drill down to your specific niche to get a more accurate picture.

Market Segmentation

Market segmentation involves dividing your broad target market into smaller, more manageable groups based on shared characteristics. This allows for more targeted marketing and product development. Think of it as dividing a giant pizza into slices, each with its own unique toppings and appeal. Different segments might respond better to different marketing messages and product features. For example, a company selling athletic wear might segment its market by activity level (beginner, intermediate, advanced), age group (teenagers, adults, seniors), or gender. By targeting specific segments with tailored marketing campaigns, you can maximize your return on investment and build stronger customer relationships.

Market Segment Comparison

| Segment Name | Size (estimated) | Growth Potential | Competitive Landscape |

|---|---|---|---|

| Eco-conscious millennials | 15 million | High (growing awareness of sustainability) | Highly competitive (many brands targeting this segment) |

| Budget-conscious families | 25 million | Moderate (sensitive to price fluctuations) | Moderately competitive (focus on value-for-money) |

| Health-conscious seniors | 10 million | Low (aging population, but slower growth) | Low (niche market with fewer competitors) |

| Luxury-seeking professionals | 5 million | High (growing disposable income) | Highly competitive (premium brands vying for market share) |

Market Research and Analysis

Entering a new market is like stepping onto a crowded dance floor – exciting, potentially lucrative, but also fraught with the risk of stepping on someone’s toes (or worse, getting trampled!). Thorough market research is your trusty dance instructor, guiding you through the steps and helping you avoid those awkward collisions. It’s the difference between a graceful waltz and a chaotic mosh pit.

Market research isn’t just about gathering data; it’s about understanding the rhythm and pulse of your chosen market. This involves scrutinizing the competitive landscape, deciphering industry trends, and identifying potential obstacles before they trip you up. Only then can you confidently strut your stuff (and your product) on the market stage.

Competitive Landscape Analysis

Understanding the competitive landscape involves identifying your main competitors, analyzing their strengths and weaknesses, and recognizing their market strategies. For example, imagine the fizzy drinks market: Coca-Cola and PepsiCo are giants, each employing vastly different marketing strategies. Coca-Cola often focuses on nostalgic campaigns, while PepsiCo might lean towards celebrity endorsements and trendy collaborations. Knowing these differences allows you to carve out your own unique niche, perhaps focusing on a healthier alternative or a specific demographic that the big players are overlooking. A thorough competitive analysis allows for informed decision-making, reducing the chances of head-on collisions with established players.

Industry Trend Analysis

Industry trends are the ever-shifting currents of the market. Failing to account for them is like trying to navigate a river without a map. Consider the rise of plant-based meat alternatives. This trend has dramatically altered the food industry, forcing established meat producers to adapt or risk being left behind. Analyzing these trends helps you predict future market demands, allowing you to anticipate changes and adapt your strategies proactively. For instance, if sustainability is a growing concern, showcasing your company’s eco-friendly practices could be a significant competitive advantage.

Barriers to Entry Evaluation

Every market has its gatekeepers. These barriers to entry can range from hefty capital requirements (think the cost of launching a new satellite versus starting a lemonade stand) to stringent regulations (like FDA approvals for pharmaceuticals). Identifying these obstacles early is crucial. For instance, the pharmaceutical industry necessitates extensive research and development, rigorous clinical trials, and navigating complex regulatory hurdles before a new drug can reach the market. This requires significant financial investment and a long-term commitment. Understanding these barriers helps you prepare realistically and determine the feasibility of your market entry strategy.

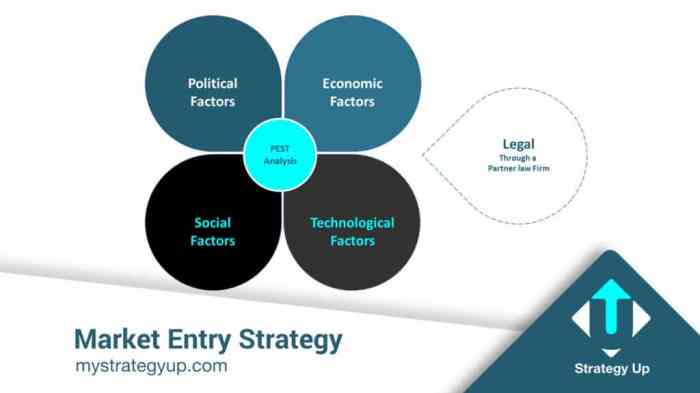

SWOT Analysis

A SWOT analysis is your personal market compass, helping you navigate the complexities of the market. It involves identifying your company’s internal Strengths and Weaknesses, as well as the external Opportunities and Threats. For example, a startup with innovative technology (strength) might face intense competition from established players (threat), but also benefit from a growing demand for sustainable products (opportunity). A clear SWOT analysis provides a holistic overview, allowing you to leverage your strengths, mitigate your weaknesses, capitalize on opportunities, and prepare for potential threats. It’s a crucial step in formulating a well-informed and resilient market entry strategy.

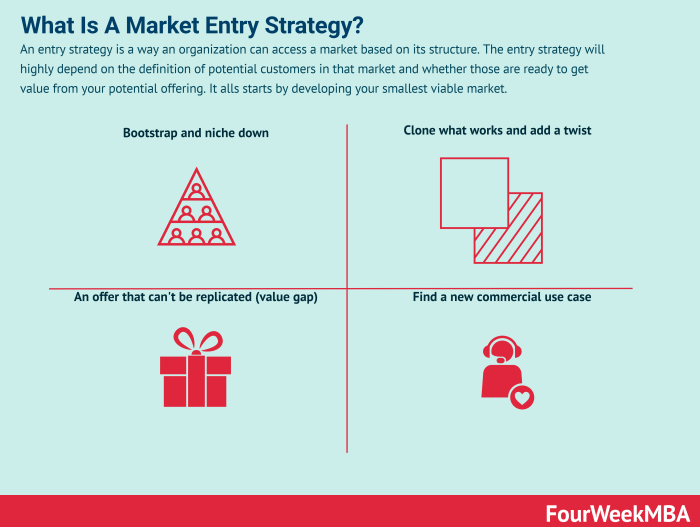

Choosing a Market Entry Strategy

So, you’ve conquered the treacherous terrain of defining your target market and meticulously researched your prospective playground. Congratulations! Now comes the thrilling, slightly terrifying part: choosing your market entry strategy. Think of it as choosing your weapon in a business battle – the wrong choice could leave you with egg on your face (and a depleted bank account). Let’s arm you with the knowledge to make the right call.

Choosing the optimal market entry strategy is crucial for success. The decision hinges on a complex interplay of factors including your company’s resources (financial muscle, personnel prowess, existing infrastructure), the target market’s characteristics (size, accessibility, regulatory environment), and your overall business objectives (market share dominance, rapid growth, or a slow and steady approach). Get this wrong, and your global expansion dreams might turn into a global expansion nightmare.

Market Entry Strategy Comparison

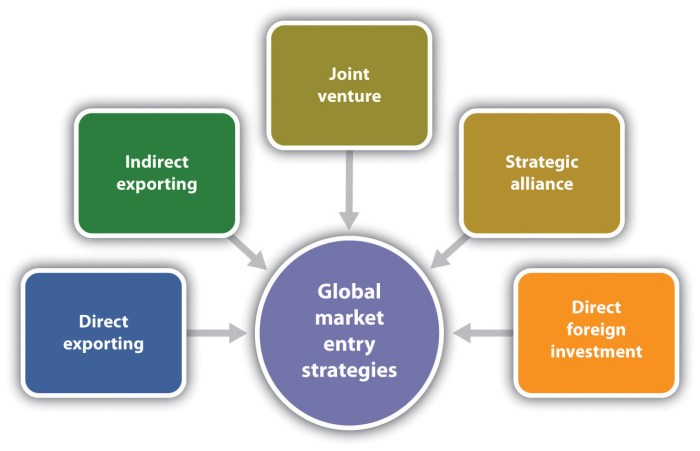

Several primary market entry strategies exist, each with its own unique set of advantages and disadvantages. Let’s pit them against each other in a friendly (but fiercely competitive) showdown.

| Strategy | Advantages | Disadvantages |

|---|---|---|

| Exporting | Low initial investment, minimal risk, easy to implement. | High transportation costs, tariffs and trade barriers, limited control over distribution. Think of trying to ship a container of oversized inflatable flamingos across the Atlantic – the logistical headache is real! |

| Joint Ventures | Shared resources and risk, access to local knowledge and expertise, faster market entry. | Potential conflicts with partners, loss of some control, sharing profits. Imagine trying to manage a business with a partner who insists on using only mime-based communication – charming, but potentially problematic. |

| Direct Investment (Foreign Direct Investment or FDI) | Maximum control, potential for high profits, strong brand presence. | High initial investment, high risk, complex regulatory hurdles. Think of building a massive, ornate castle in a foreign land – breathtaking, but potentially a financial and bureaucratic labyrinth. |

| Franchising | Rapid expansion, lower risk compared to direct investment, leveraging existing brand recognition. | Less control over franchisees, potential for brand dilution, franchise fees. Picture this: Your amazing cupcake franchise suddenly starts selling questionable meat-flavored cupcakes – not ideal for brand consistency. |

Decision Matrix for Market Entry Strategy Selection

A decision matrix provides a structured approach to weighing the pros and cons of each strategy based on your specific circumstances. Here’s a simplified example:

| Criterion | Weight | Exporting | Joint Venture | Direct Investment | Franchising |

|---|---|---|---|---|---|

| Initial Investment | 0.3 | 5 | 3 | 1 | 4 |

| Risk | 0.2 | 5 | 3 | 1 | 4 |

| Control | 0.25 | 2 | 3 | 5 | 3 |

| Market Access | 0.25 | 3 | 4 | 5 | 4 |

| Weighted Score | 3.875 | 3.375 | 3.625 | 3.875 |

(Note: Scores are hypothetical, ranging from 1 (low) to 5 (high). Weights reflect the relative importance of each criterion for your company. You would need to adjust these based on your specific situation.)

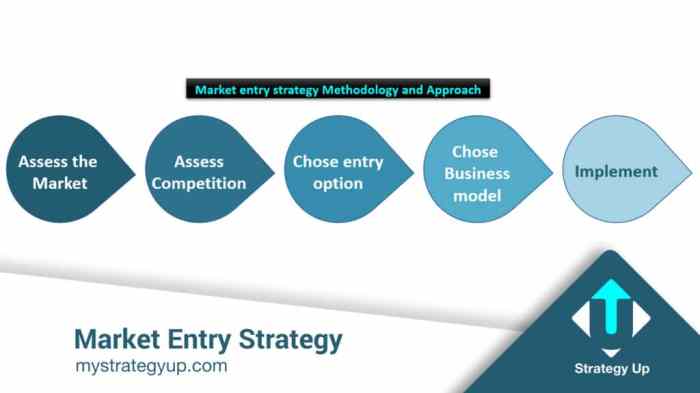

Implementing Your Chosen Market Entry Strategy

Once you’ve carefully weighed your options and made your decision, implementing your chosen strategy requires a well-defined plan.

The steps involved can vary significantly depending on the strategy, but generally include:

- Market Research and Analysis Refinement: Further investigation focusing on the chosen market and entry method.

- Legal and Regulatory Compliance: Navigating the complex legal and regulatory landscape of your target market. This may involve securing necessary permits and licenses.

- Resource Allocation: Determining the financial and human resources needed for successful implementation.

- Partner Selection (if applicable): Choosing the right partners for joint ventures or franchises – a crucial step for success.

- Operational Setup: Establishing the necessary infrastructure, including distribution channels, logistics, and customer service.

- Marketing and Sales Strategy: Developing a comprehensive marketing and sales plan tailored to the target market.

- Ongoing Monitoring and Evaluation: Continuously tracking key performance indicators (KPIs) and making necessary adjustments.

Developing a Marketing and Sales Plan

Launching a product into a new market is like throwing a party – you need a plan, and not just a vague idea of “let’s have fun.” A robust marketing and sales plan is your invitation list, your decorations, and your carefully curated playlist all rolled into one. Without it, you’re just hoping people show up. And hoping isn’t a strategy.

A comprehensive marketing and sales plan bridges the gap between your brilliant product and your ideal customer. It’s the roadmap guiding your efforts, ensuring you reach the right people with the right message at the right time. Failing to plan is planning to fail, as the old adage (slightly paraphrased) goes. So let’s get planning!

Target Audience, Messaging, and Channels

Defining your target audience is crucial. Think of it as identifying your VIP guests. Who are they? What are their needs, pain points, and aspirations? Once you know your audience intimately, crafting compelling messaging becomes much easier. Imagine sending out invitations to a rock concert to a group of opera enthusiasts – it’s a recipe for disaster! Your message needs to resonate with your target audience, speaking directly to their needs and desires. This might involve adapting your messaging for different channels. For example, a short, snappy video might work well on TikTok, while a detailed blog post might be more effective on LinkedIn. Understanding your audience informs your channel selection.

Sales Strategy and Customer Conversion

Your sales strategy Artikels how you will acquire customers. Will you rely on a direct sales force, a network of distributors, or a purely online approach? Each method requires a different set of skills, resources, and investment. Consider your target audience again – how do they prefer to be contacted? Do they respond to email marketing, social media ads, or personal calls? Converting leads into customers involves a multi-step process, often including nurturing leads through email sequences, offering free trials or demos, and providing exceptional customer service. Think of it as guiding your guests through a delightful experience, ensuring they want to come back for more.

Examples of Successful Marketing Campaigns

Let’s look at some real-world examples. Consider Dollar Shave Club’s viral video campaign, which used humor and directness to quickly gain traction. Their initial video, with its low-budget production and irreverent tone, perfectly targeted their male demographic and went viral, establishing their brand and driving sales. Alternatively, consider the success of Dove’s “Real Beauty” campaign, which resonated deeply with women by promoting body positivity and inclusivity. This demonstrated that focusing on emotional connection and societal values can be highly effective. These examples highlight the importance of understanding your audience and crafting a message that aligns with their values and preferences.

Projected Timeline for Implementation, Market Entry Strategies Guide

Creating a timeline is essential for staying on track. Break down your marketing and sales plan into manageable tasks with specific deadlines. For example, you might allocate two months to market research, one month to develop your marketing materials, and another month to launch your campaign. Regularly review your progress and adjust your timeline as needed. Think of it as setting up a detailed schedule for your party – you wouldn’t want the band to show up before the guests arrive! A well-defined timeline helps you manage resources effectively and ensures a smooth launch.

Financial Projections and Funding

Entering a new market isn’t just about a brilliant idea and a catchy slogan; it’s about the cold, hard cash. This section dives into the slightly less glamorous, but undeniably crucial, world of financial projections and securing the funds to make your market entry a resounding success (and not a spectacular failure). We’ll navigate the treacherous waters of startup costs, operating expenses, and, dare we say it, profit.

Financial projections are your roadmap to profitability. They’re not just numbers on a page; they’re your story of success, meticulously planned and convincingly presented to potential investors or lenders. Think of them as a persuasive business novel, with charts and graphs as the exciting illustrations. A well-crafted financial projection demonstrates not only your understanding of the market but also your ability to manage resources effectively. This, in turn, increases your chances of securing the necessary funding.

Startup Costs

Startup costs represent the initial investment required to launch your operations in the new market. This includes expenses such as market research, legal fees, permits and licenses, initial inventory, equipment purchases, and marketing materials. For example, a company launching a new line of organic dog treats might need to invest in a commercial kitchen, packaging equipment, and initial marketing campaigns targeting pet owners. A realistic estimate, based on their research, might be $50,000. This figure should be broken down into specific line items in your financial projection.

Operating Expenses

Operating expenses are the ongoing costs associated with running your business in the new market. These recurring expenses include rent, utilities, salaries, marketing and advertising, and transportation. Consider a tech startup launching a new software-as-a-service (SaaS) product. Their operating expenses might include server costs, employee salaries (developers, marketing, sales), and ongoing marketing campaigns to acquire new subscribers. A realistic estimate for their first year might be $200,000, again broken down into detailed categories.

Revenue Forecasts

Revenue forecasts project your expected income over a specific period. These forecasts are based on your market research, sales projections, and pricing strategy. They are crucial for demonstrating the potential return on investment (ROI) to investors or lenders. For instance, our organic dog treat company might project sales of $100,000 in the first year, increasing to $250,000 in year three, based on their anticipated market share and growth projections. This should be supported by market data and a clear explanation of the sales strategy.

Funding Sources

Securing funding is essential for most market entry strategies. Potential sources include bootstrapping (using personal savings), angel investors (high-net-worth individuals), venture capitalists (investment firms), bank loans, and government grants. Each source has its own requirements and expectations. For example, venture capitalists often look for high-growth potential and a strong management team, while bank loans require a detailed business plan and strong financial history.

Return on Investment (ROI) Strategy

A clear ROI strategy is essential for attracting investors and demonstrating the viability of your market entry plan. This involves outlining how your business will generate profits and how investors will recoup their investment. A realistic ROI strategy might involve achieving profitability within two years, with a projected return of 20% annually thereafter. This should be clearly illustrated in your financial model.

Financial Model (3-Year Projection)

Here’s a simplified financial model illustrating key financial metrics over a 3-year period. Remember, this is a simplified example, and a real-world model would be far more detailed.

| Year | Revenue | Operating Expenses | Net Income |

|---|---|---|---|

| 1 | $100,000 | $80,000 | $20,000 |

| 2 | $150,000 | $90,000 | $60,000 |

| 3 | $250,000 | $120,000 | $130,000 |

Remember, accurate financial projections are critical for securing funding and achieving success in your new market. Don’t underestimate the power of detailed planning and a compelling narrative.

Legal and Regulatory Considerations: Market Entry Strategies Guide

Entering a new market is exciting, like a thrilling rollercoaster ride! But before you scream with delight, remember the safety bars – those are your legal and regulatory requirements. Navigating this landscape can be tricky, but with careful planning, you can avoid a head-spinning legal headache. This section will equip you with the knowledge to steer clear of regulatory roadblocks and keep your business on the right track.

Successfully launching your product or service in a foreign market hinges on understanding and adhering to the local legal and regulatory framework. Ignoring these aspects can lead to hefty fines, legal battles, and even the complete shutdown of your operations. Think of it as following the rules of the game – if you don’t, you can’t win, and might even get ejected from the field!

Relevant Legal and Regulatory Requirements

The specific legal and regulatory requirements vary wildly depending on your industry, the target market, and the nature of your business. For example, food and beverage companies face significantly different regulations than software companies. In some countries, obtaining necessary permits can be a relatively straightforward process, while in others, it might involve navigating a complex bureaucratic maze. This necessitates thorough research tailored to your specific situation. Imagine trying to sell artisanal cheese in France without the proper certifications – it would be *fromage-tastically* difficult!

Necessary Permits and Licenses

Before you even think about selling your product, you’ll need the proper documentation. This could include business licenses, import/export permits, tax registration numbers, and industry-specific certifications. Failing to secure these can lead to immediate operational paralysis. It’s like trying to drive a car without a license – it’s not going to end well.

- Business License: This is the fundamental document proving your legal right to operate.

- Import/Export Permits: Essential for cross-border trade, these permits ensure compliance with customs regulations.

- Tax Registration: Avoid significant tax penalties by registering your business with the relevant tax authorities.

- Industry-Specific Certifications: Depending on your industry (e.g., food safety, medical devices), specific certifications might be mandatory.

Potential Legal Risks and Mitigation Strategies

Legal risks can range from minor infringements to major legal battles. Understanding these risks and implementing mitigation strategies is crucial. A proactive approach is far better than a reactive one – think of it as preventative medicine for your business.

- Intellectual Property Infringement: Protect your trademarks, patents, and copyrights to avoid costly legal disputes. Regularly review your IP portfolio and consider registering your IP in your target market.

- Data Privacy Violations: Ensure compliance with data protection laws (e.g., GDPR) to avoid hefty fines and reputational damage. Implement robust data security measures and clearly communicate your data privacy policy.

- Contractual Disputes: Draft clear and comprehensive contracts with suppliers, distributors, and customers to minimize the risk of disagreements. Seek legal counsel when needed.

Legal and Regulatory Compliance Checklist

A well-structured checklist is your best friend in ensuring legal compliance. This should be a living document, regularly reviewed and updated as laws and regulations change.

- Identify all relevant laws and regulations in your target market.

- Determine the necessary permits and licenses.

- Apply for and obtain all required permits and licenses.

- Develop and implement compliance procedures.

- Regularly review and update your compliance program.

- Seek legal counsel when necessary.

Operational Plan and Logistics

Launching a product or service into a new market is like sending a rocket to the moon – it requires meticulous planning and a flawlessly executed operational plan. Ignoring the nitty-gritty of logistics can lead to a spectacular (and expensive) crash landing. This section will guide you through building a robust operational plan, ensuring your product reaches your customers smoothly and efficiently.

Your operational plan is the backbone of your market entry strategy, detailing how you’ll get your product from inception to the hands of your delighted customers. It encompasses everything from sourcing raw materials (or developing your service infrastructure) to final delivery, including warehousing, inventory management, and distribution channels. A well-defined plan minimizes delays, reduces costs, and ensures customer satisfaction – three crucial ingredients for market success. Think of it as your product’s personal sherpa, guiding it safely to the summit of market dominance.

Supply Chain Management

Efficient supply chain management is the lifeblood of any successful market entry. It involves strategically managing the flow of goods and services, from origin to final destination. This includes sourcing raw materials, manufacturing (or service provision), warehousing, inventory management, and transportation. A robust supply chain ensures consistent product availability, minimizes disruptions, and optimizes costs. Consider the complexities – imagine a global tech company launching a new smartphone; they need to coordinate component sourcing from multiple countries, assembly in a designated factory, and a complex global distribution network to get the phone to consumers.

Distribution Channels

Choosing the right distribution channels is paramount. This involves determining how your product or service will reach your target market. Options include direct sales (e.g., your own online store or retail outlets), indirect sales (e.g., wholesalers, distributors, retailers), or a hybrid approach. The optimal strategy depends on factors such as your target market, product characteristics, and budget. For example, a high-end luxury brand might focus on exclusive boutiques and online flagship stores, while a mass-market product might utilize a wider network of retailers and online marketplaces.

Examples of Successful Supply Chain Strategies

Several companies have demonstrated exceptional supply chain prowess. Zara, the Spanish fashion retailer, is renowned for its fast-fashion model, which utilizes a highly responsive supply chain to quickly adapt to changing trends. They maintain close relationships with suppliers, employ efficient logistics, and minimize lead times, ensuring that the latest styles reach stores quickly. Another example is Amazon, which has built a massive and incredibly complex logistics network that allows them to deliver products to customers around the globe with remarkable speed and efficiency. Their investment in technology and infrastructure has enabled them to become a global e-commerce leader.

Operational Process Flowchart

A visual representation of your operational process helps clarify the steps involved and identify potential bottlenecks. Imagine a flowchart, starting with raw material sourcing or service development at the left, progressing through manufacturing/service delivery, quality control, warehousing, order fulfillment, shipping, and finally, customer delivery at the right. Each stage would be a box, with arrows showing the flow between stages. This visual representation would be extremely useful for planning, monitoring, and identifying areas for improvement. For instance, a delay in shipping might highlight a need for a more efficient logistics partner.

Risk Management and Contingency Planning

Entering a new market is like tightrope walking – exhilarating, potentially lucrative, and terrifyingly close to a very hard landing. Proper risk management isn’t about avoiding the tightrope; it’s about having a safety net (and maybe a really good balance beam instructor). This section will equip you with the tools to identify potential pitfalls, devise clever escape routes (contingency plans), and generally make your market entry less of a heart-stopping adventure and more of a carefully orchestrated triumph.

Potential Risks Associated with Market Entry

Launching a product or service into an unfamiliar market presents a multitude of potential challenges. Ignoring these risks is akin to setting sail without a map – you might stumble upon a treasure island, but the chances of hitting a reef are significantly higher. Let’s examine some common threats, ranging from the mildly inconvenient to the potentially catastrophic.

Developing Contingency Plans

A contingency plan isn’t just a “Plan B”; it’s a series of “Plan Bs,” “Cs,” and even “Ds,” anticipating various scenarios and providing solutions for each. Think of it as a well-stocked emergency kit for your business, filled with solutions for everything from minor supply chain hiccups to full-blown economic downturns. The key is to be proactive, identifying potential problems *before* they become crises.

Strategies for Mitigating Risks and Ensuring Business Continuity

Mitigating risks involves reducing the likelihood or impact of potential problems. This could involve anything from diversifying your supply chain to building strong relationships with local partners. Ensuring business continuity focuses on maintaining operations even in the face of unexpected challenges. This might include having backup systems, securing alternative funding sources, or developing a crisis communication plan. Remember, a well-prepared business is a resilient business.

Risk Assessment Table

A comprehensive risk assessment is crucial. Below is a table outlining some common market entry risks, their likelihood, impact, and suggested mitigation strategies. Remember, these are just examples; your specific risks will depend on your industry, target market, and chosen entry strategy.

| Risk | Likelihood | Impact | Mitigation Strategy |

|---|---|---|---|

| Regulatory hurdles (e.g., licensing, permits) | High (depending on the market) | High (delays, increased costs) | Thorough pre-entry legal research; engaging local legal counsel; building relationships with regulatory bodies. |

| Competition | Medium to High (depending on the market) | Medium to High (reduced market share, lower profitability) | Competitive analysis; differentiation strategy; strong marketing and branding; agile adaptation to market dynamics. |

| Economic downturn in target market | Low to Medium (depending on global and local economic conditions) | High (reduced sales, potential losses) | Diversification of markets; financial reserves; flexible pricing strategies; cost-cutting measures. |

| Cultural misunderstandings | Medium | Medium (marketing failures, damaged reputation) | Cultural sensitivity training for staff; local market research; adapting marketing materials to local preferences. |

| Supply chain disruptions | Medium to High (depending on global events and infrastructure) | Medium to High (production delays, stockouts) | Diversified sourcing; strong supplier relationships; contingency plans for alternative suppliers; robust inventory management. |

Post-Entry Strategy and Evaluation

So, you’ve conquered the market entry beast! Congratulations! But the adventure doesn’t end there. Think of this post-entry phase as the exciting sequel, filled with thrilling plot twists (market fluctuations), unexpected cameos (new competitors), and the ever-present challenge of keeping your audience engaged (customers). A robust post-entry strategy is your map to navigating this exciting, and sometimes chaotic, new world.

This section details how to monitor your market performance, adjust your strategies as needed, and ultimately, ensure your triumphant reign as market leader (or at least a comfortable player). We’ll explore key performance indicators (KPIs), the evaluation process, and strategies for adapting to those inevitable market shifts. Let’s dive in!

Key Performance Indicators (KPIs) for Measuring Success

Selecting the right KPIs is crucial for effective market performance monitoring. These metrics provide quantifiable insights into your progress and help identify areas needing attention. Think of them as your secret weapons in the battle for market share. Choosing the wrong KPIs is like navigating with a faulty compass – you might end up somewhere unexpected (and undesirable).

- Market Share: This classic KPI tracks your portion of the overall market. A rise in market share signifies success, while a decline might signal the need for strategic adjustments.

- Customer Acquisition Cost (CAC): This measures how much it costs to acquire a new customer. A high CAC might indicate inefficient marketing or a need to refine your targeting.

- Customer Lifetime Value (CLTV): This metric estimates the total revenue a customer will generate throughout their relationship with your business. A high CLTV shows strong customer loyalty and profitable customer relationships.

- Return on Investment (ROI): This fundamental KPI measures the profitability of your market entry strategy. A positive ROI is the ultimate sign of success, while a negative ROI screams for immediate action.

- Brand Awareness and Perception: While less easily quantifiable, tracking brand awareness (through surveys, social media monitoring, etc.) and customer perception (through feedback mechanisms) provides crucial qualitative data.

Evaluating the Effectiveness of the Market Entry Strategy

Regular evaluation is vital; it’s not just about celebrating wins, but also about learning from setbacks. This involves a systematic process of comparing your actual results against your initial projections. Think of it as a post-battle debrief, where you analyze what worked, what didn’t, and what you can improve for the next campaign.

This evaluation should encompass a comprehensive review of your initial market entry plan, examining each component (marketing, sales, operations, etc.) against the KPIs Artikeld above. Significant deviations from projections should trigger a deeper dive into the underlying causes, prompting necessary adjustments to your strategy. For instance, if your sales figures are significantly lower than projected, you might need to reassess your pricing, marketing channels, or product positioning.

Strategies for Adapting to Changing Market Conditions

The market is a dynamic beast; it’s constantly evolving, presenting both opportunities and threats. A successful market entry strategy must be adaptable and resilient. Think of your strategy as a living document, constantly updated and refined based on market feedback and emerging trends.

One approach is to implement a continuous monitoring system that tracks key market indicators, such as competitor actions, technological advancements, and shifts in consumer preferences. This allows for proactive adjustments rather than reactive fire-fighting. For example, a sudden surge in competitor activity might necessitate a reassessment of your pricing or marketing campaigns. Similarly, shifts in consumer preferences could require adjustments to your product offerings or marketing messages. Flexibility and responsiveness are key to navigating these unpredictable waters.

Closure

Entering a new market is a thrilling adventure, a high-stakes gamble with potentially enormous rewards. This guide has provided a roadmap, equipping you with the knowledge and tools to navigate the complexities involved. Remember, thorough planning, adaptable strategies, and a dash of audacious optimism are your best allies. So, go forth, conquer (or at least make a significant dent in) that market, and may your profits be as abundant as your ambition. Now, go get ’em, tiger!

Quick FAQs

What if my chosen market entry strategy fails?

Don’t panic! Thorough risk assessment and contingency planning are crucial. Failure isn’t the end; it’s a valuable learning experience. Analyze what went wrong, adapt your strategy, and try again – or pivot to a different approach. Remember, even the most successful entrepreneurs have faced setbacks.

How do I secure funding for my market entry?

Explore various avenues, including angel investors, venture capital, bank loans, crowdfunding, and government grants. A well-structured business plan demonstrating strong potential ROI is essential to attracting investors. Be prepared to pitch your vision convincingly!

What are some common legal pitfalls to avoid?

Thorough legal research is paramount. Consult with legal experts specializing in international business and the specific regulations of your target market. Ignoring legal requirements can lead to hefty fines and reputational damage. Better safe than sorry (and bankrupt).