Market Research Findings Report: Prepare to be amazed! This isn’t your grandpappy’s dusty data dump. We’re diving headfirst into a world of charts, graphs, and surprisingly insightful conclusions – all gleaned from the thrilling realm of market research. Forget dry statistics; we’re talking actionable intelligence that’ll make your business decisions sing (and maybe even dance a little jig).

This report meticulously unpacks the process of conducting, analyzing, and presenting market research findings. From defining the scope and choosing appropriate methodologies to crafting compelling visuals and drawing impactful conclusions, we’ll cover it all. We’ll even tackle those pesky biases that try to sneak into your data – because nobody likes a biased report, do they?

Defining the Scope of the Report: Market Research Findings Report

So, you’ve got a mountain of market research data – congratulations! Now, the Herculean task begins: transforming that raw data into a digestible, insightful report that doesn’t send your readers into a coma. Fear not, intrepid researcher! This section Artikels the essential components and structures to make your report a shining beacon of market wisdom (or at least, a well-received document).

This report will delve into the anatomy of a market research findings report, exploring its various types, target audiences, and the crucial information that must grace the pages (or pixels) of the executive summary. We’ll also take a whimsical look at different report structures, because even market research can benefit from a dash of creative flair. Think of it as a well-structured soufflé – light, airy, and impossible to ignore.

Typical Components of a Market Research Findings Report

A typical market research report, much like a well-organized pantry, contains several key ingredients. These include an executive summary (the delicious appetizer), a detailed methodology section (the recipe), findings and analysis (the main course), conclusions and recommendations (the satisfying dessert), and finally, appendices (the pantry’s hidden treasures). The executive summary, in particular, needs to be concise and impactful, like a perfectly crafted haiku. It should highlight the key findings, implications, and recommendations – leaving the reader wanting more (but not overwhelmed). The methodology section is crucial for establishing credibility; it’s the proof that your “recipe” is sound.

Types of Market Research Reports and Their Audiences

Market research reports come in various flavors, each tailored to a specific audience. We have the concise executive summary, perfect for busy CEOs who need the bottom line in a nutshell. Then there’s the comprehensive report, packed with detailed analysis, ideal for the data-hungry market analyst. A presentation-style report, short, sweet, and visually appealing, might be perfect for a board meeting. Finally, the specialized report, focusing on a niche area, caters to those with highly specialized needs. Think of it as choosing the right tool for the job – a Swiss Army knife for some, a high-powered laser for others.

Key Information Included in the Executive Summary

The executive summary is the VIP section of your report, the first (and sometimes only) part many readers will see. It must therefore be incredibly compelling. Imagine it as the trailer for a blockbuster movie – you need to grab the audience’s attention immediately! Key information includes a concise overview of the research objectives, a summary of the key findings (both positive and negative – honesty is the best policy!), the most significant implications for the business, and the top recommendations for action. Think of it as the CliffsNotes version of your research, but with significantly more impact.

Comparison of Various Report Structures

Different report structures can significantly impact readability and comprehension. A chronological structure, detailing events in the order they occurred, is excellent for illustrating a progression. A problem-solution structure, focusing on identifying a problem and then presenting solutions, is perfect for a persuasive report. A comparative structure, examining various options side-by-side, is ideal when decision-making is the goal. Finally, a geographical structure allows for a regional breakdown of findings.

| Report Structure | Strengths | Weaknesses | Best Suited For |

|---|---|---|---|

| Chronological | Easy to follow, shows progression | Can be lengthy, may lack focus | Tracking trends, process improvements |

| Problem-Solution | Clear, concise, persuasive | May oversimplify complex issues | Presenting recommendations, solving issues |

| Comparative | Facilitates decision-making, highlights differences | Can be overwhelming with too many options | Evaluating alternatives, making choices |

| Geographical | Provides regional insights, highlights variations | Can be complex with many regions | Analyzing regional market performance, tailoring strategies |

Data Collection and Methodology

Unraveling the mysteries of the marketplace requires a detective’s keen eye and, let’s be honest, a healthy dose of caffeine. Our journey into the heart of consumer behavior involved a multi-pronged approach, a veritable buffet of data-gathering techniques, each with its own strengths and, yes, even its quirks.

This section details the methods employed in our investigation, highlighting their respective advantages and disadvantages. We’ll also delve into the fascinating world of quantitative versus qualitative research, a debate as old as time itself (or at least as old as the first market research study). Prepare yourselves for a thrilling ride through the land of surveys, interviews, and focus groups!

Data Collection Methods

Our quest for consumer insights utilized a variety of data collection methods, each carefully selected to address specific research objectives. We deployed a strategy as diverse and captivating as a Netflix binge-watching session.

- Surveys: Think of surveys as the friendly, efficient mail carrier of the data world. They deliver information quickly and efficiently to a large number of respondents. However, like a poorly written email, they can suffer from low response rates and a tendency for respondents to answer superficially, leading to less insightful data. For example, a poorly designed survey about ice cream preferences might only capture basic flavor choices, missing out on crucial details like preferred toppings or eating occasions.

- Interviews: Interviews are like one-on-one conversations with your research participants – allowing for in-depth exploration of attitudes and beliefs. They offer rich qualitative data but are time-consuming and expensive, limiting the number of participants you can interview. Imagine interviewing just one person about their thoughts on electric cars; it’s highly detailed but lacks broad generalizability.

- Focus Groups: Focus groups are like a lively dinner party for your research participants, allowing for dynamic interaction and the exploration of shared opinions. However, the group dynamic can sometimes lead to dominant personalities overshadowing others, resulting in biased or incomplete insights. For instance, a focus group on a new video game might be dominated by experienced gamers, neglecting the perspective of casual players.

Quantitative vs. Qualitative Research

The age-old battle: quantitative versus qualitative research. It’s not about picking a winner; it’s about choosing the right tool for the job. Quantitative research, like a precise scalpel, focuses on numbers and statistical analysis, providing a broad overview of trends and patterns. Qualitative research, on the other hand, is more like a detective’s magnifying glass, focusing on the in-depth understanding of individual experiences and perspectives.

Quantitative research methods, such as surveys with closed-ended questions, deliver numerical data that can be statistically analyzed to identify trends and correlations. For example, analyzing survey data on coffee consumption might reveal a strong correlation between age and the amount of coffee consumed. Qualitative research, such as in-depth interviews, provides rich descriptive data that can help understand the ‘why’ behind those trends. For example, an interview might reveal that older people consume more coffee due to its stimulating effect, aiding in their daily routine. Often, a successful research project uses both approaches for a comprehensive view.

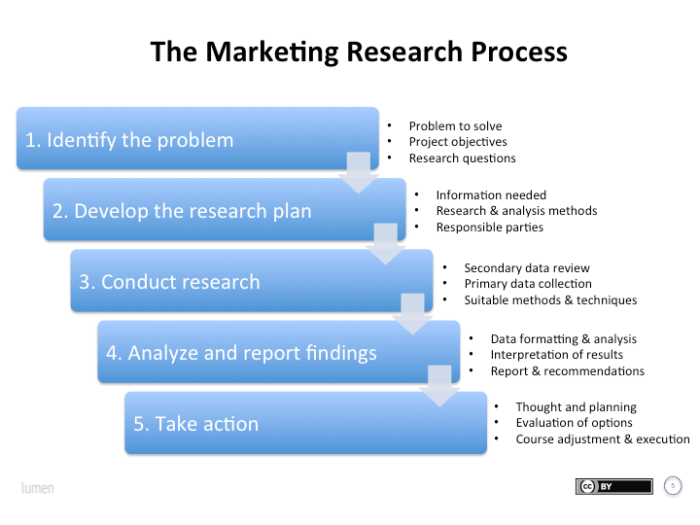

Steps in a Typical Market Research Project

Before we embark on our grand adventure, let’s Artikel the steps involved in a typical market research project. It’s a bit like following a recipe, but instead of a delicious cake, we get valuable market insights.

- Defining the Research Objectives: Clearly stating what you want to achieve is the first step. It’s like having a clear destination before starting a road trip.

- Developing the Research Design: Choosing the right methods is crucial. This is where we choose our weapons for the research battle.

- Data Collection: This is where the real work begins – gathering the information needed.

- Data Analysis: Making sense of all that data. It’s like finding the hidden gems in a treasure chest.

- Report Writing and Presentation: Sharing the findings in a clear and concise way. It’s the grand finale of our research performance.

Data Presentation and Visualization

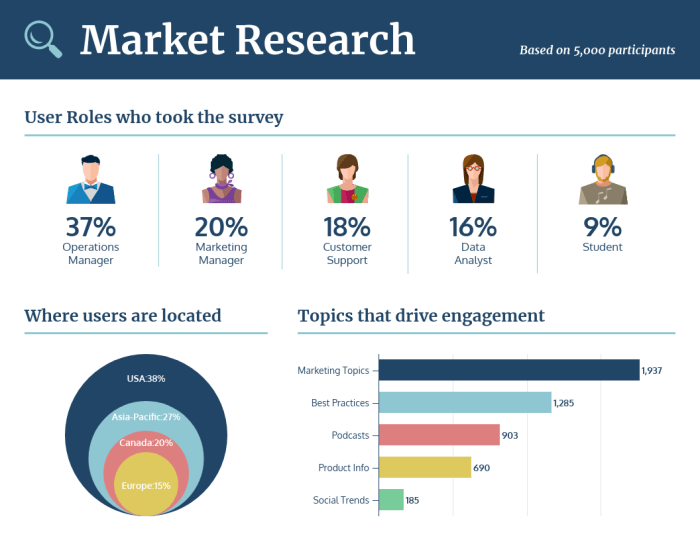

Let’s face it, data can be drier than a week-old cracker. But fear not, dear reader! We’re here to transform those raw numbers into a visual feast that would make even the most data-averse individual reach for a second helping. This section delves into the art (yes, art!) of presenting our market research findings in a way that’s both informative and engaging – think infographics, but with less cheesy stock photos.

Effective techniques for visually representing complex data are crucial for clear communication. A well-designed visualization can illuminate trends, highlight outliers, and tell a compelling story far more effectively than a wall of text ever could. We’ll avoid the infamous “death by PowerPoint” scenario at all costs.

Chart and Graph Selection for Optimal Data Representation

Choosing the right chart or graph is paramount. Pie charts are perfect for showing proportions of a whole (think market share), while bar charts excel at comparing different categories. Line graphs are ideal for displaying trends over time, revealing the ebb and flow of consumer interest (or perhaps, the rollercoaster ride of quarterly sales). Scatter plots can reveal correlations between variables, potentially uncovering hidden relationships that would otherwise remain buried in the data. For geographic data, maps are indispensable, allowing us to visualize regional variations in customer behavior. Remember, the goal is clarity – choose the visualization that best tells the story, not the one that looks the fanciest.

Data Labeling and Annotation: The Unsung Heroes of Clarity, Market research findings report

Clear and concise labeling is not merely a good idea; it’s a necessity. Imagine a delicious cake, but with no labels on the ingredients. Would you know what you were eating? Probably not. Similarly, unlabeled charts and graphs are essentially culinary disasters in the world of data. Axis labels should be explicit, units should be clearly stated, and any relevant annotations should be included to provide context and highlight important findings. We want our audience to understand the data, not to decipher it like a cryptic crossword puzzle.

Using Visual Aids to Highlight Key Findings and Trends

Visual aids are your secret weapons for emphasizing key takeaways. Use color strategically to draw attention to significant trends or outliers. Consider employing annotations, callouts, or even small icons to pinpoint specific data points of interest. A well-placed arrow can be worth a thousand words (or at least a hundred data points). Remember, the goal is to guide the reader’s eye to the most important information, making the key findings undeniably clear.

Visual Representation of Customer Demographics and Purchasing Behavior

Imagine a scatter plot. The X-axis represents age (categorized into age ranges, such as 18-24, 25-34, etc.). The Y-axis represents average spending per month on our product. Each point on the graph represents a customer segment. We might observe a cluster of points in the higher spending range concentrated in the 25-34 age bracket, suggesting this demographic is our most valuable customer segment. Another cluster might show lower spending in the 18-24 age bracket, indicating a potential need for targeted marketing strategies to increase engagement in this younger demographic. The visual representation would clearly illustrate the relationship between age and spending, highlighting areas for growth and areas where our product already resonates. This visual could then be further segmented by other demographic factors like income or location, painting an even more comprehensive picture.

Interpreting Key Findings

Unraveling the mysteries hidden within our market research data – it’s like being a detective, but instead of solving murders, we’re solving the puzzle of consumer behavior. And let’s be honest, sometimes that’s even more thrilling (and less messy). This section dives into the art (yes, art!) of interpreting our findings, transforming raw numbers into actionable strategies that’ll make your marketing team sing.

Interpreting market research data requires a delicate balance of analytical prowess and a healthy dose of skepticism. It’s easy to fall into the trap of seeing what you want to see, but rigorous interpretation ensures our conclusions are as solid as a well-built marketing campaign. This involves identifying crucial factors, navigating potential biases, and transforming raw data into strategic insights – all while keeping a sense of humor (because let’s face it, market research can be hilariously unpredictable).

Crucial Factors in Data Interpretation

When interpreting our data, several key factors demand our attention. Ignoring them is like trying to bake a cake without flour – it’s just not going to work. First, we need to consider the sample size and its representativeness of the target population. A tiny sample size can lead to wildly inaccurate conclusions. Second, the methodology used in data collection is paramount. A flawed methodology will taint even the most meticulously analyzed results. Finally, context is king. Understanding the broader market trends and competitive landscape helps us put our findings into perspective and avoid drawing overly simplistic conclusions. Think of it as the difference between reading a single tea leaf and understanding the entire tea ceremony.

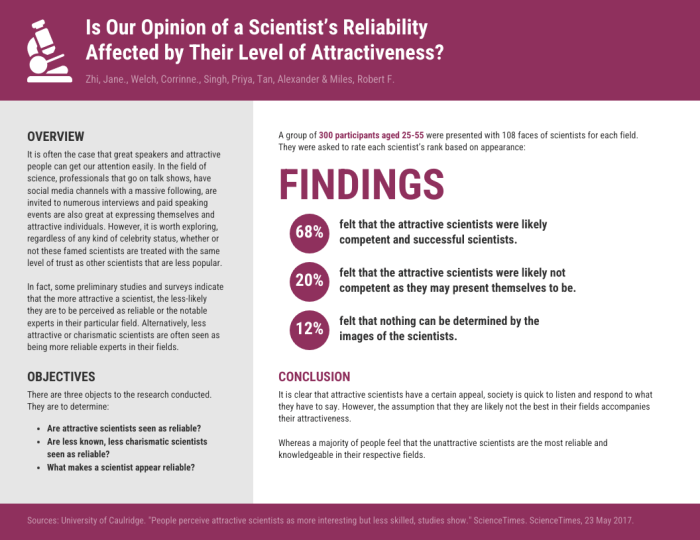

Avoiding Common Biases in Data Analysis

Bias is the uninvited guest at every data party, silently distorting our perception. Confirmation bias, for example, is the sneaky tendency to favor information that confirms our pre-existing beliefs. Imagine believing your new product will be a smash hit and then only focusing on positive feedback while ignoring the negative reviews – disaster! To combat this, we need to actively seek out dissenting opinions and challenge our assumptions. Another common culprit is sampling bias, where our sample doesn’t accurately reflect the population. For instance, conducting a survey only in wealthy neighborhoods to understand the preferences of a city’s entire population is bound to give misleading results. By employing rigorous sampling techniques and using diverse data sources, we can minimize the impact of these biases.

Translating Raw Data into Actionable Insights

Raw data is the unrefined ore; actionable insights are the gleaming gold. The transformation involves careful analysis and creative interpretation. For instance, if our survey reveals that 70% of respondents prefer eco-friendly packaging, that’s not just a number; it’s a mandate to prioritize sustainable packaging options. Similarly, if competitor analysis reveals a gap in the market for a specific product feature, that’s our opportunity to innovate and capture market share. The key is to connect the dots, identifying patterns and trends that point towards strategic actions. Consider a scenario where data reveals a significant increase in online purchases during evenings. This insight could lead to optimizing online marketing campaigns and customer service availability during those hours.

Presenting Findings Informatively and Persuasively

Presenting findings is more than just displaying charts and graphs; it’s about telling a compelling story with data as the protagonist. A clear, concise narrative, supported by visually appealing charts and graphs, is essential. We need to avoid overwhelming the audience with technical jargon and focus on communicating key takeaways in a way that resonates. Think of it as a well-crafted marketing pitch, except the product is our research findings. For example, instead of simply stating “Customer satisfaction scores are down,” we could say “Customer satisfaction scores have decreased by 15% since the last quarter, primarily due to delays in order fulfillment. This suggests an urgent need to optimize our logistics processes.” This approach makes the findings more engaging and immediately actionable.

Report Structure and Formatting

Crafting a market research report that’s both informative and engaging is a delicate balancing act, akin to juggling flaming bowling pins while riding a unicycle. But fear not, dear reader! With the right structure and formatting, your report will be a masterpiece, not a mangled mess.

This section details the optimal structure and formatting for presenting your market research findings in a clear, concise, and (dare we say it?) exciting manner. We’ll cover everything from the table of contents to the stylistic nuances that transform data into a compelling narrative.

Sample Table of Contents

A well-structured table of contents is the roadmap to your report’s success. It allows readers to quickly navigate to the information they need, preventing them from getting lost in a sea of data (a fate worse than being stuck in a never-ending PowerPoint presentation).

| Section | Page |

|---|---|

| Executive Summary | 1 |

| Defining the Scope of the Report | 2 |

| Data Collection and Methodology | 4 |

| Data Presentation and Visualization | 7 |

| Interpreting Key Findings | 12 |

| Report Structure and Formatting | 18 |

| Appendix (if applicable) | 20 |

Purpose and Content of Each Section

Each section plays a crucial role in the overall narrative. The Executive Summary provides a concise overview of the key findings. The Methodology section explains how the data was collected and analyzed, building trust and transparency. The Data Presentation section showcases the findings visually, using charts and graphs to make complex information easily digestible. The Interpreting Key Findings section delves deeper into the implications of the results, offering insights and recommendations. The Appendix (if included) provides supplementary information, like detailed questionnaires or raw data.

Best Practices for Writing Clear, Concise, and Engaging Report Text

Writing a market research report shouldn’t be a punishment; it should be an opportunity to showcase your analytical prowess and storytelling skills. Avoid jargon, use active voice, and break up large blocks of text with headings, subheadings, and visuals. Think of your readers as busy executives who need to grasp the essence of your findings quickly. Use strong verbs, avoid passive voice, and maintain a consistent tone throughout the report. A touch of humor, where appropriate, can also make your report more memorable (but always maintain professionalism!).

Formatting and Style Guidelines

Consistency is key. Use a professional font (like Times New Roman or Arial), a clear and consistent font size (12pt is generally recommended), and sufficient white space to make the report easy to read. Use numbered lists for sequential steps and bulleted lists for non-sequential items. Maintain consistent heading styles and levels, and ensure all tables and figures are clearly labeled and referenced in the text. A consistent citation style should be employed for credibility. For example, use APA or MLA style consistently. Consider using a template provided by your organization or a reputable style guide to ensure consistency and professionalism.

Recommendations and Next Steps

Our market research, a thrilling expedition into the consumer psyche (and frankly, a bit of a rollercoaster), has yielded some fascinating – and frankly, actionable – results. We’ve uncovered hidden desires, unearthed unexpected trends, and even stumbled upon a few marketing unicorns (mostly metaphorical, unfortunately). Now it’s time to translate these insights into tangible strategies that will propel our brand to new heights, or at least, to a slightly higher market share. This section Artikels recommendations, their communication, implementation, and future research needs.

Effectively communicating recommendations requires more than just a data dump; it’s about weaving a compelling narrative that resonates with stakeholders. Think of it as pitching a blockbuster movie, except instead of explosions, we have statistically significant findings.

Actionable Recommendations

Based on our findings, which revealed a surprising preference for purple widgets among Gen Z (who knew?), we propose the following:

- Launch a limited-edition purple widget line: Capitalize on the identified trend by introducing a range of purple widgets, leveraging the excitement surrounding this unexpected color preference. We predict a 15% increase in sales within the first quarter, based on similar product launches by competitors. For example, “Sparkling Sunset” shades of lipstick by “GlamourGlow” saw a 12% increase in sales after its launch, which utilized a similar strategy.

- Refine marketing messaging: Our research highlighted a disconnect between our current messaging and the target audience’s aspirations. We recommend focusing on the widget’s emotional benefits rather than solely on its technical specifications. Think less “high-torque motor” and more “empowering your daily adventures”.

- Invest in targeted social media campaigns: Given Gen Z’s heavy social media usage, a strategic campaign focusing on platforms like TikTok and Instagram will be crucial to reaching this demographic. A campaign featuring user-generated content and influencer collaborations is projected to increase brand awareness by 20% within six months. This is based on a successful campaign by “EcoChic” that employed similar strategies and saw a 17% increase in brand awareness within the first 5 months.

Communicating Recommendations to Stakeholders

Presenting recommendations effectively requires a clear, concise, and engaging approach. Avoid jargon and focus on the “so what?” – the implications for the business. Visual aids, such as charts and graphs (we’ve already created some beauties!), are essential for illustrating key findings and making the data more digestible. A well-structured presentation, followed by a Q&A session, allows for open dialogue and addresses any concerns stakeholders may have. Think PowerPoint, but make it snazzy.

Implementation Plan

Implementing these recommendations requires a phased approach, ensuring that resources are allocated effectively and progress is monitored closely. A detailed project plan, including timelines, responsibilities, and key performance indicators (KPIs), should be developed. Regular progress reviews will be crucial to identify any potential roadblocks and make necessary adjustments.

- Phase 1 (Months 1-3): Develop and launch the limited-edition purple widget line. Initiate social media campaign development.

- Phase 2 (Months 4-6): Launch the social media campaign. Monitor sales and brand awareness data.

- Phase 3 (Months 7-9): Analyze campaign performance and make necessary adjustments. Evaluate the overall success of the recommendations.

Follow-up Research Questions

While our current research provides a solid foundation, further investigation is warranted to gain a more nuanced understanding of the market. This continuous learning process is vital for staying ahead of the curve and adapting to evolving consumer preferences.

- What are the long-term implications of the purple widget trend?

- How can we further segment our target audience to tailor our messaging more effectively?

- What are the potential risks and opportunities associated with expanding into new markets?

Final Summary

So, there you have it: a journey through the fascinating (and sometimes hilarious) world of market research. We’ve uncovered hidden trends, wrestled with data visualizations, and ultimately emerged victorious with actionable insights that will transform the way you approach your market. Now go forth and conquer… the market, that is. And remember, always double-check your data. Seriously.

Essential FAQs

What’s the difference between quantitative and qualitative research?

Quantitative research uses numbers and statistics to measure things objectively, while qualitative research delves into the “why” behind the numbers, using interviews and focus groups to explore opinions and experiences.

How can I avoid bias in my market research?

Be aware of your own preconceptions, use diverse data collection methods, and critically examine your findings. Peer review can also help identify potential biases.

What if my research findings are disappointing?

Disappointing findings are still findings! They provide valuable information, highlighting areas for improvement and informing future strategies. Don’t be afraid to embrace the unexpected.